Market Overview

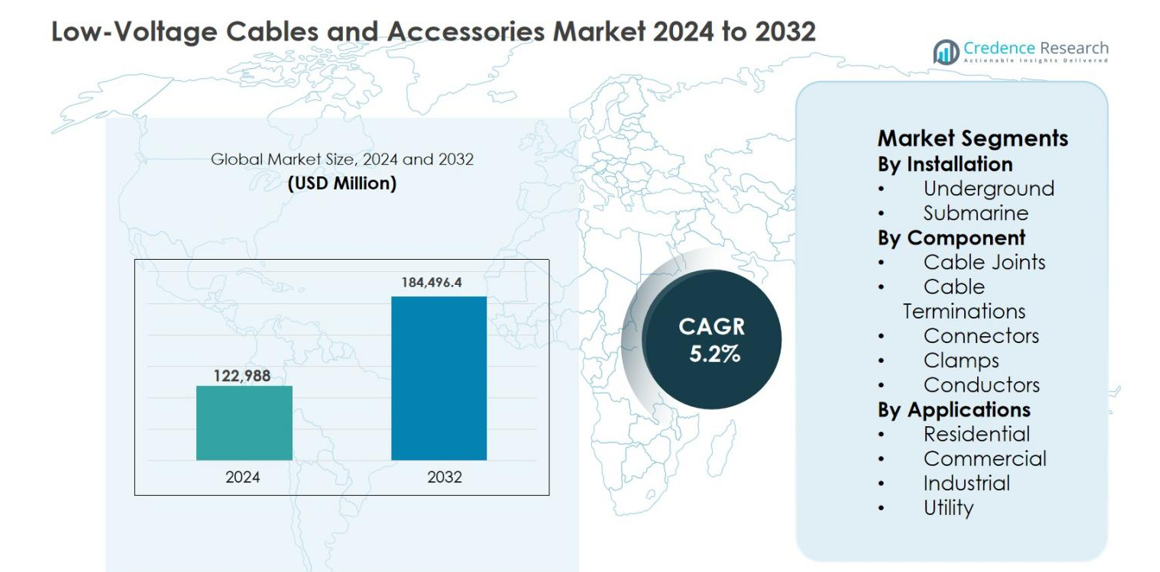

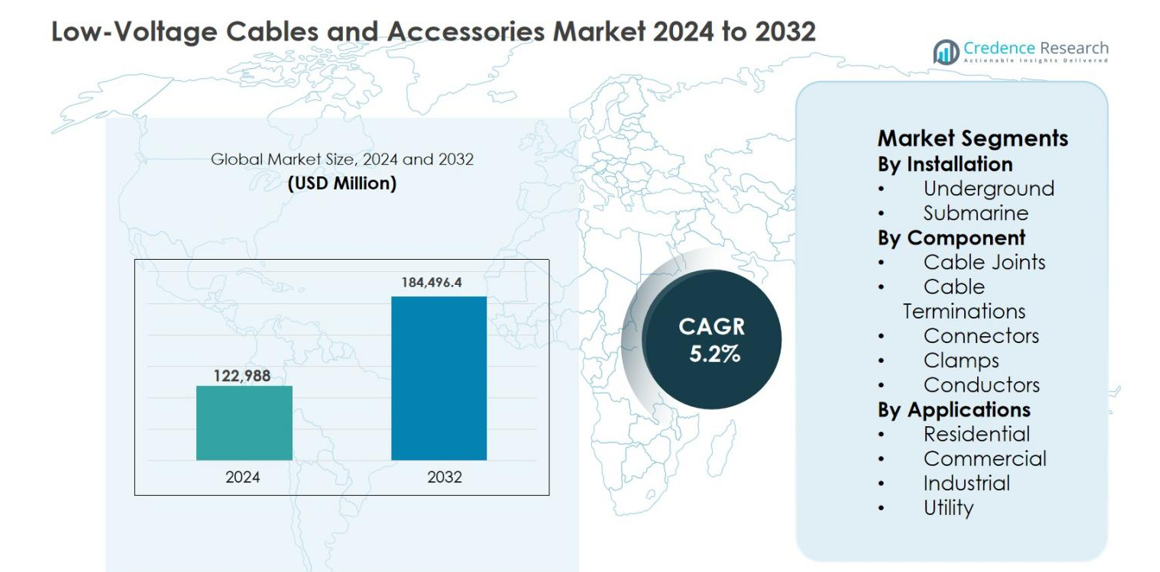

The Low-Voltage Cables and Accessories Market size was valued at USD 122,988 million in 2024 and is anticipated to reach USD 184,496.4 million by 2032, expanding at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low-Voltage Cables and Accessories Market Size 2024 |

USD 122,988 million |

| Low-Voltage Cables and Accessories Market, CAGR |

5.2% |

| Low-Voltage Cables and Accessories Market Size 2032 |

USD 184,496.4 million |

The Low-Voltage Cables and Accessories market is supported by a diverse mix of global and regional manufacturers focusing on reliability, safety, and infrastructure-driven demand. Key players such as Prysmian Group, NKT A/S, Hellenic Cables, Elsewedy Electric, TE Connectivity, Ensto, Raychem RPG, Alcon Megarad, Ikebana Engineering Ltd, and REPL International Ltd strengthen their positions through product innovation, capacity expansion, and strong utility and construction partnerships. Asia Pacific leads the market with an exact 42.6% share, driven by rapid urbanization, power distribution expansion, and large-scale infrastructure investments in China, India, and Southeast Asia. Europe follows with 26.8% share, supported by grid modernization and stringent safety regulations, while North America holds 18.4% share due to infrastructure upgrades and electrification initiatives.

Market Insights

- The Low-Voltage Cables and Accessories market was valued at USD 122,988 million in 2024 and is expected to reach USD 184,496.4 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Expansion of power distribution networks, grid modernization, rapid urbanization, and rising electrification across residential, commercial, industrial, and utility sectors are the primary growth drivers, supported by smart city projects, renewable energy integration, and large-scale infrastructure investments.

- Increasing adoption of underground and submarine cabling, rising demand for fire-resistant and low-smoke cables, and growing use of advanced cable joints and terminations in smart buildings and industrial automation are key market trends driving product innovation.

- Volatility in copper and aluminum prices, intense price competition among global and regional manufacturers, and high cost sensitivity in utility and infrastructure projects remain major market restraints.

- Asia Pacific dominates with 42.6% share, followed by Europe at 26.8%, North America at 18.4%, Latin America at 7.1%, and Middle East & Africa at 5.1%, while underground installation leads with 61.4% share and cable joints hold 29.6% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Installation

The Low-Voltage Cables and Accessories market is led by the Underground installation segment, which accounted for 61.4% market share in 2024. This dominance is driven by rapid urbanization, expansion of smart cities, and increasing preference for concealed power distribution to enhance safety, reliability, and aesthetics. Underground installations reduce exposure to weather-related disruptions and lower maintenance requirements, making them suitable for dense urban, commercial, and industrial environments. Rising investments in metro rail projects, underground utilities, and renewable energy infrastructure further support demand, while regulatory mandates promoting resilient and safer power networks strengthen adoption.

- For instance, Prysmian Group was awarded a major contract to supply approximately 1,000 km of 525 kV HVDC underground and subsea cable for the Eastern Green Link 2 project between Scotland and England, bolstering the UK’s transmission network to support renewables and grid resilience.

By Component

Among components, the Cable Joints segment held the dominant position with a market share of 29.6% in 2024. Cable joints play a critical role in ensuring secure electrical continuity, fault resistance, and long-term reliability across low-voltage networks. Their extensive use in underground and industrial installations drives consistent demand. Growth is supported by increasing refurbishment of aging power infrastructure, expansion of distribution networks, and rising industrial electrification. Advancements in heat-shrink and cold-shrink joint technologies, offering faster installation and improved insulation performance, further enhance adoption across residential, commercial, and utility applications.

- For instance, TE Connectivity’s Raychem heat-shrink cable joints are widely used in low-voltage underground networks due to their cross-linked polyolefin insulation, which provides high dielectric strength, moisture sealing, and resistance to soil chemicals.

By Application

The Utility application segment dominated the Low-Voltage Cables and Accessories market, capturing 34.8% share in 2024. Utilities require extensive low-voltage networks for power distribution, grid modernization, and last-mile connectivity, driving sustained demand. Large-scale investments in grid expansion, renewable energy integration, and rural electrification programs significantly support this segment. Additionally, the transition toward smart grids and digital substations increases the need for reliable cables, connectors, and terminations. Government-backed infrastructure spending and energy access initiatives continue to reinforce the utility segment’s leading position.

Key Growth Drivers

Expansion of Power Distribution and Grid Modernization

The Low-Voltage Cables and Accessories market is strongly driven by large-scale expansion of power distribution networks and ongoing grid modernization initiatives worldwide. Governments and utilities are investing heavily in upgrading aging electrical infrastructure to improve efficiency, reduce losses, and enhance reliability. Rising electricity demand from urbanization, industrialization, and electrification of rural areas accelerates the need for robust low-voltage networks. Smart grid deployment, integration of digital monitoring systems, and replacement of outdated wiring further stimulate demand for advanced cables, joints, and terminations. Utility-led investments, supported by favorable policy frameworks and infrastructure funding, continue to create sustained growth opportunities across developed and emerging economies.

- For instance, the Government of India’s Revamped Distribution Sector Scheme (RDSS) focuses on upgrading distribution infrastructure, including replacement of obsolete low-voltage lines and installation of underground cabling to reduce outages and losses.

Rapid Urbanization and Infrastructure Development

Accelerated urbanization and infrastructure development significantly fuel demand in the Low-Voltage Cables and Accessories market. Construction of residential complexes, commercial buildings, transportation systems, and smart cities requires extensive low-voltage power distribution for lighting, HVAC, communication, and safety systems. Underground cabling is increasingly preferred in urban environments to improve aesthetics, safety, and resilience. Growing investments in metros, airports, data centers, and public utilities further increase consumption of cables and accessories. The rise of mixed-use developments and high-density housing also drives demand for compact, high-performance cable solutions that support efficient space utilization and long-term operational reliability.

- For instance, the Delhi Metro Rail Corporation (DMRC) extensively deploys underground low-voltage and control cables for station lighting, signaling, ventilation, and safety systems across its expanding metro corridors.

Industrial Electrification and Renewable Energy Integration

Industrial electrification and the growing integration of renewable energy sources are key drivers shaping the Low-Voltage Cables and Accessories market. Manufacturing facilities, process industries, and logistics hubs increasingly rely on automated and electrically driven systems, increasing demand for reliable low-voltage connectivity. In parallel, renewable energy projects such as solar and wind require extensive low-voltage cabling for inverters, substations, and auxiliary systems. Electrification of transport infrastructure and EV charging networks further expands application scope. These trends collectively support sustained demand for durable, high-efficiency cables and accessories capable of operating in diverse industrial and energy environments.

Key Trends & Opportunities

Shift Toward Underground and Submarine Cabling Solutions

A key trend in the Low-Voltage Cables and Accessories market is the growing shift toward underground and submarine cabling solutions. Urban congestion, land-use constraints, and reliability concerns drive adoption of concealed power networks. Underground systems reduce exposure to environmental damage, improve safety, and lower maintenance costs, while submarine cables support offshore renewable projects and interconnections. This shift creates opportunities for advanced insulation materials, moisture-resistant joints, and long-life terminations. Manufacturers focusing on high-performance, installation-friendly solutions can benefit from increasing demand across urban infrastructure and offshore energy applications.

- For instance, Prysmian Group supplies low- and medium-voltage submarine cable systems for offshore wind farms, designed with water-blocking layers and corrosion-resistant insulation to ensure long service life in harsh marine environments.

Rising Demand for Smart, Sustainable, and Fire-Resistant Cables

The market is witnessing increasing demand for smart, sustainable, and fire-resistant low-voltage cables. Regulatory emphasis on energy efficiency, fire safety, and environmental compliance encourages adoption of halogen-free, low-smoke, and recyclable cable materials. Smart buildings and industrial facilities require cables compatible with digital monitoring and automation systems. These requirements open opportunities for innovation in material science, lightweight designs, and value-added accessories. Companies offering sustainable and technologically advanced solutions can differentiate their portfolios and capture premium segments in residential, commercial, and industrial markets.

- For instance, Nexans offers fire-resistant low-voltage cables compliant with IEC 60331, ensuring circuit integrity for emergency systems in commercial buildings, metros, and hospitals.

Key Challenges

Volatility in Raw Material Prices

Volatility in raw material prices remains a major challenge for the Low-Voltage Cables and Accessories market. Key inputs such as copper, aluminum, and polymers are subject to frequent price fluctuations driven by global supply-demand imbalances, geopolitical factors, and energy costs. These variations directly impact manufacturing costs and profit margins, particularly for price-sensitive infrastructure and construction projects. Passing cost increases to end users is often difficult due to competitive pricing pressures. Manufacturers must adopt strategic sourcing, inventory optimization, and pricing mechanisms to mitigate risks and maintain financial stability.

Intense Competition and Pricing Pressure

Intense competition and pricing pressure pose significant challenges in the Low-Voltage Cables and Accessories market. The presence of numerous regional and global manufacturers leads to commoditization of standard products, limiting differentiation and margin expansion. Price-based competition is particularly strong in large infrastructure and utility tenders, where cost remains a key decision factor. Smaller players face challenges in scaling operations and meeting stringent quality standards. To remain competitive, companies must invest in innovation, branding, and service capabilities while balancing cost efficiency and compliance with evolving regulatory requirements.

Regional Analysis

Asia Pacific

Asia Pacific dominated the Low-Voltage Cables and Accessories market with an 42.6% market share in 2024, driven by rapid urbanization, large-scale infrastructure development, and expanding power distribution networks. Strong growth in China, India, and Southeast Asia is supported by rising residential construction, industrial expansion, and government-led electrification programs. Investments in smart cities, metro rail projects, renewable energy installations, and manufacturing capacity upgrades continue to boost demand. The presence of cost-competitive manufacturing hubs and increasing adoption of underground cabling further strengthen Asia Pacific’s leadership in the global market.

Europe

Europe accounted for 26.8% market share in 2024, supported by grid modernization initiatives, renewable energy integration, and strict safety and sustainability regulations. Countries such as Germany, France, the UK, and the Nordics are investing heavily in underground cabling, smart grids, and energy-efficient infrastructure. Replacement of aging electrical networks and rising demand for fire-resistant, low-smoke cables in commercial and residential buildings drive market growth. Strong regulatory enforcement and emphasis on sustainable materials create steady demand for advanced low-voltage cables and accessories across utility, industrial, and building applications.

North America

North America held 18.4% market share in 2024, driven by power infrastructure upgrades, data center expansion, and increasing electrification across residential and commercial sectors. The United States leads regional demand due to investments in grid resilience, renewable energy integration, and EV charging infrastructure. Replacement of aging transmission and distribution systems supports consistent demand for low-voltage cables, joints, and connectors. Growing adoption of smart buildings and industrial automation further contributes to market expansion. Regulatory focus on safety standards and energy efficiency continues to shape product demand in the region.

Latin America

Latin America captured 7.1% market share in 2024, supported by expanding power distribution networks and urban infrastructure development. Countries such as Brazil, Mexico, and Chile are investing in residential construction, renewable energy projects, and industrial facilities, driving demand for low-voltage cables and accessories. Rural electrification programs and grid expansion initiatives improve market penetration. However, budget constraints and economic volatility limit rapid adoption. Despite these challenges, increasing foreign investments and gradual modernization of electrical infrastructure present steady growth opportunities across utility, commercial, and industrial segments.

Middle East & Africa

The Middle East & Africa region accounted for about 5.1% market share in 2024, driven by infrastructure expansion, urban development, and energy diversification efforts. Gulf countries invest heavily in smart cities, commercial buildings, and power distribution systems, supporting demand for low-voltage cables and accessories. In Africa, rural electrification and grid extension projects play a key role in market growth. While adoption remains uneven due to funding and regulatory challenges, rising construction activity and long-term energy access initiatives continue to support gradual regional expansion.

Market Segmentations:

By Installation

By Component

- Cable Joints

- Cable Terminations

- Connectors

- Clamps

- Conductors

By Applications

- Residential

- Commercial

- Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Low-Voltage Cables and Accessories market features a fragmented yet highly competitive landscape characterized by the presence of global manufacturers and strong regional players. Leading companies such as Prysmian Group, NKT A/S, Hellenic Cables, Elsewedy Electric, TE Connectivity, Ensto, Raychem RPG, Alcon Megarad, Ikebana Engineering Ltd, and REPL International Ltd focus on expanding production capacity, strengthening distribution networks, and enhancing product reliability. Key players invest in advanced insulation technologies, fire-resistant materials, and installation-friendly accessories to meet evolving regulatory and safety standards. Strategic partnerships with utilities, infrastructure developers, and industrial customers support long-term contracts and recurring demand. Regional players compete through cost efficiency and localized manufacturing, while global firms leverage technological expertise and broad portfolios. Continuous product innovation and infrastructure-driven demand remain central to maintaining market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Raychem RPG

- Prysmian Group

- Ikebana Engineering Ltd

- TE Connectivity

- Elsewedy Electric

- Ensto

- Repl International Ltd

- NKT A/S

- Alcon Megarad

- Hellenic Cables

Recent Developments

- In December 2025 Value Added Distributors (VAD) announced the acquisition of L.T.L. Supply (LTL), a manufacturer and distributor of custom wire harnesses and electrical assemblies.

- In October 2025 Nexans signed an agreement to acquire Electro Cables Inc., a Canadian manufacturer of low-voltage cable systems, strengthening Nexans’ positioning in the PWR-Connect business in Canada.

- In September 2025 Kinderhook Industries announced the acquisition of Advanced Digital Cable Inc. (ADC), a wire and cable solutions manufacturer with a focus on low-voltage copper wire, as part of Kinderhook’s Fund 8 expansion.

Report Coverage

The research report offers an in-depth analysis based on Installation, Component, Applications and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Low-Voltage Cables and Accessories market will benefit from sustained investments in power distribution expansion and grid modernization across developed and emerging economies.

- Increasing urbanization and smart city development will continue to drive demand for underground and compact low-voltage cabling solutions.

- Renewable energy integration will create long-term opportunities for low-voltage cables and accessories used in inverters, substations, and auxiliary systems.

- Electrification of transportation infrastructure and expansion of EV charging networks will support steady market growth.

- Adoption of fire-resistant, low-smoke, and halogen-free cables will increase due to stricter safety and building regulations.

- Digitalization of power networks will boost demand for advanced connectors, joints, and terminations with higher reliability.

- Industrial automation and manufacturing electrification will strengthen demand across industrial and utility applications.

- Product innovation focused on durability, ease of installation, and lifecycle performance will gain importance.

- Emerging economies will present strong growth potential due to infrastructure development and rural electrification programs.

- Strategic partnerships between manufacturers, utilities, and infrastructure developers will shape long-term market expansion.