Market Overview

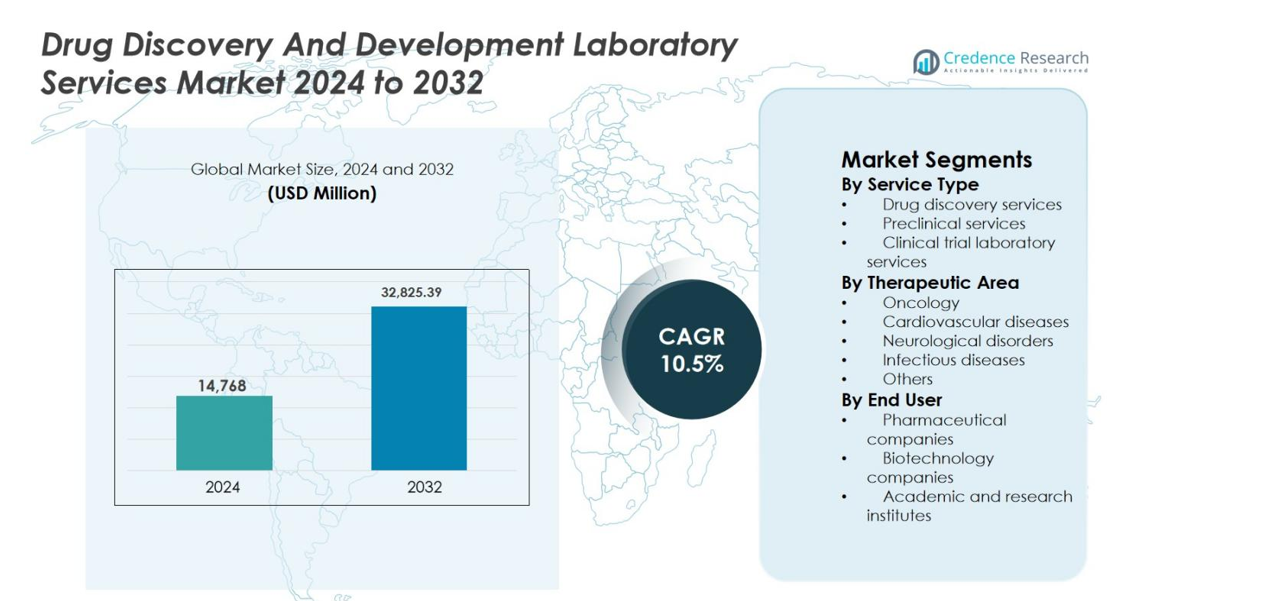

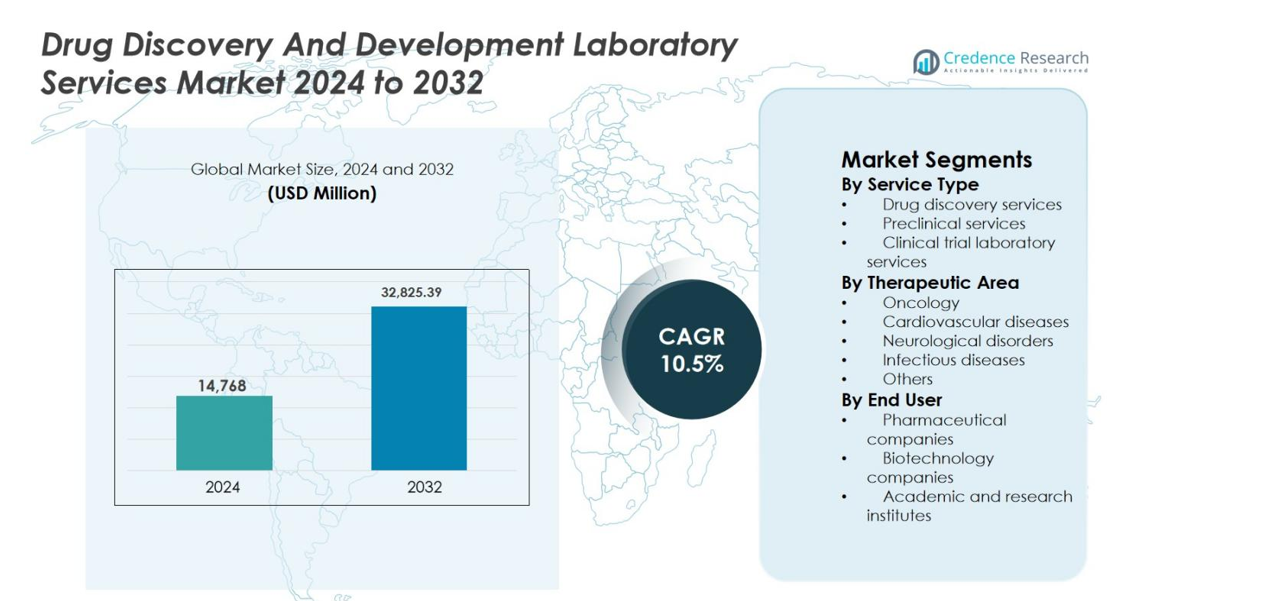

Drug Discovery And Development Laboratory Services Market size was valued at USD 14,768 million in 2024 and is anticipated to reach USD 32,825.39 million by 2032, expanding at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug Discovery and Development Laboratory Services Market Size 2024 |

USD 14,768 million |

| Drug Discovery and Development Laboratory Services Market, CAGR |

10.5% |

| Drug Discovery and Development Laboratory Services Market Size 2032 |

USD 32,825.39 million |

Drug Discovery And Development Laboratory Services Market is led by established global players that offer comprehensive discovery, preclinical, and clinical laboratory capabilities. Companies such as Thermo Fisher Scientific Inc., Laboratory Corporation of America Holdings, Agilent Technologies Inc., F Hoffmann-La Roche AG, Merck & Co. Inc., Pfizer Inc., AstraZeneca, Eli Lilly and Company, Bayer AG, and Abbott Laboratories Inc. strengthen their positions through technology investments, integrated service offerings, and long-term partnerships with pharmaceutical and biotechnology firms. Regionally, North America dominates the market with a 41.8% share, supported by high R&D spending, strong drug pipelines, and advanced laboratory infrastructure. Europe follows with a 28.6% share, driven by robust clinical research activity, while Asia Pacific holds 22.4% share, benefiting from cost-efficient services and rising outsourcing of drug development activities.

Market Insights

- Drug Discovery And Development Laboratory Services Market size was valued at USD 14,768 million in 2024 and is projected to reach USD 32,825.39 million by 2032, growing at a CAGR of 10.5% during the forecast period.

- Market growth is driven by increasing outsourcing of R&D activities, rising global drug pipelines, and strong demand for specialized discovery, preclinical, and clinical laboratory services to reduce development time and costs.

- A key market trend is the growing adoption of integrated and end-to-end laboratory service models, along with rising focus on biomarker research, precision medicine, and advanced analytical technologies.

- The market features active participation of large multinational service providers and specialized players that focus on portfolio expansion, global laboratory network development, and strategic partnerships with pharmaceutical and biotechnology companies.

- North America leads with 41.8% market share, followed by Europe at 28.6% and Asia Pacific at 22.4%, while drug discovery services dominate the segment landscape with a 42.6% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Service Type

By service type, the Drug Discovery And Development Laboratory Services Market is led by drug discovery services, which accounted for 42.6% market share in 2024. This dominance is driven by increasing outsourcing of target identification, hit-to-lead screening, and lead optimization activities as pharmaceutical and biotechnology companies seek to reduce early-stage R&D costs and timelines. Preclinical services hold a substantial share due to rising demand for toxicology, pharmacokinetics, and safety assessment studies. Clinical trial laboratory services continue to grow steadily, supported by complex trial designs, biomarker-based studies, and rising global clinical trial volumes.

- For instance, Charles River introduced its Fast-Track HTS offering (launching October 2024) to provide a faster, fixed-cost route through hit identification for high-throughput screening programs.

By Therapeutic Area

By therapeutic area, oncology represents the dominant segment in the Drug Discovery And Development Laboratory Services Market, capturing 38.9% share in 2024. Strong oncology pipelines, high R&D spending, and the rapid expansion of precision medicine and biomarker-driven drug development underpin this leadership. Neurological and infectious disease segments are gaining momentum due to increasing prevalence, unmet clinical needs, and public–private funding initiatives. Cardiovascular diseases maintain stable demand, supported by chronic disease burden and long-term clinical research programs, while other therapeutic areas contribute through niche and orphan drug development activities.

- For instance, in June 2024, Thermo Fisher Scientific expanded its oncology biomarker and CDx laboratory services, strengthening support for NGS-based patient stratification in oncology clinical trials.

By End User

By end user, pharmaceutical companies dominated the Drug Discovery And Development Laboratory Services Market with a 49.7% market share in 2024. Large pharmaceutical firms increasingly outsource laboratory services to optimize costs, access advanced technologies, and accelerate drug development timelines. Biotechnology companies represent a fast-growing segment, driven by innovation-focused pipelines and limited in-house infrastructure. Academic and research institutes contribute a steady share through government-funded research, early-stage discovery programs, and collaborations with industry players, supporting translational research and novel therapeutic development across multiple disease areas.

Key Growth Drivers

Rising Outsourcing of R&D Activities

The Drug Discovery And Development Laboratory Services Market is strongly driven by the increasing outsourcing of research and development activities by pharmaceutical and biotechnology companies. Rising drug development costs, longer timelines, and growing regulatory complexity encourage sponsors to rely on specialized laboratory service providers. Outsourcing allows access to advanced technologies, skilled scientific expertise, and scalable infrastructure without heavy capital investment. Small and mid-sized biotechnology firms, in particular, depend on external laboratories to support discovery, preclinical, and clinical testing. This shift improves R&D efficiency, accelerates development timelines, and enables sponsors to focus on core innovation and commercialization strategies.

- For instance, Catalent expanded its integrated drug discovery and development services by adding new biologics and cell-therapy laboratory capabilities to support sponsors without in-house early-stage infrastructure.

Expansion of Global Drug Pipelines

The continuous expansion of global drug pipelines significantly supports growth in the Drug Discovery And Development Laboratory Services Market. Increasing investment in biologics, cell and gene therapies, and precision medicines drives demand for specialized laboratory capabilities. Rising prevalence of cancer, chronic diseases, and rare disorders further accelerates pipeline growth. Laboratory service providers play a critical role in analytical testing, biomarker validation, and regulatory-compliant data generation. As sponsors pursue multiple indications and complex trial designs, the need for high-quality laboratory services continues to rise, reinforcing sustained market demand.

- For instance, WuXi AppTec expanded its integrated drug discovery and bioanalytical laboratory services, adding advanced biologics characterization and DMPK capabilities to support growing oncology and rare-disease pipelines.

Technological Advancements in Laboratory Services

Technological progress is a major growth driver in the Drug Discovery And Development Laboratory Services Market. Advances in automation, high-throughput screening, artificial intelligence, and advanced analytics enhance efficiency, accuracy, and reproducibility across drug development workflows. Digital data management platforms support real-time monitoring and faster decision-making. These technologies reduce experimental failure rates and improve candidate selection. Service providers that invest in cutting-edge instrumentation and digital capabilities strengthen their competitive positioning and attract long-term partnerships from pharmaceutical and biotechnology sponsors.

Key Trends & Opportunities

Growth of Precision Medicine and Biomarker Research

Precision medicine is a prominent trend creating new opportunities in the Drug Discovery And Development Laboratory Services Market. The shift toward targeted therapies increases demand for biomarker discovery, validation, and companion diagnostic development. Laboratory service providers support genomic, proteomic, and molecular analyses essential for patient stratification. Oncology remains a key focus area, driving high demand for specialized assays and biomarker-driven research. As regulatory agencies emphasize biomarker-supported clinical evidence, service providers offering integrated biomarker capabilities are well positioned to capture long-term growth opportunities.

- For instance, QIAGEN expanded its NGS-based biomarker and CDx development services, supporting genomic profiling and patient stratification for targeted oncology therapies.

Increasing Adoption of Integrated Service Models

The market is witnessing growing adoption of integrated, end-to-end laboratory service models. Sponsors increasingly prefer single providers capable of supporting multiple stages of drug development, from early discovery to clinical trials. Integrated models reduce coordination complexity, improve data continuity, and shorten development timelines. Laboratory service providers expand their portfolios through capability enhancement and partnerships to deliver comprehensive solutions. This trend creates opportunities to deepen client relationships, increase contract value, and differentiate through seamless service delivery across the drug development lifecycle.

- For instance, SGS enhanced its drug development laboratory portfolio through added bioanalytical and clinical trial testing capabilities, enabling sponsors to rely on a single provider for coordinated, multi-stage development support.

Key Challenges

High Cost and Operational Complexity

High costs and operational complexity remain key challenges in the Drug Discovery And Development Laboratory Services Market. Advanced technologies, specialized talent, and strict quality requirements significantly increase service costs. Smaller sponsors often face budget constraints, limiting outsourcing potential. Service providers must balance cost efficiency with continuous investment in innovation and quality systems. Managing global laboratory networks while maintaining consistent service standards further adds to operational complexity and margin pressure.

Regulatory and Compliance Pressures

Regulatory and compliance pressures pose another significant challenge for the Drug Discovery And Development Laboratory Services Market. Providers must comply with stringent global regulations related to data integrity, quality assurance, and patient safety. Frequent regulatory updates and regional variations increase compliance costs and operational burden. Failure to meet regulatory standards can lead to delays, penalties, or reputational damage. Continuous investment in training, audits, and quality management systems is essential but can constrain scalability and profitability.

Regional Analysis

North America

North America dominated the Drug Discovery And Development Laboratory Services Market with a 41.8% market share in 2024, supported by strong pharmaceutical and biotechnology presence, high R&D spending, and advanced laboratory infrastructure. The region benefits from a robust drug development pipeline, particularly in oncology, rare diseases, and biologics. Extensive outsourcing by large pharmaceutical companies and emerging biotech firms drives sustained demand for specialized laboratory services. Favorable regulatory frameworks, strong funding for biomedical research, and early adoption of advanced technologies such as automation and AI further strengthen North America’s leadership in the global market.

Europe

Europe accounted for a 28.6% market share in 2024 in the Drug Discovery And Development Laboratory Services Market, driven by well-established pharmaceutical industries and strong academic research ecosystems. Countries such as Germany, the UK, and France play a central role due to high clinical trial activity and government-backed research funding. Increasing focus on precision medicine, biomarker research, and rare disease drug development supports demand for specialized laboratory services. Regulatory harmonization across the region and growing collaborations between academic institutes and industry players continue to enhance service utilization.

Asia Pacific

Asia Pacific held a 22.4% market share in 2024 and represents the fastest-growing region in the Drug Discovery And Development Laboratory Services Market. Rapid expansion of pharmaceutical manufacturing, rising R&D investments, and increasing clinical trial outsourcing to countries such as China, India, South Korea, and Japan drive market growth. Cost-effective services, large patient populations, and improving regulatory frameworks attract global sponsors. Growing biotechnology startups and supportive government initiatives further accelerate demand for discovery, preclinical, and clinical laboratory services.

Latin America

Latin America captured a 4.5% market share in 2024 in the Drug Discovery And Development Laboratory Services Market. The region shows steady growth supported by increasing clinical trial activity, particularly in Brazil, Mexico, and Argentina. Expanding pharmaceutical manufacturing, improving healthcare infrastructure, and rising participation in multinational clinical studies drive demand for laboratory services. Global sponsors increasingly leverage the region for cost-efficient trials and diverse patient recruitment, although moderate R&D investment levels limit faster expansion.

Middle East & Africa

The Middle East & Africa accounted for a 2.7% market share in 2024 in the Drug Discovery And Development Laboratory Services Market. Growth is supported by gradual improvements in healthcare infrastructure, increasing government investments in life sciences, and rising participation in international clinical research. Countries such as the UAE, Saudi Arabia, and South Africa are emerging as regional research hubs. Demand remains focused on clinical trial laboratory services, while limited local R&D capacity and regulatory variability restrain rapid market growth.

Market Segmentations

By Service Type

- Drug discovery services

- Preclinical services

- Clinical trial laboratory services

By Therapeutic Area

- Oncology

- Cardiovascular diseases

- Neurological disorders

- Infectious diseases

- Others

By End User

- Pharmaceutical companies

- Biotechnology companies

- Academic and research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Drug Discovery And Development Laboratory Services Market features a competitive landscape characterized by the presence of large multinational service providers and specialized regional players offering end-to-end and niche laboratory solutions. Key players such as Thermo Fisher Scientific Inc., Laboratory Corporation of America Holdings, Agilent Technologies Inc., F Hoffmann-La Roche AG, Merck & Co. Inc., Pfizer Inc., AstraZeneca, Eli Lilly and Company, Bayer AG, and Abbott Laboratories Inc. focus on expanding service portfolios across discovery, preclinical, and clinical stages. Market participants prioritize strategic partnerships with pharmaceutical and biotechnology companies, investment in advanced analytical technologies, and expansion of global laboratory networks to enhance service scalability. Continuous emphasis on biomarker research, precision medicine support, and integrated service models strengthens client retention. Mergers, acquisitions, and capability enhancements remain central strategies to improve geographic reach, technological depth, and long-term contract value in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bayer AG

- Thermo Fisher Scientific Inc.

- Pfizer Inc.

- Agilent Technologies Inc.

- Laboratory Corporation of America Holdings

- Eli Lilly and Company

- Abbott Laboratories Inc.

- F Hoffmann-La Roche AG

- Merck & Co. Inc.

- AstraZeneca

Recent Developments

- In December 2025, The Jackson Laboratory (JAX) received up to $30 million in funding under the ARPA-H CATALYST program to advance AI-powered virtual hearts for safer drug safety testing, signifying a major contract expansion in drug discovery laboratory services.

- In October 2025, Thermo Fisher Scientific showcased its enhanced Accelerator™ Drug Development capabilities and announced a strategic collaboration with OpenAI at CPHI Frankfurt 2025 to boost laboratory service support for biopharma and biotech customers.

- In September 2025, Ginkgo Bioworks’ Datapoints entered into a strategic partnership with Inductive Bio and Tangible Scientific to deploy AI-driven lab-in-the-loop workflows across the biopharma industry to accelerate drug discovery services innovation.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Therapeutic Area, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Drug Discovery And Development Laboratory Services Market will continue to expand as pharmaceutical and biotechnology companies increase reliance on outsourced R&D models.

- Growing focus on biologics, cell and gene therapies, and precision medicines will drive demand for advanced laboratory capabilities.

- Adoption of automation, artificial intelligence, and digital laboratory platforms will enhance efficiency and data quality across development stages.

- Integrated, end-to-end service offerings will gain preference as sponsors seek streamlined workflows and faster development timelines.

- Biomarker discovery and validation services will see sustained growth, particularly in oncology and rare disease research.

- Asia Pacific will emerge as a key growth hub due to cost efficiency, expanding clinical trial activity, and improving regulatory frameworks.

- Strategic partnerships between laboratory service providers and drug developers will strengthen long-term contract pipelines.

- Regulatory compliance and data integrity requirements will encourage continued investment in quality systems and standardized processes.

- Demand for specialized analytical and clinical trial laboratory services will rise with increasing trial complexity.

- Innovation-driven service differentiation will remain critical for providers to maintain competitiveness and client retention.