Market Overview

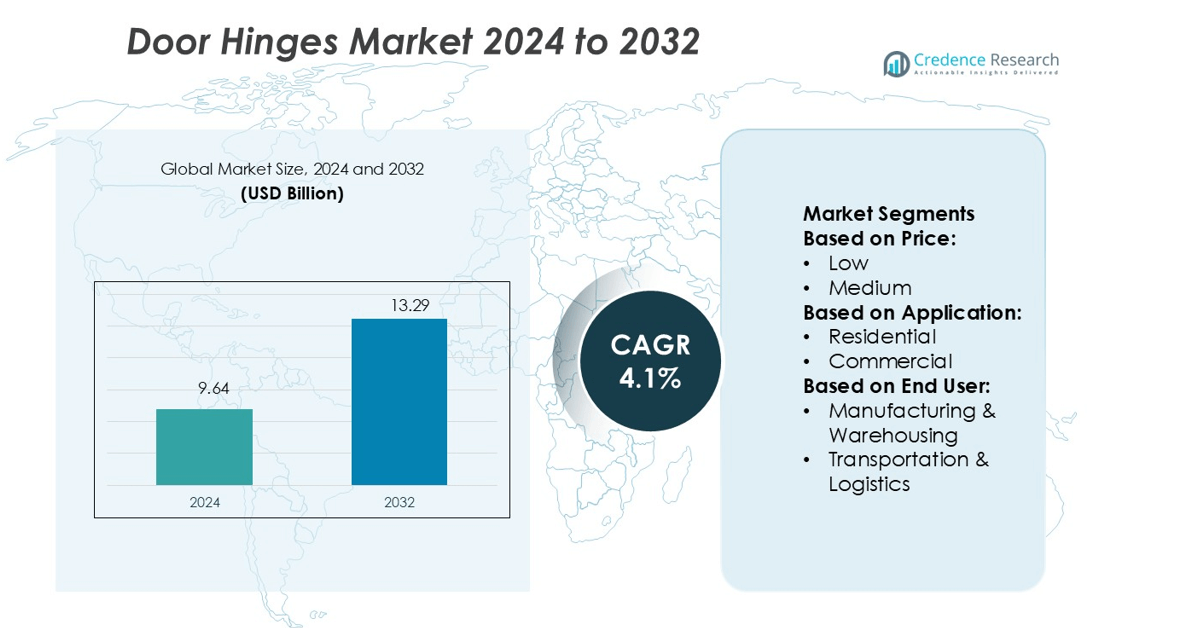

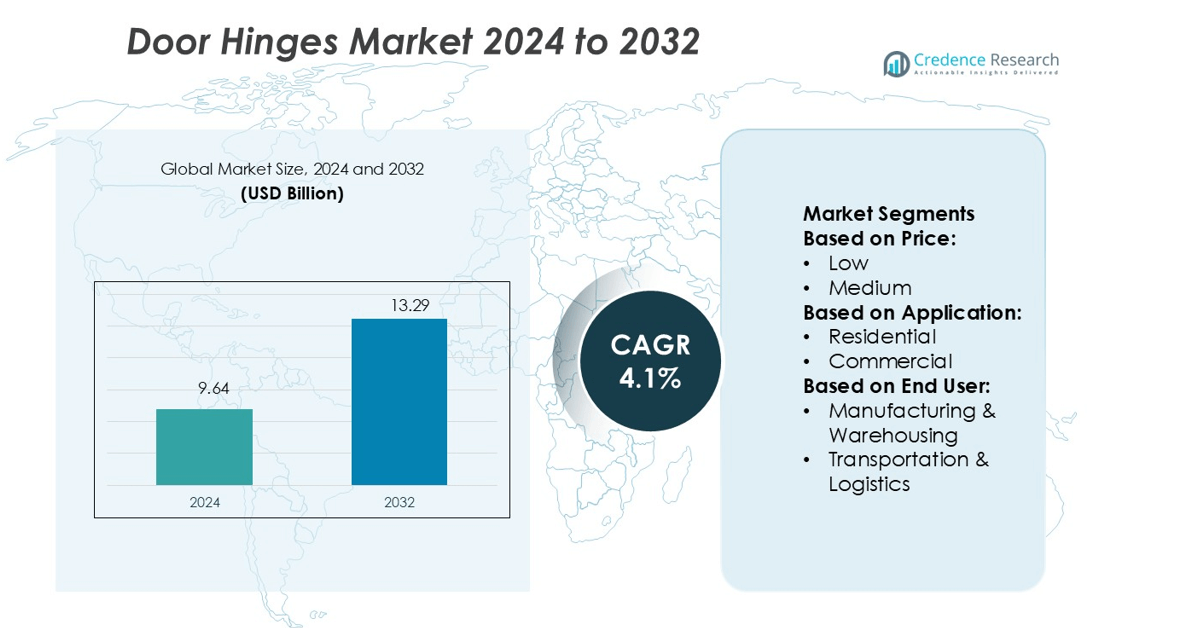

Door Hinges Market size was valued USD 9.64 billion in 2024 and is anticipated to reach USD 13.29 billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Door Hinges Market Size 2024 |

USD 9.64 billion |

| Door Hinges Market, CAGR |

4.1% |

| Door Hinges Market Size 2032 |

USD 13.29 billion |

The door hinges market is driven by major players such as Hettich Holding GmbH & Co. KG, Blum, Inc., JMA Hardware, Godrej & Boyce Manufacturing Co. Ltd., Hafele Group, Allegion plc, EPOMAY Hardware, ASSA ABLOY AB, Dormakaba Holding AG, and FGV (Formenti & Giovenzana). These companies focus on product innovation, precision engineering, and expanding their global distribution networks. They are also integrating advanced manufacturing technologies and sustainable materials to meet evolving construction standards. Asia Pacific leads the global market with a 30% share, supported by rapid urbanization, infrastructure development, and strong demand from residential and commercial construction sectors. Strategic investments and new product launches strengthen the competitive position of key players in this region.

Market Insights

- The Door Hinges Market was valued at USD 9.64 billion in 2024 and is projected to reach USD 13.29 billion by 2032, growing at a CAGR of 4.1%.

- Growing residential and commercial construction activity is driving strong product demand across global markets.

- Product innovation, smart hinge systems, and eco-friendly manufacturing are shaping key market trends.

- Intense competition among major players is fueling strategic investments, new product launches, and advanced manufacturing integration.

- Asia Pacific leads with a 30% market share, followed by North America at 33% and Europe at 28%, with concealed hinges emerging as the dominant segment.Top of Form

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Price

The medium price segment dominates the door hinges market with 46% share. This segment benefits from its balance between durability and affordability, making it suitable for residential and commercial installations. Medium-priced hinges offer reliable load-bearing capacity and corrosion resistance, driving their adoption in interior and exterior doors. They are commonly used in housing projects, office buildings, and retail facilities. Manufacturers focus on enhancing product life and finish to meet quality standards. The low-price segment follows, mainly serving cost-sensitive residential applications, while the high-price segment caters to premium commercial and architectural projects.

- For instance, Hettich Holding GmbH & Co. KG introduced its Sensys 8645i hinge series, designed with a soft-close mechanism tested for over 80,000 opening cycles, ensuring long-term performance in residential and commercial applications.

By Application

The residential segment holds the largest market share of 41%. Its dominance is driven by rapid urban housing development and renovation activities. Demand for stainless steel and brass hinges is increasing due to their strength and aesthetic appeal. Residential buildings typically use standard butt hinges and concealed hinges for doors, windows, and cabinets. Growing emphasis on home aesthetics and functionality supports steady growth in this segment. The commercial segment follows, driven by retail, office, and institutional construction projects requiring heavy-duty and fire-rated hinge systems. Industrial and transportation applications are also expanding with smart hinge integration.

- For instance, Blum, Inc. has engineered its CLIP top BLUMOTION 155° hinges with an integrated soft-close mechanism, tested for over 200,000 opening and closing cycles, ensuring consistent performance in high-use environments.

By End User

The construction segment accounts for 39% of the market share, leading due to rising infrastructure development and housing expansion. Builders and contractors prefer reliable, corrosion-resistant hinges for high-traffic doors and gates. The segment benefits from government-backed affordable housing programs and private real estate investments. Residential and commercial users follow closely, driven by demand for aesthetic and functional hardware. Manufacturing and warehousing facilities also adopt heavy-duty hinges for operational durability. Transportation and logistics applications are growing with rising use of high-load hinges in containers and fleet doors, while agriculture and others add niche demand.

Key Growth Drivers

Rising Construction and Infrastructure Development

Rapid urbanization and large-scale construction projects are driving door hinge demand. Growth in residential and commercial buildings increases the need for durable and cost-effective hinge systems. Developers prefer corrosion-resistant, heavy-duty hinges for modern architectural designs. Expansion of smart cities and infrastructure upgrades further boost product adoption. Strong growth in renovation and remodeling activities also supports the market. These trends enhance the demand for both standard and specialty hinges in global markets, especially in fast-growing urban regions.

- For instance, JMA offers a double-action spring hinge “DASH01-5” sized 125 mm, rated to carry up to 30 kg per pair in satin nickel finish (as per Keeler Hardware).

Increased Demand for High-Performance Hinges

Modern construction and manufacturing require hinges with higher load-bearing capacity and durability. Growth in industrial and commercial projects drives the adoption of high-strength stainless steel and brass hinges. Manufacturers are investing in innovative designs that support larger and heavier doors while ensuring smooth operation. Fire-rated and anti-friction hinge technologies are gaining popularity in high-traffic areas. This focus on performance and safety standards increases the use of advanced hinge solutions in public and private infrastructure projects.

- For instance, Godrej slip-on cabinet hinge supports a shutter size of up to 34″ × 22″, uses a 35 mm diameter cup, and is tested for 50,000 cycles before failure.

Expansion of the Automotive and Aerospace Sectors

Rising vehicle production and demand for lightweight components are fueling hinge adoption in automotive and aerospace applications. Hinges in these sectors must support high mechanical loads while remaining compact and lightweight. Manufacturers are developing precision-engineered components for doors, hoods, and cargo systems. Growth in electric vehicles and advanced aircraft designs increases the need for reliable and corrosion-resistant hinge materials. Stringent quality and safety standards further drive innovation and market penetration of advanced hinge systems.

Key Trends & Opportunities

Growing Adoption of Smart and Adjustable Hinges

Smart hinges with adjustable and self-closing mechanisms are becoming popular in commercial and residential buildings. These systems improve energy efficiency and offer smoother operation. Manufacturers are focusing on integrating automation features to support modern security systems and access controls. Smart hinge solutions are also compatible with energy-saving door frames and advanced locking systems. The demand for intelligent building components is creating strong opportunities for suppliers to introduce innovative and premium hinge products.

- For instance, ASSA ABLOY’s standard hinges are rated for 200,000 cycles (grade SS 304, EN tested) to ensure long life in high-use applications.

Focus on Sustainable and Eco-Friendly Materials

Environmental regulations and rising awareness of green building practices are influencing material choices. Manufacturers are shifting toward recyclable metals and low-emission coatings to meet sustainability goals. Hinges made from stainless steel, aluminum, and eco-friendly alloys offer long lifespans with minimal maintenance. Adoption of these products aligns with global green certifications and building standards. This trend supports long-term growth as governments and companies invest in sustainable construction projects worldwide.

- For instance, dormakaba’s self-closing TENSOR hinge has been tested for 500,000 cycles while operating a door weight up to 65 kg, showing durability with eco design.

Rising Popularity of Aesthetic and Designer Hinges

Architectural projects now demand hinges that combine function with modern aesthetics. Decorative finishes and concealed designs are gaining traction in premium residential and commercial spaces. High-end interior projects use polished brass, matte black, or brushed steel hinges to match door styles. Manufacturers are capitalizing on this trend by offering customizable hinge solutions. This focus on design-driven functionality creates opportunities in luxury construction and renovation markets.

Key Challenges

Price Pressure from Low-Cost Manufacturers

The availability of low-cost hinge products from unorganized and local manufacturers affects profit margins. Many small builders and contractors opt for cheaper alternatives, which limits the growth of premium and mid-range segments. This intense price competition makes it difficult for established brands to sustain revenue growth. Maintaining quality while staying cost-competitive is a key challenge for global and regional manufacturers.

Fluctuations in Raw Material Costs

Steel, brass, and aluminum are the primary materials used in hinge manufacturing. Fluctuations in global metal prices increase production costs, affecting pricing strategies and profit margins. Small and medium-scale manufacturers are more vulnerable to these shifts, leading to supply chain disruptions. Volatile raw material costs also impact inventory planning and pricing stability, creating uncertainty for manufacturers and distributors in competitive markets.

Regional Analysis

North America

North America holds a 33% share of the global door hinges market, driven by strong construction and renovation activity in the U.S. and Canada. The region benefits from rising smart home installations, energy-efficient building standards, and premium hardware adoption. Growth is also supported by increasing demand from the commercial real estate sector, especially offices and retail spaces. Major manufacturers are introducing corrosion-resistant and fire-rated hinges to meet building codes. Strong distribution networks and product innovation strengthen the regional market position. Strategic collaborations with builders and contractors further support sustained demand.

Europe

Europe accounts for 28% of the global door hinges market, supported by advanced construction standards and high-quality architectural designs. Strong regulatory focus on safety and sustainability drives demand for fire-rated and eco-friendly hinge systems. Germany, the UK, and France lead regional adoption due to large-scale residential and commercial projects. Renovation of old buildings with modern fixtures boosts sales. European manufacturers focus on precision-engineered products with longer service life. Growth is further supported by retrofitting programs and smart access control integration in modern infrastructure.

Asia Pacific

Asia Pacific leads the global door hinges market with a 30% share, driven by rapid urbanization and infrastructure growth. China, India, and Japan dominate demand due to expanding residential and commercial construction. Smart city developments, affordable housing schemes, and industrial expansion create strong market potential. Local manufacturers supply cost-effective hinges, while international players bring advanced, durable solutions. Modernization of building structures and rising consumer preference for quality fittings boost regional adoption. Growing investment in commercial buildings and transportation infrastructure supports sustained growth.

Latin America

Latin America holds a 5% share of the global door hinges market, supported by steady growth in residential construction. Brazil and Mexico lead demand, driven by government-backed housing projects and urban infrastructure expansion. The region sees increasing adoption of stainless-steel and concealed hinges due to shifting consumer preferences toward premium finishes. Local production capabilities help reduce costs and support regional supply chains. However, uneven economic conditions and limited large-scale commercial projects slightly restrain growth. International manufacturers are expanding distribution to strengthen their presence.

Middle East & Africa

The Middle East & Africa region accounts for 4% of the global door hinges market, driven by large-scale commercial and residential developments in GCC countries. Mega projects in Saudi Arabia and the UAE, including hotels and office buildings, boost demand for high-performance hinges. The region focuses on architectural hardware that supports modern design and durability in extreme climatic conditions. Government-led infrastructure investments increase hinge installations in public and private buildings. Expanding urbanization and tourism infrastructure are expected to drive consistent market growth.

Market Segmentations:

By Price:

By Application:

By End User:

- Manufacturing & Warehousing

- Transportation & Logistics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the door hinges market features leading players such as Hettich Holding GmbH & Co. KG, Blum, Inc., JMA Hardware, Godrej & Boyce Manufacturing Co. Ltd., Hafele Group, Allegion plc, EPOMAY Hardware, ASSA ABLOY AB, Dormakaba Holding AG, and FGV (Formenti & Giovenzana). The door hinges market is shaped by intense product innovation, strategic expansion, and a focus on quality. Manufacturers are investing in advanced production technologies, such as automated machining and precision casting, to improve efficiency and product consistency. Companies are developing hinges with enhanced durability, smooth functionality, and corrosion resistance to meet modern construction standards. Design aesthetics and concealed hinge systems are gaining traction across residential and commercial segments. Firms are also strengthening their global distribution networks and digital channels to expand market reach. Sustainability initiatives, including the use of eco-friendly materials and energy-efficient processes, are becoming a key differentiator. Continuous R&D investments and strategic collaborations enable companies to stay competitive and respond effectively to evolving consumer preferences and regulatory requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hettich Holding GmbH & Co. KG

- Blum, Inc.

- JMA Hardware

- Godrej & Boyce Manufacturing Co. Ltd.

- Hafele Group

- Allegion plc

- EPOMAY Hardware

- ASSA ABLOY AB

- Dormakaba Holding AG

- FGV (Formenti & Giovenzana)

Recent Developments

- In February 2025, Allegion entered into a definitive agreement to acquire Lemaar Australia, a privately held door hardware company headquartered in Victoria. Pending customary closing conditions, the transaction is anticipated to be finalized in Q1 2025.

- In August 2024, ASSA ABLOY made a tactical takeover of Modern Entrance Systems, Inc., strengthening the hardware and hinges portfolio. Such development was necessary to maintain existing market share and improve technological capabilities within smart doors solutions.

- In January 2024, Hafele launched the Oaplus Series of Designer Lever Handles, an innovative addition designed to enhance both the aesthetic appeal and value of well-arranged spaces. This new collection reflects a commitment to efficiency and elegance, embodying the principles of contemporary architectural design.

- In March 2023, Magna launched its Smart Access power door system on the Ferrari Purosangue. The system includes Magna’s power door drive unit, Smart Latch with a cinch actuator, and motion control software Haptronik

Report Coverage

The research report offers an in-depth analysis based on Price, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing residential and commercial construction projects.

- Smart and automated hinge systems will gain wider adoption in modern buildings.

- Manufacturers will focus on corrosion-resistant and durable hinge materials.

- Demand for concealed hinges will rise due to aesthetic and functional benefits.

- Energy-efficient and eco-friendly production will become a key industry priority.

- Companies will expand distribution networks to strengthen global market reach.

- Integration with smart access control systems will enhance product value.

- Customization and premium finishes will drive demand in luxury construction.

- Strategic collaborations and mergers will boost product innovation.

- Emerging markets will offer strong growth opportunities for new entrants.