Market overview

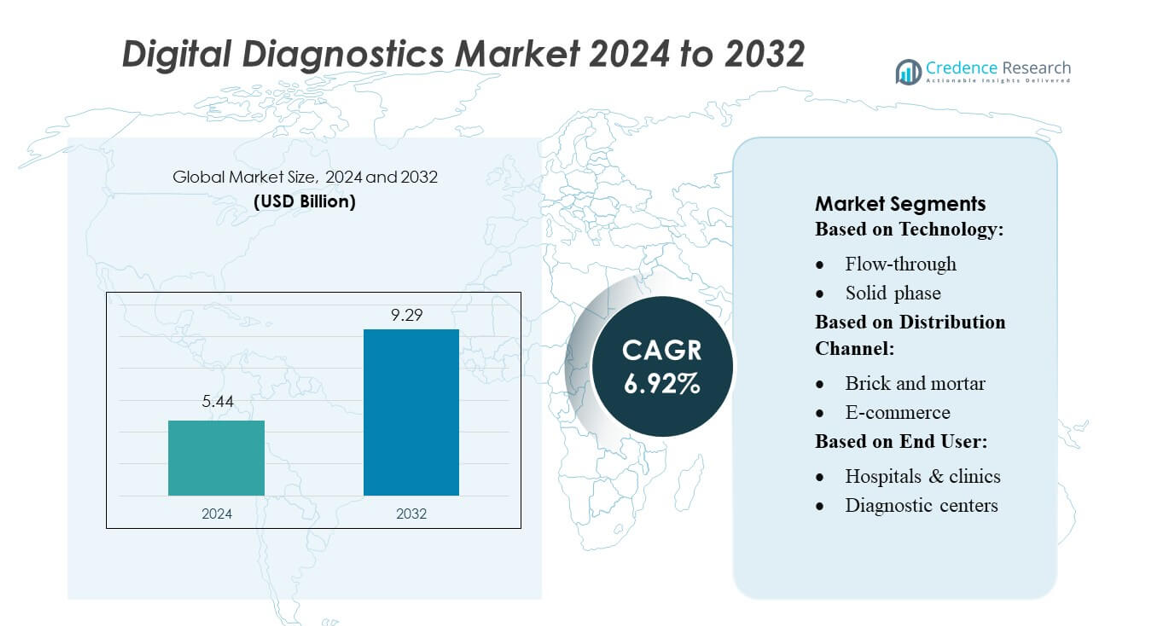

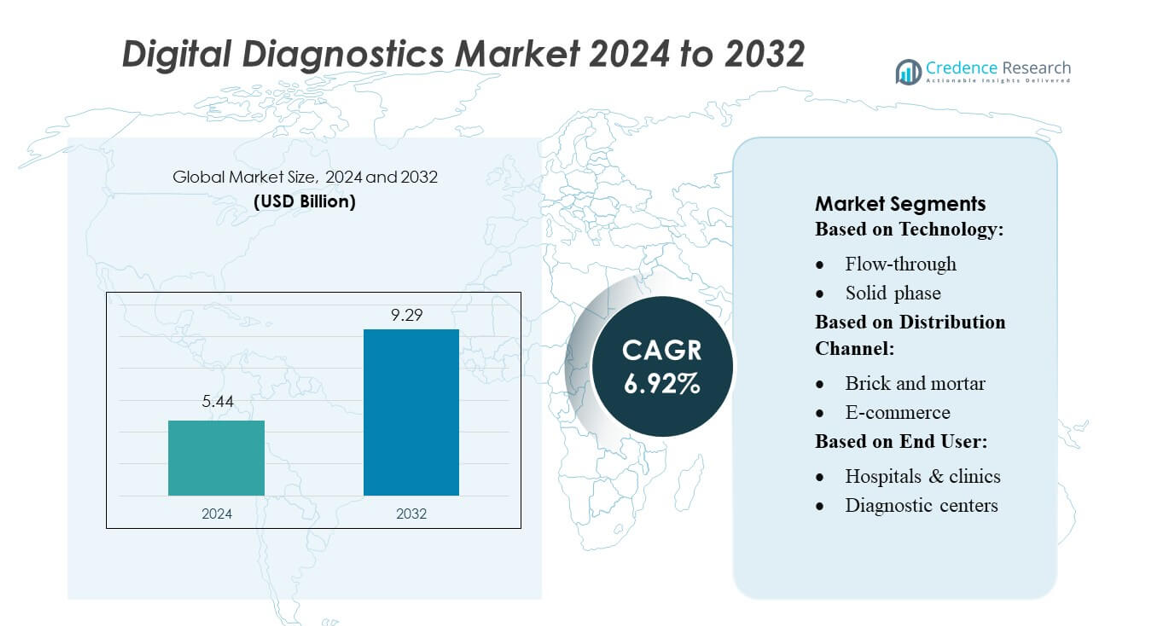

Digital Diagnostics Market size was valued USD 5.44 billion in 2024 and is anticipated to reach USD 9.29 billion by 2032, at a CAGR of 6.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Diagnostics Market Size 2024 |

USD 5.44 billion |

| Digital Diagnostics Market, CAGR |

6.92% |

| Digital Diagnostics Market Size 2032 |

USD 9.29 billion |

The Digital Diagnostics Market is shaped by a diverse group of global companies that continuously strengthen their portfolios through AI integration, advanced molecular testing platforms, and connected point-of-care technologies. These players focus on improving diagnostic accuracy, enabling remote data access, and expanding digital ecosystems that support faster clinical decision-making across hospitals, diagnostic centers, and homecare settings. Strategic investments in cloud-enabled workflows, digital pathology, and wearable-powered monitoring further enhance market competitiveness. North America leads the global market with approximately 38% share, driven by strong healthcare IT infrastructure, high adoption of digital testing solutions, and rapid integration of AI-driven diagnostic tools.

Market Insights

- The Digital Diagnostics Market was valued at USD 5.44 billion in 2024 and is projected to reach USD 9.29 billion by 2032, registering a CAGR of 6.92%, supported by expanding digital testing adoption and continuous demand for connected diagnostic solutions.

- Rising need for rapid, accurate, AI-enabled diagnostic tools drives strong market growth as hospitals, clinics, and homecare settings prioritize faster decision-making and improved clinical outcomes across major technology segments led by flow-through platforms holding the largest share.

- Increasing adoption of digital pathology, cloud-integrated workflows, and wearable-based monitoring represents a major market trend, enhancing interoperability and enabling real-time diagnostic insights across clinical environments.

- Competitive intensity increases as global companies invest in advanced molecular platforms, remote data connectivity, and digital ecosystems, while high implementation costs and interoperability gaps restrain adoption in low-resource settings.

- North America leads the market with 38% share, supported by strong IT infrastructure and early AI adoption, while hospitals and clinics remain the dominant end-user segment with the highest share due to large test volumes and advanced digital integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Flow-through technology holds the dominant position in the Digital Diagnostics Market, capturing around 38% share due to its rapid signal generation, minimal sample preparation, and compatibility with high-throughput clinical workflows. Its adoption accelerates in infectious disease testing and point-of-care applications where faster turnaround improves clinical decision-making. Lateral flow assays follow closely as demand rises for self-testing solutions in chronic and acute conditions. Growth across platforms is driven by rising digital integration, improved assay sensitivity, and the shift toward decentralized diagnostics supporting real-time data capture and remote monitoring.

- For instance, Sysmex’s imaging flow cytometer MI-1000 enables measurement of more than 10,000 cells in about 10 minutes for its automated flow FISH system, which handles 20 to 100 times more cells than conventional manual methods.

By Distribution Channel

Brick-and-mortar channels account for nearly 62% share, making them the dominant distribution segment as hospitals, clinics, and authorized distributors continue to rely on regulated supply chains and assured product authenticity. Their leadership is sustained by institutional purchasing, procurement contracts, and the need for validated devices in clinical settings. E-commerce platforms expand rapidly driven by consumer preference for home-based testing, wider product visibility, and competitive pricing. Digital-first distribution grows further as manufacturers adopt direct-to-consumer models and integrate telehealth platforms for seamless diagnostic ordering, remote interpretation, and follow-up care.

- For instance, Agilent’s CrossLab logistics network manages over 35,000 certified parts SKUs and supports instrument uptime through 24/7 regional service hubs, ensuring validated delivery and compliance for CLIA-regulated laboratories.

By End User

Hospitals and clinics lead the market with approximately 47% share, supported by strong investment in digital diagnostic infrastructure, higher test volumes, and the need for integrated reporting systems that connect with electronic health records. Diagnostic centers follow as they deploy AI-enabled imaging and pathology solutions to enhance workflow accuracy and reduce turnaround times. Homecare settings witness fast growth due to rising self-testing adoption and expansion of connected devices enabling remote disease monitoring. Market expansion is driven by increasing chronic disease burden, demand for rapid digital testing, and ongoing emphasis on value-based care models.

Key Growth Drivers

Rising Demand for Rapid and Connected Diagnostic Solutions

Demand for rapid, digitally enabled diagnostics continues to increase as healthcare systems shift toward faster clinical decisions and decentralized care delivery. Digital platforms integrate AI, cloud connectivity, and automated workflows to support remote monitoring, real-time reporting, and streamlined triage. Hospitals and homecare users adopt these tools to improve diagnostic accuracy and reduce turnaround times, particularly in infectious diseases and chronic condition management. Growth strengthens as payers reward faster diagnoses and as digital tools extend diagnostic access to underserved populations.

- For instance, bioMérieux’s BIOFIRE® FilmArray® systems deliver fully automated syndromic test results in about 45 minutes and can detect up to 27 respiratory pathogens in a single run, supported by closed-cartridge processing that requires two minutes of hands-on time.

Expansion of Point-of-Care and At-Home Testing Ecosystems

The expansion of point-of-care and home-based testing ecosystems drives strong adoption across digital diagnostics. Consumers favor self-testing for chronic diseases, fertility, infectious conditions, and routine wellness screening, supported by smartphone integration and app-based result interpretation. Healthcare providers increasingly deploy portable analyzers and connected lateral flow platforms to support decentralized workflows. This shift reduces patient load in hospitals, accelerates therapeutic interventions, and enhances continuity of care. The ecosystem grows further as governments promote early detection programs and reimburse remote testing solutions.

- For instance, Quest’s “Quest Mobile™” service deploys a network of 5,000 trained mobile phlebotomists and will cover 44 U.S. states by end of 2023, enabling in-home specimen collection for more than 800 different tests via physician order.

Integration of AI and Advanced Analytics in Diagnostic Workflows

AI and analytics play a central role in improving diagnostic precision, enabling automated image interpretation, anomaly detection, and predictive insights. Machine learning models enhance sensitivity and specificity for pathology, radiology, and molecular diagnostics while reducing clinician workload. These capabilities support early disease identification and help standardize decision-making across diverse healthcare settings. Adoption accelerates as regulatory bodies approve AI-enabled diagnostic tools and as providers seek cost-effective technologies that reduce errors and improve operational efficiency across clinical pathways.

Key Trends & Opportunities

Rapid Growth of Digital Pathology and Remote Diagnostic Review

Digital pathology adoption increases rapidly as laboratories convert glass slides into high-resolution digital formats that support remote review and AI-assisted assessments. This trend expands access to subspecialty expertise, particularly in regions facing pathologist shortages. High-speed scanners, secure cloud platforms, and interoperable data systems drive efficiencies in oncology, infectious diseases, and chronic condition monitoring. The opportunity grows as health systems invest in telepathology networks and as vendors enhance collaboration tools enabling multi-site case discussions and integrated quality assurance workflows.

- For instance, QIAGEN’s QIAseq Digital Insights platform processes over 25 million sequencing reads per run for oncology variant calling and integrates AI-enabled annotation pipelines used in more than 600 clinical laboratories globally.

Rising Adoption of Wearable and Continuous Monitoring Devices

Wearables and continuous monitoring devices create major opportunities by capturing real-time biomarkers such as heart rhythm, glucose levels, respiratory parameters, and physiological stress indicators. Their integration with mobile apps and telehealth platforms enables early detection and proactive intervention in chronic and acute conditions. Manufacturers expand sensor accuracy, battery life, and device interoperability, increasing their value in remote patient management programs. Growth is reinforced by consumer health trends, employer wellness initiatives, and health insurers adopting digital monitoring to reduce long-term care costs.

- For instance, Charles River’s subsidiary Data Sciences International (DSI) provides PhysioTel™ telemetry implants capable of recording ECG, blood pressure, and activity at sampling rates up to 2,000 Hz, delivering uninterrupted physiologic data for up to 12 weeks depending on the model.

Expansion of Cloud-Based Diagnostic Data Platforms

Cloud-based diagnostic platforms gain momentum as healthcare providers prioritize scalable data management, seamless integration, and secure multi-site collaboration. These platforms allow centralized storage of imaging, laboratory, and pathology data while supporting real-time analytics and cross-facility workflow optimization. Interoperable cloud architectures accelerate clinical decision-making and enable comprehensive patient insights across care teams. Opportunities expand as vendors enhance cybersecurity frameworks and as health systems pursue digital transformation strategies aligned with population health analytics and precision medicine goals.

Key Challenges

Data Privacy, Security, and Interoperability Barriers

Data privacy and security concerns remain major obstacles as digital diagnostics rely heavily on cloud platforms, connected devices, and AI models. Health systems face difficulties integrating diagnostic data across disparate electronic health record systems, limiting workflow efficiency and clinical visibility. Cybersecurity risks increase with the rise of remote testing and home-based devices, requiring stronger encryption and compliance frameworks. These challenges slow digital adoption and demand significant investment in secure data exchange protocols, standardized formats, and resilient digital health infrastructure.

High Implementation Costs and Limited Digital Readiness

High implementation and maintenance costs challenge providers, especially in low-resource settings where digital infrastructure remains underdeveloped. Upgrading diagnostic equipment, deploying AI-enabled systems, and training personnel require substantial investment, limiting adoption among smaller clinics and diagnostic centers. Variability in digital literacy across end users further restricts optimal utilization. These cost and readiness gaps contribute to uneven digital penetration across regions and delay the transition toward fully integrated diagnostic workflows, despite growing clinical and operational benefits.

Regional Analysis

North America

North America leads the Digital Diagnostics Market with approximately 38% share, driven by strong adoption of AI-enabled diagnostic systems, advanced imaging platforms, and connected point-of-care technologies. Hospitals and diagnostic networks invest heavily in digital workflow automation, remote monitoring tools, and cloud-based data platforms. Regulatory support for AI-driven diagnostics, growing reimbursement pathways, and rapid expansion of telehealth strengthen market penetration. High disease screening rates, a mature healthcare IT ecosystem, and widespread use of at-home testing kits accelerate ongoing digital transformation across the U.S. and Canada, reinforcing the region’s dominant position.

Europe

Europe holds around 29% share of the Digital Diagnostics Market, supported by well-established healthcare infrastructure and consistent investment in digital health modernization. Countries across Western Europe adopt AI-integrated imaging, digital pathology networks, and remote diagnostic review tools to address clinician shortages and improve care efficiency. Cross-border health data frameworks and national e-health programs accelerate interoperability and connectivity. Rising chronic disease prevalence and demand for early screening push adoption of portable and home-based diagnostic solutions. Strong regulatory harmonization and public–private innovation programs reinforce Europe’s steady transition toward digitally enabled diagnostic care.

Asia-Pacific

Asia-Pacific accounts for nearly 24% share, making it one of the fastest-growing regions in the Digital Diagnostics Market as healthcare systems prioritize modernization and accessibility. Expanding digital infrastructure, rapid urbanization, and rising demand for affordable point-of-care testing drive adoption in China, India, Japan, and South Korea. Governments support telemedicine, AI-based screening tools, and home diagnostics to reduce clinical burden and enhance disease surveillance. Growing investment from regional tech companies and multinational players accelerates market expansion. Increasing health awareness and wider smartphone penetration further stimulate uptake of connected diagnostic devices and mobile-enabled testing platforms.

Latin America

Latin America captures roughly 6% share of the Digital Diagnostics Market, supported by growing interest in remote patient monitoring, AI-driven imaging, and decentralized diagnostic services. Countries such as Brazil, Mexico, and Colombia invest in telehealth expansion and digital pathology solutions to improve specialist access across underserved regions. Public health initiatives promoting early diagnosis of infectious and chronic diseases strengthen demand for rapid digital tools. Despite infrastructure gaps and reimbursement limitations, the region shows accelerating adoption due to rising private-sector investments and increasing integration of cloud and mobile diagnostics into clinical workflows.

Middle East & Africa

The Middle East & Africa region holds about 3% share, with adoption driven by national digital health strategies, modernization of diagnostic laboratories, and investments in telemedicine and remote screening programs. Gulf countries lead with strong expenditure on AI diagnostics, digital pathology, and cloud-enabled radiology systems, while African nations gradually expand mobile-based diagnostics to improve accessibility in low-resource settings. Rising prevalence of infectious diseases supports demand for rapid digital testing and connected point-of-care platforms. Although cost and infrastructure barriers persist, ongoing public–private partnerships and healthcare digitalization efforts continue to strengthen market momentum.

Market Segmentations:

By Technology:

By Distribution Channel:

- Brick and mortar

- E-commerce

By End User:

- Hospitals & clinics

- Diagnostic centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Digital Diagnostics Market features a highly competitive landscape shaped by leading players such as Sysmex Corporation, Agilent Technologies, Inc., bioMérieux SA, Quest Diagnostics Incorporated, Qiagen, Charles River Laboratories, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Abbott, and QuidelOrtho Corporation. The Digital Diagnostics Market is defined by rapid innovation, strong product differentiation, and continuous advancement in digital testing technologies. Companies across the sector prioritize AI-driven diagnostic platforms, automated analyzers, and connected point-of-care solutions that improve clinical accuracy and reduce diagnostic turnaround times. Vendors invest heavily in cloud-enabled data systems, remote monitoring tools, and digital pathology platforms to support decentralized care delivery and enhance interoperability across healthcare networks. Competition intensifies as firms expand molecular diagnostics portfolios, strengthen software integration capabilities, and pursue strategic collaborations with telehealth providers and technology partners. Market participants also focus on regulatory compliance, global expansion, and product commercialization strategies aimed at addressing chronic disease management, infectious disease surveillance, and home-testing demand. Growing emphasis on high-precision analytics, workflow automation, and seamless data connectivity continues to elevate competitive intensity and accelerate digital transformation throughout the diagnostic ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, the Anti-MCV (anti-mutated citrullinated vimentin) antibody test in India was launched by Agilus Diagnostics. Developed by Sebia, this advanced diagnostic tool significantly improves the early detection of rheumatoid arthritis (RA), especially in patients who test negative for conventional markers like anti-CCP and rheumatoid factor (RF).

- In June 2025, Amazon Diagnostics, a new at home diagnostics service that allows customers to book lab tests, schedule, and track appointments, and access digital reports instantly from the Amazon app was launched by Amazon India.

- In August 2024, Sysmex Corporation expanded its strategic alliance with QIAGEN to enhance genetic testing, focusing on research, development, production, clinical trials, and global sales marketing.

- In May 2024, Danaher collaborated with John Hopkins University to develop new methods to diagnose Traumatic Brain Injury. The scientists at the John Hopkins University would focus on evaluating new blood-based biomarkers leveraging highly sensitive technology from Beckmann Coulter

Report Coverage

The research report offers an in-depth analysis based on Technology, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt AI-driven diagnostic tools to enhance accuracy and reduce clinical interpretation time.

- Digital pathology and remote slide review will expand rapidly as health systems modernize laboratory workflows.

- Point-of-care and at-home digital testing will continue gaining traction due to rising demand for decentralized care.

- Cloud-based diagnostic data platforms will grow as providers prioritize interoperability and multi-site collaboration.

- Wearable and continuous monitoring devices will integrate more advanced biosensors for real-time disease tracking.

- Telehealth platforms will play a greater role in connecting digital diagnostics with virtual clinical consultations.

- Regulatory bodies will accelerate approvals of AI-enabled diagnostics, supporting broader clinical adoption.

- Predictive analytics and automated triage tools will become standard components of digital diagnostic ecosystems.

- Partnerships between device manufacturers, software companies, and healthcare providers will intensify.

- Digital diagnostics adoption will rise across emerging markets as infrastructure and mobile connectivity improve.