Market Overview

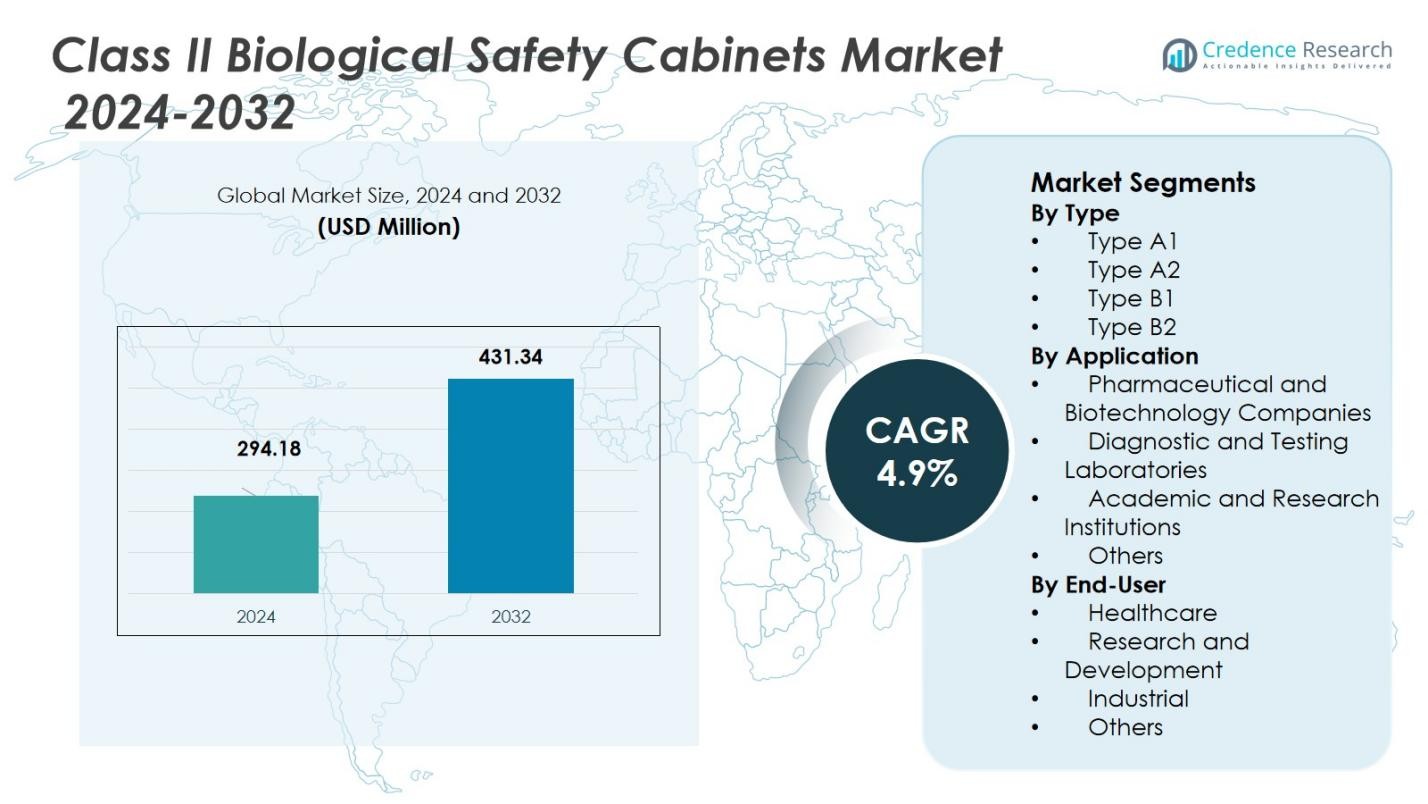

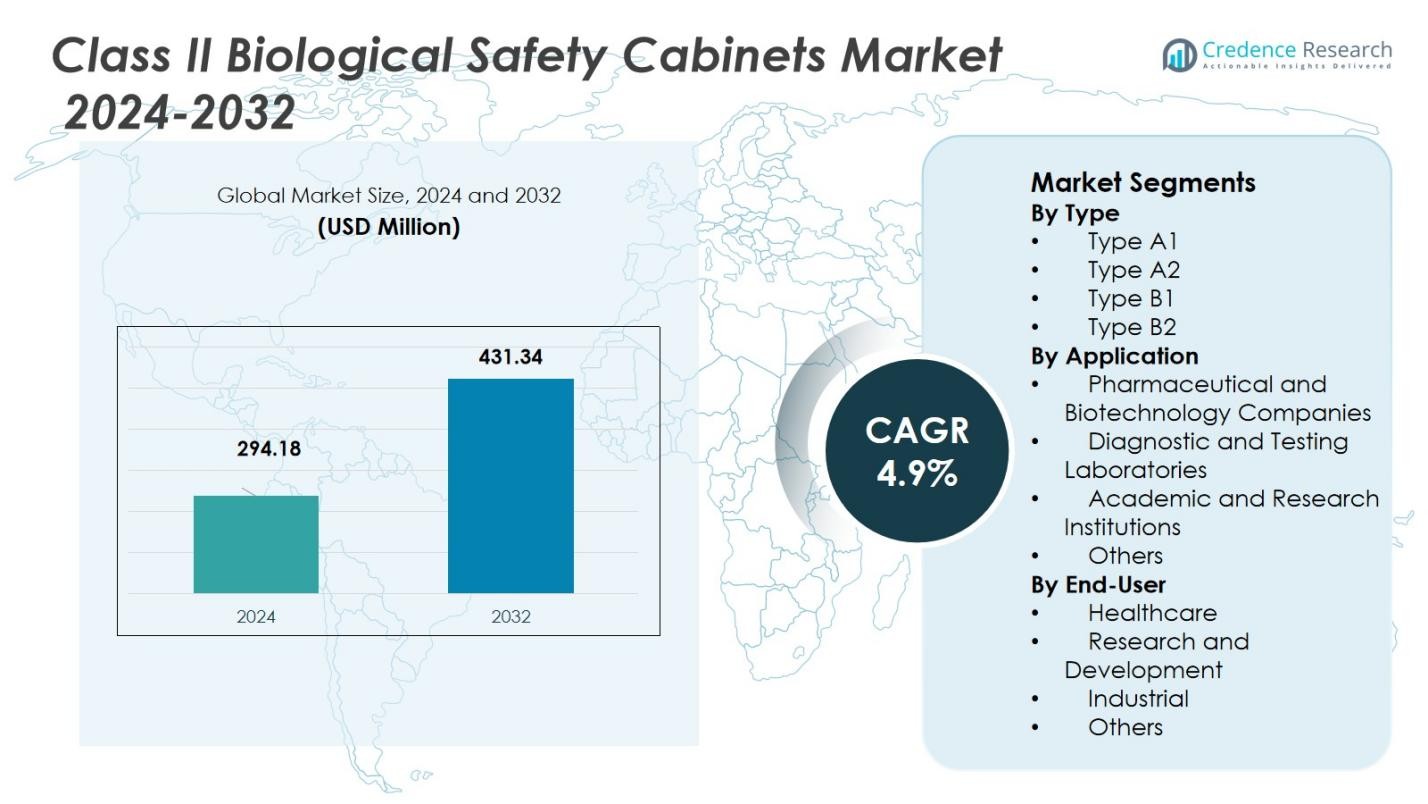

The Class II Biological Safety Cabinets Market size was valued at USD 294.18 Million in 2024 and is anticipated to reach USD 431.34 Million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blockchain Technology in Healthcare Market Size 2024 |

USD 294.18 Million |

| Blockchain Technology in Healthcare Market, CAGR |

4.9% |

| Blockchain Technology in Healthcare Market Size 2032 |

USD 431.34 Million |

The Class II Biological Safety Cabinets Market includes leading players such as Thermo Fisher Scientific Inc., Labconco Corporation, Esco Micro Pte Ltd, The Baker Company, NuAire Inc., Germfree Laboratories Inc., Kewaunee Scientific Corporation, Air Science USA LLC, Azbil Telstar, and others. In this landscape, North America stands out as the leading region with a market share of 38.25% in 2024, underpinned by high R&D investment, robust biopharma activity, and stringent biosafety regulations. Europe follows with 30.40%, supported by mature pharmaceutical and research infrastructure and strong regulatory compliance. Rapid growth in Asia Pacific, holding 19.30%, is driven by expanding biotech, healthcare infrastructure enhancement, and rising adoption of biosafety standards in countries such as China, India, and Japan. Together, these regions anchor the global demand for Class II biological safety cabinets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Class II Biological Safety Cabinets Market was valued at USD 294.18 Million in 2024 and is projected to reach USD 431.34 Million by 2032 at a CAGR of 4.9%.

- Growth in biopharmaceutical R&D, vaccine development, and expanding life‑sciences research drive increasing demand for Class II cabinets, particularly in pharmaceutical and biotechnology companies where contamination control is critical.

- Laboratories worldwide increasingly adopt advanced containment equipment as regulatory standards tighten and biosafety compliance becomes mandatory, fueling upgrades from older cabinets to modern, certified models.

- Innovation in “smart” safety cabinets integrating features such as real‑time airflow monitoring, energy‑efficient filtration, and ergonomic design is gaining traction, creating new opportunities for manufacturers.

- North America leads the market with a regional share of 38.25%, followed by Europe at 30.40%, while Asia‑Pacific is growing rapidly with a share of 19.30%; within market segments, Type A2 by type and pharmaceutical & biotechnology companies by application dominate.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

The Class II Biological Safety Cabinets market is primarily segmented into four types: Type A1, Type A2, Type B1, and Type B2. Among these, Type A2 dominates the market with a share of 45%, driven by its widespread adoption in pharmaceutical and biotechnology laboratories due to its superior protection and versatility. The demand for Type A2 is bolstered by its ability to offer a combination of personnel, product, and environmental protection, making it ideal for handling low- to moderate-risk biological agents. Additionally, increasing awareness regarding lab safety standards is further contributing to its market growth.

- For instance, Thermo Fisher Scientific employs Type A2 cabinets like the 1300 Series A2 in its clinical diagnostics operations to maintain contamination-free test environments

By Application

In the Class II Biological Safety Cabinets market, the application segment is categorized into pharmaceutical and biotechnology companies, diagnostic and testing laboratories, academic and research institutions, and others. Pharmaceutical and biotechnology companies hold the largest share of 41%, driven by the rising need for contamination control in drug development and manufacturing. The expansion of biopharmaceutical research and the increasing focus on biosafety standards for handling hazardous biological materials are key factors driving the dominance of this segment. The robust growth in this industry fuels the demand for high-quality biological safety cabinets.

- For instance, Moderna utilizes biosafety cabinets for mRNA vaccine formulation and quality control to maintain sterility throughout vaccine production.

By End-User

The end-user segment of the Class II Biological Safety Cabinets market includes healthcare, research and development (R&D), industrial, and others. The R&D sector leads the market with a share of 38%, driven by the growing investment in biological research, particularly in biotechnology and pharmaceutical sectors. The need for controlled environments to conduct experiments with potentially hazardous materials is a significant driver for this sub-segment. Increased government funding for R&D activities and the continuous growth of life sciences research are key factors enhancing the demand for Class II Biological Safety Cabinets in this segment.

Key Growth Drivers

Rising Demand in Biopharmaceuticals and Biotechnology Research

The growing demand for biopharmaceuticals and biotechnology research is a major growth driver for the Class II Biological Safety Cabinets market. As the focus on drug discovery, genetic research, and personalized medicine intensifies, the need for highly controlled and sterile laboratory environments is paramount. Biological safety cabinets, especially Type A2, are essential for ensuring the safety of both researchers and products. With a growing number of pharmaceutical and biotechnology companies expanding their research and development activities, the demand for Class II Biological Safety Cabinets is expected to continue its upward trajectory.

- For instance, NuAire’s Class II, Type A2 Biological Safety Cabinets are widely used in pharmaceutical development to maintain clean air conditions during drug formulation, crucial for protecting both researchers and drug integrity.

Increased Focus on Laboratory Safety and Regulatory Standards

An increasing emphasis on laboratory safety and stringent regulatory standards is driving the adoption of Class II Biological Safety Cabinets. Regulatory bodies such as OSHA, the CDC, and the WHO have established guidelines for laboratory safety, particularly in handling hazardous materials. These regulations are pushing organizations to adopt more advanced and certified biological safety cabinets to comply with safety standards. As awareness grows regarding the potential risks associated with biological agents, companies are prioritizing the installation of reliable and efficient safety cabinets to meet regulatory requirements and ensure lab safety.

- For instance, Thermo Fisher Scientific has integrated advanced filtration and real-time monitoring systems into its Class II biological safety cabinets to comply with OSHA and CDC requirements, enhancing protection against biohazards.

Growth in Research Funding and Investments

The surge in research funding and investments, particularly in the fields of biotechnology and life sciences, is contributing to the growth of the Class II Biological Safety Cabinets market. Government and private sector investments in research and development have been increasing, with a focus on infectious disease research, vaccine development, and genetic engineering. This financial support enables laboratories and research institutions to procure advanced safety equipment, including Class II Biological Safety Cabinets, to ensure safe working conditions. Consequently, the demand for such safety cabinets is closely tied to the level of investment in scientific research.

Key Trends & Opportunities

Technological Advancements in Safety Cabinet Design

Technological advancements in the design and functionality of Class II Biological Safety Cabinets present significant opportunities for market growth. Innovations such as real-time monitoring systems, energy-efficient filtration, and improved airflow technology are making these cabinets more efficient and user-friendly. These technological improvements not only enhance laboratory safety but also reduce operating costs, making Class II Biological Safety Cabinets more attractive to a wider range of customers. As laboratories seek to optimize both safety and energy efficiency, manufacturers are increasingly focusing on integrating these advanced features into their products.

- For instance, Thermo Fisher Scientific’s Herasafe 2030i Cabinet integrates a real-time airflow monitoring system and a full-color touchscreen interface that alerts users instantly to airflow fluctuations.

Emerging Markets in Developing Regions

The Class II Biological Safety Cabinets market is witnessing expanding opportunities in emerging markets in Asia-Pacific, Latin America, and the Middle East. With the growing focus on healthcare infrastructure and the rapid expansion of research facilities in these regions, the demand for biological safety cabinets is on the rise. Developing countries are investing in advanced laboratory technologies, driven by government initiatives to boost research capabilities and address public health challenges. As these regions continue to industrialize and prioritize biosafety, the market for Class II Biological Safety Cabinets will experience significant growth.

- For instance, iGene Labserve Pvt. Ltd. offers Class II, Type A2 Biosafety Cabinets with features like ULPA filters and motorized front windows, designed for microbiological and pharmaceutical research environments, catering specifically to developing regions’ labs.

Key Challenges

High Initial Investment and Maintenance Costs

One of the key challenges in the Class II Biological Safety Cabinets market is the high initial investment and ongoing maintenance costs associated with these advanced systems. The price of high-quality biological safety cabinets can be a barrier for smaller research institutions or labs with limited budgets. Additionally, regular maintenance and replacement of filters add to the long-term operating costs. For organizations looking to optimize their expenditures, the cost factor can sometimes outweigh the benefits, leading to reluctance in adopting these cabinets despite their clear advantages in safety.

Lack of Awareness in Emerging Markets

In emerging markets, the lack of awareness regarding the importance of biosafety equipment, including Class II Biological Safety Cabinets, remains a significant challenge. While developed regions are well-versed in laboratory safety standards, many laboratories in developing countries are still operating with outdated or insufficient safety measures. This lack of awareness, combined with lower investment in laboratory infrastructure, results in slower adoption of essential safety equipment. Education and awareness campaigns are needed to encourage the uptake of biological safety cabinets in these regions, which could hinder the market’s growth potential in the short term.

Regional Analysis

North America

North America leads the Class II Biological Safety Cabinets market with a market share of 38.25% in 2024. The robust presence of advanced biopharmaceutical manufacturing, large R&D investments, and strict regulatory frameworks drive strong demand in this region. The well-established healthcare infrastructure, combined with high adoption of biosafety standards across pharmaceutical, diagnostic, and research laboratories, reinforces the dominance of North America. Continued funding for cell and gene therapy, vaccine development, and biologics manufacturing underpins steady growth for Class II cabinets throughout the forecast period, contributing significantly to the region’s market share.

Europe

Europe holds a substantial share of the Class II Biological Safety Cabinets market at 30.40%. The region benefits from a mature pharmaceutical and research sector with a strong emphasis on regulatory compliance and biosafety standards. Growing investments in biotechnology and academic research institutions maintain steady demand for biological safety cabinets. European laboratories are increasingly upgrading their equipment to meet stringent safety protocols for handling hazardous materials. As a result, Europe remains a critical market for Class II Biological Safety Cabinets, driven by ongoing research and established life-science infrastructure.

Asia Pacific

Asia Pacific is experiencing rapid growth in the Class II Biological Safety Cabinets market, holding a share of 19.30% in 2024. The region’s burgeoning pharmaceutical, biotechnology, and research sectors, particularly in China, India, and Japan, drive rising demand. Increasing public and private investment in healthcare infrastructure, biotech research, and regulatory modernization further fuels the adoption of biosafety cabinets. Growth in vaccine manufacturing, diagnostics labs, and academic research creates substantial opportunities for suppliers. With the region’s dynamic market expansion, Asia Pacific is positioned for significant growth in the forecast period.

Latin America

Latin America represents a smaller share of the global Class II Biological Safety Cabinets market, at 7.15%. However, the region shows growing demand due to the expanding biotech, diagnostics, and academic research sectors. Public health awareness is increasing, and as regulatory frameworks improve, demand for biosafety cabinets in diagnostic laboratories and research institutions rises. While the region faces slower R&D investment and limited large-scale biopharmaceutical manufacturing, it still offers incremental market potential as healthcare infrastructure develops and biosafety standards gain traction.

Middle East & Africa

The Middle East & Africa region accounts for a smaller share of the global Class II Biological Safety Cabinets market, at 4.90%. Despite its smaller market size, the region is demonstrating emerging demand driven by public health initiatives and investments in healthcare infrastructure. The establishment of new laboratories and an increasing focus on improving biosafety standards in research and diagnostic facilities contribute to gradual market growth. However, the region’s adoption of Class II Biological Safety Cabinets is constrained by lower overall R&D expenditure and limited biopharma manufacturing. Still, the region offers long-term growth opportunities as infrastructure develops and regulatory frameworks strengthen.

Market Segmentations:

By Type

- Type A1

- Type A2

- Type B1

- Type B2

By Application

- Pharmaceutical and Biotechnology Companies

- Diagnostic and Testing Laboratories

- Academic and Research Institutions

- Others

By End-User

- Healthcare

- Research and Development

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The key players in the Class II Biological Safety Cabinets market include Thermo Fisher Scientific Inc., Labconco Corporation, Esco Micro Pte Ltd., The Baker Company, NuAire Inc., Germfree Laboratories Inc., Kewaunee Scientific Corporation, Air Science USA LLC, Azbil Telstar, and others. In this competitive environment, leading providers differentiate themselves through innovation in airflow control, ergonomic design, and compliance with international biosafety standards, which fosters high entry barriers. Many firms now bundle cabinets with lab furniture or integrated facility solutions, responding to demand from large biopharmaceutical and research institutions. Strategic alliances and acquisitions, such as partnerships combining containment equipment with lab furnishing, further strengthen vendor portfolios and global reach. As regulatory compliance, R&D expansion, and demand for biocontainment grow, competition remains concentrated among these established players, sustaining high margins for those who can offer certified, high-performance solutions.

Key Player Analysis

- Air Science USA LLC

- Heal Force Bio-Meditech Holdings Limited

- Thermo Fisher Scientific Inc.

- Azbil Telstar

- The Baker Company

- Germfree Laboratories Inc.

- Kewaunee Scientific Corporation

- Labconco Corporation

- Esco Micro Pte Ltd

- NuAire Inc.

Recent Developments

- In May 2025, Thermo Fisher Scientific Inc. launched its new 1500 Series Class II, Type A2 Biological Safety Cabinet featuring enhanced airflow control, ergonomic design, and a touchscreen interface for improved lab safety and user convenience.

- In November 2023, Esco Micro Pte Ltd introduced a new Class II biological safety cabinet, marking an expansion of its biosafety product offerings.

- In September 2023, Air Science USA LLC announced that its AS‑AHA‑193 Purair BIO biological safety cabinet received official certification under NSF/ANSI 49, reinforcing compliance with global safety standards.

- In August 2024, Labconco Corporation launched its redesigned Logic Biosafety Cabinet, offering an updated operating system, touchscreen controls, lower energy consumption, and quieter performance to optimize laboratory workflows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global demand for Class II biological safety cabinets is expected to grow steadily, driven by rising investments in life‑sciences research, vaccine development, and biologics manufacturing.

- Expansion of clinical diagnostics, microbiology studies, and infectious disease research—especially in response to emerging and re-emerging pathogens will increase the need for reliable containment and biosafety equipment.

- Laboratories worldwide will increasingly adopt advanced containment solutions as regulatory standards for biosafety tighten and compliance with global guidelines becomes more mandatory, prompting upgrades from older cabinet models.

- The trend toward automation and digitalization in laboratories including real‑time airflow monitoring, remote diagnostics, and IoT‑enabled systems will drive demand for “smart” Class II cabinets with advanced safety and operational features.

- Growth in emerging economies’ biotech and healthcare sectors will open new markets, particularly in Asia‑Pacific and Latin America, as governments boost public health infrastructure and research capabilities.

- Demand from academic and research institutions will rise, given the expanding emphasis on molecular biology, genetic engineering, and bioconvergence increasing the share of cabinets deployed in non-commercial research settings.

- Manufacturers will increasingly differentiate their offerings through value‑added services like maintenance, certification support, and customization creating recurring revenue streams beyond initial cabinet sales.

- Growing awareness of biosafety and contamination risk will prompt more diagnostic and clinical labs to replace older biosafety setups enlarging replacement and upgrade markets for Class II cabinets.

- As pharmaceutical firms scale vaccine and biologics output, demand for high‑containment manufacturing and downstream processes will drive procurement of high‑specification safety cabinets.

- Environmental concerns and energy‑efficiency imperatives will push innovation toward greener, lower‑power biosafety cabinets, making energy‑efficient models more desirable for cost-conscious labs and institutional buyers.

Market Segmentation Analysis:

Market Segmentation Analysis: