Market Overview:

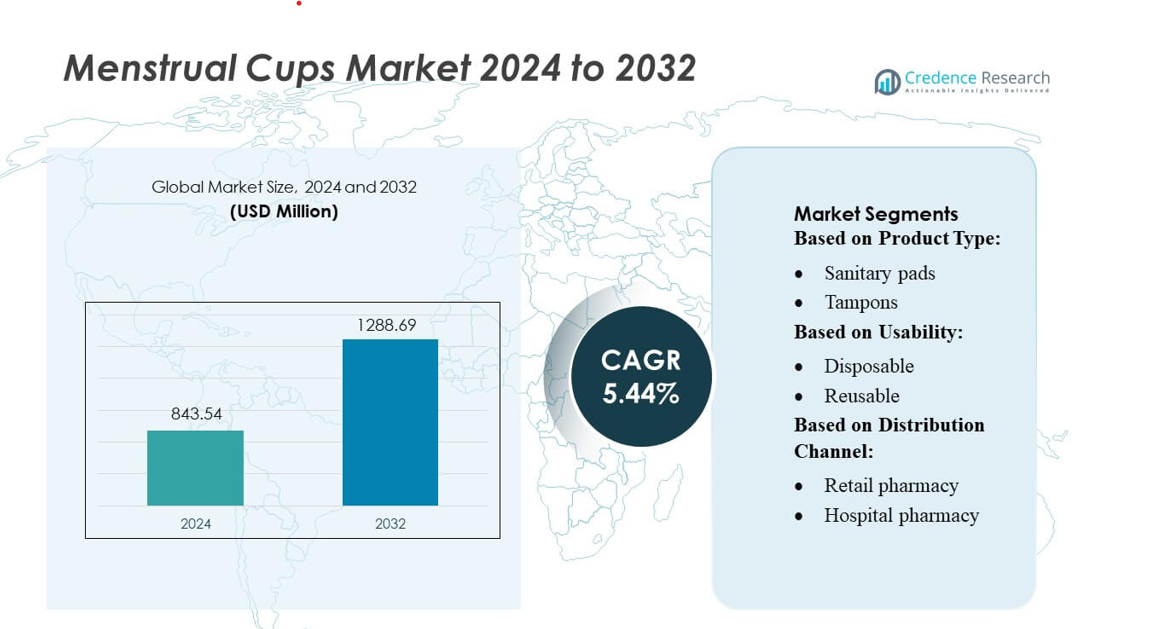

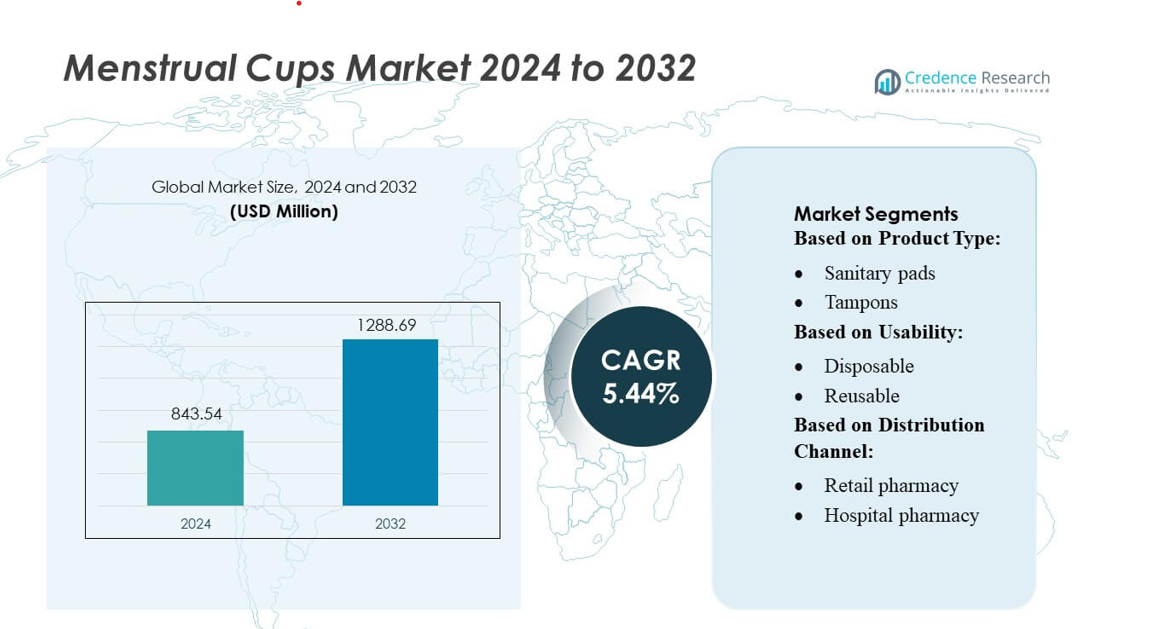

Menstrual Cups Market size was valued USD 843.54 million in 2024 and is anticipated to reach USD 1288.69 million by 2032, at a CAGR of 5.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Menstrual Cups Market Size 2024 |

USD 843.54 million |

| Menstrual Cups Market, CAGR |

5.44% |

| Menstrual Cups Market Size 2032 |

USD 1288.69 million |

The menstrual cups market is competitive, with leading players focusing on product innovation, ergonomic design, and high-quality materials to strengthen their market position. Companies such as Lena Cup LLC, Fleurcup, Diva International Inc., Lune Group Oy Ltd., LYV Life Inc. (Cora), The Flex Company, Mooncup Ltd., Me Luna GmbH, LELOi AB (Intimina), and Blossom Cup are driving growth through expanded distribution, digital marketing, and consumer education initiatives. North America emerges as the leading region, capturing approximately 35% of the global market share, driven by high awareness of menstrual health, preference for sustainable products, and strong retail and e-commerce penetration. The combination of advanced healthcare infrastructure, supportive social and regulatory frameworks, and rising eco-conscious consumer behavior makes North America a critical hub for innovation and adoption in the global menstrual cups market.

Market Insights

- The menstrual cups market was valued at USD 843.54 million in 2024 and is expected to reach USD 1288.69 million by 2032, growing at a CAGR of 5.44% during the forecast period.

- Market growth is driven by increasing awareness of menstrual hygiene, rising demand for sustainable and reusable products, and expanding e-commerce and retail availability.

- Key trends include product innovation with ergonomic designs, multiple sizes, and improved comfort, as well as rising digital marketing campaigns and consumer education programs to increase adoption.

- The market is competitive, with leading players focusing on high-quality materials, product differentiation, and expanding distribution networks to strengthen their position. North America is the leading region with approximately 35% market share, followed by Europe and Asia-Pacific showing significant growth potential.

- Challenges include cultural taboos, limited awareness in some regions, and higher upfront costs compared to disposable products, which can slow adoption in price-sensitive markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Within the broader menstrual-care products market, the Menstrual Cups segment remains relatively small compared to Sanitary Pads and Tampons. Traditional sanitary pads continue to dominate overall feminine‑hygiene consumption due to their affordability, wide availability, and cultural acceptance. However, menstrual cups are gaining ground as an emerging alternative: they currently account for a modest but growing share of the market, driven by increasing consumer awareness about sustainability, long‑term cost efficiency, and environmental concerns. Their growth trajectory reflects a gradual but steady shift toward reusable menstrual products.

- For instance, Lena Cup LLC reports that it has sold over 1 million cups worldwide, and each cup can be reused for up to 10 years, potentially replacing thousands of disposable pads or tampons over its lifespan. Their growth trajectory reflects a gradual but steady shift toward reusable menstrual products.

By Usability

In the usability dimension, the market leans strongly toward disposable products because of their convenience, ease of use, and entrenched consumer habits. Nevertheless, within the menstrual‑cup submarket, the reusable variant is the dominant sub‑segment. Reusable cups benefit from environmental sustainability and cost savings over time — often lasting several years — making them far more attractive to health‑ and eco‑conscious consumers. This reusability advantage remains the primary driver of their market acceptance.

- For instance, Fleurcup clearly lead. Fleurcup’s silicone is 100% USP Class VI, Shore 60 platinum medical‑grade, ensuring biocompatibility and durability.

By Distribution Channel

Among distribution channels, the ascendancy of e‑commerce (online retail) stands out for menstrual cups. Online platforms now capture a significant share of sales, offering privacy, broad product selection, peer reviews, and convenient home delivery — factors especially appealing given the potentially sensitive nature of menstrual‑product shopping. Traditional channels such as retail pharmacies, supermarkets/hypermarkets, and brick‑and‑mortar stores still contribute substantially, but their growth is comparatively slower. The rise in online distribution has thus become a key enabler of menstrual‑cup adoption globally.

Key Growth Drivers

Environmental Sustainability

Environmental concerns are a significant driver for the menstrual cups market. Traditional disposable products such as pads and tampons generate large volumes of non-biodegradable waste annually, creating environmental challenges. Menstrual cups, being reusable, can replace hundreds of disposable items over their lifespan, substantially reducing waste. Growing awareness about climate change, plastic pollution, and sustainable living has led environmentally conscious consumers to adopt menstrual cups as a practical solution. Urban populations, especially among younger generations, increasingly prefer products that offer minimal environmental impact while maintaining personal hygiene standards.

- For instance, DivaCup is made from 100% medical‑grade silicone, free from BPA, latex, plastics, and dyes — ensuring biocompatibility and durability for repeated use.

Health, Hygiene, and Cost Benefits

Health and hygiene factors are key motivators for menstrual cup adoption. Made from medical-grade silicone or thermoplastic elastomers, menstrual cups minimize exposure to chemicals, fragrances, and synthetic fibers found in some disposable products, reducing the risk of irritation or infections. They are designed for safe long-duration use and provide a hygienic alternative to pads and tampons. Additionally, the long lifespan of a menstrual cup, often up to 5–10 years, results in significant cost savings over time, making it an attractive choice for budget-conscious consumers. This combination of safety, hygiene, and cost efficiency drives adoption.

- For instance, Flex Company’s menstrual‑cup line. Their flagship Flex Cup is made from 100% medical‑grade silicone, free from BPA, phthalates, latex, or other harmful additives, ensuring hypoallergenic and body‑safe use.

Product Innovation and Improved Accessibility

Innovation in design and distribution is enhancing the market for menstrual cups. Manufacturers now offer products in multiple sizes, shapes, and flexibility levels to accommodate different anatomies and menstrual flows, improving user comfort and satisfaction. Innovations such as softer materials, ergonomic stems, and spill-proof designs address previous concerns about ease of use and comfort. At the same time, accessibility has increased through e-commerce platforms, online education campaigns, and digital awareness initiatives, allowing consumers to purchase products discreetly and learn proper usage. These factors expand market reach and accelerate adoption globally.

Key Trends & Opportunities

Rising Adoption in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present substantial growth opportunities for menstrual cups. Rising urbanization, increasing awareness of menstrual hygiene, and improving women’s health education are gradually shifting consumer preferences from traditional pads to reusable products. Cost-effectiveness and sustainability appeal strongly in these regions, especially among younger, urban populations. As cultural acceptance grows and disposable products become less attractive due to environmental concerns, menstrual cups are witnessing increasing demand, opening up new opportunities for brands to expand in untapped markets.

- For instance, Mooncup Original in size A has a rim diameter of 46 mm and a length of 50 mm, while size B offers a 43 mm diameter and the same length; both versions include a 21 mm stem that users can trim for comfort.

Customization and User-Centric Design

The trend toward personalization is shaping the menstrual cups market. Brands are introducing cups with varying sizes, capacities, and firmness levels to suit different age groups, flow intensities, and anatomical differences. Innovative designs now focus on ease of insertion and removal, comfort, and leak protection, addressing common user concerns. This customization not only enhances user experience but also helps attract first-time users while retaining existing consumers. Manufacturers leveraging user feedback to improve designs can capitalize on this opportunity to differentiate their products and gain market share.

- For instance, Me Luna reports offering over 260 different product variations to match individual needs — an unusually broad range for the sector.

Digital Platforms and Awareness Campaigns

E-commerce and digital marketing are playing a critical role in increasing menstrual cup adoption. Online retail platforms offer convenience, discreet purchasing, and access to a wider product range. Social media, influencer campaigns, and educational content help break societal taboos and provide guidance on proper usage and benefits. Awareness campaigns by NGOs and health organizations have further enhanced trust and knowledge among consumers. These digital-driven initiatives create opportunities to reach younger, tech-savvy audiences, expanding the market beyond traditional distribution channels.

Key Challenges

Cultural Taboos and Limited Awareness

Cultural stigma and misinformation remain major barriers to menstrual cup adoption, particularly in conservative or rural areas. Many women are hesitant to use internal menstrual products due to myths about safety, virginity concerns, or discomfort. Limited education about proper use and maintenance further restricts market penetration. These cultural and awareness challenges require targeted educational campaigns and community outreach programs to encourage adoption and increase consumer confidence. Without overcoming these barriers, market growth may remain slow in certain regions.

High Upfront Cost and Initial Hesitation

Although menstrual cups are more economical over time, their initial purchase cost is higher than disposable pads or tampons. This upfront price, combined with apprehension about proper usage, hygiene, or insertion, can discourage first-time users. In price-sensitive markets or regions where disposable products are widely available and inexpensive, this cost factor remains a key adoption barrier. Educating consumers on long-term savings and demonstrating ease of use are essential strategies to overcome hesitation and drive market growth.

Regional Analysis

North America

North America is the largest market for menstrual cups, holding around 35% of the global share. High awareness about menstrual health, preference for eco-friendly products, and strong disposable incomes drive demand. Easy access through retail stores and online platforms supports adoption. Women in urban areas increasingly prefer reusable cups due to sustainability and cost savings. Strong brand presence and supportive social and regulatory environments make North America a dominant region in the global menstrual cups market.

Europe

Europe accounts for about 28% of the global menstrual cups market. Rising environmental awareness, regulations to reduce single-use products, and health education encourage adoption. Countries with progressive norms regarding women’s health show higher usage. Easy availability through retail, supermarkets, and online channels ensures reach across urban and semi-urban populations. Increased disposable income and government or NGO campaigns promoting sustainable hygiene products also drive market growth in the region.

Asia-Pacific

Asia-Pacific holds roughly 20% of the global menstrual cups market and is one of the fastest-growing regions. Urbanization, rising awareness of menstrual hygiene, and better disposable incomes support growth. E-commerce platforms make products more accessible in countries like India, China, and Japan. Awareness campaigns by NGOs and changing social attitudes are increasing acceptance. Many women are shifting toward cost-effective, sustainable menstrual solutions, making Asia-Pacific a key growth region for menstrual cups.

Latin America

Latin America holds around 7% of the global menstrual cups market. Adoption is growing in countries like Brazil and Mexico due to rising urbanization, environmental awareness, and expanding middle-class populations. Cultural preferences for traditional products and limited awareness still constrain growth. However, increasing education, social media campaigns, and online availability are encouraging more women to try menstrual cups, gradually expanding the market across the region.

Middle East & Africa

Middle East & Africa currently account for about 5% of the global market. Growth is slower due to cultural taboos, lower awareness, and limited product availability in rural areas. However, urbanization, NGO education campaigns, and rising female workforce participation are gradually increasing adoption. As more women become aware of the benefits of reusable menstrual products, this region is expected to see steady growth in the coming years.

Market Segmentations:

By Product Type:

By Usability:

By Distribution Channel:

- Retail pharmacy

- Hospital pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The menstrual cups market include Lena Cup LLC, Fleurcup, Diva International Inc., Lune Group Oy Ltd., LYV Life Inc. (Cora), The Flex Company, Mooncup Ltd., Me Luna GmbH, LELOi AB (Intimina), and Blossom Cup. The menstrual cups market is highly competitive and characterized by innovation, product differentiation, and growing consumer awareness. Companies are focusing on ergonomic designs, high-quality medical-grade materials, and user-friendly features to enhance comfort and convenience. Market participants are expanding their presence through e-commerce platforms and digital marketing campaigns, while also leveraging educational initiatives to promote awareness about menstrual hygiene and sustainability. Sustainability, eco-friendly packaging, and long-term cost-effectiveness are increasingly used as differentiating factors. Continuous research and development, coupled with expansion into emerging markets and collaborations with health organizations, are shaping the competitive environment, driving both product adoption and market growth globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lena Cup LLC

- Fleurcup

- Diva International Inc.

- Lune Group Oy Ltd.

- LYV Life Inc. (Cora)

- The Flex Company

- Mooncup Ltd.

- Me Luna GmbH

- LELOi AB (Intimina)

- Blossom Cup

Recent Developments

- In July 2024, Unilever Ventures invested over in Luna Daily, a UK-based intimate body care brand focusing on microbiome-balancing, natural, and vegan products. This investment aims to expand Luna Daily’s motherhood product line and marketing strategies.

- In May 2024, Yee Wah Global shifting from manufacturing styrofoam to producing eco-friendly disposable cups and utensils in response to a plastics ban is real. The company, formerly Hong Kong’s largest styrofoam maker, indeed turned the regulatory change into an opportunity for research and investment in sustainable tableware.

- In April 2024, Kimberly-Clark launched Liv by Kotex in the U.S. market, a new product line that provides dual protection for both menstrual flow and bladder leaks. The line was initially launched as a Target-exclusive brand, available in stores and online.

- In June 2023, P&G Whisper began a partnership with UNESCO to launch a menstrual health campaign in Bengaluru, India. This campaign further solidified Whisper’s image as a socially responsible advocate in the scope of menstruation by removing stigmas and building social consciousness

Report Coverage

The research report offers an in-depth analysis based on Product Type, Usability, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of menstrual cups is expected to grow steadily due to rising awareness of sustainable menstrual hygiene solutions.

- Increasing preference for reusable and eco-friendly products will drive market expansion globally.

- Greater digital penetration and e-commerce availability will enhance accessibility for consumers in urban and remote areas.

- Product innovation with improved comfort, size options, and ease of use will attract new users.

- Educational campaigns and awareness programs will reduce cultural stigma and increase acceptance in emerging markets.

- Expansion into untapped regions will create new growth opportunities for market participants.

- Rising environmental concerns and regulations promoting reduction of single-use products will boost demand.

- Collaboration with health organizations and NGOs will strengthen market credibility and consumer trust.

- Increasing disposable incomes in developing regions will support wider adoption of menstrual cups.

- Continuous research and development will lead to advanced designs, materials, and user-friendly solutions, enhancing overall market growth.