Market Overview

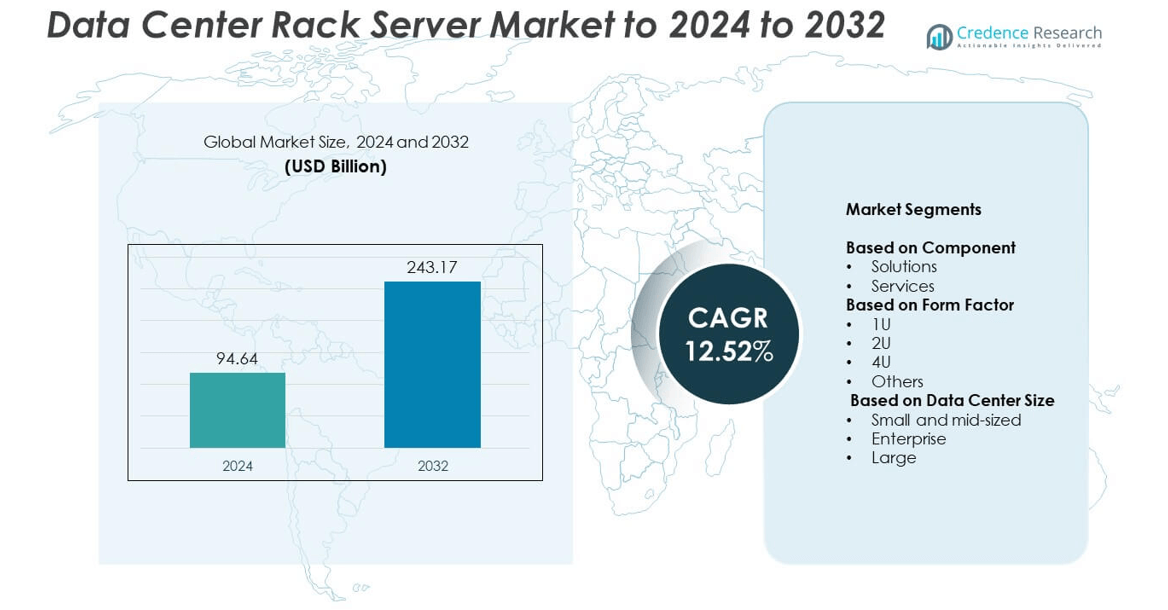

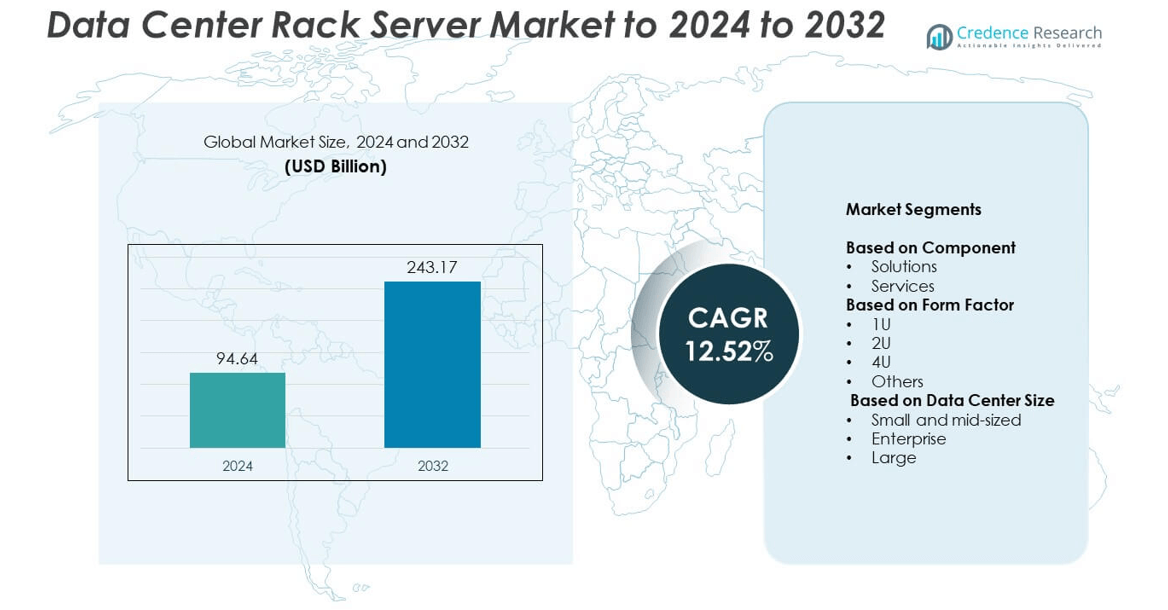

The Data Center Rack Server Market size was valued at USD 94.64 billion in 2024 and is anticipated to reach USD 243.17 billion by 2032, at a CAGR of 12.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Rack Server Market Size 2024 |

USD 94.64 billion |

| Data Center Rack Server Market, CAGR |

12.52% |

| Data Center Rack Server Market Size 2032 |

USD 243.17 billion |

The Data Center Rack Server market is driven by major companies such as Hewlett Packard Enterprise (HPE), Lenovo, Super Micro Computer, Inc., Dell Technologies, IBM Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Fujitsu, Oracle Corporation, HP, and Inspur Technologies. These players focus on innovation in high-density, energy-efficient servers to meet growing cloud, AI, and edge computing demands. North America dominated the market with a 38% share in 2024, supported by extensive hyperscale infrastructure and digital transformation initiatives. Europe followed with 28%, driven by sustainable data center expansion, while Asia-Pacific held 24%, fueled by rapid industrialization and increasing cloud service adoption.

Market Insights

- The Data Center Rack Server market was valued at USD 94.64 billion in 2024 and is projected to reach USD 243.17 billion by 2032, expanding at a CAGR of 12.52%.

- Growth is driven by rising demand for cloud computing, AI-driven applications, and digital transformation across enterprise and hyperscale data centers.

- Key trends include increasing adoption of energy-efficient rack designs, integration of AI for automated management, and expansion of edge computing infrastructure.

- The market is competitive, with companies focusing on innovation, sustainability, and strategic partnerships to strengthen global presence.

- North America led the market with a 38% share in 2024, followed by Europe at 28% and Asia-Pacific at 24%, while the solutions segment dominated with 71% of the overall market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solutions segment dominated the Data Center Rack Server market in 2024 with a 71% share. This dominance is driven by the rising adoption of integrated server infrastructure that enhances scalability, performance, and automation in large data centers. Demand for advanced rack solutions is growing due to increased cloud workloads and virtualization needs. The services segment, covering installation, maintenance, and consulting, is also expanding as enterprises seek managed services to optimize operational efficiency and reduce downtime in complex IT environments.

- For instance, Dell’s integrated rack solutions featuring the liquid-cooled PowerEdge XE9680L servers support up to 72 NVIDIA Blackwell GPUs per rack. The PowerEdge XE9680L server itself is a 4U system that supports 8 NVIDIA HGX B200 GPUs and utilizes direct liquid cooling to enhance thermal efficiency and support high-density deployments for AI training and inference.

By Form Factor

The 2U segment held the largest share of 46% in 2024, leading the form factor category. Its popularity is attributed to its balance between high compute density and efficient cooling capabilities, making it ideal for both enterprise and hyperscale data centers. The 1U servers are also gaining traction due to compact designs suited for edge deployments. Increasing demand for rack-efficient designs with enhanced power performance is encouraging vendors to offer modular, space-saving server architectures.

- For instance, Cisco’s 2U UCS C240 M7 supports up to 8 TB DDR5 memory across 32 DIMMs.

By Data Center Size

The enterprise data center segment accounted for 48% of the overall market share in 2024, emerging as the leading category. Growth is driven by expanding corporate digital transformation programs and the need for scalable IT infrastructure to handle AI and analytics workloads. Large data centers continue to invest heavily in high-density racks to improve resource utilization, while small and mid-sized facilities are adopting cost-effective server solutions to enhance performance, flexibility, and sustainability within limited operational budgets.

Key Growth Drivers

Rising Cloud and AI Workloads

The growing demand for cloud computing, artificial intelligence, and data analytics has accelerated the adoption of rack servers. Enterprises are expanding their infrastructure to support high-performance computing and massive data processing. Rack servers offer scalability, efficiency, and optimized performance for virtualized and cloud environments. This trend is further strengthened by the increasing number of hyperscale data centers and government digitalization initiatives, making cloud and AI integration a major growth catalyst for the market.

- For instance, Supermicro reported shipping over 100,000 NVIDIA GPUs per quarter, underscoring AI server demand.

Expansion of Hyperscale Data Centers

The continuous construction of hyperscale facilities by technology giants is a major growth driver. These centers require high-density rack servers to support large-scale data processing, content delivery, and storage. Companies like Amazon, Google, and Microsoft are investing heavily in new hyperscale infrastructure to enhance global network capacity. This surge in large-scale deployments is pushing demand for rack servers designed with modularity, energy efficiency, and advanced cooling systems to handle increasing data loads efficiently.

- For instance, Microsoft operates 70+ Azure regions and 400+ data centers, expanding hyperscale capacity.

Growing Shift Toward Edge Computing

The shift toward edge computing is driving significant growth in compact and modular rack servers. As industries adopt IoT and real-time analytics, decentralized data processing closer to the source has become critical. Rack servers designed for edge environments enable low latency, improved reliability, and faster data insights. Telecom operators and enterprises are increasingly deploying micro data centers at network edges, boosting demand for small and mid-sized rack servers optimized for remote and harsh environments.

Key Trends & Opportunities

Adoption of Energy-Efficient Server Designs

Sustainability has become a key trend as organizations seek energy-efficient server solutions to reduce operational costs and carbon emissions. Rack server manufacturers are developing systems with improved airflow, liquid cooling, and power management technologies. Governments and enterprises are emphasizing green data centers that comply with global environmental standards. This transition toward low-power, high-performance servers offers strong opportunities for innovation and long-term competitiveness in the global market.

- For instance, Google reported a fleet-wide average PUE of 1.09 in 2024 across its data centers.

Integration of AI and Automation in Server Management

AI-driven automation is reshaping the management and performance optimization of rack servers. Machine learning algorithms now enable predictive maintenance, resource allocation, and dynamic workload balancing. Automated management solutions help reduce downtime and energy use while improving operational efficiency. The integration of AI in server infrastructure also supports autonomous decision-making, enabling data centers to handle complex tasks without human intervention, thereby creating lucrative opportunities for solution providers.

- For instance, HPE states InfoSight has saved customers over 1.5 million hours of lost productivity via predictive analytics.

Key Challenges

High Capital and Operational Costs

One of the major challenges in the Data Center Rack Server market is the high cost of deployment and maintenance. Building or upgrading data center infrastructure requires significant investment in hardware, cooling systems, and energy resources. Operational expenses rise further with growing power and space requirements. These costs can restrict adoption among small and mid-sized enterprises, limiting market penetration and reducing the pace of digital transformation in emerging economies.

Thermal Management and Power Efficiency Issues

Managing heat and power efficiency in high-density rack environments remains a major technical challenge. As data centers expand, servers generate more heat, increasing cooling demands and energy consumption. Inefficient thermal management can lead to hardware failures and reduced server life cycles. Manufacturers are working to improve airflow design, liquid cooling, and real-time monitoring systems, but balancing performance, energy efficiency, and cost continues to challenge large-scale data center operators.

Regional Analysis

North America

North America held the largest share of 38% in the Data Center Rack Server market in 2024. The dominance is driven by rapid cloud adoption, large hyperscale data centers, and investments by major technology companies such as Amazon, Google, and Microsoft. The U.S. leads the region with extensive digital infrastructure and growing demand for AI and edge computing. The rise in data-intensive industries and sustainability initiatives promoting energy-efficient data centers further supports market expansion across the region.

Europe

Europe accounted for 28% of the market share in 2024, supported by strong digital transformation initiatives and regulatory frameworks promoting green data centers. Countries such as Germany, the U.K., and France are major contributors, emphasizing data localization and sustainable IT infrastructure. Rising demand for advanced computing solutions in the banking, manufacturing, and government sectors continues to fuel regional growth. The increasing adoption of modular and energy-efficient rack servers further drives investment in data center modernization projects across Europe.

Asia-Pacific

Asia-Pacific captured 24% of the total market share in 2024, driven by rapid industrialization and rising cloud-based service adoption. China, Japan, India, and South Korea are leading markets, supported by strong investments in hyperscale and colocation facilities. Expanding digital ecosystems and 5G rollout are driving the need for high-performance and compact rack servers. The growth of local data center operators and government-backed digital initiatives continue to strengthen the region’s data infrastructure development.

Latin America

Latin America accounted for 6% of the global market share in 2024. The region is witnessing rising investments in data center construction, particularly in Brazil, Mexico, and Chile. Increasing cloud adoption by enterprises and the expansion of telecom infrastructure are key growth drivers. International players are entering the market through partnerships and colocation services. However, high energy costs and limited infrastructure remain key barriers to faster adoption of large-scale rack server deployments across the region.

Middle East and Africa

The Middle East and Africa represented 4% of the global market share in 2024. Growth is supported by government-led digital transformation programs and expansion of data centers in the UAE, Saudi Arabia, and South Africa. Rising demand for cloud computing, smart city projects, and AI-based applications are driving rack server installations. The emergence of new colocation facilities and investment from global providers is improving data infrastructure, although challenges such as high operational costs and limited connectivity persist.

Market Segmentations:

By Component

By Form Factor

By Data Center Size

- Small and mid-sized

- Enterprise

- Large

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Data Center Rack Server market is led by major players such as Hewlett Packard Enterprise (HPE), Lenovo, Super Micro Computer, Inc., Dell Technologies, IBM Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Fujitsu, Oracle Corporation, HP, and Inspur Technologies. The competitive environment is characterized by continuous innovation, with companies focusing on developing energy-efficient, high-density server systems to meet rising cloud and AI-driven workloads. Vendors are expanding their product portfolios through modular designs and advanced cooling solutions to enhance performance and sustainability. Strategic partnerships with cloud providers and hyperscale operators are strengthening market positioning. Moreover, players are investing in automation, AI-based server management, and hybrid architecture integration to optimize operations. Strong emphasis on customization, service flexibility, and rapid deployment capabilities helps maintain competitiveness in enterprise and colocation facilities. The ongoing shift toward edge computing and green data centers continues to shape competition, encouraging further product differentiation and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hewlett Packard Enterprise (HPE)

- Lenovo

- Super Micro Computer, Inc.

- Dell Technologies

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Cisco Systems

- Fujitsu

- Oracle Corporation

- HP

- Inspur Technologies

Recent Developments

- In 2025, Lenovo Provided new rack servers like the ThinkSystem SR630 V3, with updated Intel Xeon processors and EDSFF drive support for high-performance storage. Continued to improve its XClarity Controller (XCC) for enhanced management.

- In 2024, Hewlett Packard Enterprise (HPE) Partnered with NVIDIA to deliver turnkey AI private cloud solutions.

- In 2024, Supermicro launched its new X14 server portfolio, which includes AI, rackmount, multi-node, and edge systems based on Intel’s Xeon 6 processors with E-cores, and will later support P-cores

Report Coverage

The research report offers an in-depth analysis based on Component, Form Factor, Data Center Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising adoption of AI and machine learning workloads will drive demand for high-density rack servers.

- Expansion of hyperscale data centers will continue to fuel large-scale rack server deployments globally.

- Increasing edge computing applications will boost demand for compact and modular rack servers.

- Integration of liquid cooling systems will enhance energy efficiency and thermal management in data centers.

- Growing 5G infrastructure will create opportunities for localized data processing and rack server installations.

- Cloud service providers will continue investing in scalable rack architectures to support digital workloads.

- Sustainability goals will push development of low-power, energy-efficient server designs.

- AI-driven server management will improve predictive maintenance and reduce operational downtime.

- Rising colocation data centers will increase adoption of standardized and easily deployable rack systems.

- Strategic collaborations among hardware and cloud companies will accelerate product innovation and market expansion.