Market Overview

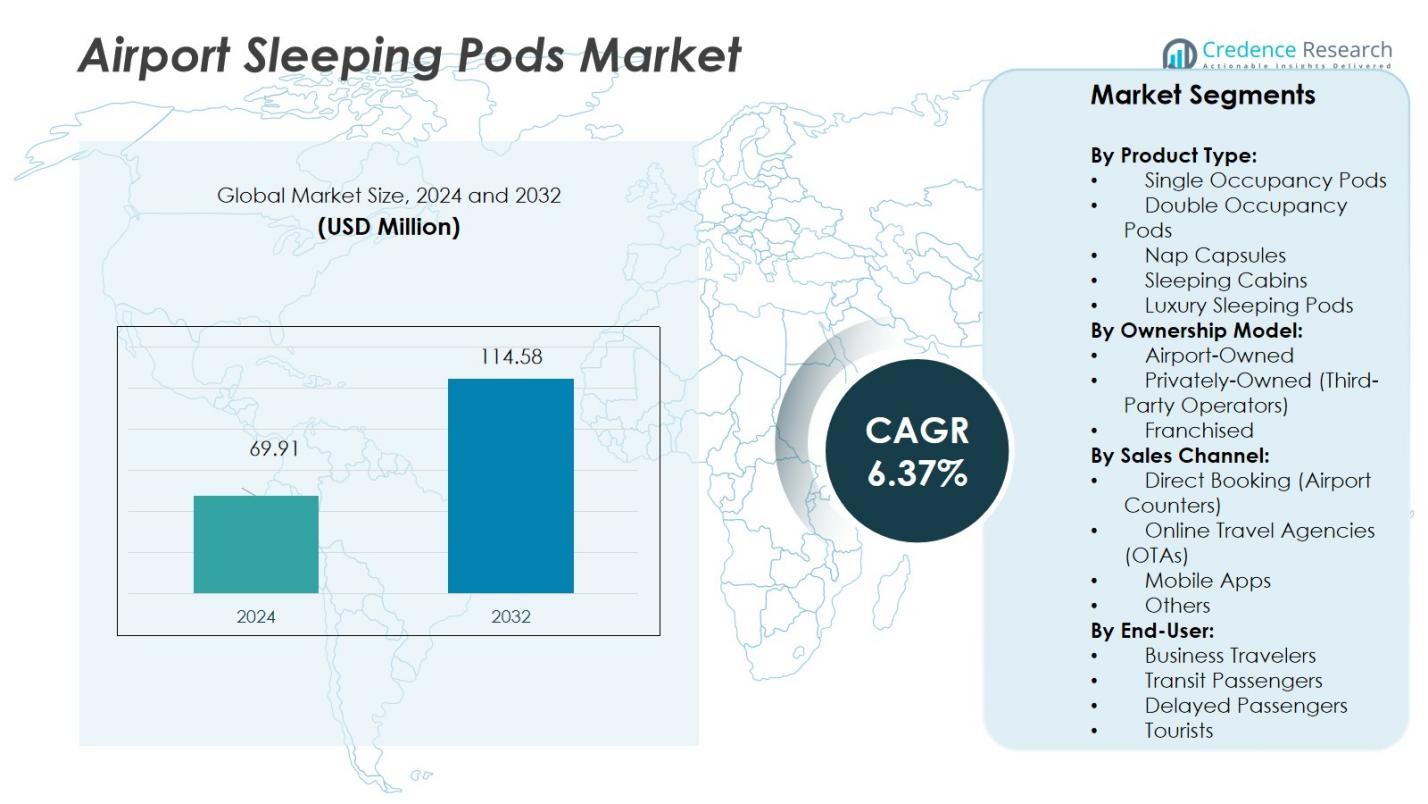

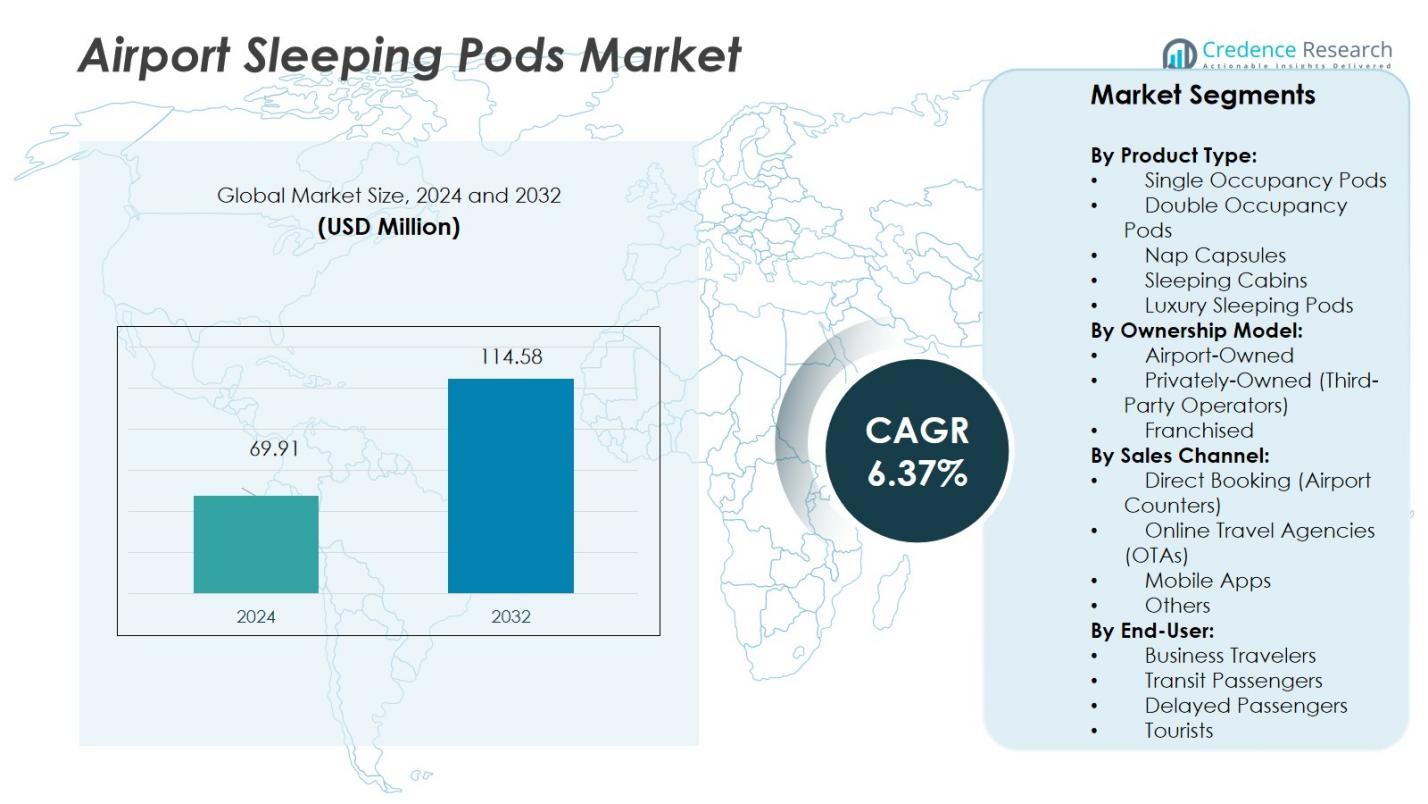

The Airport Sleeping Pods Market size was valued at USD 69.91 million in 2024 and is anticipated to reach USD 114.58 million by 2032, growing at a CAGR of 6.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aircraft Sleeping Pods Market Size 2024 |

USD 69.91 Million |

| Aircraft Sleeping Pods Market, CAGR |

6.37% |

| Aircraft Sleeping Pods Market Size 2032 |

USD 114.58 Million |

The Airport Sleeping Pods Market features prominent players such as GoSleep, NapCabs, Minute Suites, 9h Nine Hours, Sleepbox, Snooze at My Space, JetQuay, Metronaps, Podtime, and Smart Carte. These companies focus on enhancing traveler comfort through advanced pod designs, digital booking systems, and modular solutions suited for various airport layouts. Strategic collaborations with airport authorities and airlines have strengthened their presence in major transit hubs. North America leads the global market with a 34% share in 2024, driven by strong infrastructure development, high air traffic, and early adoption of automated and luxury sleeping pods across major airports like JFK, LAX, and Hartsfield-Jackson.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Airport Sleeping Pods Market was valued at USD 69.91 million in 2024 and is projected to reach USD 114.58 million by 2032, growing at a CAGR of 6.37%.

- Rising global air passenger traffic and increasing layover durations drive strong demand for short-term rest facilities in major transit hubs.

- The market trends toward smart, modular, and luxury pod designs with digital booking and contactless access systems enhancing user convenience.

- Competition remains strong among key players such as GoSleep, NapCabs, Minute Suites, and Sleepbox, focusing on innovation, partnerships, and premium traveler experiences.

- North America leads with a 34% regional share, while single occupancy pods dominate by product type with 38% share in 2024; Asia-Pacific shows the fastest growth due to expanding airport infrastructure and rising middle-class air travel.

Market Segmentation Analysis:

By Product Type:

Single occupancy pods dominate the Airport Sleeping Pods Market with a 38% share in 2024, driven by strong demand from solo travelers seeking privacy and convenience during layovers. These compact pods are widely installed in international and domestic terminals due to their efficient space utilization and affordability. Double occupancy pods and sleeping cabins are gaining traction as airports focus on enhancing passenger comfort for couples and families. Meanwhile, luxury sleeping pods grow steadily, targeting premium travelers with features like entertainment systems, climate control, and enhanced ergonomics.

- For instance, GoSleep pods installed across international terminals feature a fully automatic reclining seat that converts to a flat-bed configuration, complete with double USB charging ports and storage compartments beneath the seat for hand luggage.

By Ownership Model:

Privately-owned (third-party operators) segment leads the market with a 46% share in 2024, supported by the rise of specialized hospitality firms managing pay-per-use pods across global airports. These operators provide flexible pricing, 24/7 service, and digital booking integration, driving operational efficiency. Airport-owned models follow closely as major airports invest in infrastructure to enhance passenger satisfaction and brand value. Franchised models are emerging, supported by consistent service standards and reduced capital risk, particularly across expanding airport networks in Asia-Pacific and the Middle East.

- For instance, Minute Suites operates across multiple major U.S. hubs including Atlanta Hartsfield-Jackson International, where locations are positioned across concourses B, E (International Terminal), and F (International Terminal), providing flexible hourly booking and digital reservation integration.

By Sales Channel:

Direct booking through airport counters holds the largest market share of 41% in 2024, reflecting travelers’ preference for on-the-spot, short-duration bookings during layovers or delays. The segment benefits from high visibility and convenience for transit passengers. Online travel agencies (OTAs) and mobile apps are rapidly expanding channels, supported by the digitalization of airport services and pre-travel planning trends. Mobile app-based bookings, in particular, are rising among tech-savvy travelers seeking seamless check-in and real-time availability updates, enhancing overall accessibility and revenue generation for operators.

Key Growth Drivers

Rising Air Passenger Traffic and Layover Durations

Growing global air traffic and increasing layover durations are key drivers of the Airport Sleeping Pods Market. With expanding international routes and congested flight schedules, travelers seek short-term rest options within terminals. The demand for convenient, secure, and private sleeping spaces continues to surge as passenger volumes rise in major transit hubs such as Dubai, London, and Singapore. Airports are investing in sleeping pod facilities to enhance passenger experience, reduce fatigue, and improve customer retention rates during long connection intervals.

- For instance, Hamad International Airport in Doha expanded its sleep pod infrastructure by opening a second sleep ‘n fly lounge facility at the North Node, spanning 420 square meters and capable of accommodating over 50 guests simultaneously, featuring FlexiSuite pods, bunk cabins, and family accommodation options to serve the airport’s high volume of transit passengers.

Expansion of Airport Infrastructure and Smart Terminal Concepts

The modernization of airport terminals and adoption of smart infrastructure strongly support sleeping pod installations. Global airports are redesigning passenger areas to include premium rest zones, tech-enabled lounges, and automated service pods. Integration of smart lighting, biometric access, and real-time occupancy monitoring enhances user convenience and operational efficiency. These innovations align with airport sustainability goals and improve space utilization, encouraging the integration of modular sleeping solutions in both new and renovated terminals.

- For instance, Dubai International Airport operates Sleep ‘n Fly across four terminals with multiple pod configurations including FlexiSuite Pods featuring adjustable air-conditioning, reading lights, and storage compartments, along with YAWN Cabins offering full bedding and lockable private spaces with individual climate controls.

Growing Preference for Cost-Effective Transit Accommodation

Rising airfare and accommodation costs have led to an increased preference for cost-effective airport lodging solutions. Sleeping pods offer travelers a budget-friendly alternative to airport hotels, especially for short transit stays or unexpected flight delays. Their pay-per-use model and compact design attract solo and business travelers who prioritize privacy and flexibility. Operators benefit from high occupancy turnover and reduced maintenance compared to traditional hotel setups, making sleeping pods an appealing addition to airport commercial infrastructure.

Key Trends & Opportunities

Integration of Digital Booking and Contactless Access Systems

Digital transformation is reshaping how travelers book and access airport sleeping pods. Mobile applications, online travel agencies, and airport kiosks now enable instant booking, contactless check-in, and seamless payments. This integration improves operational efficiency while catering to tech-savvy passengers seeking convenience and hygiene assurance. The adoption of IoT-enabled pods and AI-driven occupancy management systems presents opportunities for operators to streamline maintenance and maximize utilization, enhancing profitability across international airport networks.

- For instance, Abu Dhabi’s Zayed International Airport has expanded its Smart Travel Project to implement facial recognition technology at nine passenger touchpoints by 2025, enabling contactless authentication throughout the entire journey from check-in to boarding gates, allowing passengers to move from curbside to gate in under 15 minutes.

Emergence of Luxury and Customizable Pod Designs

Luxury sleeping pods are gaining traction as airports compete to attract high-value travelers and airline loyalty members. These pods feature personalized comfort settings, inbuilt entertainment, climate control, and premium materials that elevate the passenger experience. The rising number of long-haul routes and growing competition among hub airports create opportunities for differentiated rest solutions. Customizable pod designs also appeal to diverse traveler demographics, enabling airports to balance affordability with premium service offerings.

- For instance, Sleep ‘n Fly at Hamad International Airport’s North Node features premium FlexiSuite Pods alongside family-sized YAWN Double and Bunk Cabins spread across a 420-square-meter lounge that accommodates over 50 guests simultaneously, allowing couples and families to select accommodation matching their specific travel needs while solo travelers access individual soundproof pods with privacy shades and power outlets.

Key Challenges

High Installation and Maintenance Costs

Implementing sleeping pods involves significant capital expenditure related to pod procurement, space renovation, and integration with existing terminal systems. Regular maintenance, cleaning, and software upgrades further add to operational costs. Smaller airports with limited budgets find such investments challenging, slowing adoption rates. Additionally, ensuring consistent service quality and uptime across multiple terminals demands robust operational management, which can strain financial returns in the early deployment stages.

Regulatory and Space Allocation Constraints

Airport infrastructure regulations and limited terminal space pose major challenges to market expansion. Authorities often enforce strict safety, fire, and accessibility codes that complicate pod installation and layout planning. Allocating commercial space for sleeping pods within high-traffic zones requires negotiation between airport authorities and private operators. These logistical and compliance barriers delay implementation timelines, particularly in older or smaller airports with restricted design flexibility and complex approval procedures.

Regional Analysis

North America

North America leads the Airport Sleeping Pods Market with a 34% share in 2024, driven by strong adoption across major hubs such as Hartsfield-Jackson, JFK, and LAX. The region’s focus on enhancing passenger convenience and integrating smart technologies fuels demand for automated and luxury pod designs. The growing number of long-haul international flights and frequent business travelers further support installations. Airport authorities and private operators collaborate to expand short-stay infrastructure, while high disposable income and digital booking adoption sustain the region’s dominant position during the forecast period.

Europe

Europe holds a 28% share in 2024, supported by advanced airport infrastructure and early adoption of capsule-style accommodations in transit hubs like Heathrow, Frankfurt, and Amsterdam Schiphol. The region emphasizes sustainable airport expansion and passenger comfort, encouraging the inclusion of eco-friendly and modular sleeping pods. Rising tourism, business travel, and transit passenger traffic across the Schengen zone boost demand. Competitive airport operations and strong partnerships with hospitality service providers further enhance service offerings, solidifying Europe’s position as a key market for premium and tech-integrated sleeping pod solutions.

Asia-Pacific

Asia-Pacific accounts for a 25% share in 2024, emerging as the fastest-growing region due to expanding air connectivity and growing middle-class air travel. Airports in China, Japan, Singapore, and India are investing in modern terminal facilities with rest zones to improve passenger satisfaction. The rise in low-cost carriers and frequent flight delays drives interest in affordable nap pods. The region’s technological progress and urban travel culture promote widespread adoption of app-based booking and automated access systems, making Asia-Pacific a major growth engine for the Airport Sleeping Pods Market.

Latin America

Latin America captures a 7% share in 2024, with growing adoption in countries such as Brazil, Mexico, and Chile. Expanding airport modernization projects and the rise of international transit traffic support sleeping pod installations in major terminals. The region’s increasing tourism and corporate travel activities drive the demand for convenient rest spaces. Operators are introducing cost-efficient single occupancy pods to cater to budget-conscious travelers. Government initiatives for improving airport infrastructure and private investments in hospitality services are expected to strengthen market growth across Latin America.

Middle East & Africa

The Middle East & Africa region holds a 6% share in 2024, supported by significant investments in large international airports such as Dubai International, Hamad International, and Abu Dhabi. High transit passenger volumes and the prominence of global carriers drive the adoption of luxury and family-sized sleeping pods. Africa’s emerging aviation sector, led by South Africa and Kenya, shows growing interest in modular pod systems for long layovers. Strategic partnerships between airport authorities and hospitality brands promote expansion, positioning the region as an evolving market for advanced airport accommodation solutions.

Market Segmentations:

By Product Type:

- Single Occupancy Pods

- Double Occupancy Pods

- Nap Capsules

- Sleeping Cabins

- Luxury Sleeping Pods

By Ownership Model:

- Airport-Owned

- Privately-Owned (Third-Party Operators)

- Franchised

By Sales Channel:

- Direct Booking (Airport Counters)

- Online Travel Agencies (OTAs)

- Mobile Apps

- Others

By End-User:

- Business Travelers

- Transit Passengers

- Delayed Passengers

- Tourists

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Airport Sleeping Pods Market includes key players such as GoSleep, NapCabs, Minute Suites, 9h Nine Hours, Sleepbox, Snooze at My Space, JetQuay, Metronaps, Podtime, and Smart Carte. These companies compete through innovation in pod design, user comfort, digital booking systems, and strategic airport partnerships. Leading operators emphasize modular designs, hygiene features, and privacy enhancements to meet diverse traveler needs. Expansion strategies focus on high-traffic airports across North America, Europe, and Asia-Pacific, supported by collaborations with airport authorities and airlines. Companies are increasingly investing in automated check-in systems, biometric access, and smart connectivity to improve customer experience and operational efficiency. With rising passenger traffic and growing demand for affordable transit accommodation, market competition remains strong, pushing players to differentiate through premium features, flexible pricing models, and integration with digital travel ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, NAPHUBS launched 13 sleeping pods at Terminal 2 in the international departure area of Shanghai Pudong International Airport. The pods recorded use by more than 300 passengers within the first weeks.

- In April 2025, Minute Suites opened its second location at JFK Terminal 8, Concourse C near Gate C36, under the Minute Suites Express brand. The company now operates 16 airport locations across the U.S. Each suite includes a desk, chair, private internet, charging ports, Alexa, and a Smart TV, catering to business and leisure travelers seeking privacy and comfort.

- In April 2025, Al-Bahar Group increased its ownership in YOTEL Limited to over 95%, gaining majority control. The strategic move supports YOTEL’s expansion plan to double its global portfolio to 15,000 rooms by 2030.

- In June 2025, Finnish company GoSleep expanded its partnership with wellness brand XWELL to install GoSleep Recovery Pods at Amsterdam Schiphol Airport’s D-Pier.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Ownership Model, Sales Channel, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to increasing global air passenger traffic.

- Airports will integrate more smart and automated pod systems for convenience.

- Demand for luxury and customizable sleeping pods will grow among premium travelers.

- Digital booking through mobile apps and OTAs will dominate future sales channels.

- Asia-Pacific will emerge as the fastest-growing region with large-scale airport upgrades.

- Sustainability-focused materials and energy-efficient pod designs will gain importance.

- Partnerships between airports and hospitality providers will boost service expansion.

- Compact modular pods will become standard in new airport terminal designs.

- Contactless access and biometric authentication will enhance safety and hygiene.

- Growing competition will drive innovation in design, comfort, and pricing models.