Market Overview

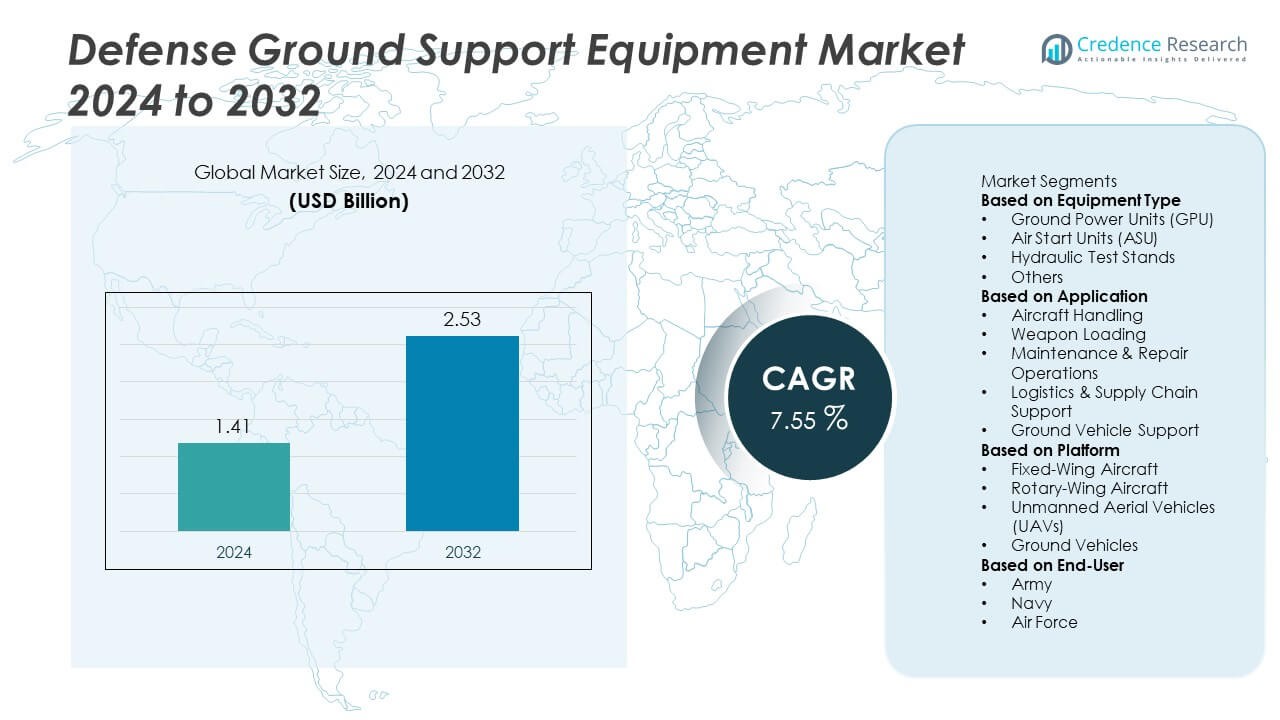

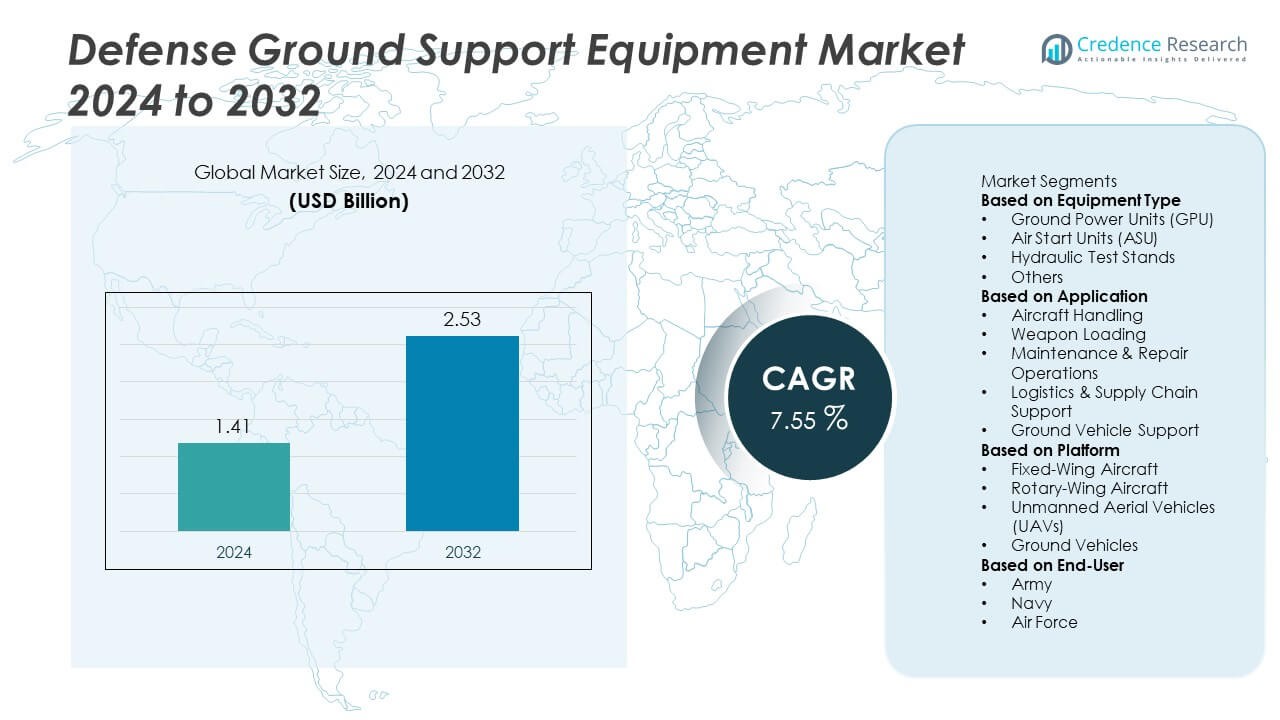

The Defense Ground Support Equipment market was valued at USD 1.41 billion in 2024 and is expected to reach USD 2.53 billion by 2032, expanding at a CAGR of 7.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Defense Ground Support Equipment market Size 2024 |

USD 1.41 Billion |

| Defense Ground Support Equipment market, CAGR |

7.55% |

| Defense Ground Support Equipment market Size 2032 |

USD 2.53 Billion |

The defense ground support equipment market is led by major players including Textron Ground Support Equipment Inc., JBT Corporation, TLD Group, Tronair Inc., Mallaghan Engineering Ltd., ITW GSE, Cavotec SA, Rheinmetall AG, Cobham Limited, and ST Engineering Aerospace Ltd. These companies dominate through advanced product portfolios, strategic collaborations, and extensive global service networks. North America emerged as the leading region with a 38% market share in 2024, supported by strong defense budgets and modernization programs across the United States and Canada. Europe followed with a 27% share, driven by sustainable equipment adoption and airbase upgrades, while Asia-Pacific accounted for 24%, propelled by expanding military aviation infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The defense ground support equipment market was valued at USD 1.41 billion in 2024 and is projected to reach USD 2.53 billion by 2032, growing at a CAGR of 7.55%.

- Market growth is driven by increasing defense modernization programs, rising procurement of advanced aircraft, and expanding maintenance infrastructure across airbases worldwide.

- Key trends include adoption of electric and hybrid ground systems, automation in towing and handling operations, and integration of IoT-enabled predictive maintenance technologies.

- The market is moderately consolidated, with major players such as Textron GSE, JBT Corporation, TLD Group, and Rheinmetall AG focusing on product innovation, sustainability, and global defense collaborations.

- North America led the market with a 38% share in 2024, followed by Europe with 27% and Asia-Pacific with 24%; among segments, ground power units held a 36% share, driven by demand for efficient and low-emission power solutions for modern defense aircraft.

Market Segmentation Analysis:

By Equipment Type

Ground Power Units (GPU) led the defense ground support equipment market with a 36% share in 2024. Their dominance is supported by the increasing electrification of aircraft systems and the growing need for efficient on-ground power solutions. Defense forces are investing in modern GPUs to ensure uninterrupted maintenance and operations during deployments. Rising adoption of hybrid and battery-based GPUs enhances fuel efficiency and reduces carbon emissions, aligning with sustainability goals in military aviation. Air Start Units and Hydraulic Test Stands follow, driven by demand for improved engine reliability and system diagnostics.

- For instance, ITW GSE’s 7400 eGPU is capable of delivering 90 kVA output power using a lithium-ion battery pack. This unit enables silent operation during maintenance activities and significantly reduces operational fuel consumption and emissions compared to diesel systems.

By Application

Maintenance and Repair Operations accounted for the largest 41% market share in 2024. This segment benefits from expanding aircraft fleets and the need for regular overhauls to maintain mission readiness. Defense organizations are prioritizing predictive maintenance and diagnostic testing for better operational uptime. Increased deployment of digital monitoring tools and automated test equipment has further boosted efficiency in maintenance tasks. Aircraft Handling and Weapon Loading segments also contribute significantly, supported by automation in ground logistics and faster turnaround requirements during field operations.

- For instance, Rheinmetall AG provides comprehensive digital services and fleet management solutions, such as its IRIS®fleet and digital twin technology, to the German Army and allied forces to improve vehicle maintenance and increase availability.

By Platform

Fixed-Wing Aircraft dominated the market with a 48% share in 2024, driven by extensive use in combat, transport, and surveillance missions. Growing modernization of fighter and transport aircraft fleets across major defense nations has spurred demand for advanced GSE. Technological upgrades, such as smart tow tractors and integrated diagnostics for ground systems, enhance operational readiness. Rotary-Wing Aircraft and UAV platforms are also witnessing steady growth, fueled by increasing deployment in tactical operations, border surveillance, and reconnaissance missions that require mobile and efficient support infrastructure.

Key Growth Drivers

Rising Military Modernization Programs

Global defense forces are modernizing fleets and infrastructure to enhance operational efficiency. This modernization includes upgrading airbases, logistics systems, and maintenance facilities to support next-generation aircraft. Growing focus on improving ground operations efficiency and readiness drives adoption of advanced support systems. Defense organizations increasingly invest in electric ground power units, hydraulic test stands, and tow tractors to reduce downtime and ensure rapid deployment. These modernization efforts strengthen mission capabilities and improve overall defense preparedness across major nations.

- For instance, Textron Ground Support Equipment supplied TUG ALPHA tow tractors to the U.S. Air Force as part of its flight line modernization initiative. The TUG ALPHA 4 model is suited for pushback and towing wide-bodied aircraft. The TUG ALPHA 1 has a maximum drawbar pull of 24,000 pounds (about 10,886 kilograms) and a gross vehicle weight of 35,000 pounds.

Expansion of Unmanned and Autonomous Systems

The expanding use of unmanned aerial vehicles in surveillance and tactical missions is fueling demand for specialized ground support systems. Defense agencies require reliable equipment for UAV handling, fueling, and maintenance to ensure continuous mission readiness. Advanced systems with automation and remote monitoring features are gaining traction. Integration of artificial intelligence and compact power technologies enables efficient support for high-frequency UAV operations. This expansion promotes innovation in lightweight, portable, and intelligent ground systems across defense sectors.

- For instance, General Atomics developed extended-range fuel pods for the MQ-9A Reaper, which can increase the drone’s endurance by extending its fuel capacity via wing-borne tanks. The system is retrofittable and enhances endurance and mission flexibility for long-range UAV operations.

Shift Toward Electric and Sustainable Equipment

Defense organizations are increasingly shifting to electric and hybrid ground support systems to meet sustainability goals. Electrification reduces noise, emissions, and operational costs while improving reliability. Military airbases are gradually replacing diesel-based units with battery-powered or hybrid alternatives. This transition aligns with broader global initiatives for energy efficiency and environmental responsibility. Adoption of sustainable ground support solutions enhances fuel savings and supports long-term defense infrastructure modernization, particularly in environmentally regulated defense regions.

Key Trends & Opportunities

Integration of IoT and Predictive Maintenance

Defense forces are adopting connected ground equipment with built-in sensors and diagnostic tools. These systems enable real-time monitoring of performance and maintenance needs. Predictive maintenance technologies reduce downtime and extend the service life of critical equipment. Data analytics platforms enhance operational efficiency by forecasting equipment failures before they occur. The use of smart monitoring solutions allows defense organizations to optimize maintenance schedules and improve fleet availability during demanding missions.

- For instance, JBT Corporation has deployed its iOPS telematics platform for ground support units to provide predictive maintenance by collecting and analyzing real-time performance data. The system is designed to maximize equipment uptime, productivity, and profitability by moving from reactive to predictive maintenance.

Increasing Automation in Ground Handling Operations

Automation is transforming ground operations by introducing autonomous towing vehicles, robotic loaders, and self-monitoring systems. These technologies minimize manual effort and enhance safety during aircraft servicing. Artificial intelligence and machine vision tools improve accuracy in handling operations and reduce human error. Automated ground support systems also enable faster aircraft turnaround and better coordination between maintenance teams. This shift toward automation represents a major opportunity to improve efficiency in defense logistics and airbase management.

- For instance, TLD Group introduced its TractEasy autonomous tow tractor developed with EasyMile, with different models having varying capacities, some reaching up to 25,000 kilograms in demonstrations. The vehicle uses Level 4 autonomy and a navigation system that combines LiDAR, GPS, and other sensors to achieve centimeter-level accuracy.

Key Challenges

High Procurement and Maintenance Costs

Adopting advanced ground support systems requires substantial investment in technology and infrastructure. Electric and hybrid units, while efficient, involve high production and setup costs. Budget constraints often slow modernization programs, especially in smaller defense markets. The requirement for skilled maintenance personnel further adds to operational expenses. Balancing technological advancement with cost efficiency remains a key challenge for defense agencies planning long-term equipment upgrades.

Supply Chain Vulnerabilities and Component Shortages

The defense ground support sector faces persistent supply chain disruptions and component shortages. Limited availability of critical parts, such as electronic modules and batteries, affects production and delivery timelines. Geopolitical tensions and dependency on global suppliers create risks for equipment availability. These vulnerabilities can delay repair cycles and mission readiness. Strengthening local manufacturing and diversifying supply networks are essential strategies to ensure stable and uninterrupted equipment support.

Regional Analysis

North America

North America held the largest share of 38% in the defense ground support equipment market in 2024. The dominance stems from continuous modernization of airbases, strong defense budgets, and widespread adoption of electric and automated ground systems. The United States leads regional demand with extensive procurement of advanced GPUs, tugs, and maintenance units for fighter and transport aircraft. Canada also contributes through investments in aircraft servicing and logistics infrastructure. Ongoing replacement of legacy equipment and focus on rapid deployment capabilities continue to strengthen regional growth prospects.

Europe

Europe accounted for a 27% share of the defense ground support equipment market in 2024. Growth in this region is driven by expanding defense infrastructure programs and rising investments in sustainable ground operations. Countries such as the United Kingdom, France, and Germany are upgrading airbases with energy-efficient GPUs and digital maintenance tools. The European Union’s defense cooperation initiatives and increased aircraft modernization projects further support adoption. The shift toward hybrid-powered equipment and automation aligns with the region’s carbon neutrality goals and long-term strategic defense commitments.

Asia-Pacific

Asia-Pacific captured a 24% share of the defense ground support equipment market in 2024. The region’s growth is propelled by expanding military aviation fleets and strengthening defense capabilities in countries such as China, India, Japan, and South Korea. Rising cross-border tensions and increasing aircraft procurement drive investments in advanced maintenance and ground handling systems. Governments are upgrading base infrastructure with locally manufactured and imported GSE. The shift toward electric ground vehicles and predictive maintenance systems also supports operational readiness across major defense airbases.

Middle East & Africa

The Middle East & Africa region accounted for an 8% share of the defense ground support equipment market in 2024. The market benefits from ongoing fleet expansion and infrastructure upgrades in Gulf Cooperation Council nations. Saudi Arabia and the United Arab Emirates lead regional demand with investments in maintenance and logistics systems to support air defense programs. Africa’s emerging defense modernization initiatives, particularly in South Africa and Egypt, are gradually contributing to growth. Increased procurement of multi-role aircraft continues to create opportunities for equipment suppliers.

Latin America

Latin America represented a 3% share of the defense ground support equipment market in 2024. The market is supported by gradual modernization of defense fleets and airbase facilities in Brazil, Mexico, and Argentina. Growing emphasis on border security and disaster response operations is driving adoption of advanced ground handling systems. Regional forces are investing in cost-efficient and durable GSE to enhance mission readiness. Collaborations with international equipment suppliers and defense technology transfers are further supporting the development of local maintenance and logistics capabilities.

Market Segmentations:

By Equipment Type

- Ground Power Units (GPU)

- Air Start Units (ASU)

- Hydraulic Test Stands

- Others

By Application

- Aircraft Handling

- Weapon Loading

- Maintenance & Repair Operations

- Logistics & Supply Chain Support

- Ground Vehicle Support

By Platform

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- Unmanned Aerial Vehicles (UAVs)

- Ground Vehicles

By End-User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the defense ground support equipment market is defined by the presence of major players such as Textron Ground Support Equipment Inc., JBT Corporation, TLD Group, Tronair Inc., Mallaghan Engineering Ltd., ITW GSE, Cavotec SA, Rheinmetall AG, Cobham Limited, and ST Engineering Aerospace Ltd. These companies focus on continuous innovation, product reliability, and integration of smart technologies to enhance operational performance. Leading manufacturers are investing in electric and hybrid GSE to meet sustainability targets and reduce emissions at military airbases. Strategic collaborations with defense agencies and aircraft OEMs enable suppliers to expand their global footprint and improve maintenance support. Firms are also strengthening after-sales services and digital monitoring capabilities to boost equipment lifecycle efficiency. The market remains moderately consolidated, with key participants emphasizing automation, predictive diagnostics, and rapid deployment technologies to maintain competitiveness in global defense modernization programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Mallaghan Engineering Ltd. won Ground Support Worldwide’s “Product Leader of the Year 2025” for its SkyBelt system.

- In July 2024, CVC DIF, the infrastructure strategy of prominent global private markets manager CVC (through its CIF III fund), has finalized an agreement to acquire HiSERV, the leading German provider of aviation ground service equipment (GSE) leasing, from AVECO Holding.

- In June 2024, The International Air Transport Association (IATA) has introduced an initiative aimed at encouraging the industry to adopt Enhanced Ground Support Equipment (GSE).

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Application, Platform, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric and hybrid ground support systems will continue to rise due to sustainability goals.

- Defense forces will increasingly adopt automated and remotely operated towing and maintenance systems.

- Integration of IoT and AI technologies will enhance predictive maintenance and equipment efficiency.

- Military modernization programs will expand across developing regions, creating new procurement opportunities.

- UAV operations will drive the need for compact and specialized ground handling systems.

- Manufacturers will focus on lightweight, modular, and rapidly deployable ground support solutions.

- Strategic collaborations between defense contractors and equipment suppliers will strengthen market competitiveness.

- Rising investments in smart airbase infrastructure will boost demand for connected ground systems.

- Supply chain localization efforts will increase to reduce dependency on international component suppliers.

- Continuous upgrades in military aircraft fleets will sustain long-term demand for advanced support equipment.