Market Overview

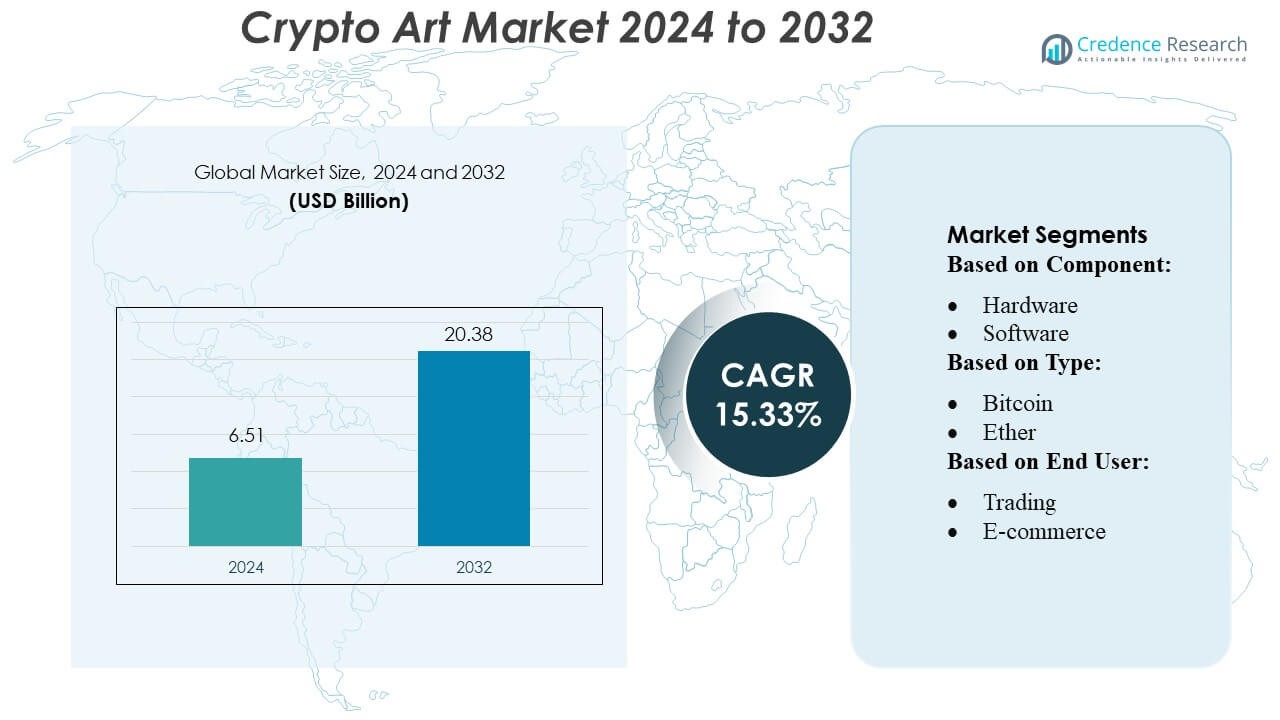

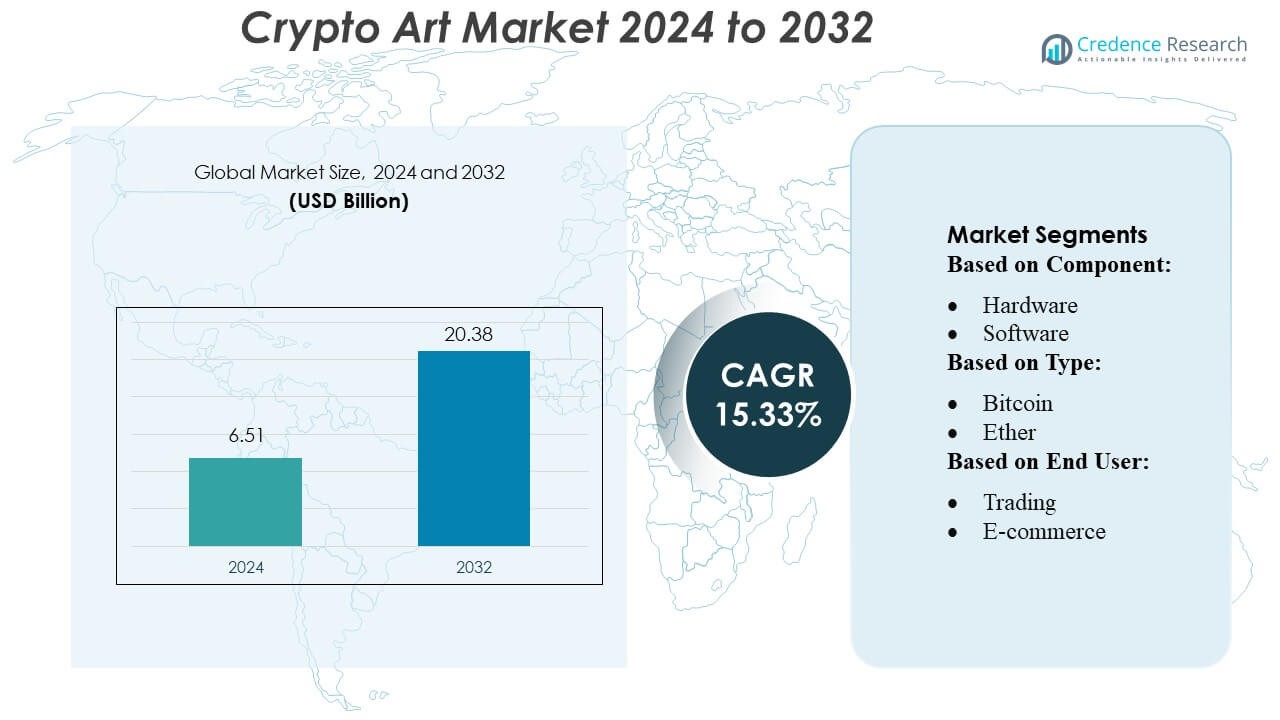

Crypto Art Market size was valued USD 6.51 billion in 2024 and is anticipated to reach USD 20.38 billion by 2032, at a CAGR of 15.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crypto Art Market Size 2024 |

USD 6.51 Billion |

| Crypto Art Market, CAGR |

15.33% |

| Crypto Art Market Size 2032 |

USD 20.38 Billion |

The Crypto Art Market centers on a handful of high-profile NFT platforms, including OpenSea, Rarible, SuperRare, Foundation, and Nifty Gateway, which drive most of the trading volume and artist activity. These platforms continuously innovate by enhancing smart contract functionality, improving royalty enforcement, and enabling cross-chain minting. They also offer curated, community-driven gallery experiences, attracting both emerging digital artists and established creators. North America leads this market with a commanding 42 % share, thanks to its advanced blockchain infrastructure, strong investor base, and deep Web3 ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Crypto Art Market was valued at USD 6.51 billion in 2024 and is projected to reach USD 20.38 billion by 2032, expanding at a CAGR of 15.33%, supported by growing adoption of blockchain-based digital ownership.

- Market growth is driven by rising creator participation, expanding NFT utilities, improved smart-contract automation, and strong activity across major platforms that collectively generate the majority share of global crypto art transactions.

- Key trends include rapid integration of AI-generated art, increasing metaverse exhibitions, and expanding cross-chain minting that enhances accessibility and boosts overall marketplace liquidity.

- Competitive intensity remains high as leading NFT platforms innovate around royalties, curation models, and security, while restraints include market volatility, regulatory uncertainty, and concerns around intellectual property protection.

- Regionally, North America leads with 42% share, followed by Europe and Asia-Pacific; platform-based NFT segments dominate the market with the largest contribution to global crypto art sales.

Market Segmentation Analysis:

By Component

In the crypto art market, the software segment holds the largest market share, driven by the high adoption of digital wallets, NFT marketplaces, and blockchain-based creative tools. Software dominates because artists and collectors rely heavily on platforms for minting, trading, and storing digital artworks, while hardware plays a supporting role mainly through secure devices like hardware wallets. The rapid integration of smart-contract automation and user-friendly marketplace interfaces continues to strengthen software’s lead as the primary enabler of crypto-art creation and transactions.

- For instance, BASF filed 1,159 patents, and 44.5% of them were focused on sustainability, demonstrating how its software-augmented R&D pipeline is delivering cutting-edge innovations.

By Type

Among crypto types used in the crypto art ecosystem, Ether (ETH) holds the dominant market share due to its central role in powering NFT transactions on the Ethereum blockchain. ETH leads because most NFT marketplaces, smart-contract systems, and digital art minting protocols operate natively on Ethereum. While other cryptocurrencies participate in broader digital payment ecosystems, they remain secondary in the art segment, as ETH’s liquidity, strong developer community, and established token standards sustain its position as the preferred currency in crypto-art trading.

- For instance, No-Burn’s Technical Data Sheet specifies that at a wet film thickness of 5 mils, it achieves a flame spread (FS) of 20 and smoke development (SD) of 85, per ASTM E84 / UL 723 testing.

By End-User

Within end-user applications, the trading segment accounts for the largest share of activity in the crypto art market, driven by high volumes on NFT marketplaces and frequent resale of digital artworks. Trading dominates because collectors actively engage in short- and long-term speculation, encouraged by marketplace auction formats and rapid price movements. Although e-commerce, peer-to-peer payments, and remittance uses are expanding gradually, they contribute smaller portions compared to trading’s strong influence on liquidity, valuation cycles, and market engagement in the crypto-art ecosystem.

Key Growth Drivers

Rising Adoption of Digital Ownership Through NFTs

The rapid adoption of blockchain-based non-fungible tokens (NFTs) continues to fuel demand for crypto art by providing verifiable ownership, rarity, and provenance. Creators benefit from transparent royalty structures, while buyers gain secure asset authentication. This shift enhances trust and expands participation from both digital artists and traditional collectors seeking diversification. Increased integration of NFT marketplaces with mainstream platforms and wallets further boosts accessibility, encouraging a broader demographic to invest in digital artworks and driving sustained market expansion.

- For instance, Axalta’s SEC filings highlight its innovation infrastructure: it employs roughly 1,300 scientists, engineers, and technical experts and holds around 750 active patents.

Expanding Creator Economy and Monetization Models

Crypto art offers new monetization avenues for creators through direct-to-consumer sales, fractional ownership, and programmable royalties. Artists gain global visibility without relying on intermediaries, reducing entry barriers and maximizing revenue potential. Smart contracts automate transactions and ensure secondary-market royalty payouts, strengthening long-term earning opportunities. As more designers, animators, and independent creators adopt blockchain-based distribution, the market experiences rising artwork supply and diversified formats, fostering consistent ecosystem growth driven by creator empowerment and evolving revenue models.

- For instance, Jotun’s SeaQuantum X200 antifouling coating achieved a verified average speed-loss of just 1.0% over a dock-to-dock period, per DNV testing, setting a new benchmark for hull performance.

Institutional Interest and Digital Asset Investment Growth

Growing institutional participation in digital assets significantly accelerates crypto art market development. Galleries, auction houses, and investment firms increasingly explore tokenized art as part of broader digital asset strategies. These entities support higher-value transactions, elevate market credibility, and attract affluent collectors. Additionally, integration with Web3 infrastructure, metaverse experiences, and virtual exhibitions broadens visibility. As institutions experiment with curation, storage solutions, and digital authentication, their involvement strengthens regulatory confidence and enhances the legitimacy of crypto art as an emerging asset class.

Key Trends & Opportunities

Expansion of Metaverse-Integrated Art Experiences

The rise of immersive metaverse environments presents a major opportunity for showcasing, trading, and experiencing crypto art in virtual spaces. Artists and collectors increasingly use 3D galleries, interactive exhibitions, and avatar-based events to enhance engagement. This shift supports new art forms such as generative, dynamic, and AI-driven works that evolve based on user interaction. Brands and cultural institutions also collaborate in metaverse venues, creating cross-industry opportunities. As virtual worlds scale, their demand for digital art assets expands, reinforcing long-term market potential.

- For instance, Hempel introduced HEET Dynamic, a software tool for intumescent-coating estimation on steel structural sections. According to Hempel, HEET Dynamic performs calculations up to 10× faster than traditional methods — all while delivering 100% estimation accuracy.

Growth of Generative and AI-Powered Art Formats

Advancements in AI and algorithmic creativity are reshaping digital art creation and attracting new collectors interested in data-driven aesthetics. Generative art platforms allow artists to produce unique, code-based works that emphasize randomness and computational design. This trend drives innovation and appeals to audiences seeking complex, evolving digital expressions. NFTs enable verification and scarcity for algorithmic outputs, stimulating higher valuation potential. As AI tools become mainstream, more creators experiment with hybrid art forms, generating opportunities for marketplace differentiation and expanded buyer appeal.

- For instance, Sherwin-Williams employs over 2,000 R&D personnel globally, with more than 2,100 active patents maintained across its operations.

Emergence of Fractionalized and Community-Owned Art

Fractional ownership models continue gaining traction, allowing collectors to co-own high-value digital artworks at lower entry costs. This structure expands market participation, supports liquidity, and democratizes access to premium pieces. Decentralized autonomous organizations (DAOs) use token-based governance to collectively acquire, curate, and manage crypto art portfolios, fostering engaged communities. The approach enhances both price discovery and cultural relevance. As regulatory clarity improves, fractionalized models present significant growth potential by merging financial accessibility with collaborative digital ownership.

Key Challenges

Market Volatility and Speculative Price Fluctuations

The crypto art market faces ongoing challenges due to high volatility in digital asset pricing and speculative trading dynamics. Fluctuations in cryptocurrency values influence artwork valuations, often creating uncertainty for both artists and investors. Rapid price surges followed by sharp corrections can discourage long-term participation and complicate financial planning for creators relying on NFT income. These volatility risks hinder institutional confidence and demand structured mechanisms to stabilize pricing, reduce speculative activity, and enhance market transparency.

Regulatory Uncertainty and Intellectual Property Risks

Unclear regulatory frameworks around digital assets, copyright enforcement, and NFT transactions pose major obstacles to crypto art adoption. Artists frequently encounter unauthorized minting or plagiarism, and cross-border laws complicate dispute resolution. Inconsistent tax policies further challenge collectors and creators navigating the legal landscape. Without standardized guidelines for digital ownership, provenance, and royalty compliance, stakeholders face operational and legal risks. Strengthening intellectual property protections, marketplace verification tools, and regulatory clarity remains essential for securing sustainable market growth.

Regional Analysis

North America

North America holds the largest share of the crypto art market, accounting for around 40–45%. The region benefits from strong blockchain adoption, high digital art awareness, and the presence of major NFT marketplaces. The United States leads growth with active participation from creators, collectors, and tech investors. Frequent collaborations between digital artists, brands, and galleries also support market expansion. With advanced infrastructure and increasing institutional interest, North America continues to attract high-value crypto art transactions and remains the most influential region in shaping global market trends.

Europe

Europe represents around 20–30% of the global crypto art market. The region’s deep art culture, combined with growing acceptance of digital ownership, drives steady adoption. Countries such as the United Kingdom, Germany, and France play major roles due to strong creative communities and supportive digital policies. Museums and galleries are gradually integrating NFT exhibitions, expanding visibility for artists. Europe’s balanced mix of traditional and digital art practices strengthens market stability. While regulatory changes continue to evolve, the region remains a significant contributor to global crypto art activity.

Asia-Pacific

Asia-Pacific holds around 26–30% of the crypto art market and continues to grow rapidly. The region benefits from a large tech-savvy population, strong gaming and digital culture, and rising interest in Web3 innovation. Countries such as Japan, South Korea, China, and India are becoming major hubs for digital creators and collectors. Increasing involvement in metaverse projects and generative art formats supports further growth. As blockchain adoption spreads across the region, Asia-Pacific is expected to drive a substantial share of future market expansion in crypto art.

Latin America

Latin America accounts for about 5–7% of the crypto art market. Growth is supported by rising digital engagement, mobile-first users, and increasing participation from young creators. Brazil, Mexico, and Argentina are emerging as key contributors as more artists adopt NFTs to reach global buyers. However, challenges such as limited infrastructure and regulatory uncertainty slow broader adoption. Despite this, the region shows strong potential, with expanding digital communities and growing interest in blockchain-based creative expression.

Middle East & Africa

The Middle East & Africa region holds around 5–12% of the crypto art market. Growth is driven by increasing blockchain investment in the UAE, Saudi Arabia, and select African countries. Digital art exhibitions and Web3 innovation hubs are emerging, attracting creators and collectors. Wealthy buyers in the Gulf region also contribute to higher-value NFT purchases. However, adoption remains uneven due to infrastructure gaps and varying regulations. As digital ecosystems strengthen, the region is expected to play a larger role in the global crypto art landscape.

Market Segmentations:

By Component:

By Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Crypto Art Market features diverse activity, although companies such as Contego International Inc., BASF SE, No-Burn Inc., Henkel AG & Company KGaA, Axalta Coating Systems, Jotun, RPM International Inc., Hempel A/S, PPG Industries Inc., and The Sherwin-Williams Company. The Crypto Art Market continues to evolve as digital-native platforms, blockchain developers, and emerging NFT marketplaces expand their capabilities to attract both artists and collectors. Competition is driven primarily by innovation in smart contract design, enhanced royalty mechanisms, and improved authentication features that strengthen trust and transparency in digital ownership. Leading platforms focus on strengthening user experience through better curation tools, personalized discovery engines, and cross-chain interoperability, allowing creators to reach broader audiences. Meanwhile, the rise of metaverse environments and AI-generated art introduces new competitive dimensions, encouraging marketplaces to support immersive exhibitions and dynamic digital formats. As regulatory clarity improves and institutional interest increases, competition intensifies around security, scalability, and community engagement. Overall, the market remains dynamic, with differentiation closely tied to technological advancement, creator empowerment, and platform reliability.

Key Player Analysis

Recent Developments

- In June 2025, JSW Paints announced its agreement to acquire a majority stake in Akzo Nobel India, a deal that involves a mix of equity and debt financing, supported by lenders like Deutsche Bank and MUFG.

- In April 2025, Jotun and Thoresen Shipping Singapore Pte. Ltd. partnered to implement Jotun’s Hull Skating Solutions (HSS) on the Thor Brave bulk carrier. This commercial agreement involves Jotun’s proactive hull cleaning and antifouling technology, which aims to keep the vessel’s hull clean and reduce fuel costs and CO2 emissions.

- In January 2025, Axalta Coating Systems and Dürr Systems AG announced a strategic partnership to commercialize digital paint solutions for automotive OEMs by integrating Axalta’s NextJet™ precision paint application technology with Dürr’s advanced robotics systems.

- In March 2024, Sherwin-Williams Repacor SW-1000 is an innovative, 100% solids, VOC-free polyaspartic repair coating designed to simplify maintenance and repair of steel structures by providing a high-performance, single-coat solution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow as more artists adopt blockchain to secure ownership and monetize digital works.

- NFT platforms will enhance authentication, storage, and royalty systems to support long-term creator earnings.

- Cross-chain interoperability will expand, allowing artworks to move easily between different blockchain networks.

- Metaverse integration will increase demand for immersive and interactive digital art experiences.

- AI-generated and generative art will gain greater prominence among collectors and creators.

- Fractional ownership models will attract new buyers by lowering entry barriers for high-value digital pieces.

- Institutions and galleries will expand their involvement through curated NFT exhibitions and digital art fundraising models.

- Regulatory clarity will improve, strengthening market transparency and investor confidence.

- Community-driven platforms and DAOs will play a larger role in curating and funding digital art projects.

- Enhanced security solutions will help reduce fraud, unauthorized minting, and misuse of artist content.