Market Overview

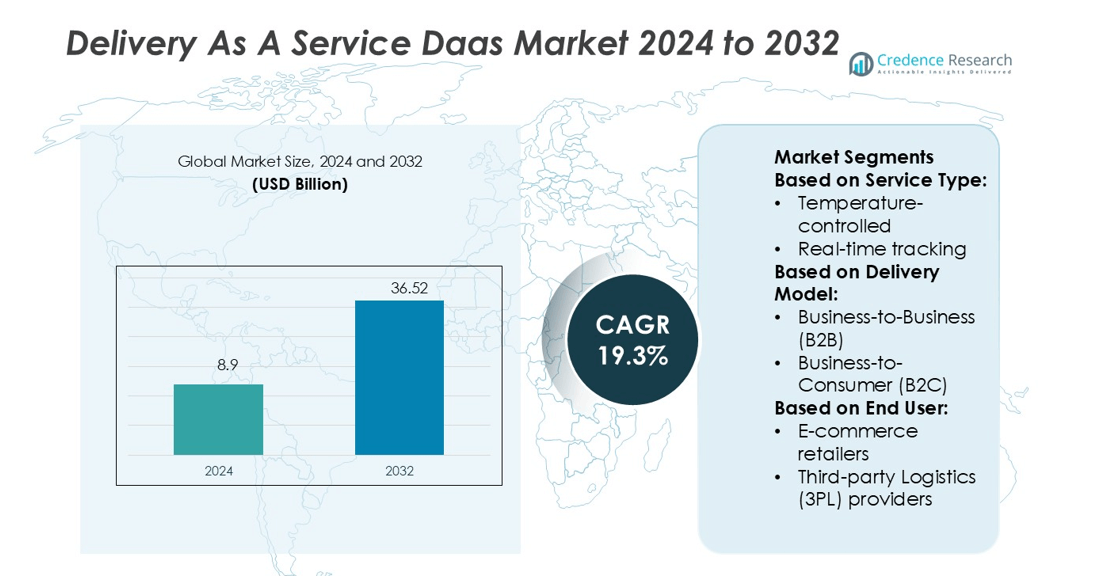

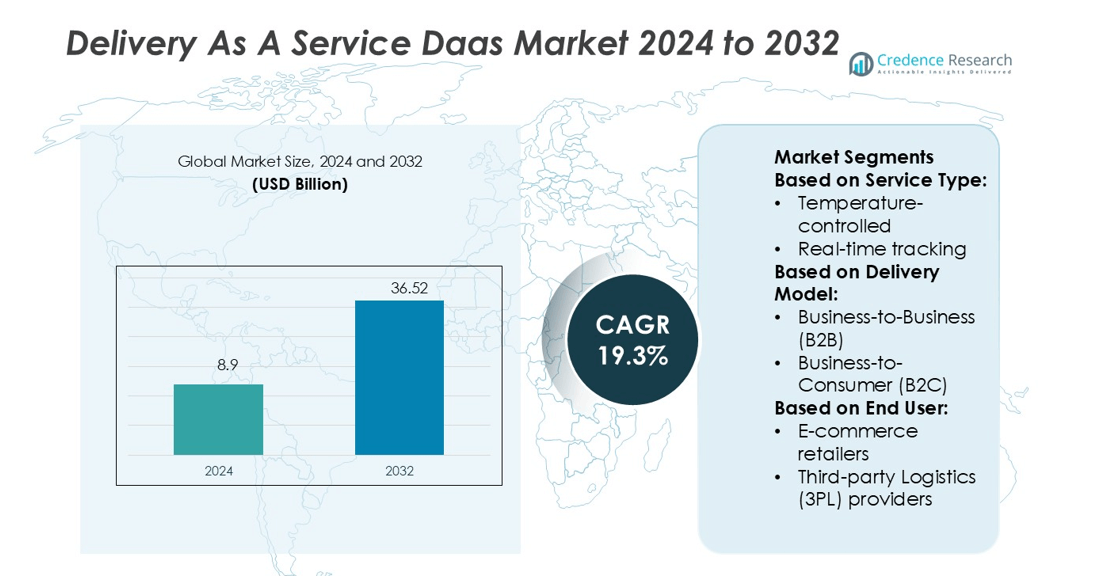

Delivery As A Service Daas Market size was valued USD 8.9 billion in 2024 and is anticipated to reach USD 36.52 billion by 2032, at a CAGR of 19.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Delivery As A Service (DaaS) Market Size 2024 |

USD 8.9 billion |

| Delivery As A Service (DaaS) Market, CAGR |

19.3% |

| Delivery As A Service (DaaS) Market Size 2032 |

USD 36.52 billion |

The Delivery as a Service (DaaS) market is driven by key players such as AT&T Inc., Cisco Systems Inc., Palo Alto, Akamai, Verizon Communications Inc., Megaport, Synnex Corporation, DXC Technology Company, Cloudflare, and Amdocs. These companies focus on expanding logistics capabilities through advanced connectivity, cloud infrastructure, and AI-powered delivery solutions. Strategic investments in automation, route optimization, and secure platforms strengthen their market positions. North America leads the global DaaS market with a 34% share, supported by strong e-commerce adoption, mature logistics infrastructure, and early technology integration. This regional dominance is expected to continue as demand for express and contactless delivery solutions rises.

Market Insights

- The Delivery as a Service (DaaS) market was valued at USD 8.9 billion in 2024 and is projected to reach USD 36.52 billion by 2032, registering a CAGR of 19.3%.

- Strong e-commerce expansion, increasing demand for express delivery, and advanced tracking technologies are driving market growth globally.

- The market is witnessing rapid adoption of AI, automation, and sustainable delivery solutions, shaping future trends and service innovation.

- Key players are investing in route optimization, secure platforms, and cloud infrastructure to strengthen their competitive edge.

- North America leads the market with a 34% share, supported by strong logistics infrastructure, while temperature-controlled services hold the largest segment share due to rising demand from food, pharmaceutical, and retail sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

Temperature-controlled services lead this segment with 26% market share. Demand is driven by the rise in perishable goods, pharmaceuticals, and fresh food delivery. Companies use advanced refrigeration systems and insulated packaging to maintain quality during transit. Real-time tracking services are expanding rapidly as businesses seek better visibility and control over shipments. Signature confirmation and insurance services build trust and accountability. Contactless and express delivery models are also growing due to increased customer expectations for speed and safety. Flexible return and exchange services enhance consumer satisfaction and loyalty.

- For instance, Cisco’s Catalyst 9000 series switches are deployed in retail and other enterprise edge networks and are capable of providing segmentation and advanced telemetry. This enables real-time traffic management for critical services.

By Delivery Model

Business-to-Consumer (B2C) delivery dominates this segment with 45% market share. E-commerce expansion, faster checkout experiences, and customer expectations for same-day or next-day delivery drive growth. B2C models benefit from widespread digital platforms and optimized route planning. Business-to-Business (B2B) delivery is also strong in industrial supply chains and retail replenishment. Consumer-to-Consumer (C2C) delivery is growing with peer-to-peer marketplaces and online resale platforms. Companies invest in digital logistics networks to ensure speed, cost efficiency, and better customer communication across models.

- For instance, Palo Alto Networks’ Strata platform handled 30.9 billion inline threat detections per day, securing e-commerce systems and protecting transaction flows.

By End User

E-commerce retailers hold the largest share of 38% in this segment. Rapid online retail expansion, seasonal sales events, and customer demand for flexible delivery options fuel this dominance. Third-party logistics (3PL) providers are key enablers, managing high delivery volumes through smart warehousing and route optimization. Local delivery fleets and shipping partners support last-mile connectivity in urban areas. Restaurants and food delivery services benefit from rising demand for quick and temperature-sensitive deliveries. Manufacturers and individual consumers also contribute to steady market growth through bulk and peer-to-peer shipments.

Key Growth Drivers

Rapid Expansion of E-Commerce Platforms

The surge in e-commerce activities is a major driver for the DaaS market. Retailers and marketplaces depend on fast, flexible delivery services to meet customer expectations. The growing preference for same-day and next-day deliveries is pushing logistics providers to enhance speed and efficiency. Strategic collaborations with delivery platforms allow retailers to scale operations without heavy investments. Rising online sales in fashion, electronics, groceries, and pharmaceuticals are fueling steady growth. This shift is strengthening the role of DaaS providers in ensuring seamless last-mile connectivity.

- For instance, Verizon reported that over 70% of its sites are now covered by C-Band spectrum. It also covers more than 99% of the U.S. population with 4G LTE.

Rising Adoption of Real-Time Tracking Technologies

The increasing use of real-time tracking is boosting demand for DaaS solutions. Businesses value end-to-end shipment visibility to enhance control and reduce operational risks. GPS-enabled platforms, IoT devices, and cloud-based dashboards improve route planning and delivery accuracy. These technologies enable customers to track orders and receive instant updates, increasing satisfaction and trust. Companies offering transparent tracking systems gain a competitive advantage in securing high-volume contracts. This trend aligns with the broader shift toward data-driven logistics and predictive delivery capabilities.

- For instance, Megaport’s network supports over 9,000 Gbps of private Virtual Cross Connect (VXC) capacity, with data-intensive industries such as logistics, energy, and finance driving this growth by channeling IoT and other tracking traffic internally.

Growth in On-Demand and Express Delivery Services

Consumer preference for speed and convenience is driving on-demand delivery growth. Urban customers expect deliveries within hours, particularly for groceries, food, and personal goods. DaaS providers are expanding express networks to meet this demand through optimized routing and dedicated fleet systems. Retailers and restaurants leverage these services to enhance customer experience and retain market share. The ability to offer reliable, time-sensitive deliveries gives businesses a clear competitive edge. This growing demand for rapid fulfillment is pushing continuous investments in fleet expansion and automation.

Key Trends & Opportunities

Integration of AI and Automation in Delivery Operations

AI and automation are transforming how DaaS platforms operate. Companies use AI for dynamic route optimization, demand forecasting, and real-time decision-making. Automation through drones, autonomous vehicles, and smart lockers is improving efficiency and reducing delivery costs. These advancements enable providers to handle high volumes with greater accuracy and speed. Investments in AI-based systems also support sustainability by minimizing idle time and fuel consumption. As adoption grows, tech-enabled delivery models will create new revenue opportunities for logistics and retail partners.

- For instance, TD Synnex launched an AI Infrastructure-as-a-Service (AI IaaS) offering that gives partners access to NVIDIA HGX B200 systems, enabling GPU-accelerated training and inference workloads with provisioning in hours.

Expansion of Sustainable and Green Delivery Solutions

Sustainability is becoming a key focus in the DaaS market. Companies are adopting electric vehicles, cargo bikes, and eco-friendly packaging to reduce emissions. Governments and cities are supporting green logistics through incentives and infrastructure. Consumers increasingly prefer brands with lower environmental impact, pushing retailers to adopt cleaner delivery options. This trend aligns with global net-zero goals and corporate ESG commitments. Providers who integrate sustainable practices into their delivery operations can strengthen brand image and attract environmentally conscious customers.

- For instance, Cloudflare was the fastest network in 48% of the top 1,000 “eyeball” networks, as measured by the 95% TCP connection time, in the period.

Growth of Cross-Border and Omnichannel Delivery Models

Cross-border e-commerce growth is expanding DaaS opportunities worldwide. Retailers seek logistics partners that can manage customs, taxes, and multi-region delivery networks. Omnichannel delivery strategies allow businesses to fulfill orders from multiple touchpoints, including stores and warehouses. This flexibility improves inventory management and shortens delivery times. Global platforms are investing in integrated supply chain technologies to support fast international shipping. The rising demand for seamless cross-border fulfillment is driving innovation in platform connectivity and partner collaborations.

Key Challenges

High Operational Costs and Pricing Pressures

Rising fuel prices, labor costs, and fleet maintenance expenses increase operational burdens for DaaS providers. Competitive pricing pressures from major logistics players make it difficult to maintain healthy profit margins. Many small and mid-sized delivery companies struggle to match the speed and cost efficiency of global giants. Seasonal demand fluctuations further affect cost predictability. Managing these expenses while maintaining service quality remains a significant challenge. Companies must adopt cost-optimization strategies, including automation and smart route planning, to stay competitive.

Infrastructure and Regulatory Barriers

Inconsistent infrastructure and strict regulations pose barriers to seamless DaaS expansion. Urban congestion, inadequate warehousing, and limited EV charging networks affect delivery timelines. Cross-border deliveries face complex customs procedures, taxation issues, and compliance requirements. These factors slow down operations and increase costs for logistics providers. Adapting to diverse legal frameworks and local transport restrictions adds further complexity. Companies must invest in strategic partnerships, regulatory compliance systems, and flexible logistics models to overcome these obstacles and ensure service reliability.

Regional Analysis

North America

North America leads the Delivery as a Service (DaaS) market with a 34% share. The region’s dominance is driven by mature e-commerce ecosystems, advanced logistics infrastructure, and widespread adoption of express and same-day delivery models. Major retailers and third-party logistics providers invest in AI-enabled route optimization, fleet automation, and real-time tracking systems to enhance efficiency. High consumer expectations for fast, flexible deliveries accelerate the deployment of temperature-controlled and contactless delivery solutions. Strategic partnerships between retailers, courier services, and technology companies further strengthen market presence across the U.S. and Canada, driving sustained growth in the region.

Europe

Europe holds a 27% share in the DaaS market, supported by strong cross-border e-commerce and efficient transportation networks. Countries such as Germany, France, and the UK lead adoption due to established logistics players and regulatory support for green delivery solutions. Urban areas are experiencing rapid expansion of electric vehicle fleets and sustainable delivery hubs. Advanced route optimization and real-time delivery tracking improve service accuracy and customer experience. The region’s strict environmental standards and digitalization initiatives encourage innovation in last-mile delivery. Continued investment in smart infrastructure and digital logistics platforms is enhancing operational efficiency across key European markets.

Asia Pacific

Asia Pacific accounts for 29% of the DaaS market, driven by booming e-commerce sectors in China, India, and Japan. Rapid urbanization and a growing middle-class population increase demand for fast, flexible delivery options. Regional players are adopting contactless and express delivery models to meet evolving consumer preferences. Governments are supporting digital logistics development through smart city initiatives and EV adoption programs. E-commerce giants are expanding same-day and next-day delivery coverage across metropolitan areas. Investments in AI, drones, and warehouse automation are further strengthening the region’s logistics ecosystem and positioning Asia Pacific as a key growth engine.

Latin America

Latin America represents an 8% share of the global DaaS market, with growth led by Brazil and Mexico. Rising online retail adoption and increasing smartphone penetration are fueling demand for flexible delivery services. Urban logistics networks are expanding to support same-day and next-day delivery in major cities. However, infrastructure gaps and regulatory complexities pose operational challenges for providers. Companies are adopting hybrid delivery models and strategic partnerships to overcome these barriers. The ongoing digital transformation in logistics, supported by local startups and international players, is expected to strengthen Latin America’s role in the global DaaS landscape.

Middle East & Africa

The Middle East & Africa hold a 6% market share, supported by expanding e-commerce activities in the UAE, Saudi Arabia, and South Africa. Logistics providers are focusing on last-mile delivery optimization to meet rising consumer expectations. Strategic investments in smart warehouses, EV fleets, and AI-powered route planning are improving operational efficiency. Government-backed digital infrastructure projects and free trade zones support cross-border logistics growth. However, uneven infrastructure and regulatory diversity remain challenges in parts of the region. The growing adoption of express and contactless delivery solutions positions the Middle East & Africa as an emerging growth market.

Market Segmentations:

By Service Type:

- Temperature-controlled

- Real-time tracking

By Delivery Model:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

By End User:

- E-commerce retailers

- Third-party Logistics (3PL) providers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Delivery as a Service (DaaS) market is shaped by leading players such as AT&T Inc., Cisco Systems Inc., Palo Alto, Akamai, Verizon Communications Inc., Megaport, Synnex Corporation, DXC Technology Company, Cloudflare, and Amdocs. The Delivery as a Service (DaaS) market is defined by rapid technological innovation and strategic partnerships. Companies are investing in AI, IoT, and automation to enhance delivery speed, visibility, and cost efficiency. Real-time tracking, predictive analytics, and route optimization are becoming standard features to meet growing customer expectations for fast and reliable delivery. Market players focus on expanding global infrastructure and improving last-mile capabilities to support both domestic and cross-border logistics. Strong emphasis on digital platforms, secure data handling, and scalable service models is driving competition and shaping the future of the DaaS industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AT&T Inc.

- Cisco Systems Inc.

- Palo Alto

- Akamai

- Verizon Communications Inc.

- Megaport

- Synnex Corporation

- DXC Technology Company

- Cloudflare

- Amdocs

Recent Developments

- In October 2024, Megaport expanded its cloud connectivity services to Milan, Italy with this plan, customers and partners of Megaport would be able to tap into a global market of business through Italy to increase their business revenues while aiding their acceleration towards digital transformation using the company’s private, scalable and vendor-neutral NaaS platform in Italy.

- In March 2024, Hewlett Packard Enterprise (HPE) launched an updated version of its cloud management platform, HPE Aruba Networking Central, at its Atmosphere event, offering AI for IT operations (AIOps) and enhanced network capabilities.

- In July 2023, Lumen Technologies unveiled a new significant addition to its Network-as-a-Service platform. With the limited scope on offering, Lumen Internet On-Demand served as the first addition to be offered on the platform. Gradually, the security services of DDoS, SASE, and Edge services will also be accommodated within the Lumen NaaS platform.

- In May 2023, Cloudflare Inc. partnered with IT services giant Kyndryl to introduce a new managed WAN as a Service offering. This collaboration combined networking services with the company’s Magic WAN DDoS mitigation and connectivity platform, aiming to enhance performance and security for users transitioning to modern IT technologies.

Report Covmerage

The research report offers an in-depth analysis based on Service Type, Delivery Model, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of AI and automation to improve delivery efficiency.

- Companies will expand real-time tracking systems to enhance transparency and customer trust.

- Sustainable and green delivery solutions will gain stronger market traction.

- Drone and autonomous vehicle deliveries will become more common in urban areas.

- Cross-border delivery services will grow with improved digital logistics networks.

- Last-mile delivery optimization will remain a key strategic focus for logistics providers.

- Contactless and express delivery options will expand to meet faster fulfillment demands.

- Integration of cloud platforms will improve scalability and operational control.

- Strategic partnerships between retailers and logistics providers will increase.

- Data-driven decision-making will shape future innovations in the delivery ecosystem.