Market Overview

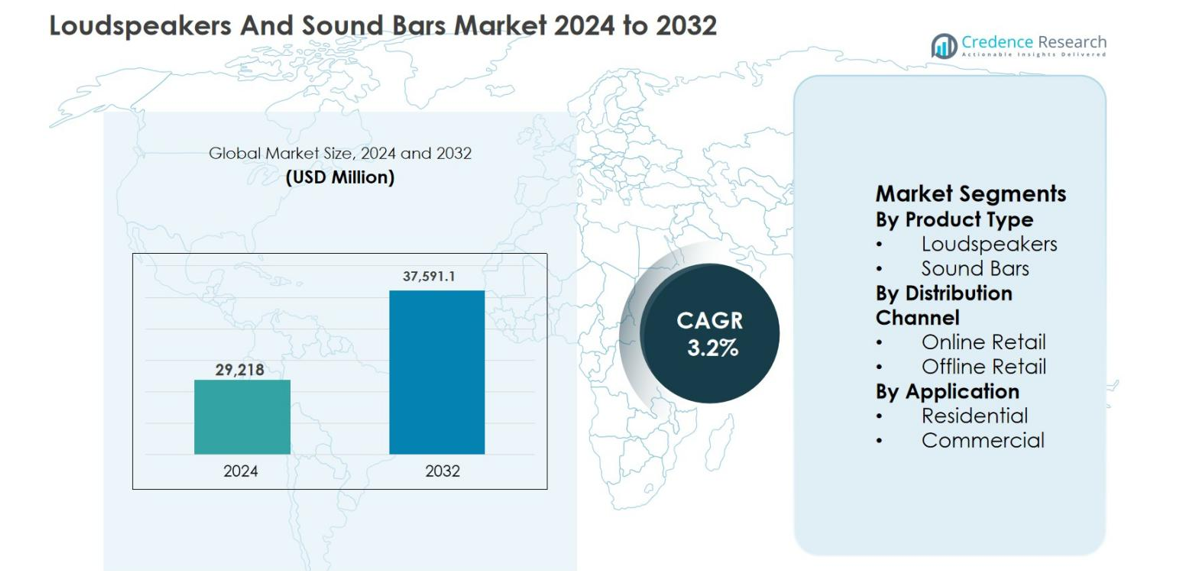

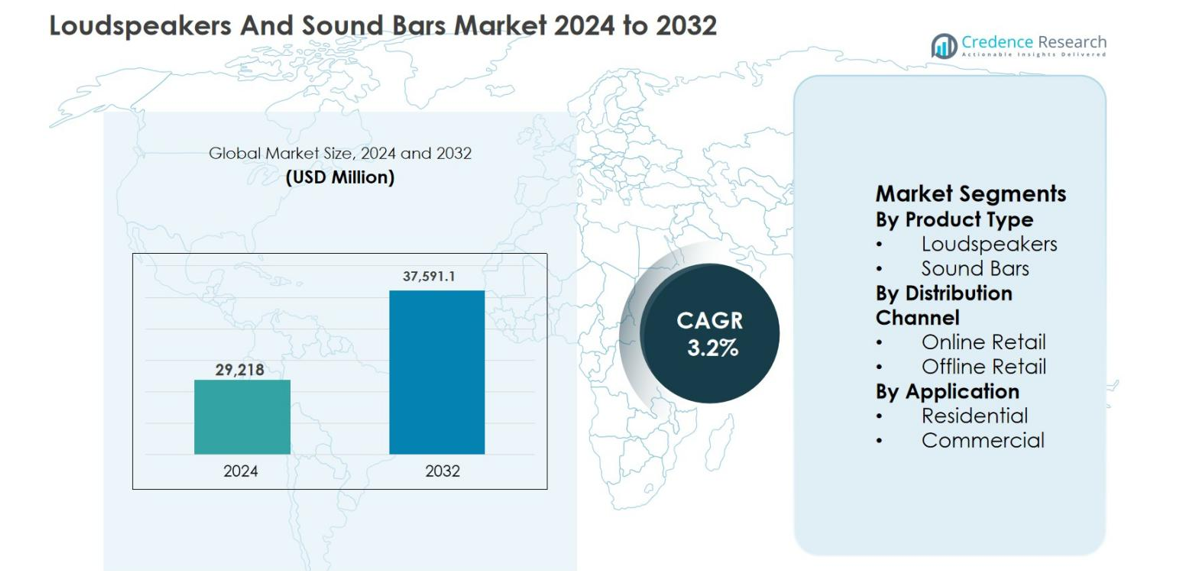

The Loudspeakers and Sound Bars Market size was valued at USD 29,218 million in 2024 and is anticipated to reach USD 37,591.1 million by 2032, growing at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Loudspeakers and Sound Bars Market Size 2024 |

USD 29,218 million |

| Loudspeakers and Sound Bars Market, CAGR |

3.2% |

| Loudspeakers and Sound Bars Market Size 2032 |

USD 37,591.1 million |

The Loudspeakers and Sound Bars market is driven by the strong presence of global audio and consumer electronics manufacturers focused on innovation, sound quality, and smart connectivity. Leading players such as Bose Corporation, Sony Corporation, Harman International Industries Incorporated, LG Electronics Inc., Yamaha Corporation, Bang & Olufsen A/S, Sennheiser Electronic GmbH & Co., Logitech International S.A., Klipsch Audio Technologies, and Sound United LLC actively compete through diversified product portfolios spanning premium, mid-range, and mass-market segments. These companies emphasize wireless technologies, voice-enabled features, and design-focused solutions to strengthen brand differentiation. Regionally, North America leads the market with an exact 34% share, supported by high adoption of home entertainment systems, strong purchasing power, and early uptake of advanced audio technologies, reinforcing its position as the dominant regional market

Market Insights

- Loudspeakers and Sound Bars market was valued at USD 29,218 million in 2024 and is projected to reach USD 37,591.1 million by 2032, growing at a CAGR of 3.2% during the forecast period, supported by steady demand from residential and commercial users.

- Rising adoption of home entertainment systems, smart TVs, and wireless audio devices is a key growth driver, with consumers increasingly upgrading to external audio solutions for enhanced sound quality and immersive viewing experiences.

- Market trends highlight strong demand for wireless, Bluetooth-enabled, and voice-controlled products, while Loudspeakers remain the dominant product type with around 62% market share due to superior sound performance and broad application usage.

- Intense competition among global brands drives continuous innovation, portfolio expansion, and pricing strategies, while high competition in mid-range products and rapid technology shifts act as key market restraints.

- Regionally, North America leads with 34% market share, followed by Europe at 28% and Asia-Pacific at 26%, while Residential applications dominate with nearly 71% share, reflecting strong household demand globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Loudspeakers and Sound Bars market, by product type, is led by Loudspeakers, which accounted for 62% market share in 2024. Strong demand for multi-room audio systems, home theater setups, and professional sound applications continues to support loudspeaker dominance. Consumers prefer loudspeakers for superior acoustic performance, customization options, and compatibility with amplifiers and smart home ecosystems. Growing adoption across commercial venues such as auditoriums, retail spaces, and hospitality environments further strengthens demand. Meanwhile, sound bars are gaining traction due to compact design and ease of installation, supporting incremental growth within this segment.

- For instance, in March 2023 Sonos introduced the Era 300, positioned around Dolby Atmos spatial audio and designed to slot into multi-room setups; it also supports Bluetooth pairing for flexible playback.

By Distribution Channel

Based on distribution channel, Offline Retail dominated the Loudspeakers and Sound Bars market with 58% share in 2024. Physical stores remain preferred for audio products as consumers value live sound demonstrations, expert consultation, and immediate product availability before purchase. Specialty electronics stores and brand-exclusive outlets play a critical role in influencing buying decisions for premium and professional-grade systems. Offline channels also benefit from bundled offers, installation support, and after-sales services. Although online retail is expanding rapidly due to price transparency and convenience, offline retail continues to retain leadership due to experiential purchasing advantages.

- For instance, Best Buy’s Magnolia and premium audio zones are designed around dedicated listening rooms that allow customers to audition speakers and sound bars under controlled acoustics, supported by trained audio advisors and in-home installation services.

By Application

By application, the Residential segment held the largest share of the Loudspeakers and Sound Bars market at 71% in 2024. Rising consumer spending on home entertainment, smart TVs, gaming consoles, and streaming services drives strong residential demand. The increasing popularity of home theaters, wireless audio systems, and voice-enabled smart speakers further supports growth. Urbanization and smaller living spaces encourage adoption of compact yet high-performance audio solutions. While commercial adoption continues across hospitality, corporate, and event venues, residential usage remains the primary revenue contributor due to higher unit volumes and replacement cycles.

Key Growth Drivers

Rising Demand for Home Entertainment and Smart Audio Systems

The Loudspeakers and Sound Bars market is experiencing strong growth due to rising global demand for advanced home entertainment systems. Increasing penetration of smart TVs, OTT streaming platforms, and gaming consoles has heightened consumer expectations for immersive audio experiences. Consumers are upgrading from built-in TV speakers to external loudspeakers and sound bars to achieve superior sound quality, clarity, and surround effects. The growing adoption of smart homes further accelerates demand, as wireless and voice-enabled audio devices integrate seamlessly with connected ecosystems. Urban lifestyles, higher disposable incomes, and increased time spent at home also support purchasing decisions. This sustained focus on enhanced in-home entertainment continues to drive consistent demand across both premium and mid-range audio products.

- For instance, in 2023 Sony expanded Dolby Atmos support across its sound bar lineup, aligning products with PlayStation 5’s 3D audio features to enhance gaming and streaming immersion.

Expansion of Wireless, Bluetooth, and Voice-Enabled Technologies

Technological advancements in wireless connectivity are a major growth driver for the Loudspeakers and Sound Bars market. Bluetooth, Wi-Fi, and multi-room audio technologies allow users to stream high-quality audio effortlessly across multiple devices and spaces. Integration with voice assistants such as Alexa, Google Assistant, and Siri enhances usability and personalization, encouraging wider adoption. Consumers increasingly prefer clutter-free, portable, and easy-to-install solutions, supporting the shift toward wireless loudspeakers and sound bars. Improvements in battery life, low-latency transmission, and audio codecs further strengthen performance. These innovations expand the consumer base, attract first-time buyers, and stimulate replacement demand, reinforcing long-term market growth.

- For instance, Bose enhanced wireless performance in its portable smart speakers by combining Bluetooth streaming with Wi-Fi-based voice assistant access, delivering both mobility and smart-home compatibility in a single device.

Growing Commercial Adoption Across Hospitality and Retail Spaces

Commercial usage is emerging as a key growth driver for the Loudspeakers and Sound Bars market. Hotels, restaurants, retail stores, and corporate offices increasingly invest in high-quality audio systems to enhance customer experience and brand ambience. Background music, digital signage integration, and event-based audio solutions rely on professional-grade loudspeakers for consistent sound delivery. The expansion of cafes, shopping malls, fitness centers, and entertainment venues globally fuels steady demand. Additionally, corporate spaces adopt sound bars and conferencing speakers to support hybrid work environments and virtual meetings. This expanding commercial footprint diversifies revenue streams and strengthens market resilience beyond residential demand.

Key Trends & Opportunities

Shift Toward Compact, Minimalist, and Design-Focused Audio Products

A key trend shaping the Loudspeakers and Sound Bars market is the growing preference for compact, minimalist, and aesthetically appealing designs. Consumers increasingly seek audio solutions that complement modern interior décor without compromising sound performance. Slim sound bars, wall-mounted speakers, and hidden in-ceiling audio systems are gaining popularity, particularly in urban homes with limited space. Manufacturers are responding by blending premium materials, sleek finishes, and customizable form factors. This design-driven approach creates opportunities for differentiation and premium pricing. As lifestyle-oriented purchasing becomes more prominent, brands that combine performance with visual appeal can capture a broader consumer base.

- For instance, in 2023 Bang & Olufsen introduced the Beosound Theatre soundbar, featuring a slim modular design with customizable wooden and aluminum fronts, allowing integration into modern interiors while supporting Dolby Atmos playback.

Growth Opportunities in Emerging Markets and Mid-Priced Segments

Emerging economies present strong growth opportunities for the Loudspeakers and Sound Bars market due to rising disposable incomes, urbanization, and expanding middle-class populations. Increasing penetration of smart TVs and smartphones in these regions boosts demand for affordable yet high-quality audio accessories. Mid-priced sound bars and wireless speakers are witnessing strong adoption among cost-conscious consumers seeking value for money. Local manufacturing, regional partnerships, and e-commerce expansion further enhance market accessibility. Companies that tailor products to regional preferences and price sensitivities can accelerate market penetration and achieve higher volume growth across developing regions.

- For instance, Bose launched the Smart Ultra Soundbar in India, featuring Dolby Atmos spatial audio and AI Dialogue Mode for crisp vocals, tailored for urban consumers upgrading home entertainment via e-commerce platforms like Amazon and Flipkart.

Key Challenges

Intense Competition and Pricing Pressure

The Loudspeakers and Sound Bars market faces significant challenges from intense competition among global brands, regional manufacturers, and new entrants. A crowded marketplace leads to aggressive pricing strategies, frequent product launches, and reduced profit margins. Consumers often compare features and prices across multiple brands, increasing sensitivity to discounts and promotions. This environment makes differentiation difficult, especially in the mid and low-price segments. Manufacturers must continuously invest in innovation, branding, and marketing to maintain visibility and customer loyalty. Sustaining profitability while balancing quality, technology upgrades, and competitive pricing remains a critical challenge for market participants.

Rapid Technological Obsolescence and Short Product Lifecycles

Rapid technological evolution poses a key challenge for the Loudspeakers and Sound Bars market. Advancements in audio codecs, connectivity standards, and smart features shorten product lifecycles and increase pressure on manufacturers to update offerings frequently. Products can quickly become outdated as consumers expect compatibility with the latest devices, platforms, and voice assistants. This dynamic increases research and development costs and raises inventory management risks. Additionally, managing software updates, firmware support, and long-term device compatibility adds complexity. Companies must balance innovation speed with cost efficiency to remain competitive while ensuring product reliability and customer satisfaction.

Regional Analysis

North America

North America dominated the Loudspeakers and Sound Bars market with approximately 34% market share in 2024, supported by high consumer spending on premium home entertainment and smart audio systems. Strong adoption of smart TVs, gaming consoles, and voice-enabled devices drives consistent demand for advanced audio solutions. The presence of leading manufacturers and well-established distribution networks further strengthens the regional market. Residential demand remains robust, while commercial adoption across hospitality, corporate offices, and entertainment venues adds steady growth. Continuous product innovation and early adoption of new audio technologies position North America as a mature yet innovation-driven market.

Europe

Europe accounted for around 28% market share in 2024 in the Loudspeakers and Sound Bars market, driven by strong demand for high-quality audio products and design-centric solutions. Consumers in Western Europe show a preference for premium sound systems that align with modern interior aesthetics. Growth is supported by expanding smart home adoption and rising demand for wireless and multi-room audio systems. Commercial installations across retail stores, restaurants, and cultural venues further contribute to market expansion. Stringent quality standards and sustainability-focused product development also influence purchasing behavior across the region.

Asia-Pacific

Asia-Pacific held nearly 26% market share in 2024, making it one of the fastest-growing regions in the Loudspeakers and Sound Bars market. Rapid urbanization, rising disposable incomes, and increasing penetration of smart TVs and smartphones fuel strong demand. Countries such as China, Japan, South Korea, and India drive volume growth, particularly in mid-priced and compact audio products. Expanding e-commerce platforms enhance product accessibility, while local manufacturing supports competitive pricing. Growing interest in home entertainment and gaming among younger consumers continues to accelerate regional market growth.

Latin America

Latin America represented approximately 7% market share in 2024 in the Loudspeakers and Sound Bars market. Growth is supported by increasing adoption of home entertainment systems and improving internet connectivity across urban centers. Consumers are gradually shifting from basic audio solutions to sound bars and wireless speakers that offer better sound quality at affordable prices. Retail expansion and rising availability of international brands contribute to market development. While economic fluctuations pose challenges, demand from residential users and small commercial spaces supports steady regional growth.

Middle East & Africa

The Middle East & Africa accounted for about 5% market share in 2024 in the Loudspeakers and Sound Bars market. Demand is driven by rising investments in residential developments, luxury homes, and hospitality infrastructure. High adoption of premium audio systems in hotels, malls, and entertainment venues supports commercial growth. Increasing urbanization and improving retail infrastructure enhance product availability across key markets. While price sensitivity remains in some areas, growing consumer awareness and demand for enhanced audio experiences continue to create long-term growth opportunities across the region.

Market Segmentations:

By Product Type

By Distribution Channel

- Online Retail

- Offline Retail

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Loudspeakers and Sound Bars market features a competitive landscape characterized by the presence of global electronics brands, premium audio specialists, and diversified consumer technology companies. Key players such as Bose Corporation, Sony Corporation, Harman International Industries Incorporated, LG Electronics Inc., Yamaha Corporation, Bang & Olufsen A/S, Sennheiser Electronic GmbH & Co., Logitech International S.A., Klipsch Audio Technologies, and Sound United LLC focus on continuous product innovation to strengthen their market positions. Companies emphasize advanced acoustic engineering, wireless connectivity, and smart features such as voice assistant integration and multi-room audio. Strategic initiatives include new product launches, expansion of premium and mid-range portfolios, and partnerships with smart TV and platform providers. Strong brand equity, extensive distribution networks, and after-sales support remain critical differentiators, while increasing competition drives ongoing investment in design, performance, and user experience across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dynaudio A/S

- Logitech International S.A.

- Bose Corporation

- Bang & Olufsen A/S

- Yamaha Corporation

- Klipsch Audio Technologies

- LG Electronics Inc. (Lucky Goldstar Electronics Inc.)

- Sennheiser Electronic GmbH & Co.

- Creative Technology Ltd.

- Sound United LLC

Recent Developments

- In August 2025, Samsung India launched its 2025 soundbar lineup featuring models such as the flagship HW-Q990F and the convertible HW-QS700F, offering AI sound optimization, dynamic bass control, and adaptive design enhancements for smarter home audio experiences.

- In July 2025, MISCO Speakers announced a partnership with ComHear to expand its portfolio of immersive audio solutions and adaptive 3D audio soundbars for OEM product developers in the U.S. market.

- In January 2025, XGIMI unveiled a new concept product XGIMI Ascend at CES 2025, a hybrid solution combining an ALR screen with dual premium Harman Kardon soundbars, showcasing future-oriented home entertainment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Loudspeakers and Sound Bars market is expected to witness steady growth driven by continued demand for enhanced home entertainment experiences.

- Increasing integration of wireless connectivity and voice assistants will shape future product development and consumer adoption.

- Compact, space-saving, and design-focused audio products will gain higher preference, particularly in urban households.

- Advancements in audio processing technologies will improve sound clarity, surround effects, and energy efficiency.

- Growing penetration of smart TVs and streaming platforms will support sustained demand for sound bars.

- Residential applications will remain the primary demand driver, supported by rising replacement and upgrade cycles.

- Commercial installations across hospitality, retail, and corporate spaces will expand gradually, supporting market diversification.

- E-commerce channels will gain importance, improving product accessibility and price transparency for consumers.

- Emerging markets will offer new growth opportunities due to urbanization and rising disposable incomes.

- Competitive intensity will encourage continuous innovation, brand differentiation, and strategic partnerships across the market