Market Overview

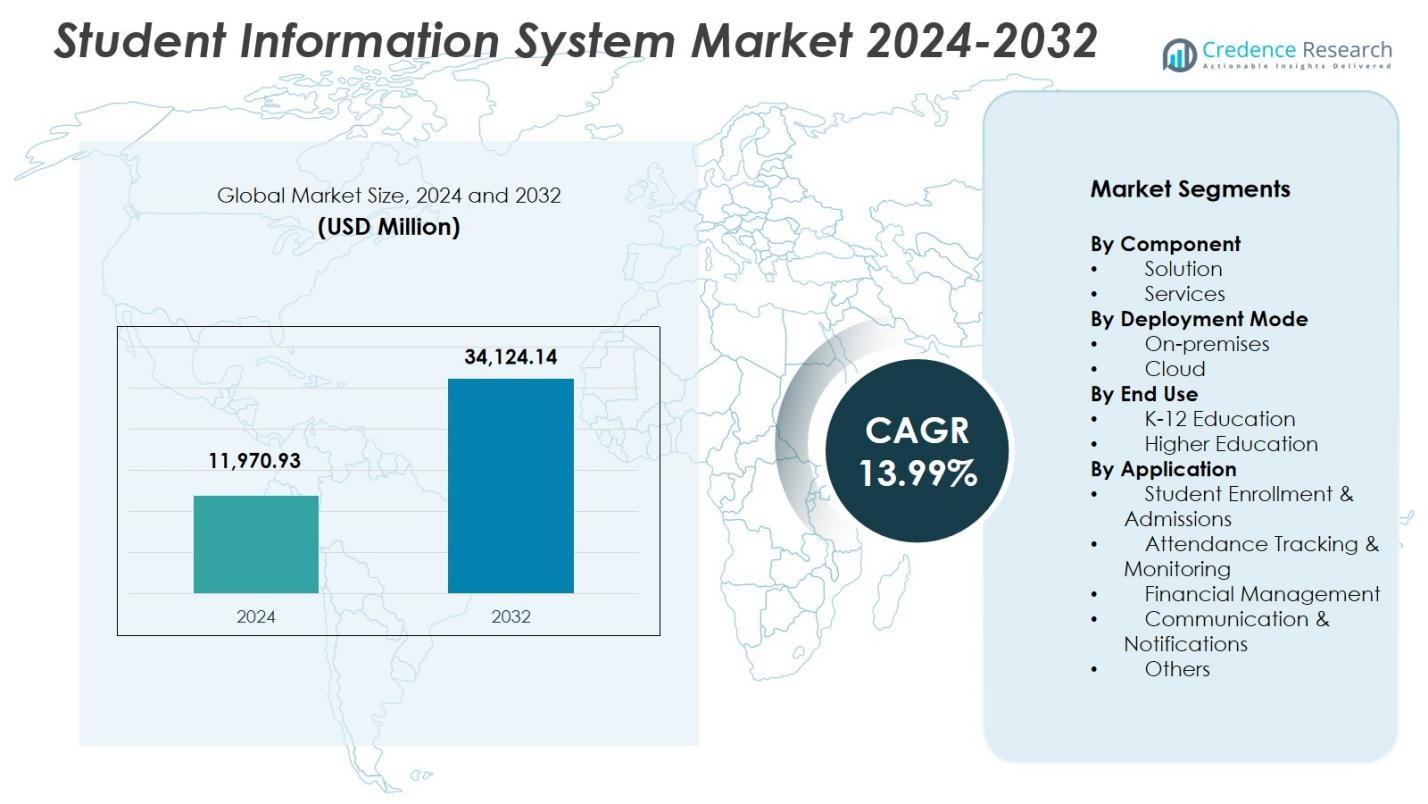

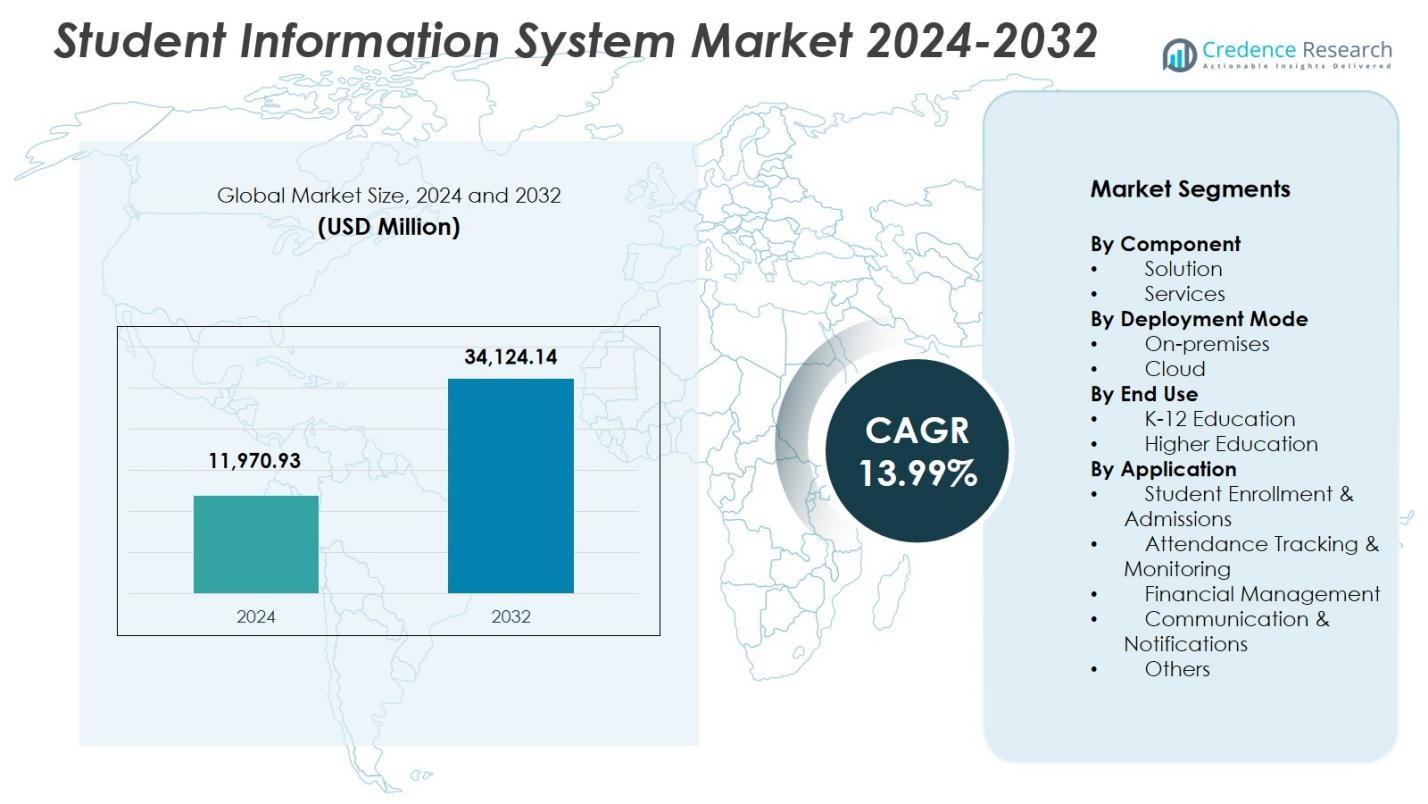

Student Information System Market size was valued at USD 11,970.93 million in 2024 and is anticipated to reach USD 34,124.14 million by 2032, at a CAGR of 13.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Student Information System Market Size 2024 |

USD 11,970.93 Million |

| Student Information System Market, CAGR |

13.99% |

| Student Information System Market Size 2032 |

USD 34,124.14 Million |

Student Information System Market features major players including Campus Management, ComSpec International, Ellucian, Focus School Software, Jenzabar, SAP, Skyward, Tribal Group, Veracross, and Workday, each strengthening their presence through cloud-enabled platforms, analytics-driven modules, and enhanced integration capabilities. These companies focus on delivering scalable and user-centric SIS solutions that streamline enrollment, academic management, communication, and compliance processes across educational institutions. Regionally, North America leads the market with a 34.6% share, supported by strong digital adoption and advanced IT infrastructure, while Europe and Asia-Pacific follow, driven by modernization initiatives and increasing demand for centralized education management systems.

Market Insights

Market Insights

- The Student Information System Market was valued at USD 11,970.93 million in 2024 and is projected to reach USD 34,124.14 million by 2032, growing at a CAGR of 13.99%.

- Growing demand for digital administration, centralized data management, and integrated academic workflows drives strong adoption of SIS solutions, with the Solution segment holding a 62.4% share.

- Cloud deployment remains the dominant trend, capturing 68.7% share as institutions shift toward scalable, secure, and mobile-accessible platforms supporting modern learning environments.

- Key players focus on enhancing interoperability, analytics, and automation to strengthen market presence, while high implementation costs and data security risks continue to restrain growth in some regions.

- North America leads with a 34.6% share, followed by Europe at 28.3% and Asia-Pacific at 24.7%, supported by rising digital initiatives; the Higher Education segment maintains leadership with a 57.9% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component:

In the Student Information System Market, the Solution segment leads with a 62.4% share, driven by rising demand for integrated platforms that streamline enrollment, attendance tracking, grade management, and administrative workflows. Institutions increasingly prioritize automation and digital transformation, pushing adoption of robust SIS solutions that offer scalability and analytics capabilities. The Services segment, holding the remaining share, grows as schools seek implementation, customization, and support to optimize system performance. The dominance of the Solution segment reflects the sector’s shift toward centralized systems that enhance operational efficiency and real-time decision-making.

- For instance, Ellucian Banner powers more than 2,500 institutions across 50 countries, serving over 20 million students, with the Colorado School of Mines transitioning to its SaaS version in 2024 to streamline operations.

By Deployment Mode:

The Cloud segment dominates the Student Information System Market with a 68.7% share, supported by rapid migration toward SaaS-based education technologies offering flexibility, lower infrastructure costs, and remote accessibility. Cloud-deployed SIS platforms enable seamless updates, data security enhancements, and scalable storage, which are increasingly essential for digitally evolving institutions. The On-premises segment remains relevant for organizations prioritizing data control, but its share continues to decline as cloud adoption accelerates. The strong dominance of cloud deployment is driven by the need for mobile-enabled access, cost optimization, and improved collaboration across stakeholders.

- For instance, KIPP Memphis Collegiate Schools moved PowerSchool SIS to cloud hosting, automating updates to ease IT burdens, ensure timely state reporting for funding, and enable secure remote data access.

By End Use:

The Higher Education segment leads the Student Information System Market with a 57.9% share, propelled by growing enrollment volumes, diversified academic programs, and the need for advanced data management across student lifecycles. Universities adopt SIS platforms to support digital learning, automate complex administrative processes, and enable analytics-driven decision-making. While K-12 Education also demonstrates solid adoption, its share remains lower as schools transition more gradually to fully integrated digital systems. The dominance of Higher Education is driven by rising demand for multi-campus management, compliance reporting, and personalized student engagement solutions.

Key Growth Drivers

Rapid Digital Transformation in Educational Institutions

Educational institutions increasingly adopt digital solutions to streamline administrative processes, enhance student engagement, and modernize campus operations. This shift accelerates the deployment of Student Information Systems (SIS), which integrate enrollment, attendance, grading, and communication into a unified platform. The growing demand for automation, coupled with the need for real-time data accessibility, strengthens system adoption across K–12 schools and higher education. As institutions prioritize operational efficiency and data-driven decision-making, SIS platforms become essential infrastructure supporting long-term modernization strategies.

- For instance, Furman University adopted Workday Student SIS, reducing course registration processing time from weeks to 15 minutes through streamlined workflows for planning, advising, finances, and academics. Students access these features via a single mobile interface.

Rising Need for Centralized Data Management and Analytics

The surge in student enrollment, diverse learning models, and complex academic structures has increased the need for centralized data ecosystems. Student Information Systems enable institutions to consolidate academic, financial, and demographic data, ensuring seamless workflows and regulatory compliance. Advanced analytics capabilities further help administrators forecast performance trends, enhance resource planning, and support personalized learning pathways. As data-driven governance becomes integral to institutional success, SIS adoption grows rapidly, driven by its capacity to improve accuracy, transparency, and institutional accountability.

- For instance, Colorado School of Mines transitioned to Ellucian Banner SaaS to manage student data and operations across its campus. This implementation supports centralized handling of enrollment, financial aid, and academic records for improved efficiency.

Expanding Adoption of Cloud-Based and Mobile-Enabled Platforms

Cloud-based SIS platforms are witnessing strong growth due to their scalability, lower upfront investment, and enhanced accessibility for students, faculty, and administrators. Mobile-enabled features further improve user convenience by supporting remote learning, digital attendance, and on-the-go communication. Cloud deployments also ensure rapid updates, stronger cybersecurity protocols, and integration with learning management systems and ERP platforms. As institutions prioritize flexibility and cost optimization, the adoption of cloud and mobile-centric SIS solutions becomes a major driver propelling market expansion worldwide.

Key Trends & Opportunities

Integration of AI, Automation, and Predictive Analytics

A major trend shaping the Student Information System Market is the integration of AI-driven automation and predictive analytics. Institutions increasingly deploy AI tools to automate administrative tasks, monitor student performance, optimize scheduling, and flag at-risk learners. Predictive analytics also unlock opportunities for personalized academic planning and targeted interventions. As educational institutions shift toward proactive, data-led management approaches, SIS vendors integrating machine learning, chatbots, and intelligent dashboards gain a competitive advantage, creating new opportunities for enhanced student outcomes and operational efficiency.

- For instance, Salesforce Education Cloud incorporates Agentforce AI agents to automate tasks like course registration holds and deliver personalized nudges. These agents provide 24/7 support, guiding students through processes and improving retention through proactive interventions.

Growing Demand for Interoperable and Modular SIS Ecosystems

The market is witnessing rising demand for interoperable SIS platforms that integrate seamlessly with LMS, CRM, ERP, and curriculum management systems. Institutions increasingly prefer modular architectures that allow incremental adoption based on evolving needs, enabling cost-effective modernization. This trend creates strong opportunities for vendors offering API-driven platforms, microservices, and plug-and-play functionalities. As education systems move toward holistic digital ecosystems, interoperable SIS solutions enable institutions to enhance collaboration, improve data flow across departments, and build scalable long-term digital strategies.

- For instance, PowerSchool SIS integrates with Instructure’s Canvas LMS via OneRoster 1.1 APIs, syncing rostering data to Canvas while posting assignments and grades back to PowerSchool’s gradebook. This setup automates data flow for teachers, reducing manual entry.

Key Challenges

Data Privacy, Security Risks, and Compliance Requirements

Educational institutions face growing concerns around sensitive student data, making cybersecurity a major challenge in SIS adoption. Cloud deployments and extensive data integration heighten risks related to breaches, unauthorized access, and compliance with regulations such as FERPA and GDPR. Institutions must invest in advanced encryption, access controls, and security monitoring, which increases operational complexity and cost. Vendors must continuously enhance security frameworks to address evolving threats, as any vulnerability can undermine trust and slow system adoption across the sector.

High Implementation Costs and Integration Complexities

Despite growing interest, many institutions especially smaller schools and resource-constrained districts struggle with the high implementation, customization, and training costs associated with SIS solutions. Integrating SIS platforms with legacy systems, diverse databases, and third-party applications further complicates deployment timelines and increases support requirements. These challenges often delay digital transition and create adoption barriers in emerging regions. Vendors must focus on simplified deployment models, low-code integrations, and cost-effective service options to overcome these limitations and expand market penetration.

Regional Analysis

North America

North America leads the Student Information System Market with a 34.6% share, supported by strong digital adoption across K–12 districts and higher education institutions. Schools increasingly invest in SIS platforms to modernize operations, enhance compliance reporting, and strengthen student engagement. Government-backed initiatives promoting digital learning, combined with widespread use of cloud-based and mobile-enabled systems, accelerate market growth. The region benefits from the presence of major SIS vendors and advanced IT infrastructure that supports seamless integration with LMS, ERP, and analytics tools. Growing demand for data-driven academic management continues to reinforce North America’s dominance.

Europe

Europe holds a 28.3% share in the Student Information System Market, driven by growing emphasis on educational modernization and the increasing adoption of digital governance frameworks across universities and public schools. Institutions focus on enhancing transparency, improving administrative workflows, and complying with GDPR-driven data management standards, fueling SIS implementation. The rise of cross-border education programs and multi-campus institutions further strengthens demand for unified student data platforms. Cloud solutions gain traction due to scalability and cost efficiency, while ongoing digital transformation initiatives across Western and Northern Europe continue to expand the region’s SIS adoption.

Asia-Pacific

Asia-Pacific accounts for a 24.7% share of the Student Information System Market, supported by rapid growth in student enrollment, expanding private education sectors, and accelerated digitalization across emerging economies. Governments invest heavily in EdTech infrastructure, enabling widespread adoption of SIS platforms in schools and universities. Cloud-based systems are increasingly preferred due to affordability and ease of deployment across large-scale institutions. The region’s strong shift toward blended and online learning models drives demand for integrated SIS and LMS environments. Growing awareness of data analytics for academic planning further positions Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America holds a 7.6% share of the Student Information System Market, with adoption steadily rising as educational institutions prioritize modernization and operational efficiency. Economic reforms and increased public investment in digital education accelerate system integration across schools and universities. Cloud-based SIS platforms attract strong demand due to lower infrastructure requirements and improved accessibility in remote areas. The region experiences growing partnerships between local governments and EdTech providers aimed at enhancing student performance tracking and administrative transparency. Despite infrastructure challenges in certain countries, SIS adoption continues to expand as institutions embrace digital transformation.

Middle East & Africa

The Middle East & Africa region captures a 4.8% share of the Student Information System Market, driven by increasing investments in digital education, expanding private schooling networks, and government-led modernization programs. Higher education institutions in the Gulf Cooperation Council (GCC) countries adopt SIS platforms to support internationalization, accreditation needs, and data-driven campus management. African nations are gradually integrating SIS solutions to improve administrative efficiency and support growing enrollment levels. Cloud-based deployments gain popularity due to their flexibility and cost efficiency. Rising focus on e-learning infrastructure continues to support steady SIS adoption across the region.

Market Segmentations:

By Component

By Deployment Mode

By End Use

- K-12 Education

- Higher Education

By Application

- Student Enrollment & Admissions

- Attendance Tracking & Monitoring

- Financial Management

- Communication & Notifications

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Student Information System Market features leading players such as Campus Management, ComSpec International, Ellucian, Focus School Software, Jenzabar, SAP, Skyward, Tribal Group, Veracross, and Workday, each strengthening their portfolios through innovation, cloud transformation, and modular system enhancements. Vendors increasingly focus on integrated platforms that unify academic, administrative, and communication functions to support institutional digitalization. Cloud-first architectures, API-driven interoperability, and mobile-enabled interfaces have become core differentiators as institutions demand scalable and user-centric systems. Many players invest in AI-driven analytics, predictive insights, and workflow automation to enhance decision-making and student outcomes. Strategic partnerships with universities, EdTech firms, and technology providers further boost market reach, while continuous upgrades in cybersecurity frameworks remain essential to address growing data protection concerns. The competitive environment continues to intensify as SIS vendors expand global footprints and develop flexible deployment models tailored to diverse institutional needs.

Key Player Analysis

Recent Developments

- In November 2025, Ellucian was named the successful bidder to acquire Anthology’s Student Information Systems (SIS) and ERP business, expanding its higher education solutions portfolio.

- In September 2025, Blackbaud introduced powerful updates and integrations, including Google Classroom integration and enhanced AI tools for its K–12 SIS offerings.

- In October 2025, Flywire expanded its partnership with Workday, integrating to support Workday Student’s financial and administrative workflows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, End Use, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as institutions accelerate digital transformation across administrative and academic workflows.

- Cloud-based SIS platforms will gain stronger adoption due to scalability, lower maintenance needs, and remote accessibility.

- AI-driven analytics and automation will play a central role in enhancing student performance tracking and operational efficiency.

- Mobile-enabled SIS solutions will become essential as students and faculty demand seamless real-time access to academic information.

- Integration with LMS, ERP, CRM, and digital payment platforms will strengthen to support unified digital campus ecosystems.

- Personalization features will rise as institutions adopt data-driven approaches to improve student engagement and retention.

- Vendors will focus on modular architectures that allow schools to adopt SIS components in phases based on evolving needs.

- Cybersecurity investments will increase as institutions prioritize protection of sensitive student and institutional data.

- Emerging markets will witness significant adoption driven by government-led digital education initiatives.

- Partnerships between SIS providers and EdTech companies will intensify, fostering ecosystem expansion and innovation.

Market Insights

Market Insights