Market Overview

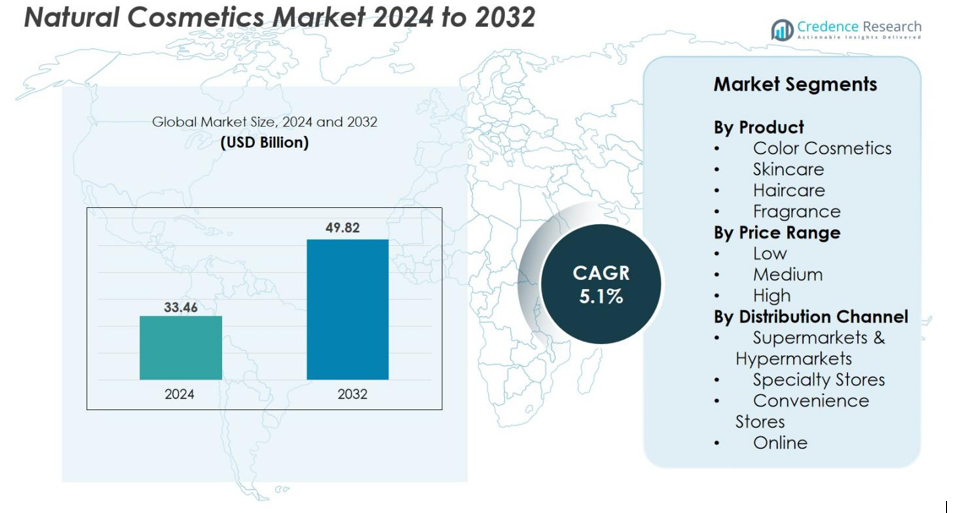

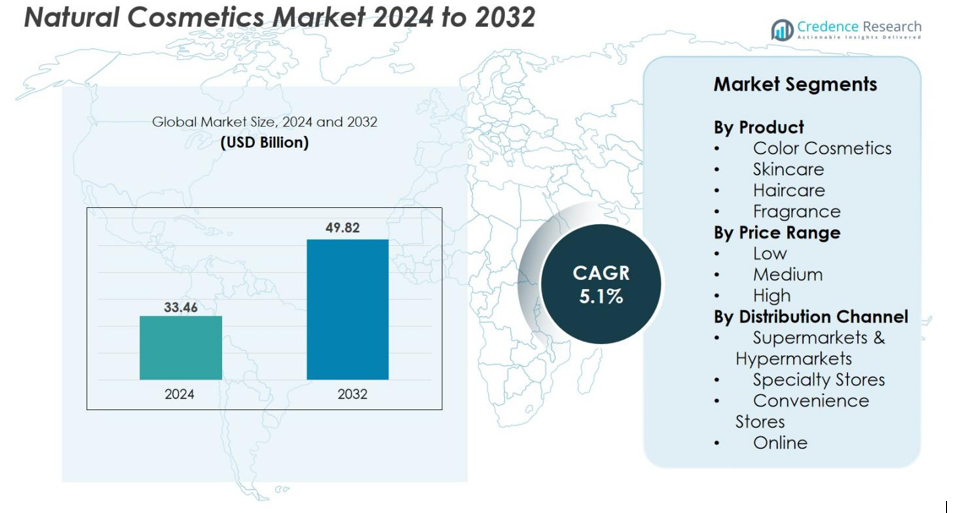

Natural Cosmetics market size was valued at USD 33.46 Billion in 2024 and is anticipated to reach USD 49.82 Billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Cosmetics market Size 2024 |

USD 33.46 Billion |

| Natural Cosmetics market, CAGR |

5.1% |

| Natural Cosmetics market Size 2032 |

USD 49.82 Billion |

The Natural Cosmetics market is shaped by prominent players such as L’Oréal S.A., Coty Inc., Avon Products Inc., Weleda, Burt’s Bees, Bare Escentuals Beauty Inc., 100% PURE, KORRES S.A., AVEENO, and Arbonne International LLC, all competing through clean formulations, botanical ingredients, and sustainability-led product innovation. These companies strengthen their positions through transparent sourcing, eco-friendly packaging, and expanded digital distribution. North America leads the market with a 31% share, driven by strong consumer preference for organic and chemical-free beauty products, followed closely by Europe at 29%, supported by strict regulatory standards and a well-established natural beauty culture.

Market Insights

- The Natural Cosmetics market reached USD 33.46 Billion in 2024 and is projected to hit USD 49.82 Billion by 2032, expanding at a 5.1% CAGR during the forecast period.

- Rising consumer demand for clean, chemical-free, and eco-friendly beauty products drives market growth, with strong uptake in skincare, which leads the product segment with a 42% share due to its widespread daily-use applications.

- Key trends include increasing adoption of vegan, organic, and ethically sourced formulations, along with biotechnology-enabled natural ingredients that enhance product performance and safety.

- The competitive landscape features major players such as L’Oréal S.A., Coty Inc., Weleda, Burt’s Bees, Bare Escentuals, and AVEENO, all investing in sustainable packaging, transparent sourcing, and dermatology-backed natural formulations.

- Regionally, North America leads with 31% share, followed by Europe at 29% and Asia-Pacific at 28%, driven by strong retail expansion, high beauty awareness, and increasing preference for natural skincare and haircare solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

The Natural Cosmetics market by product is dominated by Skincare, capturing 42% share in 2024, driven by growing consumer preference for clean formulations, botanical extracts, and chemical-free daily care routines. Rising awareness of skin sensitivity, anti-aging needs, and the demand for plant-based moisturizers, serums, and sunscreens further strengthens this segment. Color cosmetics and haircare continue to expand as brands introduce vegan, toxin-free ingredients. Fragrance products are gaining momentum through essential-oil-based alternatives, yet their adoption remains moderate compared to the broader trust and routine reliance associated with natural skincare.

- For instance, Weleda reported that in 2024 it recorded a total turnover of €456.2 million, and its Natural Cosmetics business unit recorded sales of €367.9 million.

By Price Range

The Medium price range segment leads the Natural Cosmetics market, accounting for 51% share in 2024, supported by its balance of affordability and premium-grade natural ingredients. Consumers increasingly choose mid-range brands offering certified organic components, cruelty-free labeling, and clinically tested formulas at accessible prices. While low-price products attract budget-conscious buyers, limited ingredient purity slows their penetration. High-price natural beauty items gain traction among luxury-driven consumers, especially for anti-aging and specialty treatments, but remain niche due to higher cost and restricted availability across mass-market channels.

- For instance, Melvita states that it “now has a range of over 400 products” in its natural/organic line.

By Distribution Channel

Supermarkets & Hypermarkets dominate the distribution landscape, holding 38% share in 2024, driven by their extensive product variety, strong shelf visibility, and consumer trust in established retail environments. These stores benefit from impulse purchases and promotional displays that attract a broad customer base. Specialty stores continue to grow as they offer curated natural beauty assortments, expert guidance, and premium brands. Convenience stores maintain steady but slower adoption, limited by smaller assortments. Online channels are expanding rapidly due to digital engagement, subscription models, and rising preference for home delivery, yet remain secondary to physical retail presence.

Key Growth Drivers

Rising Consumer Demand for Clean and Sustainable Beauty

The global shift toward clean, eco-friendly, and toxin-free beauty products acts as a major growth driver for the Natural Cosmetics market. Consumers increasingly prioritize formulations free from parabens, sulfates, artificial fragrances, and synthetic chemicals, enhancing trust in natural alternatives. Growing concerns about long-term health effects of chemical-based cosmetics accelerate the use of plant extracts, essential oils, and organic active ingredients. Sustainability expectations further boost the demand for biodegradable packaging, cruelty-free certifications, and ethically sourced raw materials. Millennials and Gen Z lead this transformation, valuing ingredient transparency and environmental responsibility. The influence of social media and beauty influencers amplifies awareness, encouraging consumers to seek safe, naturally derived skincare and haircare products for daily routines. Additionally, rising incidences of skin allergies and irritations linked to synthetic cosmetics strengthen the preference for gentler, dermatologically tested natural formulations. These evolving consumer priorities collectively propel consistent market expansion.

- For instance, L’Oréal’s Garnier brand achieved Global Cruelty-Free certification from Cruelty Free International after completing a review involving over 2,300 raw materials and 500 suppliers.

Expansion of Dermatology-Backed and Functional Natural Products

The increasing availability of dermatology-tested, microbiome-friendly, and clinically validated natural cosmetic products significantly boosts market growth. Consumers are more confident purchasing natural alternatives when brands emphasize scientific backing, efficacy data, and high-performance outcomes comparable to synthetic-based formulations. Advanced extraction techniques—such as cold-pressing, CO₂ extraction, and fermentation—enhance the potency and stability of botanical actives, supporting wider applications in anti-aging, pigmentation control, and sensitive skin care. Functional natural ingredients like niacinamide from plant sources, bio-retinol, antioxidants, peptides derived from natural proteins, and marine botanicals expand innovation pipelines. Beauty-conscious consumers in premium and mid-range categories increasingly seek natural products that deliver visible results without compromising safety. Healthcare professionals and dermatologists recommending natural and hypoallergenic solutions further accelerate consumer adoption. This blend of scientific credibility, proven benefits, and clean-label positioning forms a strong foundation for sustained market growth.

- For instance, in a multi-center clinical study of a plant-adaptogen serum published in 2024, 53 participants aged 45-65 saw a 50 % mean improvement in erythema, 44 % mean improvement in skin dullness, 52 % mean improvement in skin roughness/texture, and sebum levels reduced by 38 % after 12 weeks of twice-daily application.

Retail Expansion and Digital Transformation Across Beauty Ecosystems

Widespread retail expansion and digital transformation across the beauty sector serve as essential growth enablers for the Natural Cosmetics market. Supermarkets, hypermarkets, and specialty beauty chains continue to broaden their natural product portfolios, improving accessibility and consumer awareness. Enhanced in-store product placement, sampling initiatives, and ingredient-focused shelf communication drive conversion rates. Simultaneously, rapid digitalization accelerates online visibility through e-commerce platforms, social commerce, influencer partnerships, and educational content highlighting natural ingredient benefits. Subscription-based beauty boxes, AI-enabled skin assessments, and personalized product recommendations increase consumer engagement. Cross-border e-commerce also plays a major role, allowing natural beauty brands to reach global audiences without significant retail infrastructure investment. Eco-conscious consumers value transparent online information, such as ingredient lists and certification details. Combined, these omnichannel developments create a seamless purchasing environment that fosters higher adoption, repeat buying, and rapid brand scaling.

Key Trends & Opportunities

Surge in Organic, Vegan, and Ethical Beauty Positioning

A key trend in the Natural Cosmetics market is the rapid rise of organic, vegan, cruelty-free, and ethically positioned beauty products. Consumers increasingly evaluate brands on their environmental and ethical values, prioritizing products with certified organic ingredients, vegan formulations free of animal-derived compounds, and verified cruelty-free testing. This shift presents significant opportunities for manufacturers to differentiate through transparency, third-party certifications, and responsible sourcing practices. Brands embracing fair-trade botanicals, recycled packaging materials, and carbon-neutral manufacturing benefit from stronger brand loyalty. The popularity of plant-based lifestyles and growing alignment with sustainability movements further expand the demand for vegan cosmetics. Ethical positioning is also amplified through digital storytelling, where brands communicate their environmental impact reduction, community empowerment programs, and ingredient purity. As consumer expectations evolve, ethical beauty offerings become powerful engines for premiumization, market penetration, and competitive brand value.

- For instance, the Body Shop has provided sustainable livelihoods for more than 600 women from 11 villages in northern Ghana who hand-craft shea butter, supporting a wider community of approximately 49,000 people through its ethical supply chain initiatives

Advancements in Biotechnology and Bio-Active Ingredient Innovation

Biotechnology-based ingredient development is emerging as a major opportunity, enabling natural cosmetic brands to create cleaner, more stable, and highly effective products. Innovations such as bio-fermentation, cellular agriculture, and enzyme engineering allow formulators to produce high-quality natural actives like hyaluronic acid, botanical peptides, antioxidants, and bio-identical vitamins without relying on limited plant sources. These biotech-derived ingredients offer greater purity, consistency, and performance, appealing to consumers seeking natural products with strong efficacy claims. Startups and major beauty companies are increasingly investing in lab-grown botanicals and microbial fermentation technologies to reduce resource dependency and improve sustainability. This trend also supports personalized skin and hair solutions, where bio-actives can be tailored to specific concerns. As biotechnology accelerates the availability of premium natural ingredients, brands gain new opportunities to launch high-performance, science-forward natural cosmetics that bridge the gap between nature and advanced dermatology.

- For instance, Evonik commissioned a biotechnology facility in Slovakia designed for large-scale fermentation of rhamnolipids, which features a total fermentation volume of 1,150 m³ (1,150,000 liters).

Key Challenges

High Ingredient Costs and Supply Chain Limitations

Despite strong demand, the Natural Cosmetics market faces significant challenges due to high ingredient costs and supply chain vulnerabilities. Natural plant extracts, essential oils, and organic raw materials often require intensive farming, seasonal harvesting, and environmentally controlled processing, leading to higher production expenses. Fluctuations in crop yields, geographic limitations, and climate-related disruptions affect the availability and pricing of key botanicals. Many brands also struggle with ensuring consistent quality, purity, and sustainability compliance across global suppliers. Certification processes for organic and eco-friendly labels add additional cost and regulatory burden. These constraints make it difficult for brands—especially small and mid-sized players—to maintain competitive pricing while preserving ingredient authenticity. As a result, scaling natural cosmetic formulations profitably remains a core challenge, influencing product affordability and market penetration in cost-sensitive regions.

Formulation Stability, Preservation, and Regulatory Compliance

Formulating stable natural cosmetics without synthetic preservatives, binders, and stabilizers remains a significant challenge for manufacturers. Natural ingredients have shorter shelf lives, increased susceptibility to microbial contamination, and greater sensitivity to temperature and light exposure. Developing preservative systems that balance safety, performance, and regulatory compliance is complex and costly. Additionally, varying global regulatory frameworks for natural claims, organic certifications, labeling standards, and ingredient restrictions create operational hurdles for multinational brands. Misleading natural claims, known as “greenwashing,” also increase industry scrutiny, forcing brands to invest heavily in transparency and compliance documentation. Ensuring product stability, safety, and global regulatory acceptance while maintaining natural integrity remains one of the most difficult obstacles for manufacturers, often slowing product launches and increasing development costs.

Regional Analysis

North America

North America holds 31% share of the Natural Cosmetics market in 2024, driven by strong consumer awareness of clean beauty, high spending on premium natural skincare, and widespread availability across specialty retailers and online channels. The region benefits from advanced product innovation, strict regulatory standards, and rising demand for organic, vegan, and cruelty-free cosmetics. Brands leverage influencer marketing and dermatology-backed formulations to strengthen adoption. The U.S. remains the dominant contributor due to robust retail penetration, while Canada shows strong growth supported by increasing preference for sustainable packaging and ethically sourced botanical ingredients.

Europe

Europe accounts for 29% share of the Natural Cosmetics market, supported by stringent cosmetic regulations, strong sustainability commitments, and high consumer trust in certified organic products. Countries such as Germany, France, and the U.K. exhibit strong inclination toward eco-friendly personal care, fueling consistent market expansion. The region benefits from mature specialty retail ecosystems and high adoption of natural skincare and haircare products. Growing preference for plant-based formulations and demand for transparency in ingredient sourcing further support market development. Additionally, European consumers’ sensitivity toward chemical additives strengthens the shift toward clean-label cosmetics across premium and mid-range segments.

Asia-Pacific

Asia-Pacific leads global growth momentum with 28% share, driven by expanding middle-class spending, rising beauty consciousness, and strong demand for herbal and plant-based cosmetic solutions. Countries like China, Japan, South Korea, and India significantly contribute due to established beauty cultures and rapid product innovation. The region benefits from large-scale manufacturing, competitive pricing, and increasing penetration of e-commerce platforms that promote natural beauty brands. Growing awareness of skin health, pollution-related concerns, and preference for traditional botanical ingredients accelerate adoption. International and domestic brands leverage K-beauty and J-beauty trends to strengthen the appeal of natural skincare and cosmetic products.

Latin America

Latin America holds 7% share of the Natural Cosmetics market, supported by expanding urban populations, rising awareness of sustainable beauty products, and strong cultural affinity for natural and plant-based ingredients. Brazil and Mexico lead regional consumption due to increasing product availability across pharmacies, specialty stores, and online channels. Economic improvements and growing preference for chemical-free skincare and haircare foster market growth. Local brands emphasize biodiversity-driven formulations using regional botanicals, helping differentiate offerings. However, affordability and limited distribution in rural markets remain challenges, although expanding e-commerce platforms are improving accessibility and supporting future adoption.

Middle East & Africa

The Middle East & Africa region captures 5% share, driven by growing interest in herbal, organic, and luxury natural cosmetic products. Increased awareness of skin sensitivity, climatic skincare needs, and influence of global beauty trends contribute to rising demand. The UAE and Saudi Arabia dominate due to strong retail infrastructure, high purchasing power, and preference for premium natural skincare and fragrance products. African markets, led by South Africa and Nigeria, show rising adoption supported by expanding middle-class populations and growing use of traditional botanical ingredients. Despite progress, limited product availability and price sensitivity temper faster market acceleration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Product

- Color Cosmetics

- Skincare

- Haircare

- Fragrance

By Price Range

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Natural Cosmetics market is characterized by a mix of multinational beauty corporations and specialized natural-focused brands competing through innovation, ingredient transparency, and sustainability-driven strategies. Leading players such as L’Oréal S.A., Coty Inc., Avon Products Inc., Weleda, Burt’s Bees, 100% PURE, KORRES S.A., Bare Escentuals Beauty Inc., AVEENO, and Arbonne International LLC strengthen their market presence through clean-label formulations, botanical-based actives, and eco-friendly packaging initiatives. Companies increasingly invest in dermatology-backed research, microbiome-friendly ingredients, and plant-derived alternatives to synthetic chemicals to enhance product efficacy. Strategic expansions through acquisitions, partnerships with organic ingredient suppliers, and entry into emerging markets further reinforce competitiveness. Digital transformation, including influencer collaborations, online exclusives, and personalized beauty solutions, enables brands to target younger consumer demographics. As regulatory scrutiny intensifies, companies emphasize certification compliance and transparent sourcing to build trust. Overall, competition centers on innovation, sustainability, and performance-driven natural formulations.

Key Player Analysis

- Weleda

- Coty Inc

- KORRES S.A.

- Bare Escentuals Beauty Inc

- ARBONNE INTERNATIONAL, LLC

- Burt’s Bees

- L’Oréal S.A

- 100% PURE

- AVEENO

- Avon Products, Inc

Recent Developments

- In October 2025, Kering and L’Oréal signed a long-term strategic partnership covering luxury beauty and wellness.

- In April 2025, Unilever officially announced the acquisition of Wild, a UK-based refillable personal care brand. The acquisition is part of Unilever’s strategy to expand its portfolio with premium, high-growth, and sustainable brands.

Report Coverage

The research report offers an in-depth analysis based on Product, Price Range, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as consumers increasingly prefer clean, plant-based, and chemical-free beauty formulations.

- Brands will accelerate innovation using biotechnology, fermentation, and lab-grown botanicals to enhance product performance.

- Demand for vegan, cruelty-free, and ethically certified cosmetics will strengthen as sustainability expectations rise.

- Personalization technologies will gain momentum, offering ingredient-based beauty solutions tailored to individual skin and hair needs.

- Digital channels and social commerce will expand, driving higher engagement and global accessibility for natural beauty brands.

- Premium natural skincare and anti-aging solutions will grow rapidly as consumers seek safer yet effective alternatives.

- Companies will invest more in eco-friendly packaging and circular beauty initiatives to reduce environmental impact.

- Regulatory standards will become more stringent, pushing brands toward greater transparency and clean-label compliance.

- Emerging markets in Asia-Pacific, Latin America, and Africa will experience faster adoption due to rising beauty awareness.

- Strategic mergers, partnerships, and acquisitions will increase as companies expand portfolios and strengthen competitive positions.