Market Overview

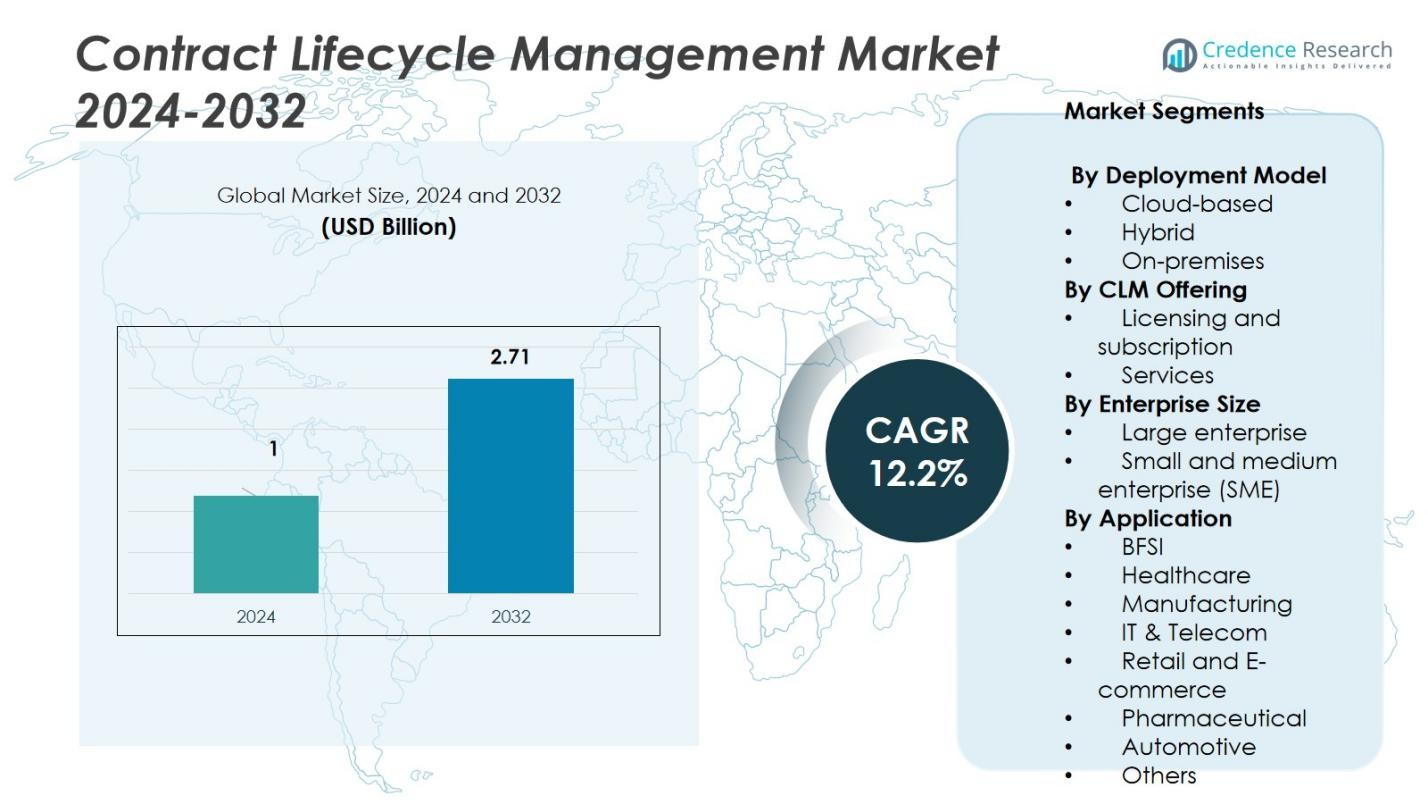

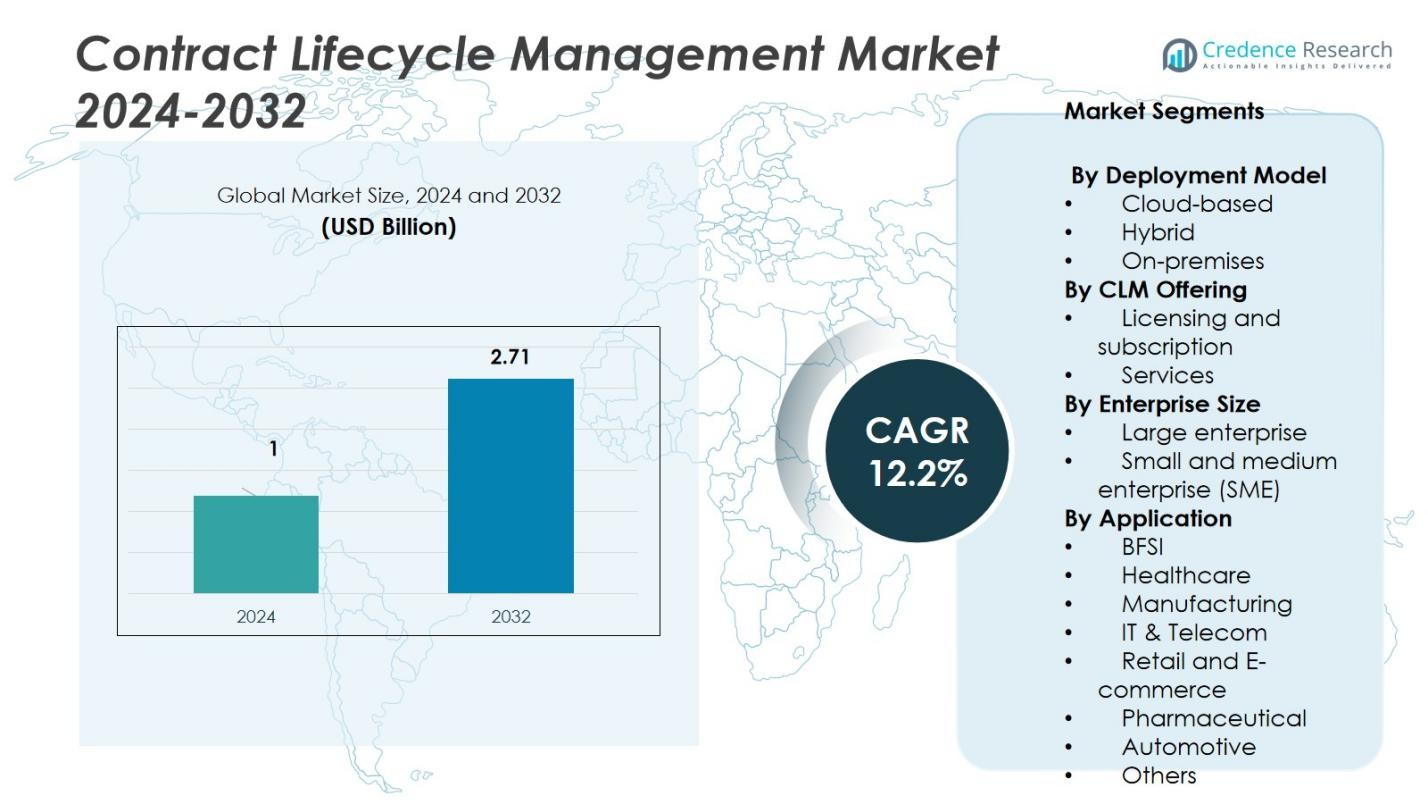

The Contract Lifecycle Management (CLM) Market was valued at USD 1 billion in 2024 and is projected to reach USD 2.71 billion by 2032, growing at a compound annual growth rate (CAGR) of 12.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Contract Lifecycle Management (CLM) Market Size 2024 |

USD 1 Billion |

| Contract Lifecycle Management (CLM) Market, CAGR |

12.2% |

| Contract Lifecycle Management (CLM) Market Size 2032 |

USD 2.71 Billion |

The contract lifecycle management (CLM) market is highly competitive, with key players such as DocuSign, Icertis, Oracle, Agiloft, and Conga shaping the industry. These companies offer advanced solutions that streamline contract creation, management, and compliance. DocuSign is renowned for its eSignature capabilities, complementing its CLM platform to help businesses automate contract workflows. Icertis stands out with its cloud-based solution, integrating AI to enhance contract visibility and compliance. Oracle, Agiloft, and Conga cater primarily to large enterprises, offering features such as automated contract generation, workflow automation, and ERP integration. North America leads the global CLM market, capturing around 40% of the market share in 2024. This region’s dominance is driven by the presence of key vendors, high adoption rates of cloud solutions, and significant demand for automation, compliance, and data security in sectors like finance, healthcare, and manufacturing. The region is also benefiting from the ongoing digital transformation in businesses across various industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The contract lifecycle management market reached USD 1 billion in 2024 and is projected to hit USD 2.71 billion by 2032, growing at a CAGR of 12.2 %.

- The market is driven by digital transformation initiatives, regulatory compliance needs, and increasing adoption of cloud‑based deployment models—which held over 70% share in 2024.

- Key trends include the rise of AI‑enabled contract intelligence, shift toward subscription/licensing offerings (around 60% share in 2024), and growing demand from SMEs in emerging markets.

- Competitive analysis shows leading players such as DocuSign, Icertis, Oracle, Agiloft, and Conga actively innovating and partnering to expand cloud and AI‑based CLM services while market fragmentation remains moderate.

- Regional analysis reveals North America leading with a 40% market share, followed by Europe at 30%, Asia‑Pacific at 20%, and Latin America and Middle East & Africa combined at 10%, signalling strong growth potential outside mature markets.

Market Segmentation Analysis:

By Deployment Model

In the deployment‑model segmentation of the contract lifecycle management (CLM) market, the cloud‑based sub‑segment dominates, with over 70% market share in 2024. This dominance is driven by the scalability, remote‑access capability and lower upfront investment that cloud models offer compared to on‑premises setups. Hybrid deployments are gaining traction due to enterprises’ need to balance legacy systems with modern solutions, while the on‑premises model retains a minor share because many organisations still require full control of data and infrastructure.

- For instance, SAP’s cloud-based Contract and Lease Management solution in SAP S/4HANA Public Cloud seamlessly integrates lease contracts into core business processes with centralized online repositories, reducing manual data entry across finance and asset accounting systems.

By CLM Offering

Within the CLM market’s offerings, the licensing and subscription segment holds the largest share approximately 60% in 2024 reflecting broad adoption of software‑as‑a‑service (SaaS) models and flexible spending by organisations. This strong position is fueled by the growing preference for subscription‑based access, rapid deployment and continuous updates. The services sub‑segment (including consulting, integration and maintenance) is expanding steadily, driven by the complexity of integrations and need for customisation, but remains secondary in revenue.

- For instance, Conga CLM, deployed on AWS and priced through subscription models, allows organizations to manage contract lifecycles through cloud-native SaaS architecture, with customers reporting 25% reductions in contract processing time through their templated, self-service licensing approach.

By Enterprise Size

For the enterprise‑size segmentation, large enterprises lead the market, accounting for roughly 59% of revenue in 2024. They dominate because they handle complex, high‑volume contract workflows, require advanced features and possess the budget for enterprise‑grade CLM tools. Small and medium enterprises (SMEs) represent the remainder of the market; their growth is accelerating thanks to more affordable cloud options and rising regulatory pressures, but they currently trail large enterprises in terms of absolute market share.

Key Growth Drivers

Digital Transformation and Operational Efficiency

The increasing adoption of CLM solutions is largely driven by the need for digital transformation. Businesses are moving away from manual processes to automated systems that streamline contract workflows. This shift significantly enhances operational efficiency by reducing processing time, improving accuracy, and lowering human errors. As organizations prioritize greater productivity and better governance, CLM solutions are becoming a central tool in transforming contract management and boosting business operations across industries.

- For instance, bioMérieux, a global diagnostics leader, modernized its contract operations through Icertis CLM (branded internally as “myContract”) to enhance structure and compliance across over 12,000 contracts, shifting from reliance on live trainings and manual support to real-time, in-app user enablement that reduced friction and support overhead.

Regulatory Compliance and Risk Mitigation

Rising regulatory pressures and the need for stricter compliance are key factors driving the demand for CLM solutions. As organizations face complex regulations and heightened scrutiny, the ability to manage contracts effectively becomes critical. CLM tools help businesses ensure they meet regulatory requirements, track obligations, and prepare for audits. The demand for systems that facilitate compliance, minimize risks, and provide transparency in contract management is accelerating, making CLM an essential part of corporate governance.

- For instance, Wipro helped a leading healthcare services company centralize contracts from multiple acquired entities onto a single CLM platform. This move ensured compliance, eliminated fake and irrelevant documents, and delivered 99% quality in contract abstraction, significantly improving productivity and audit readiness.

Cloud Adoption and Technology Integration

The shift toward cloud‑based platforms and advanced technologies is a significant growth driver in the CLM market. Cloud‑based deployment offers scalability, flexibility, and lower costs, which appeals to a wide range of businesses. Additionally, the integration of artificial intelligence and machine learning with CLM solutions allows for enhanced contract analysis, smarter decision‑making, and predictive insights. These technological advancements are making CLM solutions more efficient, driving greater adoption across various sectors.

Key Trends & Opportunities

AI‑Enabled Contract Intelligence

AI is revolutionizing the contract lifecycle management process by enabling smarter contract analysis, automation, and risk assessment. AI‑powered CLM systems are becoming increasingly adept at reviewing contracts, suggesting terms, and automatically identifying discrepancies. This trend is opening up new opportunities for companies to leverage advanced technologies for more efficient and accurate contract management, reducing manual effort while ensuring compliance and risk mitigation. The rise of AI in CLM is paving the way for faster, more accurate contract decision‑making.

- For instance, Icertis implemented an AI-powered centralized CLM platform for a European automation company, reducing contract cycle times from 72 days to just 4 days while eliminating manual errors through automated processes.

Expansion into SME and Emerging Markets

While large enterprises have traditionally led the adoption of CLM solutions, small and medium enterprises (SMEs) are increasingly adopting these technologies due to the availability of affordable, scalable cloud models. Emerging markets also present untapped potential, as digital readiness improves globally. CLM vendors have a significant opportunity to expand their reach by offering tailored solutions that address the unique needs of SMEs and organizations in developing regions, driving growth in previously underserved markets.

- For instance, Johnson & Johnson implemented a CLM system to centralize contract management across its 175 operating companies worldwide, improving contract visibility, compliance, and speeding execution with data-driven insights.

Key Challenges

High Implementation and Integration Costs

Implementing CLM systems often involves significant initial costs, including software licensing, integration with existing systems, and change management efforts. These expenses can be prohibitive, particularly for small and medium enterprises (SMEs) with limited budgets or complex IT environments. While the long‑term benefits of CLM solutions are substantial, the upfront financial and resource commitments required for implementation and integration remain a significant barrier to widespread adoption.

Data Security and Change Resistance

Data security is a primary concern when adopting CLM systems, as they handle sensitive contract information. Ensuring the confidentiality, integrity, and accessibility of this data is crucial. Additionally, resistance to change from traditional, manual contract processes can slow the adoption of CLM solutions. Employees and organizations accustomed to legacy methods may be hesitant to transition to digital systems, presenting a challenge for businesses seeking to modernize their contract management processes and gain the full benefits of CLM technology.

Regional Analysis

North America

North America leads the contract lifecycle management (CLM) market, holding the largest market share of 40% in 2024. The region’s dominance is driven by the presence of key market players like DocuSign, Oracle, and Icertis, alongside a high adoption rate of cloud‑based CLM solutions. The increasing demand for automation, compliance, and data security in contract management across industries like finance, healthcare, and manufacturing fuels this growth. Additionally, North America benefits from the rapid digital transformation across enterprises, further driving CLM adoption and innovation in the region.

Europe

Europe holds a significant share in the contract lifecycle management market, accounting for 30% of the global market. The region’s growth is driven by the increasing need for regulatory compliance, especially in industries such as healthcare, manufacturing, and energy. The adoption of digital contract management solutions has been accelerated by stringent data protection regulations like GDPR. European businesses are increasingly adopting cloud‑based and hybrid CLM models to streamline their contract processes, reduce risks, and improve compliance with evolving legal requirements.

Asia-Pacific

Asia-Pacific (APAC) is a rapidly growing market for CLM, contributing 20% of the global market share. The growth in this region is primarily driven by the region’s booming economies, increasing digitalization, and rising adoption of cloud technologies. Countries like India, China, and Japan are leading the charge in adopting CLM solutions across various sectors, including manufacturing, IT, and retail. The rise of small and medium enterprises (SMEs) in the region also plays a key role in accelerating the adoption of affordable and scalable CLM solutions, further fueling the market growth.

Latin America

Latin America holds a smaller but growing share of the global contract lifecycle management market, contributing 5% of the overall market. The adoption of CLM solutions in the region is being driven by the need for greater efficiency, transparency, and compliance, especially in industries like energy, finance, and retail. Brazil and Mexico are the key markets within Latin America, with a rising number of enterprises in these countries transitioning to digital contract management systems. The increasing availability of cloud‑based solutions is making CLM more accessible to businesses of all sizes.

Middle East & Africa

The Middle East & Africa (MEA) region, though still in the early stages of CLM adoption, holds a share of 5% of the global market. The growth in this region is driven by the region’s ongoing digital transformation, particularly in sectors like oil and gas, construction, and healthcare. Governments and enterprises are increasingly recognizing the need for effective contract management systems to reduce risks and improve compliance with local and international regulations. The market is expected to expand rapidly as more businesses in the region adopt digital and cloud‑based CLM solutions.

Market Segmentations:

By Deployment Model

- Cloud-based

- Hybrid

- On-premises

By CLM Offering

- Licensing and subscription

- Services

By Enterprise Size

- Large enterprise

- Small and medium enterprise (SME)

By Application

- BFSI

- Healthcare

- Manufacturing

- IT & Telecom

- Retail and E-commerce

- Pharmaceutical

- Automotive

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The contract lifecycle management (CLM) market is highly competitive, with leading players such as DocuSign, Icertis, Oracle, Agiloft, and Conga shaping the industry landscape. These companies offer a range of solutions designed to streamline contract creation, management, and compliance. DocuSign, for instance, is renowned for its eSignature solutions, which complement its CLM platform, helping businesses to manage and automate contract workflows. Icertis, on the other hand, has established a strong presence with its cloud‑based CLM solution, which offers advanced analytics and AI capabilities to improve contract visibility and compliance. Oracle, Agiloft, and Conga provide robust CLM systems that cater to large enterprises, offering features such as automated contract generation, workflow automation, and integration with existing enterprise resource planning (ERP) systems. The market is also seeing increased adoption by small and medium enterprises (SMEs), driving innovation as vendors introduce more affordable and scalable solutions. As the market evolves, these key players continue to focus on enhancing their offerings with AI, cloud computing, and data analytics to stay competitive.

Key Player Analysis

- JAGGAER (U.S.)

- GEP (U.S.)

- Icertis (U.S.)

- DocuSign, Inc. (U.S.)

- Oracle (U.S.)

- Agiloft Inc. (U.S.)

- Ironclad, Inc. (U.S.)

- CobbleStone Software (U.S.)

- SirionLabs (U.S.)

- Conga (U.S.)

Recent Developments

- In April 2025, Summize unveiled its next-generation Contract Lifecycle Management (CLM) platform, integrating agentic AI through Summize Intelligent Agents (SIA). This multi-agent system enhances contract reviews by automating redlines, providing AI-driven summaries, and facilitating contract Q&A directly within Microsoft Word.

- In April 2025, Ironclad introduced new capabilities to help enterprises recapture millions in lost contract value. The platform’s Obligation Management feature enables users to systematically track critical contract obligations, ensuring compliance and minimizing revenue leakage.

- In May 2024, Icertis and Evisort announced a strategic partnership to enhance contract intelligence capabilities. By integrating Evisort’s AI engine with the Icertis Contract Intelligence platform, the collaboration aims to accelerate the ingestion and analysis of both legacy and new contracts.

- In February 2024, PwC India formed a strategic alliance with Sirion, an AI-powered Contract Lifecycle Management (CLM) platform, to transform enterprise contract management. This collaboration combines PwC India’s consulting expertise with Sirion’s advanced CLM technology to enhance contract efficiency, reduce risks, and drive innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Deployment Model, CLM Offering, Enterprise Size, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI‑powered analytics will accelerate, enabling organizations to extract insights from large volumes of contracts and support decision‑making.

- Cloud‑native deployment will increase as companies seek flexible, scalable contract lifecycle management platforms that support remote and hybrid workforces.

- SMEs will drive future growth as vendors launch cost‑effective, modular CLM solutions tailored to smaller businesses with limited budgets.

- Integration of CLM platforms with enterprise systems such as procurement, sales, and legal will deepen to offer end‑to‑end contract workflow automation.

- Demand for industry‑specific CLM configurations will rise, especially in sectors like healthcare, manufacturing, and government, to address unique regulatory needs.

- Expansion across emerging geographic markets including Asia‑Pacific and Latin America will open new revenue opportunities as digital transformation accelerates.

- Automation of renewal, obligation tracking, and compliance will reduce contract cycle times and operational risk, enhancing business agility.

- Vendors will increasingly embed sustainability and ESG clauses within CLM platforms, reflecting growing corporate responsibility and regulatory pressure.

- Strategic partnerships, mergers, and acquisitions among CLM software providers will increase as companies seek to consolidate capabilities and market share.

- User focus will shift from basic contract management to proactive contract intelligence—enabling organizations to treat contracts as strategic assets.