Market Overview:

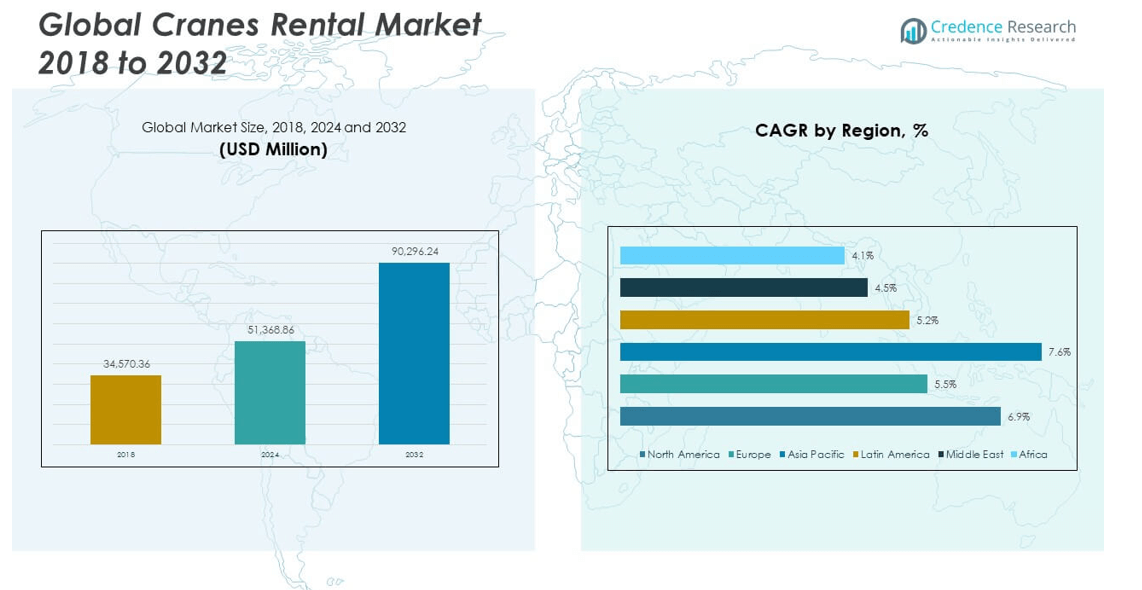

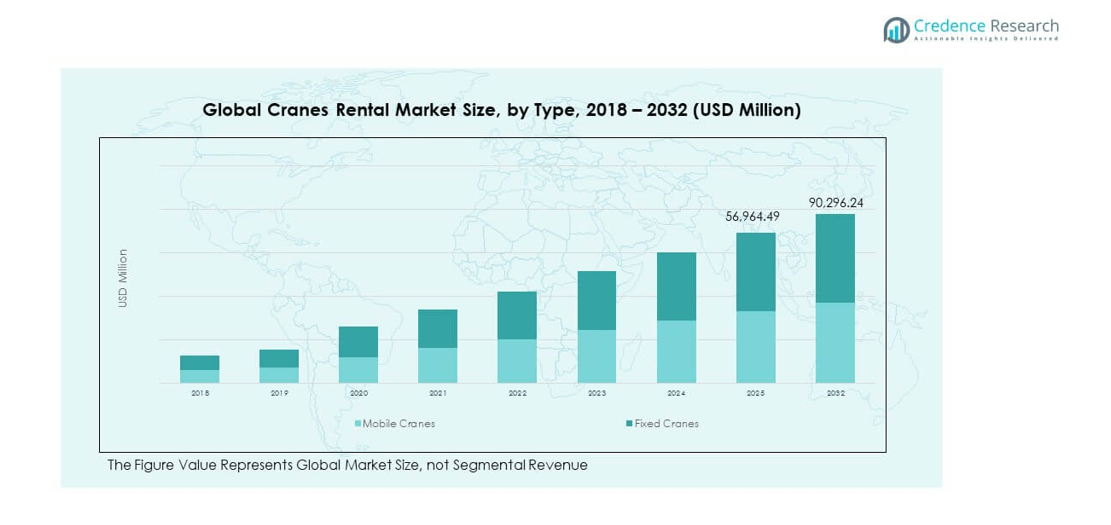

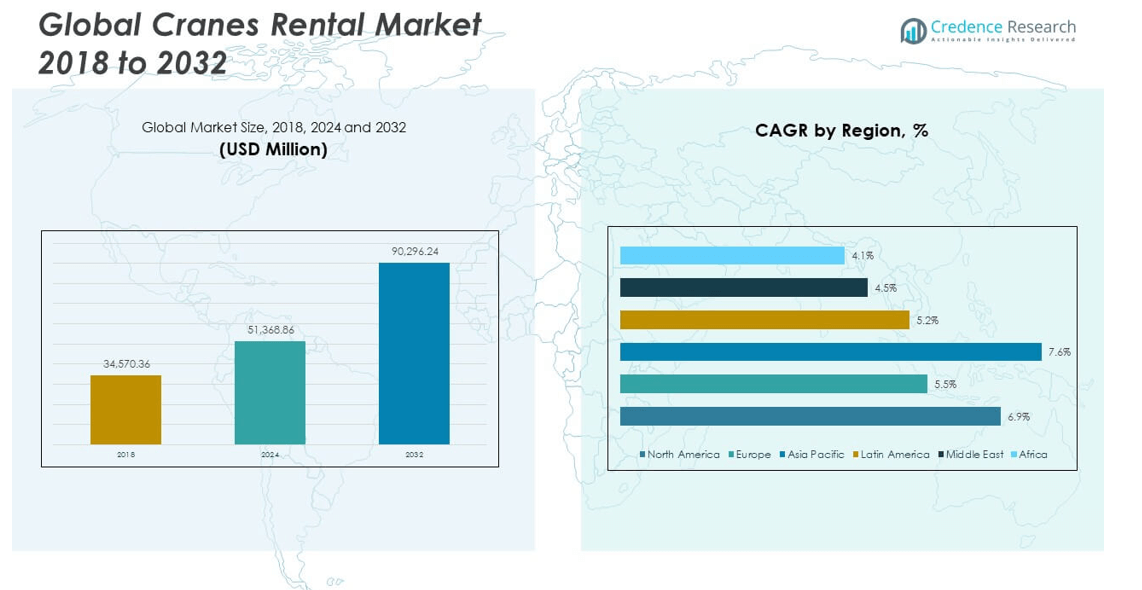

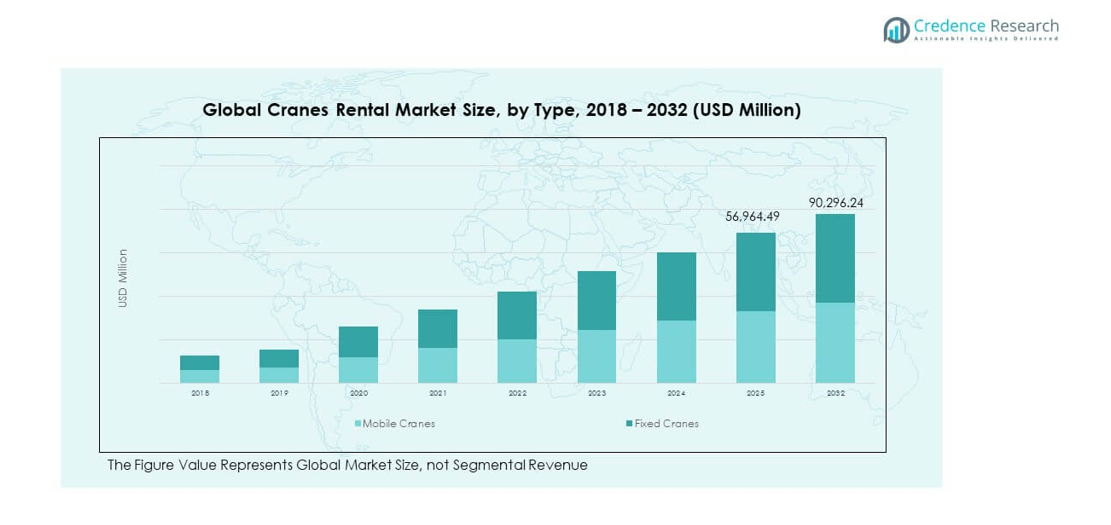

The Global Cranes Rental Market size was valued at USD 34,570.36 million in 2018 to USD 51,368.86 million in 2024 and is anticipated to reach USD 90,296.24 million by 2032, at a CAGR of 6.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cranes Rental Market Size 2024 |

USD 51,368.86 million |

| Cranes Rental Market, CAGR |

6.80% |

| Cranes Rental Market Size 2032 |

USD 90,296.24 million |

The market is experiencing strong growth driven by increasing demand for heavy lifting equipment across construction, mining, oil and gas, and infrastructure development projects. Companies are renting cranes to avoid the high ownership costs, maintenance expenses, and storage requirements, while benefiting from flexible and project-specific usage. Rising urbanization, large-scale infrastructure investments, and government-backed smart city and transportation projects are further accelerating adoption. The trend of using advanced cranes with digital monitoring and safety features also strengthens rental demand.

Regionally, North America and Europe lead the market due to mature construction sectors, stringent safety regulations, and high adoption of advanced equipment. Asia-Pacific is emerging as the fastest-growing region, supported by rapid industrialization, urban expansion, and government infrastructure initiatives in countries like China and India. The Middle East shows strong momentum fueled by large-scale oil and gas projects and ambitious mega construction programs, while Africa is gradually adopting crane rentals to support mining and infrastructure development. Latin America is also witnessing steady growth, driven by industrial projects and modernization efforts across key economies.

Market Insights:

- The Global Cranes Rental Market size was valued at USD 34,570.36 million in 2018, reached USD 51,368.86 million in 2024, and is projected to attain USD 90,296.24 million by 2032, expanding at a CAGR of 6.8% during the forecast period.

- Asia Pacific led the market with 45% share in 2024, followed by North America with 28.3% and Europe with 17.6%, driven by strong infrastructure investments, advanced industrial bases, and regulatory compliance across these regions.

- Asia Pacific is the fastest-growing region, supported by rapid urbanization, renewable energy expansion, and government-backed infrastructure initiatives across China, India, and Southeast Asia.

- Mobile cranes held the dominant share of 68% in 2024, reflecting their flexibility, mobility, and suitability for diverse project requirements.

- Fixed cranes accounted for 32% of the market share in 2024, primarily serving industrial and port operations where stability and continuous lifting are essential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Infrastructure Development Projects Creating Strong Demand

The Global Cranes Rental Market is gaining momentum due to large-scale infrastructure development across both developed and emerging economies. Governments are investing heavily in smart cities, highways, metro rail networks, airports, and renewable energy projects, all of which require heavy lifting solutions. Renting cranes allows contractors to meet demand without facing the high financial burden of ownership. It also helps companies access the latest models with advanced safety systems and higher lifting capacities. Urban expansion and industrialization continue to push the demand further across multiple industries. Construction companies prefer short-term crane rentals to align costs with project phases. This trend ensures higher utilization rates for crane rental providers. Growing public–private partnerships in infrastructure also stimulate market adoption.

- Liebherr launched the LR 1700-1.0 crawler crane in 2021 with a lifting capacity of 700 tonnes. The redesigned base machine delivers 10–15% higher lifting performance compared to its predecessor while maintaining transport-friendly dimensions under 3 m wide, which reduces overall transport effort and costs. The model has been applied in wind energy projects, including turbine installation in Germany, highlighting its suitability for large-scale renewable infrastructure.

High Cost of Crane Ownership Encouraging Rental Preference

The cost of purchasing, maintaining, and storing cranes is a significant burden for contractors and builders. The Global Cranes Rental Market benefits from this dynamic, as companies increasingly choose rentals to avoid such fixed expenses. It becomes more practical to rent equipment for temporary projects rather than invest in machinery that may remain idle later. High maintenance requirements and spare part costs also discourage outright purchases. By opting for rental, businesses gain operational flexibility and improved budget management. Access to a diverse fleet ensures suitability for different terrain and lifting capacities. It also reduces long-term liabilities while offering immediate solutions. Rental services provide operators, which further minimizes labor costs and training efforts for clients. This economic advantage strengthens rental demand.

Technological Advancements in Cranes Accelerating Rental Adoption

The integration of telematics, digital monitoring, and automated safety features is transforming crane operations. The Global Cranes Rental Market benefits as contractors seek these advanced features without committing to permanent ownership. Smart cranes equipped with load monitoring systems and GPS tracking improve efficiency and enhance safety at worksites. Rental companies continually upgrade fleets with the latest technology to maintain competitive advantage. Clients gain access to such innovations without large capital expenditure. Improved fuel efficiency, hybrid models, and reduced emissions also appeal to eco-conscious contractors. The adoption of cranes designed for precision lifting in confined urban spaces has further increased demand. Rental providers are well-positioned to offer advanced solutions aligned with global construction standards. This technological shift is becoming a crucial driver for rental adoption.

- For example, Terex’s Demag CC 2800-2 crawler crane builds on the capabilities of its predecessor, the CC 2800-1, with a maximum lifting capacity of about 600 tonnes. It offers versatile boom configurations, including Superlift options and luffing jib extensions reaching up to 192 meters. The model is equipped with the IC-1 control system that provides multiple operator displays to support safe and efficient crane operations. Its design emphasizes transport efficiency and flexibility for deployment across a wide range of heavy-lifting projects.

Expanding Oil, Gas, and Energy Projects Driving Rental Market Growth

Energy projects in oil, gas, wind, and solar sectors require extensive use of cranes for installation and maintenance. The Global Cranes Rental Market gains from this, as contractors depend on specialized cranes for offshore platforms, pipeline construction, and renewable energy setups. Renting becomes cost-efficient since these projects demand heavy lifting equipment for specific phases. Wind farms need cranes for turbine erection and blade replacement, while solar plants use them for module positioning. Offshore oil rigs require large-capacity cranes that are costly to own. Rental services provide access to these machines when required. The global energy transition toward renewables further amplifies demand. Project-based crane usage aligns well with the rental model. Energy sector expansion is expected to sustain rental growth over the forecast period.

Market Trends:

Growing Adoption of Eco-Friendly and Hybrid Crane Solutions

The Global Cranes Rental Market is observing a significant transition toward eco-friendly and hybrid crane solutions. Rental companies are investing in fleets with reduced emissions to comply with tightening environmental regulations. Contractors demand equipment that supports sustainability goals and minimizes carbon footprints. Hybrid cranes offering fuel efficiency and lower noise levels are gaining attention in urban projects. This trend aligns with global efforts to meet decarbonization targets in construction and energy sectors. It is also creating opportunities for rental firms to differentiate their services. Compliance with emission norms enhances market trust and competitiveness. Rental demand is shifting toward sustainable models, setting a long-term trend for the industry.

- For example, Manitowoc’s Grove GMK6400-1 all-terrain crane builds on the success of the GMK6400 with improved driveline and hydraulic systems that enhance efficiency and operating performance. It features MEGATRAK suspension and MegaDrive technology, delivering smoother movements and better handling on diverse terrains. The model is designed to provide faster setup and optimized lifting operations while supporting lower fuel consumption compared to earlier generations.

Increasing Preference for Short-Term Rentals Across Diverse Sectors

Flexibility in project execution has led to greater reliance on short-term rentals across multiple industries. The Global Cranes Rental Market benefits from companies opting for hourly, weekly, or monthly rental contracts. This preference allows businesses to align equipment use directly with project requirements. Sectors like logistics, ports, and mining now utilize short-term rentals to handle fluctuating demands. Seasonal projects in agriculture and infrastructure also contribute to this growth. Rental providers are expanding packages to cater to such needs. This trend strengthens revenue streams while expanding client bases. The focus on adaptable rental contracts highlights a shift in industry dynamics.

Integration of Digital Platforms and Online Rental Services

Digital platforms are reshaping how crane rental services are offered and managed. The Global Cranes Rental Market is witnessing rapid adoption of online portals for booking, fleet tracking, and contract management. Clients prefer seamless access to crane availability and pricing through digital platforms. Real-time monitoring and predictive maintenance reduce downtime for contractors. Rental firms use telematics to optimize fleet utilization and ensure safety compliance. This technological integration builds customer trust and transparency. It also supports better coordination in large-scale projects. The move toward digital solutions reflects the modernization of the rental ecosystem and its alignment with global digital transformation.

- For example, Liebherr’s MyLiebherr portal allows customers to register their machines and access an integrated service platform. Users can check spare parts availability and pricing, order directly online, download machine documentation, and access tools like Crane Finder and Crane Planner all through a single interface linked to serial-number-specific machine records.

Expansion of Rental Services into Emerging Economies

The expansion of crane rental services into developing economies is shaping future growth trajectories. The Global Cranes Rental Market is benefiting from rising urbanization and industrialization in Asia-Pacific, Africa, and Latin America. Rental providers are establishing partnerships and regional hubs to tap into this growing demand. Emerging economies require cranes for infrastructure, ports, and renewable energy projects but face budget limitations for ownership. Rental services bridge this gap by offering affordable and flexible solutions. The presence of international players accelerates technology transfer and service quality in these regions. This expansion diversifies revenue sources and strengthens the global footprint of rental companies. The trend positions emerging economies as pivotal growth markets.

Market Challenges Analysis:

Rising Safety and Compliance Concerns Increasing Pressure on Rental Firms

The Global Cranes Rental Market faces rising challenges due to stringent safety standards and compliance regulations across different regions. Governments are implementing strict guidelines to minimize worksite accidents, requiring advanced safety features in equipment. Rental firms must invest heavily in upgrading fleets to meet these standards, increasing operational costs. The demand for certified operators further adds to labor challenges. Non-compliance risks not only legal penalties but also reputational damage. Frequent inspections and certification renewals strain resources for small and mid-size providers. Clients demand equipment with advanced load monitoring systems, which requires additional investments. Balancing compliance with profitability remains a significant obstacle for rental companies.

Volatile Economic Conditions and Fluctuating Project Pipelines Limiting Growth

The cyclical nature of construction, mining, and energy projects impacts the Global Cranes Rental Market. Economic downturns delay or cancel infrastructure investments, reducing demand for rental services. Volatile commodity prices influence mining and oil projects, creating uncertainty in crane utilization. Rental companies face idle fleets during slowdowns, leading to revenue losses. Intense competition in mature markets drives down rental rates, putting pressure on margins. Seasonal demand fluctuations also create imbalances in fleet allocation. The capital-intensive nature of cranes makes it difficult for smaller rental firms to sustain operations during downturns. These financial pressures remain one of the major barriers to long-term growth.

Market Opportunities:

Rising Demand for Specialized Cranes in Renewable Energy Projects

The Global Cranes Rental Market is well-positioned to benefit from the global shift toward renewable energy. Wind, solar, and hydro projects demand specialized cranes for installation and maintenance activities. Renting provides contractors with access to high-capacity cranes without incurring ownership costs. The rising number of offshore wind farms presents new opportunities for rental providers. Crane rental companies can expand their portfolios with advanced machines tailored for energy projects. Partnerships with renewable developers enhance growth prospects. Demand from energy transition projects is expected to provide long-term stability for the rental business. This opportunity strengthens the role of rentals in sustainable infrastructure development.

Increasing Urbanization and Smart City Projects Driving Crane Rentals

Urbanization and government-backed smart city initiatives are creating significant opportunities for crane rental services. The Global Cranes Rental Market benefits from rising demand for high-rise buildings, metro networks, and large commercial complexes. Renting cranes allows contractors to scale operations efficiently for such complex projects. Rental providers with diverse fleets are better equipped to meet these requirements. Technological innovations such as digital monitoring enhance service quality. Smart city projects often operate under strict timelines, making rentals the preferred choice for flexibility. This growing demand creates a favorable environment for expansion in both developed and emerging economies. Rental adoption in urban projects is set to accelerate in the coming years.

Market Segmentation Analysis:

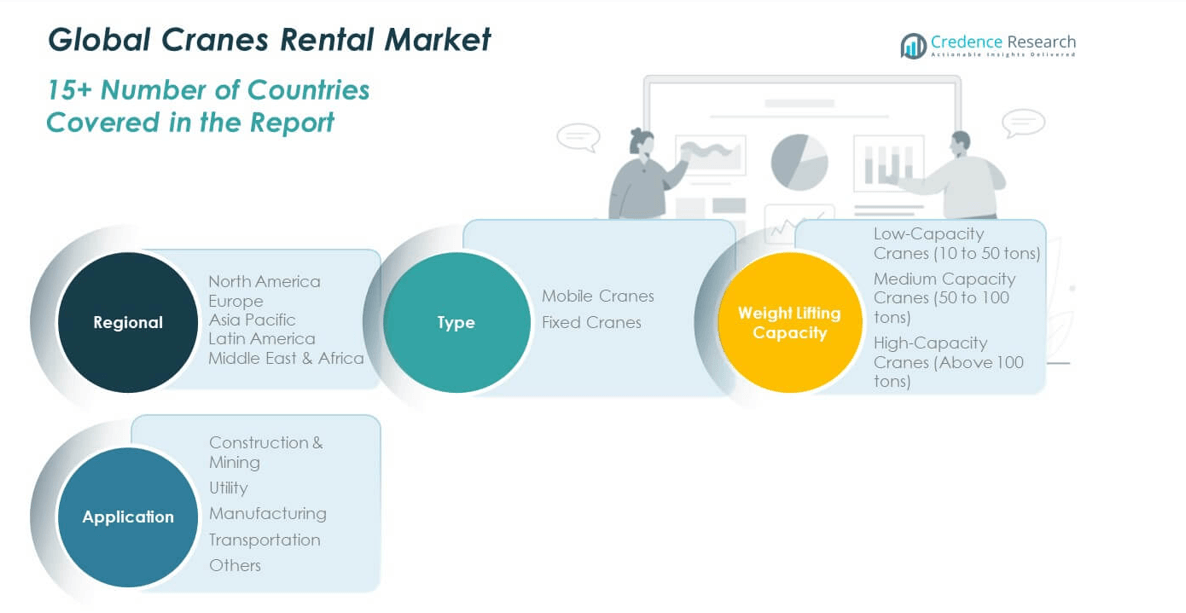

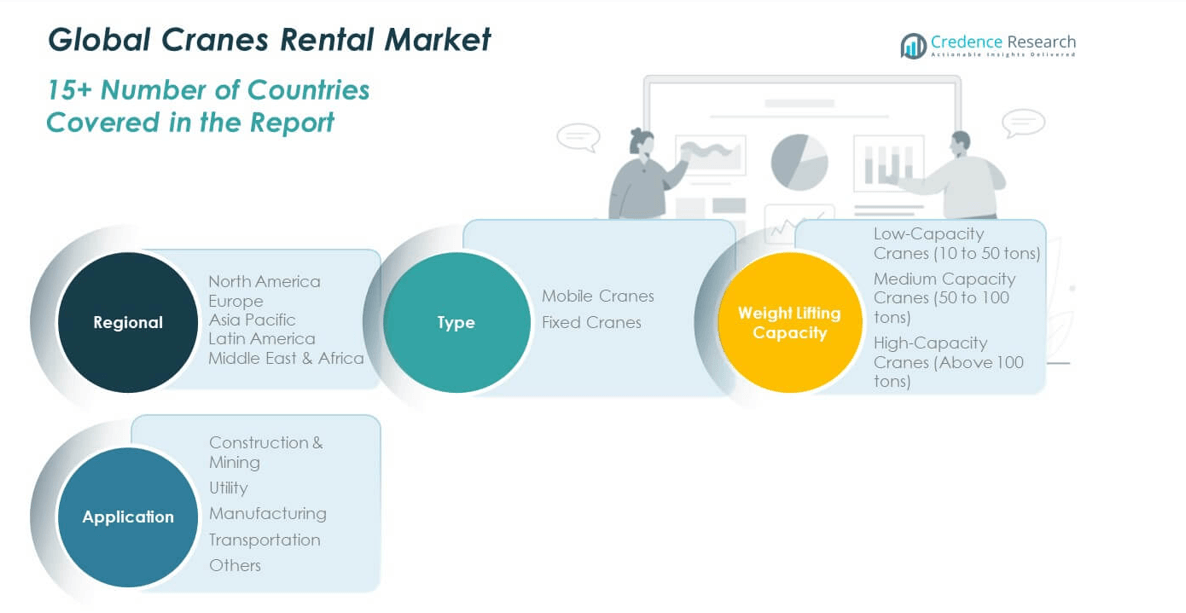

The Global Cranes Rental Market is segmented

By type into mobile cranes and fixed cranes. Mobile cranes dominate due to their flexibility, mobility, and suitability for diverse projects across construction, infrastructure, and energy sectors. Fixed cranes maintain steady demand in large-scale industrial and port operations where stability and continuous lifting are essential. It is witnessing higher demand for mobile cranes as contractors prioritize efficiency and time-sensitive deployment in urban and remote sites.

By weight lifting capacity, the market is divided into low capacity cranes (10 to 50 tons), medium capacity cranes (50 to 100 tons), and high capacity cranes (above 100 tons). Low and medium capacity cranes find wide application in building construction, utilities, and manufacturing facilities, while high capacity cranes are critical in mining, oil and gas, and heavy industrial projects. It is showing strong traction for medium and high capacity cranes as global infrastructure projects expand in scale and complexity.

- For example, Sarens deployed a 1,600 MT‑capacity crawler lattice boom crane (Demag CC 8800) to lift two blast furnaces and a 512 MT tower module for Tata Steel in Kalinganagar, India. This operation stands among the heaviest lifts performed at that site.

By application, the market is categorized into construction and mining, utility, manufacturing, transportation, and others. Construction and mining remain the largest segment, driven by continuous investments in infrastructure and resource extraction. Utility and manufacturing sectors contribute significantly due to grid expansion, plant upgrades, and industrial projects. Transportation projects, including ports, rail, and logistics hubs, also generate steady demand. It is evolving with balanced contributions across applications, but construction and mining continue to lead growth trajectories.

- For example, Terex Rough Terrain Cranes serve a diverse range of applications. They handle steel structure installation for hospitals in Toronto and manage mining equipment relocation in Indiana quarries. These cranes combine excellent ground clearance and up to four steering modes, which enable them to maneuver effectively across rugged terrains and constrained urban sites.

Segmentation:

By Type

- Mobile Cranes

- Fixed Cranes

By Weight Lifting Capacity

- Low Capacity Cranes (10 to 50 tons)

- Medium Capacity Cranes (50 to 100 tons)

- High Capacity Cranes (Above 100 tons)

By Application

- Construction & Mining

- Utility

- Manufacturing

- Transportation

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Cranes Rental Market size was valued at USD 9,929.80 million in 2018 to USD 14,521.95 million in 2024 and is anticipated to reach USD 25,635.06 million by 2032, at a CAGR of 6.9% during the forecast period. North America accounts for 28.3% share of the global market in 2024. The region benefits from strong demand in construction, oil and gas, and utility projects across the United States, Canada, and Mexico. It is experiencing steady growth due to modernization of transport networks and renewable energy expansion. Strict safety standards and advanced fleet availability strengthen rental adoption. The United States dominates the regional market, supported by large-scale infrastructure initiatives and industrial expansion. Canada contributes significantly through mining and energy projects, while Mexico shows rising demand in construction and logistics. Rental companies in the region are also investing in eco-friendly and hybrid crane fleets. Digital platforms for rental management are further enhancing competitiveness across North America.

Europe

The Europe Global Cranes Rental Market size was valued at USD 6,438.18 million in 2018 to USD 9,041.26 million in 2024 and is anticipated to reach USD 14,448.00 million by 2032, at a CAGR of 5.5% during the forecast period. Europe represents 17.6% share of the global market in 2024. The region is driven by infrastructure renovation, manufacturing upgrades, and strict environmental regulations. It is witnessing consistent adoption of rental services for construction and utility projects. Countries such as Germany, the UK, and France lead in crane rentals with strong emphasis on efficiency and sustainability. Southern and Eastern Europe are expanding demand through transport and industrial development. Rental providers focus on hybrid cranes to meet carbon reduction targets. Growing adoption of modular and large-scale manufacturing units further enhances rental requirements. Digital integration and fleet optimization remain central to market competitiveness across Europe.

Asia Pacific

The Asia Pacific Global Cranes Rental Market size was valued at USD 15,007.79 million in 2018 to USD 23,129.24 million in 2024 and is anticipated to reach USD 43,152.39 million by 2032, at a CAGR of 7.6% during the forecast period. Asia Pacific accounts for 45% share of the global market in 2024, making it the largest regional segment. The region benefits from rapid urbanization, industrialization, and large-scale infrastructure initiatives. It is showing strong growth across China, India, and Southeast Asia where governments prioritize transport, energy, and urban projects. Japan and South Korea maintain high adoption through advanced technology integration. Australia contributes through mining and renewable energy activities. Rental demand is expanding as contractors prefer flexibility in handling large-scale construction. International players are expanding partnerships with regional firms to serve growing demand. Asia Pacific remains the fastest-growing region due to its economic scale and infrastructure pipeline.

Latin America

The Latin America Global Cranes Rental Market size was valued at USD 1,663.63 million in 2018 to USD 2,441.86 million in 2024 and is anticipated to reach USD 3,808.32 million by 2032, at a CAGR of 5.2% during the forecast period. Latin America represents 4.7% share of the global market in 2024. The region is supported by investments in infrastructure, mining, and energy projects. It is gaining momentum in Brazil, Argentina, and Mexico where urban development is driving rental adoption. Brazil remains the largest contributor with growing demand in oil and gas and construction. Argentina shows increasing reliance on rentals to support infrastructure modernization. Mining and port development projects also contribute to rental needs. Rental companies are expanding service offerings with mid-capacity and high-capacity cranes. Political and economic volatility remains a limiting factor, but overall demand is strengthening gradually. Contractors across Latin America continue to adopt rentals for cost-effective project execution.

Middle East

The Middle East Global Cranes Rental Market size was valued at USD 941.49 million in 2018 to USD 1,275.36 million in 2024 and is anticipated to reach USD 1,880.64 million by 2032, at a CAGR of 4.5% during the forecast period. The Middle East accounts for 2.5% share of the global market in 2024. The region benefits from large-scale oil and gas projects, mega construction programs, and transport infrastructure expansion. It is witnessing steady demand in GCC countries led by Saudi Arabia and UAE, where government-backed projects dominate. Qatar and Kuwait are also contributing through energy and logistics projects. Turkey plays a strong role with investments in industrial and infrastructure sectors. Demand for high-capacity cranes remains strong for energy and mega projects. Rental providers expand fleets to serve the scale of upcoming smart cities and tourism-related infrastructure. Growing emphasis on energy diversification supports adoption of specialized cranes across the Middle East.

Africa

The Africa Global Cranes Rental Market size was valued at USD 589.48 million in 2018 to USD 959.19 million in 2024 and is anticipated to reach USD 1,371.83 million by 2032, at a CAGR of 4.1% during the forecast period. Africa contributes 1.9% share of the global market in 2024. The region is driven by mining, energy, and urban infrastructure projects. It is experiencing growing demand in South Africa, Nigeria, and Egypt, where industrialization is strengthening. Mining expansion in Central and Southern Africa also fuels crane rentals. Governments are investing in energy and transport to improve connectivity and utilities. South Africa leads with advanced adoption in construction and manufacturing. Egypt benefits from major infrastructure programs in housing and transport. Rental services help contractors balance costs against fluctuating project cycles. Africa remains a gradually developing region with significant long-term opportunities for crane rentals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Konecranes Plc

- Liebherr Group

- Manitowoc Cranes (Terex Corporation)

- XCMG Group

- Tadano Ltd

- Zoomlion Heavy Industry Science & Technology Co., Ltd

- Hyundai Construction Equipment Co., Ltd

- Sany Heavy Industry Co., Ltd

- Terex Corporation

- Gruas Ibarra

Competitive Analysis:

The Global Cranes Rental Market is highly competitive with international and regional players focusing on fleet expansion, technological integration, and service differentiation. Major companies such as Konecranes, Liebherr, Manitowoc, Tadano, Sany, and Zoomlion dominate with broad product portfolios and strong regional presence. It is characterized by partnerships, mergers, and regional expansions aimed at strengthening customer reach and operational efficiency. Players emphasize hybrid and eco-friendly cranes to align with sustainability goals. Digital platforms for fleet management and predictive maintenance create a competitive edge. Regional firms compete by offering flexible rental packages and specialized equipment tailored to local project needs. Market leaders leverage financial strength to invest in advanced fleets, while smaller firms target niche segments with localized services. Competitive intensity remains strong as demand continues to rise across construction, mining, and energy sectors.

Recent Developments:

- In April 2025, Konecranes strengthened its footprint in the European market by acquiring Polipastos y Instalaciones MEG (PIMEG), a Spain-based specialist in crane sales and services. In addition, Konecranes secured a significant deal with Port Houston in the U.S., supplying 16 new hybrid Rubber-Tyred Gantry (RTG) cranes and retrofitting eight existing ones; the order was booked in Q1 2025 with delivery set for H1 2026.

- In Nov 2024, MyCrane, renowned as the first global online crane rental platform, expanded its reach by launching a new marketplace dedicated to the international sale and purchase of lifting equipment. Officially unveiled at bauma China, the marketplace allows MyCrane’s growing base of over 1,500 registered crane rental companies and more than 12,000 cranes to buy and sell both used and new equipment.

- In March 2024, Kobelco, a prominent crane rental company operating in Colorado and Utah, entered into a partnership with Bigge, a major nationwide provider of crawler cranes in the United States. Under this arrangement, Bigge became an authorized Kobelco dealer for the Colorado and Utah regions. This partnership aims to deliver advanced crane technology and superior equipment to clients in construction and heavy lifting, while pooling resources and expertise to offer improved productivity, broader fleet availability, and competitive pricing.

- In February 2023, ACE, a leading player in India’s crane industry, launched the country’s first fully electric mobile crane, a significant technological milestone for the sector. This crane is notable for its 180-tonne lifting capacity and represents the nation’s largest indigenous mobile crane.

Market Concentration & Characteristics:

The Global Cranes Rental Market shows moderate to high concentration with leading players controlling a significant share through large fleets and established networks. It is shaped by high entry barriers due to capital-intensive equipment requirements and strict compliance regulations. Global players maintain dominance with advanced technology adoption and diversified service offerings, while regional companies compete through cost-effective contracts and localized expertise. The market operates on recurring rental demand from construction, utilities, and industrial projects, creating stable revenue streams. Competition is influenced by fleet modernization, operator availability, and after-rental services. Rental contracts often vary from short-term to project-based agreements, enhancing flexibility for clients. Growth opportunities remain attractive across emerging regions, yet operational efficiency and fleet utilization determine profitability in this evolving landscape.

Report Coverage:

The research report offers an in-depth analysis based on Type, Weight Lifting Capacity and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will strengthen with large-scale infrastructure development across urban and industrial projects.

- Adoption of hybrid and eco-friendly cranes will rise as sustainability becomes a priority.

- Digital platforms for rental booking, fleet tracking, and predictive maintenance will gain wider integration.

- Short-term and project-based rental contracts will expand as contractors seek operational flexibility.

- Specialized cranes for renewable energy projects, including wind and solar, will drive new opportunities.

- Regional expansion of global players into Asia Pacific, Latin America, and Africa will intensify competition.

- High-capacity cranes will gain preference for complex projects in oil, gas, and heavy industries.

- Safety regulations and compliance requirements will push rental firms to upgrade fleets regularly.

- Consolidation through mergers and acquisitions will shape the competitive landscape.

- Localized service models with tailored solutions will strengthen customer loyalty in emerging regions.