Market Overview

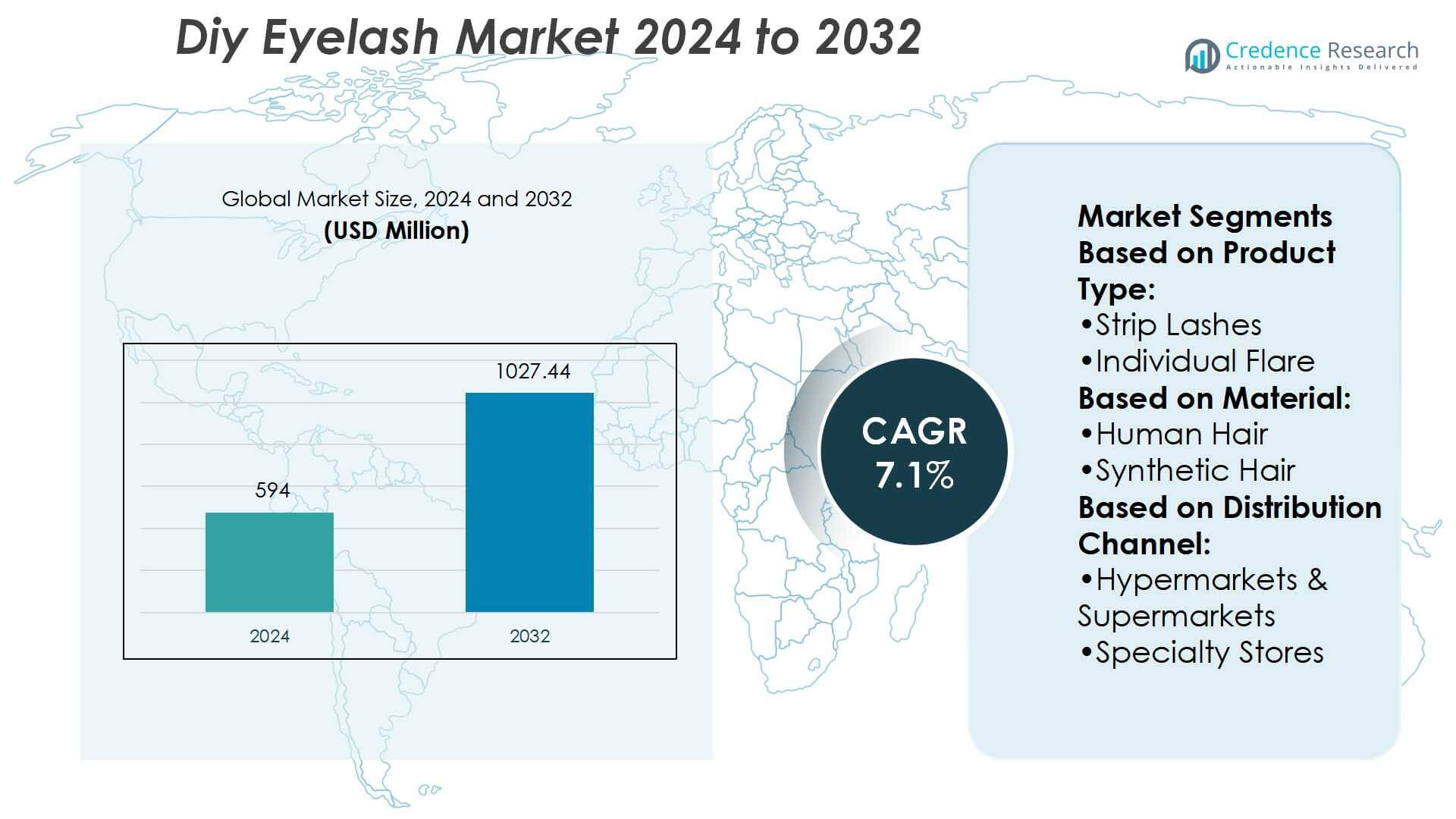

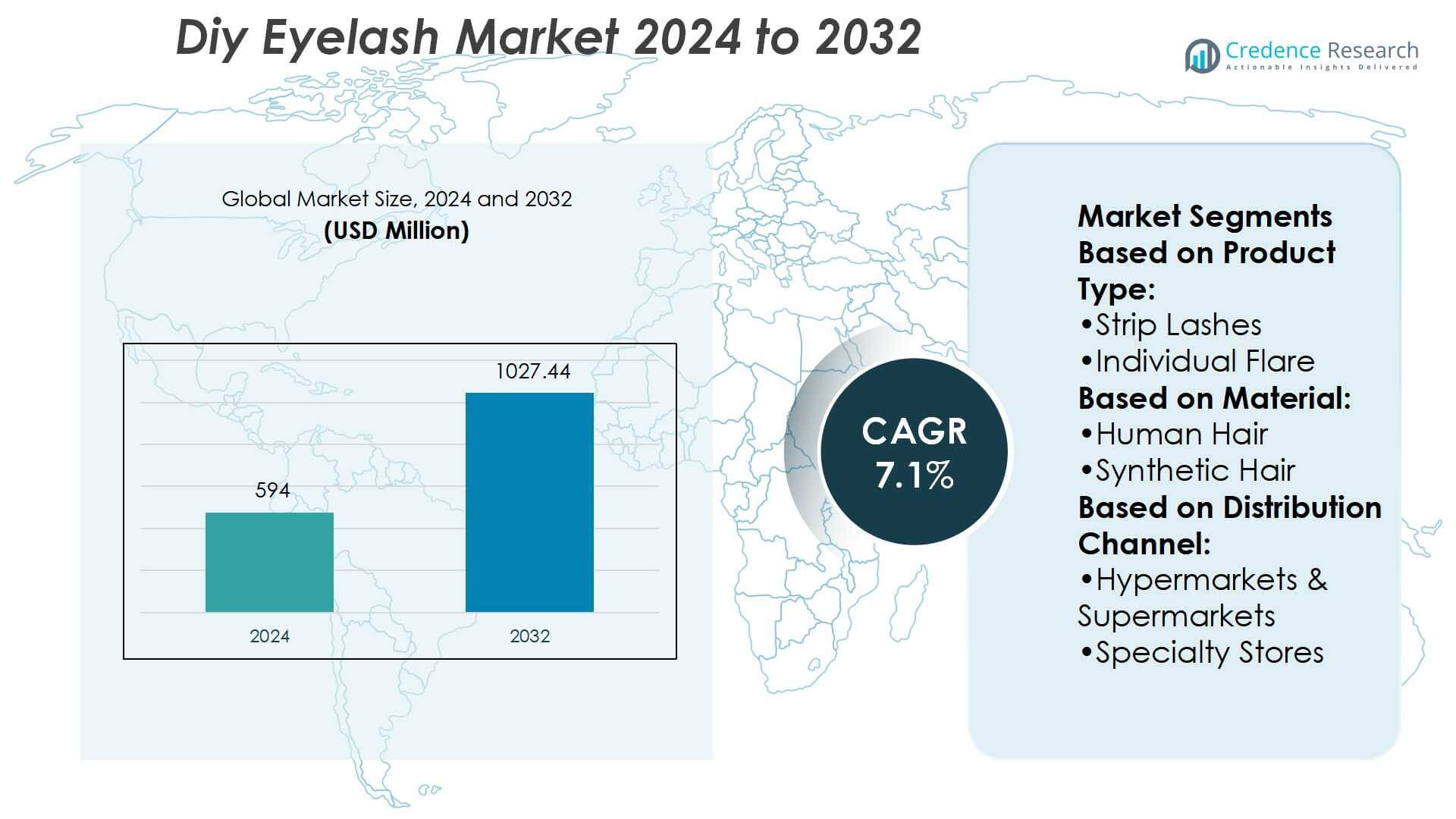

Diy Eyelash Market size was valued USD 594 million in 2024 and is anticipated to reach USD 1027.44 million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diy Eyelash Market Size 2024 |

USD 594 Million |

| Diy Eyelash Market, CAGR |

7.1% |

| Diy Eyelash Market Size 2032 |

USD 1027.44 Million |

The DIY eyelash market is shaped by prominent players including American International Industries, Kiss Products Inc., PT. Royal Korindah, Ulta Beauty Inc., Qingdao Lashbeauty Cosmetic Co. Ltd., L’Oreal S.A., LVMH, Shiseido Co. Ltd., SY LASHES, and Miranda Lashes Inc. These companies compete through innovation, diverse product portfolios, and strategic distribution networks spanning both offline and online channels. While U.S. and European brands leverage strong retail presence and premium offerings, Asian manufacturers dominate production with cost-effective, high-volume supply. Asia-Pacific emerges as the leading region, holding 38% share in 2024, driven by cultural emphasis on beauty, growing disposable incomes, and widespread e-commerce adoption.

Market Insights

- The DIY eyelash market size was valued at USD 594 million in 2024 and is projected to reach USD 1027.44 million by 2032, growing at a CAGR of 7.1% during the forecast period.

- Rising beauty consciousness, social media influence, and affordability of strip lashes, which hold the largest product share, drive consistent consumer demand across both developed and emerging economies.

- Key players compete through product diversification, innovation, and strong distribution networks, with Asian manufacturers leading cost-effective production while U.S. and European brands emphasize premium offerings.

- Market restraints include intense price competition, health and safety concerns related to adhesives, and limited awareness among first-time users about safe application practices.

- Asia-Pacific leads with 38% share in 2024, supported by strong beauty culture and e-commerce dominance, while North America and Europe follow with significant shares driven by disposable incomes, premium demand, and sustainable product adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Strip lashes dominate the DIY eyelash market, holding over 45% share in 2024. Their popularity stems from ease of application, affordability, and wide design variety. Consumers prefer strip lashes for quick, temporary enhancement, making them a staple in retail outlets and online platforms. Individual flare and single lashes, while offering customization, appeal more to skilled users. Growth in makeup tutorials and influencer marketing continues to drive demand for strip lashes, reinforcing their leadership within this category.

- For instance, Shiseido developed its VOYAGER formulation platform, which processes more than 500,000 unique ingredient data points and runs simulations to accelerate the design of cosmetics, including products for skincare and foundations.

By Material

Synthetic hair lashes lead the segment with a 60% market share, supported by low cost and durability. These lashes are available in diverse styles, providing consumers with both natural and dramatic looks. Human hair lashes attract premium buyers seeking realistic appearance but remain niche due to higher prices. Rising innovations in lightweight synthetic fibers, offering a natural feel and reusability, further strengthen synthetic dominance. Expanding online platforms and fashion-conscious younger demographics sustain this material’s strong growth trajectory.

- For instance, High-quality mega volume synthetic silk lashes, widely available from multiple suppliers, are commonly produced in thicknesses of 0.03 mm, 0.05 mm, and 0.07 mm. These lashes offer a range of curls, including J, B, C, Cc, D, and Dd styles, with various lengths typically ranging from 8 mm to 25 mm.

By Distribution Channel

Specialty stores dominate distribution, capturing 48% share in 2024. These outlets offer curated selections, professional guidance, and exclusive branded collections, enhancing customer trust. Hypermarkets and supermarkets cater to mass buyers but face limitations in range and expertise. Specialty stores benefit from growing consumer preference for personalized experiences and professional recommendations. The rise of beauty chains and dedicated cosmetic outlets further consolidates this channel’s dominance, making it a key driver of consistent market expansion.

Key Growth Drivers

Rising Beauty and Cosmetic Awareness

Increasing awareness of beauty and personal grooming is a major driver for the DIY eyelash market. Consumers, especially millennials and Gen Z, actively seek affordable and convenient solutions for enhancing appearance. Social media platforms such as Instagram and TikTok amplify demand through makeup tutorials and influencer endorsements. The cultural shift toward self-expression through cosmetics further strengthens market adoption. As beauty trends evolve rapidly, DIY eyelashes provide a quick, cost-effective option, fueling strong sales growth across both developed and emerging economies.

- For instance, LVMH’s central data-platform aggregates data from 75 brands, delivering predictive and generative AI applications used in cosmetics and fragrance units, improving customer outreach and e-commerce search refinement.

Expanding E-Commerce and Online Retail

The growth of e-commerce has significantly boosted DIY eyelash accessibility and sales. Online platforms offer wide product variety, competitive pricing, and direct-to-consumer brand launches. Subscription models and influencer-driven campaigns expand consumer reach and brand loyalty. Convenience in browsing, reviews, and doorstep delivery strengthens online shopping appeal. Cross-border e-commerce also enables global consumers to access niche and premium eyelash products. The ongoing digital transformation in beauty retail ensures that online channels remain a core growth driver for the market.

- For instance, lash industry typically offer extensive catalogs, featuring a wide variety of styles in production lines, including 25 mm faux mink lashes, magnetic lashes, and custom packaging options.

Affordable Pricing and Product Variety

DIY eyelashes attract buyers with low prices and diverse product offerings. Strip, flare, and synthetic lashes cater to different styles, occasions, and budgets, ensuring broad consumer appeal. This affordability encourages frequent repurchase, making DIY eyelashes an entry-level beauty product for many consumers. Seasonal launches, celebrity collaborations, and limited-edition designs further boost repeat sales. Combined with increasing disposable incomes in emerging economies, the price-versatility balance positions DIY eyelashes as a fast-moving cosmetic product with steady growth potential worldwide.

Key Trends & Opportunities

Sustainability and Eco-Friendly Materials

Sustainability is emerging as a key trend, with brands developing biodegradable and cruelty-free lashes. Growing consumer preference for eco-friendly packaging and ethically sourced materials drives innovation in product design. Vegan lashes made from synthetic fibers gain traction among environmentally conscious buyers. This shift presents opportunities for new entrants to differentiate their offerings with green credentials. As beauty regulations tighten, sustainable DIY eyelashes are likely to capture premium market share while enhancing brand reputation and consumer trust.

- For instance, L’Oréal’s Beauty Tech division has rolled out CREAITECH is being used to create content across L’Oréal’s portfolio of 37 beauty brands, helping to standardize content creation while preserving each brand’s unique identity.

Customization and Premiumization

Rising demand for personalized beauty solutions creates opportunities for customizable DIY eyelash kits. Consumers increasingly favor lashes tailored to eye shape, style preference, and comfort. Premium product lines offering reusable, lightweight, and natural-looking lashes gain momentum among urban buyers. Technology-driven tools, such as virtual try-ons, support customization and boost consumer engagement. The premiumization trend aligns with rising disposable incomes and growing interest in professional-quality results at home, positioning customized eyelashes as a high-value growth opportunity in the market.

- For instance, Their “imPRESS Long Lasting” press-on clusters come in packs of 24 lash segments, using self-adhesive bands that can last for up to 5 days with no glue. Each wisp is reusable a total of up to 2 times.

Key Challenges

Intense Market Competition

The DIY eyelash market faces intense competition from numerous global and local players. Low entry barriers result in continuous product launches, leading to price wars and margin pressure. Consumers often switch between brands due to similar product features and aggressive promotions. This saturation challenges established companies to differentiate their offerings and maintain loyalty. To counter competition, brands must focus on innovation, quality improvements, and targeted marketing strategies while balancing affordability to retain a sustainable market presence.

Health and Safety Concerns

Health risks such as allergic reactions, eye irritation, and improper application limit DIY eyelash adoption. Inadequate consumer awareness about safe usage and adhesive quality raises concerns, especially among first-time users. Reports of infections or discomfort can damage consumer trust and slow market penetration. Regulatory compliance for cosmetic safety adds further challenges for manufacturers. Ensuring hypoallergenic materials, clear usage instructions, and high-quality adhesives will be essential for companies to overcome these barriers and maintain consumer confidence in the product.

Regional Analysis

North America

North America holds 28% share of the DIY eyelash market in 2024, driven by strong consumer interest in beauty enhancements and high disposable incomes. The U.S. dominates the region, supported by the influence of social media and widespread adoption of at-home cosmetic products. Rising demand for reusable synthetic lashes further boosts sales. Retail chains and specialty beauty stores play a key role, complemented by growing e-commerce penetration. Innovation in lash adhesives and premium kits attracts professional and casual users alike, reinforcing North America’s position as a lucrative market for both established brands and new entrants.

Europe

Europe accounts for 22% share of the global DIY eyelash market, reflecting steady growth supported by fashion-conscious consumers and expanding cosmetic retail networks. Countries such as the U.K., Germany, and France lead due to high awareness of personal grooming trends. Specialty stores and online platforms capture significant sales, with eco-friendly and cruelty-free products gaining traction. Rising demand for premium human hair lashes among younger consumers supports diversification. Regulatory emphasis on product safety ensures consumer confidence, while ongoing fashion events and beauty expos continue to drive visibility and demand across the European market landscape.

Asia-Pacific

Asia-Pacific dominates the DIY eyelash market with a 38% share in 2024, led by China, Japan, and South Korea. The region’s strong beauty culture, driven by K-beauty and J-beauty trends, significantly boosts product adoption. High population density, rapid urbanization, and increasing disposable incomes support sustained growth. Online platforms dominate distribution, with influencers shaping consumer preferences. Synthetic lashes remain most popular due to affordability, while premium natural styles gain traction in urban areas. The region’s manufacturing capabilities also reduce costs, enhancing accessibility. With rising interest in fashion and cosmetics, Asia-Pacific remains the key growth engine for the global market.

Latin America

Latin America represents 7% share of the DIY eyelash market, with Brazil and Mexico leading adoption. Growing urban populations and rising middle-class incomes drive demand for affordable beauty solutions. Influencer-driven marketing and the popularity of social media tutorials increase visibility of DIY eyelash products among younger consumers. Hypermarkets and specialty stores are primary distribution channels, while e-commerce penetration continues to expand. Despite economic volatility, rising demand for accessible and fashionable cosmetics sustains growth. Increasing awareness of international beauty trends positions Latin America as a promising region with untapped opportunities for both local and international brands.

Middle East & Africa

The Middle East & Africa accounts for 5% share of the global DIY eyelash market, showing steady expansion. Countries such as the UAE and Saudi Arabia drive growth due to rising beauty consciousness and a preference for luxury cosmetic products. Specialty stores and premium retail chains dominate distribution, supported by strong consumer interest in high-quality and reusable eyelashes. Growth in African markets is supported by increasing urbanization and social media influence, though affordability remains a challenge. With rising disposable incomes and expanding beauty retail infrastructure, the region presents moderate but promising opportunities for future market penetration.

Market Segmentations:

By Product Type:

- Strip Lashes

- Individual Flare

By Material:

- Human Hair

- Synthetic Hair

By Distribution Channel:

- Hypermarkets & Supermarkets

- Specialty Stores

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The DIY eyelash market players such as American International Industries (U.S.), Kiss Products Inc. (U.S.), PT. Royal Korindah (Indonesia), Ulta Beauty Inc. (U.S.), Qingdao Lashbeauty Cosmetic Co. Ltd. (China), L’Oreal S.A. (France), LVMH (France), Shiseido Co. Ltd. (Japan), SY LASHES (China), and Miranda Lashes Inc. (China). The DIY eyelash market is characterized by intense competition, driven by constant product innovation and shifting consumer preferences. Brands differentiate through diverse product ranges, including strip, flare, and reusable lashes, catering to both budget-conscious and premium buyers. E-commerce has become a critical growth channel, supported by influencer marketing and social media promotions that amplify brand visibility. Sustainability also shapes competition, with increasing emphasis on cruelty-free, vegan, and eco-friendly materials. Companies focus on improving adhesive quality, lash comfort, and customization options to enhance user experience. Pricing strategies, distribution networks, and premiumization trends further define the competitive landscape, creating opportunities for differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shiseido Co. Ltd. (Japan)

- SY LASHES (China)

- LVMH (France)

- Qingdao Lashbeauty Cosmetic Co. Ltd. (China)

- Royal Korindah (Indonesia)

- L’Oreal S.A. (France)

- Miranda Lashes Inc. (China)

- Kiss Products Inc. (U.S.)

- Ulta Beauty Inc. (U.S.)

- American International Industries (U.S.)

Recent Developments

- In April 2025, KISS Products introduced its Spring 2025 nail and lash collections, featuring innovative design and enhanced formulations. The company continues to maintain its focus on product development and market expansion amid increasing competition from magnetic lash manufacturers.

- In December 2024, MODEL ROCK introduced plant fiber press-on lashes made from biodegradable materials including bamboo, hemp, and cotton, offering eco-friendly alternatives that maintain lightweight, flexible properties while supporting sustainability initiatives.

- In October 2024, OPT Industries has partnered with TAD Beauty to introduce 3D-printed DIY eyelashes. The eyelashes are durable and flexible, offering beauty consumers a new option in premium-quality false eyelashes.

- In September 2024, Velour, a prominent name in the false lashes industry, unveiled a new premium line designed to empower consumers in expressing their individuality. The V by Velour eLAStic laces debut as the industry’s first, featuring stretch-fit lash bands, ensuring an unparalleled comfort experience.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising beauty and cosmetic awareness among younger demographics.

- Online platforms will drive sales through influencer marketing and subscription models.

- Sustainable and cruelty-free eyelashes will gain stronger consumer preference worldwide.

- Customizable and reusable eyelashes will attract premium buyers seeking long-term value.

- Advancements in lightweight synthetic fibers will improve comfort and natural appearance.

- Emerging economies will contribute significantly due to increasing disposable incomes and urbanization.

- Specialty beauty stores will strengthen dominance with curated product offerings and professional guidance.

- Digital tools such as virtual try-ons will enhance consumer engagement and purchasing decisions.

- Competition will intensify, encouraging innovation in adhesives and eco-friendly packaging.

- Social media trends and beauty tutorials will continue shaping consumer demand globally.