Market overview

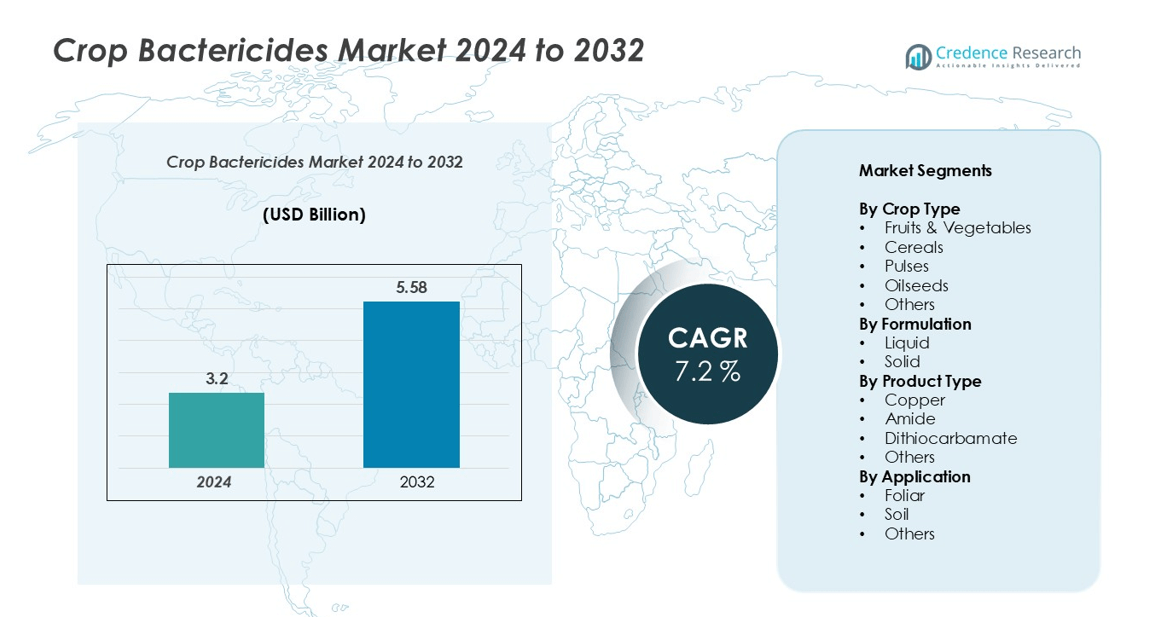

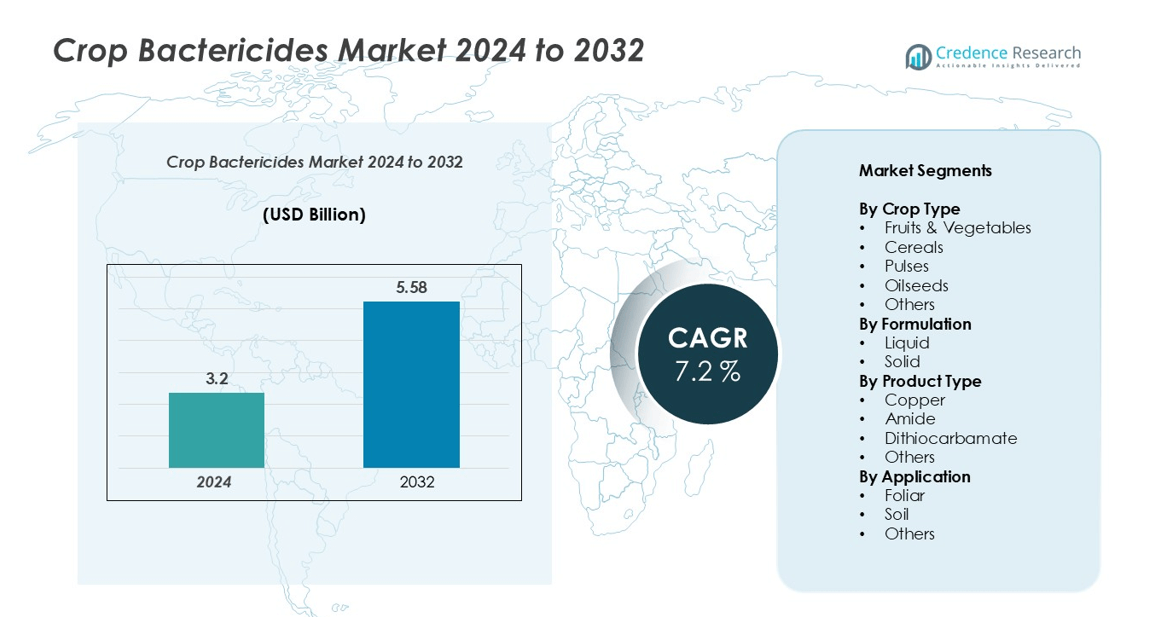

The crop bactericides market size was valued at USD 3.2 billion in 2024 and is anticipated to reach USD 5.58 billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crop Bactericides Market Size 2024 |

USD 3.2 billion |

| Crop Bactericides Market, CAGR |

7.2% |

| Crop Bactericides Market Size 2032 |

USD 5.58 billion |

The global crop bactericides market is led by major players such as Syngenta AG, BASF SE, Bayer CropScience AG, FMC Corporation, Nufarm Limited, Sumitomo Chemical Co., Ltd, Nippon Soda Co., Ltd, Dow AgroSciences LLC, American Vanguard Corporation, and PI Industries. These companies dominate through extensive R&D capabilities, strong product portfolios, and established distribution networks across major agricultural regions. Asia-Pacific remains the leading regional market, accounting for approximately 35% of the global share in 2024, driven by large-scale cultivation of fruits, vegetables, and cereals. North America and Europe follow, supported by advanced farming technologies and growing adoption of sustainable crop protection products. The market is witnessing intensified competition as players focus on bio-based innovations and strategic collaborations to strengthen their global presence.

Market Insights

- The global crop bactericides market was valued at USD 3.2 billion in 2024 and is projected to reach USD 5.58 billion by 2032, registering a CAGR of 7.2% during the forecast period.

- Increasing incidences of bacterial crop diseases and expanding cultivation of high-value crops such as fruits and vegetables are driving market growth, with the fruits & vegetables segment holding the largest share due to higher disease vulnerability.

- Key trends include the growing adoption of bio-based and eco-friendly bactericides, technological advancements in formulation development, and the integration of precision agriculture for efficient application.

- The market is moderately consolidated, with major players such as Syngenta AG, BASF SE, Bayer CropScience AG, and FMC Corporation focusing on R&D, product innovation, and strategic collaborations to maintain competitiveness.

- Asia-Pacific leads with 35% share, followed by North America (28%) and Europe (25%), driven by large-scale farming, export-oriented production, and regulatory shifts toward sustainable agriculture.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Crop Type:

The crop bactericides market, by crop type, is segmented into fruits & vegetables, cereals, pulses, oilseeds, and others. The fruits & vegetables segment dominates the market, accounting for the largest share in 2024. This dominance is driven by the high susceptibility of fruits and vegetables to bacterial infections such as bacterial blight and soft rot, which significantly impact yield and quality. The increasing global demand for fresh produce and the rising adoption of bactericide-treated crops to meet export quality standards further support segment growth. Additionally, intensive horticulture practices in regions like Asia-Pacific and Europe fuel higher product utilization.

- For instance, Nutrien Ag Solutions, through its Loveland Products business, completed the acquired Suncor Energy’s AgroScience assets on June 17, 2024.

By Formulation:

Based on formulation, the market is divided into liquid and solid forms. The liquid formulation segment holds the dominant share due to its superior ease of application, faster absorption, and compatibility with foliar spraying systems. Liquid bactericides are preferred in large-scale commercial farming, as they provide uniform coverage and efficient protection against a broad spectrum of bacterial pathogens. Growing adoption of precision agriculture techniques and the convenience of integrating liquid formulations with other crop protection products are key factors driving segment expansion.

- For instance, BASF SE, a leading global chemical company, has been actively involved in the development and commercialization of liquid-based agricultural solutions.

By Product Type:

The crop bactericides market, by product type, includes copper, amide, dithiocarbamate, and others. The copper-based bactericides segment leads the market, capturing the highest share in 2024. Copper compounds, such as copper hydroxide and copper oxychloride, are widely used due to their broad-spectrum activity, cost-effectiveness, and proven efficacy against bacterial leaf spot, fire blight, and other diseases. Regulatory approvals for copper-based formulations and their long-standing reliability in both organic and conventional farming practices continue to support demand. However, innovations in amide-based alternatives are emerging as eco-friendly substitutes in response to sustainability concerns.

Key Growth Drivers

Rising Incidence of Bacterial Crop Diseases

The increasing prevalence of bacterial infections such as bacterial blight, leaf spot, and wilt in major crops is a significant driver of the crop bactericides market. Climate change, excessive humidity, and intensive agricultural practices have created favorable conditions for the spread of bacterial pathogens. These infections cause severe yield losses, prompting farmers to adopt effective bactericidal treatments. Countries in Asia-Pacific and Latin America, where horticultural and cereal crops are heavily affected, are witnessing a surge in bactericide usage. Additionally, the growing awareness among farmers about integrated pest management (IPM) and preventive crop protection is boosting the adoption of bactericides, both in conventional and high-value horticultural crops.

- For instance, in India, bacterial wilt disease caused by Ralstonia solanacearumhas been identified as a major limiting factor for crops such as chili, capsicum, eggplant, potato, tomato, tobacco, ginger, and jute.

Expanding Horticulture and High-Value Crop Cultivation

The expansion of horticulture and the rising cultivation of high-value crops such as fruits, vegetables, and ornamentals are key growth drivers for the crop bactericides market. These crops are highly prone to bacterial infections that can compromise yield, quality, and export potential. With increasing consumer demand for fresh produce and aesthetic plants, farmers are investing more in bactericidal protection. Moreover, government initiatives supporting horticultural productivity and export quality standards further encourage bactericide usage. In countries like India, China, and Spain, the shift toward greenhouse and protected cultivation has intensified bactericide application to maintain consistent quality and disease-free production.

- For instance, in India, the state of Telangana cultivated horticultural crops over 5.24 lakh hectares in the 2023–24 period, producing 42.58 lakh metric tonnes..

Technological Advancements in Formulation Development

Ongoing advancements in bactericide formulations are significantly propelling market growth. Manufacturers are focusing on developing next-generation formulations that enhance bioavailability, reduce phytotoxicity, and offer prolonged protection. Nano-based and bio-bactericide technologies are gaining traction as sustainable and residue-free alternatives to conventional copper-based products. These innovations align with the growing demand for environmentally friendly crop protection solutions and comply with evolving regulatory frameworks. Additionally, improved compatibility of new formulations with other agrochemicals and their suitability for modern spraying systems are enhancing their adoption among large-scale growers, thereby driving the global crop bactericides market forward

Key Trends & Opportunities

Increasing Adoption of Bio-based and Sustainable Bactericides

A major trend shaping the market is the rising adoption of bio-based and eco-friendly bactericides. Growing environmental awareness and regulatory pressure to reduce chemical pesticide residues are encouraging the use of plant-derived and microbial-based bactericides. These products offer targeted action, minimal environmental impact, and compatibility with organic farming systems. Manufacturers are increasingly investing in R&D to develop bio-bactericides that provide comparable efficacy to synthetic formulations. This trend presents a significant opportunity for market players to cater to the expanding organic and sustainable agriculture sectors, especially in Europe and North America.

- For instance, Certis Biologicals, a leading manufacturer of biological solutions, acquired multiple assets from AgBiome in March 2024, including the biofungicides Howler® and Theia®.

Integration of Precision Agriculture and Smart Application Techniques

The integration of precision agriculture technologies presents a strong opportunity for the crop bactericides market. Advanced tools such as drone-based spraying, remote sensing, and AI-driven disease diagnostics are enhancing the precision and efficiency of bactericide application. These technologies enable site-specific treatments, minimize chemical wastage, and improve crop health monitoring. The growing adoption of digital farming platforms, particularly in developed markets, allows farmers to predict bacterial outbreaks and apply bactericides more effectively. This trend supports higher productivity, lower costs, and improved sustainability, positioning smart farming as a major opportunity for market expansion.

- For instance, the Rainforest Alliance is using Cropin’s AI-powered risk mitigation and crop protection solution (specifically the CocoaSense tool) to identify cacao plants, predict yields (with up to 90% accuracy), and provide disease alerts (e.g., for black pod disease, with 80% accuracy) to help farmers in regions like Ghana.

Key Challenges

Regulatory Restrictions on Chemical Bactericides

Stringent regulations governing the use of copper and other synthetic bactericides pose a major challenge to market growth. Many regions, particularly the European Union, are enforcing stricter residue limits and promoting the phase-out of chemical-based products due to environmental and health concerns. These restrictions compel manufacturers to reformulate or re-register their products, increasing development costs and delaying market entry. Additionally, compliance with evolving regulatory standards creates uncertainty for producers and distributors, especially small and mid-sized companies operating in multiple jurisdictions.

Resistance Development and Limited Efficacy

The growing resistance of bacterial pathogens to existing chemical bactericides is a significant barrier to market sustainability. Continuous and excessive use of copper-based formulations has led to reduced effectiveness, forcing farmers to increase dosage levels or seek alternative treatments. This resistance not only limits the long-term efficacy of bactericides but also increases production costs and environmental risks. The challenge is further intensified by the lack of new active ingredients entering the market due to complex approval processes and high R&D costs. As a result, there is an urgent need for innovative, multi-mode bactericides to address resistance issues and maintain crop protection efficiency.

Regional Analysis

North America:

North America holds a significant share of the global crop bactericides market, accounting for over 28% in 2024. The region’s strong agricultural infrastructure, high adoption of advanced crop protection solutions, and frequent bacterial outbreaks in fruits, vegetables, and cereals drive demand. The United States dominates the regional market, supported by extensive horticultural production and government emphasis on sustainable farming practices. Increasing adoption of copper and bio-based bactericides, coupled with rising awareness of integrated pest management (IPM) programs, continues to strengthen the regional market outlook through 2032.

Europe:

Europe accounts for approximately 25% of the crop bactericides market share in 2024, driven by stringent regulations promoting eco-friendly and bio-based solutions. Countries such as Spain, Italy, and France are major contributors due to their large-scale fruit and vegetable cultivation. The region’s strong focus on sustainable agriculture and compliance with EU residue limits has accelerated the transition from synthetic to biological bactericides. Growing adoption of precision farming technologies and expanding organic crop acreage are further supporting the market, particularly in Western and Southern European nations.

Asia-Pacific:

Asia-Pacific dominates the global crop bactericides market with a share exceeding 35% in 2024. The region’s leadership is attributed to extensive agricultural activities, increasing prevalence of bacterial crop diseases, and government initiatives supporting food security. Countries such as China, India, and Japan are major consumers, driven by high fruit, vegetable, and cereal production. Rising farmer awareness, rapid adoption of modern farming practices, and expansion of horticulture exports are key growth contributors. Additionally, growing demand for high-yield and disease-resistant crops continues to boost bactericide utilization across the region.

Latin America:

Latin America holds around 8% of the crop bactericides market in 2024, supported by strong agricultural exports and large-scale cultivation of fruits, vegetables, and oilseeds. Brazil and Argentina lead the market, with increasing incidences of bacterial blight and spot diseases driving bactericide adoption. Expanding horticultural production for export and growing investment in sustainable crop protection solutions are further enhancing market growth. The region’s favorable climatic conditions for bacterial infestations and rising adoption of foliar applications also contribute to higher bactericide consumption across major crops.

Middle East & Africa:

The Middle East & Africa region accounts for nearly 4% of the global crop bactericides market in 2024. Market growth is primarily driven by increasing government efforts to enhance agricultural productivity and reduce crop losses caused by bacterial diseases. Countries such as South Africa, Egypt, and Saudi Arabia are key contributors, with rising demand for bactericides in horticultural and cereal crops. Although adoption remains relatively low compared to other regions, growing awareness of integrated pest management and expanding irrigation-based agriculture are expected to support gradual market expansion.

Market Segmentations:

By Crop Type:

- Fruits & Vegetables

- Cereals

- Pulses

- Oilseeds

- Others

By Formulation:

By Product Type:

- Copper

- Amide

- Dithiocarbamate

- Others

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The crop bactericides market features a moderately consolidated competitive landscape, dominated by several global and regional players focusing on innovation, product diversification, and sustainability. Key companies such as Syngenta AG, BASF SE, Bayer CropScience AG, FMC Corporation, and Nufarm Limited hold substantial market shares through extensive distribution networks and strong research capabilities. These players are investing heavily in the development of bio-based and copper-alternative formulations to comply with evolving environmental regulations and address resistance issues. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their geographic reach and strengthen product portfolios. Emerging participants, including PI Industries and Nippon Soda Co., Ltd, are leveraging technological advancements and localized production strategies to compete effectively. The growing emphasis on eco-friendly bactericides and integrated pest management (IPM) solutions is reshaping competition, prompting established players to focus on sustainable innovation and digital agriculture integration to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Syngenta AG

- Nufarm Limited

- BASF SE

- Sumitomo Chemical Co., Ltd

- Bayer CropScience AG

- FMC Corporation

- Nippon Soda Co., Ltd

- Dow AgroSciences LLC

- American Vanguard Corporation

- PI Industries

Recent Developments

- In March 2024, the USA EPA approved Sym‑Agro’s Instill, a combined bactericide and fungicide, for expanded use on crops including coffee, potatoes, hazelnuts, and sugar beets, enhancing disease management options across specialty and row crops.

- In January 2024, Bayer secured EPA registration for its Vios FX herbicide, which also exhibits bactericidal properties, offering farmers integrated dual weed and bacterial disease control in wheat production systems.

- In June 2025, Kothari Industrial Corporation Ltd (KICL) launched a suite of 30 agricultural products focusing on bio-inputs, including neem-based and organic formulations. This move is designed to enhance crop yields and promote sustainable farming practices nationwide.

Report Coverage

The research report offers an in-depth analysis based on Crop Type, Formulation, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The crop bactericides market is expected to grow steadily due to rising bacterial crop infections.

- Demand for fruits, vegetables, and high-value crops will continue to drive bactericide adoption.

- Adoption of bio-based and eco-friendly bactericides will expand in response to environmental regulations.

- Technological advancements in formulation will improve efficacy and ease of application.

- Integration with precision agriculture tools will enhance targeted and efficient usage.

- Growing awareness of integrated pest management will encourage preventive bactericide treatments.

- Expansion of greenhouse and protected cultivation will boost product demand.

- Emerging markets in Asia-Pacific, Latin America, and Africa will present new growth opportunities.

- Resistance management strategies will drive innovation in multi-mode and sustainable products.

- Strategic collaborations, mergers, and acquisitions will strengthen global and regional market presence.