Market Overview

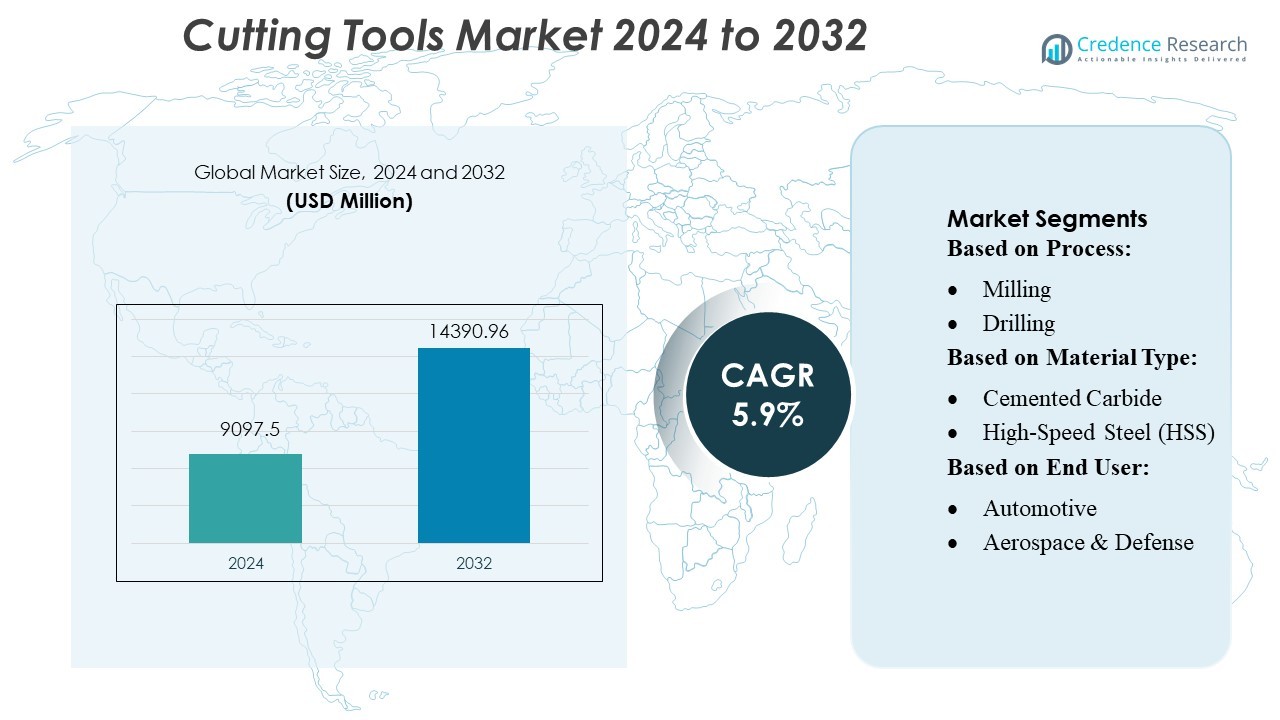

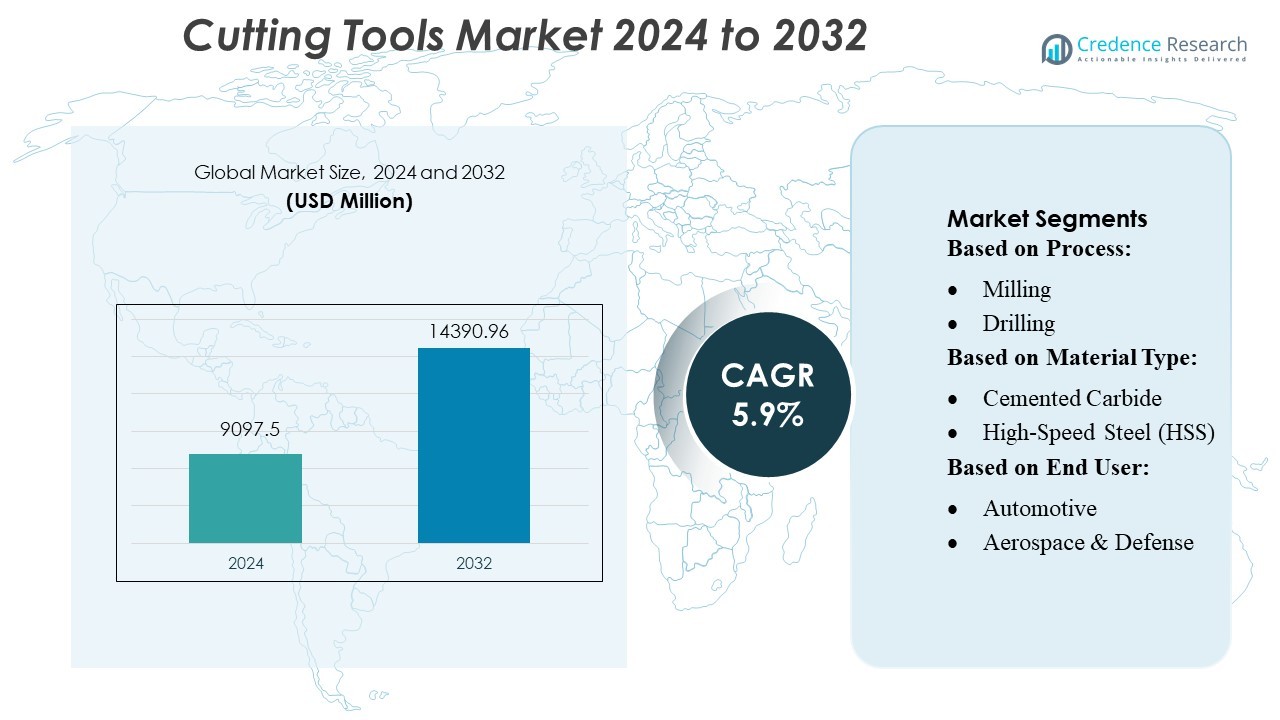

Cutting Tools Market size was valued USD 9097.5 million in 2024 and is anticipated to reach USD 14390.96 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cutting Tools Market Size 2024 |

USD 9097.5 Million |

| Cutting Tools Market, CAGR |

5.9% |

| Cutting Tools Market Size 2032 |

USD 14390.96 Million |

The cutting tools market is shaped by strong competition among leading manufacturers that continuously advance tool materials, coatings, and precision machining technologies. Key players drive innovation through expanded product portfolios, CNC-integrated solutions, and services that enhance productivity across automotive, aerospace, and industrial sectors. The market’s competitive strength is reinforced by advancements in carbide, PCD, and CBN tools designed for high-performance metal cutting and complex geometries. Asia-Pacific remains the leading region, supported by its extensive manufacturing base and rapid industrialization, and holds an estimated 40% share of the global cutting tools market, making it the dominant contributor to global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cutting Tools Market reached USD 9,097.5 million in 2024 and is projected to grow to USD 14,390.96 million by 2032 at a 5.9% CAGR, driven by rising demand for high-precision machining and advanced manufacturing technologies.

- Increasing adoption of carbide, PCD, and CBN tools, along with rapid CNC automation in automotive and aerospace sectors, continues to drive market expansion.

- Major players enhance competitiveness by improving tool life, integrating digital monitoring capabilities, and expanding customized tooling solutions.

- Market growth faces restraints from fluctuating raw material costs and the shortage of skilled machinists required for advanced multi-axis machining operations.

- Asia-Pacific holds about 40% of regional share, leading global demand, while carbide tools represent the dominant segment, supported by widespread use in high-speed and high-tolerance machining across industrial applications.

Market Segmentation Analysis:

By Process

Milling remains the dominant process segment in the cutting tools market, holding the highest market share due to its extensive use in contouring, slotting, and precision surface generation across metals and composites. Its leadership is driven by rising adoption in CNC machining centers and the demand for multi-axis milling cutters that enhance productivity and tool life. Drilling and turning follow, supported by improvements in indexable insert designs. Grinding and boring continue to grow in high-accuracy applications, while other niche processes gain traction with advancements in adaptive machining solutions.

- For instance, 3D Systems Inc. operates its cloud-connected On Demand Manufacturing platform that has produced more than 1,000,000 industrial parts, and the system manages over 500 qualified material options while using remote monitoring across multiple data centers to maintain uptime.

By Material Type

Cemented carbide leads the material type segment with the largest market share, driven by its exceptional wear resistance, thermal stability, and suitability for high-speed machining of hardened alloys. Its dominance is further reinforced by continuous improvements in micro-grain carbide formulations and advanced PVD/CVD coatings that extend tool life. High-speed steel (HSS) maintains relevance in low-speed and budget-sensitive operations, while ceramics and CBN gain adoption in high-temperature and hard-turning applications. PCD tools expand rapidly in non-ferrous machining, and exotic materials and stainless steel grades address specific performance environments.

- For instance, Bentley Systems reports that its digital-twin solution for telecom towers under its OpenTower iQ platform has already been deployed to digitize more than 25,000 cell towers in the United States, leveraging drone imaging, IoT sensor data, and AI/ML workflows in the iTwin Platform environment.

By End User

Automotive is the dominant end-user segment, holding the highest market share due to large-scale machining of engine blocks, transmission components, and precision metal parts. The shift toward EV manufacturing further accelerates demand for milling and drilling tools tailored for aluminum and high-strength lightweight alloys. Aerospace & defense follows, driven by the need for high-performance tools capable of machining titanium and composites. Construction, electronics, power generation, and oil & gas collectively support diversified growth, while woodworking and die-and-mold manufacturing sustain specialized tool requirements for high-accuracy operations.

Key Growth Drivers

1. Expansion of Precision Manufacturing and Automation

The rapid expansion of precision manufacturing and automation is a major growth driver, as industries increasingly rely on CNC machining, robotics, and multi-axis systems for complex part production. Cutting tools with advanced geometries and coatings support higher spindle speeds, reduced cycle time, and tight tolerances. Demand intensifies across automotive, aerospace, and electronics facilities that aim to boost productivity and accuracy. The trend toward automated tool monitoring and predictive maintenance also accelerates adoption of premium cutting tools that integrate seamlessly with smart manufacturing environments.

- For instance, ESAB recently acquired Swift-Cut Automation, which has more than 4,000 light-industrial CNC plasma and waterjet systems installed globally, significantly boosting its automation footprint.

2. Rising Adoption of Advanced Materials in End-Use Industries

Growth in the use of advanced materials such as titanium, carbon-fiber composites, superalloys, and hardened steels drives demand for cutting tools engineered for extreme performance. Aerospace and power generation industries increasingly use high-strength materials that require tools with superior heat resistance and minimal wear. This shift supports wider deployment of carbide, CBN, and PCD tools. Manufacturers continue to invest in innovative tool substrates and coating technologies to optimize machining of difficult-to-cut materials, driving consistent replacement cycles and greater adoption of high-performance cutting tools.

- For instance, Water Jet Sweden AB has installed over 900 waterjet machines in more than 40 countries, enabling precision cuts in titanium and composites without introducing heat-affected zones.

3. Global Growth in Automotive and EV Manufacturing

Automotive and EV manufacturing expansion strongly boosts cutting tool consumption, driven by high-volume machining of engine, transmission, chassis, and precision structural components. EV platforms further require specialized tools for aluminum housings, battery trays, and lightweight alloys. As OEMs automate production lines and reduce machining time per component, demand grows for high-speed milling and drilling solutions. Hybrid and electric vehicles introduce new machining requirements that accelerate adoption of advanced tools capable of maintaining accuracy, reducing tool wear, and enhancing throughput in modern manufacturing facilities.

Key Trends & Opportunities

1. Growing Shift Toward Digital and Smart Cutting Tools

The shift toward digital machining solutions presents a significant opportunity, as manufacturers adopt sensor-enabled cutting tools, tool-condition monitoring systems, and data-driven optimization technologies. Smart tools help reduce downtime, detect wear in real time, and improve machining consistency. As Industry 4.0 progresses, integrated tool management platforms enhance traceability and support automated tool replacement. This trend benefits toolmakers that offer adaptive solutions enabling higher cutting efficiency and better process control. The increasing use of digital twins further strengthens demand for simulation-ready tool geometries.

- For instance, Vuforia Engine platform has supported over 1.5 million developers creating augmented-reality solutions, with a newly released Enterprise Plan enabling unlimited target generations and on-premises advanced model-target support.

2. Rising Demand for Sustainable Machining Solutions

Sustainability initiatives create new opportunities for cutting tool providers, with manufacturers seeking longer tool life, lower energy consumption, and reduced scrap rates. Eco-efficient coatings, recyclable tool substrates, and coolant-reduction technologies gain traction across machine shops aiming to minimize environmental impact. Dry machining and minimum quantity lubrication (MQL) systems accelerate the shift toward greener operations. Companies that provide energy-efficient machining strategies and tools designed for low-emission manufacturing stand to benefit as global industries prioritize carbon reduction and resource optimization.

- For instance, Siemens announced it recorded 5,250 new inventions in fiscal 2024—averaging 24 inventions per workday—with over half of the award-winning solutions leveraging artificial intelligence.

3. Increasing Customization for Niche and High-Performance Applications

Demand for customized cutting tools tailored to specific geometries, materials, and machine setups continues to rise. Industries such as die and mold, aerospace, and medical devices require unique tool profiles that support complex 5-axis machining and ultra-precision finishing. Toolmakers offering rapid prototyping, additive-manufactured tool bodies, and application-specific designs gain competitive advantage. As product designs grow more intricate, custom and semi-standard tools present significant opportunities for manufacturers to deliver superior accuracy, minimal material waste, and reduced machining cycles.

Key Challenges

1. High Cost of Advanced Tool Materials and Technologies

The rising cost of high-performance tool materials—such as carbide, CBN, and PCD—poses a significant challenge for manufacturers and end users. Advanced coatings and precision manufacturing processes further elevate production costs, making premium tools expensive for small and mid-sized machine shops. This limits widespread adoption despite performance gains. Additionally, frequent tool replacement in high-intensity machining environments increases operational expenses. Balancing cost with performance efficiency remains difficult for buyers seeking to optimize productivity while managing fluctuating material and production costs.

2. Skilled Labor Shortage and Complexity of Modern Machining

A persistent shortage of skilled machinists challenges the cutting tools market, especially as modern machining requires expertise in CNC programming, tool-path optimization, and advanced material handling. Complex geometries and high-speed operations demand specialized knowledge that many facilities struggle to source or retain. The learning curve associated with digital tools, smart machining systems, and multi-axis equipment further intensifies the skills gap. As manufacturers adopt automation, the need for technically proficient workers becomes more critical, constraining production efficiency and limiting tool utilization in many regions.

Regional Analysis

North America

North America holds a strong 26–27% share of the global cutting tools market, supported by its advanced manufacturing ecosystem, high automation adoption, and strong concentration of high-precision industries. The United States leads regional demand with its extensive aerospace, automotive, medical device, and defense machining capabilities, all of which require carbide, PCD, and coated cutting tools capable of operating at high speeds with tight tolerances. The rise of EV and hybrid vehicle production further drives consumption of tools optimized for machining aluminum housings, battery casings, and lightweight alloys. North American manufacturers also integrate smart machining, tool-condition monitoring, and automated tool changers, strengthening demand for high-performance, long-life tools. Reshoring initiatives, investments in industrial robotics, and modernization of metalworking shops continue to reinforce the region’s solid market share and long-term growth position.

Europe

Europe maintains a substantial 20–24% share of the global cutting tools market, driven by a technologically advanced industrial environment and strong focus on precision machining. Germany, France, Italy, and the United Kingdom represent core demand centers supported by automotive OEMs, aerospace component producers, industrial machinery manufacturers, and high-precision engineering firms. Europe’s high industrial standards push adoption of carbide, CBN, ceramic, and PCD tools for machining hardened steels, superalloys, composites, and titanium-based materials widely used in aerospace and energy applications. Increasing emphasis on sustainability also accelerates demand for long-life coatings, energy-efficient machining solutions, and minimal lubrication processes. Industry 4.0 integration—including predictive maintenance, digital twins, and AI-based tool management—strengthens tool performance requirements across European manufacturing. Continuous upgrades to automation and robotics help Europe sustain its strong global market presence.

Asia-Pacific

Asia-Pacific dominates the global cutting tools market with the largest share, approximately 35–45%, due to massive industrialization, competitive manufacturing costs, and rapid scaling of automotive, electronics, and general engineering sectors. China accounts for the highest tool consumption in the region, driven by large machining clusters and growing semiconductor and consumer electronics production. India’s expanding automotive, infrastructure, and industrial machinery sectors contribute significantly, while Japan and South Korea drive demand for ultra-precision tools used in advanced robotics, aerospace parts, and high-tolerance machining. Widespread adoption of CNC machines, rising penetration of carbide tools, and government-led industrial modernization programs further strengthen regional dominance. Asia-Pacific’s extensive machine tool production capacity, combined with export-driven manufacturing and increasing investment in smart factories, ensures its continued leadership and fastest-growing trajectory in the global cutting tools market.

Latin America

Latin America holds an emerging 8–9% share of the global cutting tools market, driven by growing industrial expansion across Brazil, Mexico, and Argentina. The region’s manufacturing growth is supported by automotive assembly, agricultural machinery production, mining equipment maintenance, and construction-driven metal fabrication. As industries modernize, there is increasing adoption of carbide, HSS, and coated tools to improve machining productivity and reduce operational downtime. Brazil’s strong presence in heavy machinery and Mexico’s role as a manufacturing hub for North American automotive supply chains further elevate tool demand. Although advanced CNC automation adoption is slower compared to mature markets, improving industrial infrastructure and increasing foreign investment are accelerating the shift toward higher-precision tooling. Continuous upgrades in machining technologies and regional efforts to strengthen manufacturing competitiveness support steady growth in tool consumption.

Middle East & Africa

The Middle East & Africa region accounts for a smaller yet steadily expanding 3–6% share of the global cutting tools market. The region’s demand is largely driven by extensive activity in oil & gas, power generation, industrial equipment manufacturing, and metal fabrication. Countries such as Saudi Arabia, the UAE, and South Africa invest heavily in modernizing machining capabilities for pipeline components, drilling equipment, structural metal parts, and maintenance operations. As diversification initiatives expand into aerospace, automotive assembly, and heavy engineering, tool demand is rising for carbide, coated, and wear-resistant cutting tools. The development of new industrial zones, infrastructure megaprojects, and manufacturing-focused economic reforms further support regional growth. Although the region’s advanced machining capabilities are still developing, increasing equipment imports and rising precision manufacturing needs are gradually strengthening MEA’s market footprint.

Market Segmentations:

By Process:

By Material Type:

- Cemented Carbide

- High-Speed Steel (HSS)

By End User:

- Automotive

- Aerospace & Defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cutting tools market features prominent technology-driven manufacturers such as Flow International Corporation, ESAB Corporation, Water Jet Sweden AB, Lincoln Electric Company, Koike Aronson, Inc., TRUMPF, WARDJet, Bystronic Laser AG, Nissan Tanaka Corporation, and AMADA Co. Ltd. The cutting tools market is defined by continuous innovation, strong manufacturing capabilities, and a focus on precision-driven machining technologies. Leading companies compete by expanding their portfolios with high-performance carbide tools, advanced coatings, and digitally enabled cutting systems designed to operate at higher speeds with improved wear resistance. Investments in automation, CNC integration, and smart tool-monitoring platforms strengthen competitiveness as manufacturers prioritize productivity, accuracy, and reduced downtime. Market players also focus on enhancing customer value through technical support, tool reconditioning services, and customized tooling solutions. As industries adopt advanced materials and complex component designs, competition intensifies around product reliability, machining efficiency, and lifecycle performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Flow International Corporation

- ESAB Corporation

- Water Jet Sweden AB

- Lincoln Electric Company

- Koike Aronson, Inc.

- TRUMPF

- WARDJet

- Bystronic Laser AG

- Nissan Tanaka Corporation

- AMADA Co. Ltd.

Recent Developments

- In March 2025, Siemens acquired Altair Engineering Inc., a software solutions provider in the industrial simulation and analysis sector. This strategic move aligns with Altair’s goal of accelerating customers’ digital and sustainability transformations by bridging the physical and digital worlds.

- In December 2024, Tata Consultancy Services, a leading IT service provider, extended a partnership with Telenor Denmark (TnDK), the second-largest mobile operator in the Danish market.

- In September 2024, Bentley Systems, Incorporated acquired Cesium, a 3D geospatial company. Cesium Ion, the company’s SaaS platform, delivers 3D geospatial experiences to over 1 million active devices monthly. Bentley’s iTwin Platform enables engineering and construction firms and asset owners to design, build, and operate the world’s infrastructure using digital twin solutions.

Report Coverage

The research report offers an in-depth analysis based on Process, Material Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt smart cutting tools integrated with sensors and real-time monitoring capabilities.

- Automation-driven demand will rise as CNC machines and robotic machining systems become more widespread.

- Advanced coatings and carbide formulations will continue improving tool life and heat resistance.

- Adoption of cutting tools designed for machining lightweight alloys used in EVs and aerospace will expand.

- Digital tool management platforms will gain traction to optimize tool usage and reduce downtime.

- Sustainable machining practices will drive demand for long-life tools and reduced coolant consumption.

- Custom and application-specific tooling will grow in importance as component geometries become more complex.

- The market will see greater investment in hybrid machining technologies combining milling, drilling, and laser processes.

- Regional manufacturing expansions in Asia-Pacific will continue shaping global supply and demand patterns.

- Increased focus on ultra-precision machining will drive innovations in CBN, PCD, and ceramic tool technologies.