Market Overview

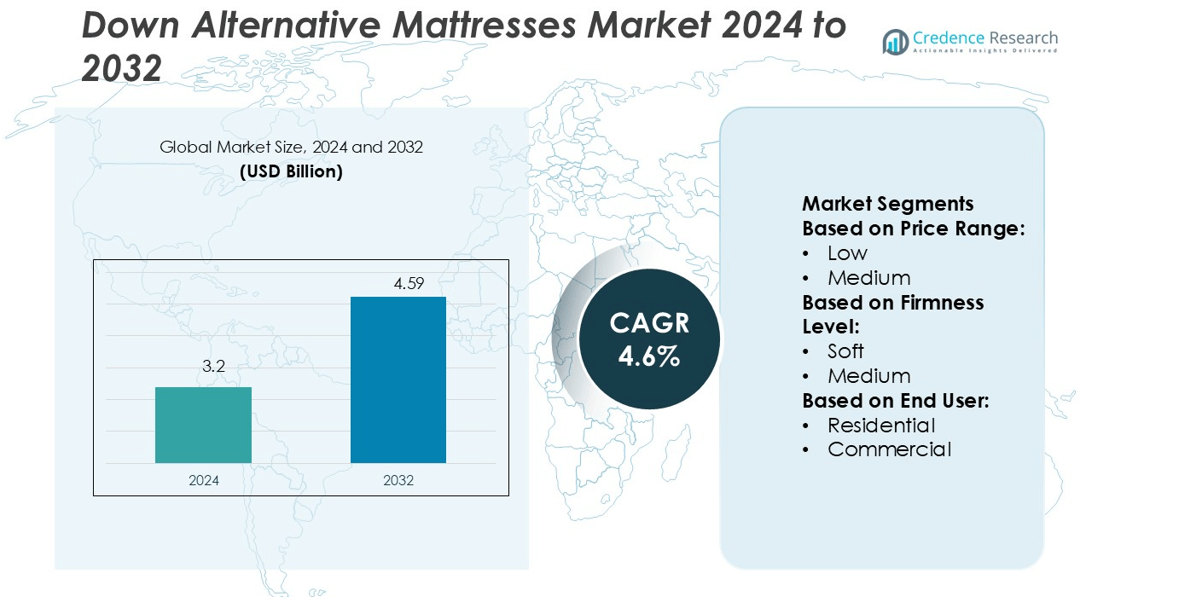

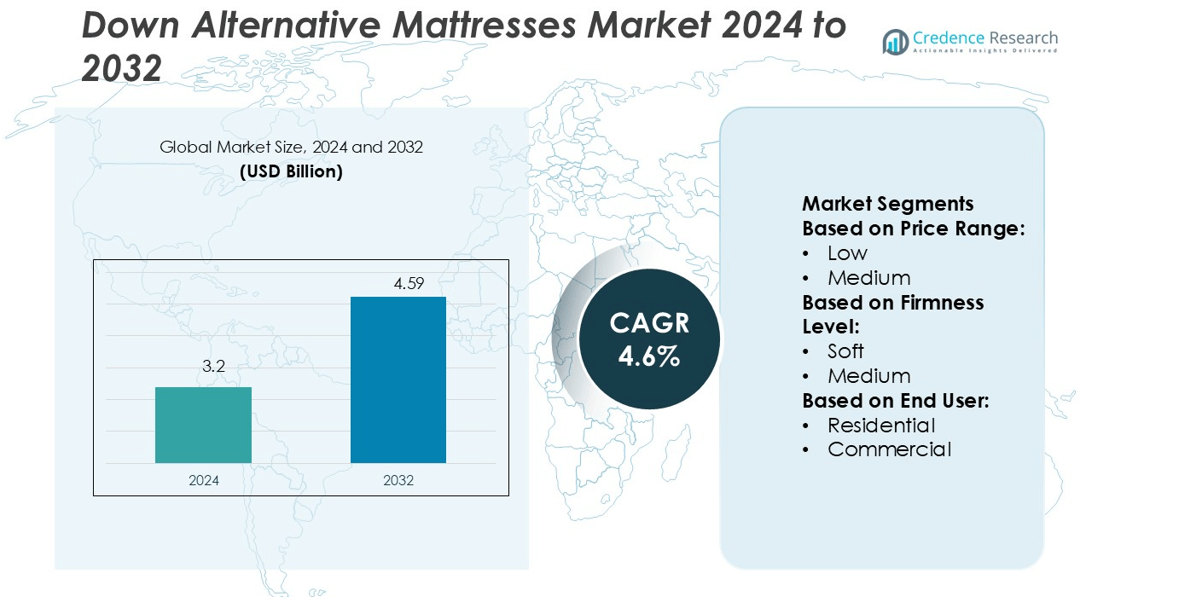

Down Alternative Mattresses Market size was valued USD 3.2 billion in 2024 and is anticipated to reach USD 4.59 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Down Alternative Mattresses Market Size 2024 |

USD 3.2 billion |

| Down Alternative Mattresses Market, CAGR |

4.6% |

| Down Alternative Mattresses Market Size 2032 |

USD 4.59 billion |

The Down Alternative Mattresses Market is shaped by major players including Puffy Mattress, Saatva Inc., Brooklyn Bedding, LLC, Nest Bedding, Inc., Helix Sleep, Inc., Purple Innovation, Inc., Avocado Green Mattress, LLC, Layla Sleep, DreamCloud (Resident Home LLC), and Casper Sleep Inc. These companies drive competition through advanced fiber technologies, sustainable materials, and innovative ergonomic designs. Their strong e-commerce presence and direct-to-consumer strategies enable broad market reach and fast delivery. Asia Pacific leads the global market with a 35.6% share, supported by rapid urbanization, a growing middle-class population, and expanding online retail channels. Strategic product positioning and rising health awareness further strengthen the region’s leadership.

Market Insights

- The Down Alternative Mattresses Market was valued at USD 3.2 billion in 2024 and is expected to reach USD 4.59 billion by 2032, growing at a CAGR of 4.6%.

- Strong demand is driven by the rising focus on ergonomic comfort, hypoallergenic materials, and eco-friendly designs, boosting adoption across residential and hospitality sectors.

- Competitive intensity is growing as major players focus on sustainable fiber innovation, advanced mattress technologies, and direct-to-consumer e-commerce channels.

- Market restraints include high product costs in the premium segment and increased competition from traditional and hybrid mattresses, limiting penetration in price-sensitive regions.

- Asia Pacific holds a 35.6% regional share, supported by rapid urbanization, expanding online retail, and strong consumer spending, while the medium price range segment dominates overall market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Price Range

The medium price range segment dominates the down alternative mattresses market with a 48.6% share. This segment attracts budget-conscious customers who seek comfort and durability without premium costs. Consumers in residential spaces and mid-range hotels prefer these mattresses for their balance between quality and affordability. Manufacturers focus on breathable fabrics, hypoallergenic fills, and enhanced stitching to maintain product value. Growing urban middle-class demand and rising e-commerce accessibility further drive this segment’s expansion, making it the most stable price category for sustained revenue growth.

- For instance, Puffy mattresses, such as the all-foam Puffy Cloud and the hybrid Puffy Lux Hybrid, are constructed with multiple layers of CertiPUR-US certified foam to provide pressure relief and support. The Puffy Cloud features a 6-layer design, while the Puffy Lux Hybrid has an 8-layer construction.

By Firmness Level

The medium firmness segment holds a 52.1% share, making it the most dominant in the market. Medium firmness mattresses offer a balance of comfort and spinal support, appealing to a wide consumer base. They are ideal for back and side sleepers and are preferred by hotels for their universal comfort fit. This versatility reduces inventory complexity for commercial buyers. Manufacturers leverage adaptive foam layering and advanced quilting to enhance sleeping comfort, strengthening the demand across residential and hospitality segments.

- For instance, the Spartan model uses an 8-inch core of up to 1,032 individually encased Ascension® coils that are zoned in three regions to target support and minimize motion transfer.

By End-User

The residential segment leads with a 57.4% market share, driven by rising home furnishing trends and increased consumer spending on sleep comfort. Urbanization and online retail platforms make down alternative mattresses more accessible to households. Consumers value hypoallergenic properties and affordable luxury as key purchase factors. Manufacturers respond with ergonomic designs and temperature-regulating materials to improve sleep quality. Hotels and hospitals represent secondary growth segments, but residential use remains the primary driver of market volume and recurring purchases.

Key Growth Drivers

Rising Demand for Hypoallergenic and Sustainable Bedding

Consumers increasingly prefer bedding products that reduce allergens and support better sleep quality. Down alternative mattresses use synthetic fill that resists dust mites and mold. This makes them ideal for people with allergies and asthma. The growing awareness of health and wellness is driving this demand further. Many brands now focus on eco-friendly fibers and ethical sourcing, which align with sustainable consumer values. This trend is strongly influencing purchase behavior across both residential and commercial sectors.

- For instance, Natural Latex Hybrid mattress includes a 3-inch natural Talalay latex comfort layer above 6-inch pocketed coils, and it incorporates a non-chemical hydrogenated silica fire barrier instead of conventional fiberglass.

Growing Hospitality Sector and Commercial Adoption

Hotels and resorts are adopting down alternative mattresses to meet hygiene and comfort standards. These mattresses offer easier cleaning and maintenance than natural down. Their durability and cost-effectiveness support high occupancy environments. Global travel growth and luxury accommodation expansion are increasing product installations in hotels, hospitals, and serviced apartments. The commercial demand for allergy-free, soft-feel mattresses is pushing manufacturers to innovate product designs and improve durability.

- For instance, Purple’s Rejuvenate collection uses DreamLayer™ technology combining multiple GelFlex Grid® layers, claiming testing shows up to 35% more immersion, 71–91% reduction in high-pressure regions, and a 23% drop in peak pressure (for side sleepers) compared to conventional foam.

Expanding E-Commerce and Omnichannel Distribution

The rapid growth of online retail is making down alternative mattresses more accessible to a wider audience. E-commerce platforms offer better product visibility, competitive pricing, and doorstep delivery. Manufacturers benefit from direct-to-consumer models that increase brand reach. Retailers use digital tools like virtual try-ons and AR visualization to boost customer confidence. These factors help drive steady sales growth, particularly among younger, tech-savvy buyers seeking comfort and convenience.

Key Trends & Opportunities

Technological Advancements in Fill Materials

Manufacturers are investing in advanced synthetic fibers that mimic the softness of natural down. Microfiber and gel-infused fibers enhance breathability, temperature regulation, and shape retention. These materials also support longer product lifecycles, reducing replacement frequency. Brands adopting these innovations gain a clear competitive advantage. This shift opens opportunities for premium product positioning in mature and emerging markets.

- For instance, Layla Memory Foam mattress is 10 inches thick and is reversible, featuring both a “soft” and a “firm” side. It utilizes copper-infused memory foam layers on either side of a high-resilience polyfoam core.

Sustainability and Eco-Certified Products

Consumers prefer mattresses made with certified, recycled, or plant-based materials. Manufacturers are introducing OEKO-TEX and GRS-certified products to meet this demand. Eco-friendly production helps brands align with global sustainability goals. This growing awareness offers strong opportunities to differentiate products in a competitive market. Companies integrating green materials can strengthen customer loyalty and market presence.

- For instance, Casper’s Snow mattress (v3) incorporates cooling features including three HeatDelete® Bands and Phase Change Material (PCM) in the top layers. This technology is designed to help maintain cooler surface temperatures for over 12 hours.

Product Customization and Premiumization

Demand for personalized sleep solutions is rising. Manufacturers offer customization in firmness levels, cover materials, and filling density. This supports niche segments like luxury hospitality and wellness-focused consumers. Premium mattress lines with smart features and enhanced comfort layers are also growing. This shift helps brands expand their pricing strategies and target higher-value customer segments.

Key Challenges

Intense Market Competition and Price Pressure

The market faces growing competition from established and emerging bedding brands. Many companies offer similar product features, creating limited differentiation. Price wars in online and retail channels further reduce profit margins. Smaller players struggle to maintain competitiveness without compromising quality. This intense rivalry makes brand positioning and innovation critical for survival.

Product Durability and Perception Issues

ome consumers still perceive synthetic fill as less durable or premium than natural down. Low-quality products from unorganized players often worsen this perception. Issues like fiber clumping and reduced loft over time affect customer satisfaction. Overcoming these concerns requires investment in advanced material technology and better quality control. Educating consumers on product benefits remains a major challenge for manufacturers.

Regional Analysis

North America

North America holds a 33.4% share of the Down Alternative Mattresses Market in 2025. Strong consumer demand for sustainable, hypoallergenic bedding drives regional growth. The U.S. dominates due to rising disposable incomes and health-focused lifestyle choices. High penetration of online retail channels accelerates product availability and customization. Brands focus on advanced fiber technologies to improve comfort and durability. Product innovation and strong marketing strategies support sales expansion. Canada also shows steady growth, backed by a shift toward eco-friendly home furnishings. Favorable consumer preferences and strong retail infrastructure strengthen market leadership in this region.

Europe

Europe accounts for a 27.9% share of the Down Alternative Mattresses Market in 2025. Demand is driven by increasing awareness of sustainable and cruelty-free products. Germany, France, and the UK lead due to advanced manufacturing, strong retail presence, and high spending power. Strict regulatory standards encourage the use of certified, non-toxic materials. Brands focus on innovative designs to meet evolving sleep wellness trends. Online and specialty stores support product diversification. Steady economic growth and rising consumer comfort preferences drive continued expansion. The region remains a strong base for premium and eco-friendly mattress products.

Asia Pacific

Asia Pacific holds the largest share at 35.6% in the Down Alternative Mattresses Market in 2025. China and India lead with expanding middle-class populations and rapid urbanization. Growing awareness of affordable, comfortable bedding fuels strong market growth. E-commerce platforms enable easy product access and competitive pricing. Local manufacturers focus on cost-effective fiber innovations. Japan and South Korea contribute through strong retail infrastructure and advanced sleep technology integration. Rising consumer spending power strengthens regional demand. Asia Pacific’s scale, combined with affordability trends, cements its position as the fastest-growing market.

Latin America

Latin America represents a 1.8% share of the Down Alternative Mattresses Market in 2025. Brazil and Mexico lead regional demand with increasing adoption of mid-range bedding products. Urban lifestyle shifts and growing awareness of allergen-free materials support market penetration. Expanding e-commerce platforms improve accessibility and variety. Local manufacturers focus on competitive pricing strategies. Economic stabilization in key countries helps boost consumer spending on home comfort products. While growth is gradual, increasing health consciousness drives steady expansion. The region presents strong opportunities for international brands seeking emerging market growth.

Middle East & Africa

The Middle East & Africa account for a 1.3% share of the Down Alternative Mattresses Market in 2025. Growth is supported by rising urbanization and expanding retail infrastructure. The UAE and South Africa lead regional demand, driven by rising hospitality investments and home furnishing trends. Consumers show growing interest in lightweight, breathable, and hypoallergenic bedding options. Brands target niche premium segments and e-commerce platforms for expansion. Tourism growth increases hotel mattress upgrades, supporting B2B demand. Although market size remains small, improving economic conditions enhance growth prospects across this region.

Market Segmentations:

By Price Range:

By Firmness Level:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Down Alternative Mattresses Market features strong competition among leading players such as Puffy Mattress, Saatva Inc., Brooklyn Bedding, LLC, Nest Bedding, Inc., Helix Sleep, Inc., Purple Innovation, Inc., Avocado Green Mattress, LLC, Layla Sleep, DreamCloud (Resident Home LLC), and Casper Sleep Inc. The Down Alternative Mattresses Market is characterized by intense competition driven by continuous innovation and strong brand positioning. Manufacturers focus on enhancing sleep comfort through breathable, hypoallergenic materials and advanced fiber technologies. Many companies invest in sustainable production practices to align with rising eco-conscious consumer preferences. Direct-to-consumer models and e-commerce platforms play a key role in market expansion, allowing brands to offer competitive pricing and faster delivery. Product differentiation often centers on ergonomic designs, pressure-relief features, and superior durability. Strategic marketing, including influencer partnerships and digital campaigns, boosts brand visibility. Expanding global distribution networks further strengthens competitive dynamics across multiple regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Puffy Mattress

- Saatva Inc.

- Brooklyn Bedding, LLC

- Nest Bedding, Inc.

- Helix Sleep, Inc.

- Purple Innovation, Inc.

- Avocado Green Mattress, LLC

- Layla Sleep

- DreamCloud (Resident Home LLC)

- Casper Sleep Inc.

Recent Developments

- In February 2025, Tempur Sealy International, Inc. purchased Mattress Firm which is America’s largest mattress specialty retailer. This is likely to strengthen Tempur Sealy’s position within the US market. Furthermore, by integrating Mattress Firm’s extensive network of over 2300 stores with its own DTC, Tempur Sealy hopes to strengthen its consumer presence.

- In May 2024, Serta Simmons Bedding (SSB) added to its premium mattress line the new Beautyrest Black series. This customized collection is said to include four different models, namely Beautyrest Black Series One to Four, tasked to ensure improved comfort and adequate support.

- In November 2023, Emma, a Germany-based brand, ventured into the online bedding products market in India, offering products through its local website along with major e-commerce platforms such as Amazon.

- In April 2023, Sleep Number introduced their next-generation smart beds and lifestyle furniture, sold separately which could be used together for individuals for better sleep.

Report Coverage

The research report offers an in-depth analysis based on Price Range, Firmness Level, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for eco-friendly and sustainable mattress materials.

- Consumer focus on hypoallergenic and breathable products will continue to grow.

- E-commerce platforms will play a bigger role in driving product sales.

- Brands will invest more in ergonomic and pressure-relief mattress technologies.

- Direct-to-consumer strategies will strengthen brand-customer relationships.

- Global expansion will increase through localized product offerings.

- Product personalization will become a key factor for brand differentiation.

- Advanced manufacturing will support faster and more efficient production.

- Marketing strategies will rely more on digital campaigns and influencer collaborations.

- The hospitality and healthcare sectors will drive growing demand for premium mattresses.