Market Overview

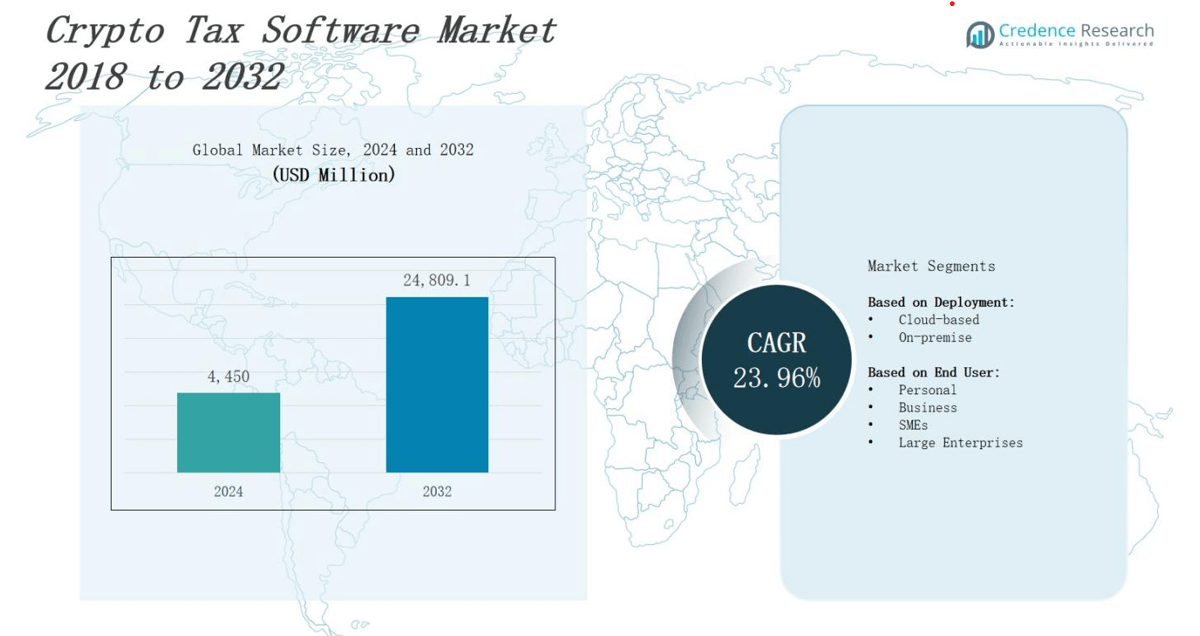

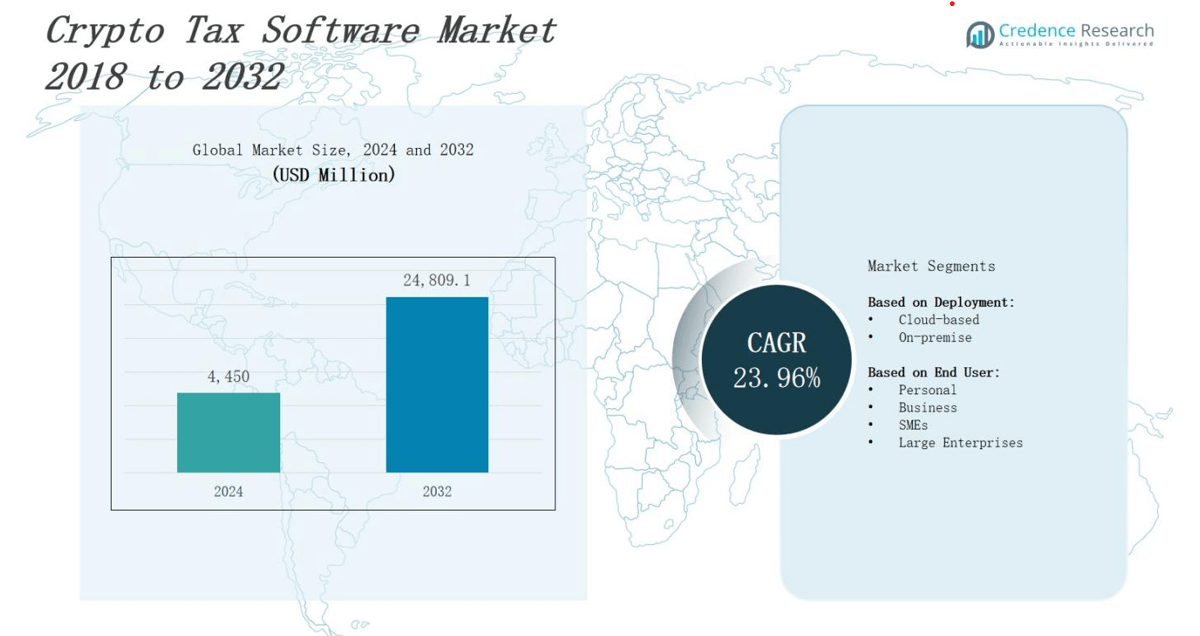

The crypto tax software market is projected to grow from USD 4,450 million in 2024 to USD 24,809.1 million by 2032, registering a CAGR of 23.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crypto Tax Software Market Size 2024 |

USD 4,450 million |

| Crypto Tax Software Market, CAGR |

23.96% |

| Crypto Tax Software Market Size 2032 |

USD 24,809.1 million |

The crypto tax software market is driven by the increasing global adoption of cryptocurrencies, rising regulatory scrutiny, and the need for accurate tax reporting. Governments are enforcing stricter compliance standards, prompting individuals and enterprises to adopt automated tax solutions. The rise in decentralized finance (DeFi) and complex crypto transactions further amplifies demand for advanced tracking and reporting tools. Key trends include integration with major crypto exchanges and wallets, AI-powered tax optimization, and cloud-based platforms offering real-time updates. The growing emphasis on transparency and streamlined digital tax filing continues to shape the market’s rapid expansion and technological innovation.

The crypto tax software market spans North America, Europe, Asia Pacific, and the Rest of the World, including Latin America, the Middle East, and Africa. North America leads due to strong regulatory enforcement, followed by Europe with rising adoption under MiCA. Asia Pacific is expanding rapidly with formalized tax structures in India, Japan, and Australia. Emerging regions show growing interest amid evolving tax policies. Key players include CoinTracking, CoinLedger, Koinly, Zenledger, Taxbit, CoinTracker, TokenTax, Fyn, Blockpit, Coinpanda, Accointing, TurboTax, and others driving innovation and compliance solutions globally.

Market Insights

- The crypto tax software market is expected to grow from USD 4,450 million in 2024 to USD 24,809.1 million by 2032, registering a CAGR of 23.96%.

- Rising global crypto adoption and regulatory scrutiny are key drivers pushing individuals and businesses to adopt automated tax solutions.

- Complex DeFi activities, NFT transactions, and high-frequency trading increase the need for accurate, real-time tracking and tax reporting tools.

- Cloud-based platforms, AI-powered tax optimization, and integration with exchanges and wallets define current innovation trends.

- Key regional shares include North America (38%), Europe (28%), Asia Pacific (22%), and Rest of the World (12%), led by evolving tax rules and growing adoption.

- Challenges include fragmented transaction data, lack of reporting standards, and constantly changing tax regulations across jurisdictions.

- Leading players such as CoinTracking, CoinLedger, Koinly, Taxbit, and others focus on compliance automation, regional localization, and enterprise scalability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Regulatory Compliance and Tax Enforcement

Governments worldwide are implementing stricter tax regulations for digital assets, compelling investors and institutions to adopt specialized tax software. The crypto tax software market is expanding rapidly due to the growing need for accurate reporting of crypto transactions. Tax authorities are issuing guidelines to ensure transparent disclosures, making manual calculations risky and impractical. It helps users stay compliant with complex regulations across jurisdictions. The market also benefits from real-time audit readiness and automated report generation. This compliance-driven demand continues to strengthen software adoption across both individual and enterprise segments.

- For instance, Koinly supports over 300 exchanges and 6,000 cryptocurrencies, generating country-specific tax forms for more than 34 jurisdictions and facilitating seamless compliance with complex international regulations.

Growth in Cryptocurrency Adoption and Transaction Volume

The widespread adoption of cryptocurrencies in retail and institutional sectors drives demand for scalable tax solutions. Investors are engaging in high-frequency trading, yield farming, and staking, complicating tax calculations. The crypto tax software market supports accurate tracking across multiple exchanges, wallets, and blockchains. It simplifies portfolio management and ensures timely capital gains reporting. As digital asset ownership grows, tax reporting tools become essential for minimizing errors and avoiding penalties. The software market grows in parallel with transaction complexity and asset diversity.

- For instance, CoinTracker offers real-time portfolio tracking and detailed tax event breakdowns, with seamless integration to tax filing software like TurboTax, aiding investors in accurate reporting.

Need for Real-Time Tracking and Portfolio Insights

Investors seek transparency and control over their crypto portfolios, prompting demand for real-time tax and performance tracking. The crypto tax software market addresses this by offering features like automated transaction imports and real-time gain/loss summaries. It supports strategic decision-making through actionable insights into taxable events and asset movements. Multi-account integration and cross-border tax localization enhance its value to global users. The need for consolidated tax dashboards continues to drive feature-rich software adoption. Demand intensifies as crypto portfolios become more diversified and dynamic.

Rise of Institutional Participation and DeFi Activities

Institutional entry into digital assets introduces complex custody structures and regulatory expectations, driving software demand. The crypto tax software market enables enterprises to manage high-volume, multi-jurisdictional tax liabilities. It assists compliance teams in navigating DeFi protocols, NFT taxation, and token-based income. Tax software now supports API integrations for streamlined data collection and audit preparation. It helps reduce operational burden while ensuring tax accuracy. As institutions expand exposure to crypto, software becomes a critical compliance and risk management tool.

Market Trends

Integration with Exchanges, Wallets, and DeFi Platforms

Seamless integration with cryptocurrency exchanges, wallets, and DeFi protocols has become a central trend in the crypto tax software market. Users demand unified platforms that can automatically import transaction data across multiple sources. It reduces manual entry and minimizes reporting errors, especially for active traders. The software now supports popular exchanges like Binance, Coinbase, and decentralized wallets such as MetaMask. API connectivity improves data accuracy and enables real-time tracking. This integration trend enhances usability and supports regulatory compliance at scale.

- For instance, Vezgo’s Crypto Tax API aggregates transaction histories, balances, and asset types from dozens of exchanges and wallets, including Binance and MetaMask, enabling automatic synchronization that saves time and improves accuracy.

AI-Driven Tax Optimization and Error Detection

Advanced tax software solutions are incorporating artificial intelligence to improve tax efficiency and accuracy. The crypto tax software market benefits from AI tools that identify tax-loss harvesting opportunities and flag discrepancies in data. It provides tailored recommendations based on user behavior and asset performance. These smart algorithms enhance user trust by delivering audit-ready outputs with minimal human oversight. AI-driven modules streamline complex decision-making in multi-asset portfolios. The market is moving toward predictive features that reduce liabilities and optimize returns.

- For instance, FiscalMind Pro offers predictive tax planning and real-time compliance monitoring, helping companies reduce their tax liabilities by an average of 25% while minimizing compliance risks in complex industries like healthcare and finance.

Cloud-Based Deployment and Real-Time Reporting Features

Cloud-based architecture is gaining traction due to its scalability, flexibility, and remote accessibility. The crypto tax software market is witnessing a shift toward SaaS-based platforms that offer real-time reporting dashboards. It supports multi-device access, seamless updates, and secure data backups. These platforms enable fast deployment without IT infrastructure dependency. Users can monitor tax positions across devices and receive alerts for taxable events. Cloud-native solutions offer better uptime, automatic syncing, and simplified collaboration with tax advisors and accountants.

Expansion of Global Tax Localization and Regulatory Mapping

As crypto adoption grows globally, software providers are building capabilities to handle region-specific tax rules. The crypto tax software market is evolving to support localization for jurisdictions such as the U.S., U.K., India, Germany, and Australia. It allows users to generate reports that align with local tax forms and audit requirements. Regulatory mapping tools help users stay informed of policy changes. Cross-border investors benefit from automated currency conversions and jurisdictional thresholds. This trend improves software relevance in emerging and mature markets.

Market Challenges Analysis

Complexity of Evolving Regulatory Landscape and Global Tax Laws

Frequent changes in cryptocurrency tax regulations across different countries present a major challenge. Governments continuously revise compliance rules, creating uncertainty for both users and software developers. The crypto tax software market must adapt to these shifting frameworks while ensuring consistency and accuracy. It requires constant updates and jurisdiction-specific customization, increasing development costs and time-to-market. Users may face penalties due to discrepancies caused by outdated or misaligned reporting features. This dynamic regulatory environment strains product scalability and operational efficiency.

Data Fragmentation and Limited Standardization Across Platforms

Crypto transactions span multiple blockchains, wallets, and exchanges, each with its own data formats and reporting limitations. The crypto tax software market faces difficulties aggregating and interpreting this fragmented data in a standardized manner. It often requires extensive reconciliation efforts, which can lead to errors and compliance risks. Missing or inconsistent data from decentralized finance platforms adds to the challenge. Lack of industry-wide data standards slows automation and increases the risk of inaccurate tax filings. This inconsistency weakens the software’s ability to deliver reliable and timely outputs.

Market Opportunities

Emergence of Institutional Investors and Enterprise Crypto Adoption

Institutional participation in crypto assets creates a strong opportunity for enterprise-grade tax software. Large organizations require scalable tools to manage multi-asset portfolios, global tax liabilities, and internal compliance processes. The crypto tax software market can expand by offering solutions tailored for custodians, hedge funds, and corporate treasuries. It supports audit trails, regulatory disclosures, and integration with enterprise resource planning systems. Serving this segment enhances revenue potential and long-term software adoption. Sophisticated reporting and automation features are essential for enterprise-scale deployments.

Expansion into Emerging Markets and Retail Investor Segments

Emerging markets with rising crypto adoption present untapped opportunities for tax software providers. These regions often lack robust tax infrastructure for digital assets, creating demand for easy-to-use and localized tools. The crypto tax software market can grow by introducing simplified, mobile-friendly platforms for first-time investors. It can also provide educational features that improve tax literacy. Partnerships with local exchanges and regulatory bodies can strengthen market presence. Expanding into underserved regions supports user base growth and market diversification.

Market Segmentation Analysis:

By Deployment

The crypto tax software market shows strong preference for cloud-based solutions due to their scalability, remote accessibility, and real-time data syncing. Cloud-based platforms support automatic updates, integration with exchanges, and mobile access, making them ideal for both individuals and businesses. It enables faster deployment without IT infrastructure investment, attracting users seeking convenience and flexibility. On-premise solutions appeal to enterprises with strict data security requirements or internal compliance protocols. However, adoption remains limited due to higher upfront costs and longer implementation times.

- For instance, Koinly integrates with over 900 crypto platforms, enabling users to import transactions automatically and receive up-to-date tax reports without manual intervention.

By End User

Personal users drive significant demand by seeking simple tools for tracking gains and generating tax reports across multiple wallets and exchanges. The crypto tax software market also serves businesses and institutions that manage high-volume or multi-jurisdictional transactions. SMEs prefer cost-effective, automated solutions with built-in compliance features to reduce manual workloads. Large enterprises require advanced capabilities such as multi-user access, regulatory mapping, and audit support. It provides tailored solutions across user categories to meet diverse needs in compliance, scalability, and user experience. Each segment’s growth depends on regulatory complexity, transaction volume, and operational priorities.

- For instance, CoinLedger connects with over 500 exchanges and handles complex transactions including DeFi and NFTs, providing user-friendly tax reporting for casual investors.

Segments:

Based on Deployment:

Based on End User:

- Personal

- Business

- SMEs

- Large Enterprises

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America dominates the crypto tax software market with a 38% share, driven by widespread crypto adoption and strict tax enforcement. The Internal Revenue Service (IRS) mandates reporting of digital asset transactions, pushing users toward automated tax solutions. High investor participation and frequent trading activity increase the demand for accurate and scalable platforms. It benefits from a strong ecosystem of crypto exchanges, fintech startups, and regulatory clarity. Enterprise clients and retail investors both contribute to consistent software adoption. The U.S. and Canada lead regional growth through innovation and favorable technology infrastructure.

Europe

Europe holds a 28% share of the crypto tax software market, supported by evolving regulatory frameworks such as MiCA (Markets in Crypto-Assets Regulation). Countries like Germany, the UK, and France promote tax compliance through official guidelines, fueling demand for reporting tools. It provides region-specific features like VAT calculations and EU tax harmonization. European users value transparency, audit readiness, and multilingual support. Businesses and financial institutions adopt tax software to align with tightening compliance obligations. The presence of major blockchain hubs strengthens market expansion.

Asia Pacific

Asia Pacific accounts for 22% of the crypto tax software market, driven by increasing digital asset investments and emerging regulatory enforcement. Countries like India, Japan, and Australia are formalizing tax rules for crypto income and capital gains. It supports growing demand from both tech-savvy retail users and crypto-focused startups. Regional adoption benefits from expanding exchange networks and mobile-first financial tools. Government scrutiny and digital tax initiatives contribute to rising adoption. The market continues to gain traction as regional tax systems mature and enforcement intensifies.

Rest of the World

The Rest of the World contributes 12% to the crypto tax software market, with interest growing in Latin America, the Middle East, and Africa. Countries in these regions begin introducing crypto tax policies, prompting initial demand for compliance tools. It caters to early adopters and cross-border traders seeking clarity on tax obligations. Market expansion depends on regulatory development and digital finance infrastructure. Localized offerings and partnerships with regional exchanges support gradual adoption. These regions offer long-term potential as awareness and enforcement grow.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CoinTracking

- Fyn

- Coinpanda

- CoinLedger

- Zenledger

- Blockpit

- TokenTax

- Koinly

- CoinTracker

- TurboTax

- Taxbit

- Accointing

Competitive Analysis

The crypto tax software market features a competitive landscape with both specialized startups and established tax solution providers. Key players include CoinTracking, Fyn, Coinpanda, CoinLedger, Zenledger, Blockpit, TokenTax, Koinly, CoinTracker, TurboTax, Taxbit, and Accointing. These companies compete on integration capabilities, geographic coverage, user interface, and accuracy in handling complex transactions. The crypto tax software market favors platforms that offer real-time tracking, multi-exchange support, and jurisdiction-specific compliance features. It rewards providers that deliver scalable, secure, and audit-ready solutions for both retail and institutional clients. Market leaders focus on expanding partnerships with exchanges and integrating AI for automated tax optimization. Competitive pressure continues to drive innovation in mobile access, regulatory mapping, and enterprise-grade reporting features. Companies also prioritize data privacy, responsive customer support, and flexible pricing models to retain users. Strategic investments in regional localization and tax law updates further distinguish key players from new entrants in this dynamic software landscape.

Recent Deveopments

- In June 2025, Taxbit announced a partnership with the Global Blockchain Business Council (GBBC) to advance enterprise-focused solutions for cryptocurrency and stablecoin compliance management.

- In 2023, Blockpit completed the acquisition of Accointing, expanding its footprint across Europe and enhancing its user offering through integrated data migration and improved compliance capabilities.

- In Early 2025 – Coinbase names CoinTracker an official tax partner for the fifth straight year, reinforcing collaboration to support accurate crypto tax reporting

Market Concentration & Characteristics

The crypto tax software market exhibits moderate concentration, with a mix of established providers and emerging players competing on functionality, geographic reach, and regulatory alignment. Leading companies such as Koinly, CoinLedger, Taxbit, and CoinTracking hold significant market share by offering extensive integration with exchanges and real-time tax reporting. It features low entry barriers for new entrants but high customer retention for platforms with strong compliance support and user-friendly design. The market is characterized by rapid innovation, cloud-based deployments, and increasing demand for multi-jurisdictional reporting. User expectations focus on accuracy, automation, and seamless experience across wallets and DeFi protocols. It continues to attract both retail investors and institutional clients, driven by rising crypto adoption and growing tax enforcement. Vendors differentiate by supporting local tax regulations, offering audit-ready reports, and delivering AI-driven optimization features. The competitive environment fosters continuous improvements in usability, scalability, and security to meet the evolving needs of global users.

Report Coverage

The research report offers an in-depth analysis based on Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for crypto tax software will grow with increasing regulatory clarity across global jurisdictions.

- Governments will continue enforcing stricter reporting rules, driving higher adoption among retail and institutional users.

- Integration with decentralized finance (DeFi) platforms will become a standard feature for tax solutions.

- AI-driven tools will improve accuracy in tax calculations and identify opportunities for optimization.

- Real-time transaction tracking and automated gain/loss reports will enhance user experience.

- More platforms will support multi-country tax compliance to serve cross-border investors.

- Enterprises will adopt advanced tax software to manage high-volume crypto portfolios and reporting obligations.

- Mobile-first tax platforms will gain traction in emerging markets with rising crypto adoption.

- Vendors will prioritize data security, privacy, and regulatory certifications to build user trust.

- Partnerships with exchanges and financial institutions will expand software reach and utility.