Market Overview

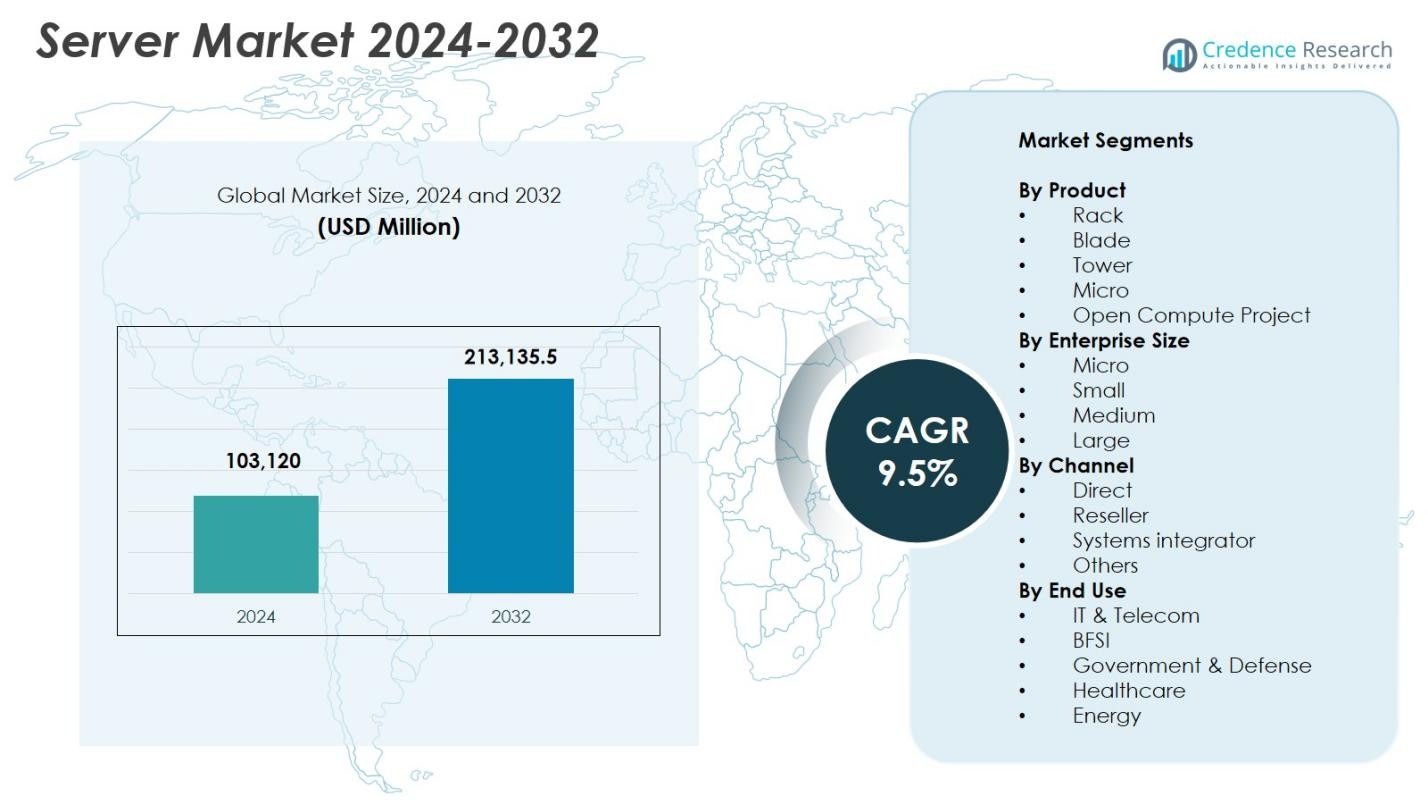

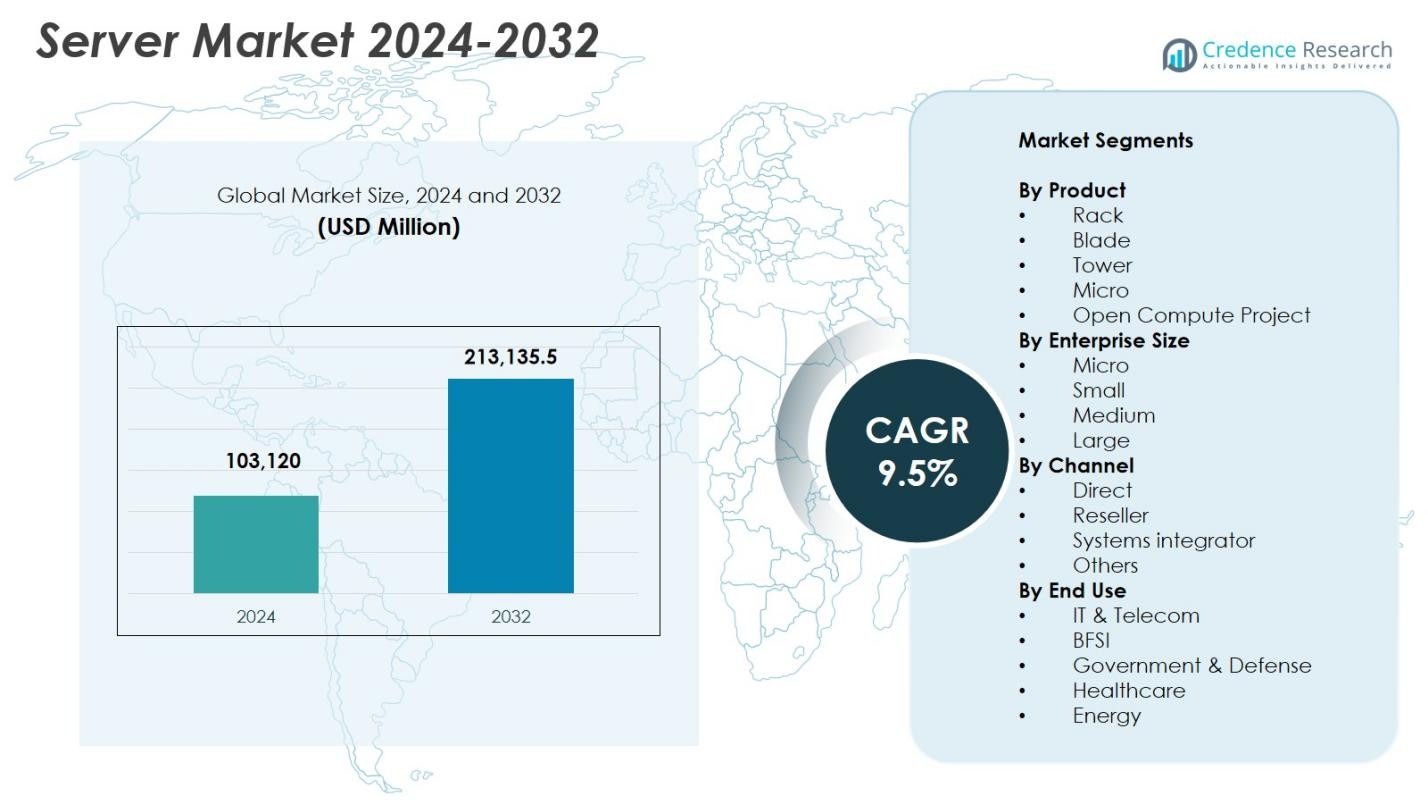

Server Market size was valued at USD 103,120 Million in 2024 and is anticipated to reach USD 213,135.5 Million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Server Market Size 2024 |

USD 103,120 Million |

| Server Market, CAGR |

9.5% |

| Server Market Size 2032 |

USD 213,135.5 Million |

Server market growth is driven by strong innovation and expansion efforts from major players, including Dell Inc., Hewlett Packard Enterprise Development LP, Lenovo, Cisco Systems Inc., Super Micro Computer Inc., IBM Corporation, Nvidia Corporation, Inspur, Hitachi Vantara LLC, and Fujitsu. These companies strengthen their presence through advanced GPU-accelerated systems, modular server designs, and cloud-ready infrastructure solutions tailored for AI, analytics, and hybrid cloud workloads. North America leads the Server market with a 36.8% share in 2024, supported by extensive data center development and enterprise digital transformation initiatives. Asia Pacific follows as the fastest-growing region with a 28.7% share, driven by rapid cloud adoption and large-scale IT modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Server market was valued at USD 103,120 Million in 2024 and is projected to reach USD 213,135.5 Million by 2032, growing at a CAGR of 9.5%.

- Rising deployment of AI, machine learning, and data-intensive applications is accelerating demand for high-performance and GPU-accelerated servers across enterprises and hyperscale environments.

- Trends such as edge computing expansion, modular server designs, and adoption of energy-efficient architectures are reshaping workload management and data center optimization globally.

- Key players including Dell, HPE, Lenovo, Cisco, Super Micro, IBM, Nvidia, Inspur, Fujitsu, and Hitachi Vantara strengthen their market presence through innovation, strategic partnerships, and AI-driven server portfolios.

- North America led the market with 36.8% share in 2024, followed by Asia Pacific at 28.7%, while rack servers dominated the product segment with 42.6% share, supported by strong adoption in cloud and enterprise IT modernization.

Market Segmentation Analysis

By Product

The Server market by product is led by the Rack server segment, accounting for over 42.6% share in 2024, driven by its superior scalability, dense compute capability, and suitability for modern virtualized and cloud-native workloads. Enterprises prefer rack solutions due to simplified management, modular expansion, and improved energy efficiency. Blade servers continue to gain adoption in high-density data centers, while tower servers remain relevant for SMEs with limited IT infrastructure needs. Micro servers and Open Compute Project (OCP) designs also expand steadily, supported by hyperscale operators seeking customizable, cost-efficient architectures.

- For instance, Nvidia announced in 2025 that its RTX Pro 6000 Blackwell Server Edition GPUs would ship in 2U rack-mount systems from partners including Dell, HPE, Lenovo and others, enabling significantly higher AI performance and energy efficiency per rack unit

By Enterprise Size

The large enterprise segment dominated the Server market with a 48.9% share in 2024, supported by growing investments in AI-accelerated compute, hybrid cloud workloads, and advanced storage-intensive applications. These organizations deploy high-performance servers to manage expanding datasets, real-time analytics, and mission-critical operations. Medium enterprises increasingly adopt scalable server clusters to support digital transformation initiatives, while small and micro enterprises show gradual uptake due to rising adoption of SaaS, edge computing, and remote IT infrastructure modernization.

- For instance, Lenovo expanded its ThinkSystem V3 rack servers with enhanced memory bandwidth and PCIe 5.0 support, helping mid-sized enterprises scale hybrid-cloud workloads and analytics at lower latency.

By Channel

The Server market by channel is primarily led by the direct sales segment, capturing 41.3% share in 2024, as large enterprises and hyperscale data centers prefer direct procurement for customization, faster deployment, and integrated support services. Resellers play a crucial role in serving SMEs through bundled solutions and competitive pricing, while system integrators drive adoption across sectors requiring tailored architectures, such as BFSI, telecom, and government. Other channels also grow, supported by rising demand for managed services and cloud-ready infrastructure across emerging markets.

Key Growth Drivers

Rapid Expansion of AI, ML, and HPC Workloads

The Server market experiences robust growth as enterprises accelerate adoption of artificial intelligence, machine learning, and high-performance computing to manage complex analytical, automation, and simulation workloads. Modern AI applications require GPU-accelerated servers, high-bandwidth memory, and advanced interconnects, prompting organizations to replace legacy systems and scale high-density data center environments. Industries such as healthcare, automotive, BFSI, and manufacturing rely on AI for diagnostics, fraud detection, autonomous systems, and predictive maintenance. Hyperscale providers are also investing heavily in AI supercomputing clusters to support generative AI and large-scale model training. Innovations such as liquid cooling, advanced thermal management, and heterogeneous compute systems combining CPUs, GPUs, and NPUs are accelerating market expansion. This shift strengthens long-term demand for high-performance, energy-efficient server infrastructure.

- For instance, NVIDIA introduced its Blackwell architecture including the GB200 Grace-Blackwell Superchip enabling multi-node AI clusters with significantly higher training throughput and powering next-generation enterprise and hyperscale server deployments.

Growing Enterprise Digital Transformation and Cloud Adoption

Digital transformation initiatives significantly boost server demand as organizations modernize IT systems to support hybrid cloud, multi-cloud, and edge environments. Businesses adopting cloud-native applications, microservices, and containerized workloads require scalable, flexible server deployments with advanced orchestration capabilities. The shift toward remote work, automation, and data-driven decision-making further increases need for resilient compute infrastructure across industries such as telecom, BFSI, retail, and government. Adoption of SaaS, PaaS, and IaaS models encourages enterprises to invest in hybrid server architectures that balance flexibility, data sovereignty, and operational continuity. The continuous expansion of digital services, cybersecurity needs, and mission-critical applications reinforces server upgrades and modernization programs worldwide, driving strong and sustained market growth.

- For instance, Amazon Web Services expanded its Graviton3-based EC2 portfolio, enabling customers running containerized workloads to achieve up to 25% better compute performance and improved orchestration efficiency for cloud-native applications.

Increasing Data Growth Driven by IoT, 5G, and Edge Computing

The explosive growth of data from IoT devices, 5G networks, industrial automation, and digital commerce fuels demand for scalable server infrastructure at both the edge and the core. Enterprises deploy edge servers to process data closer to the source, reducing latency and enabling real-time analytics for applications such as autonomous vehicles, smart factories, smart grids, and precision healthcare. Meanwhile, centralized data centers expand storage, compute capacity, and virtualization layers to manage rising data volumes. This dual infrastructure evolution drives adoption of high-density, energy-efficient servers with advanced connectivity. The expansion of Industry 4.0, digital twins, predictive intelligence, and connected consumer ecosystems further accelerates demand for distributed compute architectures capable of delivering fast processing, optimized bandwidth usage, and high service reliability.

Key Trends & Opportunities

Rise of Modular, OCP, and Energy-Efficient Server Designs

A major trend in the Server market is the growing adoption of modular server designs and Open Compute Project (OCP)-based architectures, driven by hyperscale buyers seeking customization, cost efficiency, and sustainability. Modular systems allow flexible scaling, simplified component replacement, and reduced maintenance complexity, making them ideal for cloud, AI, and large data center environments. Rising global focus on energy conservation and carbon reduction accelerates demand for servers with advanced cooling solutions, low-power processors, and optimized airflow engineering. Vendors increasingly develop liquid-cooled, high-density systems that reduce energy consumption while maximizing performance. As ESG compliance becomes mandatory across regions, organizations prioritize energy-efficient server deployments. This trend opens significant opportunities for innovations in thermal management, recyclable materials, and green data center models.

- For instance, Meta expanded its OCP-aligned hardware portfolio by introducing next-generation open rack designs optimized for AI and large-scale cloud workloads, improving thermal efficiency and reducing operational energy consumption.

Growing Adoption of Edge Servers Across Industries

Edge server deployment is expanding rapidly as enterprises seek real-time processing capabilities closer to the point of data generation. Industries such as telecom, automotive, healthcare, retail, and industrial manufacturing increasingly depend on edge compute nodes for low-latency operations, automation, and localized analytics. The rollout of 5G networks accelerates this shift, enabling high-speed, reliable connectivity for mission-critical and latency-sensitive applications. Vendors are developing compact, ruggedized, and AI-optimized edge servers designed to operate in remote, high-temperature, or space-constrained environments. Edge computing also supports new business models such as autonomous systems, extended reality (XR), next-gen IoT, and smart infrastructure. This creates long-term opportunities for hybrid architectures combining centralized data centers with distributed edge ecosystems.

- For instance, HPE expanded its Edgeline EL8000 portfolio with ruggedized, short-depth edge servers optimized for telecom and industrial AI workloads, enabling real-time data processing in harsh and space-constrained sites.

Key Challenges

Rising Infrastructure Costs and Energy Consumption

One of the major challenges in the Server market is the escalating cost of building and operating advanced compute environments. High-performance servers require substantial investment in power, cooling, racks, and physical space, driving up operational expenses for enterprises and hyperscale facilities. The growing adoption of GPU-based AI servers further increases power density and electricity consumption, straining both budgets and sustainability goals. Regions with limited grid capacity or high utility costs face additional hurdles in scaling data centers. Organizations must balance performance requirements with environmental responsibility, pushing vendors to innovate in energy-efficient hardware, liquid cooling systems, and renewable-powered data centers. Managing rising carbon emissions, thermal loads, and long-term TCO remains a critical challenge for the industry.

Supply Chain Disruptions and Semiconductor Shortages

The Server market continues to experience disruptions caused by global semiconductor shortages, component supply delays, and geopolitical tensions affecting manufacturing hubs. Limited availability of CPUs, GPUs, memory modules, power components, and networking chips leads to extended lead times and fluctuating costs for server vendors and buyers. Export restrictions, transportation bottlenecks, and reliance on a small number of semiconductor fabrication facilities further exacerbate the issue. These constraints impact vendors’ ability to meet demand from hyperscale cloud providers and large enterprises undergoing digital transformation. To mitigate the challenge, manufacturers are diversifying supplier bases, investing in regional production, and optimizing inventory strategies. However, long-term semiconductor capacity expansion remains essential to ensure stable server market growth.

Regional Analysis

North America

North America held the largest share of the Server market in 2024, accounting for 36.8%, driven by strong data center expansion, early adoption of AI, and robust hyperscale cloud investments from major providers. Enterprises across BFSI, healthcare, retail, and government continue modernizing infrastructure to support hybrid cloud and advanced analytics workloads. The U.S. leads the region due to concentrated technology innovation, rapid deployment of GPU-accelerated servers, and rising demand for high-performance compute environments. Ongoing investments in 5G, cybersecurity, and digital transformation further reinforce North America’s position as a key growth hub for server infrastructure.

Europe

Europe captured 26.4% of the Server market in 2024, supported by increasing enterprise modernization, strict data sovereignty regulations, and rising investment in regional cloud infrastructure. Germany, the U.K., and France dominate server deployments due to strong industrial automation, IoT integration, and growing adoption of edge computing across manufacturing and automotive sectors. The region prioritizes energy-efficient server technologies and green data centers to meet sustainability targets. Demand continues to rise as enterprises implement AI-driven applications, expand digital public services, and migrate to hybrid cloud architectures, strengthening Europe’s momentum in next-generation computing infrastructure.

Asia Pacific

Asia Pacific emerged as the fastest-growing region in the Server market, holding 28.7% share in 2024, driven by rapid digitalization, large-scale cloud expansion, and increasing enterprise IT spending. China, Japan, India, and South Korea lead growth due to strong data center construction, rising 5G adoption, and accelerated rollout of AI and IoT applications. Local hyperscalers and telecom operators continue investing heavily in high-density server deployments to meet surging demand for online services, e-commerce, fintech solutions, and industrial automation. Expanding startup ecosystems and strong government support for digital infrastructure further enhance Asia Pacific’s long-term growth outlook.

Latin America

Latin America accounted for 4.1% of the Server market in 2024, supported by growing cloud adoption, digital transformation in enterprises, and increasing investments in regional data centers. Brazil and Mexico lead deployments as organizations modernize IT infrastructure to handle rising data volumes, cybersecurity needs, and AI-driven analytics. The region’s expanding fintech, telecom, and e-commerce sectors drive demand for scalable and cost-efficient server architectures. Although infrastructure challenges remain, improving connectivity, cloud service availability, and supportive regulatory reforms are accelerating market penetration. Latin America continues transitioning toward hybrid IT environments, fueling steady server market expansion.

Middle East & Africa

The Middle East & Africa region held 4.0% share of the Server market in 2024, driven by growing investments in smart city initiatives, cloud data centers, and digital government programs. Countries such as the UAE, Saudi Arabia, and South Africa lead server deployment supported by strong IT modernization efforts and rapid adoption of AI, IoT, and cybersecurity solutions. Telecom operators expanding 5G networks further boost demand for edge and high-performance servers. Although the region faces challenges related to infrastructure maturity, increasing enterprise digital adoption and national transformation agendas continue to strengthen market growth opportunities.

Market Segmentations

By Product

- Rack

- Blade

- Tower

- Micro

- Open Compute Project

By Enterprise Size

By Channel

- Direct

- Reseller

- Systems integrator

- Others

By End Use

- IT & Telecom

- BFSI

- Government & Defense

- Healthcare

- Energy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Server market features a diverse and evolving competitive landscape, shaped by continuous innovation in high-performance computing, AI-optimized architectures, and cloud-ready infrastructure. Leading players such as Dell Inc., Hewlett Packard Enterprise Development LP, Lenovo, Cisco Systems Inc., Super Micro Computer Inc., IBM Corporation, Nvidia Corporation, Inspur, Hitachi Vantara LLC, and Fujitsu actively expand their portfolios with energy-efficient servers, GPU-accelerated systems, and modular data center solutions. Vendors increasingly focus on strategic partnerships, AI ecosystem integrations, and customized deployments to address the growing needs of hyperscale cloud providers, enterprises, and edge computing environments. Ongoing investments in liquid cooling, Open Compute Project designs, and advanced security-embedded servers strengthen market differentiation. As competition intensifies, companies emphasize performance enhancements, sustainability, and total cost-of-ownership reduction to capture expanding opportunities across hybrid cloud, multi-cloud, and data-intensive workloads.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lenovo (China)

- Super Micro Computer, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Hitachi Vantara, LLC (Japan)

- Cisco Systems, Inc. (U.S.)

- Nvidia Corporation (U.S.)

- Dell, Inc. (U.S.)

- Inspur (China)

- Fujitsu (Japan)

- IBM Corporation (Canada)

Recent Developments

- In May 2024, Ericsson and Dell Technologies partnered to combine their deep industry expertise with telecommunications solutions, software, and support to oversee Communications Service Providers (CSPs) throughout their cloud transformation journey and Radio Access Network (RAN).

- In May 2024, GIGABYTE launched the G593-SD0, NVIDIA’s 5U AI server, to support the HGX H100 8 x SXM5. The company continues to expand its AI super server lineup with AI servers by presenting the Grace Hopper super chip and AI servers supporting the AMD MI300X GPU and next-generation MI300A APU super chip.

- In April 2024, Hewlett Packard Enterprise announced that its “Made in India” servers were being installed at a large scale to meet the rising demands of Indian customers and design various applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Enterprise Size, Channel, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Server market will experience strong growth as enterprises accelerate adoption of AI, ML, and data-intensive workloads.

- Demand for GPU-optimized and heterogeneous compute architectures will expand across cloud and on-premise environments.

- Edge server deployments will rise as low-latency processing becomes essential for IoT, 5G, and industrial automation.

- Modular, energy-efficient, and liquid-cooled server designs will gain wider adoption to reduce power consumption.

- Hybrid and multi-cloud strategies will drive continuous upgrades in enterprise server infrastructure.

- AI-driven automation will optimize server management, workload distribution, and data center operations.

- Regional data sovereignty rules will increase adoption of localized and secure server deployments.

- Semiconductor advancements will enhance server processing speeds, efficiency, and scalability.

- Hyperscale data center expansion will continue to be a major demand driver globally.

- Sustainability and carbon-neutral initiatives will push organizations toward greener server technologies and infrastructure.