Market Overview:

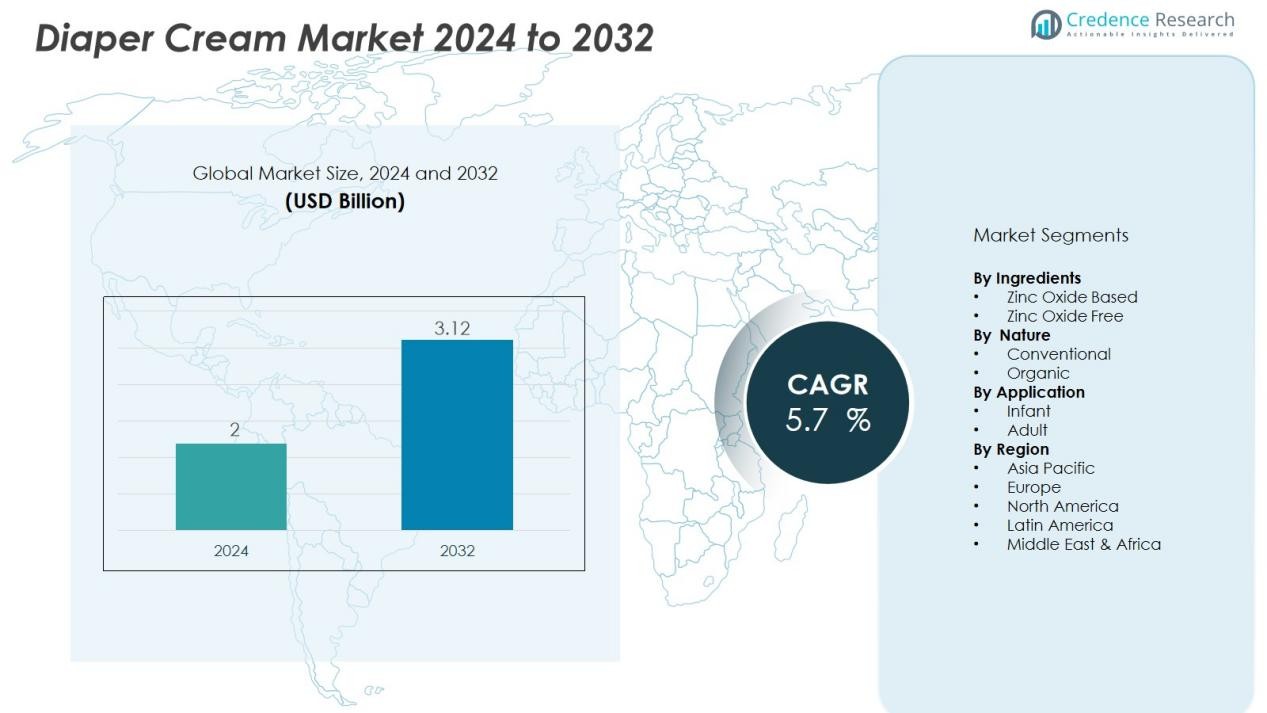

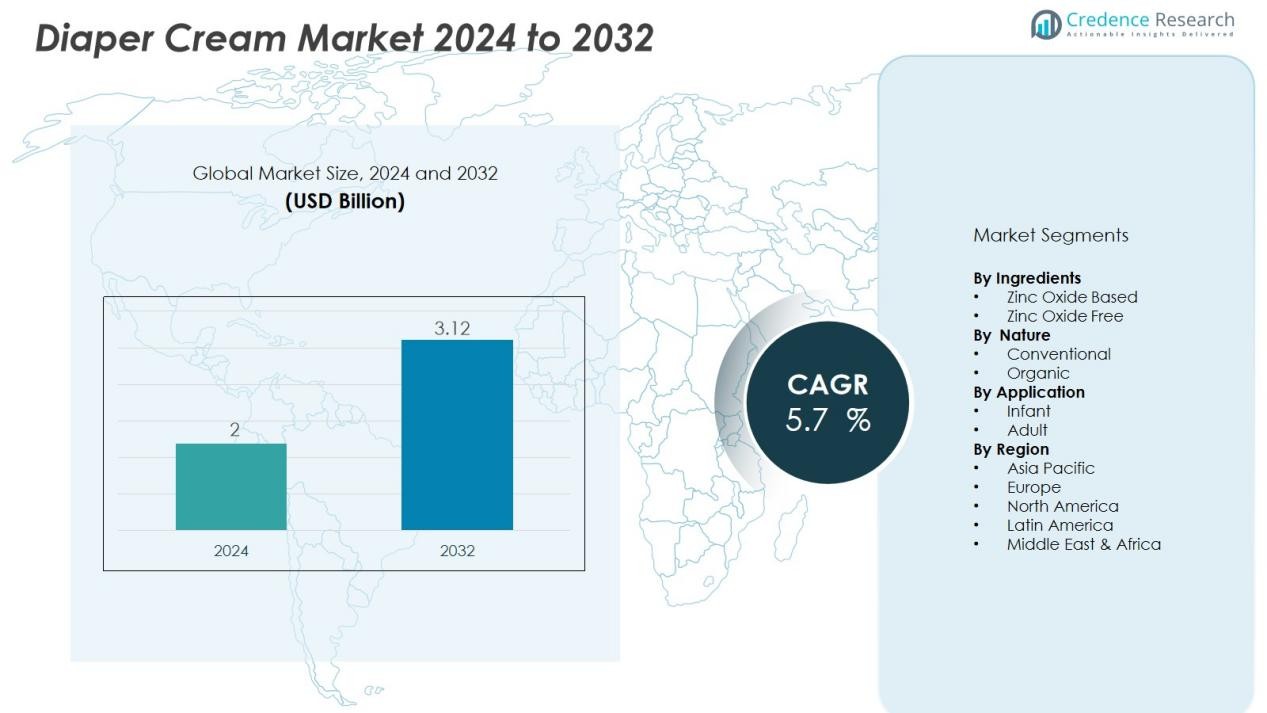

The Diaper Cream Market size was valued at USD 2 billion in 2024 and is anticipated to reach USD 3.12 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diaper Cream Market Size 2024 |

USD 2 Billion |

| Diaper Cream Market, CAGR |

5.7% |

| Diaper Cream Market Size 2032 |

USD 3.12 Billion |

The primary drivers of market growth include rising consumer awareness regarding infant skin health, with more parents prioritizing effective and gentle skin care solutions for their babies. Additionally, an increase in birth rates in emerging markets, along with rising disposable incomes, has resulted in greater purchasing power for baby care products. Furthermore, product innovation, such as the introduction of hypoallergenic, organic, and zinc-oxide-free formulations, has expanded product offerings, catering to a wider range of consumer needs. The growth of e-commerce also plays a significant role in improving product accessibility and consumer reach.

North America remains the leading market for diaper creams due to high consumer awareness, strong retail infrastructure, and a preference for premium baby care products. Europe also holds a substantial market share, driven by stringent safety regulations and a demand for natural, organic formulations. In contrast, the Asia-Pacific region is expected to experience the highest growth rate, fueled by increasing birth rates, expanding middle-class populations, and a rising inclination towards online shopping in countries like China and India.

Market Insights:

- The Diaper Cream Market was valued at USD 2 billion in 2024 and is projected to reach USD 3.12 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

- North America holds the largest market share at approximately one‑third of global revenue, driven by high consumer spending power, advanced retail infrastructure, and a preference for premium, clinically tested formulations.

- Europe follows with a significant share of about one‑quarter to one‑third of the market, bolstered by stringent regulations, demand for organic products, and a preference for eco‑friendly skincare solutions.

- The Asia-Pacific region, with a market share in the low‑to‑mid twenties percent range, is the fastest‑growing region, fueled by rising birth rates, growing middle‑class populations, and the rapid expansion of e‑commerce.

- The market segments into zinc‑oxide based (larger share) and zinc‑oxide free formulations, with the latter growing faster due to the shift towards gentler, hypoallergenic products. Organic products also exhibit strong growth, catering to health-conscious consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Consumer Awareness of Infant Skin Health

An increasing focus on infant skin health drives the demand for diaper creams, particularly among parents and caregivers who seek preventive and effective solutions for diaper rashes. This awareness is bolstered by educational campaigns and online platforms highlighting the importance of proper skin care. Diaper creams are increasingly viewed as essential products to protect infants from irritation caused by prolonged exposure to moisture, enhancing their role in daily baby care routines.

- For instance, Huggies launched its Skin Essentials diaper in 2024 featuring proprietary SkinProtect liner technology that leaves behind up to 5 times less mess than ordinary diapers.

Rising Birth Rates in Emerging Markets

In many developing regions, a rise in birth rates has fueled a surge in demand for baby care products, including diaper creams. Countries in Asia-Pacific and Latin America are seeing significant growth in their infant populations, which leads to an increased market for products that cater to this demographic. The growing middle class in these regions also contributes to higher spending on premium baby care items, further expanding the reach of diaper creams.

- For Instance, In October 2025, the Kimberly-Clark Foundation announced an expanded commitment to supporting women and girls through new partnerships, including with UNICEF, Baby2Baby, Plan International, and Project HOPE. This initiative aims to increase access to essential care in Brazil, China, India, Indonesia, Peru, the U.S., and Vietnam, with the goal of improving the lives of an estimated 24 million women and girls across all partner organizations and countries over the next three years.

Preference for Natural and Hypoallergenic Ingredients

Consumers are becoming more conscious of the ingredients in baby care products, including diaper creams. There is a notable shift towards natural, organic, and hypoallergenic formulations due to concerns over the use of harsh chemicals. This preference is especially strong among parents who prioritize the health and safety of their babies. The diaper cream market has responded with a variety of products free from artificial fragrances, parabens, and synthetic preservatives, making them appealing to a growing segment of health-conscious consumers.

Growth of E-commerce and Online Retail Channels

The rapid expansion of e-commerce platforms has significantly impacted the diaper cream market by providing consumers with convenient access to a wide range of products. Online shopping offers competitive pricing, ease of comparison, and the availability of customer reviews, which influence purchasing decisions. E-commerce also allows consumers to explore niche and premium brands, increasing overall market accessibility and stimulating growth within the diaper cream segment.

Market Trends:

Shift Towards Natural, Clean‑Label, and Eco‑Friendly Formulations

The Diaper Cream Market is witnessing a marked transition from conventional zinc‑oxide‑centric products toward formulations that emphasize natural, clean‑label, and environmentally considerate ingredients. Manufacturers are introducing creams that exclude parabens, synthetic fragrances, phthalates and petrochemical derivatives in favour of botanical extracts, aloe vera, calendula and other soothing agents. Consumer demand now strongly reflects concern over ingredient safety and long‑term skin health, particularly for infants and sensitive skin. Brands are responding by expanding their “organic” and “hypoallergenic” lines and highlighting transparent ingredient lists and certifications. Packaging is also under scrutiny, with sustainable materials, recyclable tubes and reduced‑plastic options becoming more common. This trend supports innovation and premiumization within the market by enabling differentiation on ingredient and ethical bases.

- For instance, Earth Mama Organics developed its USDA Certified Organic Diaper Balm free from zinc, petroleum, parabens, and artificial fragrance, earning a rating of 1 on EWG’s Skin Deep Cosmetics Database—the lowest hazard rating achievable.

Rapid Expansion of Online Channels, Direct‑to‑Consumer Models and Market Reach

The Diaper Cream Market has benefited significantly from the growth of e‑commerce, mobile commerce and direct‑to‑consumer (DTC) models that enhance accessibility and consumer engagement. Online platforms provide broader product choice, peer reviews, subscription services and doorstep delivery that appeal to busy parents and caregivers. Retailers and brands have increased digital marketing efforts, social‑media campaigns and influencer partnerships to reach younger, connected consumers who research before purchasing. The expansion of omnichannel retailing—linking online with offline stores—has allowed brands to integrate purchase experiences and build loyalty. Emerging markets show especially strong growth via digital channels, where internet penetration rises and traditional retail may be less developed. This trend is likely to continue, amplifying geographic reach for new brands and accelerating competitive dynamics in distribution and consumer access.

- For instance, Sonoma Pharmaceuticals launched its hypochlorous acid-based diaper rash product across 3,600 Walmart stores and Amazon.com in August 2025, marking its strategic expansion into large-scale retail channels.

Market Challenges Analysis:

High Price Sensitivity and Cost Pressure on Manufacturers

The Diaper Cream Market faces significant challenges due to high price sensitivity among consumers, especially in lower‑income regions. It encounters strong downward pressure on premiums as retailers promote private‑label and generic alternatives that compete aggressively on price. The need to maintain quality while controlling production and raw‑material costs places strain on manufacturers’ margins. It must balance the cost of incorporating advanced ingredients, natural formulations or sustainable packaging with affordability. The presence of many brands intensifies competition and compels brands to invest more in marketing and differentiation while still keeping prices acceptable.

Regulatory and Ingredient Innovation Constraints Limiting Growth

The market also contends with regulatory complexities and the cost of innovation in formulation that restrict growth. It must observe stricter safety and cosmetic regulations in key regions, which raises the time and expense of product development and approval. The shift toward “clean‑label” and biodegradable ingredients adds technical challenges in maintaining efficacy and stability of diaper creams. It faces substitution risks when consumers perceive barrier creams or other skincare products as alternatives. These factors slow the rollout of new products and limit the ability of brands to respond rapidly to evolving consumer demands.

Market Opportunities:

Expansion into Emerging Geographies with Rising Infant Populations

The Diaper Cream Market has a substantial opportunity to scale in regions where birth rates remain elevated and baby‑care infrastructure is still evolving. It can capture significant growth by localising product lines to meet regional skin‑care norms, cultural preferences and price sensitivities. Partnerships with regional distributors and e‑commerce marketplaces can expand reach into semi‑urban and rural markets, where access to premium baby‑care products has historically been limited. It may leverage educational campaigns and healthcare‑provider endorsements to build trust in new markets. Tailoring marketing and packaging for local languages and consumption habits will further strengthen market entry efforts. This geo‑expansion strategy can deliver incremental revenue streams while diversifying regional risk.

Innovation in Formulation and Product Adjacent Segments for Differentiation

The market can also capitalise on rising demand for natural‑ingredient, hypoallergenic and eco‑friendly formulations to differentiate itself in a crowded space. It may develop barrier creams that include botanical extracts, probiotic skin‑support systems or zinc‑oxide‑free technologies to appeal to health‑conscious parents. Opportunities extend into adjacent adult‑care segments, such as rash creams for elder incontinent populations, thereby leveraging core competencies in barrier skincare. Subscription models and direct‑to‑consumer packaging formats offer further expansion avenues by creating loyal customer bases and recurring revenue. Value‑added services like personalised skin‑care kits and mobile‑app‑based product selection can enhance consumer engagement and raise brand equity. These innovations will enable companies to move beyond commodity competitions and build premium positioning.

Market Segmentation Analysis:

By Ingredients

The market segments ingredients into zinc‑oxide based and zinc‑oxide free formulations. Zinc‑oxide based creams currently hold the largest share because they form a strong protective barrier on the skin and deliver trusted efficacy. The zinc‑oxide free segment grows faster, driven by consumers seeking gentler formulations with botanical extracts and minimal synthetic components. Brands that offer zinc‑oxide free options often appeal to niche and health‑conscious buyers who favour lightweight textures and hypoallergenic claims.

- For instance, Aleva Naturals formulated a plant-based Soothing Diaper Cream enriched with organic shea butter, aloe vera, and calendula extracts that is free of zinc oxide, beeswax, and lanolin

By Nature

In terms of nature, the market divides into conventional and organic categories. Conventional products dominate through broad availability, lower price points and familiar barrier‑based performance. The organic segment, although smaller, shows higher growth due to rising parental demand for clean‑label, naturally derived ingredients, and environmentally friendly packaging. Companies investing in organic creams must manage higher input costs, regulatory certification and shorter shelf lives, but gain differentiation in premium tiers.

- For instance, Hyland’s Naturals expanded into the baby skincare category in 2023 with a collection of 6 USDA Certified Organic products, including Baby Diaper Rash Cream, all dermatologist and pediatrician tested and formulated with organic floral and botanical ingredients.

By Application

Application segmentation splits the market between infant and adult usage. The infant segment leads the market since babies face frequent diaper‑related skin irritation and caregivers prioritise preventive skincare. The adult segment presents a growing opportunity, particularly in long‑term care, incontinence management and hospital settings where skin protection remains critical. Manufacturers developing adult‑specific formulations can expand beyond traditional child‑care channels and tap new use‑cases for barrier skincare.

Segmentations:

By Ingredients

- Zinc‑Oxide Based

- Zinc‑Oxide Free

By Nature

By Application

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America – Strong Leading Position

The North American region holds an estimated market share of approximately one‑third of the global Diaper Cream Market. It benefits from high consumer spending power, sophisticated healthcare infrastructure and elevated awareness of infant skincare. It maintains strong retail penetration via pharmacies, mass‑market chains and online platforms, which supports product availability and brand visibility. Parents in this region prioritize premium, clinically tested formulations and natural ingredients, driving demand for differentiated products. The adult application segment, linked to aging populations and incontinence care, further contributes to growth. The mature market environment challenges brands to maintain innovation and value to safeguard their market positions.

Europe – Significant Share with Premium Orientation

Europe commands a sizable share of the diaper‑cream market, accounting for roughly one‑quarter to one‑third of global revenue. The region’s regulatory standards and preference for eco‑friendly and organic skincare support premium product uptake. It features well‑established retail networks and increasing online commerce, enabling widespread consumer access. Skin‑sensitive consumer segments and sustainability‑driven purchasing behaviour amplify the appeal of high‑value formulations. However, slower birth‑rate trends and cost constraints in some markets impose moderation on volume growth. Companies in Europe emphasise certification, heritage brands and transparent labelling to differentiate.

Asia‑Pacific and Rest of World – Rapid Growth Potential

The Asia‑Pacific region currently captures a smaller share relative to North America and Europe but leads in growth potential, with an estimated share in the low‑to‑mid twenties percent range. It gains momentum from rising birth‑rates, growing middle‑class populations, increased urbanisation and expanding e‑commerce infrastructure. It features diverse national markets with varying price sensitivities, local skincare preferences and regulatory landscapes. It offers opportunities for localised product development, affordable premium brands and digital‑first distribution models. The Rest of World (including Latin America, Middle East & Africa) builds incremental volume through improving distribution and rising awareness of infant skin health. It demands cost‑competitive solutions and often presents supply‑chain and regulatory complexity that manufacturers must navigate to succeed.

Key Player Analysis:

- Bayer AG

- Unilever

- Tubby Todd Bath Co.

- Himalaya Wellness Company.

- Beiersdorf Inc.

- Sebapharma

- Babo Botanicals

- Johnson & Johnson Services, Inc.

- The Honest Company, Inc.

- Summers Laboratories, Inc.

Competitive Analysis:

The competitive landscape in the Diaper Cream Market features several leading players such as Bayer AG, Unilever, Tubby Todd Bath Co., Himalaya Wellness Company, Beiersdorf Inc., and Sebapharma. These companies deploy distinct strategies to gain market share, including formulation innovation, brand extension, and global distribution expansion. It often competes on ingredient quality, barrier efficacy, and product safety to win parental trust. Bayer emphasizes clinically proven barrier creams under its Bepanthen brand, which aid in skin repair and protection. Unilever leverages its broad personal‑care portfolio and strong retail reach to market baby‑care and diaper‑rash solutions efficiently. Tubby Todd targets niche segments with natural and gentle formulations, appealing to health‑conscious parents seeking premium options. All competitors must balance premium positioning with cost pressures and ingredient transparency to maintain growth in this space.

Recent Developments:

- In June 2025, Bayer AG and Kimitec launched two new biological products, Ambition Complete Gen2 and Ambition Secure Gen2, expanding Bayer’s Crop Performance Enhancer portfolio as part of their strategic partnership.

- In June 2025, Unilever acquired Dr Squatch, an American men’s personal care brand, with the goal of expanding its premium direct-to-consumer product portfolio

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Ingredients, Nature, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Diaper Cream Market can harness growth through expanded adult‑use offerings, tapping into aging populations and long‑term care segments.

- It will benefit from enhanced formulations that incorporate microbiome‑friendly ingredients and advanced delivery systems for sensitive skin.

- The market will see greater penetration in emerging economies where rising infant populations and expanding middle classes drive consumption.

- It will gain traction via e‑commerce and direct‑to‑consumer channels that offer convenience, subscription models and personalised product options.

- Sustainable packaging and ethical sourcing will become key differentiators, attracting environmentally conscious buyers and premium segments.

- It will face opportunity in brand collaborations with paediatricians and dermatologists to build trust and clinical credibility in protective skin solutions.

- Multi‑channel marketing strategies with influencer partnerships and digital communities will amplify brand visibility and consumer engagement.

- It will benefit from product diversification into adjacent categories, such as rash care for elder or incontinent populations, expanding its addressable market.

- Regional localisation of ingredients, packaging and pricing strategies will enable it to adapt to varied cultural preferences and regulatory environments.

- It will drive loyalty by offering bundled care kits and loyalty programmes that encourage repeat purchases and support long‑term skin‑care routines.