Market Overview

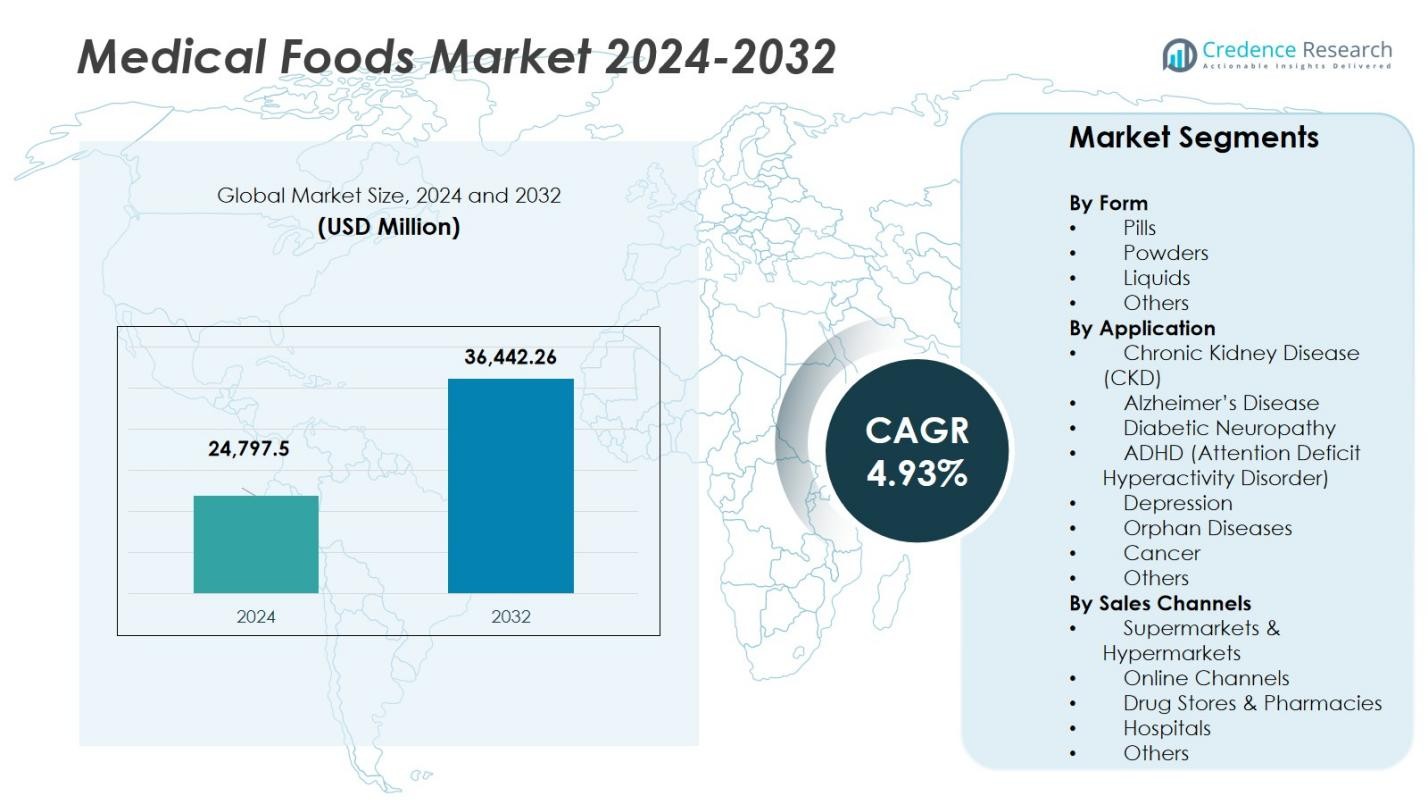

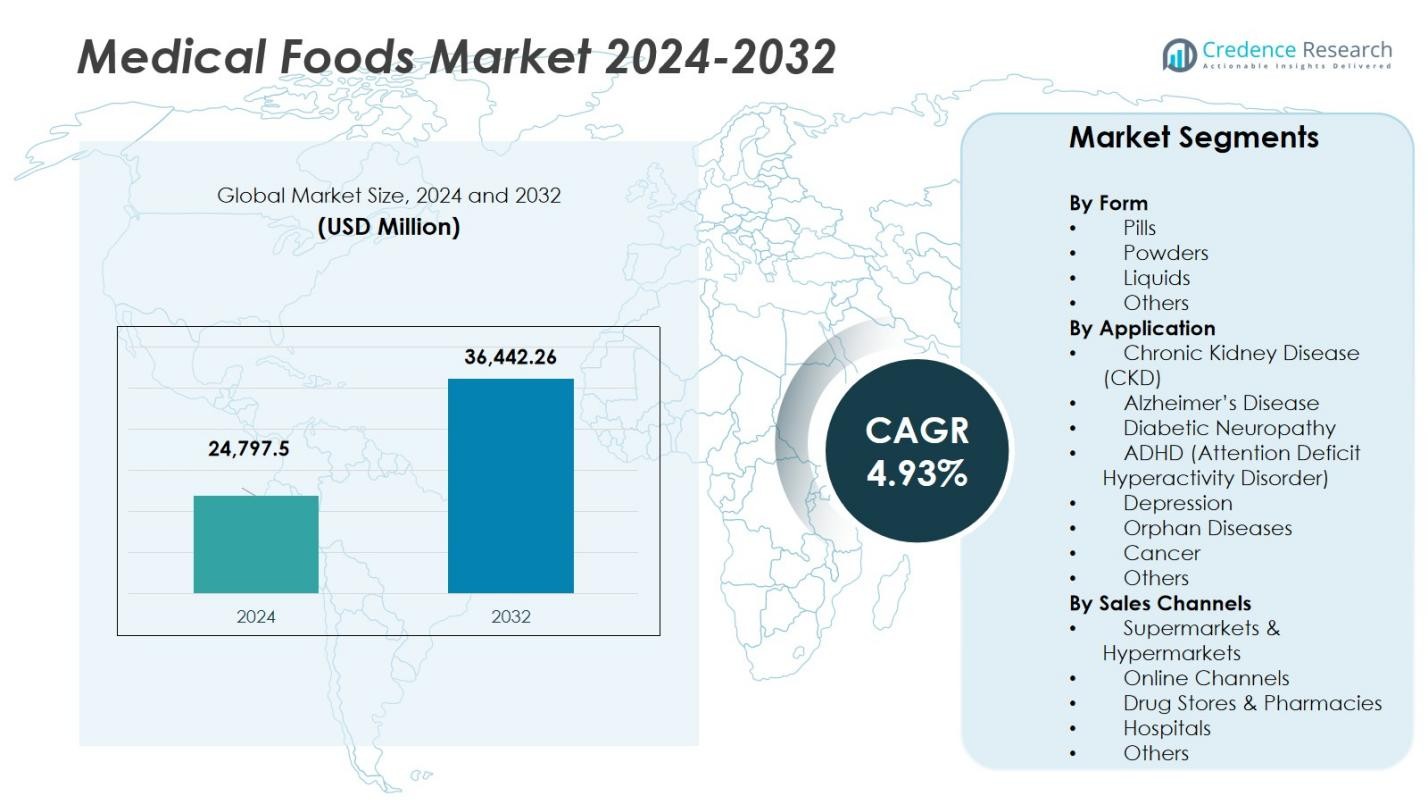

The Medical Foods Market size was valued at USD 24,797.5 Million in 2024 and is anticipated to reach USD 36,442.26 Million by 2032, at a CAGR of 4.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Foods Market Size 2024 |

USD 24,797.5 Million |

| Medical Foods Market, CAGR |

4.93% |

| Medical Foods Market Size 2032 |

USD 36,442.26 Million |

The Medical Foods Market is dominated by key players such as Nestlé Health Science, Abbott Laboratories, Danone S.A. (Nutricia Advanced Medical Nutrition), Fresenius Kabi AG, Mead Johnson Nutrition (Reckitt Benckiser), Primus Pharmaceuticals, Inc., Targeted Medical Pharma, Inc., Medtrition, Inc., Metagenics, Inc., and Alfasigma S.p.A. These companies lead the market through product innovation, expansion into new therapeutic areas, and strategic mergers and acquisitions. Nestlé Health Science, for instance, has significantly expanded its portfolio in specialized nutrition to cater to chronic diseases such as diabetes and kidney conditions. The North America region holds the largest share of the market, accounting for 29.90% in 2024, driven by strong healthcare infrastructure, high prevalence of chronic diseases, and extensive market penetration. Europe follows closely with 20.00%, supported by an aging population and well-established healthcare systems. Asia Pacific, while smaller, is the fastest-growing region, expected to see increased demand for medical foods due to rising healthcare investments.

Market Insights

Market Insights

- The Medical Foods Market size was valued at USD 24,797.5 Million in 2024 and is projected to reach USD 36,442.26 Million by 2032 at a CAGR of 4.93%.

- Demand for medical foods is rising due to increasing prevalence of chronic diseases and the growing adoption of home‑based healthcare solutions.

- A key trend is the dominance of online sales channels with about a 35% share in 2024, alongside the Pills form segment holding around a 40% market share.

- Major players such as Nestlé Health Science, Abbott Laboratories and Danone S.A. compete through innovation, global expansion and disease‑specific formulations, though regulatory complexity remains a notable restraint.

- Regionally, North America leads with a market share of 29.90% in 2024, followed by Europe at around 20.00% and Asia Pacific at about 18.50%, with Latin America and Middle East & Africa trailing behind.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form:

The Medical Foods Market is segmented by form into Pills, Powders, Liquids, and Others. Among these, the Pills segment holds the dominant market share, accounting for approximately 40% of the market in 2024. Pills are preferred due to their convenience, portability, and ease of use, especially for chronic conditions. The rising demand for home-based healthcare solutions and the increasing adoption of pills for conditions such as chronic kidney disease and diabetes are key drivers of this segment’s growth. The liquid form is also gaining traction for specific therapeutic needs, but pills continue to lead the market.

- For instance, BOOST® Pre‑Meal Hunger Support by Nestlé offers 10 g of clinically studied whey protein per 4.2 fl oz serving, helping manage appetite when taken 10–30 minutes before a meal.

By Application:

The Medical Foods Market is divided by application into Chronic Kidney Disease (CKD), Alzheimer’s Disease, Diabetic Neuropathy, ADHD, Depression, Orphan Diseases, Cancer, and Others. The Chronic Kidney Disease (CKD) segment holds the largest share, accounting for approximately 25% of the market. The increasing prevalence of CKD, driven by the rising incidence of diabetes and hypertension, is a significant driver of this segment’s growth. Medical foods tailored for CKD patients support kidney function and provide essential nutrients, fueling demand in the healthcare sector. Other applications, including cancer and depression, are also witnessing substantial growth.

- For instance, Fresenius Kabi’s Fresubin® Kidney range is specifically formulated for CKD patients to provide protein‑based nutritional support. Medical foods tailored for CKD patients support kidney function and provide essential nutrients, fueling demand in the healthcare sector.

By Sales Channels:

The Medical Foods Market is further segmented by sales channels, including Supermarkets & Hypermarkets, Online Channels, Drug Stores & Pharmacies, Hospitals, and Others. The Online Channels segment is the dominant sub-segment, holding a market share of about 35% in 2024. The growing shift toward e-commerce, driven by convenience, accessibility, and home delivery services, is propelling the growth of medical foods through online sales. Additionally, drug stores and pharmacies contribute significantly to the market share due to their widespread availability and consumer trust in pharmaceutical outlets.

Key Growth Drivers

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases such as diabetes, chronic kidney disease (CKD), and cancer is a major driver of the Medical Foods Market. With a growing aging population and lifestyle factors contributing to these conditions, there is a higher demand for medical foods to manage symptoms and improve patients’ quality of life. Medical foods play a critical role in supporting nutritional needs in managing these chronic conditions, which fuels market growth and drives the development of specialized products for long-term healthcare management.

- For instance, Abbott Laboratories’ Ensure® Plus, a medical food product, is widely used to provide essential nutrition for patients with chronic conditions like cancer and kidney disease, supporting immune health and muscle strength.

Rising Demand for Home Healthcare Solutions

The shift towards home-based healthcare is significantly driving the Medical Foods Market. As healthcare becomes more focused on outpatient care, patients increasingly seek convenient, at-home solutions to manage their health. Medical foods, especially in forms such as pills and powders, provide easy-to-administer options for patients dealing with chronic conditions or post-surgical recovery. This trend is further supported by advancements in telemedicine, making healthcare management more accessible and less reliant on hospital visits, thus promoting the use of medical foods in home care environments.

- For instance, Companies like Nestlé Health Science have introduced BOOST® Very High Calorie, a supplement designed for at‑home use to support patients recovering from surgery or managing chronic conditions like diabetes and cancer.

Growing Consumer Awareness of Health and Nutrition

There is a growing consumer focus on health and wellness, which is directly influencing the Medical Foods Market. As more individuals become proactive about their nutritional needs, there is an increasing demand for medical foods to support various health conditions, from diabetes to depression. Consumers are becoming more educated on the benefits of medical foods, with an emphasis on their role in managing chronic diseases and enhancing general well-being. This awareness is expected to expand the consumer base, particularly among health-conscious individuals and those seeking preventive care.

Key Trends & Opportunities

Innovation in Product Formulations

Innovation in the formulation of medical foods presents significant opportunities for market growth. Manufacturers are focusing on creating more targeted and effective products for specific diseases and conditions. Advances in ingredient sourcing, formulation techniques, and customization for individual health needs are increasing the efficacy and appeal of medical foods. With growing research into the role of nutrition in disease management, personalized medical foods that address unique patient needs, such as cognitive health and metabolic disorders, are opening up new market avenues.

- For instance, Metagenics has developed Ultraflora® Intensive Care, a targeted probiotic supplement designed to support digestive health (including relief from occasional irritation and bowel discomfort) and immune function

Growth in E-commerce and Online Sales Channels

The rapid expansion of e-commerce is transforming how medical foods are distributed and purchased. Online sales channels are providing greater accessibility for consumers, allowing them to purchase medical foods from the comfort of their homes. This trend is particularly strong during the pandemic and in regions with high internet penetration. E-commerce platforms are also allowing for direct-to-consumer marketing and providing a wealth of information, making it easier for patients to find the right products for their conditions, thus fueling market growth.

- For instance, Abbott Laboratories has made its Ensure® line of products widely available through online platforms like Amazon, allowing consumers to conveniently purchase nutritional supplements from home.

Key Challenges

Regulatory and Compliance Issues

The Medical Foods Market faces significant regulatory challenges, as medical foods must comply with specific government regulations to ensure safety and efficacy. Different regions have varying requirements for approval, labeling, and marketing, which can create barriers for manufacturers entering new markets. Additionally, the process of meeting these regulations is often time-consuming and costly, which can slow down product development and increase prices. Navigating complex regulatory frameworks is an ongoing challenge for companies operating in the medical foods sector.

Limited Awareness and Acceptance

Despite the growing interest in medical foods, limited consumer awareness and acceptance still pose a challenge. Many individuals are not fully informed about the benefits of medical foods or may confuse them with regular nutritional supplements. This lack of understanding can impact consumer adoption, particularly in regions where traditional medicine dominates. To address this, manufacturers must invest in educational campaigns that clearly differentiate medical foods from other health products and emphasize their role in managing specific medical conditions.

Regional Analysis

North America

The North America region held a market share of 29.90% in 2024. Strong healthcare infrastructure, advanced reimbursement frameworks, and high incidence of chronic diseases bolster demand for medical foods. A growing geriatric population and the prevalence of conditions like metabolic disorders underscore region‑specific growth dynamics. The presence of leading manufacturers and research facilities also fuels product innovation and uptake of disease‑specific nutrition solutions in clinical settings. Reimbursement clarity and patient access channels further reinforce North America’s leadership in the medical foods market.

Europe

The Europe region captured a market share of 20.00% in 2024. The region’s ageing population and high prevalence of chronic illnesses such as cardiovascular and renal disorders drive need for medical foods. Nutritional support programmes within hospitals and home care systems are expanding to address malnutrition in elderly patients. Regulatory momentum and product launches tailored to European patient profiles support regional growth. Manufacturers are increasingly collaborating with healthcare providers to integrate medical foods into disease‑management protocols across Europe.

Asia Pacific

The Asia Pacific region accounted for a market share of 18.50% in 2024. Rapid growth arises from rising healthcare spending, a growing middle‑class population, and increasing prevalence of diabetes and cancer. Improvements in healthcare infrastructure, awareness of nutrition‑based therapies, and entry of global players unlock opportunities in countries such as China and India. The region benefits from large patient pools and governments emphasising supportive care and preventive nutrition. As access improves, Asia Pacific is positioned as a high‑growth market for medical foods.

Latin America

Latin America delivered a market share of 8.00% in 2024. Growth is supported by rising healthcare access, increasing chronic‑disease incidence such as obesity and diabetes, and expanding retail and hospital channels for specialized nutrition. However, adoption lags due to reimbursement inconsistencies and weaker awareness of medical‑food applications. Regional players are initiating partnerships and custom product offerings to localise solutions and improve market penetration. Latin America represents a promising yet under‑penetrated segment in the global medical foods market.

Middle East & Africa

The Middle East & Africa region held a market share of 3.60% in 2024. Growth is driven by improved healthcare investments, increasing chronic‑disease burden, and an expanding geriatric population in key markets. Structural challenges such as uneven infrastructure, limited reimbursement frameworks, and lower awareness hinder faster adoption. Nevertheless, increasing regional government priority for nutrition‑support programmes and strategic entry by global manufacturers suggest incremental uptake of medical foods in this region over the forecast period.

Market Segmentations:

By Form

- Pills

- Powders

- Liquids

- Others

By Application

- Chronic Kidney Disease (CKD)

- Alzheimer’s Disease

- Diabetic Neuropathy

- ADHD (Attention Deficit Hyperactivity Disorder)

- Depression

- Orphan Diseases

- Cancer

- Others

By Sales Channels

- Supermarkets & Hypermarkets

- Online Channels

- Drug Stores & Pharmacies

- Hospitals

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players such as Nestlé Health Science, Abbott Laboratories, Danone S.A. (Nutricia Advanced Medical Nutrition), Fresenius Kabi AG, Mead Johnson Nutrition (Reckitt Benckiser), Primus Pharmaceuticals, Inc., Targeted Medical Pharma, Inc., Medtrition, Inc., Metagenics, Inc., and Alfasigma S.p.A. lead the medical foods market. Major companies compete on product innovation, disease‑specific formulations, and global reach. They are investing in R&D for targeted therapies, for example, custom nutrition for renal, neurological or metabolic disorders. Strategic mergers and acquisitions, like Nestlé’s expansion into specialized nutrition, boost market presence and enable entry into new therapeutic segments. Distribution excellence also matters: strong partnerships with hospitals, pharmacies and e‑commerce channels help companies reach patients efficiently. Cost control and regulatory compliance remain key competitive advantages, allowing firms to bring medically‑tested foods to market quickly and meet varying regional requirements.

Key Player Analysis

- Metagenics, Inc.

- Danone S.A. (Nutricia Advanced Medical Nutrition)

- Primus Pharmaceuticals, Inc.

- Abbott Laboratories

- Nestlé Health Science

- Alfasigma S.p.A.

- Targeted Medical Pharma, Inc.

- Fresenius Kabi AG

- Mead Johnson Nutrition (part of Reckitt Benckiser)

- Medtrition, Inc.

Recent Developments

- In October 2025, Danone S.A., through its Nutricia brand, launched Fortimel PlantBased Protein, a savory-flavored, high-protein, high-energy plant-based medical nutrition drink aimed at patients at risk of malnutrition.

- In October 2025, Nestlé Health Science entered a partnership with the University of California, Davis, and other institutions to accelerate nutrition-based innovations focused on women’s health, healthy longevity, and weight management.

- In July 2023, Pentec Health Inc. acquired ZOIA Pharma, expanding its medical‑foods offerings for rare metabolic conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Sales Cahnnel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing incidence of chronic diseases will propel demand for medical foods in treatment protocols.

- Increasing ageing population will drive consumption of disease‑specific nutrition solutions globally.

- Rising awareness among healthcare professionals about nutrition’s role in disease management will enhance adoption rates.

- Expansion of online sales and home‑based healthcare will facilitate broader access to medical foods.

- Advancements in nutrigenomics and precision nutrition will enable more tailored and effective medical food products.

- Entry of global players into emerging markets will widen geographic reach and boost market growth.

- Innovations in product formats- such as powders, liquids and ready‑to‑drink options—will improve patient compliance.

- Stronger regulatory frameworks and clearer guidelines will validate medical foods and reinforce market credibility.

- Partnerships between healthcare providers, nutrition specialists and manufacturers will drive integrated care models.

- Rising investments in R&D for orphan diseases and specialised applications will open new therapeutic niches for medical foods.

Market Insights

Market Insights