Market Overview

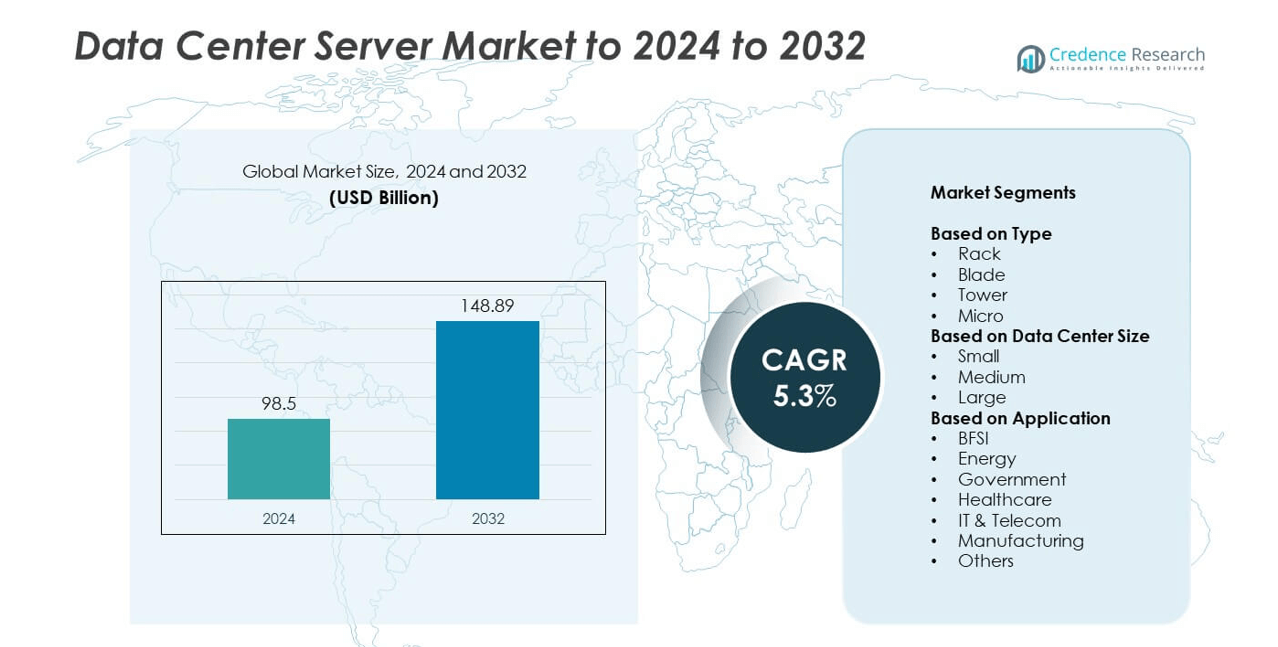

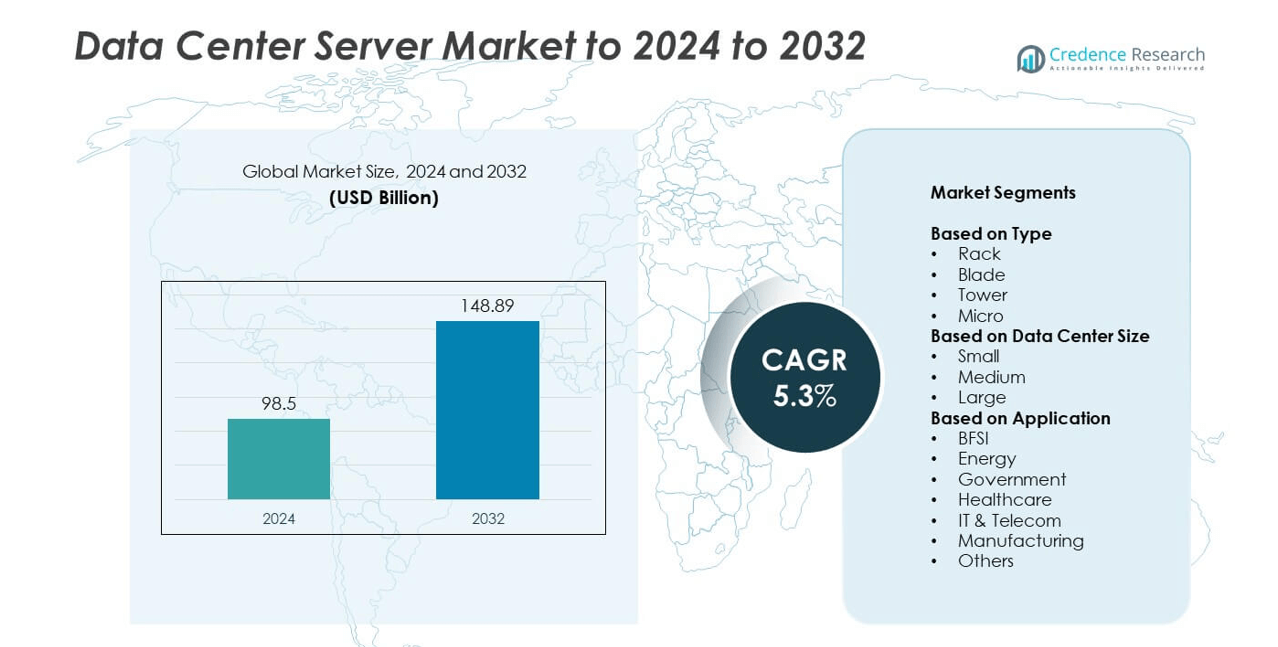

The Data Center Server Market size was valued at USD 98.5 billion in 2024 and is anticipated to reach USD 148.89 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Server Market Size 2024 |

USD 98.5 billion |

| Data Center Server Market, CAGR |

5.3% |

| Data Center Server Market Size 2032 |

USD 148.89 billion |

The Data Center Server market is driven by leading companies such as Cisco Systems, FUJITSU, Lenovo, NVIDIA, Schneider Electric, Hewlett Packard Enterprise, Huawei Technologies, Dell, Atos SE, IBM, NEC Corporation, Vertiv Group, Oracle, and Intel. These players focus on developing high-performance, energy-efficient, and AI-optimized servers to support growing data and cloud workloads. North America dominated the market with a 38% share in 2024, supported by strong cloud infrastructure and hyperscale data centers. Europe followed with a 28% share, driven by data localization regulations and enterprise modernization, while Asia-Pacific accounted for 24% due to rapid digital transformation and 5G expansion.

Market Insights

- The Data Center Server market was valued at USD 98.5 billion in 2024 and is projected to reach USD 148.89 billion by 2032, expanding at a CAGR of 5.3%.

- Rising cloud computing adoption, AI-driven workloads, and digital transformation across industries are key drivers of market growth.

- Trends such as edge computing deployment, energy-efficient infrastructure, and AI-optimized server designs are shaping future developments.

- The market is competitive, with companies focusing on innovation, sustainability, and expansion of hyperscale and modular data centers to maintain leadership.

- North America led with a 38% share in 2024, followed by Europe at 28% and Asia-Pacific at 24%, while the rack server segment dominated with 47% of the overall market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The rack server segment dominated the Data Center Server market in 2024 with a 47% share. Its modular structure, scalability, and efficient space utilization make it ideal for large enterprises and hyperscale data centers. Rack servers deliver high processing power and simplified maintenance, driving their adoption across cloud and colocation facilities. Rising demand for virtualized environments and efficient energy use strengthens their preference over tower and blade servers. The microserver segment is gaining attention for edge computing, but rack servers remain the industry standard due to cost-effectiveness and performance efficiency.

- For instance, Dell’s PowerEdge R760 supports 32 DDR5 DIMMs and up to 24 NVMe U.2 drives in a 2U chassis, with configurations up to 16 E3.S Gen5 NVMe bays. These densities fit high-performance, modular rack designs.

By Data Center Size

Large data centers held the largest share of 54% in 2024, driven by expanding hyperscale facilities supporting cloud computing and big data analytics. These centers require high-density servers to manage complex workloads and ensure uninterrupted performance. The growth of major cloud providers and colocation service expansions globally contributes significantly to this dominance. Medium data centers are growing due to enterprise-level modernization, while small facilities serve niche workloads. Investments in large-scale infrastructure and increasing deployment of AI-driven workloads continue to fuel this segment’s market leadership.

- For instance, Meta’s Richland Parish campus is planned at 4 million square feet, its largest to date. The site is part of a 2,250-acre megasite plan supporting next-gen AI workloads.

By Application

The IT and telecom segment led the Data Center Server market with a 39% share in 2024. The growing reliance on cloud platforms, data traffic surge, and network virtualization drive strong server demand in this sector. Telecom operators are modernizing networks with 5G infrastructure, which increases the need for high-performance, low-latency servers. BFSI and healthcare sectors are rapidly adopting secure data management systems, boosting overall market growth. The increasing role of data-intensive technologies, such as AI, IoT, and edge computing, continues to strengthen server deployment across IT and telecom operations.

Key Growth Drivers

Rising Cloud Computing and Virtualization Demand

Growing cloud adoption and virtualization are major forces driving the Data Center Server market. Enterprises are shifting workloads to cloud-based environments for scalability, flexibility, and cost savings. This migration increases demand for high-performance servers capable of handling dynamic workloads efficiently. The expansion of hyperscale data centers by companies like Amazon, Google, and Microsoft fuels consistent hardware upgrades. Additionally, businesses investing in private and hybrid cloud infrastructures contribute to sustained market growth, ensuring strong demand for energy-efficient, rack-optimized servers worldwide.

- For instance, Microsoft Azure cites 70+ regions and 400+ datacenters, offering availability zones with under 2-millisecond intra-region latency. Such scale enables highly available, virtualized workloads globally.

Expansion of AI and Data-Intensive Applications

The rapid adoption of artificial intelligence, machine learning, and big data analytics has transformed server requirements globally. AI-driven workloads demand faster processing, higher memory capacity, and advanced GPU-based systems. Enterprises are upgrading to next-generation servers to manage these complex operations efficiently. The trend toward real-time data processing in industries like finance, telecom, and healthcare is intensifying investments in high-performance servers. The growing use of automation and predictive analytics further strengthens the need for scalable, high-density server architectures.

- For instance, NVIDIA’s GH200 platform offers up to 624 GB fast memory per superchip and 900 GB/s NVLink-C2C, accelerating GNN training up to 8× versus H100 PCIe. These specs target AI servers and clusters.

Growing Digitalization Across Industries

Rising digital transformation initiatives in government, manufacturing, and healthcare sectors are increasing server installations globally. Organizations are integrating digital systems for better data management, automation, and cybersecurity. This transition requires reliable server infrastructure to support mission-critical applications and remote operations. Additionally, the expansion of e-commerce, online banking, and telemedicine is driving continuous data generation. The resulting need for secure and high-speed data processing boosts demand for advanced servers, supporting long-term industry growth and modernization.

Key Trends and Opportunities

Edge Computing Deployment Expansion

The shift toward edge computing presents new opportunities for the Data Center Server market. Enterprises are deploying servers closer to data sources to reduce latency and improve real-time processing. This trend is especially strong in sectors like telecommunications, automotive, and smart cities. Edge servers are enabling faster response times and more efficient bandwidth usage. Manufacturers are focusing on compact, power-efficient designs to meet growing edge computing needs, leading to broader adoption in distributed and remote environments worldwide.

- For instance, Cloudflare runs in 330 cities across 120+ countries, processing traffic at the closest location. This edge presence reduces latency for real-time services.

Sustainability and Energy-Efficient Infrastructure

Sustainability has become a central focus for data center operators. Companies are investing in energy-efficient servers with improved thermal management and reduced carbon footprints. The use of renewable energy sources and liquid cooling technologies supports green data center initiatives. Governments and enterprises are aligning operations with global emission-reduction targets, creating demand for eco-friendly infrastructure. This shift toward sustainable design and resource optimization provides manufacturers with new opportunities to develop servers that meet regulatory and environmental standards.

- For instance, Google reports a fleet-wide trailing twelve-month PUE of 1.09 at large-scale data centers in stable operations. Lower PUE reduces energy overhead per compute.

Key Challenges

High Capital and Maintenance Costs

The high initial investment and ongoing maintenance costs of data center servers remain major challenges. Building large-scale facilities with advanced cooling systems, power supplies, and backup equipment requires substantial financial resources. Small and medium enterprises often struggle with these expenses, slowing technology adoption. Additionally, frequent hardware upgrades and rising energy costs further increase operational expenses. The need to balance performance and cost efficiency continues to pressure both server manufacturers and data center operators globally.

Cybersecurity and Data Privacy Risks

The growing volume of sensitive data processed by data centers heightens cybersecurity concerns. As organizations adopt cloud and hybrid environments, the risk of data breaches and cyberattacks intensifies. Protecting data integrity and ensuring compliance with international security regulations demand continuous investment in secure server architectures. Emerging threats such as ransomware and advanced persistent attacks challenge infrastructure resilience. Maintaining strong encryption, real-time monitoring, and regulatory compliance remains critical yet costly for data center operators.

Regional Analysis

North America

North America dominated the Data Center Server market with a 38% share in 2024. The region benefits from the strong presence of hyperscale data centers and leading cloud service providers. Rapid expansion in AI, IoT, and 5G infrastructure supports continuous server upgrades. The United States remains the primary contributor, driven by high enterprise digitalization and strong investments in cloud computing. Canada’s data sovereignty policies are also stimulating localized data center construction. Ongoing innovation and large-scale adoption of virtualization technologies further solidify North America’s leadership in global market growth.

Europe

Europe accounted for 28% of the Data Center Server market share in 2024. The region’s growth is supported by stringent data protection laws and a rising number of colocation facilities. Major markets such as Germany, the United Kingdom, and the Netherlands are expanding hyperscale and enterprise data centers. The adoption of cloud-based solutions and digital transformation initiatives across government and BFSI sectors are major drivers. Increased focus on energy-efficient data centers and renewable-powered operations further supports server demand across European markets, enhancing their competitiveness globally.

Asia-Pacific

Asia-Pacific held a 24% share of the Data Center Server market in 2024. Rapid digitalization in countries like China, India, Japan, and South Korea is accelerating demand for high-capacity servers. Growing internet usage, cloud adoption, and e-commerce expansion are fueling regional data center investments. Governments are promoting smart city initiatives and 5G deployment, creating opportunities for edge and hyperscale data centers. Local and international players are expanding capacity to meet rising enterprise needs. Strong economic growth and increasing IT infrastructure spending continue to drive market expansion in the region.

Latin America

Latin America captured a 6% share of the Data Center Server market in 2024. The region’s growth is supported by increasing adoption of cloud computing and digital banking services. Brazil and Mexico are leading data center hubs due to strong enterprise and telecom investments. The growing e-commerce sector and rising data localization regulations are stimulating infrastructure expansion. Although the market is in an early development phase, growing demand for reliable and energy-efficient servers indicates a positive outlook. Ongoing investments by global hyperscale providers further strengthen regional growth potential.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the Data Center Server market in 2024. Regional growth is driven by rising digital transformation initiatives and government-backed smart infrastructure projects. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are investing in large-scale data centers to support cloud and enterprise workloads. The expansion of telecom networks and increased use of digital services are boosting server demand. Growing focus on local data hosting and security compliance continues to attract foreign investments and infrastructure development.

Market Segmentations:

By Type

By Data Center Size

By Application

- BFSI

- Energy

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Data Center Server market is led by major players such as Cisco Systems, Inc., FUJITSU, Lenovo, NVIDIA, Schneider Electric, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Dell Inc., Atos SE, IBM, NEC Corporation, Vertiv Group Corp, Oracle, and Intel. The market is characterized by intense competition and continuous technological innovation. Companies are focusing on developing high-performance, energy-efficient, and AI-optimized server solutions to meet growing data processing needs. Strategic partnerships, product diversification, and expansion of global manufacturing capabilities are key strategies to strengthen market presence. Vendors are investing heavily in R&D to enhance server virtualization, cloud integration, and cooling efficiency. Increasing demand for edge and hyperscale data centers is driving competitive differentiation based on scalability and energy optimization. Additionally, firms are emphasizing sustainable operations and next-generation semiconductor technologies to gain a long-term competitive edge in this rapidly evolving market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco Systems, Inc. (U.S.)

- FUJITSU (Japan)

- Lenovo (Hongkong)

- NVIDIA (U.S.)

- Schneider Electric (France)

- Hewlett Packard Enterprise Development LP (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Dell Inc. (U.S.)

- Atos SE (France)

- IBM (U.S.)

- NEC Corporation (U.S.)

- Vertiv Group Corp (U.S.)

- Oracle (U.S.)

- Intel (U.S.)

Recent Developments

- In 2024, NVIDIA partnered with Cisco to launch the Nexus HyperFabric AI cluster solution, an end-to-end architecture for scaling generative AI.

- In 2024, Dell Inc. (U.S.) Introduced the Dell AI Factory with NVIDIA, a solution offering high-performance servers specifically tailored for AI workloads. This partnership responded to the increasing demand for AI-optimized infrastructure.

- In 2023, Intel delivered 5th-generation Xeon processors with Emerald Rapids to customers, along with impressive AI performance gains. It also delivered Agilex 9 Direct RF FPGAs, showcasing its chiplet-based heterogeneous integration.

Report Coverage

The research report offers an in-depth analysis based on Type, Data Center Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising AI and machine learning workloads will increase demand for high-performance data center servers.

- Edge computing adoption will accelerate localized server deployment for low-latency data processing.

- Expansion of 5G networks will drive investments in scalable and energy-efficient server infrastructure.

- Sustainability initiatives will promote the use of green and liquid-cooled data center servers.

- Growing adoption of hybrid and multi-cloud models will create opportunities for modular server solutions.

- Advances in chip design and processing architecture will enhance computing efficiency and power density.

- Increased data traffic from IoT devices will boost demand for high-capacity server systems.

- Government regulations on data sovereignty will encourage regional data center expansion.

- Cybersecurity integration will become a critical focus in future server architecture development.

- Ongoing digital transformation across industries will sustain steady long-term demand for data center servers.