Market Overview

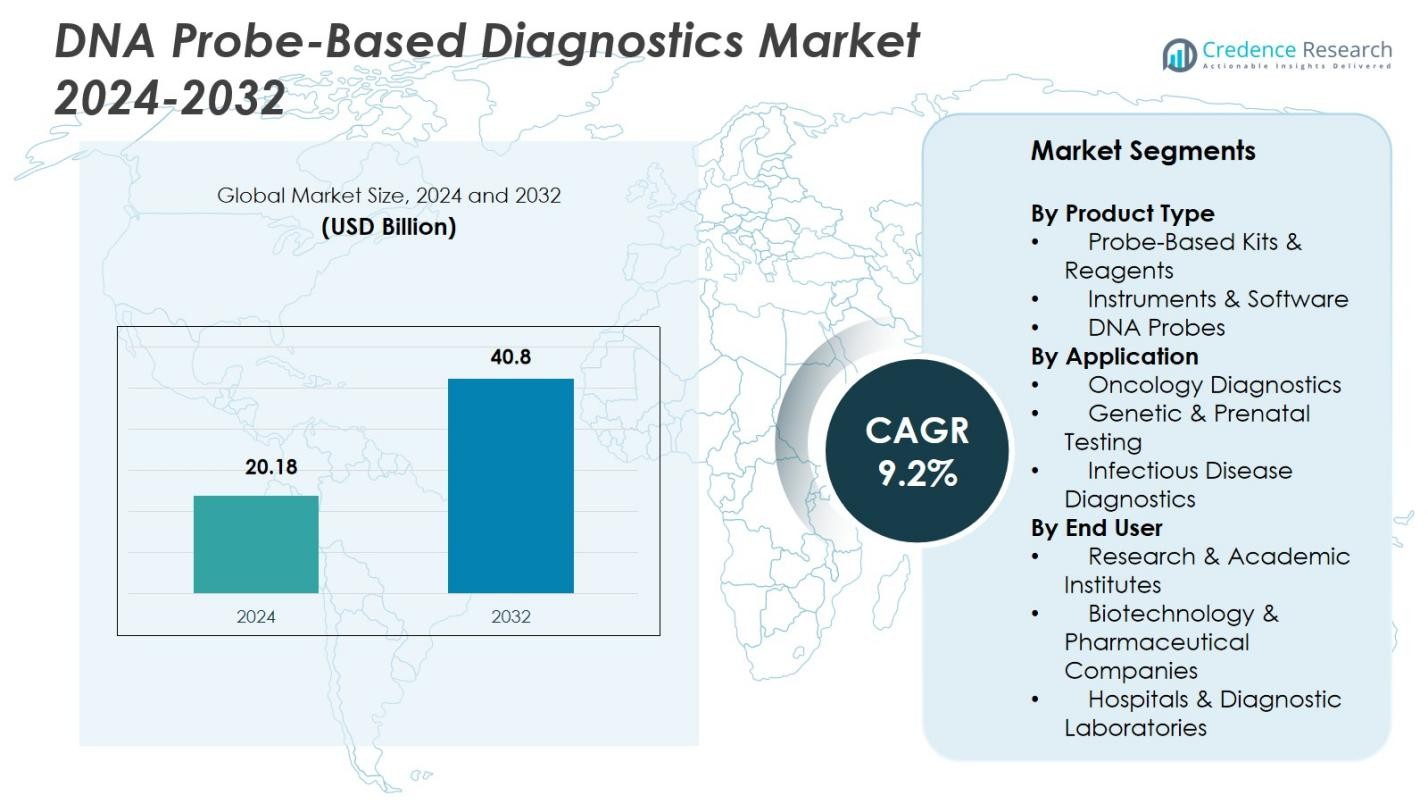

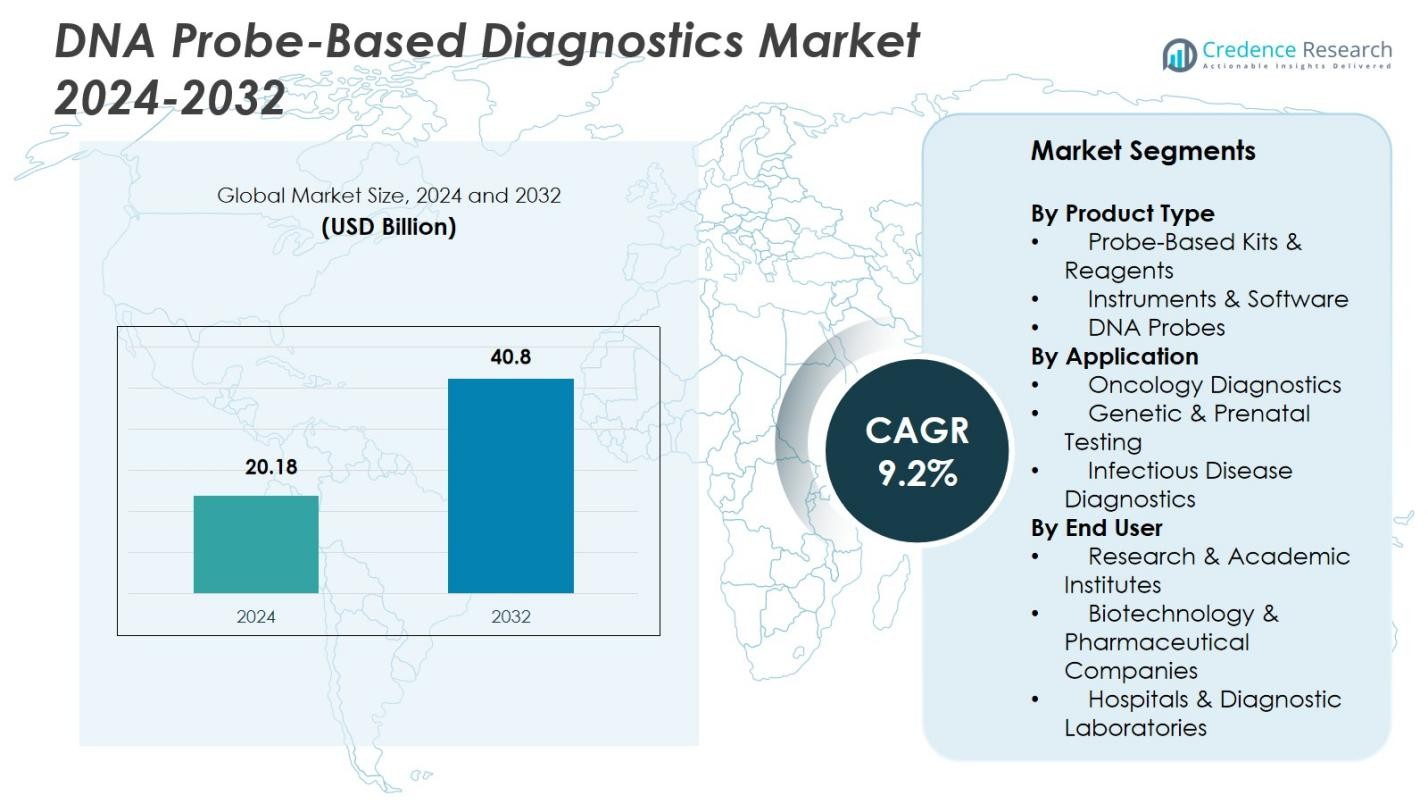

DNA Probe-Based Diagnostics Market size was valued at USD 20.18 Billion in 2024 and is anticipated to reach USD 40.8 Billion by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DNA Probe-Based Diagnostics Market Size 2024 |

USD 20.18 Billion |

| DNA Probe-Based Diagnostics Market, CAGR |

9.2% |

| DNA Probe-Based Diagnostics Market Size 2032 |

USD 40.8 Billion |

DNA Probe-Based Diagnostics Market showcases strong participation from leading players such as Abbott Molecular, Beckman Coulter Inc., Becton, Dickinson and Company, bioMérieux, F. Hoffmann-La Roche Ltd., GE Healthcare Life Sciences, Luminex Corporation, QIAGEN N.V., Siemens Healthineers, and Thermo Fisher Scientific Inc., all of whom strengthen market advancement through molecular innovation, automated platforms, and high-throughput assay development. North America remains the leading regional market with a 39.6% share in 2024, driven by advanced healthcare infrastructure, strong R&D activity, and early adoption of probe-based technologies. Europe follows with a 28.4% share, supported by government-led screening programs, growing genetic testing uptake, and rising utilization of molecular diagnostics across public and private healthcare systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- DNA Probe-Based Diagnostics Market reached USD 20.18 Billion in 2024 and will grow at a CAGR of 9.2% through 2032, supported by rising molecular testing adoption.

- Growing demand for rapid and accurate diagnostics drives adoption of probe-based kits and reagents, which held a 3% share, supported by high-throughput workflows and automated platforms.

- Multiplex assay development and AI-enabled molecular interpretation are key trends, enabling faster detection across infectious, oncology, and genetic testing applications; infectious disease diagnostics led with a 7% share in 2024.

- Key players such as Abbott Molecular, QIAGEN N.V., Siemens Healthineers, and Thermo Fisher Scientific Inc. expand portfolios through innovation and partnerships, strengthening their global presence amid rising assay standardization needs.

- North America led the market with a 6% share, followed by Europe at 28.4%, while Asia-Pacific with 22.7% is positioned as the fastest-growing region due to rising healthcare investment and expanding molecular diagnostic capacity.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The DNA Probe-Based Diagnostics Market demonstrates strong traction across product categories, with Probe-Based Kits & Reagents holding the dominant share of 46.3% in 2024. Their leadership is driven by widespread use in high-throughput workflows, rapid testing formats, and compatibility with automated systems, enabling accurate detection across infectious, oncological, and genetic applications. Instruments & software continue to gain adoption due to advancements in imaging platforms and analytical algorithms, while standalone DNA probes support specialized assays. The rising shift toward multiplex testing and standardized diagnostic workflows further reinforces the demand for reagent-centric solutions.

- For instance, Thermo Fisher Scientific’s TaqMan Probe-based assays are widely used for rapid viral detection, supporting large-scale COVID-19 testing efforts globally.

By Application

Within the application landscape, Infectious Disease Diagnostics leads the market with a 51.7% share in 2024, supported by the global need for rapid pathogen detection, antimicrobial resistance surveillance, and early outbreak management. Oncology diagnostics show accelerated uptake driven by precision medicine initiatives and expanding use of DNA probe-based assays for tumor profiling. Genetic and prenatal testing continues to benefit from rising birth-defect screening programs and chromosomal abnormality detection. The expanding clinical emphasis on early, accurate, and molecular-level diagnosis strongly drives demand across all application areas.

- For instance, Roche’s Cobas Liat system offers rapid molecular testing for influenza and SARS-CoV-2 with results in under 20 minutes, enhancing timely clinical decision-making.

By End User

Among end users, Hospitals & Diagnostic Laboratories dominate the DNA Probe-Based Diagnostics Market with a 57.4% share in 2024, driven by high patient volumes, strong adoption of molecular testing platforms, and the need for reliable assays for clinical decision-making. Research & academic institutes maintain steady demand fueled by genomic studies, biomarker discovery, and R&D-driven assay development. Biotechnology and pharmaceutical companies increasingly deploy probe-based diagnostics to support drug development, companion diagnostics, and clinical trial workflows. Growing investments in molecular infrastructure and quality-driven laboratory operations continue to reinforce end-user adoption.

Key Growth Drivers

Growing Adoption of Molecular Diagnostics in Clinical Settings

The DNA Probe-Based Diagnostics Market is expanding rapidly as healthcare systems shift toward molecular-level disease detection. Hospitals and diagnostic laboratories increasingly rely on probe-based assays for their precision, sensitivity, and ability to detect pathogens, mutations, and biomarkers in early stages. Rising demand for rapid and accurate diagnostic decisions, coupled with greater integration of molecular workflows in infectious disease testing and oncology, significantly accelerates market growth. Government-backed screening initiatives and quality-driven clinical protocols further strengthen the adoption of DNA probe-based technologies.

- For instance, Abbott’s Alinity m platform integrates probe-based assays for multiplex detection of respiratory pathogens, enhancing workflow efficiency in hospital labs.

Advancements in Automation and High-Throughput Testing Technologies

Automation and high-throughput platforms play a major role in driving the adoption of DNA probe-based diagnostics. Modern instruments integrate advanced imaging, robotics, and analytical software, enabling laboratories to process large sample volumes with consistent accuracy. Automated probe-based systems reduce labor requirements, minimize human error, and enhance reproducibility, making them critical for large-scale infectious disease screening and cancer diagnostics. The growing use of multiplex assays and digital data analytics further boosts laboratory efficiency and supports wider clinical deployment of probe-based technologies.

- For instance,Thermo Fisher Scientific’s Ion Torrent Genexus offers a streamlined workflow that integrates sample prep and sequencing, reducing hands-on time by more than 50%.

Rising Burden of Infectious and Genetic Disorders

Increasing global prevalence of infectious diseases, genetic abnormalities, and chronic illness significantly fuels demand for DNA probe-based diagnostics. These assays provide rapid detection of viral, bacterial, and hereditary conditions, supporting early intervention and personalized treatment pathways. Public health surveillance programs, antimicrobial resistance monitoring, and expanding newborn screening frameworks strengthen utilization rates. With rising emphasis on preventive healthcare and early disease identification, DNA probe-based solutions continue to gain prominence across high-burden regions and specialized diagnostic programs.

Key Trends & Opportunities

Expansion of Multiplex and Point-of-Care Probe-Based Testing

A major market trend is the shift toward multiplex systems capable of detecting multiple pathogens or mutations in a single run. Laboratories and clinical settings increasingly adopt these assays to reduce turnaround time and improve diagnostic efficiency. Simultaneously, advancements in portable molecular devices are unlocking opportunities for point-of-care testing, especially in remote or resource-limited areas. Integrating probe-based diagnostics into decentralized models supports faster clinical decisions, enhances disease surveillance, and helps healthcare providers respond efficiently to epidemic or outbreak scenarios.

- For instance, Cepheid’s GeneXpert system integrates multiple test modules for rapid tuberculosis and COVID-19 detection, enabling real-time clinical decisions at the point of care.

Growing Integration of AI and Digital Platforms in Probe-Based Diagnostics

Artificial intelligence and digital analytics are transforming the capabilities of DNA probe-based systems. AI-driven image analysis, automated result interpretation, and cloud-based data platforms enhance accuracy and streamline reporting. These technologies enable laboratories to detect subtle genetic variations, improve assay reliability, and reduce manual oversight. Rising adoption of digital interfaces in clinical diagnostics creates opportunities for real-time monitoring, interoperability with electronic health records, and large-scale population health management, strengthening the overall value of DNA probe-based diagnostics.

- For instance, Illumina’s AI-powered variant calling software improves the precision of sequencing data interpretation, reducing errors in genetic analysis.

Key Challenges

High Cost of Advanced Molecular Diagnostic Platforms

The adoption of DNA probe-based diagnostics faces significant barriers due to the high cost of instruments, reagents, and automated platforms. Many healthcare facilities, particularly in low- and middle-income regions, struggle to justify investment in advanced systems despite their clinical benefits. Expensive maintenance, calibration, and software upgrades further increase operational costs. Limited reimbursement coverage for molecular diagnostics in several countries also restricts patient accessibility. These financial constraints slow the transition toward modern probe-based testing and hinder market penetration in developing markets.

Complex Regulatory Requirements and Validation Processes

Regulatory approval for molecular diagnostics involves stringent validation, extensive clinical evidence, and compliance with evolving standards such as FDA, CE-IVDR, and ISO guidelines. Manufacturers face long development timelines and high compliance costs, delaying commercialization of new probe-based technologies. Frequent updates to regulatory frameworks, particularly for genetic and infectious disease assays, create additional hurdles. Laboratories must also meet strict accreditation and quality requirements to deploy these tests. These complexities collectively limit product launch speed and pose strategic challenges for market participants.

Regional Analysis

North America

North America holds the leading position in the DNA Probe-Based Diagnostics Market with a 39.6% share in 2024, driven primarily by the strong presence of advanced diagnostic infrastructure and high adoption of molecular testing across hospitals and laboratories. The region benefits from extensive R&D investments, early integration of automated platforms, and robust regulatory support for innovative diagnostic technologies. Widespread use of probe-based assays in infectious disease detection, oncology, and genetic screening further strengthens demand. Growing emphasis on precision medicine and large-scale genomic initiatives continues to reinforce North America’s dominant market position.

Europe

Europe accounts for a significant 28.4% share in the DNA Probe-Based Diagnostics Market in 2024, supported by strong government-led screening programs, well-established laboratory networks, and increasing adoption of molecular diagnostics for cancer and infectious diseases. The region demonstrates rapid integration of advanced probe-based platforms across public health systems, along with high demand for quality-driven clinical testing. Expanding prenatal and genetic testing initiatives and investment in healthcare digitalization further accelerate market growth. Regulatory alignment under IVDR is prompting modernization of molecular workflows, enhancing technology adoption across leading European countries.

Asia-Pacific

Asia-Pacific exhibits substantial growth potential and holds a 22.7% share in 2024, driven by rising healthcare expenditure, expanding molecular diagnostic capabilities, and high burden of infectious and genetic disorders. Countries such as China, India, Japan, and South Korea are rapidly scaling their adoption of probe-based diagnostics through increased hospital capacity, public health initiatives, and investments in biotechnology. The region benefits from improving laboratory automation, government-backed disease surveillance programs, and growing awareness of early diagnosis. Strong demand for affordable and high-throughput diagnostic solutions continues to position Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America represents a growing opportunity in the DNA Probe-Based Diagnostics Market with a 5.8% share in 2024, supported by expanding molecular testing infrastructure and increasing focus on infectious disease diagnosis. Brazil, Mexico, and Argentina are witnessing rising adoption of probe-based assays due to government-driven disease surveillance programs and improving access to diagnostic services. Despite cost constraints, private healthcare facilities are investing in automated molecular platforms to strengthen clinical efficiency. Growing collaboration with international diagnostic companies and rising awareness of genetic and prenatal testing contribute to regional market expansion.

Middle East & Africa

The Middle East & Africa region holds a 3.5% share in the DNA Probe-Based Diagnostics Market in 2024, driven by improving healthcare modernization efforts and rising demand for accurate infectious disease testing. Gulf countries lead regional adoption due to strong investments in laboratory automation and advanced molecular tools. Sub-Saharan Africa is gradually expanding probe-based diagnostic capabilities through public health partnerships and international funding. However, challenges such as limited laboratory infrastructure and high equipment costs restrict wider adoption. Ongoing healthcare reforms and capacity-building initiatives continue to support market growth in the region.

Market Segmentations:

By Product Type

- Probe-Based Kits & Reagents

- Instruments & Software

- DNA Probes

By Application

- Oncology Diagnostics

- Genetic & Prenatal Testing

- Infectious Disease Diagnostics

By End User

- Research & Academic Institutes

- Biotechnology & Pharmaceutical Companies

- Hospitals & Diagnostic Laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the DNA Probe-Based Diagnostics Market is shaped by leading players including Abbott Molecular, Beckman Coulter Inc., Becton, Dickinson and Company, bioMérieux, F. Hoffmann-La Roche Ltd., GE Healthcare Life Sciences, Luminex Corporation, QIAGEN N.V., Siemens Healthineers, and Thermo Fisher Scientific Inc. These companies strengthen their market presence through continuous innovation, extensive product portfolios, and strong global distribution networks. Competition is driven by advancements in automated molecular platforms, the introduction of high-throughput probe-based assays, and strategic investments in R&D to enhance diagnostic accuracy and turnaround times. Key players actively pursue mergers, acquisitions, and partnerships to expand technological capabilities and address rising clinical demand across infectious disease, oncology, and genetic testing. Increasing regulatory approvals, expansion into emerging markets, and integration of digital and AI-enabled diagnostic tools further intensify market competitiveness while supporting widespread adoption of probe-based diagnostics across clinical and research settings.

Key Player Analysis

- GE Healthcare Life Sciences

- QIAGEN N.V.

- Thermo Fischer Scientific Inc.

- Beckman Coulter Inc.

- bioMerieux

- Becton, Dickinson and Company

- Siemens Healthineers

- Abbott Molecular

- Luminex Corporation

- F. Hoffmann-La Roche Ltd.

Recent Developments

- In January 2025, QIAGEN launched the QIAcuity High Multiplex Probe PCR Kit and updated QIAcuity Software to enable simultaneous detection of up to 12 DNA/RNA targets from a single sample.

- In June 2025 QIAGEN entered a strategic partnership with Foresight Diagnostics to bring the CLARITY™ circulating tumor DNA (ctDNA) assay into kit-based format, expanding its reach beyond central labs.

- In December 2024 Siemens Healthineers acquired Advanced Accelerator Applications Molecular Imaging from Novartis, extending the company’s molecular imaging network enhancing its diagnostics footprint.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of multiplex probe-based assays will increase as laboratories seek faster and more comprehensive diagnostic workflows.

- Demand for automated and high-throughput probe-based systems will rise across hospitals and centralized laboratories.

- AI-driven analysis will enhance probe interpretation accuracy and streamline clinical decision-making.

- Expansion of point-of-care molecular platforms will support decentralized testing in remote and resource-limited settings.

- Integration of probe-based diagnostics with digital health platforms will strengthen real-time disease monitoring.

- Oncology and genetic testing will drive higher utilization of advanced probe-based assays.

- Emerging markets will witness accelerated adoption due to improving molecular infrastructure.

- Strategic collaborations between diagnostic companies and healthcare providers will expand product availability.

- Regulatory advancements will support faster introduction of next-generation probe-based technologies.

- Growing emphasis on preventive healthcare will boost demand for early detection through probe-based diagnostics.

Market Segmentation Analysis:

Market Segmentation Analysis: