Market Overview

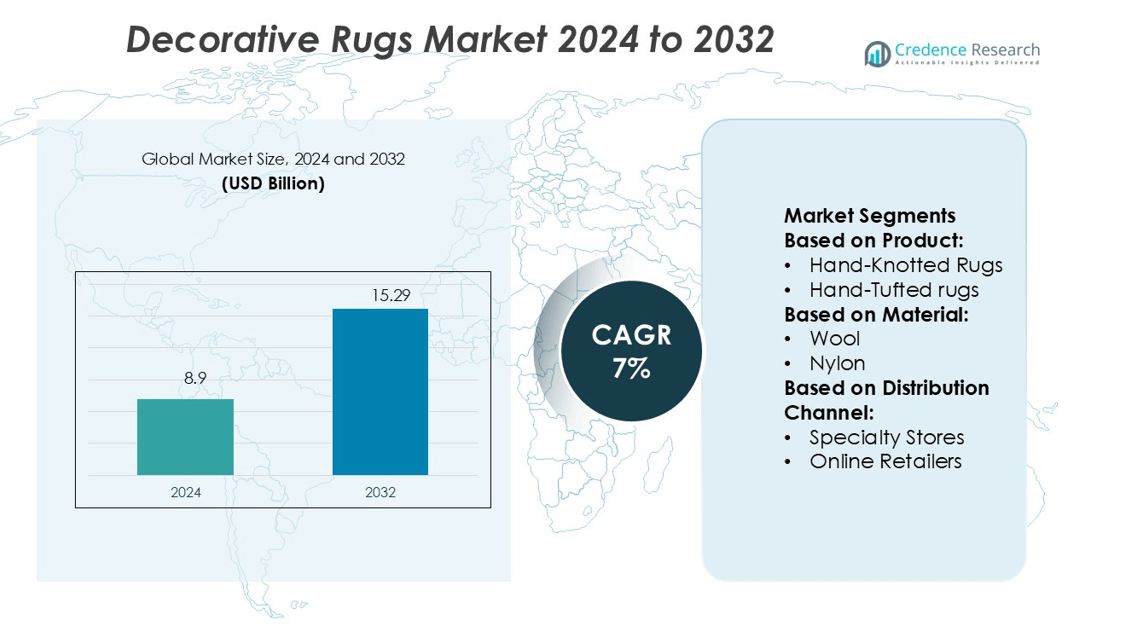

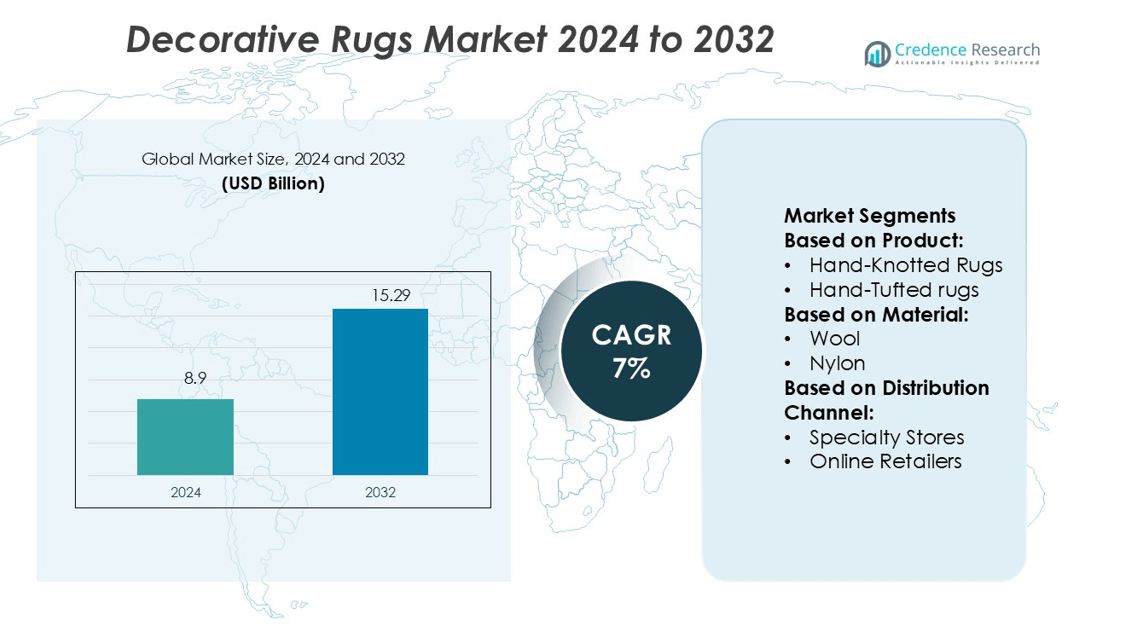

Decorative Rugs Market size was valued USD 8.9 billion in 2024 and is anticipated to reach USD 15.29 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decorative Rugs Market Size 2024 |

USD 8.9 billion |

| Decorative Rugs Market, CAGR |

7% |

| Decorative Rugs Market Size 2032 |

USD 15.29 billion |

The decorative rugs market is shaped by major players including Kalaty Rug Corp, Balta Group, Momeni Inc., Harounian Rugs International, Agnella, Loloi Inc., Milliken and Co, Mohawk Industries Inc, Capel Rugs, and Bukhara Oriental Rugs. These companies focus on premium product development, advanced weaving technologies, and sustainable materials to strengthen their market presence. Strategic partnerships with designers and online retail expansion enhance their global reach. North America leads the decorative rugs market with a 31.6% share, driven by strong consumer demand for luxury and eco-friendly home décor. High spending on home improvement, rapid e-commerce growth, and preference for artisanal craftsmanship further solidify the region’s leadership position.

Market Insights

- The Decorative Rugs Market was valued at USD 8.9 billion in 2024 and is expected to reach USD 15.29 billion by 2032, growing at a CAGR of 7%.

- Rising demand for premium and sustainable rugs is driving market growth, supported by increased consumer spending on home décor.

- Key players focus on advanced weaving technologies, eco-friendly materials, and strategic partnerships to strengthen their global position.

- High production costs and strong price competition among manufacturers remain major restraints for market expansion.

- North America leads with a 31.6% share, followed by Europe with 27.8%, while hand-knotted rugs hold the largest product segment share due to their premium quality and design appeal.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Hand-knotted rugs dominate the Decorative Rugs Market, holding a 32.7% share in 2024. These rugs are valued for their craftsmanship, durability, and luxury appeal. High demand comes from premium residential spaces, boutique hotels, and designer showrooms. Hand-tufted rugs follow closely, driven by lower prices and faster production cycles. Machine-made and flatweave rugs cater to mass consumers seeking affordable décor options. Growth in this segment is fueled by rising disposable incomes, evolving home décor trends, and growing demand for sustainable, artisan-made interior products.

- For instance, Momeni Inc. offers a New Moroccan line of hand-woven shag rugs made entirely of 100% New Zealand wool.The Momeni website has a product page dedicated to the “New Moroccan” collection.

By Material

Wool leads the market with a 29.8% share due to its softness, resilience, and eco-friendly properties. The material is popular for premium and mid-range rugs, especially in Europe and North America. Nylon and polyester follow, supported by their stain resistance and affordability. Cotton and jute are gaining traction among eco-conscious consumers for their natural look and sustainable sourcing. Increasing interior design investments, preference for organic materials, and rising interest in sustainable manufacturing practices are key growth drivers for wool-based rugs.

- For instance, Brintons, the parent company of Agnella, developed high-definition weaving technology that enables looms to use up to 32 colors per pass. This represents a significant advancement over earlier technology, which typically supported only 12 to 16 colors.

By Distribution Channel

Specialty stores dominate the segment with a 34.2% market share, driven by personalized service and a curated product mix. These stores offer design consultation and quality assurance, attracting mid- to high-income consumers. Online retail channels are growing rapidly due to improved logistics, wide product availability, and competitive pricing. Hypermarkets and wholesalers support bulk sales for commercial projects and exports. E-commerce expansion, enhanced digital visualization tools, and home delivery convenience are strengthening the market presence of online and specialty channels.

Key Growth Drivers

Rising Demand for Premium Home Décor Products

Consumers are increasingly investing in high-quality interior furnishings, boosting demand for decorative rugs. Premium rugs enhance aesthetics and offer durability, making them a preferred choice for modern homes and luxury spaces. Growing urbanization and rising disposable incomes further support this shift. The hospitality sector also contributes significantly, using premium rugs to elevate interior appeal. Hand-knotted and hand-tufted rugs are gaining popularity among design-conscious buyers. This preference for luxury and artisanal craftsmanship continues to drive market expansion across developed and emerging regions.

- For instance, Loloi Inc. offers the Magnolia Home x Loloi collection, which included new rug designs and matching throw pillows launched in 2024. The Charlie line within this collection is hand-loomed from 100% recycled post-consumer polyester, using repurposed plastic bottles.

Expansion of E-Commerce and Digital Retail Channels

E-commerce platforms have simplified rug selection, pricing comparison, and delivery, driving strong market growth. Consumers can access a wider product range online, including custom and imported designs, without visiting physical stores. Advanced visualization tools, AR applications, and improved logistics enhance the online shopping experience. Retailers are investing in digital platforms to reach a larger audience and expand sales. This rapid digitalization strengthens the distribution network, boosts cross-border trade, and enables small manufacturers to access global buyers efficiently.

- For instance, Capel Rugs now offers over 5,000 braided rug style-size-color combinations, making it the largest braided rug producer in the U.S. The company also manufactures flat-woven, machine-made, and custom fabric-bordered rugs at their North Carolina facility.

Rising Focus on Sustainable and Eco-Friendly Materials

Growing environmental awareness is pushing manufacturers to adopt eco-friendly materials such as wool, jute, and organic cotton. Consumers increasingly prefer rugs made using sustainable and ethically sourced fibers. Government regulations supporting green products further strengthen this demand. Manufacturers are investing in low-impact dyeing and energy-efficient production methods to meet sustainability goals. Premium segments are witnessing higher adoption of natural materials for their durability and aesthetics. This trend is boosting innovation in product design and supporting long-term market growth.

Key Trends & Opportunities

Technological Integration in Manufacturing

Rug manufacturers are adopting advanced weaving technologies to increase efficiency and precision. Automation and digital printing enable faster production while maintaining intricate designs. These technologies help reduce costs, minimize defects, and meet rising customization demand. Many companies are integrating 3D modeling and AR tools to offer virtual product previews. The trend supports both traditional craftsmanship and modern design flexibility. This balance between innovation and heritage is opening new opportunities in global premium and mass-market segments.

- For instance, Rug News reported that Momeni had officially opened a new 300,000-square-foot facility in Adairsville, Georgia, effectively doubling its previous warehouse space.

Growing Popularity of Artisanal and Handcrafted Rugs

Consumers increasingly value craftsmanship and uniqueness, fueling demand for artisanal rugs. Hand-knotted and hand-tufted designs are associated with quality, cultural heritage, and aesthetic appeal. Global luxury buyers seek exclusive, limited-edition pieces that reflect local artistry. Manufacturers are partnering with artisans to preserve traditional weaving techniques while expanding production capacity. This trend aligns with premium interior design movements and rising interest in sustainable, authentic home décor. The growing emphasis on storytelling through design is creating strong brand differentiation opportunities.

- For instance, Ruggable LLC utilizes a patented 2-piece rug system where the rug cover is fully machine-washable, detachable from the non-slip pad via their Cling Effect™ mechanism.

Rising Demand in Commercial Spaces

Hotels, offices, and retail outlets are using decorative rugs to create premium interiors and improve acoustic comfort. Custom-designed rugs are increasingly integrated into modern commercial architecture to enhance ambiance. Developers and interior designers are prioritizing durable, low-maintenance options suitable for high-traffic areas. This demand is driving large-scale installations of machine-made and hand-tufted rugs. As commercial construction projects expand globally, especially in Asia-Pacific and the Middle East, this segment presents significant growth potential for manufacturers and suppliers.

Key Challenges

High Production Costs and Pricing Pressure

The manufacturing of premium decorative rugs, especially hand-knotted varieties, involves high labor and material costs. Artisanal craftsmanship requires skilled weavers, making production slower and more expensive. At the same time, growing competition from machine-made alternatives creates pricing pressure. Many consumers prioritize affordability over heritage value, limiting premium market penetration. Rising raw material prices further intensify cost challenges. Balancing quality and competitive pricing remains a key challenge for manufacturers targeting both high-end and mid-range segments.

Intense Competition and Market Fragmentation

The decorative rugs market is highly fragmented, with numerous local and international brands competing for market share. Large manufacturers focus on automation and scale, while smaller players emphasize craftsmanship and niche designs. This fragmented structure creates pricing pressure and limits brand differentiation. Rapid expansion of online retail platforms intensifies competition, making customer retention more challenging. Companies must continuously innovate in design, sustainability, and service offerings to stay competitive in an evolving and crowded market landscape.

Regional Analysis

North America

North America holds a 31.6% share of the decorative rugs market, driven by strong demand for premium and sustainable home décor. The U.S. dominates the region due to high consumer spending on interior design and renovation projects. Rising popularity of artisanal and hand-knotted rugs supports the luxury segment, while machine-made rugs cater to mass consumers. E-commerce platforms such as Amazon and Wayfair play a key role in expanding product reach. Sustainable materials like wool and jute are gaining traction, aligning with eco-conscious preferences. Hospitality and commercial sectors further boost demand for durable, high-quality decorative rugs.

Europe

Europe accounts for a 27.8% share of the decorative rugs market, supported by strong design traditions and demand for high-quality craftsmanship. Countries such as Germany, France, and the UK lead in premium rug consumption. Consumers favor wool and flatweave rugs for their durability and timeless appeal. Strict environmental regulations also push manufacturers toward sustainable production methods. Online retail channels are expanding, enhancing access to artisanal and luxury rugs. The hospitality sector and residential remodeling trends continue to drive sales, with growing interest in culturally inspired and eco-friendly designs strengthening the region’s position in the global market.

Asia Pacific

Asia Pacific captures a 24.5% market share, emerging as a major production hub and a rapidly growing consumer base. India and China are leading exporters of hand-knotted and machine-made rugs, supplying to North America and Europe. Rising disposable incomes and urbanization are fueling strong domestic demand. E-commerce expansion and a growing middle-class population drive sales of affordable and mid-range rugs. Manufacturers in the region also benefit from lower production costs and skilled artisans. The shift toward sustainable materials and modern design trends supports further growth. Increasing investments in infrastructure and commercial spaces boost market penetration.

Latin America

Latin America holds a 9.2% share of the decorative rugs market, supported by growing interest in interior décor among urban consumers. Brazil and Mexico lead regional sales, driven by increasing housing development and rising disposable incomes. Demand is concentrated in affordable machine-made and flatweave rugs, though premium segments are slowly gaining traction. Online retail is expanding, improving product accessibility in emerging urban markets. Consumers increasingly prefer rugs with vibrant colors and cultural patterns. Local manufacturing and import activity are growing steadily, positioning the region as a rising market with significant long-term potential for international brands.

Middle East & Africa

The Middle East & Africa region accounts for a 6.9% market share, with growth driven by strong construction activity and luxury interior demand. Countries such as the UAE, Saudi Arabia, and South Africa are major contributors. High-end hand-knotted and hand-tufted rugs are popular in luxury residences, hotels, and cultural spaces. Urbanization and infrastructure development boost commercial installations. Consumers show increasing interest in Persian and artisanal designs that reflect heritage and exclusivity. Expanding retail networks and rising online shopping trends support wider product adoption, positioning the region as a promising market for premium decorative rug manufacturers.

Market Segmentations:

By Product:

- Hand-Knotted Rugs

- Hand-Tufted rugs

By Material:

By Distribution Channel:

- Specialty Stores

- Online Retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The decorative rugs market features prominent players such as Kalaty Rug Corp, Balta Group, Momeni Inc., Harounian Rugs International, Agnella, Loloi Inc., Milliken and Co, Mohawk Industries Inc, Capel Rugs, and Bukhara Oriental Rugs. The decorative rugs market is characterized by intense competition, with companies focusing on innovation, design, and sustainable production to strengthen their position. Manufacturers are investing in advanced weaving technologies and automation to improve efficiency, quality, and product variety. Strong emphasis is placed on eco-friendly materials and artisanal craftsmanship to meet growing consumer demand for premium home décor. E-commerce platforms are expanding market reach, allowing brands to connect directly with global customers. Strategic collaborations with designers and retailers help create exclusive collections and enhance brand identity. Customization, storytelling, and sustainable practices are emerging as key differentiators in this competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kalaty Rug Corp

- Balta Group

- Momeni Inc.

- Harounian Rugs International

- Agnella

- Loloi Inc.

- Milliken and Co

- Mohawk Industries Inc

- Capel Rugs

- Bukhara Oriental Rugs

Recent Developments

- In July 2025, Mohawk Industries launched Products reflecting Mohawk’s sustainable leadership include SolidTech® R, a high performance waterproof, PVC-free flooring. Designed for unconditioned spaces like three-season rooms, this sustainable flooring solution combines durability, water resistance, and eco-friendliness to meet growing demand for versatile, renewable options.

- In December 2024, Benuta, Europe’s largest online rug retailer, adopted Constructor’s AI-powered e-commerce platform to enhance and personalize shopping experiences. With over 20,000 products, the platform streamlines product discovery, saving time for both shoppers and merchandisers. It operates across European domains, offering localized, seamless, and engaging searches.

- In May 2024, FLOR announced the launch of new area rug styles designed to welcome the summer season. This release features a vibrant collection of customizable rugs that reflect the latest design trends while maintaining the brand’s commitment to sustainability.

- In November 2023, Oriental Weavers Group collaborated with a leading solar energy solutions provider, Amarenco Solarize, to power its factory in the Tenth of Ramadan area using solar energy. The goal of the 1.3 MWp solar power plant is to supply 80% of the factory’s energy needs, which will result in a yearly decrease of 2,300 tons of carbon emissions.

Report Coverage

The research reIn May 2024, FLOR announced the launch of new area rug styles designed to welcome the summer season. This release features a vibrant collection of customizable rugs that reflect the latest design trends while maintaining the brand’s commitment to sustainability.port offers an in-depth analysis based on Product, Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and eco-friendly rugs will continue to rise across major markets.

- Manufacturers will increasingly adopt automation and digital weaving technologies.

- Online retail platforms will become a dominant distribution channel for decorative rugs.

- Premium and artisanal rug segments will experience steady expansion.

- Customization and limited-edition designs will gain higher consumer preference.

- Strategic collaborations with designers will strengthen brand positioning.

- Commercial and hospitality sectors will drive large-scale rug installations.

- Regional production hubs will expand to support global supply chains.

- Smart visualization tools will enhance customer buying experiences online.

- Companies will focus on building strong sustainability and circular economy strategies.