Market Overview:

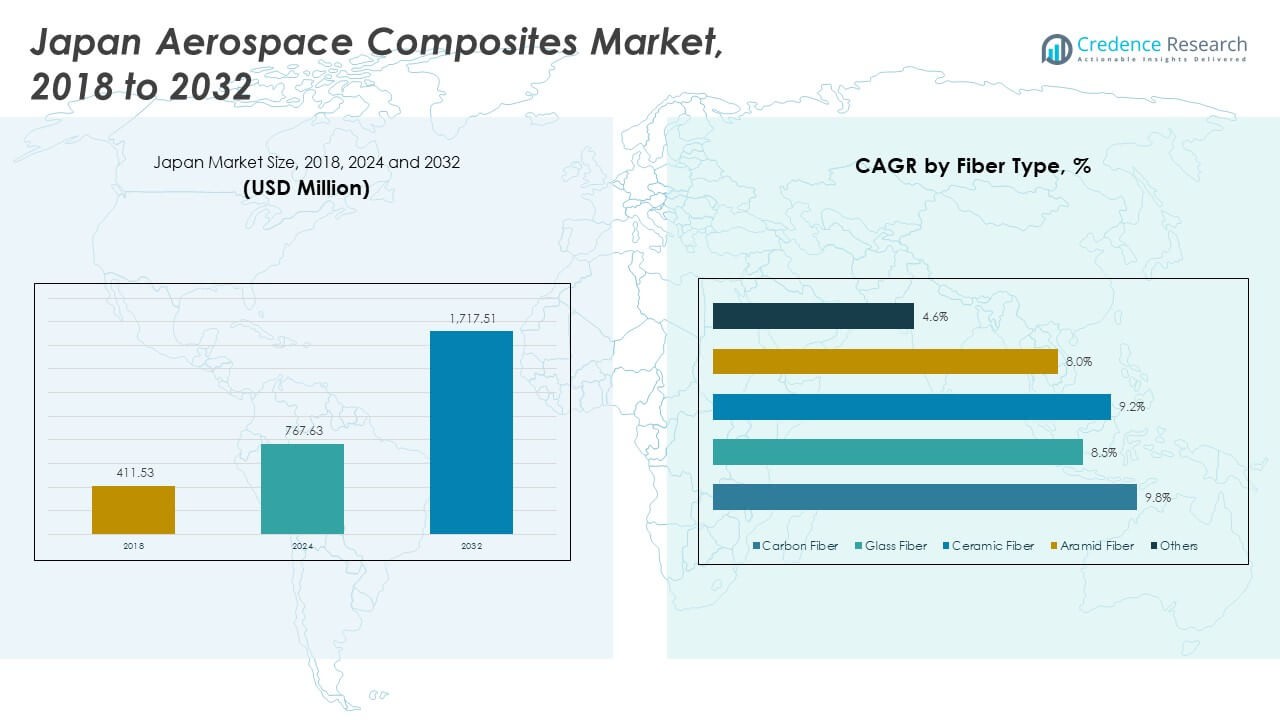

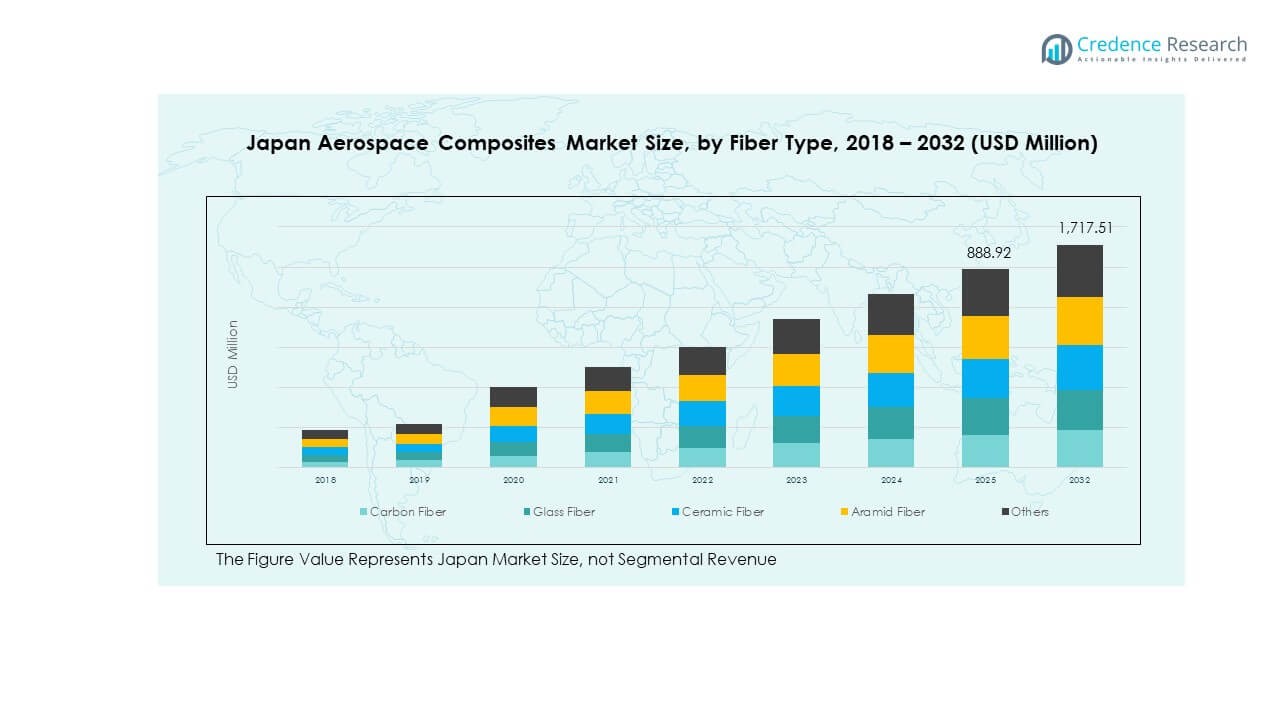

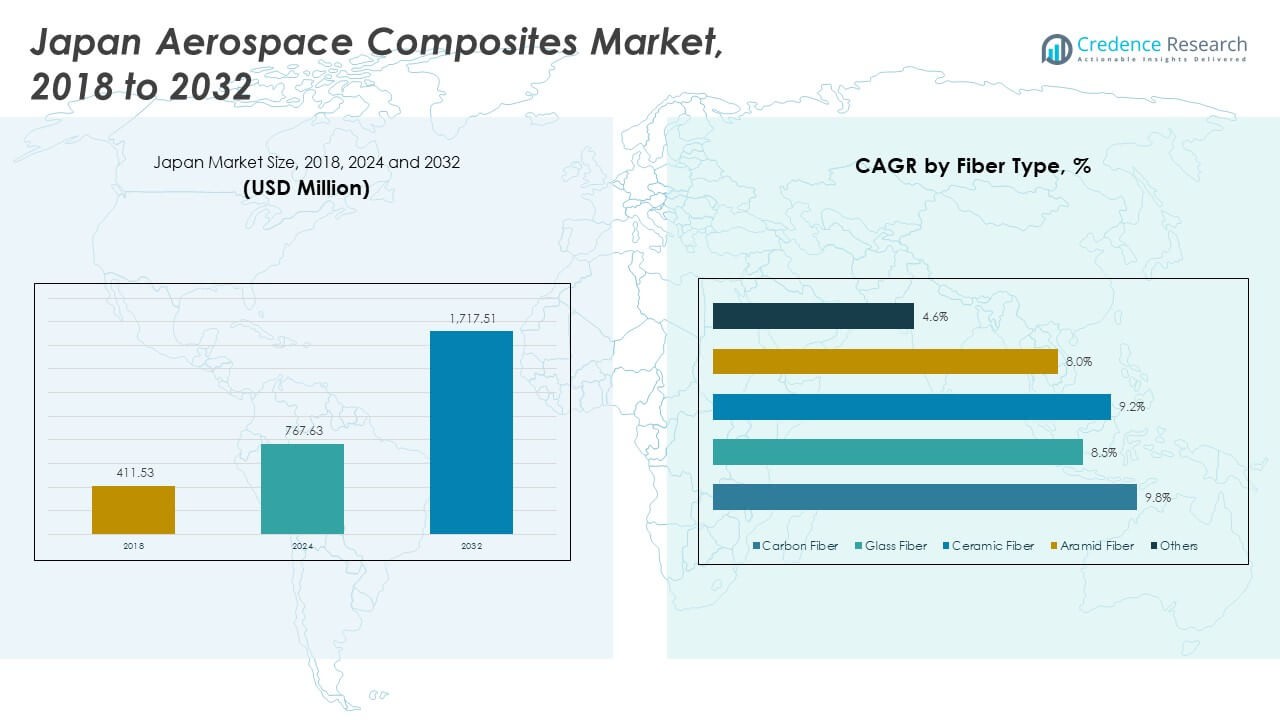

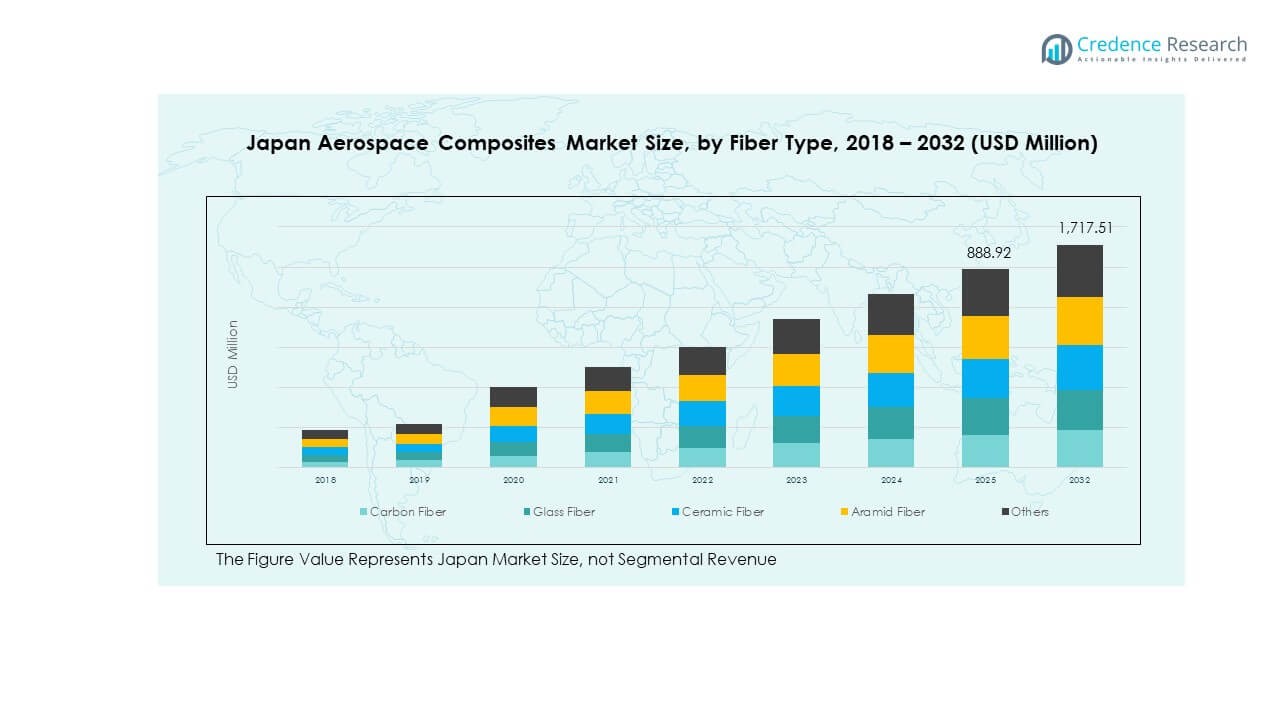

The Japan Aerospace Composites Market size was valued at USD 411.53 million in 2018 to USD 767.63 million in 2024 and is anticipated to reach USD 1,717.51 million by 2032, at a CAGR of 9.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Aerospace Composites Market Size 2024 |

USD 767.63 Million |

| Japan Aerospace Composites Market, CAGR |

9.87% |

| Japan Aerospace Composites Market Size 2032 |

USD 1,717.51 Million |

Rising demand for lightweight aircraft materials, growing fleet modernization, and rapid carbon fiber innovation are key drivers of market growth. Manufacturers are integrating advanced composites to reduce aircraft weight, improve fuel efficiency, and extend component life cycles. Expanding OEM and Tier 1 collaborations, coupled with increased R&D investments, are strengthening the supply chain. It is further supported by government initiatives that encourage production capacity expansion and sustainable aerospace material development.

The market is regionally concentrated in technologically advanced subregions with strong industrial clusters. Kanto leads due to its established aerospace ecosystem, skilled workforce, and proximity to key suppliers. Kansai is emerging as a center for material innovation and OEM integration, supported by growing manufacturing infrastructure. Chubu and other subregions are also gaining significance through capacity expansions and strategic partnerships. Regional investments and specialized capabilities position Japan as a strong hub in the global aerospace composite value chain.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Aerospace Composites Market was valued at USD 411.53 million in 2018, reached USD 767.63 million in 2024, and is projected to achieve USD 1,717.51 million by 2032, growing at a CAGR of 9.87%.

- Kanto leads with 41.5% share due to its strong aerospace ecosystem and advanced manufacturing infrastructure. Kansai holds 33.2% supported by material innovation and OEM integration. Chubu and other subregions together account for 25.3%, benefiting from new investments and expanding supply chain capabilities.

- Chubu is the fastest-growing region, supported by its precision engineering base and increasing partnerships with Kanto and Kansai. Strong investment in composite manufacturing and skilled labor is driving its rapid expansion.

- Carbon fiber accounts for the largest segment share, representing approximately 37% of the total market, supported by its strength-to-weight advantage in structural applications.

- Glass fiber holds the second-largest share, representing around 26% of the total market, favored for its cost efficiency and versatility across multiple aircraft components.

Market Drivers

Rising Demand for Lightweight Composite Materials in Aircraft Manufacturing

The Japan Aerospace Composites Market is expanding rapidly due to the increasing preference for lightweight materials in aircraft construction. Carbon fiber composites are gaining strong traction due to their high strength-to-weight ratio. OEMs are integrating these materials to reduce aircraft weight and improve operational efficiency. Fuel consumption levels drop significantly with lighter structures, enhancing sustainability goals. Airlines seek longer flight ranges and lower maintenance costs, making these materials critical. Strategic collaborations between manufacturers and suppliers are accelerating technological advancements. Government initiatives supporting advanced manufacturing strengthen the domestic ecosystem. High adoption across commercial and defense programs reflects this growing demand.

- For instance, Toray Industries, Inc. manufactures the TORAYCA™ carbon fiber series, used globally for aerospace applications, including aircraft structural components.

Growing Investment in Research and Development to Advance Composite Technologies

Companies are investing heavily in R&D to develop advanced composite solutions for next-generation aircraft. New production techniques improve durability, thermal resistance, and design flexibility. These improvements enable efficient integration of composite structures across critical aircraft components. Domestic firms are focusing on scalable and cost-effective methods to enhance competitiveness. Global partnerships with leading aerospace firms are boosting technology transfer. High investment is leading to breakthroughs in thermoplastic and thermoset composites. It supports development of stronger and more efficient airframes. Continuous innovation aligns with Japan’s strategic vision for advanced aerospace capabilities.

Expanding Fleet Modernization and Aircraft Production Programs

Rising demand for new aircraft and fleet upgrades is strengthening composite consumption. Commercial and military operators are prioritizing modern airframes with improved performance. High strength and corrosion resistance of composites make them ideal for long-term operations. Airlines are focusing on cost efficiency, driving material replacement strategies. Maintenance and lifecycle benefits encourage integration in both new builds and retrofits. Aircraft OEMs are securing long-term supply contracts with composite suppliers to meet rising demand. It helps build a stable value chain for production. Advanced manufacturing facilities further accelerate industry momentum.

- For instance, in September 2024, Subaru Corporation secured a 7.6-billion-yen contract from the Japan Maritime Self-Defense Force (JMSDF) to supply 30 new Fuji T-5 training aircraft as part of a fleet modernization initiative.

Supportive Government Policies and Strategic Industry Collaborations

The government is supporting the aerospace ecosystem with favorable policies and investments. Infrastructure expansion and incentives for high-tech production enhance competitiveness. Universities and research centers work closely with private firms to foster innovation. Collaborative programs with global aerospace leaders bring advanced know-how into the domestic market. Long-term strategic planning aligns with defense modernization and export targets. Government-backed initiatives encourage capacity expansion for composite material production. It creates an enabling environment for sustainable industry growth. These efforts position Japan as a global innovation hub in aerospace materials.

Market Trends

Increasing Use of Carbon Fiber Composites in Next-Generation Aircraft Platforms

The industry is witnessing rising integration of carbon fiber composites in aircraft design. Manufacturers prefer these materials for their lightweight and superior mechanical strength. Commercial aircraft platforms increasingly rely on high-performance composite structures to optimize efficiency. New fuselage and wing designs incorporate larger composite sections, reducing assembly complexity. Maintenance benefits are contributing to widespread adoption across operators. It is shaping design strategies for next-generation aircraft models. Defense programs are following similar material strategies to enhance mobility and endurance. Carbon fiber adoption trends underline a decisive shift in structural engineering approaches.

- For instance, Airbus’ Multifunctional Fuselage Demonstrator (MFFD), developed under the Clean Sky 2 program, integrates large-scale thermoplastic composite fuselage sections and achieved its weight-saving targets at neutral cost. The demonstrator validated high-rate fuselage manufacturing using automated ultrasonic welding.

Automation and Digitalization of Composite Manufacturing Processes

Automation is transforming the composite production ecosystem through precision and speed. Advanced robotic systems improve accuracy in layup and molding processes. Digital twins and real-time monitoring reduce errors and material wastage. It ensures higher consistency across complex structural components. Major firms are investing in intelligent production lines to meet rising demand. Automated techniques reduce labor costs and cycle times. Integration with AI tools enhances quality control and predictive maintenance capabilities. This trend is reshaping operational efficiency in composite manufacturing.

Expansion of Thermoplastic Composites in High-Performance Aerospace Applications

Thermoplastic composites are emerging as a preferred choice for advanced aircraft parts. Their recyclability, short cycle times, and high toughness make them attractive to manufacturers. Material innovation enables improved resistance to fatigue and impact. It enhances overall reliability in structural applications. Lightweight characteristics align well with sustainability and performance targets. OEMs are adopting these composites to accelerate production rates. Partnerships between resin producers and aerospace companies are strengthening the thermoplastic value chain. This material shift is opening new frontiers in aircraft design.

Integration of Composite Components in Defense and Space Programs

Defense and space sectors are expanding their use of advanced composites. Structural efficiency and high temperature tolerance make these materials suitable for extreme conditions. Composite components are deployed in UAVs, missiles, and satellite structures. It improves maneuverability and payload efficiency while lowering weight. Government-backed R&D programs are boosting local production capacity. Strategic defense programs prioritize composite solutions for their performance benefits. International collaborations are enhancing access to advanced defense-grade materials. This trend reinforces Japan’s position in high-value aerospace manufacturing.

- For instance, Mitsubishi Heavy Industries is a key partner in the Japan-UK-Italy Global Combat Air Programme (GCAP), which aims to develop and deliver a next-generation fighter aircraft by 2035. The program focuses on advanced technologies and international industrial collaboration to strengthen future air combat capabilities.

Market Challenges Analysis

High Material Costs and Complex Manufacturing Processes Restricting Wider Adoption

The Japan Aerospace Composites Market faces cost challenges due to expensive raw materials and manufacturing processes. Carbon fibers require advanced production technologies that drive overall component pricing. Fabrication involves precision equipment and skilled labor, increasing operational costs. It limits adoption among smaller aerospace firms. Complex curing cycles and long production times affect supply chain flexibility. Many OEMs face difficulties in balancing cost efficiency with quality standards. High tooling investments create additional entry barriers for new players. Economic pressure from global competition further intensifies pricing constraints.

Limited Standardization and Regulatory Compliance Requirements Increasing Development Complexity

Standardization gaps in testing and certification add layers of complexity. Aerospace components must comply with strict safety and performance regulations. It demands extensive validation cycles and documentation. Variability in global standards slows international market expansion for domestic producers. Meeting these requirements increases development time and cost. Small and mid-sized firms face challenges aligning with certification frameworks. Limited harmonization impacts global supply chain integration. These regulatory complexities slow down the pace of innovation in composite applications.

Market Opportunities

Growing Demand for Lightweight and Sustainable Aircraft Solutions Globally

Rising emphasis on fuel-efficient aviation creates new opportunities for composite manufacturers. Lightweight structures reduce emissions and align with global sustainability goals. Carbon fiber and thermoplastic innovations enable broader adoption in commercial aviation. It strengthens Japan’s position as a technology exporter. Global OEM partnerships are expected to create new revenue streams. Expansion in air mobility solutions further drives market diversification. Regional manufacturing collaborations will enhance export capacity.

Strategic Expansion of Defense and Space Programs Creating Long-Term Growth Scope

National defense modernization is opening fresh opportunities for domestic composite suppliers. High-performance materials are key for future fighter jets, UAVs, and space vehicles. It strengthens strategic capabilities and secures technological leadership. Collaborative ventures with international defense OEMs are increasing. Investment in satellite and launch vehicle programs will accelerate innovation. Long-term contracts provide revenue stability. Advanced composite integration enhances Japan’s competitive position in high-end aerospace segments.

Market Segmentation Analysis

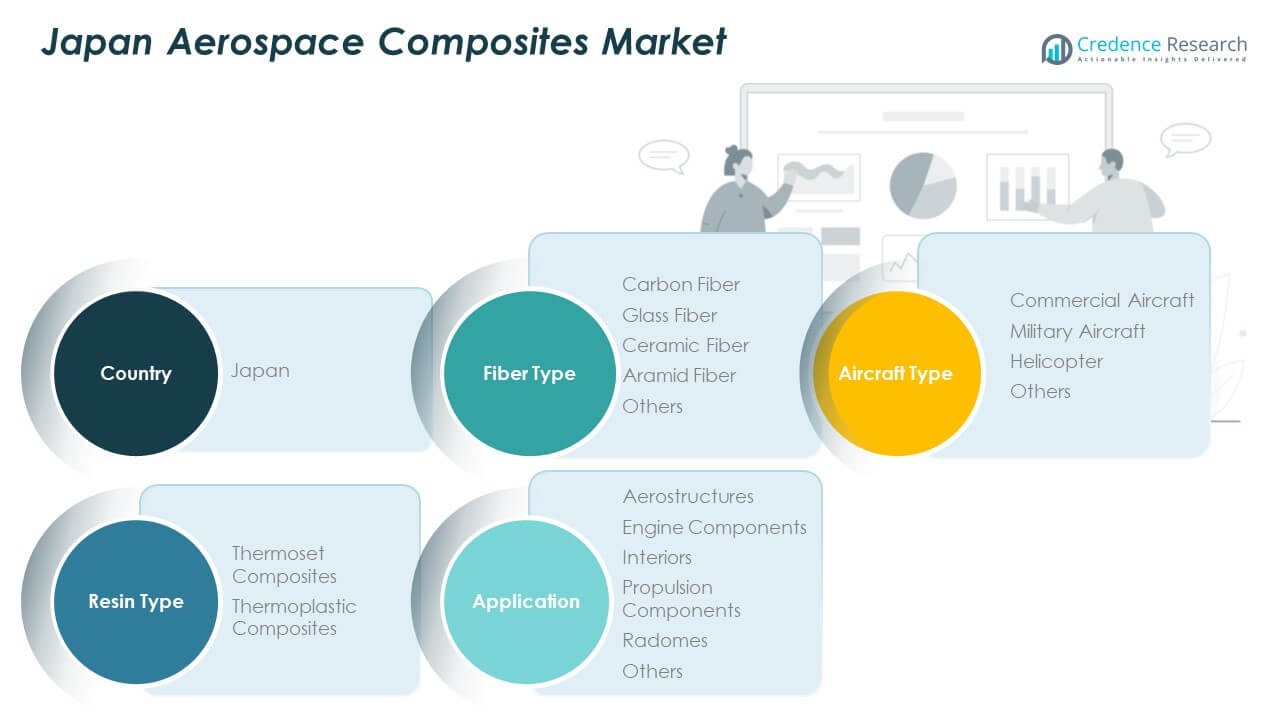

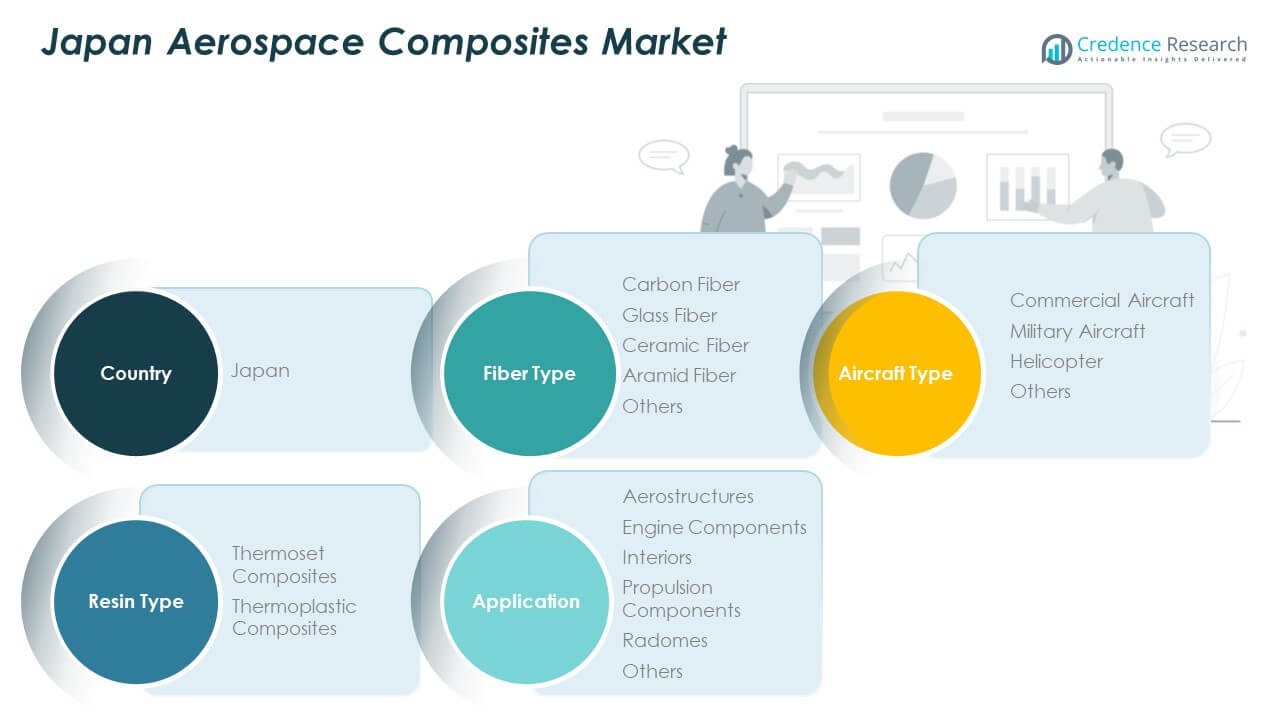

The Japan Aerospace Composites Market is segmented into multiple strategic categories reflecting diverse applications and material innovations.

By fiber type segment includes carbon fiber, glass fiber, ceramic fiber, aramid fiber, and others, with carbon fiber holding the dominant position due to its superior strength-to-weight ratio.

- For instance, Toray Carbon Fibers Europe, a subsidiary of Toray Industries, announced an investment of around €100 million to build a new carbon fiber production line in Lacq, France. The expansion aims to increase capacity by 1,000 tons per year to support rising demand in aerospace and other industries.

By aircraft type segment covers commercial aircraft, military aircraft, helicopters, and others, with commercial aircraft accounting for the largest demand share supported by strong fleet expansion.

- For instance, Airbus reported 243 aircraft deliveries by the end of May 2025 and surpassed 300 total deliveries by mid-year, maintaining its lead in global commercial aircraft output. Boeing followed closely with a strong delivery pace during the same period.

By resin type segment comprises thermoset and thermoplastic composites, both driving structural performance improvements.

By application segment includes aerostructures, engine components, interiors, propulsion components, radomes, and others, where aerostructures play a key role in airframe integration. This segmentation reflects growing material diversity, manufacturing advances, and rising demand from both commercial and defense aerospace programs.

Segmentation

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Ceramic Fiber

- Aramid Fiber

- Others

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Helicopter

- Others

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By Application

- Aerostructures

- Engine Components

- Interiors

- Propulsion Components

- Radomes

- Others

Regional Analysis

Dominance of Kanto Region with Advanced Aerospace Manufacturing Base

The Kanto region holds a leading position with 41.5% market share, supported by its strong aerospace manufacturing ecosystem. Major aerospace component producers and research institutions are concentrated in this subregion. It benefits from advanced infrastructure, skilled labor, and strong government support. High carbon fiber composite adoption rates are driving large-scale production for both commercial and defense applications. Strategic proximity to global supply chains strengthens its export capabilities. The Kanto region serves as a hub for innovation, testing, and large aircraft structure fabrication. The strong cluster of OEMs and tier suppliers gives it a decisive competitive edge.

Growing Contribution of Kansai Region through Material Innovation and OEM Integration

The Kansai region accounts for 33.2% of the market share, driven by its growing role in material innovation and OEM partnerships. Advanced thermoplastic and thermoset resin production facilities are expanding capacity. It benefits from close collaboration between industry and research institutions focused on composite applications. OEM integration within Kansai supports rapid prototyping and large-scale assembly operations. The region is emerging as a key contributor to domestic aircraft programs. It is also strengthening its position in export-oriented manufacturing strategies. Strong material development capabilities position Kansai as a critical node in the national aerospace supply chain.

Emerging Potential of Chubu and Other Subregions in Aerospace Composites

The Chubu region and other subregions collectively represent 25.3% of the market share, supported by growing investment in new aerospace manufacturing units. Regional firms are expanding production capacity to support rising demand from domestic and global aircraft programs. Chubu benefits from its automotive and precision engineering base, which supports technology transfer into aerospace composites. It is becoming an important supplier for secondary structures and interior components. Growing partnerships with established players from Kanto and Kansai enhance production flexibility. Investment in workforce development and automation technologies is improving competitiveness. These regions are expected to play a greater role in the national supply network.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Japan Aerospace Composites Market features a concentrated competitive landscape driven by a few leading domestic and global players. Toray Industries, Teijin Limited, and Mitsubishi Chemical Corporation dominate the market with strong production capacity and advanced material technologies. These companies focus on carbon fiber innovation, large-scale production, and integration with OEM programs. It benefits from their deep R&D capabilities and strong partnerships with aircraft manufacturers. Global firms like Hexcel Corporation, Solvay SA, SGL Carbon SE, and Huntsman Corporation strengthen the competitive field through technology transfer and strategic collaborations. Product differentiation focuses on performance, durability, and cost efficiency. Competitive strategies emphasize long-term supply contracts, automation of manufacturing processes, and product diversification. This competitive structure supports steady innovation and reinforces Japan’s position as a global hub for aerospace composite materials.

Recent Developments

- In October 2025, SGL Carbon SE formed a partnership with Austrian composite recycling company Carbon Cleanup. The collaboration focuses on scaling Carbon Cleanup’s CARB-E recycling technology to recover and reuse carbon fiber scraps, reducing CO₂ emissions.

- In September 2025, Teijin Limited entered a strategic alliance with Aeronautical Service through its European subsidiary, Teijin Automotive Technologies. The partnership aims to produce cost-effective, fireproof composite components for aerospace and industrial applications.

- In March 2025, Huntsman Corporation entered a strategic collaboration with Advanced Material Development Ltd. (AMD) to create carbon nanotube-integrated composite materials. The partnership, supported by Huntsman’s resin systems, aims to produce electrically enhanced composites optimized for defense and aerospace functions.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Aircraft Type, Resin Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for lightweight aircraft materials will continue to drive large-scale composite adoption in both commercial and defense sectors.

- Expanding fleet modernization programs will strengthen domestic manufacturing and long-term supply agreements.

- Increased R&D investments will enhance carbon fiber innovation and accelerate thermoplastic composite development.

- Automation and digital twin technologies will improve precision and reduce production lead times across the value chain.

- Strong government support will sustain infrastructure development and boost global competitiveness.

- OEM collaborations will deepen, enabling faster product integration and high-value component exports.

- Expanding application scope beyond aerostructures will create new opportunities in interiors, propulsion, and radomes.

- Regional clusters such as Kanto and Kansai will attract new investments and consolidate leadership positions.

- Integration with space and defense programs will drive advanced composite production capabilities.

- Growing international partnerships will strengthen technology transfer, innovation capacity, and export potential.