Market Overview

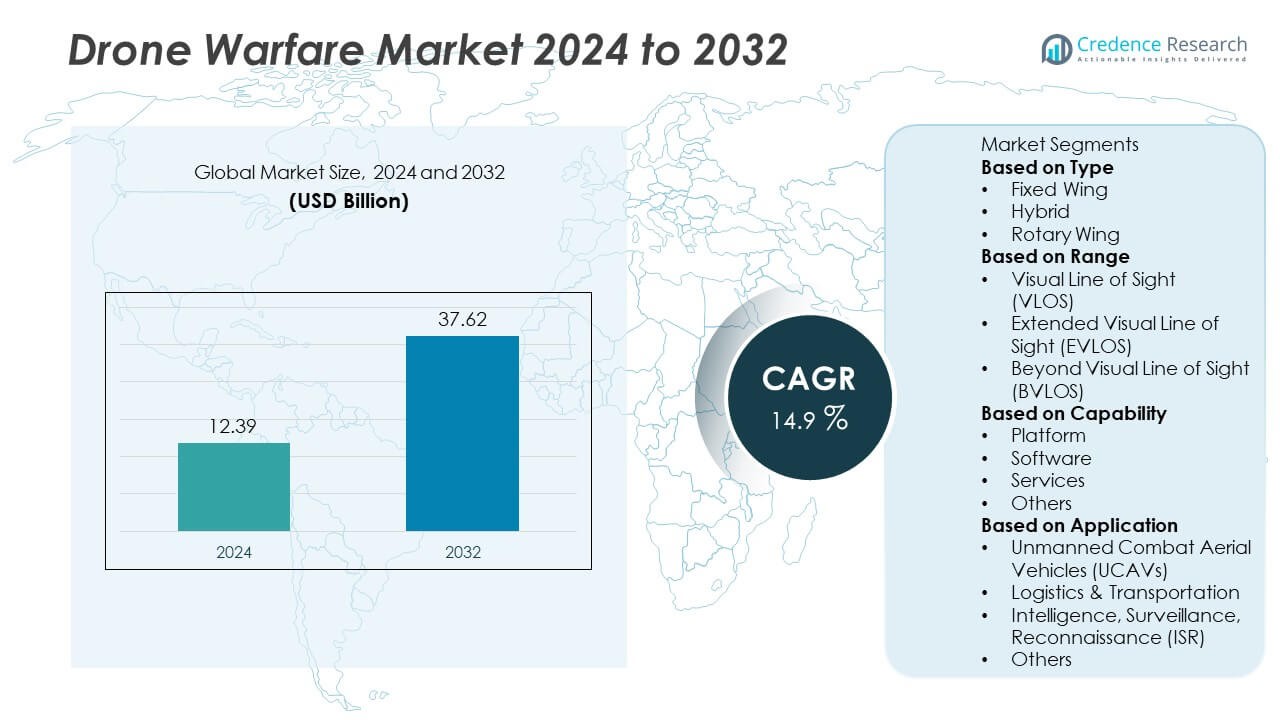

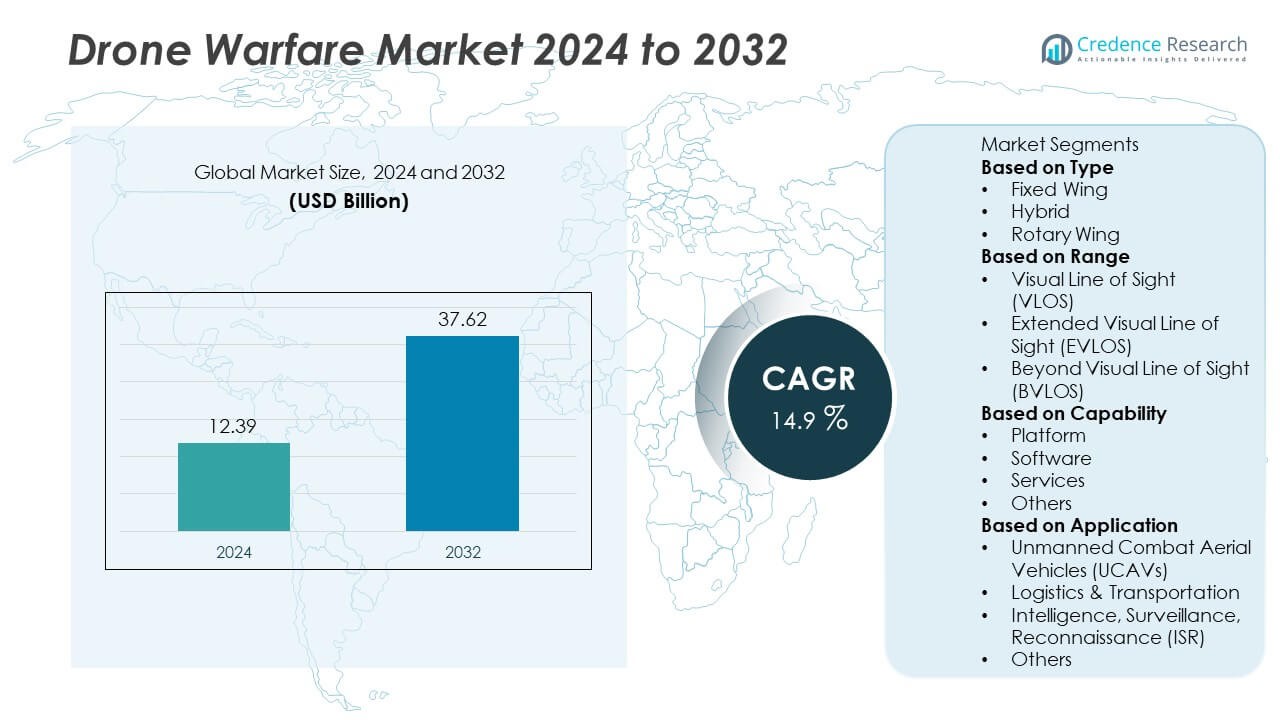

The global drone warfare market was valued at USD 12.39 billion in 2024 and is projected to reach USD 37.62 billion by 2032, growing at a CAGR of 14.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Warfare Market Size 2024 |

USD 12.39 Billion |

| Drone Warfare Market, CAGR |

14.9% |

| Drone Warfare Market Size 2032 |

USD 37.62 Billion |

The drone warfare market is led by key players such as Skydio, Inc., Teledyne Technologies Incorporated, Dronamics Global Limited, Parrot Drones SAS, Lockheed Martin Corporation, AeroVironment, Inc., Flyability SA, RTX Corporation, General Atomics, and The Boeing Company. These companies dominate through innovation in AI-driven targeting, autonomous navigation, and long-endurance UAV platforms. North America led the market in 2024 with a 34% share, supported by substantial U.S. defense investments and technological advancements. Europe followed with a 28% share, driven by collaborative defense programs, while Asia-Pacific held a 27% share, fueled by regional military expansion and indigenous UAV production initiatives enhancing operational efficiency and defense readiness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global drone warfare market was valued at USD 12.39 billion in 2024 and is projected to reach USD 37.62 billion by 2032, growing at a CAGR of 14.9% during 2025–2032.

- Rising defense modernization programs and growing demand for autonomous surveillance and combat systems are driving adoption across global militaries.

- Key trends include integration of AI, swarm drone technology, and network-centric warfare systems enhancing mission precision and real-time intelligence.

- Major players such as Lockheed Martin, General Atomics, AeroVironment, RTX, and Boeing focus on innovation, long-range UAV platforms, and strategic defense collaborations.

- North America led the market with a 34% share, followed by Europe at 28% and Asia-Pacific at 27%, while the fixed-wing segment dominated with a 57% share, driven by its superior endurance and suitability for long-range military operations.

Market Segmentation Analysis:

By Type

The fixed-wing segment dominated the drone warfare market in 2024, accounting for a 57% share. Its dominance is attributed to superior endurance, higher altitude operation, and extended range capabilities essential for intelligence, surveillance, and reconnaissance (ISR) missions. Fixed-wing drones are widely used by defense forces for long-duration missions requiring stable flight and large payload capacity. Key militaries such as the U.S. and Israel are investing heavily in advanced fixed-wing UAVs for precision targeting and border monitoring. The segment’s growth is further supported by the integration of AI and advanced sensor systems enhancing operational effectiveness.

- For instance, the General Atomics MQ-9 Reaper can achieve an endurance of up to 27 hours and a ceiling of 50,000 feet, providing intelligence, surveillance, and reconnaissance (ISR) and strike capabilities.

By Range

The beyond visual line of sight (BVLOS) segment held the leading position with a 62% share in 2024. This dominance is driven by the growing need for long-range surveillance and autonomous combat operations without direct human control. BVLOS drones enable real-time intelligence and remote strike capabilities across vast and high-risk zones. Militaries globally are prioritizing BVLOS-enabled UAVs for border patrol, maritime surveillance, and strategic reconnaissance. Increasing investments in satellite communication and advanced control systems further enhance BVLOS efficiency, making it a critical component in modern drone warfare operations.

- For instance, the Elbit Systems Hermes 900 platform achieved beyond-line-of-sight (BVLOS) operation via Ku-band satellite data links, enabling a mission range that can exceed 1,000 kilometers from the ground control station.

By Capability

The platform segment accounted for a 49% share in 2024, emerging as the largest category within the drone warfare market. This segment’s strength stems from the demand for advanced UAV airframes, propulsion systems, and integrated payloads capable of executing complex missions. Governments are investing in next-generation combat drones with stealth features, autonomous navigation, and AI-enabled targeting. Continuous innovation in multi-role platforms—capable of carrying sensors, weapons, and communication modules—drives segment growth. Additionally, rising collaborations between defense contractors and technology firms are accelerating the development of more efficient and modular drone warfare platforms.

Key Growth Drivers

Rising Defense Modernization and Military Spending

Global defense modernization programs are significantly boosting the adoption of drone warfare systems. Nations such as the U.S., China, and India are increasing defense budgets to enhance surveillance, reconnaissance, and precision strike capabilities. Drones provide real-time intelligence and reduce risks to personnel in hostile environments. The growing emphasis on autonomous and unmanned combat systems further accelerates procurement. Strategic defense collaborations and cross-border tensions are also prompting countries to invest heavily in UAV fleets, strengthening drone integration into national security frameworks.

- For instance, Lockheed Martin RQ-170 Sentinel integrates stealth composites and advanced data links for secure intelligence transfer, its endurance and range are significantly more limited than those of larger platforms. An RQ-4 Global Hawk, for comparison, is a non-stealthy drone capable of endurance over 30 hours and a much greater operational range for extended ISR missions.

Advancements in Artificial Intelligence and Autonomous Systems

Rapid progress in artificial intelligence and autonomous technologies is transforming drone warfare efficiency. AI-driven drones can conduct target identification, navigation, and mission planning with minimal human intervention. These advancements enhance decision-making speed and reduce response time during combat operations. Integration of machine learning and real-time data analytics also improves mission accuracy and adaptability. Defense forces are increasingly adopting AI-enabled drones for ISR and offensive missions, establishing a strong foundation for fully autonomous warfare systems with enhanced operational resilience.

- For instance, AeroVironment’s Switchblade 600 integrates AI-assisted target recognition and autonomous flight controls with a strike range of 90 kilometers. The loitering munition can stay airborne for 40 minutes and uses real-time GPS and EO/IR sensors to lock onto mobile armored targets.

Growing Demand for Long-Range and Multi-Mission Drones

The need for drones capable of operating across extended distances and performing multiple roles is driving market growth. Defense agencies are deploying long-range UAVs for surveillance, combat, and logistics operations in high-risk or remote areas. Multi-mission drones equipped with hybrid propulsion and modular payload systems improve flexibility across varied missions. Enhanced endurance and payload capacity enable advanced ISR operations and strategic strike capabilities. The shift toward network-centric warfare and integrated command systems further supports adoption of these high-performance UAV platforms.

Key Trends & Opportunities

Integration of Swarm and Network-Centric Warfare Systems

Swarm drone technology is emerging as a major trend in modern combat strategies. Coordinated drone swarms can overwhelm enemy defenses, enhance battlefield situational awareness, and execute synchronized missions. Defense agencies are exploring AI-driven swarm operations integrated with command networks to improve battlefield coordination. Network-centric warfare strategies that connect drones with ground, naval, and aerial assets provide unified intelligence and rapid response capabilities. This trend is creating new opportunities for advanced communication and control technologies in military drone systems.

- For instance, Raytheon BBN, a subsidiary of RTX (formerly Raytheon Technologies), demonstrated a system that allowed a single operator to control a swarm of 130 physical and 30 simulated drones using a secure mesh network.

Expansion of Indigenous Drone Production and Export Programs

Countries are increasingly focusing on local drone manufacturing to reduce import dependence and strengthen defense autonomy. Governments in India, Turkey, and South Korea are promoting indigenous UAV programs through defense partnerships and funding initiatives. These efforts not only reduce procurement costs but also enhance technological sovereignty. Export of domestically developed combat drones to allied nations is rising, creating economic and strategic benefits. This shift toward self-reliance and global defense trade diversification presents a major opportunity for market expansion.

- For instance, the Turkish Aerospace Industries ANKA-S UAV achieves a long operational endurance of up to 30 hours, with satellite-controlled versions capable of operating beyond line-of-sight. Older variants had a payload capacity of 200 kilograms, while newer models can carry over 350 kilograms.

Key Challenges

Stringent Regulatory and Ethical Constraints

The use of drones in warfare is subject to complex international regulations and ethical debates. Concerns over civilian casualties, cross-border violations, and autonomous decision-making limit widespread deployment. Strict export control laws and compliance requirements slow production and international trade of military drones. Balancing operational efficiency with accountability and compliance remains a critical challenge. Governments and defense organizations must establish clear regulatory frameworks to ensure responsible use while maintaining strategic advantage in drone-based combat systems.

Cybersecurity Risks and Communication Vulnerabilities

Rising dependence on digital connectivity exposes military drones to cybersecurity threats and signal interference. Adversaries can exploit communication links to jam or hijack drone systems, compromising mission integrity. Protecting command-and-control networks, encryption protocols, and onboard data storage is becoming increasingly critical. The integration of advanced cybersecurity measures, secure satellite communication, and AI-based threat detection is essential to counter these risks. Ensuring secure data transmission and resilience against electronic warfare remains a key challenge for defense drone operations.

Regional Analysis

North America

North America held a 34% share of the global drone warfare market in 2024, driven by strong defense budgets and advanced military modernization programs. The United States leads the region, supported by significant investments in combat and surveillance UAVs through the Department of Defense and key defense contractors. Canada is also expanding its UAV procurement for border and maritime surveillance. The region’s dominance is reinforced by early adoption of AI-based targeting systems and autonomous platforms. Increasing cross-border security initiatives and technological innovation continue to position North America as a key global defense UAV hub.

Europe

Europe accounted for a 28% share of the drone warfare market in 2024, supported by rising defense spending and joint military programs. Nations such as the UK, France, and Germany are investing in next-generation UAVs under collaborative initiatives like the European MALE RPAS project. Heightened regional security concerns and modernization efforts are accelerating demand for reconnaissance and combat drones. Regulatory harmonization across the European Union is improving UAV deployment efficiency. Ongoing development of indigenous platforms and partnerships with U.S. and Israeli defense firms strengthen Europe’s position in the global defense UAV ecosystem.

Asia-Pacific

Asia-Pacific captured a 27% share in 2024, reflecting rapid military expansion and increasing cross-border tensions. China, India, and Japan lead the region’s adoption of UAV technology for surveillance and combat operations. China dominates production and exports, while India is boosting local manufacturing under defense self-reliance programs. Japan is advancing AI-based reconnaissance drones to enhance maritime and airspace defense. Growing investments in autonomous technologies and strategic defense collaborations are fueling market growth. The region’s geopolitical dynamics and modernization programs make Asia-Pacific one of the fastest-growing drone warfare markets worldwide.

Latin America

Latin America held a 6% share of the drone warfare market in 2024, driven by rising interest in UAVs for border security, counterterrorism, and anti-narcotics operations. Brazil and Mexico lead regional investments, supported by modernization of defense infrastructure. Local governments are increasingly partnering with global defense manufacturers to enhance surveillance capabilities. Limited defense budgets and technological dependencies remain challenges. However, adoption of tactical UAVs for monitoring and reconnaissance missions is expanding steadily. Growing emphasis on cost-effective and versatile UAV solutions continues to drive gradual market development in the region.

Middle East & Africa

The Middle East & Africa region accounted for a 5% share in 2024, fueled by growing defense investments and geopolitical tensions. Countries such as Israel, Saudi Arabia, and the UAE are leading adopters of combat and reconnaissance drones. Israel remains a global UAV technology exporter, while the UAE focuses on developing indigenous drone capabilities. Ongoing regional conflicts and border surveillance needs drive strong demand for armed and tactical UAVs. In Africa, countries like South Africa are adopting drones for intelligence and security operations. Rising defense collaborations and technological advancements will further support regional growth.

Market Segmentations:

By Type

- Fixed Wing

- Hybrid

- Rotary Wing

By Range

- Visual Line of Sight (VLOS)

- Extended Visual Line of Sight (EVLOS)

- Beyond Visual Line of Sight (BVLOS)

By Capability

- Platform

- Software

- Services

- Others

By Application

- Unmanned Combat Aerial Vehicles (UCAVs)

- Logistics & Transportation

- Intelligence, Surveillance, Reconnaissance (ISR)

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the drone warfare market is defined by leading players such as Skydio, Inc., Teledyne Technologies Incorporated, Dronamics Global Limited, Parrot Drones SAS, Lockheed Martin Corporation, AeroVironment, Inc., Flyability SA, RTX Corporation, General Atomics, and The Boeing Company. These companies dominate the market through continuous innovation in autonomous flight systems, AI-driven targeting, and advanced payload integration. Global defense contractors focus on developing high-endurance, stealth, and multi-role combat drones to meet modern military requirements. Strategic collaborations with governments and defense organizations are expanding operational deployment worldwide. Players such as Lockheed Martin and General Atomics lead in heavy combat UAVs, while Skydio and AeroVironment excel in tactical and reconnaissance drones. Continuous R&D investments, mergers, and product diversification are reshaping competition, enabling companies to enhance situational awareness, combat precision, and interoperability across complex battlefield environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Skydio, Inc.

- Teledyne Technologies Incorporated

- Dronamics Global Limited

- Parrot Drones SAS

- Lockheed Martin Corporation

- AeroVironment, Inc.

- Flyability SA

- RTX Corporation

- General Atomics

- The Boeing Company

Recent Developments

- In August 2025, AeroVironment, Inc. delivered initial P550 Group 2 eVTOL unmanned aircraft systems to the U.S. Army for its Long-Range Reconnaissance (LRR) programme

- In May 2025, Skydio, Inc. delivered its first systems for the U.S. Army’s Tranche 2 short-range reconnaissance programme.

- In 2025, Lockheed Martin Corporation (via its Skunk Works division) unveiled its “Vectis” stealth drone wingman concept, designed to perform electronic warfare, precision strikes, ISR and counter-air missions.

Report Coverage

The research report offers an in-depth analysis based on Type, Range, Capability, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing defense investments in unmanned combat technologies.

- AI and machine learning will enhance real-time decision-making and targeting precision.

- Swarm drone systems will gain prominence in coordinated battlefield operations.

- Autonomous drones will reduce human intervention in high-risk missions.

- Nations will focus on developing indigenous UAV programs to ensure defense independence.

- Integration of drones with satellite and 5G communication networks will improve control efficiency.

- Miniaturized and stealth drone technologies will drive next-generation combat applications.

- Cybersecurity and counter-drone systems will become critical areas of defense focus.

- Asia-Pacific will emerge as a key manufacturing and deployment hub for combat drones.

- Strategic partnerships between defense contractors and governments will accelerate technological innovation.