Market Overview

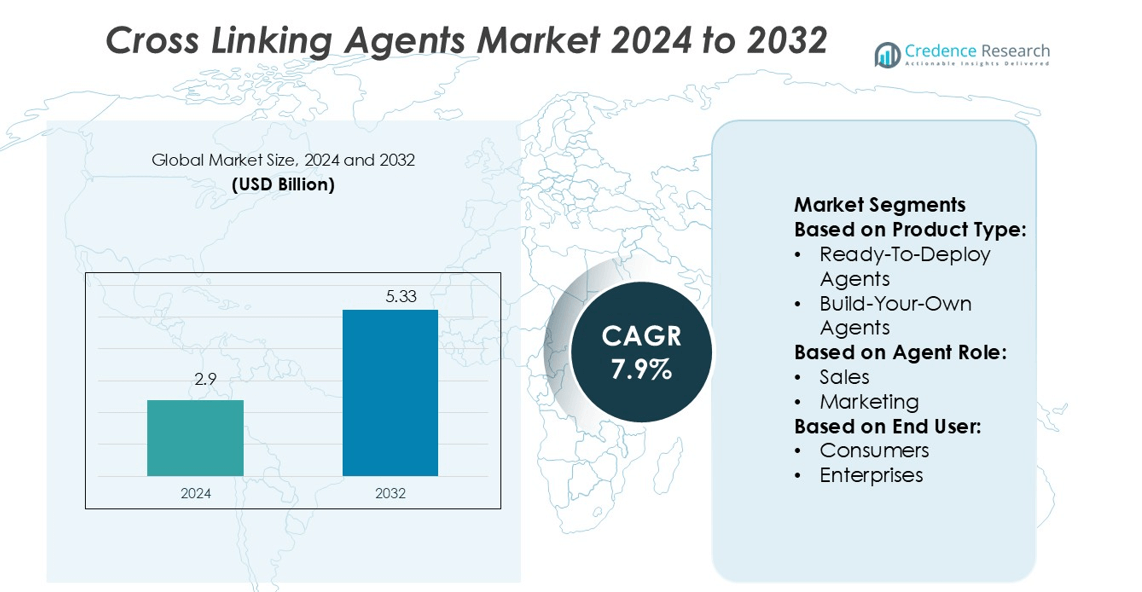

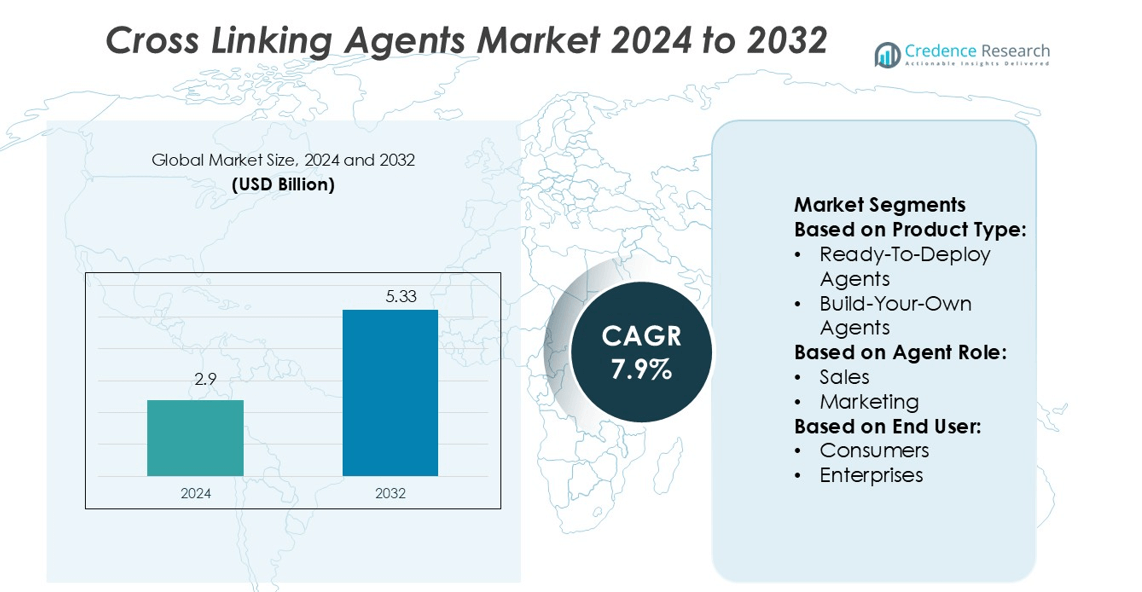

Cross Linking Agents Market size was valued USD 2.9 billion in 2024 and is anticipated to reach USD 5.33 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cross Linking Agents Market Size 2024 |

USD 2.9 billion |

| Cross Linking Agents Market, CAGR |

7.9% |

| Cross Linking Agents Market Size 2032 |

USD 5.33 billion |

The Cross Linking Agents Market is driven by major companies including Wacker Chemie AG, H.B Fuller Company, Huntsman Corporation, Arkema S.A., BASF SE, DIC Corporation, Eastman Chemical Company, Perstorp Holding AB, Dow Inc., and Evonik Industries AG. These players focus on product innovation, sustainable formulation development, and strategic partnerships to strengthen their global presence. Asia Pacific leads the market with a 34.5% share, supported by rapid industrialization, infrastructure expansion, and rising demand for advanced coating and adhesive solutions. Strong regional manufacturing capacity and favorable regulatory support further enhance competitiveness. This leadership positions the region as a key growth hub for future market expansion.Top of Form

Market Insights

- The Cross Linking Agents Market was valued at USD 2.9 billion in 2024 and is projected to reach USD 5.33 billion by 2032, growing at a CAGR of 7.9%.

- Strong demand from construction, automotive, and healthcare industries is driving product adoption, supported by a growing shift toward eco-friendly and low-VOC formulations.

- Product innovation and sustainable formulation development remain core strategies, with major players expanding through partnerships and capacity enhancements.

- High production costs and stringent environmental regulations act as key restraints, influencing pricing strategies and product development timelines.

- Asia Pacific leads with a 34.5% share, followed by North America and Europe, while coating and adhesive applications hold the largest segment share, supported by rapid infrastructure growth and rising manufacturing activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Ready-To-Deploy Agents dominate the segment with a 58.6% share. Their appeal lies in fast integration and low setup costs. Businesses prefer pre-built frameworks that reduce deployment time and maintenance efforts. These agents support scalable workflows without heavy technical investments, attracting both small and large enterprises. Build-Your-Own Agents hold a smaller share but grow steadily with customization demand. Their adoption is rising among tech-driven firms seeking advanced control. Increased developer tools and modular platforms are fueling this segment’s expansion.

- For instance, H.B. Fuller’s EV Therm 601 UV-curable coating can be applied at a minimum thickness of 150 µm and cures in under one minute with 1,000 mJ/cm² UV light.

By Agent Role

Productivity & Personal Assistants lead this segment with a 26.3% share. These agents enhance operational efficiency by automating routine tasks, improving scheduling, and managing workflows. Enterprises use them to streamline communications and reduce administrative costs. Customer Service & Support agents also gain strong traction as companies shift toward automated interaction models. Their ability to handle queries at scale drives cost savings and faster response times. Sales and Marketing agents are growing due to lead generation and campaign automation capabilities.

- For instance, Arkema’s MyArkema customer portal, launched in 2022, aggregates product documentation, order tracking, and support ticket handling. It makes doing business with Arkema easier for customers by providing quick, 24/7 access to information.

By End User

Enterprises dominate the end-user segment with a 63.7% share. Their focus on process automation, customer engagement, and cost optimization drives rapid adoption. BFSI and Telecommunications follow closely, leveraging these agents for secure transactions, fraud monitoring, and support automation. Government & Public Sector adoption is increasing for citizen services and data management. Healthcare & Life Sciences are also expanding usage in diagnostics support and patient engagement. Rising AI integration across manufacturing and media industries strengthens overall market demand.

Key Growth Drivers

Rising Demand in Coating and Adhesive Applications

Cross linking agents improve durability, heat resistance, and chemical stability in coatings and adhesives. The growing construction, automotive, and industrial sectors rely on these enhanced properties to meet performance standards. Companies use advanced epoxy, polyurethane, and silane-based systems to increase product lifespan and reduce maintenance costs. Demand for high-performance protective coatings in infrastructure projects and OEM manufacturing continues to grow. Regulatory standards promoting stronger, more sustainable materials further accelerate adoption, making this a key driver in market expansion.

- For instance, BASF’s Basonat® HW 2100 serves as a water-dilutable polyisocyanate cross-linker, used to create durable two-component (2K) polyurethane coatings for industrial and automotive applications. It is capable of curing at elevated temperatures to accelerate the process.

Expanding Use in Medical and Healthcare Products

The healthcare industry uses cross linking agents in biomaterials, wound dressings, drug delivery, and implant coatings. These agents enhance material biocompatibility and mechanical strength, ensuring safety and stability in medical applications. Rising investments in regenerative medicine and tissue engineering boost consumption. Medical device manufacturers adopt high-purity and low-toxicity agents to meet stringent FDA and EMA standards. The growing demand for advanced healthcare solutions is increasing production volumes, strengthening the position of cross linking agents in the medical sector.

- For instance, Eastman’s MXF portfolio materials show retention rates in disinfectant exposure tests (for example, ≥ 80 % retention for certain compositions after standard 4-step protocols).

Shift Toward Sustainable and Low-VOC Formulations

Environmental regulations are pushing manufacturers to develop low-VOC and eco-friendly formulations. Cross linking agents support the transition to waterborne and solvent-free coating systems, reducing harmful emissions. Green building projects and energy-efficient manufacturing amplify this demand. Companies invest in bio-based and non-toxic chemistries to align with global sustainability goals. This shift drives innovation in product development, improves environmental performance, and attracts customers seeking greener solutions, creating long-term growth momentum in the market.

Key Trends & Opportunities

Innovation in High-Performance and Multifunctional Systems

Manufacturers are developing multifunctional cross linking agents that offer improved flexibility, temperature resistance, and chemical durability. These advanced formulations are ideal for electronics, aerospace, and renewable energy applications. Hybrid technologies combining different chemistries enable faster curing and superior adhesion. Companies investing in R&D gain competitive advantages through product differentiation and performance improvements. This trend creates opportunities to serve demanding industries that need lightweight, durable, and sustainable material solutions.

- For instance, Perstorp’s collaboration with Intel’s Open IP Advanced Liquid Cooling uses its synthetic thermal management fluids (with Ester base chemistries) to support Gaudi 3 accelerators, balancing low viscosity and high flash point for immersion cooling.

Rising Penetration in 3D Printing and Advanced Manufacturing

The expansion of additive manufacturing creates new opportunities for cross linking agents. They enhance mechanical stability and structural integrity of 3D printed components. High-performance resins with adjustable crosslink density improve surface finish and heat resistance. Industries such as automotive, aerospace, and medical are integrating these materials into rapid prototyping and production. The growing adoption of 3D printing technologies expands application areas, boosting long-term market growth prospects.

- For instance, Dow’s SILASTIC™ 3D 3335 Liquid Silicone Rubber enables prototyping of LSR parts with physical and dynamic properties near injection-molded grades, reducing design-test cycles to days.

Growth in Asia Pacific and Emerging Markets

Industrialization and infrastructure expansion in China, India, and Southeast Asia are fueling demand. These regions adopt advanced coating systems and construction chemicals rapidly. Rising investments in manufacturing, energy, and healthcare sectors increase consumption. Local producers collaborate with global chemical companies to develop region-specific solutions. The strong economic base and policy support in emerging markets offer significant opportunities for market expansion.

Key Challenges

Regulatory Pressure on Chemical Emissions

Stringent environmental regulations restrict the use of VOCs and hazardous chemicals. Manufacturers face rising compliance costs to meet global standards such as REACH and EPA guidelines. Reformulating products with safer chemistries requires significant R&D investment. Smaller companies struggle to adapt due to cost and technical limitations. Non-compliance can lead to production delays, fines, and reduced market access, posing a key challenge for industry participants.

High Production Costs and Technical Complexity

Cross linking agents involve complex synthesis processes and high raw material costs. Developing high-performance and eco-friendly solutions requires advanced technology and skilled workforce. Price volatility of petrochemical feedstocks adds financial pressure. Manufacturers must balance product quality with cost efficiency to remain competitive. This technical and economic complexity can limit market entry for smaller players and slow innovation cycles.

Regional Analysis

North America

North America holds a 28.4% market share in the cross linking agents market. The region benefits from strong demand in construction, automotive coatings, and medical applications. The U.S. leads due to robust industrial activity, strict regulatory standards, and a well-developed manufacturing base. Advanced R&D in bio-based cross linking agents supports sustainability goals. Rising investments in infrastructure upgrades and aerospace further boost demand. High adoption of low-VOC and high-performance coatings in commercial and industrial projects positions North America as a key growth hub in the global market.

Europe

Europe accounts for 26.1% of the global cross linking agents market share. Germany, France, and the UK drive demand through their advanced automotive, chemical, and healthcare industries. Strong environmental regulations such as REACH encourage the adoption of low-emission and sustainable formulations. Growing investments in green construction and renewable energy support wider usage in protective coatings and adhesives. Technological advancements in multifunctional agents enhance market growth. Europe’s mature industrial base and commitment to sustainability position the region as a key contributor to product innovation and regulatory compliance leadership.

Asia Pacific

Asia Pacific dominates the market with a 34.5% share, driven by rapid industrialization and construction growth. China, India, Japan, and South Korea are major contributors, supported by expanding automotive and infrastructure sectors. Rising investments in manufacturing and green building projects fuel product adoption. Government incentives for low-VOC and waterborne coatings strengthen market penetration. Strong regional production capacity reduces costs, boosting competitiveness. Continuous technological upgrades and increasing demand from end-user industries make Asia Pacific the fastest-growing region in the cross linking agents market.

Latin America

Latin America represents a 6.3% market share, supported by infrastructure development and industrial expansion. Brazil and Mexico lead regional demand, particularly in construction and manufacturing coatings. Increasing foreign investments in industrial projects and renewable energy create new opportunities. The gradual shift toward sustainable chemical formulations aligns with regional environmental goals. However, limited local production capacity and dependency on imports influence pricing structures. With improving regulatory frameworks and growing economic activity, Latin America is emerging as a promising growth market for cross linking agents.

Middle East & Africa

The Middle East & Africa hold a 4.7% market share in the cross linking agents market. Growth is driven by rising construction activities, oil and gas infrastructure, and urban development projects in countries such as the UAE and Saudi Arabia. The shift toward modern building materials and protective coatings is increasing product consumption. Investments in industrial diversification and smart city initiatives further support market expansion. However, limited domestic production capacity and reliance on imports create cost challenges. Strategic collaborations with global chemical producers are expected to strengthen regional market presence.

Market Segmentations:

By Product Type:

- Ready-To-Deploy Agents

- Build-Your-Own Agents

By Agent Role:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cross Linking Agents Market is shaped by key players such as Wacker Chemie AG, H.B Fuller Company, Huntsman Corporation, Arkema S.A., BASF SE, DIC Corporation, Eastman Chemical Company, Perstorp Holding AB, Dow Inc., and Evonik Industries AG. The Cross Linking Agents Market is defined by strong innovation, strategic partnerships, and sustainability-driven initiatives. Companies focus on developing advanced, low-VOC formulations to meet tightening environmental regulations and shifting industry standards. Expanding production capacities and establishing efficient global supply chains strengthen their market positioning. Strategic collaborations help improve technological capabilities and broaden product portfolios. R&D investments emphasize performance enhancement, durability, and application versatility across industries such as automotive, construction, and healthcare. Regional expansion in high-growth markets, especially in Asia Pacific, supports cost efficiency and market penetration. This dynamic competition encourages continuous product innovation and market consolidation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wacker Chemie AG

- B Fuller Company

- Huntsman Corporation

- Arkema S.A.

- BASF SE

- DIC Corporation

- Eastman Chemical Company

- Perstorp Holding AB

- Dow Inc.

- Evonik Industries AG

Recent Developments

- In February 2025, GitHub introduced Agent Mode for GitHub Copilot, enhancing the AI-powered coding assistant’s ability to independently iterate on code, identify errors, and implement fixes. This upgrade allows Copilot to interpret high-level requests, generate code across multiple files, and debug its output with minimal human intervention.

- In September 2024, IBM Corporation partnered with Salesforce, inc., to offer AI agents and tools that organizations can implement in their own IT infrastructures, utilizing their specific data while maintaining rigorous oversight of their systems. Through the integration of Agentforce, Salesforce, Inc.’s collection of autonomous agents, with the functionalities from IBM Corporation’s WatsonX, businesses aim to empower customers by leveraging agents’ strength in their daily applications.

- In July 2024, BRYTER, an AI workflow automation provider, launched AI Agents, a new product suite, and major updates to its no-code platform. Utilizing specialized trained AI, BRYTER’s AI Agents assist law firms and legal departments in handling their tasks’ repetitive and laborious aspects

Report Coverage

The research report offers an in-depth analysis based on Type, Agent Role, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and low-VOC formulations will continue to grow across industries.

- Asia Pacific will remain the fastest-growing region, driven by industrial expansion.

- Advancements in multifunctional chemistries will enhance product performance and durability.

- Regulatory standards will push manufacturers toward sustainable production methods.

- Investments in R&D will increase to support innovation and application diversification.

- Adoption in healthcare and medical device applications will expand steadily.

- The construction sector will drive demand through infrastructure modernization projects.

- Strategic partnerships and mergers will strengthen global supply chains.

- Digitalization and smart manufacturing technologies will optimize production efficiency.

- Emerging markets will offer strong opportunities for capacity expansion and localization.