Market Overview

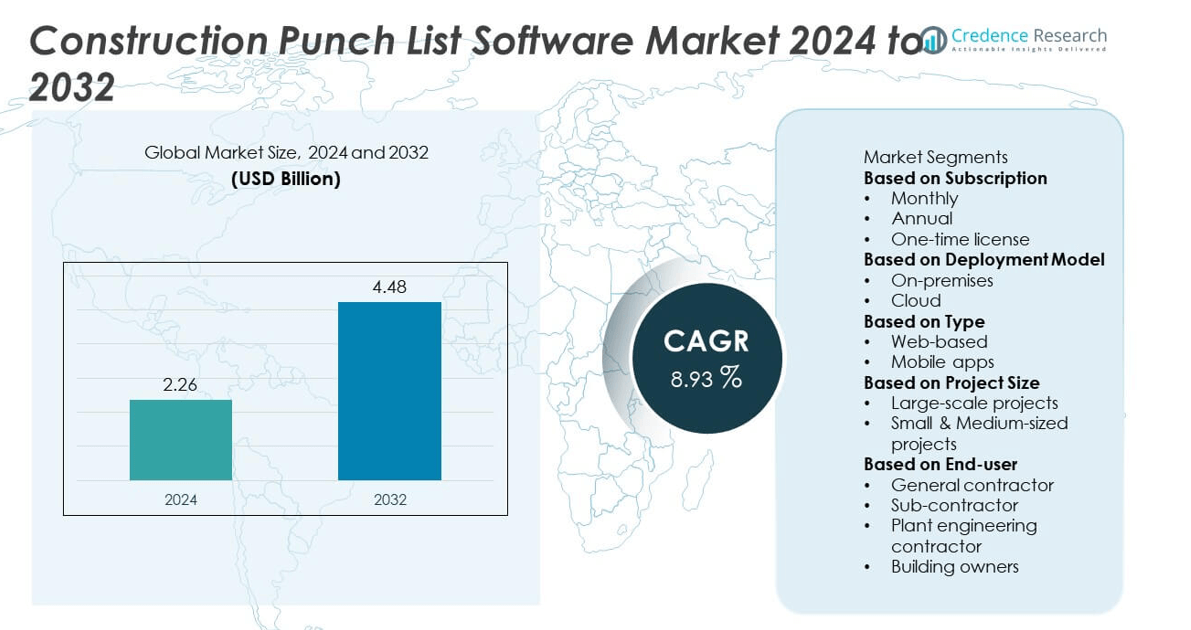

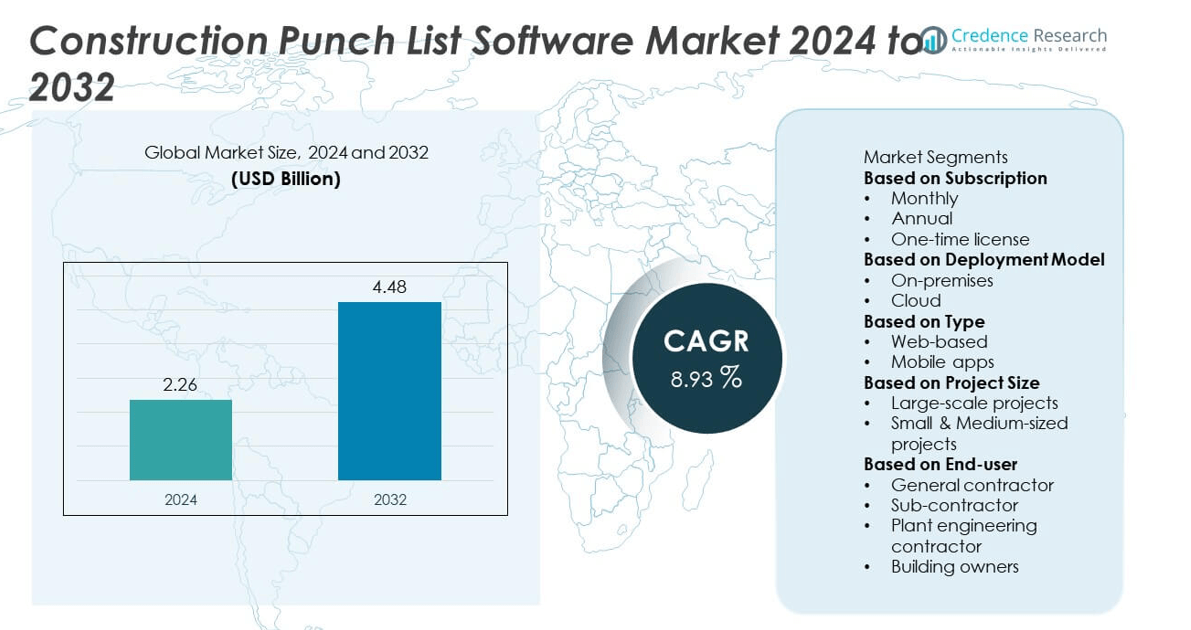

The Construction Punch List Software market was valued at USD 2.26 billion in 2024 and is projected to reach USD 4.48 billion by 2032, growing at a CAGR of 8.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Punch List Software Market Size 2024 |

SD 2.26 billion |

| Construction Punch List Software Market, CAGR |

8.93% |

| Construction Punch List Software Market Size 2032 |

USD 4.48 billion |

The Construction Punch List Software market is led by major players such as Fieldwire, Trimble (Viewpoint Inc.), Procore Technologies Inc., Autodesk Inc., Buildertrend, Oracle Corporation, Deltek Inc., Alpha Software Corporation, UDA Technologies Inc., and Strata Systems. These companies dominate through advanced cloud-based and mobile solutions that enhance real-time communication, defect tracking, and project completion efficiency. North America led the global market with a 33% share in 2024, supported by strong digital infrastructure and widespread adoption of construction management technologies. Asia-Pacific followed closely with 30%, driven by large-scale infrastructure projects and rapid digital transformation, while Europe, holding 27%, continued to invest in automation and compliance-focused construction solutions.

Market Insights

- The Construction Punch List Software market was valued at USD 2.26 billion in 2024 and is projected to reach USD 4.48 billion by 2032, growing at a CAGR of 8.93% during the forecast period.

- Market growth is driven by rising demand for digital construction management solutions that streamline defect tracking, project handover, and quality assurance across large-scale projects.

- Key trends include the rapid adoption of mobile-based platforms, cloud integration, and AI-enabled automation that enhance collaboration and real-time task monitoring.

- The market is moderately competitive, with leading players such as Fieldwire, Procore Technologies, Trimble, and Autodesk focusing on innovation, automation, and strategic partnerships to strengthen their market positions.

- North America led with a 33% share, followed by Asia-Pacific at 30% and Europe at 27%, while the cloud deployment model dominated with a 64% share due to scalability and accessibility advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Subscription

The annual subscription segment dominated the Construction Punch List Software market in 2024, accounting for 58% of the total share. Its leadership is attributed to cost-effectiveness and long-term access to updates, support, and integrations essential for ongoing construction projects. Annual plans are preferred by contractors and developers managing multiple sites, as they ensure consistent service continuity and reduced administrative overhead. The growing adoption of SaaS-based pricing models and multi-user licensing further supports annual subscriptions, while monthly plans remain popular among small firms seeking flexible budgeting options.

- For instance, Procore Technologies Inc. reported that as of December 31, 2024, it had 17,088 customers, with its platform being used in more than 150 countries. The software provides centralized access for tasks such as managing punch lists, scheduling, and RFIs, and offers an annual licensing model.

By Deployment Model

The cloud deployment model held a 64% market share in 2024, driven by its scalability, low setup cost, and remote accessibility. Cloud-based platforms enable real-time collaboration among project teams, streamlining issue tracking and task closure. The model supports automatic updates, secure data storage, and easy integration with other project management tools. Increasing adoption of mobile-enabled construction management systems and the shift toward remote work environments further enhance demand. In contrast, on-premises solutions maintain a presence among enterprises requiring strict data control and localized infrastructure management.

- For instance, Fieldwire operates on its cloud platform, processing millions of tasks with automatic sync across web and mobile devices, and has been used on over 4 million projects worldwide.

By Type

The mobile apps segment led the market with a 55% share in 2024, fueled by the growing use of smartphones and tablets on construction sites. Mobile-based punch list software allows field engineers and site managers to capture, assign, and resolve defects in real time, improving communication efficiency. Its offline functionality, photo documentation, and instant synchronization with cloud servers enhance project transparency and speed. The rising adoption of mobile-first platforms aligns with the industry’s shift toward digital field operations, while web-based tools continue to serve as complementary solutions for back-office coordination and data analysis.

Key Growth Drivers

Increasing Adoption of Digital Construction Management

The growing shift toward digital construction practices is a primary driver of the Construction Punch List Software market. Contractors and developers are replacing manual inspection and reporting with digital tools to improve project accuracy and productivity. These platforms enable real-time tracking of tasks, issue resolution, and quality assurance across job sites. The push for streamlined workflows, reduced rework, and faster project closeouts fuels strong adoption. Integration with project management and document control systems further enhances operational transparency and efficiency.

- For instance, Autodesk Inc.’s BIM 360 Build platform enabled Skanska USA to manage over 12,000 field inspections and link 2.5 terabytes of site documentation in a single digital environment, achieving seamless synchronization between design and construction workflows.

Rising Demand for Cloud-Based Collaboration Platforms

The construction sector’s growing reliance on cloud-based solutions is accelerating software adoption. Cloud-enabled punch list systems offer scalability, easy access, and instant updates across teams, ensuring smoother coordination between contractors, architects, and project owners. These platforms reduce communication delays and provide centralized data storage, improving accountability and project timelines. The global trend toward remote work and mobile accessibility reinforces this demand, as real-time synchronization and multi-device compatibility become essential for large-scale construction projects.

- For instance, Trimble Construction One (formerly ViewpointOne) is a suite of solutions that facilitates live project data sharing for construction teams across North America. It helps to streamline workflows, improve collaboration, and increase productivity by connecting the back office with the field.

Expansion of Large-Scale Infrastructure Projects

Increasing investments in infrastructure and commercial construction are driving the need for efficient quality management tools. Governments and private developers are adopting punch list software to enhance inspection accuracy and compliance. These systems help monitor task completion, safety standards, and defect resolution throughout complex projects. The growing scale of smart city developments and public infrastructure initiatives across Asia-Pacific, North America, and the Middle East is further fueling demand for automated issue-tracking solutions that minimize delays and cost overruns.

Key Trends & Opportunities

Integration of Mobile and AI Technologies

The integration of AI-driven analytics and mobile functionality is transforming punch list management. Mobile-based software allows field teams to log and resolve issues instantly, while AI tools help prioritize defects based on severity and location. Automated image recognition and predictive insights are improving inspection accuracy. This combination enhances speed, reduces manual errors, and increases decision-making efficiency. As construction firms embrace digital transformation, the demand for intelligent, mobile-first solutions continues to create new market opportunities for software providers.

- For instance, Buildertrend integrated an AI-powered Client Updates feature in its mobile app that automatically generates weekly project summaries for builders. The feature compiles information such as daily logs, schedules, and change orders to help contractors save time and improve client communication.

Growing Focus on Automation and Real-Time Reporting

Automation and real-time reporting capabilities are emerging as key trends in the market. Automated task assignment, instant notifications, and cloud-based dashboards are improving collaboration between on-site and off-site teams. These tools enable managers to track progress and compliance metrics instantly, reducing administrative workload. The use of real-time reporting enhances transparency, helping stakeholders monitor performance across multiple sites. As project owners demand faster handovers and higher quality standards, automated punch list solutions are becoming integral to modern construction workflows.

- For instance, Deltek Inc.’s Project Information Management (PIM) solution helps firms improve collaboration and save time by managing emails, drawings, and documents in a centralized location.

Key Challenges

High Implementation and Integration Costs

Despite clear advantages, the high cost of software deployment and system integration remains a significant challenge. Smaller construction firms often struggle with upfront investments in subscription plans, customization, and training. Integrating punch list platforms with existing project management tools and legacy systems requires additional technical expertise. These expenses can slow adoption, particularly in developing regions. Software vendors are responding with modular pricing models and simplified cloud setups, but cost sensitivity continues to limit widespread adoption across smaller enterprises.

Data Security and Connectivity Issues

Data privacy and connectivity challenges hinder the full potential of cloud-based punch list platforms. Construction sites often operate in remote areas with inconsistent internet access, affecting real-time synchronization. Meanwhile, sensitive project data such as blueprints, inspection records, and client details face cybersecurity risks. Ensuring robust encryption and secure access remains a top priority for developers. Companies are increasingly demanding compliance with global data protection standards. Addressing these issues through advanced cloud infrastructure and offline functionality will be crucial for market scalability.

Regional Analysis

North America

North America held a 33% market share in 2024, driven by the rapid digital transformation of the construction industry and high adoption of cloud-based project management tools. The United States leads the region with extensive use of mobile and AI-integrated punch list software across large infrastructure and commercial projects. Stringent safety regulations and growing emphasis on productivity optimization have accelerated digital adoption. Major players such as Procore Technologies and Autodesk continue to expand their product offerings through advanced analytics and automation, strengthening North America’s leadership in the construction punch list software market.

Europe

Europe accounted for 27% of the market share in 2024, supported by increasing demand for quality control, sustainability, and compliance in construction operations. Countries like Germany, the United Kingdom, and France are at the forefront of adopting digital solutions for project inspection and documentation. The region’s strong focus on energy-efficient and smart building projects drives the need for real-time monitoring and reporting software. European construction firms are also investing in cloud collaboration tools to streamline workflows and meet regulatory standards, making punch list management software a vital part of their digital ecosystem.

Asia-Pacific

Asia-Pacific dominated the global market with a 30% share in 2024, fueled by rapid urbanization, infrastructure expansion, and smart city initiatives. Countries such as China, India, Japan, and South Korea are witnessing increased adoption of mobile-based construction management platforms. Cloud-based punch list software is becoming essential for managing large-scale residential and commercial projects with complex inspection requirements. Government-backed infrastructure programs and the rise of digital construction startups are further driving market growth. The region’s strong emphasis on cost efficiency and project transparency ensures Asia-Pacific remains the fastest-growing market segment.

Latin America

Latin America captured a 6% market share in 2024, with Brazil and Mexico leading regional adoption. The market benefits from ongoing investments in commercial and residential construction, supported by expanding digital infrastructure. Local firms are increasingly shifting toward mobile and cloud-based solutions to reduce manual inspection errors and streamline communication between contractors and clients. While the adoption rate remains moderate due to limited budgets and connectivity issues, growing government infrastructure initiatives and partnerships with global software providers are expected to accelerate the region’s digital construction transformation in the coming years.

Middle East & Africa

The Middle East and Africa region accounted for a 4% market share in 2024, driven by major construction and urban development projects in Saudi Arabia, the United Arab Emirates, and South Africa. The region’s push toward smart city development, including projects such as NEOM and Vision 2030, is increasing the use of punch list software for real-time quality tracking and site inspections. Contractors are adopting cloud-based and mobile-enabled solutions to enhance coordination across large-scale sites. Despite limited local vendors, global providers are expanding partnerships to meet the growing demand for digital construction management tools.

Market Segmentations:

By Subscription

- Monthly

- Annual

- One-time license

By Deployment Model

By Type

By Project Size

- Large-scale projects

- Small & Medium-sized projects

By End-user

- General contractor

- Sub-contractor

- Plant engineering contractor

- Building owners

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the Construction Punch List Software market includes key players such as Fieldwire, Trimble (Viewpoint Inc.), Procore Technologies Inc., Autodesk Inc., Buildertrend, Oracle Corporation, Deltek Inc., Alpha Software Corporation, UDA Technologies Inc., and Strata Systems. These companies compete through innovation in cloud-based platforms, real-time collaboration tools, and mobile integration to streamline project closeout processes. Leading players are investing in AI-driven analytics, automation, and seamless data synchronization to enhance task tracking and quality control. Strategic partnerships with contractors, design firms, and project owners help expand market reach and improve interoperability with existing construction management systems. North American firms dominate in enterprise-grade solutions, while emerging players are focusing on cost-effective and mobile-friendly applications for SMEs. Continuous development in predictive analytics, user-friendly interfaces, and integration with BIM and ERP systems defines the evolving competitive dynamics of this rapidly growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fieldwire

- Trimble (Viewpoint Inc.)

- Procore Technologies Inc.

- Autodesk Inc.

- Buildertrend

- Oracle Corporation

- Deltek Inc.

- Alpha Software Corporation

- UDA Technologies Inc.

- Strata Systems

Recent Developments

- In August 2025, Procore Technologies Inc. released a modernized Punch List UI that unifies the create, view, edit, and configuration pages for smoother user flow.

- In May 2025, Procore rolled out enhanced list views in the Punch List module (List, My Items, Recycle Bin) to speed up load times and improve responsiveness.

- In April 2025, Fieldwire added the ability to connect with SharePoint and auto-sync plans to projects, streamlining plan updates and supporting punch list coordination.

- In February 2025, Fieldwire improved task filtering by showing sub-locations automatically in search, making punch item location tagging more accurate

Report Coverage

The research report offers an in-depth analysis based on Subscription, Deployment Model, Type, Project Size, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing digital adoption across global construction projects.

- Cloud-based solutions will remain the preferred deployment model for scalability and real-time collaboration.

- Mobile-enabled platforms will dominate as field teams increasingly rely on on-site data access.

- Integration of AI and automation will enhance defect detection, prioritization, and resolution speed.

- Partnerships between software developers and construction firms will drive customized, end-user-focused solutions.

- Adoption among small and medium-sized enterprises will rise due to affordable subscription models.

- Data security and compliance features will become central to software design and deployment.

- Demand for BIM-integrated platforms will increase for better visualization and project tracking.

- Asia-Pacific will witness the fastest growth supported by rapid infrastructure development and urbanization.

- Continuous R&D in predictive analytics and automation will strengthen competitiveness and operational efficiency.