Market Overview

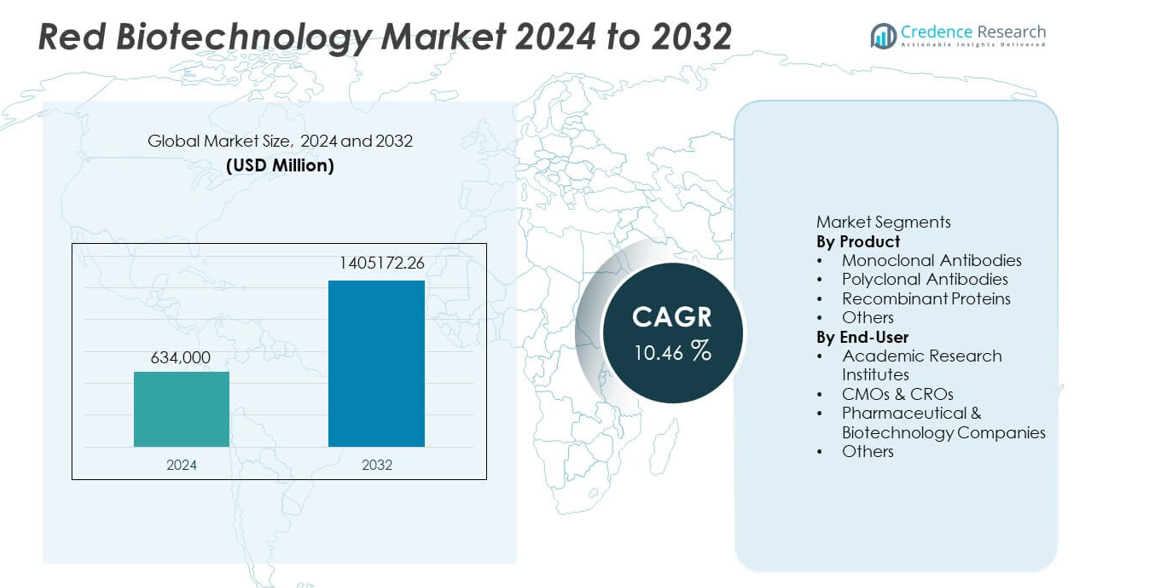

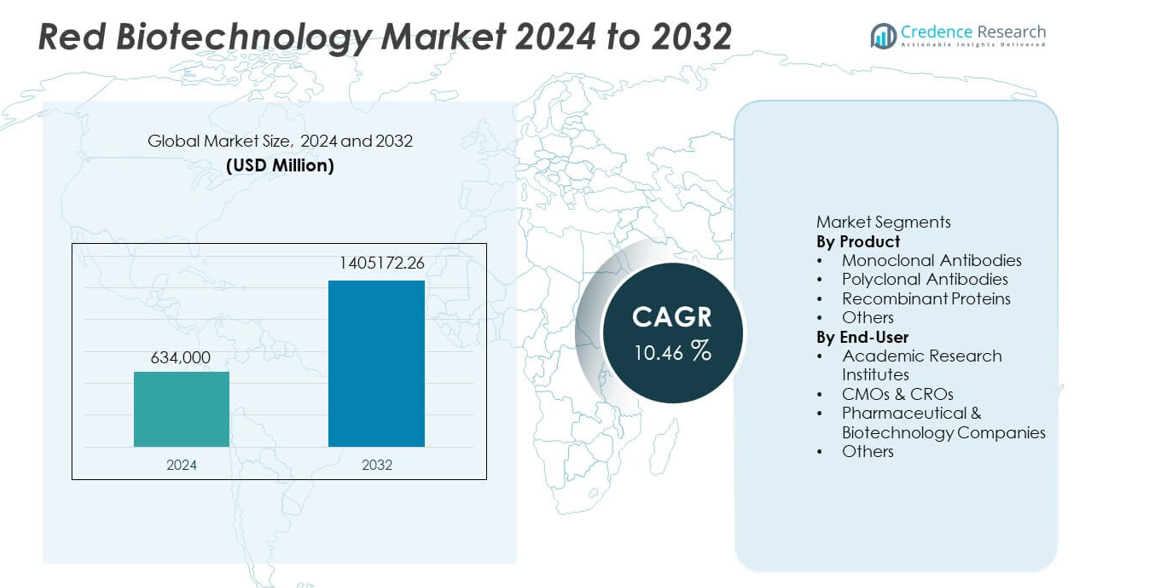

The Red Biotechnology Market was valued at USD 634,000 million in 2024 and is projected to reach USD 1,405,172.26 million by 2032, growing at a CAGR of 10.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Red Biotechnology Market Size 2024 |

USD 634,000 million |

| Red Biotechnology Market, CAGR |

10.46% |

| Red Biotechnology Market Size 2032 |

USD 1,405,172.26 million |

Top players in the Red Biotechnology market include F. Hoffmann-La Roche Ltd, Amgen Inc., Pfizer Inc., Novartis AG, Johnson & Johnson (Janssen Biotech), Merck & Co., Inc., AbbVie Inc., Bristol-Myers Squibb Company, Biogen Inc., and Eli Lilly and Company. These companies lead through strong biologics pipelines, advanced manufacturing platforms, and continuous innovation in monoclonal antibodies, recombinant proteins, and targeted therapies. Their strategic partnerships and high R&D spending support rapid development of next-generation therapeutics. North America remains the leading region with a 41% market share, driven by robust biotechnology infrastructure and high biologics adoption. Europe follows with 29%, while Asia Pacific holds 24%, supported by growing biopharmaceutical investment and rising clinical activity.

Market Insights

- The Red Biotechnology market reached USD 634,000 million in 2024 and will grow at a CAGR of 10.46% through 2032, supported by rising adoption of advanced biologics.

- Monoclonal antibodies lead the product segment with a 47% share, driven by strong demand for targeted therapies across oncology, autoimmune disorders, and infectious diseases.

- Precision medicine, gene-based therapeutics, and increased biosimilar development shape major market trends as companies expand biologics pipelines and invest in next-generation technologies.

- High development costs, complex regulatory pathways, and limited manufacturing capacity restrain growth, especially for smaller biotech firms and emerging markets.

- North America leads with a 41% share, followed by Europe at 29% and Asia Pacific at 24%, driven by strong R&D ecosystems, rising biologics adoption, and expanding clinical trial activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Monoclonal antibodies dominate the product segment with a 47% market share, driven by their extensive use in targeted therapies across oncology, autoimmune disorders, and infectious diseases. Advancements in antibody engineering and rising approvals for biologic drugs accelerate adoption. Recombinant proteins also experience strong demand due to their role in enzyme replacement therapies, vaccines, and advanced research applications. Polyclonal antibodies retain relevance in diagnostics and early-stage research but hold a smaller share. Continuous innovation in biologics manufacturing and increasing investments in precision medicine further strengthen the lead of monoclonal antibodies within the red biotechnology market.

- For instance, Amgen expanded its recombinant protein capabilities by scaling its next-generation biomanufacturing facility to produce over 10 biologic molecules using optimized Chinese Hamster Ovary (CHO) systems with yields reaching 13 grams per liter.

By End-User

Pharmaceutical and biotechnology companies lead the end-user segment with a 52% market share, supported by large-scale investment in drug discovery, biologics development, and commercialization of advanced therapies. These companies drive high demand for monoclonal antibodies, recombinant proteins, and cell-based products. CMOs and CROs expand rapidly as firms outsource specialized production and research functions to improve efficiency and reduce development timelines. Academic institutes contribute significantly through early-stage research and innovation but maintain a smaller share. Growing clinical activity, rising R&D spending, and increasing biologics pipelines continue to reinforce the dominance of pharmaceutical and biotech companies.

- For instance, Samsung Biologics increased its contract manufacturing output to a total bioreactor capacity of 784,000 liters, enabling production of more than 20 commercial biologic products each year.

Key Growth Drivers

Rising Prevalence of Chronic and Genetic Diseases

The growing burden of cancer, autoimmune disorders, and genetic conditions drives strong demand for advanced biologics developed through red biotechnology. Monoclonal antibodies, recombinant proteins, and gene-based therapies offer high precision and improved patient outcomes. Increasing adoption of targeted and personalized treatment approaches further accelerates market expansion. Governments and private organizations invest heavily in R&D to improve therapeutic capabilities and address unmet clinical needs. This rising global disease load continues to push healthcare systems toward biotechnology-driven interventions.

- For instance, Novartis advanced precision treatment through its CAR-T therapy manufacturing network, producing individualized cell-therapy doses using advanced processes across its global facilities.

Expansion of Biopharmaceutical R&D and Product Pipelines

Pharmaceutical and biotechnology companies significantly expand their research pipelines to accelerate biologics, biosimilars, and gene-based therapy development. Higher R&D spending supports innovation in antibody engineering, protein therapeutics, and cell-based technologies. The rapid increase in clinical trials for biologics strengthens market momentum. Strategic collaborations between pharma companies, CMOs, and academic institutes improve development efficiency and reduce time to market. This expanding innovation ecosystem continues to fuel long-term growth in red biotechnology.

- For instance, Eli Lilly advanced antibody engineering by integrating its high-capacity screening platform to evaluate a vast range of antibody variants and identify high-affinity candidates.

Advancements in Bioprocessing and Manufacturing Technologies

Technological progress in upstream and downstream bioprocessing enhances production efficiency, scalability, and quality of biologics. Single-use systems, high-throughput screening, and improved purification methods reduce operational costs and accelerate manufacturing cycles. These innovations enable large-scale production of monoclonal antibodies and recombinant proteins with higher purity and consistency. Automation and AI-driven process optimization further strengthen productivity for both commercial and clinical applications. Such advancements make biotechnology more accessible and commercially viable.

Key Trends & Opportunities

Growth of Personalized and Precision Medicine

Personalized medicine continues to shape the red biotechnology market as treatments are increasingly tailored to genetic and molecular profiles. Advances in genomics, biomarker discovery, and companion diagnostics enable more selective therapeutic approaches. Companies invest in developing targeted biologics, immunotherapies, and gene-based drugs that offer improved efficacy and reduced adverse effects. This trend creates strong opportunities for innovation across diagnostics, drug development, and clinical research. Rising adoption of precision medicine models fuels sustained demand for advanced biotechnological solutions.

- For instance, Illumina strengthened precision medicine by enabling massive sequencing capacity through its NovaSeq platform, supporting large-scale genomic profiling for targeted therapies.

Increasing Commercialization of Biosimilars and Biobetters

Biosimilars gain traction as patents for major biologics expire, creating opportunities for cost-effective alternatives. Manufacturers invest in high-quality biosimilar development to expand access to monoclonal antibodies and therapeutic proteins. Biobetters, offering enhanced efficacy or reduced toxicity, further expand market potential. Regulatory agencies streamline approval pathways to support biosimilar commercialization, encouraging global adoption. Growing healthcare cost pressures and demand for affordable biologics continue to drive this trend.

- For instance, Biocon Biologics strengthened biobetter development through its insulin analog program, producing recombinant insulin doses annually using high-efficiency microbial fermentation systems.

Key Challenges

High Development Costs and Complex Regulatory Requirements

Biologic drug development requires substantial investment, long timelines, and adherence to strict regulatory standards. Complex manufacturing processes, quality assurance requirements, and clinical validation increase overall costs. Smaller companies struggle to enter the market due to high capital needs. Regulatory agencies mandate extensive safety and efficacy data, slowing approvals and raising compliance burdens. These factors create financial and operational challenges for industry participants.

Limited Manufacturing Capacity and Supply Chain Constraints

Production of biologics demands specialized facilities, skilled personnel, and controlled environments, leading to capacity shortages in several regions. Supply chain disruptions impact availability of raw materials, reagents, and single-use bioprocessing components. Increasing global demand for monoclonal antibodies and recombinant proteins intensifies pressure on existing manufacturing networks. Companies face challenges in scaling production while maintaining quality and consistency. Expanding biomanufacturing infrastructure remains essential to address these constraints.

Regional Analysis

North America

North America holds a 41% market share, driven by strong biopharmaceutical R&D activity, high adoption of monoclonal antibodies, and rapid advancements in gene and cell therapies. The region benefits from robust funding, well-established biotechnology companies, and supportive regulatory pathways that accelerate clinical development. Leading universities and research institutes contribute significantly to innovation through collaborations with biotech firms. High healthcare spending and strong demand for advanced biologics continue to support market expansion. Growing investment in personalized medicine and next-generation therapeutics further strengthens the region’s leadership in red biotechnology.

Europe

Europe accounts for a 29% market share, supported by strong biotechnology research infrastructure, rising biologics production, and increasing demand for targeted therapies. The region benefits from government-backed R&D initiatives and a high presence of biopharmaceutical companies specializing in monoclonal antibodies and recombinant proteins. Strict regulatory standards promote high-quality development while also encouraging investments in biosimilars and advanced therapies. Countries such as Germany, the U.K., and France lead clinical innovation through strong academic–industry collaborations. Growing focus on precision medicine and improved reimbursement frameworks strengthens long-term market growth in the region.

Asia Pacific

Asia Pacific holds a 24% market share, driven by rapid expansion of biopharmaceutical manufacturing, rising healthcare investment, and increasing adoption of biologics. Countries such as China, India, South Korea, and Japan actively expand biotechnology capabilities through government incentives, R&D funding, and infrastructure development. The region becomes a major hub for biosimilar production and contract manufacturing services due to cost-efficient capabilities. Growing diagnostic advancements and widespread demand for targeted therapies further boost market expansion. Rising incidence of chronic diseases and increasing clinical trial activity strengthen the region’s growth trajectory.

Latin America

Latin America holds a 4% market share, influenced by gradual adoption of advanced biologics and expanding healthcare infrastructure. Brazil, Mexico, and Argentina lead regional demand due to growing investments in diagnostics, oncology treatments, and biotechnology research partnerships. Limited local manufacturing capacity drives reliance on imported biologics, yet biosimilar adoption continues to rise due to cost advantages. Government initiatives to expand access to biologic therapies support market penetration. Increasing collaboration with global pharmaceutical companies boosts R&D activity and technology transfer efforts across the region.

Middle East & Africa

The Middle East & Africa region captures a 2% market share, driven by rising prevalence of chronic diseases and growing investment in healthcare modernization. GCC countries expand biopharmaceutical capabilities through research funding and partnerships with global biotech firms. Demand for monoclonal antibodies and recombinant therapies increases as access to advanced treatments improves. Africa’s growth remains slower due to limited infrastructure, though efforts to enhance diagnostic capacity and biosimilar availability continue to strengthen adoption. Long-term market growth depends on improved clinical capabilities and increased investment in biotechnology research.

Market Segmentations:

By Product

- Monoclonal Antibodies

- Polyclonal Antibodies

- Recombinant Proteins

- Others

By End-User

- Academic Research Institutes

- CMOs & CROs

- Pharmaceutical & Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes leading companies such as F. Hoffmann-La Roche Ltd, Amgen Inc., Pfizer Inc., Novartis AG, Johnson & Johnson (Janssen Biotech), Merck & Co., Inc., AbbVie Inc., Bristol-Myers Squibb Company, Biogen Inc., and Eli Lilly and Company. These players maintain strong market positions through extensive biologics pipelines, large-scale R&D investments, and continuous innovation in monoclonal antibodies, recombinant proteins, and advanced therapies. Strategic collaborations with CMOs, CROs, and academic institutes accelerate development timelines and expand clinical capabilities. Companies strengthen competitiveness by advancing immunotherapies, gene-editing technologies, and personalized medicine solutions. Strong global distribution networks and regulatory expertise support rapid commercialization of new biologics. As demand for targeted and precision therapies grows, competition intensifies across oncology, autoimmune disorders, and genetic disease segments, driving ongoing innovation and expansion within the red biotechnology market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hoffmann-La Roche Ltd

- Amgen Inc.

- Pfizer Inc.

- Novartis AG

- Johnson & Johnson (Janssen Biotech)

- Merck & Co., Inc.

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Biogen Inc.

- Eli Lilly and Company

Recent Developments

- In November 2025, AbbVie Inc. received U.S. FDA approval for EPKINLY (epcoritamab-bysp) in combination with rituximab and lenalidomide for relapsed or refractory follicular lymphoma.

- In April 2025, Pfizer Inc. announced it will showcase data from its pipeline of potential breakthrough cancer medicines at the 2025 American Society of Clinical Oncology Annual Meeting (ASCO) in Chicago.

- In 2025, Amgen Inc. received full FDA approval for Imdelltra in extensive-stage small cell lung cancer, widening its biologic therapy offerings

Report Coverage

The research report offers an in-depth analysis based on Product, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for targeted biologics and precision therapies will rise across major disease areas.

- Gene editing and gene therapy advancements will expand treatment options for rare and genetic disorders.

- Biosimilar adoption will grow as more biologic patents expire and affordability becomes a priority.

- Monoclonal antibody innovation will accelerate with enhanced engineering and improved therapeutic specificity.

- Bioprocessing automation and single-use technologies will improve manufacturing efficiency and scalability.

- Partnerships between pharma companies, CMOs, and academic institutes will increase to speed up development.

- Personalized medicine programs will expand as biomarker discovery and diagnostic tools advance.

- Investment in immunotherapy research will strengthen pipelines across oncology and autoimmune diseases.

- Digital tools and AI-driven platforms will support faster drug discovery and clinical decision-making.

- Expansion of biomanufacturing capacity in emerging regions will increase global access to advanced biologics.