Market Overview

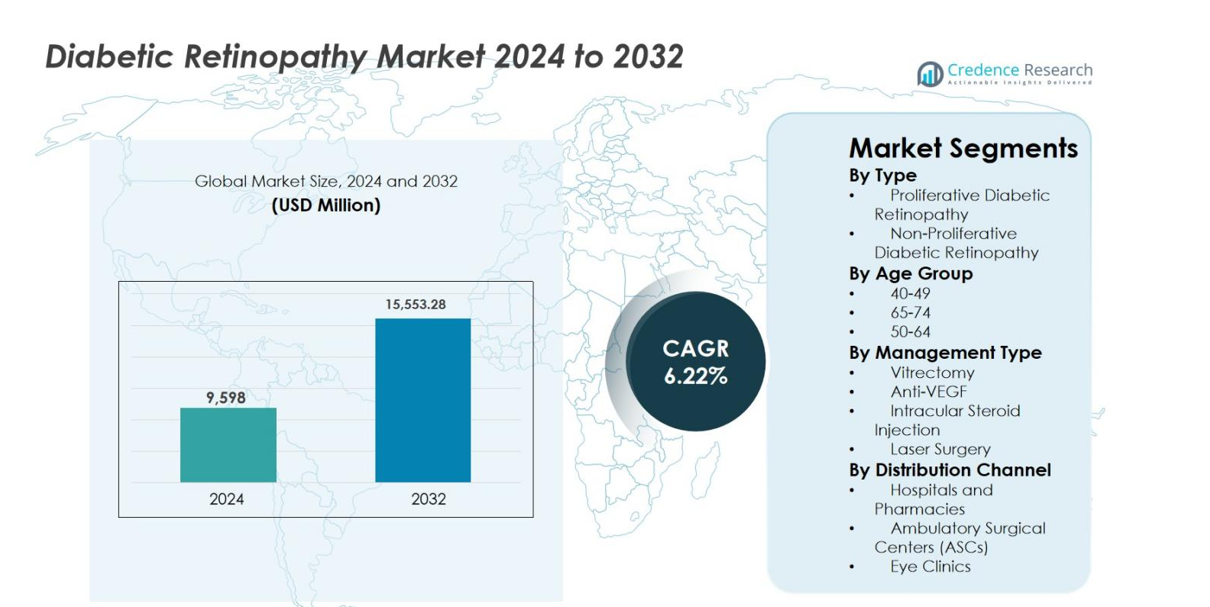

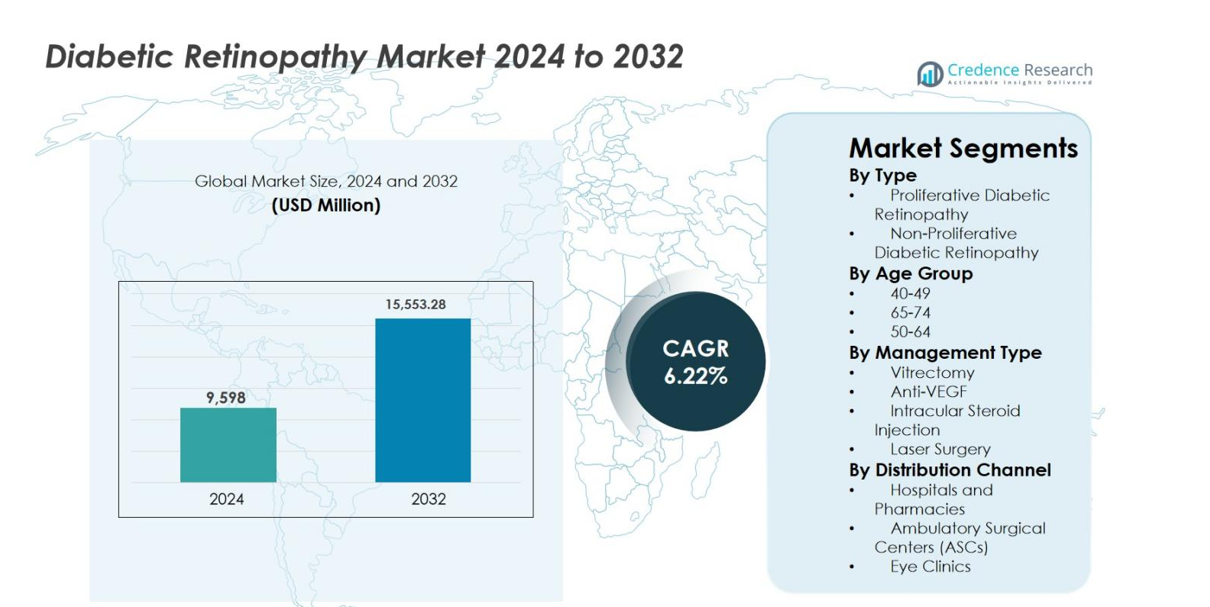

Diabetic Retinopathy market size was valued at USD 9,598 Million in 2024 and is anticipated to reach USD 15,553.28 Million by 2032, growing at a CAGR of 6.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diabetic Retinopathy Market Size 2024 |

USD 9,598 Million |

| Diabetic Retinopathy Market, CAGR |

6.22% |

| Diabetic Retinopathy Market Size 2032 |

USD 15,553.28 Million |

Diabetic Retinopathy market is driven by the strong presence of established pharmaceutical and biotechnology companies focused on retinal disease management, including Bayer AG, AbbVie Inc., Novartis AG, Genentech, Inc., Alimera Sciences, Oxurion NV, Sirnaomics, Ampio Pharmaceuticals Inc., BCNPeptides, and Kowa Company Ltd. These players emphasize innovation in anti-VEGF therapies, sustained-release drug delivery systems, and novel biologics to improve treatment durability and patient outcomes. North America leads the Diabetic Retinopathy market with an exact 38.2% market share, supported by advanced healthcare infrastructure, high screening rates, and favorable reimbursement policies. Europe follows with 27.6% share, driven by strong public healthcare programs, while Asia Pacific holds 23.4% share, supported by a large diabetic population and expanding access to ophthalmic care.

Market Insights

- Diabetic Retinopathy market size was valued at USD 9,598 million in 2024 and is projected to reach USD 15,553.28 million by 2032, growing at a CAGR of 6.22%, supported by rising diabetes prevalence and increasing demand for vision-preserving therapies.

- Market growth is primarily driven by the expanding global diabetic population, longer disease duration, and higher screening rates, which increase diagnosis and treatment volumes, particularly for early-stage non-proliferative diabetic retinopathy.

- A key market trend is the strong adoption of anti-VEGF therapy, which dominates management types with approximately 52.4% share, driven by proven clinical efficacy, favorable reimbursement, and widespread physician preference.

- Competitive activity focuses on innovation in long-acting injectables, sustained-release implants, and pipeline expansion, as leading players strengthen ophthalmology portfolios and pursue differentiation through improved treatment durability.

- Regionally, North America leads with 38.2% share, followed by Europe at 27.6% and Asia Pacific at 23.4%, while non-proliferative diabetic retinopathy remains the dominant disease segment with about 64.8% share due to higher prevalence and early diagnosis.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Diabetic Retinopathy market by disease type is led by Non-Proliferative Diabetic Retinopathy (NPDR), which accounted for 64.8% market share in 2024. NPDR dominance is driven by its higher prevalence among early- and mid-stage diabetic patients and increasing screening rates that enable earlier diagnosis. Growing awareness programs, routine fundus examinations, and the rising global diabetic population support demand for NPDR management. Proliferative Diabetic Retinopathy (PDR) represents a smaller but critical segment, driven by advanced disease severity and higher intervention needs, particularly in patients with long-standing, poorly controlled diabetes.

- For instance, Regeneron’s Eylea (aflibercept) demonstrated sustained ≥2-step DR severity score improvement in NPDR patients in DRCR Retina Network Protocol W, reinforcing early pharmacologic intervention before progression to PDR.

By Age Group

The 50–64 age group dominated the Diabetic Retinopathy market with 38.6% share in 2024, supported by a high incidence of type 2 diabetes and longer disease duration. This group shows increased susceptibility to microvascular complications due to cumulative glycemic exposure and lifestyle-related risk factors. Regular ophthalmic monitoring and early therapeutic intervention drive higher diagnosis and treatment rates. The 65–74 segment follows closely, driven by aging populations, while the 40–49 group benefits from growing preventive screening and early disease identification initiatives.

- For instance, data from the CDC National Diabetes Statistics Report (2023) show that adults aged 45–64 account for one of the highest diagnosed diabetes prevalence rates in the U.S., directly increasing routine retinal screening volumes in this age bracket.

By Management Type

The Diabetic Retinopathy market by management type is dominated by Anti-VEGF therapy, holding 52.4% market share in 2024. This leadership is driven by strong clinical efficacy in reducing macular edema, improving visual outcomes, and delaying disease progression. Favorable reimbursement coverage, repeated treatment adoption, and physician preference further reinforce dominance. Laser surgery remains widely used in advanced cases due to durability and cost-effectiveness, while vitrectomy and intravitreal steroid injections support complex or refractory cases, contributing to diversified treatment demand.

Key Growth Drivers

Rising Global Prevalence of Diabetes

The increasing global burden of diabetes remains the primary growth driver for the Diabetic Retinopathy market. Sedentary lifestyles, unhealthy dietary patterns, and rising obesity rates continue to accelerate the incidence of both type 1 and type 2 diabetes across developed and emerging economies. Longer life expectancy among diabetic patients increases cumulative exposure to hyperglycemia, significantly raising the risk of retinal complications. As a result, healthcare systems are witnessing a growing patient pool requiring regular retinal screening, monitoring, and treatment. This expanding diabetic population directly drives sustained demand for diagnostic services, pharmacological therapies, and interventional procedures.

- For instance, the World Health Organization (WHO) highlights that prolonged diabetes duration is a major risk factor for retinopathy, noting that more than one-third of people with diabetes develop some form of diabetic retinopathy during their lifetime.

Advancements in Therapeutic Technologies

Continuous innovation in therapeutic approaches strongly supports Diabetic Retinopathy market growth. The development of advanced anti-VEGF agents, sustained-release intravitreal implants, and combination treatment strategies has significantly improved clinical outcomes and patient compliance. These therapies enable better disease control, reduced injection frequency, and improved visual acuity preservation. Growing physician confidence in evidence-based treatment protocols and expanding reimbursement coverage further accelerate adoption. Technological progress in drug formulation and delivery systems enhances treatment precision, making advanced therapies more accessible across diverse patient populations.

- For instance, AbbVie’s Ozurdex (dexamethasone intravitreal implant) provides sustained corticosteroid release for up to six months, reducing treatment burden in select diabetic retinopathy and diabetic macular edema patients and supporting wider adoption of long-acting delivery systems.

Expansion of Screening and Early Diagnosis Programs

The growing emphasis on early diagnosis and preventive eye care acts as a major growth catalyst for the Diabetic Retinopathy market. Government-led public health initiatives, insurance-driven annual eye examinations, and employer-sponsored wellness programs encourage routine retinal screening among diabetic patients. Improved access to ophthalmic care in urban and semi-urban regions enables early-stage detection, particularly of non-proliferative diabetic retinopathy. Early diagnosis increases treatment initiation rates and long-term disease management, reducing vision-threatening complications while steadily expanding the treated patient base worldwide.

Key Trends & Opportunities

Adoption of AI-Enabled Retinal Imaging and Diagnostics

Artificial intelligence–driven retinal imaging solutions are transforming the Diabetic Retinopathy market by enabling faster, more accurate, and scalable disease detection. AI algorithms integrated with fundus photography and optical coherence tomography support automated screening, particularly in primary care and remote settings. These technologies reduce diagnostic burden on specialists and improve screening coverage in underserved regions. Healthcare providers increasingly adopt AI-assisted platforms to enhance early detection and optimize referral workflows. This trend creates significant opportunities for technology developers, diagnostic service providers, and healthcare systems seeking cost-efficient solutions to manage growing diabetic populations.

- For instance, Eyenuk’s EyeArt AI system received regulatory clearance in multiple regions after clinical studies showed high accuracy in detecting more-than-mild diabetic retinopathy, enabling automated referrals and reducing dependence on specialist graders in high-volume screening workflows.

Shift Toward Long-Acting and Combination Therapies

The market is witnessing a strong shift toward long-acting treatment modalities and combination therapies that reduce treatment frequency and improve patient adherence. Sustained-release intravitreal implants, extended-duration anti-VEGF agents, and therapies targeting multiple disease pathways are gaining traction. These innovations address challenges associated with frequent injections, clinic visits, and treatment fatigue. Growing clinical evidence supporting durable efficacy and safety strengthens physician adoption. This trend opens new opportunities for pharmaceutical companies to differentiate products, extend treatment lifecycles, and improve patient outcomes while optimizing healthcare resource utilization.

- For instance, Genentech’s Vabysmo (faricimab) demonstrated durable efficacy with dosing intervals up to 16 weeks in Phase III YOSEMITE and RHINE trials, reflecting growing acceptance of longer-acting anti-VEGF therapy in diabetic retinal disease management.

Key Challenges

High Treatment Costs and Reimbursement Limitations

High treatment costs remain a significant challenge in the Diabetic Retinopathy market, particularly for advanced pharmacological therapies. Anti-VEGF injections, repeated procedures, and long-term disease management impose substantial financial burdens on healthcare systems and patients. Inadequate reimbursement policies in several emerging economies limit treatment accessibility, leading to delayed intervention and disease progression. Cost constraints also restrict adoption of innovative therapies in resource-limited settings, slowing overall market penetration and creating disparities in patient care outcomes.

Limited Access to Specialized Ophthalmic Care

Limited availability of trained ophthalmologists and advanced retinal care facilities poses a critical challenge, especially in rural and low-income regions. Long waiting times, uneven distribution of specialists, and inadequate infrastructure hinder timely diagnosis and treatment. These access gaps contribute to underdiagnosis and late-stage presentation of diabetic retinopathy. Despite growing screening efforts, the lack of follow-up care and treatment capacity restricts effective disease management, impacting patient outcomes and moderating market growth potential in underserved geographies.

Regional Analysis

North America

North America dominated the Diabetic Retinopathy market with approximately 38.2% market share in 2024, supported by a high prevalence of diabetes, strong awareness levels, and advanced healthcare infrastructure. Widespread adoption of routine retinal screening, early diagnosis, and high treatment penetration for anti-VEGF therapies drive regional leadership. Favorable reimbursement frameworks, strong presence of leading pharmaceutical companies, and rapid uptake of innovative therapies further support growth. The United States remains the primary contributor due to large diabetic populations and early adoption of AI-enabled diagnostics, while Canada benefits from expanding public healthcare screening initiatives.

Europe

Europe accounted for around 27.6% market share in 2024, driven by well-established healthcare systems and rising diabetes incidence across aging populations. Strong government-led screening programs and standardized treatment guidelines support early detection and consistent disease management. Countries such as Germany, the UK, France, and Italy lead regional demand due to high diagnosis rates and access to advanced ophthalmic care. Increasing adoption of long-acting therapies and growing investments in digital health solutions further enhance market growth, while expanding awareness programs continue to improve treatment initiation across Western and Northern Europe.

Asia Pacific

Asia Pacific held approximately 23.4% market share in 2024 and represents the fastest-growing region in the Diabetic Retinopathy market. Rapid growth is driven by a large and expanding diabetic population, improving healthcare access, and increasing awareness of diabetic eye complications. China and India dominate regional demand due to rising urbanization, lifestyle changes, and government-supported screening initiatives. Expanding private healthcare infrastructure and growing adoption of cost-effective anti-VEGF therapies further support growth. Increased investments in teleophthalmology and AI-based screening platforms enhance early diagnosis across underserved areas.

Latin America

Latin America captured about 6.4% market share in 2024, supported by rising diabetes prevalence and improving access to ophthalmic care. Countries such as Brazil, Mexico, and Argentina drive regional demand due to expanding healthcare coverage and increasing awareness of diabetic eye diseases. Gradual adoption of advanced therapies, supported by public-private partnerships, improves treatment availability. However, uneven access to specialized care and reimbursement limitations continue to affect market penetration. Ongoing investments in screening programs and healthcare infrastructure are expected to strengthen long-term market growth across the region.

Middle East & Africa

The Middle East & Africa region accounted for around 4.4% market share in 2024, driven by rising diabetes incidence and improving healthcare investments. Gulf countries lead regional demand due to better access to advanced ophthalmic services and higher healthcare spending. In contrast, parts of Africa face challenges related to limited screening access and specialist availability. Increasing government initiatives, international health programs, and mobile screening solutions support early detection. Gradual expansion of healthcare infrastructure and awareness campaigns is expected to improve diagnosis and treatment rates across the region.

Market Segmentations

By Type

- Proliferative Diabetic Retinopathy

- Non-Proliferative Diabetic Retinopathy

By Age Group

By Management Type

- Vitrectomy

- Anti-VEGF

- Intracular Steroid Injection

- Laser Surgery

By Distribution Channel

- Hospitals and Pharmacies

- Ambulatory Surgical Centers (ASCs)

- Eye Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Diabetic Retinopathy market features a moderately consolidated competitive landscape, characterized by the presence of established pharmaceutical companies and emerging biotechnology firms focused on retinal disease management. Key players such as Bayer AG, AbbVie Inc., Novartis AG, Genentech, Inc., and Alimera Sciences maintain strong positions through broad ophthalmology portfolios, robust clinical pipelines, and established global distribution networks. These companies emphasize innovation in anti-VEGF therapies, sustained-release drug delivery systems, and next-generation biologics to improve treatment durability and patient adherence. Smaller players including Oxurion NV, Sirnaomics, Ampio Pharmaceuticals Inc., BCNPeptides, and Kowa Company Ltd. focus on novel mechanisms of action, gene-based therapies, and differentiated formulations targeting unmet clinical needs. Strategic initiatives such as product launches, clinical trial expansion, partnerships, and geographic market expansion remain central to competitive positioning, as companies seek to strengthen therapeutic efficacy, extend product lifecycles, and capture growing demand driven by rising diabetic populations worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Genentech, Inc.

- Oxurion NV

- Kowa Company Ltd.

- AbbVie Inc.

- Sirnaomics

- Bayer AG

- BCNPeptides

- Alimera Sciences

- Novartis AG

- Ampio Pharmaceuticals Inc.

Recent Developments

- In August 2025, Topcon Healthcare completed the acquisition of Intelligent Retinal Imaging Systems to enhance connected care across primary and eye care services, supporting diabetic retinopathy screening efforts.

- In June 2025, Avant Technologies, Inc. and its joint venture partner Ainnova Tech, Inc. began diabetic retinopathy screenings using its AI-based Vision AI platform in collaboration with Grupo Dökka’s pharmacy network in Central America.

- In May 2025, Roche’s Genentech announced that the U.S. FDA approved Susvimo® (ranibizumab injection) 100 mg/mL for the treatment of diabetic retinopathy, marking the first continuous delivery treatment requiring just one refill every nine months.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, Management Type Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Diabetic Retinopathy market will continue to expand steadily, supported by the rising global diabetic population and longer disease duration.

- Early diagnosis and preventive screening will gain stronger emphasis, increasing treatment initiation at non-proliferative stages.

- Adoption of AI-enabled retinal imaging will accelerate large-scale screening and improve diagnostic efficiency in primary care settings.

- Anti-VEGF therapies will remain the cornerstone of treatment, while next-generation agents improve durability and patient compliance.

- Long-acting drug delivery systems will reduce treatment frequency and enhance patient adherence.

- Combination therapies targeting multiple disease pathways will gain wider clinical acceptance.

- Teleophthalmology will expand access to retinal care in underserved and remote regions.

- Growing healthcare investments in emerging economies will improve treatment accessibility and infrastructure.

- Regulatory support and guideline updates will encourage standardized management and early intervention.

- Strategic collaborations and pipeline expansion will intensify as companies seek innovation-led differentiation.