Market Overview:

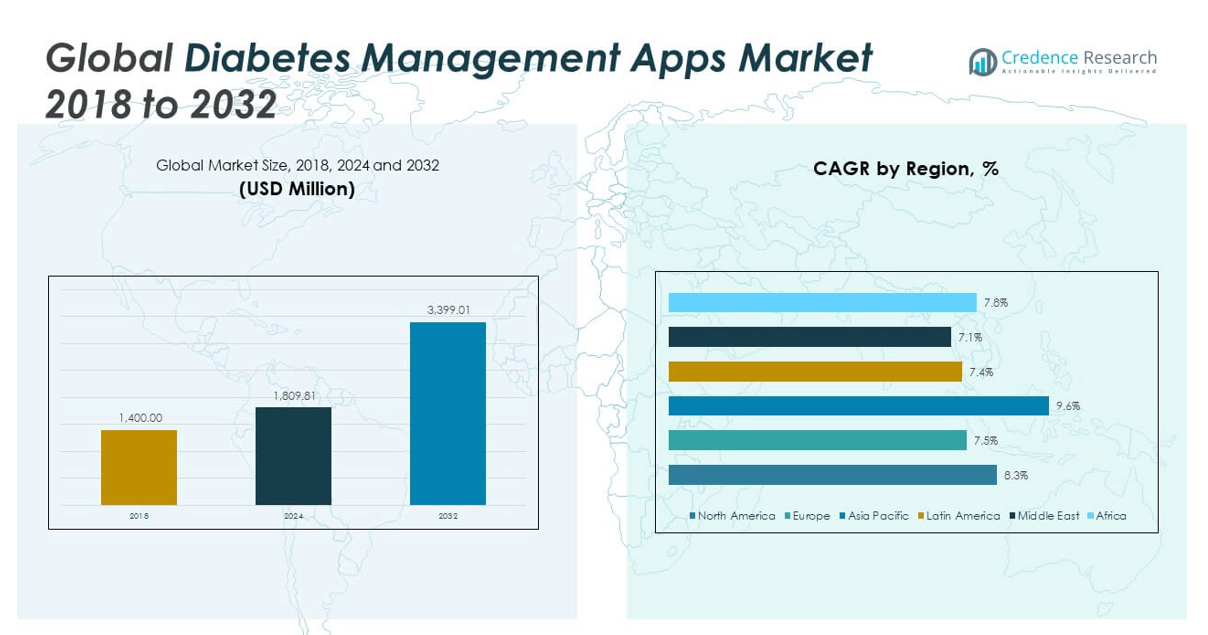

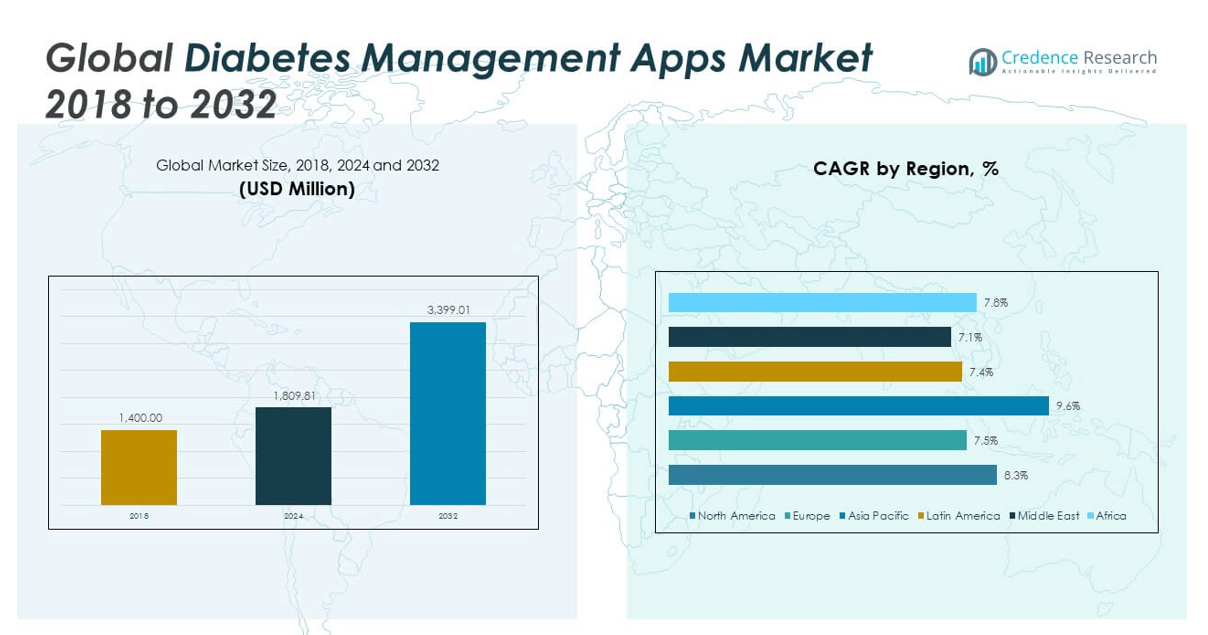

The Global Diabetes Management Apps Market size was valued at USD 1,400.00 million in 2018 to USD 1,809.81 million in 2024 and is anticipated to reach USD 3,399.01 million by 2032, at a CAGR of 8.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diabetes Management Apps MarketSize 2024 |

USD 1,809.81 million |

| Diabetes Management Apps Market, CAGR |

8.31% |

| Diabetes Management Apps Market Size 2032 |

USD 3,399.01 million |

The market is gaining traction due to rising global diabetes prevalence, increased smartphone penetration, and growing awareness of digital health solutions. Users increasingly rely on mobile apps for real-time blood glucose monitoring, insulin dosage tracking, diet planning, and integration with wearable devices. Healthcare providers endorse these apps to support remote patient monitoring and personalized care. Advancements in AI and data analytics enable predictive insights, which improve patient engagement and treatment adherence. This trend drives investments and accelerates partnerships between app developers and healthcare organizations.

North America leads the market, driven by a high diabetic population, robust digital infrastructure, and growing adoption of remote care solutions. Europe follows closely due to strong healthcare policies supporting digital therapeutics and widespread use of mobile health tools. Asia Pacific is emerging rapidly, fueled by increasing smartphone usage, rising diabetes burden, and expanding digital literacy in countries such as India and China. Latin America and the Middle East & Africa show growing interest, supported by mobile health initiatives and government-backed healthcare modernization programs.

Market Insights:

- The Global Diabetes Management Apps Market was valued at USD 1,809.81 million in 2024 and is projected to reach USD 3,399.01 million by 2032, growing at a CAGR of 8.31%.

- Rising global diabetes prevalence and increased smartphone penetration are driving consistent demand for app-based diabetes monitoring solutions.

- Integration of apps with wearables and glucose monitoring devices enhances real-time data tracking and improves treatment outcomes.

- Regulatory complexities and concerns over data privacy and cybersecurity hinder wider adoption and trust among users.

- North America dominates the market due to advanced digital infrastructure and strong healthcare reimbursement models.

- Asia Pacific is emerging rapidly, supported by expanding mobile internet access and rising diabetic populations in China and India.

- Fragmentation and lack of standardization across platforms reduce clinical reliability and limit provider recommendations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Diabetes Prevalence is Creating Continuous Demand for Digital Management Tools:

The growing incidence of diabetes across both developed and developing countries continues to expand the user base for digital tools. Increasing diagnosis of Type 1 and Type 2 diabetes fuels the need for accessible, user-friendly mobile applications to manage lifestyle and medication. Patients seek real-time tracking of glucose levels, diet, exercise, and insulin dosing. Healthcare systems promote app-based monitoring to reduce hospital visits and enhance outpatient management. The Global Diabetes Management Apps Market benefits from this long-term public health challenge. Governments are launching awareness programs that emphasize self-care and proactive disease control. These efforts align with broader digital health strategies across healthcare systems. Rising healthcare costs push insurers and providers to support app adoption for long-term cost savings.

- For instance, the mySugr app by Roche Diabetes Care has achieved over 4.6 million registered users globally and supports integration with continuous glucose monitors (CGMs) such as the Accu-Chek Instant, allowing for automatic glucose data import and reporting more than 40 million logged blood sugar readings in 2023.

Smartphone Penetration and Mobile Health Adoption Are Expanding App Accessibility:

Rapid smartphone adoption, especially in low- and middle-income countries, is driving market access for diabetes management apps. People with diabetes now access health applications without dependence on clinical infrastructure. App developers optimize for Android and iOS platforms, ensuring broad compatibility and usability. Telecom and tech advancements have enabled real-time connectivity between patients and care teams. The Global Diabetes Management Apps Market gains traction as users adopt apps for personalized care and health tracking. Cloud-based data storage allows synchronization with wearable devices, enhancing functionality. High-speed internet access, even in rural zones, increases download rates and app usage. Mobile-first behavior across demographics supports continuous engagement and data sharing.

- For instance,as of 2023, MySugr—a Roche company—reported over 4 million app downloads globally, with users syncing glucose data in real time via the app’s integration with Bluetooth-enabled meters across both Android and iOS, demonstrating effective app accessibility in diverse markets.

Healthcare Provider Integration and Clinical Support Accelerate App Utilization:

Physicians and healthcare institutions endorse diabetes apps to complement treatment protocols. Medical professionals increasingly rely on app data to monitor patient adherence, track trends, and adjust medications. The Global Diabetes Management Apps Market benefits from integration into electronic health records and patient portals. These platforms streamline communication and minimize gaps in care. Doctors use app data to offer remote counselling, avoiding delays and hospital readmissions. Insurance providers support these tools through reimbursement models and chronic care plans. Training programs for clinicians promote app-based management as standard care practice. Health systems embed app usage into value-based care strategies for chronic disease control.

Advancements in AI, Analytics, and Personalization Enhance User Experience:

Artificial intelligence powers predictive algorithms that guide insulin dosing, flag abnormal glucose patterns, and offer lifestyle advice. Developers use machine learning to refine recommendations based on behavior and biometrics. The Global Diabetes Management Apps Market sees adoption of voice assistants, chatbot support, and intuitive interfaces. Personalization increases adherence and improves health outcomes over time. Big data analytics provide actionable insights for both users and healthcare professionals. Real-time alerts, gamification features, and behavioral nudges improve long-term engagement. Platforms leverage cloud computing to handle large datasets securely. These innovations support proactive disease management and reduce long-term complications.

Market Trends:

Integration with Wearable Devices and Smart Sensors is Enhancing Real-Time Monitoring:

Smart wearables and continuous glucose monitoring (CGM) systems now link directly to mobile apps. These integrations provide automated tracking and reduce manual input by users. The Global Diabetes Management Apps Market reflects this shift toward seamless, real-time data transmission. Smartwatches, biosensors, and Bluetooth-enabled glucose meters allow dynamic updates. Users monitor glucose, activity, and nutrition simultaneously. Platforms analyze biometric inputs to personalize feedback. Real-time visualization tools give patients a clearer understanding of their health. Developers prioritize interoperability with third-party devices. This ecosystem approach drives stickiness and daily app interaction.

- For instance,Dexcom’s G7 CGM system now transmits glucose readings directly to users’ smartphones every 5 minutes, enabling continuous monitoring without manual intervention; in 2023, Dexcom reported that over 1 million users accessed real-time CGM data through the Dexcom app.

Focus on Mental Health and Behavioral Coaching is Broadening App Functionality:

Mental wellness is increasingly recognized in diabetes care. Emotional stress affects blood sugar regulation and patient outcomes. The Global Diabetes Management Apps Market incorporates mood tracking, mindfulness features, and behavior coaching. Apps now include guided meditations, cognitive behavioral therapy prompts, and motivational messaging. These features help users manage stress and reduce anxiety associated with chronic illness. Behavioral nudges improve adherence to medication and diet. Developers partner with mental health experts to refine user experiences. Emotional health modules are gaining traction among both young and elderly patients. This trend positions apps as holistic health management tools.

- For instance,in 2023, One Drop introduced a mental health module featuring mood tracking and guided stress-relief exercises; user engagement data showed a 32% increase in daily active sessions after the launch of these behavioral coaching features.

Localization and Multilingual Interfaces Are Driving User Expansion Across Regions:

Developers recognize the importance of cultural and linguistic adaptability. Localized content improves user experience and boosts retention. The Global Diabetes Management Apps Market is expanding as platforms support multiple languages and region-specific health guidelines. Local food databases, measurement systems, and visual aids cater to diverse populations. In-app consultations with regional experts build trust and relevance. Regulatory alignment with local healthcare systems encourages adoption. Emerging markets respond well to user-centric, culturally aligned platforms. App publishers form partnerships with local clinics to expand outreach. These efforts help reduce digital health disparities globally.

Gamification and User Engagement Strategies Are Increasing App Retention Rates:

Gamified features encourage consistent app usage and reward healthy behavior. Daily streaks, achievement badges, and progress charts drive motivation. The Global Diabetes Management Apps Market sees strong performance from apps that blend clinical accuracy with engaging interfaces. Challenges, quizzes, and community leaderboards promote peer support. Users track improvement through goal-setting dashboards. Interactive features improve knowledge retention and habit formation. Social integration allows sharing of milestones within peer groups. Developers measure success by user engagement, not just downloads. These tactics extend app lifecycle and improve long-term health outcomes.

Market Challenges Analysis:

Data Privacy, Regulatory Compliance, and Security Concerns Are Slowing Adoption:

Users hesitate to share sensitive health data due to concerns about privacy breaches. Apps often handle personal identifiers, glucose readings, and medication details. The Global Diabetes Management Apps Market faces regulatory hurdles such as HIPAA in the U.S. and GDPR in Europe. Developers must meet varying legal standards across countries, complicating global rollouts. Inadequate encryption and unclear data policies affect user trust. Frequent changes in health data governance require continuous app updates and audits. Smaller developers struggle with the cost and complexity of compliance. Partnerships with healthcare providers require rigorous vetting and certification. These obstacles limit speed to market and scalability.

Fragmentation, Lack of Standardization, and App Quality Disparities Limit Efficacy:

The market contains hundreds of apps with varying reliability and medical validity. Users often find it difficult to identify clinically trusted platforms. The Global Diabetes Management Apps Market lacks a unified rating or certification framework. App stores do not consistently vet health claims or scientific backing. Inconsistent features, user interfaces, and integration options frustrate patients and providers. Many apps lack real-time support or expert guidance. Some fail to update regularly or adapt to evolving clinical practices. Without central oversight, many platforms fall short of healthcare-grade performance. This fragmentation dilutes user confidence and weakens adoption momentum.

Market Opportunities:

Government Digital Health Initiatives and Public-Private Partnerships Offer Growth Potential:

National healthcare systems are promoting digital health to manage chronic diseases. Governments invest in mobile health platforms to reduce healthcare burdens. The Global Diabetes Management Apps Market can leverage policy incentives and public grants. Collaborations between public health agencies and developers improve scalability and trust. Educational campaigns boost awareness of app-based diabetes control. In underserved regions, these partnerships improve access and literacy. Developers that align with national health programs gain competitive advantage. This environment supports inclusive growth across markets.

Expansion Into Corporate Wellness and Insurance-Driven Care Models Can Accelerate Adoption:

Employers and insurers now include diabetes management apps in wellness programs. Corporate health plans integrate digital platforms to reduce absenteeism and improve employee productivity. The Global Diabetes Management Apps Market can tap into this institutional demand for preventive health tools. Insurers use app data to offer dynamic premiums and risk scoring. Integration with occupational health portals increases usage frequency. These models support long-term engagement and compliance. App developers that target enterprise clients gain stable revenue streams. This B2B segment offers scalable, recurring growth opportunities.

Market Segmentation Analysis:

By Type

Type 2 diabetes holds the dominant share due to its widespread occurrence and rising global incidence. Type 1 diabetes apps focus on advanced features like insulin tracking and continuous glucose monitoring. Gestational diabetes apps gain popularity among expectant mothers due to rising maternal health awareness. Pre-diabetes apps are expanding rapidly with increased early screening and preventive strategies supported by public health campaigns. The type-based segmentation reflects a growing need for tailored solutions based on specific diabetic conditions.

- For instance,Glooko’s mobile platform currently supports over 3 million users with tailored modules for Type 1, Type 2, gestational, and pre-diabetes, and has integrated insulin tracking specifically for Type 1 diabetes users, supporting real-time dose recommendations based on over 6 billion data points collected.

By Platform

Android leads the platform segment due to its affordability and large user base across emerging markets. iOS holds significant traction in North America and Europe with a strong premium user segment. Web-based applications serve users who prefer desktop interfaces, often favored by healthcare professionals. Integrated digital ecosystems combine multiple functionalities—monitoring, coaching, and data analytics—across devices, enabling centralized disease management. The shift toward platform convergence is shaping long-term user retention strategies.

- For instance, Health2Sync, a leading diabetes app in Asia, reported active users access the service via Android devices, while its iOS and web platforms support seamless data synchronization, allowing clinicians to remotely monitor patient progress through a unified dashboard.

By End-Use

Patients form the largest end-user group, driving the need for intuitive, real-time monitoring tools. Healthcare providers use apps for remote consultations, data tracking, and medication adjustments. Payers and insurance companies deploy apps in chronic disease management programs to reduce long-term treatment costs. These user segments support the integration of digital solutions into standard care practices and risk management strategies.

By Functionality

Blood glucose monitoring apps are the most widely adopted due to their core relevance to diabetic care. Insulin tracking apps cater to insulin-dependent users, improving dosage accuracy and adherence. Diet and nutrition planning apps guide users in managing carbohydrate intake and meal planning. Physical activity tracking apps enhance behavioral change through motivational features and personalized goals. Functional diversity ensures wider appeal and continuous user engagement.

By Subscription Model

Freemium models attract mass adoption with essential features, encouraging upgrades to paid plans. Subscription-based models offer scalable revenue through advanced services and analytics. One-time purchase apps appeal to budget-conscious users preferring upfront payments. Ad-supported apps monetize through display ads, offering free access to basic tools. Insurance reimbursement-based models are gaining support in structured healthcare systems, improving accessibility and cost efficiency for chronic care management.

Segmentation:

By Type:

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Pre-diabetes

By Platform:

- iOS

- Android

- Web-based Applications

- Integrated Digital Ecosystems

By End-Use:

- Patients

- Healthcare Providers

- Payers/Insurance Companies

By Functionality:

- Blood Glucose Monitoring Apps

- Insulin Tracking Apps

- Diet & Nutrition Planning Apps

- Physical Activity Tracking Apps

By Subscription Model:

- Freemium

- Subscription-Based

- One-time Purchase

- Ad-Supported

- Insurance Reimbursement-Based

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Diabetes Management Apps Market size was valued at USD 537.60 million in 2018 to USD 686.99 million in 2024 and is anticipated to reach USD 1,286.15 million by 2032, at a CAGR of 8.3% during the forecast period. North America accounts for the largest market share of the Global Diabetes Management Apps Market. It benefits from advanced healthcare infrastructure, widespread smartphone adoption, and supportive digital health policies. The United States drives the region’s growth with strong insurance coverage for mobile health solutions and integration of apps into chronic care models. Leading healthcare providers endorse app-based platforms for real-time monitoring and virtual consultations. Government initiatives like Medicare support remote care for diabetic patients. High awareness and early diagnosis contribute to steady user growth. Strategic collaborations between tech firms and hospitals further strengthen digital diabetes management across the region.

Europe

The Europe Diabetes Management Apps Market size was valued at USD 350.56 million in 2018 to USD 434.67 million in 2024 and is anticipated to reach USD 768.69 million by 2032, at a CAGR of 7.5% during the forecast period. Europe holds the second-largest share of the Global Diabetes Management Apps Market. Countries such as Germany, the UK, and France lead adoption due to favorable regulatory frameworks and national health programs. The region supports app-based diabetes care through reimbursement models and electronic health record integration. High smartphone penetration and digital literacy levels enable consistent app usage among elderly and chronic care patients. Local developers prioritize GDPR-compliant platforms, improving data privacy and user trust. Public awareness campaigns encourage early diagnosis and mobile-based intervention. Multilingual apps address diverse population needs across the EU. The market sees steady expansion through telemedicine partnerships and personalized care offerings.

Asia Pacific

The Asia Pacific Diabetes Management Apps Market size was valued at USD 318.92 million in 2018 to USD 431.90 million in 2024 and is anticipated to reach USD 892.98 million by 2032, at a CAGR of 9.6% during the forecast period. Asia Pacific represents the fastest-growing region in the Global Diabetes Management Apps Market, contributing a rising share. China, India, Japan, and South Korea lead growth with large diabetic populations and expanding digital infrastructure. Government-led digital health missions promote adoption in both urban and rural areas. Affordable Android smartphones increase accessibility among lower-income users. Start-ups and tech firms launch localized apps tailored to dietary patterns and languages. The region sees strong investment in wearable integration and AI-based diabetes tools. Rapid urbanization and lifestyle shifts drive demand for preventive care and digital health monitoring. Local partnerships with hospitals and insurers support long-term app engagement.

Latin America

The Latin America Diabetes Management Apps Market size was valued at USD 95.06 million in 2018 to USD 121.78 million in 2024 and is anticipated to reach USD 213.36 million by 2032, at a CAGR of 7.4% during the forecast period. Latin America shows growing potential in the Global Diabetes Management Apps Market. Brazil and Mexico lead adoption, driven by high smartphone penetration and rising awareness of diabetes complications. Government health campaigns promote lifestyle monitoring through mobile solutions. Local developers create Spanish- and Portuguese-language apps with culturally relevant content. Users rely on diet tracking and physical activity apps to support lifestyle interventions. Limited access to endocrinologists in rural regions increases demand for app-based care. Public-private partnerships are emerging to strengthen digital health inclusion. The region faces infrastructure challenges but continues to expand through mobile-first health strategies.

Middle East

The Middle East Diabetes Management Apps Market size was valued at USD 60.62 million in 2018 to USD 74.01 million in 2024 and is anticipated to reach USD 127.14 million by 2032, at a CAGR of 7.1% during the forecast period. The Middle East contributes a modest but rising share of the Global Diabetes Management Apps Market. Countries such as Saudi Arabia and the UAE are investing in digital health transformation. High diabetes prevalence and increasing healthcare digitalization fuel app demand. Urban populations adopt mobile-based solutions for blood glucose tracking and lifestyle support. Governments promote digital inclusion through telemedicine and eHealth platforms. Private clinics integrate apps for follow-up care and treatment adherence. Regional developers focus on bilingual interfaces and personalized coaching. Data privacy regulations and device compatibility remain key focus areas for further growth.

Africa

The Africa Diabetes Management Apps Market size was valued at USD 37.24 million in 2018 to USD 60.46 million in 2024 and is anticipated to reach USD 110.68 million by 2032, at a CAGR of 7.8% during the forecast period. Africa holds the smallest share of the Global Diabetes Management Apps Market but shows steady growth potential. South Africa, Egypt, and Nigeria drive regional demand with increasing mobile internet access. App-based diabetes tools address limited access to healthcare infrastructure and specialists. NGOs and health organizations introduce awareness programs promoting mobile health interventions. Developers adapt apps to low-bandwidth environments and localized languages. Demand focuses on basic functionalities like blood sugar tracking and dietary advice. Limited digital literacy and affordability challenges still affect penetration. Public health partnerships and donor funding improve accessibility and education. The market is evolving as mobile health gains momentum across underserved communities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott

- Dexcom, Inc.

- Medtronic

- Insulet Corporation

- Hoffmann-La Roche Ltd

- Glooko, Inc.

- Diabetes: M

- DarioHealth Corp.

- LifeScan IP Holdings, LLC

Competitive Analysis:

The Global Diabetes Management Apps Market features strong competition among established medtech companies and digital health startups. Key players include Abbott, Dexcom, Medtronic, Glooko, and DarioHealth, each offering unique app-based solutions for diabetes monitoring and lifestyle management. These companies focus on integrating apps with glucose monitoring devices, enhancing data analytics, and expanding their AI capabilities. Startups such as Diabetes:M and mySugr compete by offering user-centric features and subscription flexibility. Companies differentiate through interface design, multilingual support, clinical validation, and data privacy compliance. Partnerships with healthcare providers and insurers support adoption across care ecosystems. Continuous innovation and interoperability remain essential for market leadership.

Recent Developments:

- In January 2024, Medtronic presented new clinical data and launched the MiniMed 780G system, including the Simplera Sync all-in-one sensor, designed for disposable use and requiring no fingersticks. The MiniMed 780G system aims to improve type 1 diabetes management and allows remote monitoring via mobile app, enhancing user convenience and proactive disease management.

Market Concentration & Characteristics:

The Global Diabetes Management Apps Market is moderately concentrated, with a mix of global medtech leaders and emerging digital health innovators. It features rapid product innovation, high user engagement, and a focus on integrating apps with devices and healthcare systems. Leading players invest heavily in AI, analytics, and cloud-based platforms to enhance personalized care. Regulatory compliance, data security, and clinical accuracy shape market differentiation. Consumer preferences for intuitive design and real-time tracking drive competitive advantage. The market supports both B2C and B2B models, offering flexibility across regions and healthcare ecosystems.

Report Coverage:

The research report offers an in-depth analysis based on Type, Platform, End-Use, Functionality, and Subscription Model. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing global diabetes cases will continue to expand the user base for app-based monitoring and management tools.

- AI-driven features will enhance real-time insights, enabling predictive analytics and personalized care recommendations.

- Integration with wearable devices and IoT ecosystems will increase the accuracy and functionality of digital diabetes platforms.

- Expansion of telehealth and remote care services will strengthen the role of apps in chronic disease management.

- Governments and insurers will adopt supportive reimbursement models to drive app adoption across public healthcare systems.

- Emerging markets will contribute significantly to growth, driven by smartphone accessibility and digital health initiatives.

- Demand for multilingual, culturally adapted apps will rise, especially in regions with diverse user populations.

- Subscription-based and insurance-supported models will dominate monetization strategies across user segments.

- Strategic partnerships between medtech firms and app developers will lead to integrated, end-to-end care solutions.

- Data privacy, clinical accuracy, and regulatory compliance will remain critical for long-term market sustainability.