Market Overview

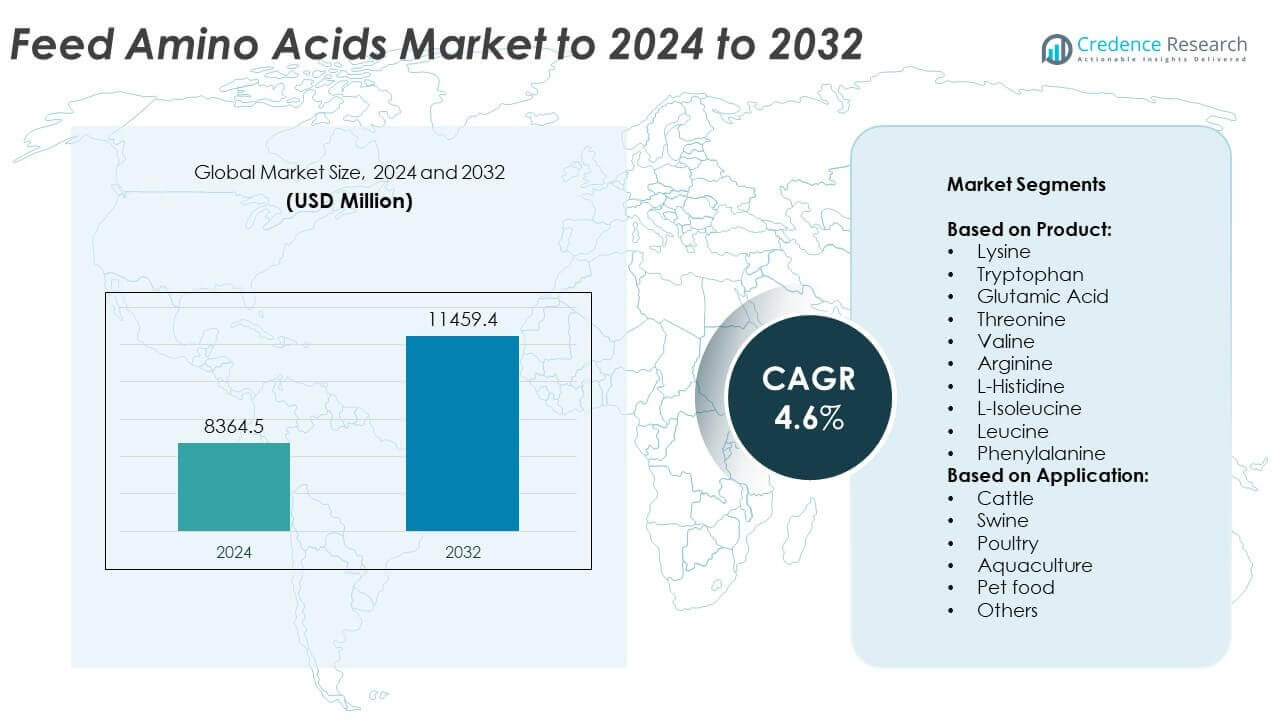

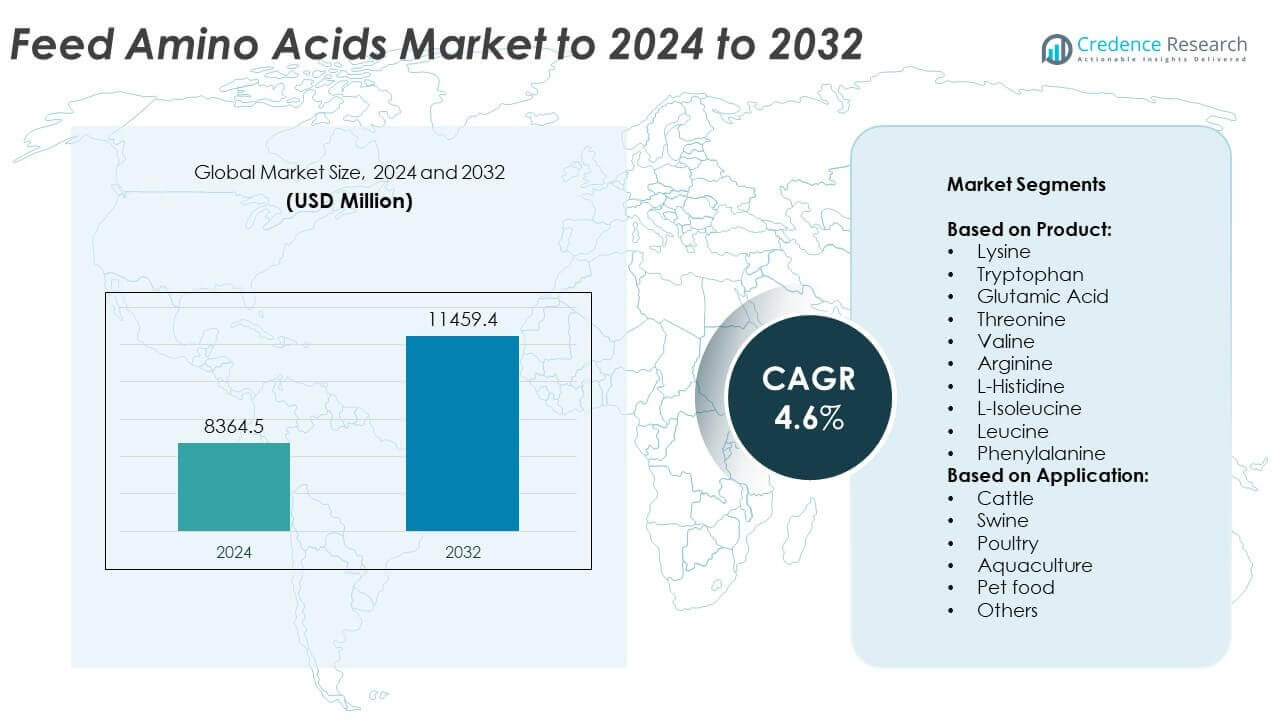

The Feed Amino Acids market size was valued at USD 8,364.5 million in 2024 and is anticipated to reach USD 11,459.4 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Feed Amino Acids market Size 2024 |

USD 8,364.5 million |

| Feed Amino Acids market, CAGR |

4.6% |

| Feed Amino Acids market Size 2032 |

USD 11,459.4 million |

The feed amino acids market is driven by leading players such as CJ Cheiljedang Corporation, Ajinomoto Co., Inc., Evonik Industries AG, Archer-Daniels-Midland Company (ADM), Meihua Group, Daesang Corporation, BBCA Group, and Kemin Industries, Inc., who focus on innovation, large-scale production, and global distribution to strengthen their market presence. These companies invest in advanced fermentation technologies and sustainable solutions to meet rising livestock and poultry feed demand. Regionally, Asia Pacific led the market with a 34% share in 2024, supported by large-scale poultry and swine farming in China, India, and Southeast Asia. North America followed with 27%, while Europe accounted for 24%, driven by sustainability-focused regulations and modern feed formulations.

Market Insights

- The feed amino acids market size was USD 8,364.5 million in 2024 and is projected to reach USD 11,459.4 million by 2032, growing at a CAGR of 4.6%.

- Rising demand for animal protein, sustainability goals, and industrial livestock expansion are driving adoption of amino acids such as lysine and threonine.

- Specialty amino acids like tryptophan and valine are gaining traction in aquaculture and pet food, reflecting trends toward premium and functional nutrition.

- Competition is intense with global leaders focusing on advanced fermentation technologies, product innovation, and regulatory compliance to maintain market share.

- Asia Pacific held the largest share with 34% in 2024, followed by North America at 27% and Europe at 24%, while lysine dominated product segments due to its essential role in livestock feed.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Lysine dominated the feed amino acids market in 2024, holding the largest share due to its essential role in improving animal growth and protein synthesis. Widely used in swine and poultry feed, lysine ensures better feed efficiency and reduces nitrogen emissions, aligning with sustainability goals. The rising demand for high-quality meat and dairy products drives its adoption. Threonine and methionine also show steady growth, supported by their role in enhancing gut health and immunity in livestock, but lysine remains the most critical additive for balanced nutrition.

- For instance, Meihua Group announced a new 400,000 tons/year lysine project that is expected in 2025, which adds to its existing lysine capacity. In 2021, the company already brought a 300,000 tons/year lysine facility online in Jilin, which helped them reach over 1 million tons of total annual production.

By Application

Poultry accounted for the largest share in the feed amino acids market in 2024, driven by the global increase in poultry meat and egg consumption. Amino acids like lysine, threonine, and methionine are vital in improving feed conversion ratios and boosting growth rates in broilers and layers. The segment benefits from rising demand for affordable protein sources, especially in Asia-Pacific. Swine feed ranks second, fueled by intensive farming practices in Europe and China, while aquaculture and pet food continue to expand due to rising protein-rich diets and specialty nutrition demand.

- For instance, Evonik’s global DL-methionine capacity, as of late 2024, has reached more than 700,000 tons per year, following expansions at its production facilities in Singapore and investments in other hubs.

Key Growth Drivers

Rising Demand for Animal Protein

The growing global consumption of meat, dairy, and eggs is the primary driver of the feed amino acids market. Increasing population, urbanization, and changing dietary habits are boosting demand for high-protein diets. To meet these requirements, livestock producers rely on amino acid supplements to improve growth performance and feed efficiency. Lysine, threonine, and methionine play critical roles in enhancing animal health and protein absorption. This trend ensures consistent growth in the market, particularly across Asia-Pacific, where poultry and swine farming dominate.

- For instance, CJ CheilJedang’s L-methionine plant in Malaysia, which began commercial operation in 2015, has an annual production capacity of 80,000 tons, using a bio-fermentation process.

Focus on Sustainable Animal Nutrition

Sustainability has become a major factor shaping the feed amino acids market. Livestock farming faces pressure to reduce greenhouse gas emissions and nitrogen excretion. Supplementing feed with amino acids enhances protein utilization, lowers crude protein levels, and minimizes environmental impact. Companies are investing in innovative formulations to meet strict environmental regulations. This shift towards sustainable practices is driving adoption in developed markets, particularly Europe, where regulatory frameworks encourage eco-friendly animal nutrition solutions.

- For instance, Novus reports that its ALIMET® feed additive, which is based on the HMTBa molecule, provides 88% methionine activity by weight.

Expansion of Industrial Livestock Farming

The intensification of livestock production, especially in emerging economies, drives market expansion. Industrial farming practices require optimized feed formulations to maximize output while maintaining animal health. Amino acids like lysine and tryptophan are essential for accelerating growth and improving reproductive performance. With rising investments in large-scale farming infrastructure, demand for feed amino acids is accelerating in regions such as Latin America and Southeast Asia. This industrial shift creates long-term growth opportunities for manufacturers.

Key Trends & Opportunities

Shift Toward Specialty Amino Acids

While lysine, methionine, and threonine dominate the market, specialty amino acids like tryptophan, valine, and arginine are gaining traction. These amino acids support immune function, stress management, and reproduction in animals. Their adoption is increasing in aquaculture and pet food applications, where health and performance are key priorities. Rising consumer awareness about animal welfare and functional nutrition is encouraging producers to invest in premium feed solutions, opening new opportunities for specialized amino acid formulations.

- For instance, Adisseo’s Nanjing site doubled methionine capacity to 350,000 tons/year.

Growth in Aquaculture and Pet Food Nutrition

The aquaculture industry is expanding rapidly to meet seafood demand, creating strong growth prospects for feed amino acids. Supplements such as glutamic acid and valine play a key role in enhancing fish growth and feed efficiency. Similarly, the pet food industry is witnessing premiumization trends, with owners seeking nutrient-rich, protein-focused diets for pets. This demand is fueling the integration of amino acids in pet feed, offering manufacturers an opportunity to diversify their product portfolios.

- For instance, Skretting produced around 2.5 million tonnes of aquafeed globally in 2024, supported by their Company Facts and their 2024 Impact Report.

Key Challenges

High Production Costs

The production of feed amino acids involves complex fermentation and chemical synthesis processes, making them cost-intensive. Fluctuating raw material prices, especially for corn and soybean, add further pressure on manufacturers. These costs often transfer to end-users, impacting affordability in price-sensitive markets. As a result, smaller farms in developing regions struggle with adoption, slowing market penetration. Companies are increasingly focusing on optimizing production methods to reduce expenses and maintain competitiveness.

Regulatory and Quality Concerns

Strict regulatory frameworks govern the use of additives in animal feed, especially in Europe and North America. Compliance with safety, purity, and sustainability standards increases operational complexity and cost for producers. Variations in global regulations create barriers for international trade, limiting market expansion for smaller players. Moreover, counterfeit and substandard amino acid products pose risks to animal health and threaten consumer trust. Addressing these quality concerns is critical for sustained market growth.

Regional Analysis

North America

North America held a market share of 27% in the feed amino acids market in 2024. The region benefits from strong demand for poultry and swine feed, driven by rising meat consumption and advanced livestock production systems. The U.S. dominates regional growth with well-established feed manufacturing facilities and investments in sustainable animal nutrition. Increasing focus on reducing nitrogen emissions and improving feed efficiency supports adoption of lysine and threonine. Canada also contributes with a growing aquaculture industry, creating opportunities for glutamic acid and valine. Strong regulatory frameworks further encourage the use of high-quality amino acid supplements.

Europe

Europe accounted for 24% of the feed amino acids market in 2024. The region emphasizes sustainability, with farmers increasingly adopting amino acids to enhance feed efficiency and reduce environmental impact. Poultry farming is a major growth driver, particularly in Germany, France, and the U.K., where demand for high-quality protein sources is strong. Regulatory frameworks like the EU Green Deal are pushing the industry toward low-protein diets supplemented with amino acids. Aquaculture in Norway and Spain is also creating opportunities, as specialty amino acids such as arginine and tryptophan gain importance for fish health and performance.

Asia Pacific

Asia Pacific dominated the feed amino acids market in 2024 with a 34% share. The region’s leadership is driven by large-scale livestock farming in China, India, and Southeast Asia, fueled by rising demand for meat, dairy, and aquaculture products. Poultry and swine are the largest consumers of lysine and threonine, while aquaculture in Vietnam, Indonesia, and China is rapidly expanding demand for glutamic acid and valine. Increasing urbanization, growing disposable incomes, and evolving dietary habits strengthen market growth. Government initiatives to enhance food security and investments in modern farming practices further support the adoption of feed amino acids.

Latin America

Latin America captured 9% of the global feed amino acids market in 2024. Brazil and Mexico drive regional growth, with strong poultry and swine industries supplying both domestic and export markets. The adoption of amino acids is supported by intensive livestock production systems focused on feed efficiency and high productivity. Lysine and threonine dominate, given their widespread use in poultry diets. Rising exports of meat products to North America and Europe enhance the need for sustainable nutrition solutions. Expanding aquaculture in Chile also boosts demand for specialized amino acids, supporting long-term opportunities for regional suppliers.

Middle East and Africa

The Middle East and Africa held a 6% share of the feed amino acids market in 2024. The region’s growth is driven by rising poultry consumption, particularly in Gulf countries, and expanding livestock farming in South Africa. Investments in modernizing animal feed industries are supporting demand for amino acids, with lysine and methionine seeing the highest adoption. Limited local production capacity makes the region heavily reliant on imports, creating opportunities for global suppliers. The aquaculture sector in Egypt and Nigeria is emerging, while increasing urbanization and rising incomes are expected to further support regional demand growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

- Lysine

- Tryptophan

- Glutamic Acid

- Threonine

- Valine

- Arginine

- L-Histidine

- L-Isoleucine

- Leucine

- Phenylalanine

By Application:

- Cattle

- Swine

- Poultry

- Aquaculture

- Pet food

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The feed amino acids market is highly competitive, with major players such as CJ Cheiljedang Corporation, Multi Vita, Daesang Corporation, Ningxia Eppen Biotech Co., Ltd, BBCA Group, Archer-Daniels-Midland Company (ADM), Meihua Group, Kemin Industries, Inc, Heilongjiang Chengfu Food Group Co., Ltd., Evonik Industries AG, Global Bio-chem Technology Group Company Limited, Henan Julong Biological Engineering Co., Ltd, and Ajinomoto Co., Inc. leading global operations. These companies compete through wide product portfolios, advanced fermentation technologies, and global distribution networks to serve livestock, poultry, aquaculture, and pet food industries. Competitive strategies include investments in research to develop specialty amino acids, expansion of production facilities to meet rising demand in Asia Pacific, and partnerships to strengthen supply chains. Regulatory compliance, sustainability, and innovation in feed formulations remain key differentiators. The competitive environment is expected to intensify as manufacturers focus on reducing production costs, enhancing product quality, and addressing environmental concerns to capture market share.

Key Player Analysis

- CJ Cheiljedang Corporation

- Multi Vita

- Daesang Corporation

- Ningxia Eppen Biotech Co., Ltd

- BBCA Group

- Archer-Daniels-Midland Company (ADM)

- Meihua Group

- Kemin Industries, Inc

- Heilongjiang Chengfu Food Group Co., Ltd.

- Evonik Industries AG

- Global Bio-chem Technology Group Company Limited

- Henan Julong Biological Engineering Co., Ltd

- Ajinomoto Co., Inc.

Recent Developments

- In 2025, ADM At the SPACE 2025 event in France, introduced a new feed additive for dairy cows designed to boost milk yields.

- In 2025, Meihua Group is undertaking a new 400 kt Lysine project, further positioning it for export dominance, especially as it maintains a large production capacity.

- In 2023, Evonik introduced an updated version of its Biolys product for animal feed, offering a higher amount of L-lysine to enhance livestock nutrition.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The feed amino acids market will expand steadily with rising global meat and dairy consumption.

- Demand will remain strong for lysine and threonine as core components of livestock nutrition.

- Specialty amino acids like tryptophan and valine will gain traction in aquaculture and pet food.

- Asia Pacific will continue leading growth due to large-scale poultry and swine farming.

- Sustainability goals will drive adoption of amino acids to reduce nitrogen emissions in feed.

- Advanced feed formulations will focus on enhancing protein absorption and animal health.

- Regulatory frameworks will push for eco-friendly and high-quality amino acid supplements.

- Industrial livestock farming expansion in emerging economies will accelerate product penetration.

- Aquaculture growth will strengthen demand for functional amino acids improving fish performance.

- Technological advances in production will reduce costs and increase market competitiveness.