Market Overview:

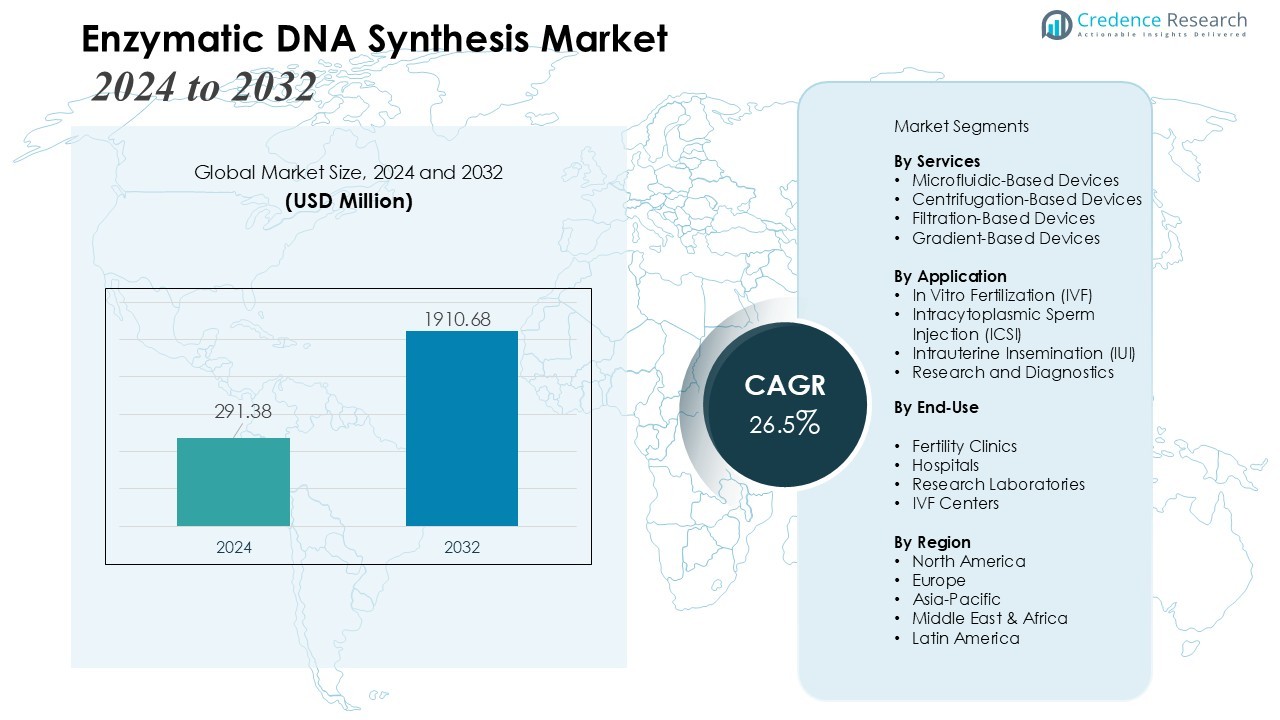

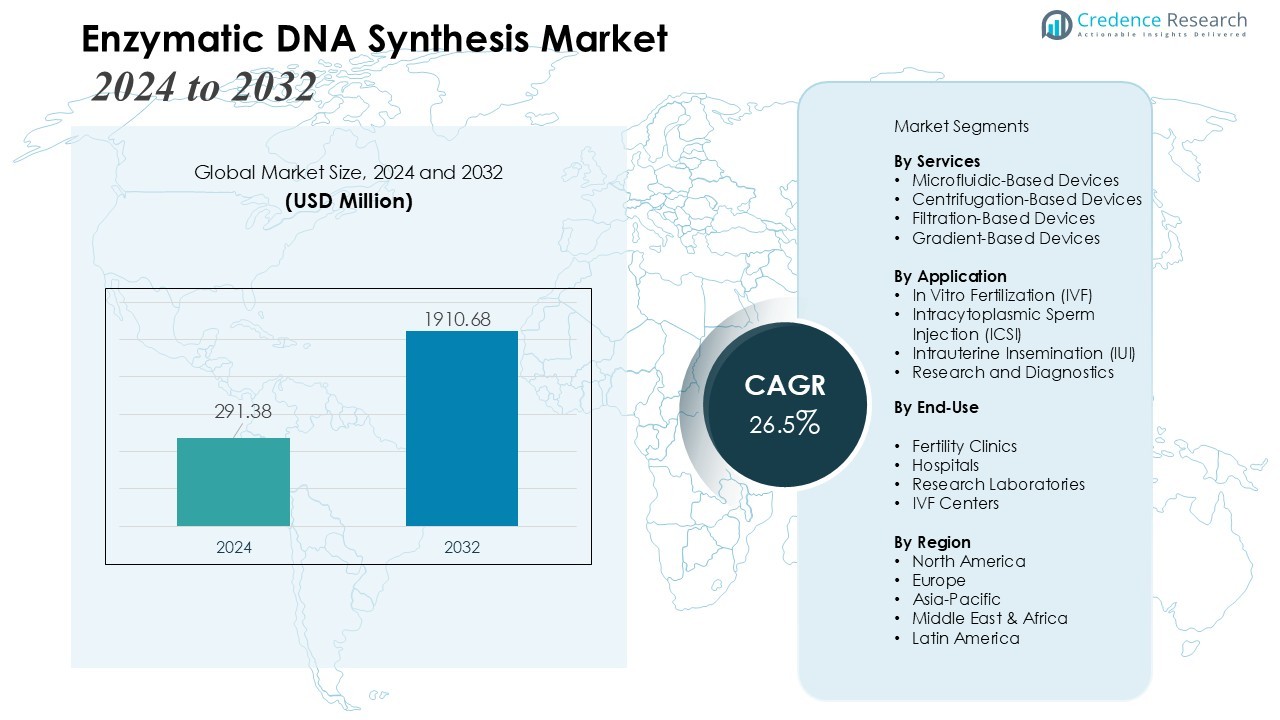

The Enzymatic DNA Synthesis Market size was valued at USD 291.38 million in 2024 and is anticipated to reach USD 1910.68 million by 2032, at a CAGR of 26.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enzymatic DNA Synthesis Market Size 2024 |

USD 291.38 Million |

| Enzymatic DNA Synthesis Market, CAGR |

26.5% |

| Enzymatic DNA Synthesis Market Size 2032 |

USD 1910.68 Million |

Key market drivers include rising investments in biopharmaceutical R&D, growing adoption of precision medicine, and the need for high-fidelity DNA synthesis in vaccine development and personalized therapeutics. Technological advancements in enzymatic synthesis, including improved polymerases and automated platforms, further accelerate market expansion. The shift toward sustainable and scalable DNA production methods is also contributing to broader adoption across research and clinical applications.

Regionally, North America dominates the market due to advanced research infrastructure, well-established biotech and pharmaceutical industries, and substantial government and private funding. Asia-Pacific is expected to witness the fastest growth, supported by increasing investments in biotechnology, expanding genomic research, and rising demand for synthetic biology applications. Europe and other regions show steady growth, driven by regulatory support for innovation and expansion of academic and commercial research initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global Enzymatic DNA Synthesis Market was valued at USD 291 million in 2024 and is expected to reach USD 1,911 million by 2032, growing at a CAGR of 26.5% during the forecast period.

- Rising investments in biopharmaceutical research and development drive demand for high-quality synthetic DNA across drug discovery, gene therapy, and vaccine development pipelines.

- The growing adoption of precision medicine and personalized therapeutics boosts the market, as it supports patient-specific treatments and tailored vaccine production.

- Technological advancements, including improved polymerases and automated synthesis platforms, enhance production efficiency, reduce errors, and enable high-throughput applications.

- Increasing focus on sustainable and scalable DNA production encourages broader adoption in academic, clinical, and commercial research sectors worldwide.

- North America dominates the market with 50% share due to advanced research infrastructure, strong biotech industries, and substantial government and private funding.

- Asia-Pacific shows the fastest growth potential with 18% market share, driven by expanding biotechnology investments, growing genomic research, and rising demand for synthetic biology applications, while Europe holds 24% share with steady growth supported by regulatory initiatives and collaborative research.

Market Drivers:

Market Drivers:

Expansion of Synthetic Biology and Genomic Research Applications

The growth of synthetic biology and genomic research significantly drives the Enzymatic DNA Synthesis Market. Researchers require accurate, high-fidelity DNA sequences to develop synthetic genes, study complex biological pathways, and advance functional genomics. It enables rapid design and construction of customized DNA, reducing errors and increasing experimental efficiency. Rising demand for engineered biological systems in pharmaceuticals and industrial biotechnology contributes to its adoption. The market benefits from continuous investment in laboratory infrastructure and advanced genomic tools.

- For instance, Twist Bioscience achieved synthesis of DNA sequences up to 1,200 bases long (and longer) using an initial chemical (phosphoramidite) method on a silicon chip to create oligonucleotides, which were then assembled and error-corrected using enzymatic reactions to produce the final gene fragments.

Rising Demand for Precision Medicine and Personalized Therapeutics

Precision medicine and personalized therapeutics create substantial opportunities for enzymatic DNA synthesis technologies. It supports the development of patient-specific treatments, gene therapies, and tailored vaccines, which require precise and reliable DNA sequences. Pharmaceutical companies increasingly rely on enzymatic synthesis to accelerate drug discovery and reduce production timelines. Growing awareness of individualized healthcare solutions fuels adoption across hospitals, research centers, and biotech firms. This trend emphasizes innovation in DNA synthesis to meet clinical and commercial requirements.

Technological Advancements Enhancing Efficiency and Accuracy

Advancements in enzymatic synthesis platforms, including improved polymerases and automated systems, enhance efficiency and accuracy. It enables faster production of oligonucleotides and synthetic genes while reducing environmental waste compared to traditional chemical methods. These innovations allow researchers to scale DNA production for high-throughput applications and complex experiments. Companies continue to invest in developing novel enzymatic approaches that increase yield and reduce synthesis errors. Such technological progress strengthens market growth by offering cost-effective and reliable solutions.

- For instance, DNA Script’s enzymatic platform synthesizes DNA oligonucleotides much faster than 18 bases per hour (e.g., producing 20-mers in about 6 hours or 60-mers in around 13 hours).

Increasing Biopharmaceutical R&D Investments Across Key Regions

Rising biopharmaceutical research and development investments propel the Enzymatic DNA Synthesis Market. It supports drug discovery, gene therapy, and vaccine development pipelines that require high-quality synthetic DNA. North America maintains leadership due to strong funding and well-established biotech industries, while Asia-Pacific shows rapid adoption fueled by expanding research facilities and government support. The market benefits from collaboration between academic institutions and commercial biotech companies to accelerate innovation. These investments provide a stable foundation for sustained market growth.

Market Trends:

Adoption of High-Throughput and Automated Enzymatic DNA Synthesis Platforms

The Enzymatic DNA Synthesis Market is witnessing a strong trend toward high-throughput and automated synthesis platforms. It enables researchers to produce large volumes of oligonucleotides and synthetic genes with consistent quality and minimal manual intervention. Laboratories increasingly integrate automated systems to reduce operational costs and accelerate research timelines. Companies focus on developing platforms that offer enhanced precision, scalability, and compatibility with downstream applications. The trend reflects growing demand for reliable, rapid, and scalable DNA synthesis solutions across pharmaceutical, biotechnology, and academic sectors. Integration with digital tools and bioinformatics further improves design accuracy and process efficiency.

- For instance Ansa Biotechnologies demonstrated direct synthesis of DNA molecules exceeding 1,000 bases long using TdT-dNTP conjugates.

Expansion of Synthetic Biology, Gene Therapy, and Personalized Medicine Applications

Enzymatic DNA synthesis is becoming a critical tool for synthetic biology, gene therapy, and personalized medicine initiatives. It supports the creation of custom DNA sequences for novel therapeutic development, vaccines, and complex genetic research. The trend includes partnerships between biotech firms and academic institutions to leverage expertise and accelerate innovation. It enables cost-effective production of long DNA fragments and complex gene constructs that were challenging with chemical synthesis. Growing adoption in emerging markets reflects increased funding for genomic research and biotechnology infrastructure. The market trends indicate that demand will continue to rise due to the need for rapid, accurate, and flexible DNA synthesis technologies to support evolving scientific and clinical applications.

- For instance, DNA Script synthesized a 150-base DNA strand of defined sequence using enzymatic methods.

Market Challenges Analysis:

High Cost and Technical Complexity of Enzymatic DNA Synthesis Technologies

The Enzymatic DNA Synthesis Market faces challenges due to the high cost and technical complexity of its platforms. It requires specialized enzymes, precision instruments, and skilled personnel, which increase operational expenses. Small and medium-sized laboratories may struggle to adopt these technologies due to limited budgets and resource constraints. The complexity of maintaining high fidelity and consistent quality in long DNA sequences further limits widespread implementation. Companies continue to invest in reducing costs, but initial capital and operational requirements remain significant barriers.

Regulatory Uncertainty and Limitations in Long-Fragment Synthesis

Regulatory uncertainty and technical limitations in synthesizing long DNA fragments restrict market growth. It faces scrutiny due to potential biosecurity risks and ethical concerns related to synthetic biology and gene manipulation. Strict regulations in different regions can delay approvals and complicate commercial adoption. Technical challenges in producing extremely long or complex sequences without errors reduce efficiency and restrict applications. These factors require continuous innovation and compliance strategies to overcome market barriers and enable broader adoption.

Market Opportunities:

Expansion of Gene Therapy and Personalized Medicine Applications

The Enzymatic DNA Synthesis Market presents significant opportunities through the growth of gene therapy and personalized medicine. It enables precise production of custom DNA sequences required for patient-specific treatments, vaccines, and therapeutic development. Pharmaceutical and biotechnology companies increasingly adopt enzymatic synthesis to accelerate research pipelines and reduce time-to-market. Rising investments in genomic research and targeted therapies further support demand. Emerging applications in regenerative medicine and rare genetic disorder treatments create additional avenues for adoption. Collaboration between academic institutions and commercial entities strengthens innovation and product development.

Emerging Markets and Increasing Biotech Infrastructure Investments

Emerging markets provide substantial growth potential for enzymatic DNA synthesis technologies. It benefits from rising investments in biotechnology infrastructure, research facilities, and life sciences education in regions such as Asia-Pacific and Latin America. Governments promote innovation through grants, incentives, and partnerships that encourage adoption of advanced DNA synthesis methods. Expanding academic and commercial research programs in synthetic biology, vaccine development, and industrial biotechnology offer new revenue streams. Market players focusing on cost-effective, scalable solutions can capture opportunities in these fast-growing regions. Increasing global demand for sustainable and efficient DNA synthesis methods reinforces long-term growth potential.

Market Segmentation Analysis:

By Services

The Enzymatic DNA Synthesis Market offers diverse services, including custom DNA synthesis, oligonucleotide production, and gene assembly solutions. It enables researchers and pharmaceutical companies to obtain precise and high-fidelity DNA sequences tailored to experimental or therapeutic needs. Custom DNA synthesis dominates the market due to demand for patient-specific treatments, vaccine development, and synthetic biology applications. Oligonucleotide production supports high-throughput screening and functional genomics studies. Companies continue to expand service portfolios to enhance efficiency, accuracy, and turnaround times, meeting the growing requirements of research and clinical laboratories.

- For instance, Camena Bioscience achieved enzymatic synthesis of a 2.7-kb (kilobase pair) plasmid in 2020 using its proprietary gSynth™ platform.

By Application

Applications in synthetic biology, gene therapy, vaccine development, and functional genomics drive the Enzymatic DNA Synthesis Market. It allows researchers to construct complex gene sequences and study biological pathways with improved accuracy and scalability. Synthetic biology and industrial biotechnology contribute significantly to market growth due to engineered biological system development. Gene therapy and personalized medicine applications increasingly rely on enzymatic synthesis to produce precise DNA constructs efficiently. The market benefits from continuous innovation in enzymatic platforms that reduce errors and accelerate experimental timelines.

- For instance, DNA Script’s enzymatic platform (the benchtop Syntax system) achieves synthesis of DNA sequences up to 120 nucleotides (nt) long for in-lab use

By End-Use

The market serves pharmaceutical and biotechnology companies, academic and research institutions, and clinical laboratories. It supports drug discovery, genomic research, and therapeutic development across these sectors. Pharmaceutical and biotech companies lead adoption due to investments in R&D and the need for high-quality DNA for vaccines, therapeutics, and diagnostics. Academic institutions leverage enzymatic synthesis for fundamental research and synthetic biology projects. Clinical laboratories increasingly utilize these solutions to support diagnostic tests and personalized treatment strategies. Continuous expansion of end-use applications reinforces market growth globally.

Segmentations:

By Services

- Custom DNA Synthesis

- Oligonucleotide Production

- Gene Assembly Solutions

By Application

- Synthetic Biology

- Gene Therapy

- Vaccine Development

- Functional Genomics

- Industrial Biotechnology

By End-Use

- Pharmaceutical Companies

- Biotechnology Companies

- Academic and Research Institutions

- Clinical Laboratories

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Maintains Leadership Driven by Advanced Research Infrastructure

North America holds 50% of the global enzymatic DNA synthesis market in 2024, maintaining its position as the largest regional contributor. The region’s dominance is supported by strong biotechnology and pharmaceutical industries with substantial government and private funding. It benefits from leading universities and research institutions driving adoption of high-throughput enzymatic synthesis platforms. Companies focus on technological innovation, expanding product portfolios, and strategic collaborations. Demand for precision medicine and personalized therapeutics further reinforces market growth. The presence of major market players ensures sustained leadership in the global market.

Europe Shows Steady Growth Fueled by Regulatory Support and Research Collaborations

Europe accounts for 24% of the global enzymatic DNA synthesis market in 2024, demonstrating consistent growth. The region benefits from regulatory frameworks that encourage biotechnology innovation and commercialization of enzymatic DNA synthesis applications in pharmaceuticals, academic research, and industrial biotechnology. It leverages collaborative initiatives between research institutions and biotech firms to accelerate product development and enhance technological capabilities. Investment in laboratory infrastructure and genomic research programs supports steady adoption. The region’s focus on gene therapy and synthetic biology strengthens its market position. Cross-border partnerships and funding programs also foster innovation across key European markets.

Asia-Pacific Emerges as a High-Growth Region with Expanding Biotech Investments

Asia-Pacific contributes 18% to the global enzymatic DNA synthesis market in 2024, reflecting rapid growth potential. The region benefits from increasing investments in biotechnology infrastructure, life sciences research, and educational programs. It leverages government grants, incentives, and strategic partnerships to encourage adoption of advanced DNA synthesis technologies. Rising demand for gene therapy, vaccine development, and synthetic biology applications accelerates market penetration. Collaborations between local biotech companies and global players strengthen technological capabilities. Expanding research activities and infrastructure position Asia-Pacific as a key growth opportunity for global market participants.

Key Player Analysis:

- Telesis Bio Inc.

- Twist Bioscience Corporation

- GenScript Biotech Corp.

- Evonetix

- Ansa Biotechnologies, Inc.

- Camena Bio

- Molecular Assemblies

- DNA Script

- Touchlight

- Kern Systems

Competitive Analysis:

The Enzymatic DNA Synthesis Market is highly competitive, with leading players focusing on innovation, strategic partnerships, and expansion of service portfolios. It includes companies offering custom DNA synthesis, oligonucleotide production, and gene assembly solutions with high accuracy and scalability. Key market participants emphasize research and development to improve enzymatic platforms, enhance synthesis efficiency, and reduce operational costs. Companies also engage in collaborations with academic institutions and biotechnology firms to strengthen technological capabilities and accelerate product development. North American and European players dominate the market due to established infrastructure and funding, while emerging companies in Asia-Pacific focus on expanding regional presence and capturing high-growth opportunities. Competitive strategies include mergers, acquisitions, and licensing agreements to secure intellectual property and expand market reach. Continuous technological innovation and focus on high-fidelity DNA production maintain strong differentiation among market participants.

Recent Developments:

- In May 2025, Telesis Bio Inc. announced a licensing agreement with Regeneron Pharmaceuticals to deploy its Gibson SOLA platform for rapid on-site DNA and gene synthesis at Regeneron’s R&D facilities.

- In August 2025, GenScript Biotech Corp. announced a strategic collaboration with Bioelectronica to accelerate antibody discovery using single B-cell screening and gene synthesis services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Services, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of gene therapy and personalized medicine applications will continue to drive adoption of enzymatic DNA synthesis technologies.

- Integration of automated and high-throughput synthesis platforms will enhance research efficiency and reduce turnaround times.

- Advancements in polymerase enzymes and enzymatic chemistry will improve synthesis accuracy and enable production of longer DNA sequences.

- Growing demand for synthetic biology and industrial biotechnology applications will create new opportunities across pharmaceuticals and research sectors.

- Collaboration between biotechnology companies and academic institutions will accelerate innovation and commercialization of novel DNA synthesis solutions.

- Emerging markets will experience significant growth due to increasing investments in biotechnology infrastructure and life sciences research.

- Development of cost-effective and scalable enzymatic DNA synthesis methods will make technology accessible to smaller laboratories and research centers.

- Regulatory frameworks supporting synthetic biology and genomic research will encourage broader adoption globally.

- Continuous focus on sustainable and environmentally friendly DNA synthesis methods will strengthen market appeal.

- Expansion of applications in vaccine development, diagnostics, and functional genomics will reinforce long-term market potential.

Market Drivers:

Market Drivers: