Market Overview

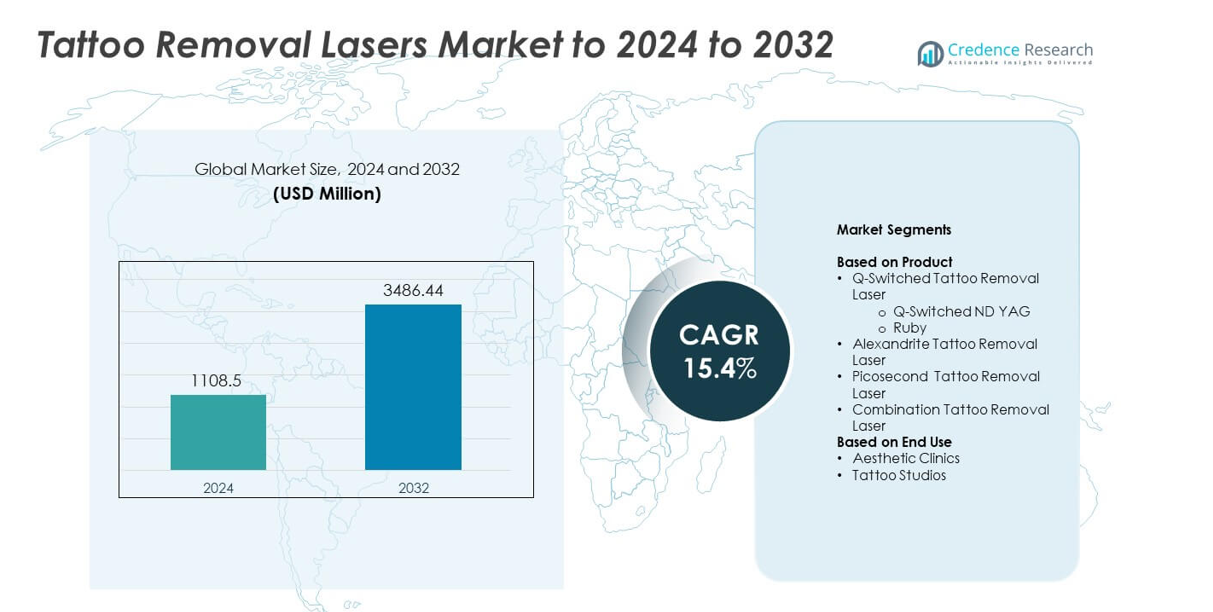

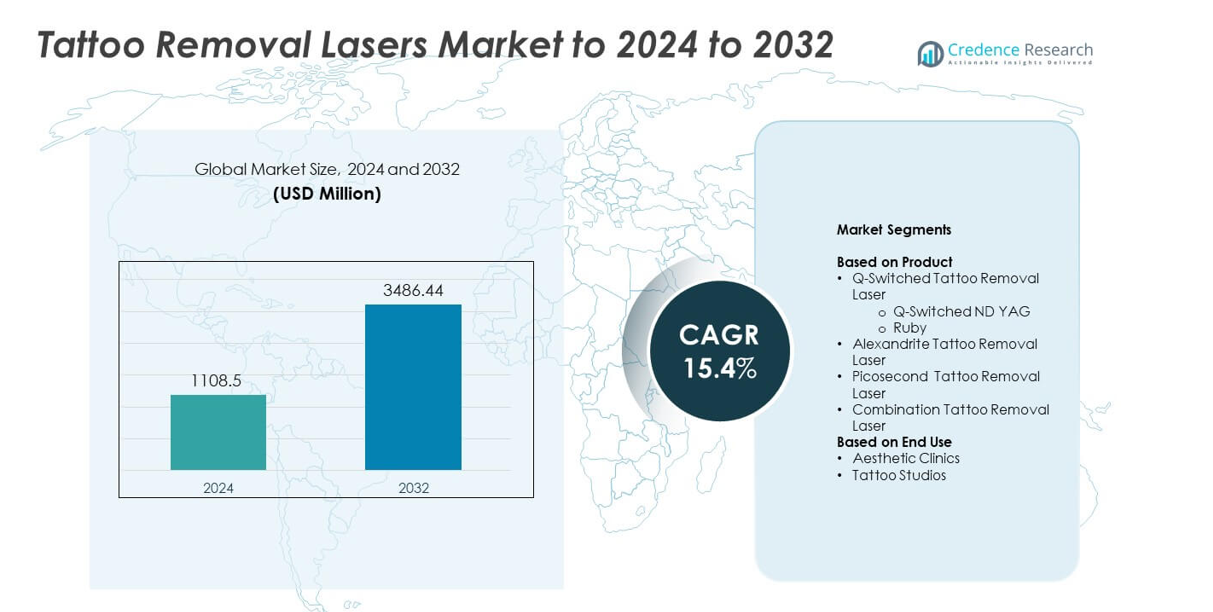

Tattoo Removal Lasers Market size was valued at USD 1108.5 million in 2024 and is anticipated to reach USD 3486.44 million by 2032, at a CAGR of 15.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tattoo Removal Lasers Market Size 2024 |

USD 1108.5 million |

| Tattoo Removal Lasers Market, CAGR |

15.4% |

| Tattoo Removal Lasers Market Size 2032 |

USD 3486.44 million |

The Tattoo Removal Lasers Market features strong competition from Fotona d.o.o., Alma Lasers Ltd., Cutera, Inc., Lumenis, LUTRONIC, Cynosure, El.En. S.p.A., Skin Care, and Hologic Inc., all of which focus on technology upgrades and wider clinical adoption. These companies strengthened their positions through advanced picosecond systems, improved multi-wavelength platforms, and expanded training support for safer and faster treatments. North America led the market in 2024 with about 38% share, driven by high tattoo prevalence, strong consumer spending, and a dense network of aesthetic clinics. Asia Pacific followed with nearly 29% share as urban cosmetic demand and clinic expansion accelerated growth.

Market Insights

- Tattoo Removal Lasers Market reached USD 1108.5 million in 2024 and is projected to hit USD 3486.44 million by 2032, growing at a CAGR of 15.4%.

- Market growth is driven by rising demand for aesthetic corrections and wider adoption of picosecond and Q-switched ND:YAG systems, with Q-switched ND:YAG holding about 44% share in 2024.

- Trends include rapid shift toward picosecond platforms, growing demand for multicolor tattoo removal, and expanding use of laser lightening services in tattoo studios.

- Competition remains strong as global players innovate in multi-wavelength technology and compact systems, while high equipment costs and training needs continue to restrain smaller clinics.

- North America led the market in 2024 with 38% share, followed by Asia Pacific at 29% and Europe at 27%, while aesthetic clinics dominated end use with around 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Q-switched ND:YAG lasers led the Tattoo Removal Lasers Market in 2024 with about 44% share. These systems stayed dominant due to strong safety, deep penetration, and effectiveness across dark ink colors. Their dual-wavelength capability supported wider patient suitability, which improved adoption in both small and large clinics. Picosecond lasers grew fast as users preferred quicker fading and fewer sessions, while alexandrite and ruby systems stayed relevant for specific pigment needs. Combination platforms gained traction as centers adopted multi-modality devices to handle mixed-color tattoos with higher precision.

- For instance, Quanta System’s Discovery Pico Series uses three wavelengths at 532, 694, and 1064 nm and can reach up to 1.8 gigawatts of peak power, as stated in the official technical brochure.

By End Use

Aesthetic clinics held the largest share in 2024 with nearly 58% of the Tattoo Removal Lasers Market. Clinics benefited from strong patient inflow, skilled operators, and wider adoption of advanced picosecond and Q-switched systems. Demand increased as adults sought safe and faster removal with minimal downtime, which pushed clinics to expand laser capacity. Tattoo studios gained attention as artists offered removal or lightening services before cover-ups, but clinics remained ahead due to stronger regulatory compliance and broader treatment capabilities.

- For instance, Lumenis’ M22 Q-switched Nd:YAG module operates at 1064 nm with a fluence between 0.9 and 14 joules per square centimeter (depending on the spot size used) and a pulse duration of 6 to 8 nanoseconds.

Key Growth Drivers

Rising Demand for Aesthetic Corrections

More people are seeking tattoo modification or complete removal due to lifestyle changes and workplace preferences. This shift increased patient visits across clinics that offer safer and faster laser solutions. Growing awareness of advanced technologies also encouraged more individuals to opt for treatment rather than live with unwanted designs. Strong social media influence supported this trend by highlighting effective outcomes.

- For instance, Cynosure’s PicoSure Pro is specified with a nominal wavelength of 755 nanometres and a pulse width range of 500 to 900 picoseconds.

Advancements in Laser Technology

Manufacturers introduced picosecond and dual-wavelength platforms that improved precision and reduced session time. These upgrades enhanced patient comfort and reduced risk of skin damage, which strengthened market confidence. Clinics adopted these systems to broaden service quality and handle complex, multicolor tattoos. The innovation pace helped providers treat more skin types safely, boosting adoption across regions.

- For instance, Cutera’s enlighten III platform provides three wavelengths at 532, 670, and 1064 nanometres with selectable pulse durations of 750 or 660 picoseconds and 2 nanoseconds, as described in its 510(k) summary and brochure.

Expanding Aesthetic Clinic Footprint

Aesthetic centers expanded in both developed and emerging markets due to rising disposable income and growing interest in cosmetic treatments. Many clinics added tattoo removal to their service mix to meet rising patient needs. Wider availability increased access to modern laser platforms and pushed treatment volumes higher. This growth created a stable environment for equipment upgrades and repeat service demand.

Key Trends and Opportunities

Shift Toward Picosecond Lasers

Picosecond systems gained strong attention due to faster pigment shattering and reduced treatment cycles. Clinics viewed these platforms as premium offerings that delivered better outcomes for stubborn inks. Higher willingness to invest in faster technologies pushed manufacturers to expand product lines. This shift opened opportunities for premium pricing and stronger service differentiation.

- For instance, Lutronic’s PicoPlus device provides four wavelengths at 532, 595, 660, and 1064 nanometres with selectable pulse durations of 450 picoseconds (ps) for picosecond mode and 2 nanoseconds (ns) for nanosecond mode.

Growing Multi-Color Tattoo Removal Demand

More individuals are seeking removal of complex, multicolor tattoos that require advanced dual-wavelength systems. This trend supported greater interest in combination lasers offering broader pigment coverage. Clinics with these systems attracted larger customer groups due to improved treatment success. Manufacturers gained new opportunities to design platforms tailored for difficult inks.

- For instance, Fotona’s StarWalker MaQX Pro can deliver up to 10 joules of Q-switched energy in a single MaQX pulse at 1064 nanometres and supports multiple wavelengths for pigment targeting, as reported in the official brochure.

Rising Adoption in Tattoo Studios

Tattoo studios began offering lightening and partial removal services to support cover-ups and design changes. This trend created a new commercial channel for compact and affordable laser units. Studios adopted these systems to improve customer satisfaction and expand revenue streams. The shift opened new opportunities for manufacturers targeting non-clinical users.

Key Challenges

High Equipment and Maintenance Costs

Advanced picosecond and dual-wavelength lasers involve high purchase and upkeep expenses, which limit adoption among small clinics and studios. Many providers delay upgrades due to strict budget constraints, slowing technology penetration. Maintenance, calibration, and part replacement add recurring costs that raise the overall financial burden. These factors create a barrier for new entrants and smaller operators.

Risk of Skin Damage and Treatment Variability

Tattoo removal outcomes vary based on skin type, ink depth, and equipment quality. Risks such as blistering or hyperpigmentation can deter potential patients and reduce service trust. Operators require strong training to minimize complications, but skill gaps still exist across regions. These challenges push clinics to invest in specialized training and safety protocols to maintain treatment reliability.

Regional Analysis

North America

North America held the largest share of the Tattoo Removal Lasers Market in 2024 with about 38%. Demand grew as aesthetic procedures gained wider acceptance and clinics invested in advanced picosecond and Q-switched systems. The United States led adoption due to strong consumer spending, high tattoo prevalence, and well-developed dermatology networks. Growth also came from rising use of laser treatments for partial removal and design modification. Canada contributed steady demand as more medical spas expanded cosmetic laser services. The region continued to benefit from strong awareness, skilled professionals, and rapid technology upgrades.

Europe

Europe accounted for nearly 27% share of the Tattoo Removal Lasers Market in 2024. Demand increased as consumers favored non-invasive treatments and clinics expanded premium services. Countries such as Germany, France, Italy, and the United Kingdom saw higher uptake of picosecond devices due to better outcomes for multicolor tattoos. Regulatory support for safe laser use also strengthened market confidence. Rising tattoo removal demand among working adults and growing coverage by aesthetic centers supported healthy growth across the region. Manufacturers expanded distribution networks to meet rising equipment demand.

Asia Pacific

Asia Pacific captured about 29% share of the Tattoo Removal Lasers Market in 2024. Growth accelerated as urban populations adopted cosmetic procedures at higher rates and clinics invested in cost-efficient Q-switched systems. China, India, South Korea, and Japan saw rapid expansion of aesthetic centers offering tattoo removal services. Growing acceptance of aesthetic correction among young consumers increased patient flow. Local and international manufacturers boosted product availability, helping clinics upgrade from older systems. Rising disposable income and social media influence also supported strong demand across major cities.

Latin America

Latin America held around 4% share of the Tattoo Removal Lasers Market in 2024. Countries such as Brazil and Mexico led demand due to expanding aesthetic clinic chains and rising interest in tattoo modification. Clinics invested in mid-range Q-switched systems to meet growing patient needs at affordable price points. Awareness of safe tattoo removal practices improved as consumers sought professional treatments over home-based alternatives. Market growth also benefited from medical tourism in select countries. Wider access to trained professionals continued to support gradual adoption across the region.

Middle East and Africa

Middle East and Africa accounted for nearly 2% share of the Tattoo Removal Lasers Market in 2024. Growth remained steady as premium aesthetic clinics expanded in the UAE, Saudi Arabia, and South Africa. Rising interest in cosmetic correction among young adults encouraged investment in modern laser platforms. High equipment costs limited adoption across smaller centers, but demand grew in major urban hubs. Medical tourism supported additional revenue for premium providers. Increased awareness of safe removal procedures improved patient confidence and encouraged wider service uptake across select countries.

Market Segmentations:

By Product

- Q-Switched Tattoo Removal Laser

- Alexandrite Tattoo Removal Laser

- Picosecond Tattoo Removal Laser

- Combination Tattoo Removal Laser

By End Use

- Aesthetic Clinics

- Tattoo Studios

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Fotona d.o.o., Alma Lasers Ltd., Cutera, Inc., Lumenis, LUTRONIC, Cynosure, El.En. S.p.A., Skin Care, and Hologic Inc. shape the competitive landscape of the Tattoo Removal Lasers Market through continuous innovation and strong global reach. Market competition intensified as companies focused on faster systems, improved pulse durations, and better energy delivery to support safe pigment removal across multiple skin types. Firms expanded training programs to help clinics achieve consistent treatment outcomes, strengthening brand reliability. Many players increased investments in compact platforms to attract small clinics and tattoo studios seeking cost-effective upgrades. Strategic expansion into emerging regions supported wider adoption as aesthetic procedures gained mainstream acceptance. Growing demand for picosecond technologies encouraged more product launches, while partnerships with distributors improved access in high-growth markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fotona d.o.o.

- Alma Lasers Ltd.

- Cutera, Inc.

- Lumenis

- LUTRONIC

- Cynosure

- El.En. S.p.A.

- Skin Care

- Hologic Inc.

Recent Developments

- In 2025, Fotona unveiled new aesthetic systems including the Dynamis Max and StarWalker PICO Pro, enhancing treatment efficacy, usability, and versatility for tattoo removal and other skin applications.

- In 2023, Alma Lasers Ltd.: Introduced the Harmony XL Pro+ platform for tattoo removal, a state-of-the-art device utilizing a variety of laser wavelengths and innovative technology.

- In 2022, Cynosure introduced the PicoSure Pro, a picosecond laser platform offering multiple wavelengths and superior cooling technology

Report Coverage

The research report offers an in-depth analysis based on Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for faster and safer tattoo removal will keep rising across major markets.

- Picosecond laser adoption will expand as clinics seek better outcomes and shorter treatment cycles.

- Combination laser platforms will gain traction for effective multicolor and complex tattoo removal.

- Aesthetic clinics will continue to dominate service delivery due to stronger regulatory compliance.

- Tattoo studios will increasingly add lightening services, creating a new growth channel.

- Advances in laser cooling and energy control will improve patient comfort and reduce side effects.

- Training programs for operators will expand to support safer and more consistent results.

- Urban regions will drive higher installation rates as aesthetic procedures become mainstream.

- Manufacturers will focus on compact and cost-efficient systems to reach smaller providers.

- Social media awareness will boost consumer interest in professional tattoo modification and removal.