Market Overview:

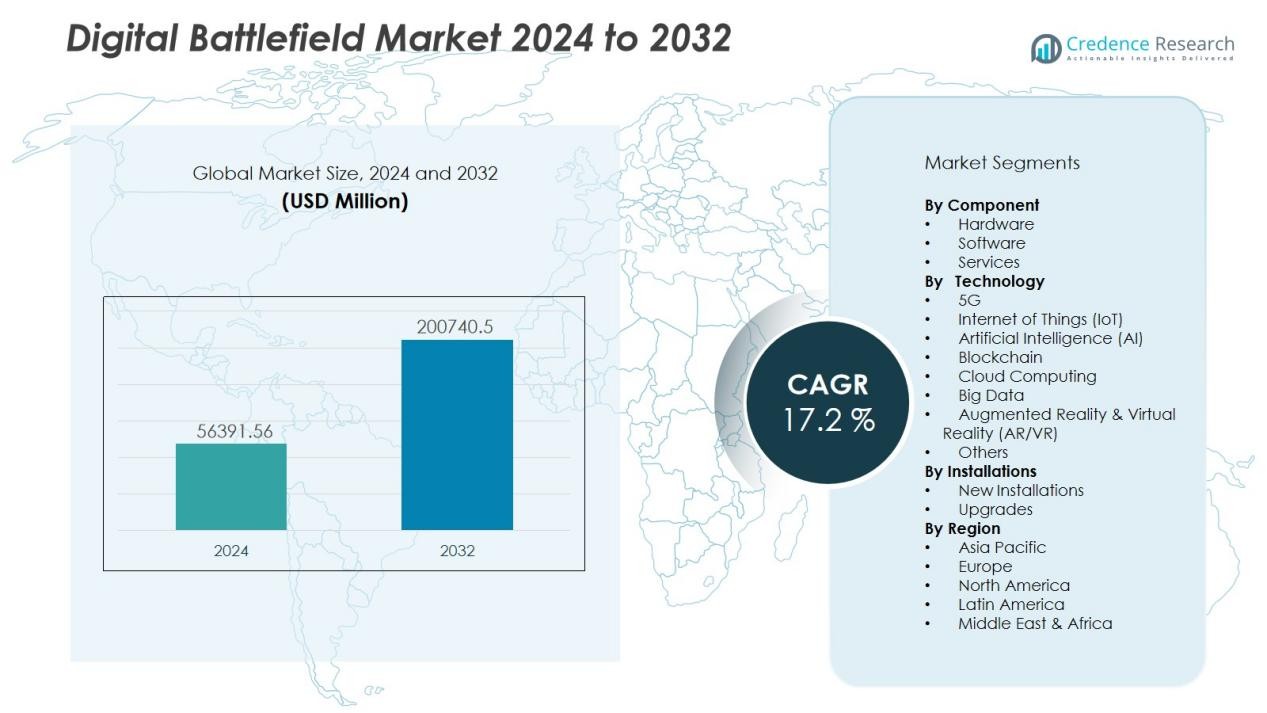

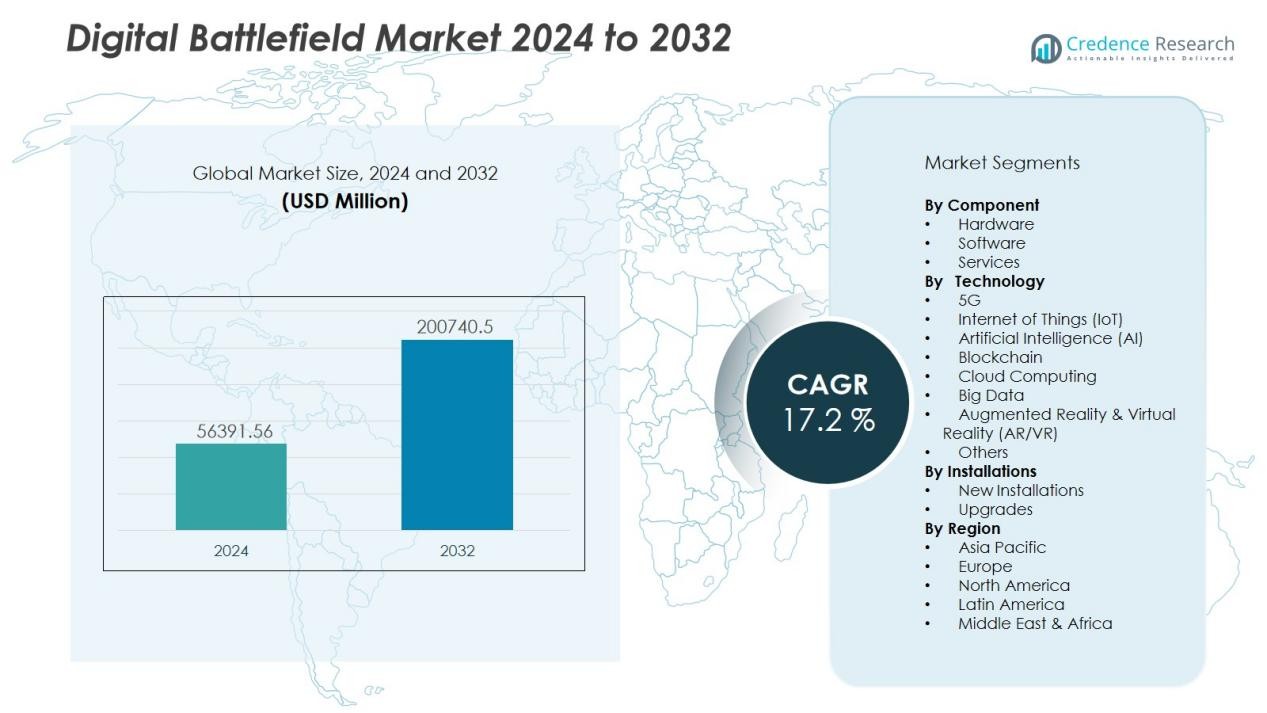

The Digital Battlefield Market size was valued at USD 56391.56 million in 2024 and is anticipated to reach USD 200740.5 million by 2032, at a CAGR of 17.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Battlefield Market Size 2024 |

USD 56391.56 Million |

| Digital Battlefield Market, CAGR |

17.2% |

| Digital Battlefield Market Size 2032 |

USD 200740.5 Million |

Key drivers for market growth include rapid integration of artificial intelligence, machine learning, and autonomous systems in military operations, the rising need for secure digital communication and network-centric warfare capabilities, and substantial defense modernization budgets globally. For example, drone and unmanned system deployments, plus cloud-based command and control platforms, are creating strong demand.

Regionally, North America currently dominates the market with over 39% share in 2023, driven by heavy defense investments and advanced technological infrastructure. Asia-Pacific is emerging fast, with nations such as India and China accelerating digital battlefield modernization and exhibiting higher-than-average growth rates. Europe also contributes significantly, while the Middle East & Africa show niche but growing opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Digital Battlefield Market was valued at USD 28,547.29 million in 2018, reached USD 56,391.56 million in 2024, and is projected to hit USD 200,740.5 million by 2032, growing at a CAGR of 17.2 %.

- North America leads with 38.6 % share, driven by heavy defense investments and advanced technological infrastructure, supported by leading U.S. defense contractors and government modernization programs.

- Asia-Pacific holds 24 % share and represents the fastest-growing region, fueled by strong defense spending, digital command systems, and domestic manufacturing programs in India, China, and Japan.

- Europe accounts for 20 % share, emphasizing interoperable systems, cybersecurity resilience, and NATO-aligned modernization projects, sustaining consistent growth across established defense networks.

- By component, hardware captures 46 % share due to high demand for sensors, communication devices, and unmanned platforms, while services record 32 % share driven by system integration and managed cybersecurity offerings.

Market Drivers:

Growing Integration of Advanced Technologies

One of the primary drivers of the Digital Battlefield Market is the increasing integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and autonomous systems into defense operations. These technologies enable faster decision-making, enhance situational awareness, and improve operational efficiency on the battlefield. By leveraging these technologies, military forces can analyze real-time data more effectively, increasing the overall success of missions. As digital transformation in defense accelerates, it is becoming clear that AI and ML will play a crucial role in shaping future warfare strategies.

- For Instance, intelligence operation timelines dropped from hours to minutes in the sensing-to-target-engagement cycle, and Army leaders are leveraging Maven to achieve 1,000 high-quality target decisions per hour on the battlefield.

Expansion of Network-Centric Warfare

The need for secure, efficient communication systems in military operations is another key factor driving the growth of the Digital Battlefield Market. Network-centric warfare focuses on integrating various systems, platforms, and data to create a unified operational environment. This integration ensures that all assets, whether land, air, or naval, are connected and share vital information. With increasing demand for network-centric operations, military forces worldwide are adopting digital solutions to improve coordination, enhance command and control, and reduce operational delays.

- For instance, the Raytheon Advanced Field Artillery Tactical Data System (AFATDS) enables the planning and control of all fire support assets for the US Army and Marine Corps, delivering timely targeting information to units and providing a common operational picture across the battlefield.

Rising Demand for Unmanned Systems and Drones

The rapid rise in the deployment of unmanned systems, including drones, is another major driver fueling market growth. Unmanned aerial vehicles (UAVs) are revolutionizing modern warfare by providing real-time reconnaissance, surveillance, and combat support. They reduce the risk to personnel while providing invaluable tactical advantages. As drone technology evolves, it will continue to play a pivotal role in shaping the future of the Digital Battlefield Market, enabling military forces to conduct more precise and effective operations.

Government Investments in Defense Modernization

Governments worldwide are significantly increasing investments in defense modernization programs, further boosting the growth of the Digital Battlefield Market. These investments focus on upgrading digital infrastructure, incorporating new technologies, and enhancing cybersecurity measures. With increasing geopolitical tensions and the need for strategic superiority, nations are prioritizing defense spending to ensure their forces remain technologically advanced. This sustained investment in modernization will drive the continued growth and innovation within the digital battlefield sector.

Market Trends:

Rapid Adoption of Multi‑Domain Connectivity Platforms

The Digital Battlefield Market continues to benefit from the military’s growing emphasis on multi‑domain connectivity across land, air, naval and space theatres. Defense forces deploy advanced communication networks, sensor fusion systems and interoperable platforms to share data in real time, giving commanders improved situational awareness. It supports faster decision‑making by linking unmanned systems, satellites and ground forces in a unified architecture. Innovations in 5G, satellite communications and edge computing enhance this connectivity trend. Equipment suppliers shift toward open‑architecture designs to enable integration of new modules and future upgrades. This connectivity focus reinforces investment priorities across allied nations.

- For Instance, Boeing’s Wideband Global SATCOM (WGS) satellite constellation provides approximately 4.875 GHz of instantaneous switchable bandwidth, delivering between 2.1 and 3.6 gigabits per second of communications capacity.

Expansion of Simulation, Training and Cyber Resilience Capabilities

Training and simulation technologies play an increasing role in the Digital Battlefield Market, supporting realistic mission rehearsal, virtual and augmented‑reality environments and scenario‑based analytics. Military organisations adopt immersive training platforms to reduce risk, lower cost and shorten preparation time for complex operations. Simultaneously, cyber‑resilience capabilities have moved into the core market focus, with defence agencies investing in secure networks, intrusion detection systems and AI‑driven counter‑cyber‑threat tools. It reflects the growing acknowledgment that digital systems themselves constitute a contested domain. Suppliers now offer integrated training‑cyber packages that combine simulation with live‑exercises and red‑teaming. The merger of simulation and cyber functions is reshaping procurement strategies and vendor offerings in the market.

- For instance, Sigma Defense Systems secured a USD 4.7 million contract to build the OMNIVORE-IT immersive virtual reality platform for the US Army, blending intelligence training with simulation technologies tailored for operator maintainers, exemplifying convergence of training and cyber resilience technologies in defense procurement.

Market Challenges Analysis:

Interoperability Constraints and Technology Fragmentation

The Digital Battlefield Market faces significant obstacles from inconsistent standards and legacy systems. It remains difficult for equipment from varied vendors to share data seamlessly and support joint operations. The lack of uniform protocols slows integration and limits scalability of battlefield networks. Some platforms require bespoke solutions, which increase maintenance burdens and reduce operational flexibility. Many defence organisations hesitate to upgrade entire systems when costly upgrades disrupt mission readiness. These factors delay deployment and hinder full capability realisation.

Cybersecurity Risks and Cost Pressures

Cyber‑threats pose a major challenge for the Digital Battlefield Market, with military networks vulnerable to hacking, jamming and data manipulation. It demands robust cybersecurity architecture, which increases upfront investment and ongoing operational expense. Budget constraints force defence agencies to prioritise between modernisation and sustaining legacy systems, creating trade‑offs. Skilled personnel shortage complicates threat mitigation and system upkeep. Regulatory hurdles and export controls add complexity to global supply chains and reduce market agility. These pressures slow innovation and restrict broader adoption across end‑users.

Market Opportunities:

Emerging Growth in Cyber Security and Data Analytics Solutions

The Digital Battlefield Market holds robust opportunity in the development and deployment of cybersecurity platforms tailored to defence environments. Military networks now face complex threats, and demand for secure encryption, intrusion detection, and resilient communication systems is growing. It opens up prospects for providers of advanced data‑analytics platforms designed to process intelligence from sensors, UAVs and satellites. Firms that deliver cloud‑native architectures, secure data management and real‑time insight tools stand to capture meaningful contracts. These solutions enable operators to assess threats faster and allocate resources with greater precision. Strong defence budgets in several nations underpin investment in such capabilities, which creates room for new entrants and rapid innovation.

Expansion of Platform Modernisation and Multidomain Connectivity

Opportunity within the Digital Battlefield Market also arises from modernisation of military platforms and integration across land, sea, air and space domains. Forces are upgrading legacy systems and implementing network‑centric architectures to improve connectivity and situational awareness. It prompts demand for interoperable hardware, software modules and services that support unified command and control. Vendors that offer modular, upgradable systems and open‑architecture frameworks can meet this market need effectively. Growth in unmanned systems, edge computing and 5G/6G communications further expand the field of engagement. With nations seeking future‑proof solutions, this development path presents solid opportunity for providers in the defence ecosystem.

Market Segmentation Analysis:

By Technology

Technology segmentation covers 5G, IoT, AI, blockchain, cloud computing, big data, AR/VR and others. IoT currently commands significant share thanks to sensor networks and connected platforms deployed by armed forces. AI and big‑data analytics show strong projected growth because they enhance decision‑making speed and autonomous operations. Cloud and edge computing solutions support real‑time mission data processing, giving defence agencies operational agility. AR/VR technologies support advanced training and simulation, carving out niche sub‑segments within the wider market.

- For instance, The AI in military market is projected to grow from approximately $8.86 billion in 2024 to approximately $21.56 billion by 2032, representing an 11.8% compound annual growth rate.

By Installations

The installations segment is divided into new installations and upgrades. New installation demand dominates due to widespread modernization programmes and fresh procurement of digital battlefield systems. Upgrade projects grow steadily since militaries update legacy networks and platforms with digital‑native capabilities. It offers opportunities for vendors to retrofit existing equipment and provide incremental system enhancements. The dual focus on green‑field deployments and refits supports robust expansion across both installation categories.

- For instance, Northrop Grumman successfully completed delivery of all 142 major end items for the Integrated Battle Command Systems (IBCS) Low-Rate Initial Production contract to the U.S. Army on July 30, 2025, as part of its ongoing digital modernization initiative.

Segmentations:

By Component

- Hardware

- Software

- Services

By Technology

- 5G

- Internet of Things (IoT)

- Artificial Intelligence (AI)

- Blockchain

- Cloud Computing

- Big Data

- Augmented Reality & Virtual Reality (AR/VR)

- Others

By Installations

- New Installations

- Upgrades

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North American Regional Landscape

North America commands a 38.6 % share of the Digital Battlefield Market, driven by sustained defence investment and advanced technology infrastructure. The United States leads with extensive funding in AI, cybersecurity and unmanned systems. It benefits from a robust defence industry base and strong integration with major tech firms. Military agencies deploy connected platforms across land, sea, air and space, reinforcing real‑time data effectiveness. Procurement cycles support large‑scale upgrades of existing systems alongside new digital installations. The market maturity prompts vendors to focus on value‑added services, lifecycle maintenance and interoperable solutions.

Asia‑Pacific Regional Landscape

Asia‑Pacific holds a 24 % share of the market and exhibits the highest growth potential in the Digital Battlefield Market. Countries such as India, China and Japan are modernising military forces, investing in drone systems, networked platforms and satellite‑based surveillance. It responds to complex regional security dynamics and rising defence budgets. Domestic defence manufacturing initiatives and local supplier partnerships support ecosystem expansion. Nations prioritise digital command‑and‑control, edge computing and unmanned deployments. The growth environment encourages global suppliers to pursue local alliances and region‑specific solution offerings.

European and Middle East & Africa (MEA) Regional Landscape

Europe accounts for an estimated 20 % share of the market and the MEA region holds roughly 10 % of the Digital Battlefield Market. European nations emphasise cybersecurity resilience, interoperable defence initiatives and autonomous systems integration across NATO alliances. It experiences steady demand for upgrades and next‑generation digital battlefield capabilities. In the MEA region, spending centres on surveillance, unmanned systems and networked communication amid geopolitical shifts and regional conflicts. Vendors emphasise modular solutions and local support infrastructure to meet cost‑sensitive requirements. Emerging players in the MEA market offer competitive entry points for defence technology providers.

Key Player Analysis:

Competitive Analysis:

The competitive analysis of the Digital Battlefield Market reveals a concentrated but evolving environment. Major players such as Airbus S.A.S., AeroVironment, Inc., BAE Systems, Inc., Elbit Systems Ltd. and General Dynamics Corporation lead by investing heavily in next‑generation systems, delivering integrated hardware‑software‑services solutions and leveraging global defence contracts. These organisations focus on differentiating through product innovation, strategic alliances and regional presence. It also means smaller specialist firms must compete on niche capabilities such as AI‑driven analytics, autonomous platforms or edge computing to gain traction. The key players maintain scale advantages in supply chains, regulatory access and long‑term service contracts. This dynamic elevates the importance of continuous technological refresh, flexible business models and agile deployment frameworks in securing leadership positions within the market.

Recent Developments:

- In October 2025, Airbus, Leonardo, and Thales signed a Memorandum of Understanding to merge their space businesses and create a new European space entity.

- In September 2025, Centech and Airbus announced a partnership to accelerate adoption of advanced aerospace technologies in Canada.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Component, Technology, Installations and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Digital Battlefield Market will see heightened deployment of AI‑enabled decision‑support systems for tactical command.

- Real‑time data fusion from multi‑domain sensors will drive battlefield awareness and system responsiveness.

- Edge computing will gain ground, enabling frontline units to operate with minimal latency and less dependency on central data centers.

- Unmanned systems and autonomous platforms will expand rapidly, reducing risk to personnel and stretching mission reach.

- Cyber‑resilience architectures will become standard in defence procurement, ensuring networks withstand increasingly sophisticated attacks.

- Open‑architecture frameworks will attract military buyers, allowing vendors to plug modules and upgrades without full system replacement.

- Multi‑domain connectivity across land, sea, air and space will form a core requirement for network‑centric operations.

- Simulation and virtual training environments will surge, lowering cost and enhancing readiness for complex scenarios.

- Emerging markets in Asia‑Pacific and the Middle East will present strong growth opportunities, driven by increasing defence modernisation.

- Service‑based models—such as managed upgrades, lifecycle support and capability‑as‑a‑service—will transform vendor‑buyer relationships.