Market overview

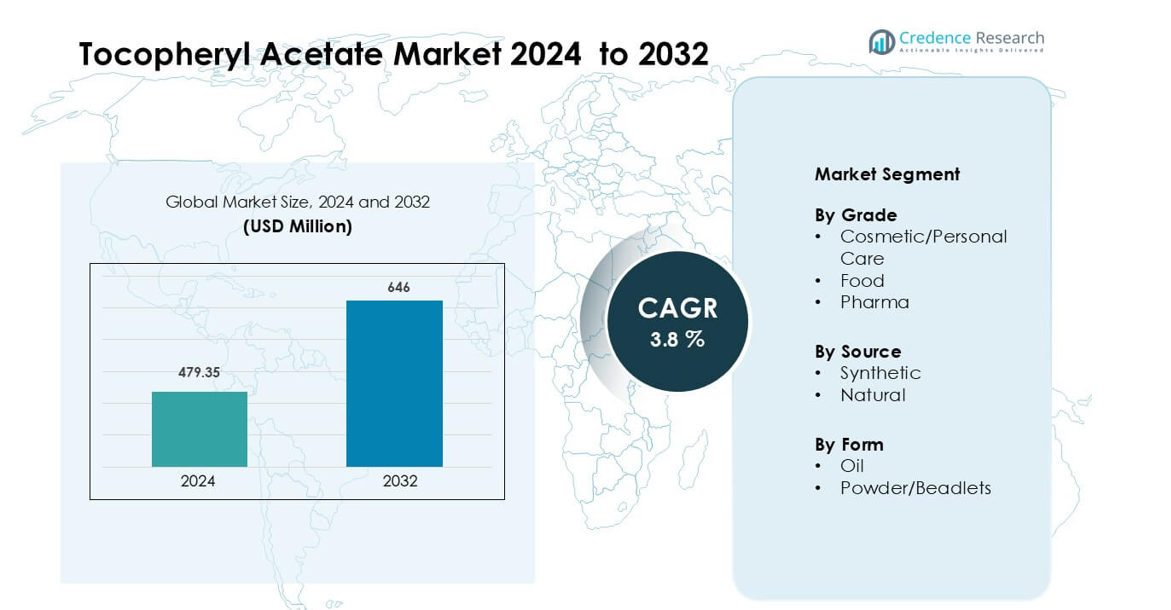

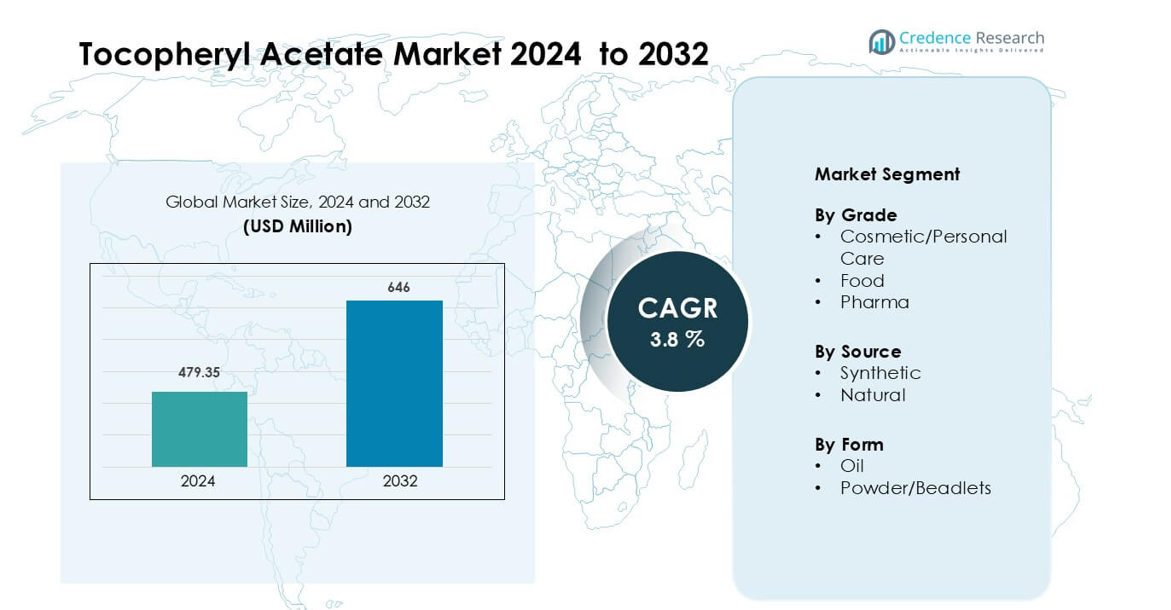

Tocopheryl Acetate Market was valued at USD 479.35 million in 2024 and is anticipated to reach USD 646 million by 2032, growing at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tocopheryl Acetate Market Size 2024 |

USD 479.35 million |

| Tocopheryl Acetate Market, CAGR |

3.8% |

| Tocopheryl Acetate Market Size 2032 |

USD 646 million |

The Tocopheryl Acetate Market is shaped by major companies such as BASF SE, DSM-Firmenich Group, Wilmar International Limited, Zhejiang NHU Co., Ltd., KLK Oleo, Mitsubishi Chemical Group Corporation, Adisseo Group, Zhejiang Medicine Co., Ltd., BTSA, and Eisen-GmbH. These suppliers lead global production through large-scale vitamin-E synthesis facilities and secure access to oleochemical feedstock. Demand rises across skincare, dietary supplements, and fortified foods, pushing firms to expand plant-derived and non-GMO grades. Asia Pacific dominates the Tocopheryl Acetate Market with about 41% share in 2024, supported by strong manufacturing bases in China, Malaysia, and Indonesia. Regional players benefit from low-cost production, integrated supply chains, and expanding export capacity toward North America and Europe.

Market Insights

- The tocopheryl acetate market is valued at USD 479.35 million in 2024 and projected to reach USD 646 million by 2032, growing at a CAGR of 3.8 %.

- A major driver is rising demand from cosmetics and personal-care products, which account for about 54 % of the total market share.

- The synthetic source segment remains dominant with nearly 63 % share, supported by lower production costs and broad availability.

- Leading companies hold around 50–55 % of global revenue through strong integration across oleochemicals, optimized supply chains, and wide formulation networks.

- Asia Pacific leads the global market due to expanding cosmetics manufacturing and strong export activity, making it the fastest-growing and largest regional contributor.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The cosmetic and personal care grade dominates the Tocopheryl Acetate Market with about 52% share in 2024. Manufacturers rely on this grade for its strong antioxidant properties, which help stabilize formulations and protect skin from oxidative stress. Demand grows as skincare brands expand product lines focused on anti-aging, moisturization, and UV protection. Tocopheryl acetate also supports improved shelf stability in creams, serums, lotions, and haircare products. The food grade follows due to rising use as a nutritional fortifier, while the pharmaceutical grade gains traction in supplements and therapeutic formulations aimed at boosting immunity and cellular health.

- For instance, BASF’s Vitamin E-Acetate (cosmetic grade) meets stringent purity standards and is widely used in sun-care and daily personal-care formulations for its moisturizing and protective functions.

By Source

Synthetic tocopheryl acetate leads the segment with nearly 64% market share in 2024. Producers prefer synthetic sources due to cost efficiency, consistent purity, and higher production volumes, which make them suitable for mass-market skincare, dietary supplements, and fortified foods. Demand rises as manufacturers standardize formulations using reliable and scalable synthetic vitamin E inputs. Natural tocopheryl acetate grows steadily, driven by clean-label trends and rising consumer preference for plant-derived antioxidants. Although more expensive, natural sources gain traction in premium cosmetics, nutraceuticals, and organic products seeking high-quality, naturally sourced ingredients.

- For instance, Zhejiang Medicine Co., one of the largest producers of synthetic vitamin E, has a production capacity of 20,000 tonnes per year for synthetic DL-alpha-tocopheryl acetate, demonstrating scale advantages in cost-effective mass manufacture.

By Form

Oil form dominates the market with approximately 67% share in 2024. Companies choose oil-based tocopheryl acetate because of its excellent solubility in cosmetic formulations, dietary supplements, and topical medications. It blends easily into creams, oils, serums, softgel capsules, and fortified foods, driving its extensive use across industries. Growth accelerates as manufacturers prioritize stable, easy-to-process ingredients that enhance texture and product performance. Powder and beadlet forms expand in demand due to their suitability in tablets, powdered supplements, and dry food mixes where flowability and controlled release are required, supporting wider functional applications.

Key Growth Drivers

Rising Demand for Skincare and Personal Care Products

The strongest driver for the Tocopheryl Acetate Market is the rapid growth of the skincare and personal care industry. Tocopheryl acetate, valued for its antioxidant, moisturizing, and skin-protective benefits, is widely used in creams, serums, sunscreens, lotions, and haircare formulations. Beauty brands incorporate this ingredient to enhance product stability, prevent oxidation, and promote smoother, younger-looking skin. Consumer preference for anti-aging, UV-protection, and skin-repair products further accelerates demand. E-commerce expansion and the popularity of premium skincare strengthen usage across global markets. As cosmetic companies shift toward multifunctional ingredients that offer both performance and formulation stability, tocopheryl acetate continues to gain relevance.

- For instance, BASF’s Vitamin E-Acetate Care (INCI: Tocopheryl Acetate) is explicitly designed for use in personal care applications including facial creams, sun-care, and body lotions, offering “in-vivo antioxidant” protection in formulations that may be exposed to light or heat.

Increased Use in Dietary Supplements and Fortified Foods

The growing health and wellness trend is driving higher demand for tocopheryl acetate in dietary supplements and functional foods. Vitamin E plays a crucial role in immunity, cell protection, and metabolism, making tocopheryl acetate a preferred form for capsules, softgels, powders, and fortified beverages. Rising awareness of micronutrient deficiencies and the global shift toward preventive healthcare boost consumption. Food manufacturers use tocopheryl acetate as both a nutrient fortifier and a natural antioxidant that preserves product freshness. With consumers prioritizing nutritional products that support immunity and overall well-being, tocopheryl acetate remains a key ingredient in supplement formulations.

- For instance, Evion® vitamin E capsules contain tocopheryl acetate: the 400 mg softgel corresponds to 180 mg alpha-tocopherol equivalent.

Expansion of Pharmaceutical and Therapeutic Applications

Pharmaceutical usage of tocopheryl acetate continues to grow due to its strong antioxidant and healing properties. The ingredient is used in dermatological treatments, wound-healing formulations, topical medications, and therapeutic creams targeting inflammation and oxidative damage. Pharma companies favor tocopheryl acetate for its stability, safety, and compatibility with other active ingredients. Growing prevalence of skin disorders, rising healthcare expenditure, and increasing demand for vitamin-based therapeutics support this expansion. Additionally, the global push toward advanced topical drug delivery systems creates a favorable environment for tocopheryl acetate adoption across pharmaceutical applications.

Key Trend & Opportunity

Rising Preference for Natural and Clean-Label Vitamin E Sources

A major trend in the market is the shift toward natural and clean-label formulations. Consumers increasingly seek plant-derived, non-synthetic ingredients in personal care, supplements, and functional foods. This shift fuels demand for naturally sourced tocopheryl acetate extracted from vegetable oils and bio-based raw materials. Premium skincare and nutraceutical brands are adopting natural vitamin E to align with organic, vegan, and eco-friendly product claims. Although natural vitamin E remains more expensive than synthetic alternatives, its association with higher purity and perceived safety attracts health-conscious consumers. This trend creates strong growth opportunities for producers focusing on sustainable extraction and natural-grade tocopheryl acetate.

- For instance, DSM-Firmenich, a leading vitamin E manufacturer, produces high-concentration, natural non-GMO vitamin E (d-α-tocopheryl acetate) in its Sisseln (Switzerland) plant, leveraging over 100 patents on vitamin E technology to ensure traceability and stability in its formulations.

Increasing Adoption in Anti-Aging and Premium Skincare Formulations

The anti-aging and luxury skincare segment continues to expand, creating new opportunities for tocopheryl acetate. Manufacturers use the ingredient to enhance skin elasticity, reduce fine lines, and strengthen barrier function. Its compatibility with retinol, hyaluronic acid, niacinamide, and botanical extracts makes it suitable for advanced formulations. As premium skincare brands introduce high-performance serums, night creams, and antioxidant blends, tocopheryl acetate becomes a core ingredient. The growing middle-class population, rising disposable income, and social media influence all contribute to the development of premium skincare portfolios where tocopheryl acetate provides both functional and marketing value.

- For instance, DSM-Firmenich, general scientific literature confirm that d-α-tocopheryl acetate (Vitamin E acetate) strengthens the skin barrier and has antioxidant effects.

Innovation in Delivery Formats and Stabilized Formulations

Technological advancements in delivery systems offer new opportunities in the Tocopheryl Acetate Market. Innovations such as microencapsulation, controlled-release beadlets, and stabilized oil dispersions enhance ingredient performance across cosmetics, food, and pharmaceuticals. These advanced formulations improve bioavailability, extend shelf life, and increase compatibility with complex product matrices. Companies producing high-stability tocopheryl acetate forms can tap into growing demand from supplement manufacturers and premium cosmetic brands. As research progresses, opportunities expand for specialized blends tailored to anti-aging, nutraceutical, and therapeutic applications.

Key Challenge

Fluctuating Raw Material Prices and Supply Constraints

The market faces raw material challenges due to dependency on vegetable oils and petrochemical intermediates used in tocopheryl acetate production. Price fluctuations in soybean, sunflower, and palm-derived inputs affect production costs, especially for natural-grade tocopheryl acetate. Supply instability caused by climate change, trade disruptions, and global demand cycles complicates procurement for manufacturers. These variations impact profit margins and limit affordable availability for small-scale producers. Companies must manage costs through diversified sourcing and improved extraction techniques to maintain stable supply and product pricing.

Competition from Alternative Antioxidants and Synthetic Additives

Tocopheryl acetate competes with a wide range of antioxidants, including ascorbic acid, BHT, and tocopherol blends. Some alternatives offer lower cost, faster absorption, or targeted performance benefits, prompting manufacturers to switch ingredients based on formulation needs. In the cosmetics sector, rising interest in natural botanical antioxidants creates further competition. In dietary supplements, mixed tocopherols sometimes replace tocopheryl acetate due to higher perceived bioactive value. To remain competitive, manufacturers must emphasize tocopheryl acetate’s formulation stability, versatility, and safety profile while continuing to innovate high-performance grades.

Regional Analysis

North America

North America holds about 31% share of the Tocopheryl Acetate Market in 2024. The region benefits from strong demand across skincare, dietary supplements, and fortified foods driven by high consumer awareness of antioxidants and vitamin-based health products. The United States dominates due to its large cosmetics manufacturing base and widespread use of tocopheryl acetate in anti-aging, moisturizing, and UV-protection formulations. Growth strengthens as natural and premium skincare trends expand across retail and e-commerce channels. The dietary supplement sector adds momentum through rising adoption of vitamin E softgels and immunity-support formulations.

Europe

Europe accounts for roughly 28% market share in 2024, supported by mature cosmetic, nutraceutical, and pharmaceutical industries. Countries such as Germany, France, Italy, and the U.K. lead consumption due to strict quality standards and high demand for dermatology-focused products. Clean-label and natural ingredient trends strengthen tocopheryl acetate adoption in premium skincare, organic supplements, and fortified foods. The region also sees continued growth in pharmaceutical use for wound care formulations and topical treatments. Strong regulatory oversight, investment in R&D, and established manufacturing infrastructure contribute to stable market expansion.

Asia-Pacific

Asia-Pacific dominates the Tocopheryl Acetate Market with about 34% share in 2024. The region’s large population, expanding middle class, and growing interest in beauty and wellness drive strong demand for vitamin E–based skincare and supplements. China, Japan, South Korea, and India lead consumption due to booming cosmetics production and rapid growth in nutritional product usage. Skincare categories such as whitening, brightening, anti-aging, and sun protection rely heavily on tocopheryl acetate. Pharmaceutical applications also expand as healthcare spending increases. Strong manufacturing capacity and rising export activity further support regional leadership.

Latin America

Latin America holds close to 5% share of the market in 2024. Demand rises steadily across Brazil, Mexico, and Argentina due to growing consumption of personal care products, fortified foods, and dietary supplements. The cosmetics sector increases tocopheryl acetate usage in moisturizers, lotions, and anti-aging formulations. Rising awareness of vitamin deficiencies supports its use in nutritional products. While economic variability affects spending power, the region benefits from expanding local manufacturing and broader availability of affordable skincare brands. Pharmaceutical use grows moderately through demand for topical vitamin E preparations.

Middle East & Africa

The Middle East & Africa region captures around 2% share in 2024. Growth is supported by increasing adoption of skincare, haircare, and pharmaceutical products containing tocopheryl acetate, particularly in Gulf countries. Rising incomes and expanding retail distribution encourage uptake of vitamin E–based cosmetics and supplements. North African markets, including Egypt and Morocco, show growing interest in fortified foods and affordable personal care formulations. Limited manufacturing capacity results in high import dependence, but demand continues to rise due to growing awareness of antioxidant benefits and expanding healthcare spending across urban centers.

Market Segmentations:

By Grade

- Cosmetic/Personal Care

- Food

- Pharma

By Source

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tocopheryl Acetate Market features strong competition among major producers, led by companies such as BASF SE, DSM-Firmenich Group, Wilmar International Limited, Zhejiang NHU Co., Ltd., KLK Oleo, Mitsubishi Chemical Group Corporation, Adisseo Group, Zhejiang Medicine Co., Ltd., BTSA, and Eisen-GmbH. Producers focus on high-purity grades that support cosmetics, dietary supplements, and fortified food products. Leading suppliers expand production lines to meet rising demand for stable vitamin-E derivatives used in skin-care creams and antioxidant blends. Manufacturers invest in advanced purification systems that improve product clarity and long-term stability. Several participants enhance backward integration across oleochemical chains to secure fatty alcohol feedstock and reduce supply risks. Strategic partnerships with nutraceutical brands help suppliers gain steady contract volumes across Asia and Europe. Product innovation centers on non-GMO, plant-derived, and sustainable grades that match clean-label preferences. Market competition strengthens as regional Asian manufacturers scale exports into North America and the EU.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Zhejiang NHU Europe issued a revised specification for Vitamin E Acetate 98 %. The document detailed stability, handling, and permitted uses in food, cosmetics, and feed additives. This update supports consistent quality and regulatory compliance for NHU’s tocopheryl acetate offerings in Europe.

- In August 2024, BASF declared Force Majeure on vitamin A, vitamin E, and carotenoids after a plant fire. The affected site produced key precursors for vitamin E and its esters. This disruption temporarily tightened global tocopheryl acetate availability and pushed customers to diversify sourcing.

- In April 2024, KLK Oleo and Davos Life Science showcased vitamin E–rich phytonutrients at Vitafoods Europe. The booth highlighted solutions for nutraceutical, cosmeceutical, and functional food applications. This promotion supports wider adoption of tocopherol and tocotrienol ingredients in premium vitamin E formulation

Report Coverage

The research report offers an in-depth analysis based on Grade, Source, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as skincare brands increase use of stable vitamin-E derivatives.

- Supplement makers will adopt higher-purity grades to meet clean-label needs.

- Natural and plant-derived tocopheryl acetate will gain stronger traction across global markets.

- Producers will expand capacity in Asia to support growing cosmetic exports.

- New formulations will focus on enhanced oxidation stability for longer shelf life.

- Companies will invest in bio-based feedstock to reduce dependency on synthetic sources.

- Regulatory focus on ingredient safety will push manufacturers toward transparent sourcing.

- Digital retail growth will boost consumption of vitamin-E enriched beauty products.

- Competition will intensify as regional players upgrade production quality and efficiency.

- Strategic collaborations between supplement brands and raw-material suppliers will accelerate market expansion.