Market Overview:

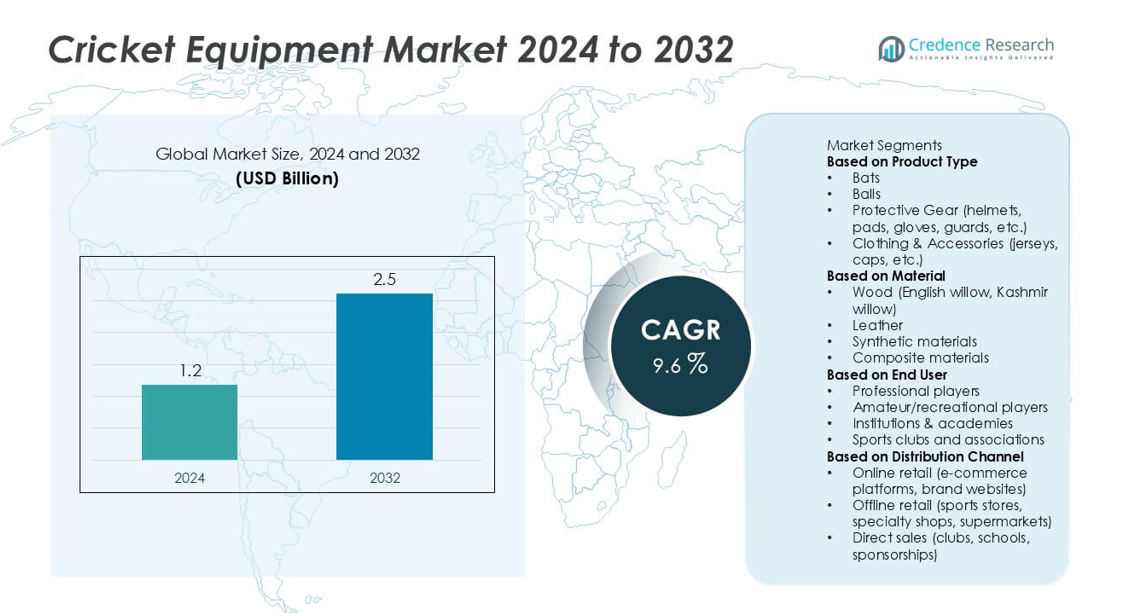

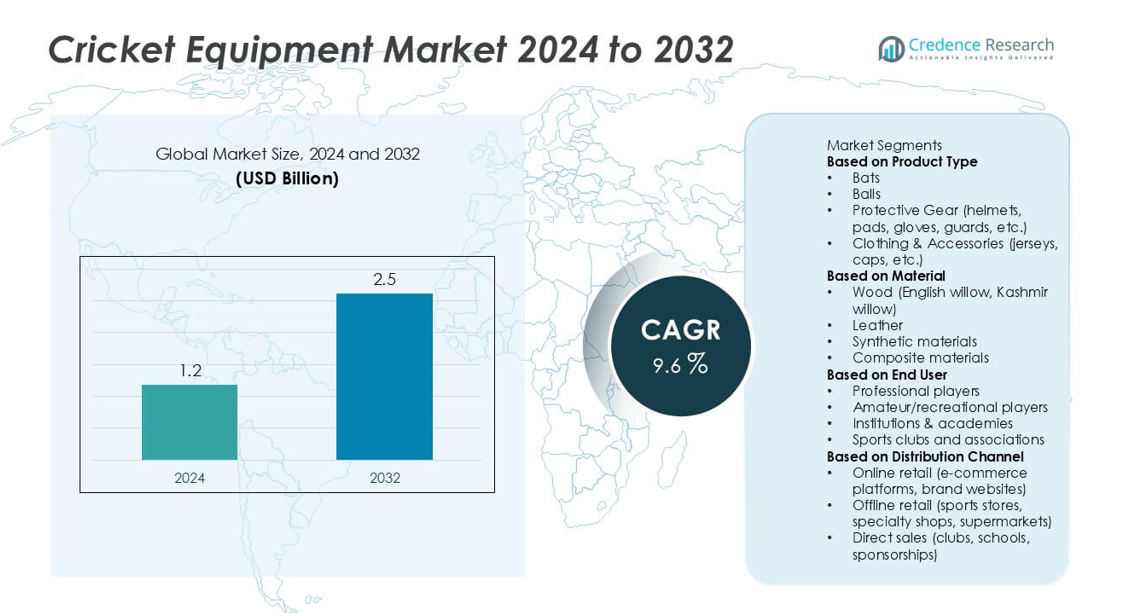

The cricket equipment market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, growing at a compound annual growth rate CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cricket Equipment Market Size 2024 |

USD 1.2 billion |

| Cricket Equipment Market, CAGR |

9.6% |

| Cricket Equipment Market Size 2032 |

USD 2.5 billion |

The cricket equipment market is dominated by key players such as Kookaburra Sport Pty Ltd, Grays International, Sommers, Kippax Willow Limited Company, Bradbury, Blue Tongue Sports, Adidas AG, Stag Cricket, Salix Cricket Bat Co. Ltd., and Blankbats. These companies lead the industry through advanced product innovation, strong brand recognition, and extensive global distribution networks. Asia Pacific emerges as the leading region, holding 55% of the total market share, driven by high cricket participation and professional leagues across India, Australia, and other South Asian countries. Europe follows with 18% market share, supported by established cricket traditions and strong manufacturing bases in the U.K. and surrounding nations.

Market Insights

- The global cricket equipment market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, registering a CAGR of 9.6% during the forecast period.

- Market growth is driven by rising participation in domestic and international cricket tournaments, increased youth engagement, and strong brand endorsements by professional players.

- Key trends include the adoption of sustainable materials, growing demand for customized and lightweight equipment, and the rising popularity of women’s and franchise cricket leagues.

- The market is moderately consolidated, with major players such as Kookaburra Sport, Grays International, and Adidas AG focusing on innovation, product diversification, and online retail expansion to strengthen their global presence.

- Asia Pacific leads with 55% of total revenue, followed by Europe at 18%, while the bats segment holds the largest share at 39%, driven by widespread use across all player categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The cricket equipment market by product type is dominated by the bats segment, which accounts for approximately 39% of total market revenue. Bats are indispensable to every player, driving consistent demand across professional and amateur levels. The rise in international and domestic tournaments, coupled with increasing player endorsements and technological advancements in bat manufacturing-such as improved balance and lightweight designs-supports this dominance. Additionally, the growing popularity of limited-overs formats and premium-grade willow bats further fuel demand, solidifying bats as the leading revenue-generating segment in the global market.

- For instance, the Kookaburra Sport’s Ghost Pro model, through its optimized spine and sweet-spot geometry, has been shown in testing to achieve 8-12% higher ball speeds than comparable models, enhancing professional-level performance consistency.

By Material

In terms of material, the wood segment, particularly English and Kashmir willow, holds the largest market share, contributing to nearly 45% of total material-based revenue. Willow remains the preferred choice due to its superior strength, elasticity, and performance benefits, which are essential for crafting high-quality cricket bats. English willow dominates professional-grade products, while Kashmir willow caters to amateur players, broadening the segment’s reach. The enduring appeal of natural materials, coupled with growing investments in advanced wood treatment and sustainability initiatives, continues to drive growth in this dominant segment.

- For instance, Gunn & Moore uses a DXM (Digital eXact Manufacturing) process that blends traditional craftsmanship with advanced CAD/CAM and CNC-controlled machinery to ensure high consistency and precision in the production of their cricket bats.

By End User

Among end users, professional players represent the leading segment, commanding around 72% of the overall market share. This dominance stems from their high purchasing frequency, demand for premium-grade equipment, and influence over consumer preferences through endorsements. Professional players require certified, performance-optimized gear that complies with international standards, driving higher revenue per unit. Furthermore, growing investments by cricket boards, sponsorship deals, and increased participation in international leagues enhance product visibility and adoption. As a result, the professional player segment continues to generate the majority of revenue within the cricket equipment market.

Key Growth Drivers

Rising Popularity of Cricket Across Emerging Economies

The rapid expansion of cricket in emerging markets such as India, Bangladesh, and parts of Africa is significantly driving demand for cricket equipment. Growing grassroots programs, increased participation in school and community-level tournaments, and the influence of major international leagues are boosting equipment sales. The sport’s inclusion in global events like the Olympics and T20 leagues’ widespread media coverage have further enhanced visibility, creating lucrative opportunities for manufacturers to cater to a larger and more diverse consumer base.

- For instance, SG (Sanspareils Greenlands) is the official manufacturer and supplier of cricket balls used in Test matches and Ranji Trophy matches in India, with its balls being approved by the BCCI.

Technological Advancements in Equipment Design

Innovations in material science and product design are transforming the performance and durability of cricket equipment. Manufacturers are adopting lightweight composite materials, ergonomic designs, and advanced manufacturing techniques to enhance player comfort and safety. Smart gear integration-such as sensor-enabled bats and performance-tracking wearables-is gaining popularity among professionals and enthusiasts. These advancements not only improve gameplay efficiency but also drive consumer preference toward premium products, encouraging higher spending and strengthening brand competitiveness in the global cricket equipment market.

- For instance, Spektacom Technologies developed the PowerBat system with an ultra-lightweight micro-sensor (PowerSticker) weighing less than 5 grams (later versions are around 12 grams), capable of capturing full bat swing data, including angles (backlift, downswing, launch, follow-through) and impact characteristics such as bat speed (km/hr), twist (degrees), and impact location (quality percentage), which are used to derive a “Power” score measured in a proprietary unit called “Speks”.

Expansion of E-Commerce and Brand Endorsements

The growing prominence of e-commerce platforms and strategic brand endorsements by international players are major contributors to market growth. Online retail channels have improved accessibility, enabling consumers to purchase a wide range of equipment globally. At the same time, celebrity endorsements and franchise collaborations build strong emotional connections with consumers, influencing purchasing behavior. These marketing strategies, coupled with discounts and product customization options offered online, are expanding customer reach and fueling consistent growth across both developed and emerging cricket markets.

Key Trends & Opportunities

Increasing Demand for Sustainable and Eco-Friendly Materials

Sustainability has become a prominent trend in the cricket equipment market as consumers and manufacturers prioritize environmentally friendly practices. The use of responsibly sourced willow, biodegradable materials, and recyclable packaging is gaining momentum. Brands that emphasize eco-conscious production are attracting environmentally aware buyers, particularly in Western and developed Asian markets. This shift toward sustainability not only enhances brand reputation but also creates opportunities for innovation in manufacturing processes and materials, aligning business strategies with global sustainability goals.

- For instance, Kookaburra Sport is committed to sustainable practices within its supply chain, focusing on initiatives like incorporating recycled polyester and Better Cotton Initiative (BCI) cotton in its apparel range and using sustainable packaging.

Growing Adoption of Customized and Premium Equipment

Customization is emerging as a key trend, with players increasingly seeking tailored products to suit their playing style and comfort. From bat profiles to personalized protective gear and apparel, manufacturers are offering bespoke solutions using digital fitting technologies. The rise of premium product lines, driven by performance-focused consumers and professionals, is expanding revenue potential. This trend reflects a broader shift toward quality and personalization, encouraging brands to innovate and differentiate through advanced product engineering and customer-centric marketing strategies.

- For instance, Gray-Nicolls launched its 3D Bat Customizer platform, allowing players to design over 15,000 possible bat configurations using handle type, blade curve, and sticker design options.

Rising Influence of Women’s Cricket

The rapid growth of women’s cricket globally presents significant opportunities for equipment manufacturers. Expanding participation in women’s leagues, professional tournaments, and school-level programs has created new demand for women-specific gear designed for comfort, fit, and safety. Increased media coverage and sponsorships have further elevated visibility and investment in this segment. As female participation continues to rise, brands focusing on this demographic are well-positioned to capture untapped market potential and drive long-term growth in the cricket equipment industry.

Key Challenges

High Cost of Premium Equipment

The rising cost of professional-grade cricket equipment poses a major challenge, particularly for amateur players and emerging markets. High-quality materials such as English willow and advanced composites significantly increase manufacturing expenses, making premium products less accessible to budget-conscious consumers. This cost barrier limits market penetration in developing regions where affordability plays a crucial role in purchasing decisions. To overcome this challenge, manufacturers are exploring cost-effective materials and production techniques to offer competitive pricing without compromising quality or performance.

Fluctuating Raw Material Supply and Quality

The availability and quality of raw materials, particularly willow wood and leather, remain volatile due to environmental constraints and limited regional supply. Dependence on specific geographic regions for raw material sourcing exposes manufacturers to supply chain disruptions, price fluctuations, and quality inconsistencies. These challenges hinder production efficiency and increase operational costs. Companies are investing in sustainable sourcing initiatives, material diversification, and strategic supplier partnerships to mitigate these risks and ensure consistent quality standards across product lines.Top of FormBottom of Form

Regional Analysis

Asia Pacific

Asia Pacific holds the largest share of the global cricket equipment market, accounting for over 55% of total revenue. The region’s dominance is driven by the immense popularity of cricket in countries such as India, Pakistan, Sri Lanka, Bangladesh, and Australia. Strong fan bases, frequent domestic and international tournaments, and increasing youth participation fuel consistent equipment demand. India remains the key growth engine due to its vast consumer base and expanding professional leagues like the IPL. Growing investments in cricket academies and grassroots programs further strengthen the region’s leadership in global market growth.

Europe

Europe captures a market share of around 18%, driven primarily by the United Kingdom’s long-standing cricket heritage and growing professional infrastructure. The presence of established manufacturers such as Gray-Nicolls, Kippax Willow, and Salix supports strong product innovation and exports. Increasing participation in club-level and county cricket, coupled with government initiatives promoting sports engagement, sustains steady demand. Additionally, the rising popularity of short-format leagues and women’s cricket in the U.K. and Ireland is encouraging equipment upgrades, positioning Europe as a key secondary market with stable long-term growth potential.

North America

North America accounts for about 10% of the global cricket equipment market, supported by the sport’s expanding footprint across the United States and Canada. The establishment of Major League Cricket (MLC) and community-level tournaments has significantly raised awareness and participation. Growing immigrant populations from cricket-playing nations are contributing to rising equipment sales and training facility development. Manufacturers are increasingly focusing on online distribution to reach this emerging customer base. Although still a developing region for cricket, North America presents high growth potential driven by rising engagement and institutional support.

Middle East & Africa

The Middle East & Africa region represents around 9% of the global market share, driven by growing interest in cricket across the UAE, South Africa, and Kenya. The UAE has become a regional cricket hub, hosting international leagues and training centers that boost equipment demand. South Africa remains a leading consumer and producer of quality cricket gear within Africa. Additionally, investments in cricket infrastructure and youth training initiatives across the GCC and African nations are fostering increased participation, positioning the region as an emerging growth frontier for global manufacturers.

Latin America

Latin America holds a market share of nearly 8%, with the sport gradually gaining popularity in countries such as Argentina, Brazil, and Mexico. Cricket’s expansion through school programs, regional associations, and international collaborations is fostering market development. While currently at a nascent stage, rising interest among younger demographics and expatriate communities is driving incremental equipment demand. Efforts by global cricket bodies to promote the sport in non-traditional markets, along with growing e-commerce accessibility, are expected to accelerate adoption and create new opportunities for brands targeting emerging markets in the region.

Market Segmentations:

By Product Type

- Bats

- Balls

- Protective Gear (helmets, pads, gloves, guards, etc.)

- Clothing & Accessories (jerseys, caps, etc.)

By Material

- Wood (English willow, Kashmir willow)

- Leather

- Synthetic materials

- Composite materials

By End User

- Professional players

- Amateur/recreational players

- Institutions & academies

- Sports clubs and associations

By Distribution Channel

- Online retail (e-commerce platforms, brand websites)

- Offline retail (sports stores, specialty shops, supermarkets)

- Direct sales (clubs, schools, sponsorships)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cricket equipment market is characterized by the presence of leading global and regional players such as Kookaburra Sport Pty Ltd, Grays International, Sommers, Kippax Willow Limited Company, Bradbury, Blue Tongue Sports, Adidas AG, Stag Cricket, Salix Cricket Bat Co. Ltd., and Blankbats. These companies compete through product innovation, brand endorsements, and strategic partnerships to strengthen market presence. The focus on high-performance materials, player-specific customization, and sustainable manufacturing practices has intensified competition. Established brands leverage strong distribution networks and sponsorships with professional teams to maintain dominance, while emerging players emphasize affordability and online sales to penetrate new markets. Technological advancements, such as smart gear and lightweight composites, are further shaping competition, driving manufacturers to invest in R&D and product diversification. The market is moderately consolidated, with continuous efforts by key players to expand their global footprint through mergers, acquisitions, and product line extensions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Salix Cricket Bat Co. Ltd. (U.K.)

- Blue Tongue Sports (Australia)

- Adidas AG (Germany)

- Stag Cricket (U.K.)

- Bradbury (Australia)

- KIPPAX WILLOW LIMITED COMPANY (U.K.)

- Sommers (Australia)

- Blankbats (U.K.)

- Kookaburra Sport Pty Ltd (Australia)

- Grays International (U.K.)

Recent Developments

- In April 2025, Gray‐Nicolls unveiled its “Quantum Series” bats for 2025 — namely the Quantum Pro and Quantum Elite — featuring a new willow pressing process for lighter weight and larger sweet-spot.

- In 2025, Kookaburra announced its 2025/26 range with new bat collections “Prism” and “Monarch”, targeting short-format cricket players with revised profiles and handle/blade combinations.

- In September 2024, Salix introduced its 2024 model “RAW W/S A” English Willow bat, highlighting upgraded pressing techniques for improved performance.

- In 2024, Adidas launched its “Under Pressure” campaign ahead of the T20 World Cup, featuring its cricket equipment line in a new creative push.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cricket equipment market is expected to witness steady growth driven by increasing global participation in professional and recreational cricket.

- Expansion of franchise-based leagues and inclusion of cricket in global sporting events will enhance market visibility.

- Manufacturers will focus on sustainability through eco-friendly materials and responsible sourcing practices.

- Rising investments in youth training academies and school-level cricket programs will create long-term demand.

- Technological advancements such as smart gear and performance-tracking tools will gain wider adoption.

- Online retail channels will continue to expand, offering greater accessibility and customization options.

- Asia Pacific will remain the dominant regional market, supported by strong cricket culture and infrastructure growth.

- Europe and North America will experience gradual expansion due to rising awareness and organized leagues.

- Premium and customized equipment will see growing demand among professional and semi-professional players.

- Strategic partnerships, brand endorsements, and innovation-driven competition will shape future market dynamics.