Market Overview

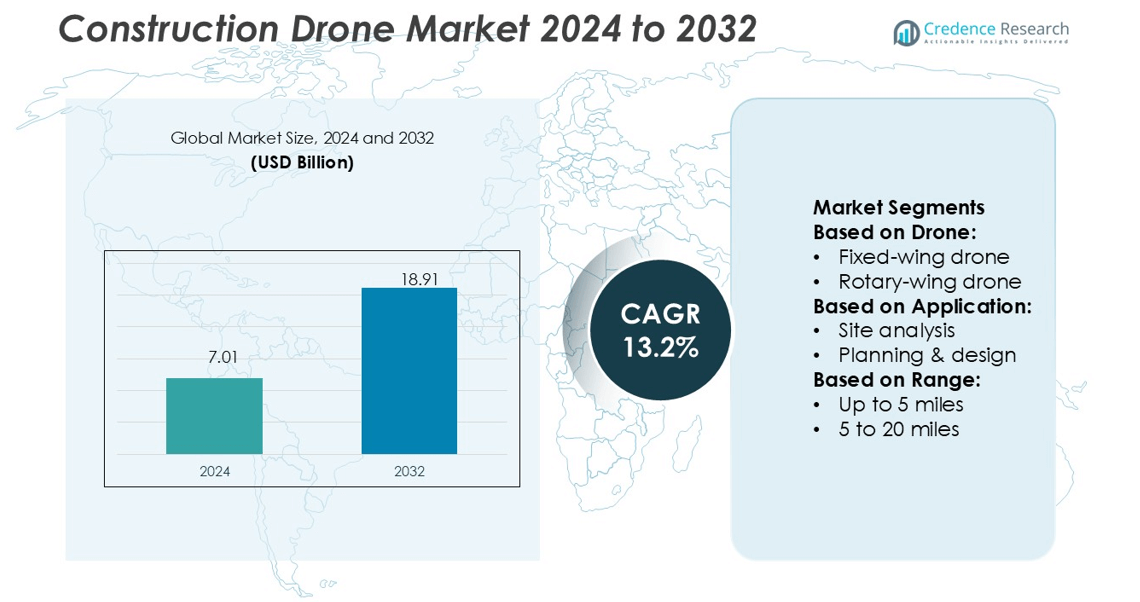

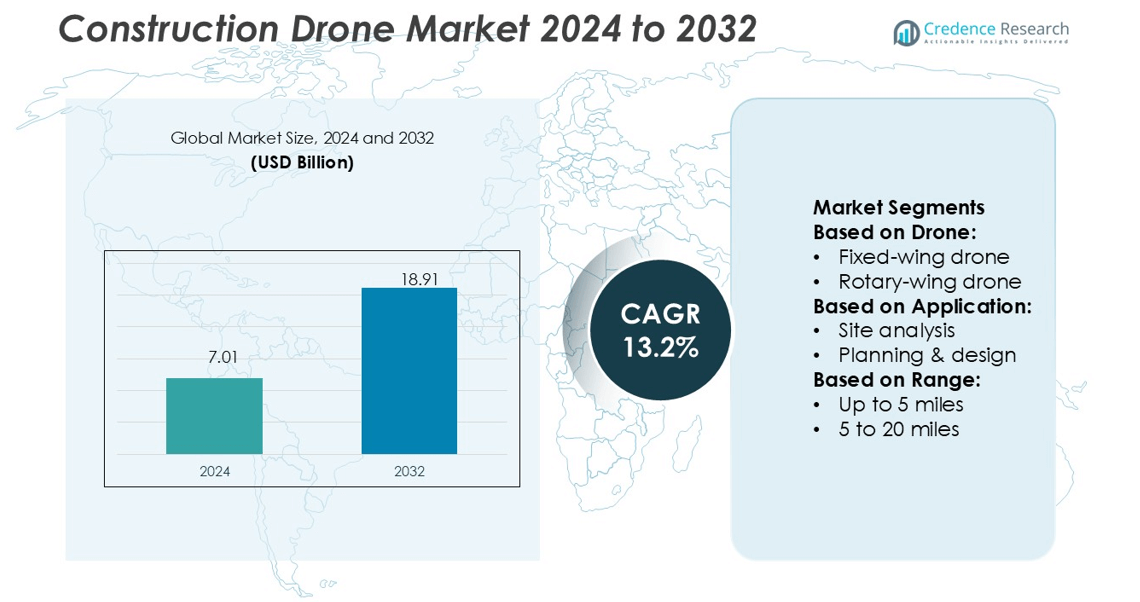

Construction Drone Market size was valued USD 7.01 billion in 2024 and is anticipated to reach USD 18.91 billion by 2032, at a CAGR of 13.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Drone Market Size 2024 |

USD 7.01 billion |

| Construction Drone Market, CAGR |

13.2% |

| Construction Drone Market Size 2032 |

USD 18.91 billion |

The Construction Drone Market is driven by key players such as Wingtra AG, Skydio, Inc., DJI (Da-Jiang Innovations), FlyGuys, PrecisionHawk, AeroVironment, Inc., JOUAV, DroneDeploy, Heliguy, and senseFly. These companies focus on developing advanced UAV systems with AI-based navigation, LiDAR integration, and real-time analytics to enhance construction efficiency and safety. DJI leads the market with a broad product portfolio and global distribution network, while DroneDeploy and PrecisionHawk dominate the software and data analytics segment. Wingtra AG and senseFly specialize in fixed-wing drones for large-scale site mapping. North America remains the leading region with a 35% market share, supported by strong technological infrastructure, government-funded infrastructure projects, and widespread adoption of drone-based surveying and monitoring solutions.

Market Insights

- The Construction Drone Market was valued at USD 7.01 billion in 2024 and is projected to reach USD 18.91 billion by 2032, registering a CAGR of 13.2% during the forecast period.

- Market growth is driven by rising adoption of drone-based surveying, mapping, and inspection, which improves project accuracy and reduces operational costs in large-scale construction.

- Advancements in AI, LiDAR, and data analytics are shaping key market trends, with increasing use of drones in infrastructure and smart city development projects.

- Competitive analysis highlights DJI, DroneDeploy, and PrecisionHawk as leaders, focusing on innovation, software integration, and automation, while fixed-wing drone segments dominate with a 68% share due to their wide-area coverage efficiency.

- North America leads the global market with a 35% share, supported by strong technological capabilities, government infrastructure investments, and rapid integration of UAVs in construction monitoring and project management activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drone

The rotary-wing drone segment holds the dominant share of the Construction Drone Market at 68%. These drones provide vertical take-off and landing capabilities, enabling precise navigation in confined spaces and complex project sites. They are widely used for monitoring construction progress, safety inspections, and capturing detailed aerial imagery. For instance, DJI’s Matrice 350 RTK delivers centimeter-level accuracy and 55 minutes of flight time, improving site efficiency. The demand for rotary-wing drones continues to rise due to their maneuverability, ease of deployment, and lower operational costs compared to fixed-wing models.

- For instance, Wingtra’s partners, the lowest GSD of 0.7 cm/px is achieved at an altitude of approximately 53–57 meters, not 60 meters. The flight altitude directly impacts the GSD, with a lower altitude yielding a higher resolution.

By Application

Surveying leads the application segment with a 31% market share. Construction firms increasingly rely on drones for 3D mapping, topographical surveys, and terrain modeling to reduce time and labor. For instance, Trimble’s SiteVision and WingtraOne drones offer survey-grade accuracy with automated photogrammetry and LiDAR integration. Drones reduce survey completion time by up to 75% compared to manual methods. Their ability to generate high-resolution orthomosaic maps and digital elevation models supports efficient planning, progress tracking, and early detection of design errors.

- For instance, Skydio X10 drone features six 32-megapixel navigation cameras for 360° obstacle avoidance and a maximum flight time of 40 minutes. Its high-resolution imaging is provided by interchangeable modular payloads.

By Range

The 5 to 20 miles range segment dominates the market with a 46% share. These drones are ideal for large-scale infrastructure projects and bridge construction, where long-distance monitoring is essential. Models like senseFly eBee X and DJI M30T combine extended range with real-time data transmission and obstacle sensing. This range category balances endurance and data accuracy while supporting multi-site inspections. Demand grows as mid-range drones enable project managers to conduct frequent, detailed inspections without recharging interruptions, optimizing construction workflows and reducing site downtime.

Key Growth Drivers

Rising Adoption of Aerial Surveying and Mapping

Construction firms increasingly use drones for aerial mapping, reducing project delays and surveying costs. These devices enable rapid 3D terrain modeling, volumetric analysis, and boundary mapping with high precision. For instance, senseFly eBee X can cover 500 hectares per flight, ensuring accurate site assessment. The integration of LiDAR and photogrammetry improves land measurement accuracy. Growing reliance on digital mapping in urban and infrastructure projects continues to accelerate drone adoption across construction and civil engineering sectors.

- For instance, DJI’s Zenmuse L2 LiDAR payload is specified to achieve a vertical accuracy of 4 cm and a horizontal accuracy of 5 cm under optimal, specific conditions. The system can cover up to 2.5 km² in a single flight.

Advancements in Drone Hardware and Sensor Technology

The use of high-resolution cameras, LiDAR, and thermal imaging sensors enhances operational efficiency. Modern drones like DJI Matrice 350 RTK and Parrot Anafi Ai offer centimeter-level accuracy for site inspection and monitoring. Such advanced hardware supports real-time decision-making and reduces manual labor. Longer battery life, better payload capacity, and automated flight features also strengthen their role in large-scale infrastructure and industrial projects. These improvements make drones indispensable for project safety and quality assurance.

- For instance, PrecisionHawk developed the Lancaster 5 fixed-wing drone, which has a dry weight of 2.4 kg, a wingspan of 1.5 m, and can carry payloads up to 1 kg. The drone achieves flight times up to 45 minutes, cruises at 12–16 m/s, and reaches a top speed of 22 m/s.

Increasing Focus on Cost Efficiency and Productivity

Construction drones significantly cut survey time, operational costs, and resource wastage. Traditional land surveys that once took weeks can now be completed within hours using automated flight plans. For example, Propeller Aero’s platform enables data analysis within 24 hours of drone deployment. Companies adopt drone-based workflows to monitor site progress, inventory, and compliance, minimizing project delays. This shift toward automation and data-driven decision-making enhances productivity and profitability in the global construction sector.

Key Trends & Opportunities

Integration of AI and Cloud-Based Analytics

Artificial intelligence and cloud platforms are transforming drone data management in construction. AI-driven tools automatically identify site anomalies, track material use, and generate predictive insights. For instance, DroneDeploy’s AI-powered analytics system supports real-time 3D modeling and defect detection. Cloud storage enables easy collaboration among teams, improving decision-making speed. The growing demand for digital twin integration offers vast opportunities for construction analytics and smart project management.

- For instance, JOUAV’s CW-15 VTOL fixed-wing drone reaches up to 3 hours (180 minutes) of endurance, carries 3 kg of payload, and handles takeoff altitudes up to 4,500 m with a service ceiling of 6,500 m.

Growing Use in Infrastructure and Smart City Projects

Government investments in smart cities and large-scale infrastructure development drive drone deployment. Drones assist in bridge, highway, and commercial complex monitoring, ensuring safety and regulatory compliance. For instance, India’s Smart City Mission and the U.S. Infrastructure Investment Act promote drone-based mapping and monitoring. The opportunity lies in integrating drones with IoT and BIM systems to create connected construction ecosystems that improve transparency and sustainability.

- For instance, DroneDeploy’s April 2025 release supports DJI M4E/T, enabling users to map up to 40 % more area per battery and generate maps 29 % faster than before.Its “Safety AI” dashboard centralizes safety metrics across all projects, giving managers a unified view of risk across sites.

Expansion of Drone-as-a-Service (DaaS) Model

The DaaS model enables firms to access drone technology without heavy ownership costs. Service providers like Kespry and Measure offer customizable packages for surveying, monitoring, and inspection. This model reduces maintenance costs and supports scalability across multiple projects. The growing preference for subscription-based drone services encourages new entrants and partnerships between software developers and drone manufacturers, creating an emerging revenue stream for construction technology providers.

Key Challenges

Regulatory Restrictions and Airspace Management

Strict drone regulations limit commercial use across many regions. Construction firms must comply with complex licensing and airspace clearance processes. For instance, FAA Part 107 in the U.S. imposes operational limits such as altitude restrictions and line-of-sight requirements. Delays in policy approval slow project execution and increase administrative costs. Harmonizing regulations across international markets remains a major challenge for global adoption.

Data Privacy and Security Concerns

The storage and transmission of aerial imagery pose risks related to data breaches and unauthorized access. Drones capture sensitive information about infrastructure layouts, which can be exploited if not securely managed. Companies like Parrot have introduced encrypted data transfer to enhance security, yet vulnerabilities persist. The lack of standardized cybersecurity frameworks for drone operations hinders trust and adoption, particularly in government and defense-related construction projects.

Regional Analysis

North America

North America holds a 35% share of the Construction Drone Market, driven by strong adoption across the U.S. and Canada. The region benefits from advanced construction technologies, government infrastructure funding, and strict safety regulations that promote drone inspections. Major companies like DJI, Kespry, and Propeller Aero dominate the regional landscape with integrated surveying and analytics solutions. The U.S. Infrastructure Investment and Jobs Act continues to boost drone usage in highway and bridge construction. High labor costs and the push for automation further strengthen drone deployment across commercial and industrial construction projects.

Europe

Europe accounts for a 27% share of the global market, supported by increasing use in urban development and renovation projects. Countries such as Germany, the U.K., and France are early adopters of UAV-based surveying and digital twin solutions. Regulatory harmonization under the European Union Aviation Safety Agency (EASA) simplifies drone operations across member states. Companies like senseFly and Parrot lead innovation with fixed-wing drones for large-scale mapping. The growing demand for sustainable, data-driven construction practices across smart city initiatives enhances drone market penetration in the region.

Asia-Pacific

Asia-Pacific commands a 28% share, emerging as one of the fastest-growing regions for construction drones. Rapid infrastructure expansion in China, India, and Japan fuels demand for aerial mapping and real-time monitoring. Government initiatives like India’s Smart City Mission and China’s Belt and Road projects accelerate UAV integration in large-scale developments. Regional players such as Terra Drone and Aerodyne Group strengthen the ecosystem through advanced surveying services. The combination of affordable drone hardware, skilled operators, and rising digitalization supports strong market growth across the region’s construction sector.

Latin America

Latin America captures a 4% share of the Construction Drone Market, led by Brazil, Mexico, and Chile. Expanding mining, energy, and infrastructure projects are boosting demand for drone-based surveying and inspection. Local construction firms use UAVs to reduce project delays and enhance safety standards. Drone companies like XMobots and DroneMapp provide region-specific mapping and photogrammetry solutions. Although regulatory inconsistencies hinder broader adoption, the region shows growing potential with increased investment in smart infrastructure and public-private partnerships aimed at improving construction efficiency and transparency.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 6% share, supported by growing investments in smart infrastructure and real estate megaprojects. Countries like the UAE and Saudi Arabia increasingly deploy drones for 3D mapping and construction site inspections. Projects such as NEOM and Expo City Dubai drive UAV demand for safety monitoring and progress tracking. Partnerships between drone service providers and local governments enhance operational efficiency. Limited skilled personnel and strict flight regulations slightly restrain expansion, yet MEA remains a key emerging region for drone-based construction innovation.

Market Segmentations:

By Drone:

- Fixed-wing drone

- Rotary-wing drone

By Application:

- Site analysis

- Planning & design

By Range:

- Up to 5 miles

- 5 to 20 miles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Drone Market features leading players such as Wingtra AG, Skydio, Inc., DJI (Da-Jiang Innovations), FlyGuys, PrecisionHawk, AeroVironment, Inc., JOUAV, DroneDeploy, Heliguy, and senseFly. The competitive landscape of the Construction Drone Market is characterized by rapid innovation, strategic collaborations, and growing investment in automation technologies. Companies are focusing on enhancing flight efficiency, payload capacity, and data accuracy to meet the diverse needs of surveying, inspection, and monitoring. The market is witnessing strong integration of AI, LiDAR, and photogrammetry software to improve real-time analytics and decision-making. Firms increasingly adopt partnerships with construction technology providers to deliver end-to-end solutions combining hardware, software, and data analytics. Continuous product innovation, compliance with aviation regulations, and customized service offerings remain key factors shaping competition and market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wingtra AG

- Skydio, Inc.

- DJI (Da-Jiang Innovations)

- FlyGuys

- PrecisionHawk

- AeroVironment, Inc.

- JOUAV

- DroneDeploy

- Heliguy

- senseFly

Recent Developments

- In February 2025, Pix4D and Freefly Systems announced a partnership aimed at enhancing drone data workflows by integrating Pix4D’s advanced photogrammetry software with Freefly’s cutting-edge drone technology. This collaboration seeks to streamline the process of capturing, processing, and analyzing aerial data, making it more efficient for industries such as construction, surveying, and agriculture.

- In January 2025, SZ DJI Technology Co., Ltd. launched the DJI Flip, a lightweight and foldable drone designed for vloggers, resembling a mini unicycle. Weighing just 249 grams, it features a 1/1.3-inch 48MP CMOS sensor capable of recording 4K HDR videos at 60 fps and slow-motion at 100 fps, along with SmartPhoto technology for enhanced clarity.

- In May 2024, Droneshield announced the release of DroneSentry C2 Next-Gen v1.00, an advanced command-and-control system that enhances the capabilities of anti-drone systems by providing centralized monitoring and control functionalities. It allows users to efficiently manage multiple sensors and countermeasures to protect critical infrastructure, public events, military installations, and other sensitive areas from potential drone threats.

- In April 2024, Virtual Surveyor upgraded its widely used smart drone surveying software by introducing new planimetric survey capabilities. Alongside various performance enhancements, Virtual Surveyor version 9.5 now allows users to swiftly, effortlessly, and accurately survey 2D features from drone orthophotos and integrate them into the 3D topographic model created from the same data set

Report Coverage

The research report offers an in-depth analysis based on Drone, Application, Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for drones in construction will rise with growing digital transformation initiatives.

- Integration of AI and machine learning will enhance real-time site monitoring and analytics.

- Drone-as-a-Service (DaaS) models will gain traction among small and mid-sized construction firms.

- Governments will implement clearer regulations to support safe and large-scale drone operations.

- Advanced battery technologies will extend flight duration and operational efficiency.

- Adoption of 3D mapping and digital twin applications will expand in large infrastructure projects.

- Cloud-based data management systems will improve collaboration across project teams.

- The use of drones for safety inspections will increase to reduce on-site risks.

- Partnerships between drone manufacturers and construction software providers will strengthen.

- Emerging markets in Asia-Pacific and the Middle East will become major growth hubs for drone adoption.