Market Overview

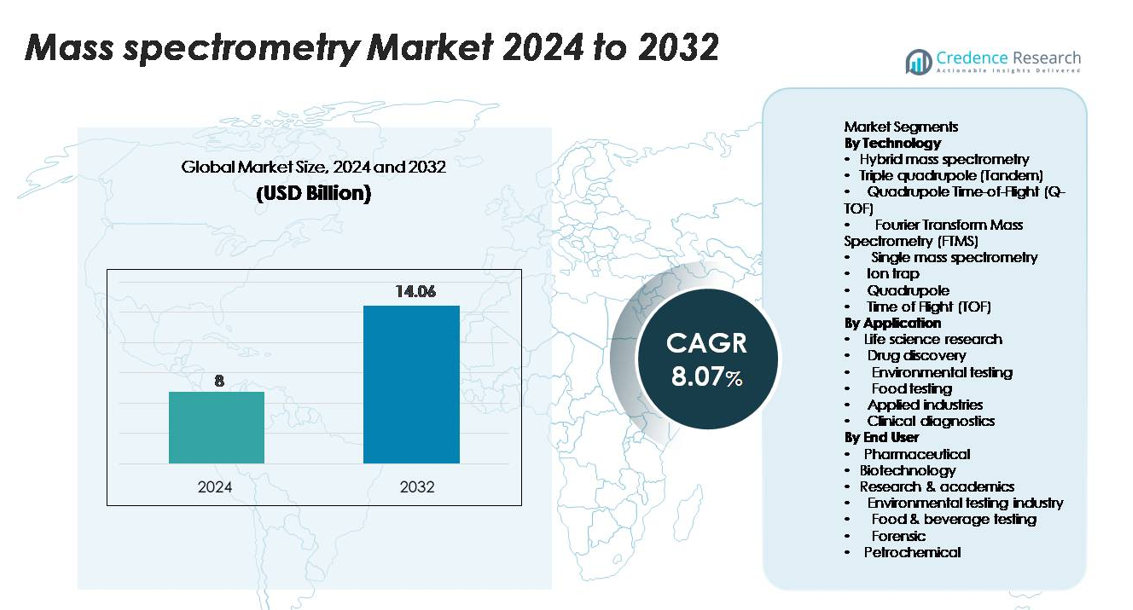

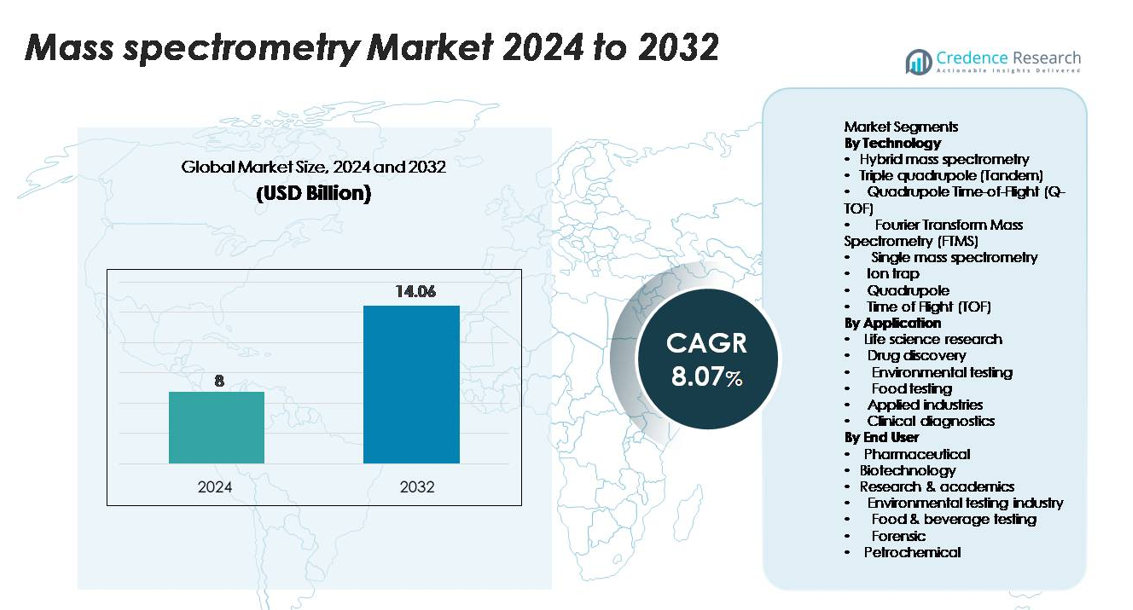

The mass spectrometry market was valued at USD 8 billion in 2024 and is projected to reach USD 14.06 billion by 2032, registering a CAGR of 8.07% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mass Spectrometry Market Size 2024 |

USD 8 billion |

| Mass Spectrometry Market, CAGR |

8.07% |

| Mass Spectrometry Market Size 2032 |

USD 14.06 billion |

Major players in the mass spectrometry market include Thermo Fisher Scientific, Agilent Technologies, Bruker Corporation, Shimadzu Corporation, Waters Corporation, and PerkinElmer, each advancing high-resolution and hybrid MS technologies for pharmaceutical, clinical, and environmental applications. Thermo Fisher and Agilent lead with strong portfolios in LC-MS/MS and hybrid systems, while Bruker and Shimadzu strengthen global adoption through innovations in FTMS and TOF platforms. Regionally, North America dominates with around 38% market share, supported by extensive biopharmaceutical research and advanced analytical infrastructure, followed by Europe with approximately 29%, driven by strict regulatory requirements in environmental and food safety testing.

Market Insights

- The mass spectrometry market was valued at USD 8 billion in 2024 and is projected to reach USD 14.06 billion by 2032, growing at a CAGR of 8.07% during the forecast period.

- Strong market growth is driven by expanding applications in proteomics, metabolomics, drug discovery, and clinical diagnostics, with hybrid mass spectrometry emerging as the largest technology segment due to its superior accuracy and sensitivity.

- Key trends include rising adoption of MS-based clinical testing, integration of AI-driven data analysis, and increased regulatory emphasis on contaminant detection in food and environmental testing.

- The competitive landscape is led by Thermo Fisher Scientific, Agilent Technologies, Bruker Corporation, Waters Corporation, and Shimadzu, each advancing high-resolution and hybrid MS platforms to strengthen global market presence.

- Regionally, North America holds around 38%, followed by Europe at 29% and Asia-Pacific at 23%, reflecting strong biotechnology investment and increasing multi-omics research adoption across key markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology:

Hybrid mass spectrometry dominates the technology segment, accounting for the largest market share due to its high resolution, sensitivity, and suitability for complex analyses in proteomics and metabolomics. Triple quadrupole and Q-TOF systems also show strong adoption in targeted quantification and high-speed screening, particularly in regulated industries. FTMS continues to grow in advanced research settings because of its ultra-high mass accuracy. Demand across ion trap, quadrupole, and TOF systems remains steady as laboratories balance cost, throughput needs, and analytical precision. Increasing use of hybrid instruments in biomarker discovery, biopharmaceutical characterization, and high-end analytical workflows drives segment growth.

- For instance, Thermo Fisher’s Orbitrap Eclipse Tribrid Mass Spectrometer achieves a resolving power of 1,000,000 (FWHM) at m/z 200 and delivers mass accuracy below 1 ppm, enabling high-confidence identification in large-scale proteomics.

By Application:

Life science research represents the dominant application segment, holding the highest market share as mass spectrometry becomes indispensable for proteomics, genomics, and metabolomics studies. Drug discovery follows closely, driven by expanding adoption in pharmacokinetics, impurity profiling, and structural elucidation. Environmental testing and food testing segments continue to grow, supported by stricter residue and contaminant regulations. Applied industries and clinical diagnostics gain momentum as mass spectrometry-based assays advance in speed and clinical readiness. The rising focus on precision medicine and molecular-level characterization further accelerates demand across research and clinical ecosystems.

- For instance, Thermo Fisher’s Orbitrap Ascend system enables identification of more than 8,000 human proteins in a single 24-hour run, supporting deep proteome mapping.

By End User:

Pharmaceutical companies lead the end-user segment, contributing the largest market share due to substantial investment in quality control, biologics analysis, and regulatory-driven testing. Biotechnology firms increasingly adopt advanced MS systems for complex biomolecule characterization, supporting rapid expansion of the segment. Research and academic institutions remain major contributors, driven by continuous funding for high-resolution analytical platforms. Environmental testing, food and beverage testing, forensic laboratories, and petrochemical industries show consistent uptake as mass spectrometry enables compliance with global safety, purity, and emissions standards. Growing reliance on high-precision instrumentation across regulated industries continues to strengthen demand.

Key Growth Drivers

Rising Adoption in Proteomics, Metabolomics, and Life Science Research

The increasing emphasis on molecular-level understanding in proteomics and metabolomics serves as a major growth driver for the mass spectrometry market. Advanced research laboratories and academic institutes are investing heavily in high-resolution MS systems to enable precise biomolecule identification, post-translational modification analysis, and pathway mapping. Pharmaceutical research relies on mass spectrometry to analyze protein structures, characterize biological drug candidates, and detect micro-level molecular changes that traditional analytical tools cannot capture. Additionally, the global rise in chronic and lifestyle diseases has accelerated demand for detailed biomarker research, where MS techniques play a central role. The growth of multi-omics workflows, integration of MS with chromatography and automation, and increasing funding for biomedical innovation continue to propel adoption across high-end research environments.

- For instance, Bruker’s timsTOF Pro 2 enables acquisition speeds of up to 200 Hz and routinely identifies more than 7,000 human proteins in a single LC-MS run, supporting deep-coverage proteomics workflows.

Expanding Use Across Regulated Industries Including Pharmaceuticals and Environmental Testing

Regulated industries increasingly rely on mass spectrometry for high-precision testing, purity validation, and compliance with global safety standards. In pharmaceuticals, MS supports impurity profiling, pharmacokinetics, active ingredient quantification, and biologics characterization, making it indispensable in drug development pipelines. Environmental agencies employ MS for detecting pesticides, heavy metals, volatile organic compounds, and emerging contaminants at extremely low detection limits. The food and beverage sector uses MS to validate residue-free production, ensuring compliance with international safety norms. As regulations tighten globally, industries are compelled to adopt advanced MS tools for consistent accuracy, traceability, and reproducibility. This regulatory-driven expansion remains a strong catalyst for sustained market growth.

- For instance, Waters’ Xevo TQ-XS achieves instrument detection limits below 0.1 fg for steroid impurities, enabling ultra-trace impurity profiling in pharmaceutical quality control.

Technological Advancements Enhancing Accuracy, Speed, and Workflow Integration

Continuous innovation in mass spectrometry platforms significantly contributes to market expansion. New hybrid MS systems offer enhanced mass accuracy, higher sensitivity, and improved fragmentation capabilities, catering to complex analytical workflows. Automation, AI-assisted data processing, and cloud-based integration reduce manual interpretation and accelerate throughput. Advancements in ion mobility spectrometry, real-time data acquisition, microfluidic interfaces, and compact benchtop instruments further improve accessibility and performance. Integration with advanced chromatography systems and emergence of triple quadrupole and Q-TOF instruments with superior speed enhances usability in both qualitative and quantitative applications. These technological improvements reduce operational complexity, expand application scope, and strengthen the role of MS in modern analytical laboratories.

Key Trends & Opportunities

Growing Shift Toward Clinical Diagnostics and Precision Medicine Applications

Clinical diagnostics is emerging as one of the most promising growth frontiers for the mass spectrometry market. Increasing demand for highly accurate, rapid, and quantitative testing in immunoassays, therapeutic drug monitoring, and disease biomarker detection is driving MS integration into hospital laboratories. Advances in LC-MS/MS instruments have made clinical workflows more streamlined, automated, and compliant with regulatory requirements. The rise of precision medicine—supported by genomic, proteomic, and metabolomic data—creates substantial opportunities for MS-based assays. As healthcare providers move toward individualized treatment strategies, MS instruments offer unmatched specificity and sensitivity for complex biomarker panels, enabling more effective disease management and early detection.

- For instance, SCIEX’s Topaz™ System for clinical LC-MS/MS enables fully compliant IVD workflows and achieves detection of tacrolimus at concentrations as low as 0.4 ng/mL, supporting ultra-sensitive immunosuppressant monitoring.

Expansion of MS-Based Environmental and Food Safety Monitoring

Growing concerns over chemical contamination, food adulteration, and emerging pollutants present significant opportunities for mass spectrometry adoption. Governments increasingly mandate ultra-low detection thresholds to monitor pesticides, microplastics, PFAS, and industrial residues in water, soil, and packaged foods. High-resolution MS offers unparalleled ability to detect trace-level contaminants and unknown compounds. The global movement toward sustainability and public health safety continues to push industries to adopt MS-based testing as a standard analytical approach. This trend fosters demand for portable MS devices, automated sample preparation, and workflow-optimized instruments tailored for routine environmental and food laboratories.

- For instance, Thermo Fisher’s Orbitrap Exploris 120 enables PFAS detection in drinking water down to 0.5 ng/L under EPA Method 537.1, allowing ultra-trace identification of persistent contaminants.

Increasing Integration of Automation, AI, and Cloud-Based Data Systems

A major emerging opportunity lies in the integration of AI-driven analytics, automated sample handling, and cloud-based platforms within mass spectrometry workflows. Laboratories face challenges managing large volumes of complex spectral data, prompting adoption of AI tools that improve peak identification, error detection, and predictive quality assessments. Cloud platforms enable real-time data sharing, remote instrument monitoring, and collaborative research. Automation solutions—such as robotic sample loading and integrated software pipelines—reduce manual errors and increase throughput. These innovations help laboratories optimize efficiency, improve reproducibility, and support high-volume testing demands across research and commercial environments.

Key Challenges

High Instrument Cost and Operational Complexity

One of the major challenges limiting mass spectrometry adoption is the high capital cost of advanced instruments, which often requires significant investment from laboratories, particularly in developing regions. Beyond initial acquisition, operational costs—including maintenance, consumables, calibration, and specialized training—add to the financial burden. The complexity of MS instruments demands trained personnel for operation, data interpretation, and troubleshooting, creating skill gaps in many markets. While benchtop and cost-optimized models are emerging, high-end systems required for research and regulated applications remain expensive, hindering widespread accessibility.

Data Management Challenges and Standardization Limitations

Mass spectrometry generates large volumes of highly complex data, making analysis, storage, and interpretation a significant challenge. The lack of global standardization in analytical methods, reporting formats, and workflow validation further complicates cross-laboratory comparability. In clinical and regulatory environments, inconsistent protocols and limited interoperability between instrument platforms hinder seamless adoption. Data overload, long processing times, and difficulties in identifying unknown compounds can delay decision-making and reduce efficiency. Although AI and automation offer support, the need for improved data harmonization, unified databases, and standardized quality frameworks remains a critical barrier to broader adoption.

Regional Analysis

North America

North America holds the largest share of the mass spectrometry market, accounting for around 38% due to strong investment in proteomics, biopharmaceutical research, and clinical diagnostics. The U.S. leads adoption, supported by advanced healthcare infrastructure, high R&D spending, and the presence of major instrument manufacturers. Regulatory emphasis on drug quality, environmental monitoring, and food safety further drives the demand for high-precision MS systems. Increasing funding for genomics and precision medicine programs strengthens regional growth, while academic institutions continue to expand multi-omics research initiatives, reinforcing North America’s dominant market position.

Europe

Europe represents approximately 29% of the global mass spectrometry market, driven by robust adoption in pharmaceuticals, food safety testing, and environmental surveillance. Countries such as Germany, the U.K., and France lead consumption due to strong biotechnology clusters and stringent regulatory frameworks. The region’s focus on contaminant detection, chemical safety compliance, and advanced clinical diagnostics supports consistent demand for hybrid and high-resolution MS systems. EU-funded research programs and collaborations between academic and industrial laboratories further accelerate technology adoption. Europe’s mature analytical testing ecosystem solidifies its position as a key global market contributor.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding about 23% of the market, supported by rapid expansion in pharmaceutical manufacturing, clinical diagnostics, and food quality testing. China, Japan, South Korea, and India increasingly invest in advanced analytical instrumentation to strengthen drug development capabilities and comply with international safety standards. Growing proteomics and metabolomics research, rising healthcare spending, and government-backed initiatives in biotechnology significantly fuel MS adoption. The region’s large population and burden of chronic diseases also boost demand for high-accuracy diagnostic applications, positioning Asia-Pacific as a major growth engine for the global market.

Latin America

Latin America accounts for around 6% of the mass spectrometry market, with growing adoption in pharmaceutical quality control, environmental monitoring, and food contamination testing. Brazil and Mexico lead regional demand due to expanding pharmaceutical production and the need for advanced analytical techniques in regulatory compliance. Increasing awareness of food safety standards and pollution monitoring encourages laboratories to upgrade to modern MS platforms. Although budget constraints limit large-scale adoption, government investment in public health and research infrastructure continues to strengthen market penetration, gradually improving access to high-performance MS instruments across the region.

Middle East & Africa

The Middle East & Africa region holds approximately 4% of the market, with growth driven by investments in healthcare modernization, petrochemical analysis, and environmental testing. Countries such as Saudi Arabia, the UAE, and South Africa are upgrading laboratory capabilities to meet international analytical standards. Expanding pharmaceutical manufacturing and rising demand for accurate diagnostic testing support increased MS deployment. While adoption remains slower compared to mature markets, improving funding for clinical research, water quality testing, and industrial safety is fostering steady growth. Regional focus on technological modernization continues to create opportunities for high-precision MS systems.

Market Segmentations:

By Technology

- Hybrid mass spectrometry

- Triple quadrupole (Tandem)

- Quadrupole Time-of-Flight (Q-TOF)

- Fourier Transform Mass Spectrometry (FTMS)

- Single mass spectrometry

- Ion trap

- Quadrupole

- Time of Flight (TOF)

By Application

- Life science research

- Drug discovery

- Environmental testing

- Food testing

- Applied industries

- Clinical diagnostics

By End User

- Pharmaceutical

- Biotechnology

- Research & academics

- Environmental testing industry

- Food & beverage testing

- Forensic

- Petrochemical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mass spectrometry market is characterized by strong innovation, technological differentiation, and strategic expansion by leading global manufacturers. Major players such as Thermo Fisher Scientific, Agilent Technologies, Bruker Corporation, Waters Corporation, Shimadzu Corporation, and PerkinElmer dominate the market through extensive portfolios spanning hybrid MS, LC-MS/MS, Q-TOF, FTMS, and benchtop systems. These companies invest heavily in R&D to enhance resolution, throughput, and automation while integrating AI-driven analytics and cloud connectivity to streamline workflows. Strategic partnerships with pharmaceutical companies, clinical laboratories, and academic research institutions further strengthen market penetration. Additionally, firms focus on expanding consumables, software, and service offerings to secure recurring revenue streams. Competition intensifies as emerging players introduce compact, cost-efficient systems targeting routine testing and decentralized laboratories. Overall, continuous innovation, regulatory-driven demand, and expansion into clinical diagnostics define the evolving competitive dynamics of the mass spectrometry market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LECO Corporation

- JEOL Ltd.

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Bruker Corporation

- PerkinElmer, Inc.

- Waters Corporation

- Thermo Fisher Scientific Inc.

- SCIEX (a division of Danaher Corporation)

- AB Sciex Pte. Ltd.

Recent Developments

- In August 2025, Shimadzu Corporation Announced the release of the LCMS-8065XE triple quadrupole mass spectrometer with enhanced sensitivity, efficiency, and sustainability features.

- In June 2024, Agilent Technologies, Inc. Introduced two new instruments at the 72nd ASMS Conference: the 7010D Triple Quadrupole GC/MS targeting food & environmental testing, and the ExD Cell paired with the 6545XT AdvanceBio LC/Q-TOF for biopharma research.

- In May 2024, LECO Corporation Announced attendance at ASMS 2024 and showcased its new BenchTop Mass Spectrometer Pegasus BTX, a next-generation GC-TOFMS instrument.

Report Coverage

The research report offers an in-depth analysis based on Technology ,Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The mass spectrometry market will continue advancing through higher-resolution hybrid systems that support complex multi-omics research.

- Clinical adoption of MS-based assays will accelerate as healthcare systems shift toward precision diagnostics.

- Integration of AI and machine learning will streamline data interpretation and reduce analysis time in high-volume laboratories.

- Automation and robotics will expand throughput, enabling fully integrated MS workflows in pharmaceutical and research settings.

- Portable and benchtop MS instruments will gain traction for on-site environmental, forensic, and food testing.

- Demand for MS in biologics and gene-therapy characterization will rise as advanced therapeutics expand globally.

- Regulatory requirements for contaminant monitoring will drive increased use of MS in food, water, and environmental testing.

- Cloud-connected MS systems will support remote data access, collaborative research, and centralized quality control.

- Growing investment in proteomics and metabolomics will further strengthen research-driven MS adoption.

- Emerging markets will expand rapidly as laboratory modernization and analytical capability improve across Asia and Latin America.