Market Overview

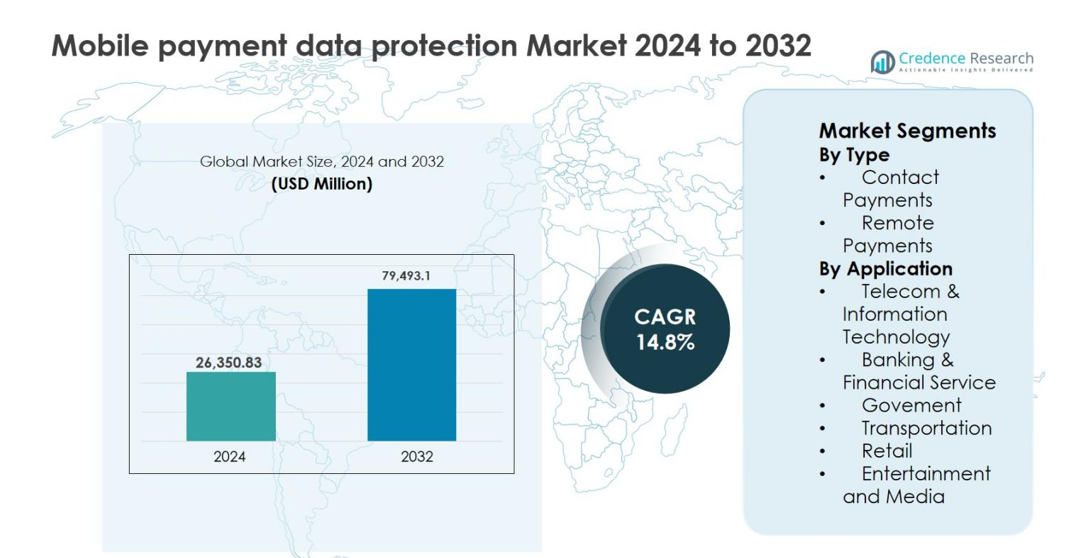

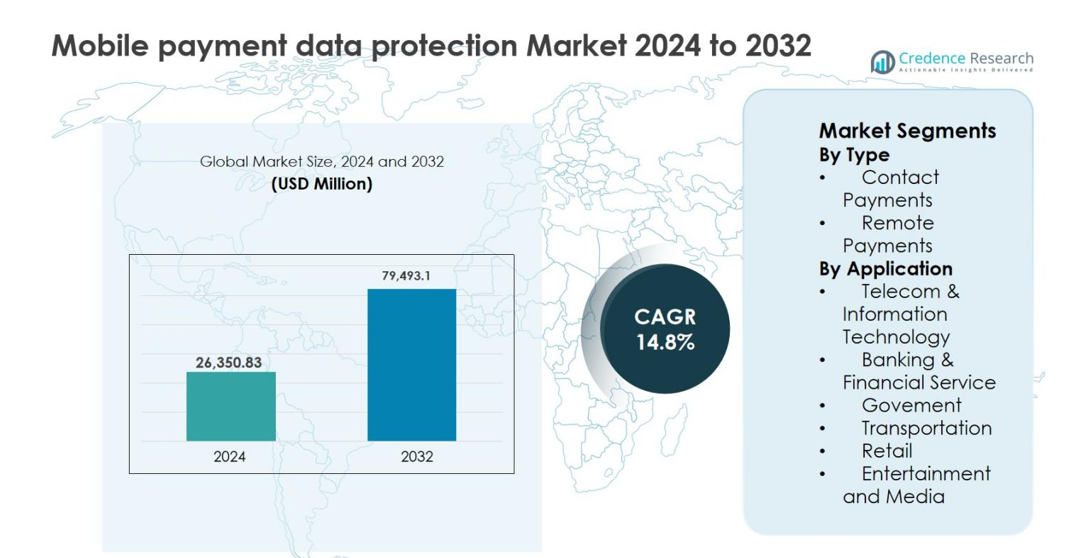

Mobile Payment Data Protection market size was valued at USD 26,350.83 million in 2024 and is anticipated to reach USD 79,493.1 million by 2032, at a CAGR of 14.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Payment Data Protection Market Size 2024 |

USD 26,350.83 million |

| Mobile Payment Data Protection Market, CAGR |

14.8% |

| Mobile Payment Data Protection Market Size 2032 |

USD 79,493.1 million |

Mobile Payment Data Protection market is shaped by the strong presence of global technology firms, payment networks, and digital wallet providers focused on securing mobile transactions. Leading players such as Google (Alphabet Inc.), Samsung Electronics Co. Ltd., Visa Inc., PayPal Holdings Inc., American Express Company, Alibaba Group Holding Limited, Tencent Holdings Limited (WeChat), Amazon.com Inc., MoneyGram International, and M-Pesa invest heavily in encryption, tokenization, biometric authentication, and AI-driven fraud prevention. These companies emphasize platform interoperability and regulatory compliance to enhance transaction security across ecosystems. Regionally, North America dominated the Mobile Payment Data Protection market with a 36.4% share in 2024, supported by advanced payment infrastructure and stringent data protection regulations, followed by Europe with 27.1%, driven by strong digital payment adoption and regulatory alignment.

Market Insights

- Mobile Payment Data Protection market was valued at USD 26,350.83 million in 2024 and is projected to grow at a CAGR of 14.8% through 2032, driven by rising digital transaction volumes and expanding mobile payment ecosystems worldwide.

- Growing adoption of mobile wallets, UPI platforms, QR-code payments, and in-app purchases is a major driver, with Remote Payments holding a dominant segment share of 61.8% in 2024 due to higher exposure to data breaches and fraud risks.

- Increasing use of AI-driven fraud detection, biometric authentication, tokenization, and cloud-based security platforms represents a key market trend, enabling real-time threat monitoring and improved user experience across payment channels.

- The market features strong participation from global technology firms, payment networks, and digital wallet providers that focus on continuous security upgrades, platform integration, and compliance-driven solutions to address evolving cyber threats.

- Regionally, North America led with a 36.4% market share in 2024, followed by Europe at 27.1% and Asia Pacific at 24.6%, supported by advanced payment infrastructure, regulatory focus, and rapid mobile payment adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Mobile Payment Data Protection market by type is led by Remote Payments, which accounted for 61.8% market share in 2024. This dominance is driven by the rapid expansion of e-commerce platforms, mobile wallets, and app-based transactions that require advanced encryption, tokenization, and fraud-detection solutions. Increasing cross-border digital transactions and rising incidences of cyber fraud further accelerate demand for robust remote payment security. Meanwhile, Contact Payments continue to grow steadily, supported by NFC-enabled smartphones and contactless POS terminals, but their adoption remains secondary due to comparatively lower data-security complexity than remote transactions.

- For instance, PayPal’s risk and fraud systems analyze billions of transactions annually using machine learning to detect anomalies in remote payments, and Stripe Radar applies behavioral modeling and network-level signals to block high-risk online transactions in real time.

By Application

Within applications, Banking & Financial Services emerged as the dominant sub-segment, holding 34.6% share in 2024. Financial institutions prioritize mobile payment data protection to comply with stringent regulatory frameworks, mitigate identity theft, and secure real-time digital transactions. The surge in mobile banking users and instant payment systems has intensified investments in biometric authentication, AI-driven fraud monitoring, and end-to-end encryption. Telecom & Information Technology follows as a key contributor, driven by mobile wallet platforms and cloud-based payment infrastructures that require continuous data protection across networks and devices.

- For instance, Vodafone’s M‑Pesa platform adopted Thales’ encryption solutions to secure cross-border mobile wallet transactions in Africa and Asia.

Key Growth Drivers

Rapid Expansion of Mobile and Digital Payments

The accelerated adoption of mobile wallets, UPI-based platforms, QR-code payments, and in-app transactions is a primary growth driver for the Mobile Payment Data Protection market. Rising smartphone penetration, improved internet connectivity, and consumer preference for cashless transactions have significantly increased mobile payment volumes across retail, banking, transportation, and digital services. This expansion has amplified the exposure of sensitive financial and personal data, compelling payment providers to invest in advanced security frameworks. Technologies such as end-to-end encryption, tokenization, secure key management, and real-time fraud detection are becoming essential to protect transaction integrity. Additionally, cross-border mobile payments and instant settlement systems further intensify data protection requirements, driving sustained demand for scalable and resilient security solutions.

- For instance, India’s UPI processed over 100 billion transactions in FY 2023–24, with apps like PhonePe, Google Pay, and Paytm handling high volumes that require strong authentication, device binding, and encrypted channels.

Increasing Cybersecurity Threats and Fraud Incidents

The rising frequency and sophistication of cyberattacks targeting mobile payment ecosystems strongly propel market growth. Threats such as phishing, malware, account takeovers, and data breaches pose significant financial and reputational risks to payment service providers and merchants. As mobile payments involve real-time processing and high transaction volumes, even minor security gaps can result in substantial losses. Consequently, organizations are prioritizing AI-driven fraud analytics, behavioral biometrics, multi-factor authentication, and continuous risk monitoring. Regulatory penalties and customer trust considerations further reinforce the need for robust data protection. This heightened focus on proactive threat prevention and rapid incident response continues to expand investments in mobile payment security infrastructures.

- For instance, Visa and Mastercard use AI-based risk scoring and network-level analytics to evaluate card‑not‑present and mobile transactions in milliseconds, while banks integrate device fingerprinting and behavioral biometrics to detect abnormal usage patterns before authorizing payments.

Stringent Regulatory and Compliance Requirements

Government regulations and industry standards play a crucial role in driving the Mobile Payment Data Protection market. Frameworks related to data privacy, consumer protection, and digital payment security require organizations to implement strong safeguards for storing, processing, and transmitting payment data. Compliance with mandates such as data localization, customer authentication, and breach notification obligations increases demand for compliant security architectures. Financial institutions, fintech firms, and telecom operators are compelled to adopt certified encryption protocols, audit-ready security platforms, and governance-driven data protection solutions. As regulators continue to tighten oversight of digital payment systems, compliance-driven investments remain a consistent catalyst for market expansion.

Key Trend & Opportunity

Integration of AI and Advanced Analytics in Security Systems

The integration of artificial intelligence and machine learning represents a major trend and opportunity in the Mobile Payment Data Protection market. AI-powered systems enable real-time transaction monitoring, anomaly detection, and predictive fraud prevention by analyzing large volumes of behavioral and transactional data. These capabilities enhance accuracy while reducing false positives, improving user experience and operational efficiency. As mobile payments scale, automated security intelligence becomes essential for managing complex threat landscapes. Vendors offering AI-enabled, cloud-native, and adaptive security platforms gain a competitive advantage. This trend opens opportunities for innovation in biometric authentication, risk-based access control, and self-learning security models tailored to evolving payment behaviors.

- For instance, Stripe Radar applies ML models trained on data from millions of businesses worldwide to dynamically adapt fraud rules for online and in‑app payments, helping balance risk reduction with approval rates.

Growth of Cloud-Based and API-Driven Payment Security

The shift toward cloud-based payment infrastructures and open banking APIs is creating new opportunities for data protection providers. Payment platforms increasingly rely on cloud environments to support scalability, interoperability, and faster deployment. This transition drives demand for cloud-native encryption, secure APIs, and centralized key management solutions. Additionally, partnerships between banks, fintech firms, and third-party developers expand the need for standardized yet flexible security layers. Vendors that deliver modular, API-compatible security solutions can address diverse use cases across industries, positioning cloud-enabled protection as a long-term growth opportunity in the market.

- For instance, Very Good Security (VGS) offers a cloud-based Zero Data™ platform that tokenizes payment data instantly upon collection via APIs or forms, storing it in a PCI-compliant Vault without merchants handling sensitive information.

Key Challenge

Balancing Security with User Convenience

One of the key challenges in the Mobile Payment Data Protection market is maintaining high security standards without compromising user convenience. Complex authentication processes and excessive verification steps can negatively impact transaction speed and customer experience. Consumers increasingly expect seamless, frictionless payments, placing pressure on providers to minimize security-related disruptions. Achieving this balance requires continuous optimization of biometric authentication, adaptive risk scoring, and contextual security measures. Failure to align security with usability can lead to transaction abandonment, reduced adoption, and customer dissatisfaction, making this a persistent challenge for market participants.

High Implementation Costs and Technical Complexity

The deployment of advanced mobile payment data protection solutions involves significant costs and technical complexity, particularly for small and mid-sized enterprises. Integrating encryption, fraud analytics, compliance monitoring, and secure infrastructure across multiple platforms requires specialized expertise and ongoing maintenance. Additionally, frequent updates to address emerging threats increase operational expenditures. Legacy system integration further complicates implementation for traditional financial institutions. These cost and complexity barriers can delay adoption and limit market penetration in price-sensitive regions, posing a challenge to uniform global growth of mobile payment data protection solutions.

Regional Analysis

North America

North America held the largest share of the Mobile Payment Data Protection market, accounting for 36.4% in 2024. The region benefits from advanced digital payment infrastructure, high smartphone penetration, and early adoption of mobile wallets and contactless payment technologies. Strong presence of major payment networks, fintech firms, and cybersecurity providers drives continuous innovation in encryption, fraud detection, and biometric authentication. Strict regulatory frameworks related to data privacy and financial security further strengthen demand. Growing use of mobile payments across retail, banking, transportation, and digital services continues to support sustained market dominance in the region.

Europe

Europe represented 27.1% market share in 2024, supported by widespread adoption of mobile banking and cashless payment solutions across both developed and emerging economies. The region places strong emphasis on data privacy and consumer protection, driving investments in compliant mobile payment security platforms. Increasing cross-border digital transactions within the region elevate the need for secure authentication and real-time fraud monitoring. Strong growth in contactless payments across retail and public transportation further accelerates demand. Regulatory alignment and expanding fintech ecosystems position Europe as a key contributor to steady market expansion.

Asia Pacific

Asia Pacific accounted for 24.6% of the Mobile Payment Data Protection market in 2024 and remains the fastest-growing regional market. Rapid expansion of mobile wallets, QR-code payments, and super-app ecosystems drives high transaction volumes across countries such as China, India, and Southeast Asia. Large unbanked populations transitioning to digital payments intensify the need for scalable and cost-efficient security solutions. Increasing smartphone adoption, government-led digital payment initiatives, and growing fintech investments strongly support demand for advanced data protection technologies across the region.

Latin America

Latin America held a market share of 7.1% in 2024, driven by rising adoption of mobile wallets and digital financial services. Increasing smartphone penetration and limited access to traditional banking have accelerated mobile payment usage across retail and peer-to-peer transactions. Growing awareness of payment fraud and cybersecurity risks is pushing financial institutions and fintech firms to enhance data protection capabilities. Regulatory improvements and expanding digital commerce ecosystems further support adoption. Although infrastructure challenges persist, the region presents strong growth potential for mobile payment security solutions.

Middle East & Africa

The Middle East & Africa accounted for 4.8% market share in 2024, supported by growing adoption of mobile money platforms and digital payment services. Government-led digital transformation initiatives and increasing smartphone usage drive mobile payment growth across the region. Mobile-based financial inclusion programs significantly increase transaction volumes, raising demand for secure payment data protection. While regulatory frameworks are still evolving, investments in fintech infrastructure and cybersecurity capabilities continue to expand. The region offers long-term growth opportunities as digital payments gain wider acceptance.

Market Segmentations:

By Type

- Contact Payments

- Remote Payments

By Application

- Telecom & Information Technology

- Banking & Financial Service

- Govement

- Transportation

- Retail

- Entertainment and Media

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mobile Payment Data Protection market is characterized by the presence of global technology leaders, payment networks, and digital wallet providers focusing on advanced security innovation and ecosystem partnerships. Key players such as Google (Alphabet Inc.), Samsung Electronics Co. Ltd., Visa Inc., PayPal Holdings Inc., American Express Company, Alibaba Group Holding Limited, Tencent Holdings Limited (WeChat), Amazon.com Inc., MoneyGram International, and M-Pesa actively invest in encryption, tokenization, biometric authentication, and AI-driven fraud detection to secure mobile transactions. These companies emphasize platform integration, cloud-native security architectures, and regulatory compliance to strengthen trust across digital payment ecosystems. Strategic collaborations with banks, fintech firms, and telecom operators further enhance market positioning. Continuous product upgrades, geographic expansion, and investments in real-time risk analytics remain central strategies, enabling leading players to address rising transaction volumes and evolving cybersecurity threats globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amazon.com Inc.

- Visa Inc.

- WeChat (Tencent Holdings Limited)

- MoneyGram International

- Samsung Electronics Co. Ltd.

- American Express Company

- Alibaba Group Holding Limited

- M-Pesa

- PayPal Holdings Inc.

- Google (Alphabet Inc.)

Recent Developments

- In September 2025, Mastercard extended its strategic partnership with Smile ID to scale secure digital identity verification across Africa, aimed at reducing fraud and boosting secure mobile onboarding.

- In September 2025, Asian e-wallets and Ant International launched the Digital Wallet Guardian Partnership to strengthen protection of global digital wallet payments and enhance cross-border payment security

- In July 2025, Visa brought Google Pay integration to fleet cards, enabling tokenization and push-to-wallet capabilities across digital wallets, strengthening secure mobile payment credentials and encrypted transaction data in mobile ecosystems

Report Coverage

The research report offers an in-depth analysis based on Type, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Mobile payment data protection solutions will experience sustained adoption as mobile transactions continue to replace cash and card-based payments globally.

- Increasing use of real-time and cross-border mobile payments will elevate demand for advanced encryption and continuous fraud monitoring systems.

- Artificial intelligence and machine learning will become core components of mobile payment security platforms for predictive threat detection.

- Biometric authentication methods will gain wider acceptance to enhance security while maintaining seamless user experiences.

- Cloud-native and API-driven security architectures will support scalability and interoperability across payment ecosystems.

- Regulatory requirements for data privacy and digital payment security will further strengthen investment in compliant protection solutions.

- Financial institutions and fintech providers will increase collaboration with cybersecurity vendors to enhance payment data protection.

- Rising mobile wallet adoption in emerging economies will create new growth opportunities for cost-efficient security solutions.

- Continuous innovation in tokenization and identity management will reduce fraud and data breach risks.

- Vendors will focus on improving user trust and transaction reliability to support long-term market expansion.