Market Overview

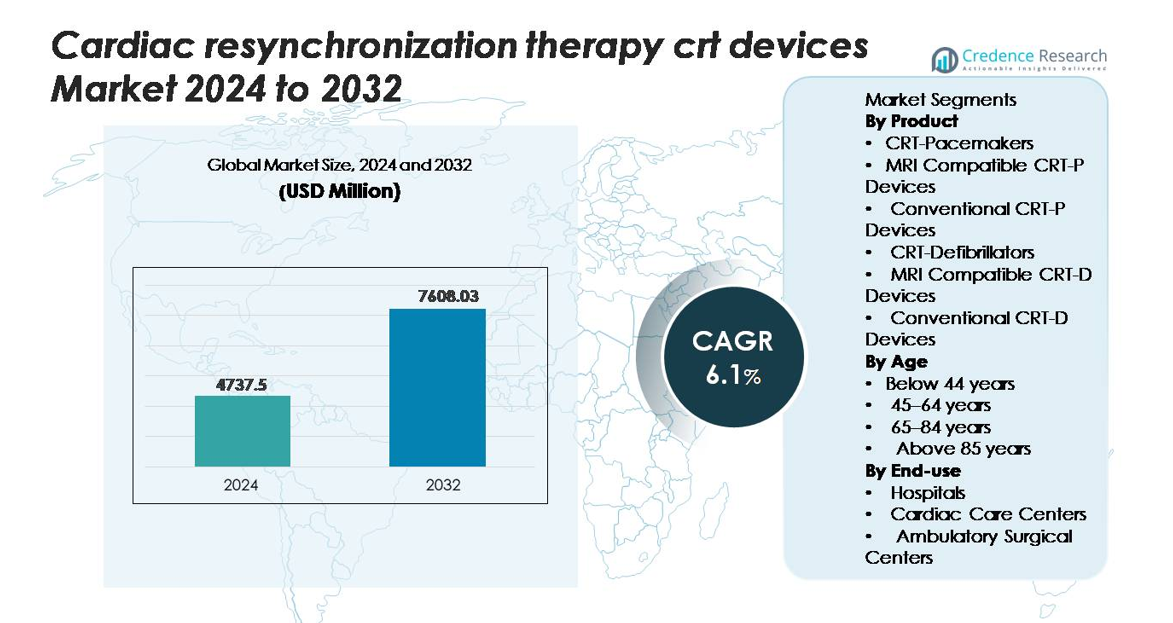

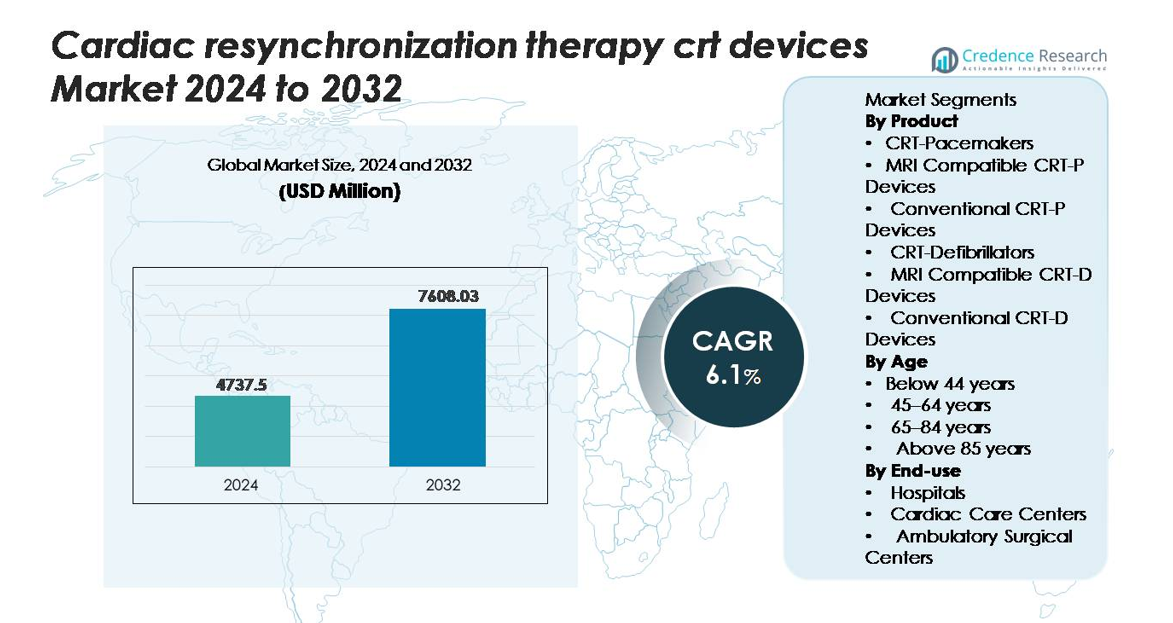

The global Cardiac Resynchronization Therapy (CRT) Devices market was valued at USD 4,737.5 million in 2024 and is projected to reach USD 7,608.03 million by 2032, reflecting a CAGR of 6.1% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cardiac Resynchronization Therapy (CRT) Devices Market Size 2024 |

USD 4,737.5 million |

| Cardiac Resynchronization Therapy (CRT) Devices Market, CAGR |

6.1% |

| Cardiac Resynchronization Therapy (CRT) Devices Market Size 2032 |

USD 7,608.03 million |

Leading players in the Cardiac Resynchronization Therapy (CRT) devices market include Medtronic, Abbott, Boston Scientific, Biotronik, and MicroPort, each offering advanced CRT-P and CRT-D platforms with enhanced pacing algorithms, MRI compatibility, and remote monitoring capabilities. These companies maintain strong global footprints through robust electrophysiology portfolios and continuous device innovation. North America emerges as the dominant region, holding an exact market share of 39.2%, supported by high heart-failure prevalence, strong reimbursement systems, and extensive adoption of next-generation CRT-D systems. Europe follows as the second-largest market, while Asia-Pacific demonstrates the fastest growth due to expanding cardiac care infrastructure and rising patient eligibility.

Market Insights

- The Cardiac Resynchronization Therapy (CRT) devices market was valued at USD 4,737.5 million in 2024 and is projected to reach USD 7,608.03 million by 2032, expanding at a CAGR of 6.1% during the forecast period.

- Growing incidence of advanced heart failure and broader guideline-based eligibility continue to drive CRT-D and CRT-P adoption, with CRT-Defibrillators holding the largest product share due to their dual therapeutic function.

- Market trends highlight strong demand for MRI-compatible systems and rapid integration of remote monitoring and adaptive pacing algorithms that improve long-term clinical outcomes.

- Competition remains intense, led by Medtronic, Abbott, Boston Scientific, Biotronik, and MicroPort, all advancing battery longevity, quadripolar lead technology, and digital connectivity to strengthen market positioning.

- Regionally, North America leads with 39.2% share, followed by Europe at roughly 31%, while Asia-Pacific accounts for about 21% and grows fastest; hospitals dominate end-use with the highest implantation volume across all major regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

CRT-Defibrillators remain the dominant product category, driven by their dual therapeutic capability that combines rhythm resynchronization with life-saving defibrillation. MRI-compatible CRT-D devices account for the largest share within this group, supported by rising demand for advanced imaging compatibility in heart-failure patients who require frequent MRI evaluations. Their wider clinical adoption is boosted by improved shock-delivery algorithms, extended battery longevity, and enhanced diagnostic telemetry. CRT-Pacemakers also show stable demand, particularly MRI-safe variants, but CRT-D systems lead the market as clinicians prioritize comprehensive protection in moderate-to-severe heart-failure cases.

- For instance, Boston Scientific’s RESONATE™ CRT-D platform delivers a documented battery longevity of up to 13.7 years and incorporates HeartLogic™ multisensor monitoring, which analyzes five physiological signals to detect early heart-failure deterioration with clinically validated accuracy.

By Age:

The 65–84 years segment constitutes the dominant share of CRT device implantation, reflecting the highest prevalence of chronic heart-failure and conduction abnormalities in this age bracket. Increased diagnosis rates, broader guideline-based eligibility, and improved survival in aging populations further reinforce the segment’s leadership. Patients in this group benefit most from optimized biventricular pacing, which enhances quality of life and reduces hospitalization frequency. While adoption among younger cohorts remains lower due to limited clinical need, the rising elderly population and growing acceptance of early intervention sustain strong procedural volumes in the 65–84 years group.

- For instance, Medtronic’s AdaptivCRT™ algorithm demonstrated a 59% reduction in atrial fibrillation episodes and a 6% improvement in left-ventricular ejection fraction in patients most of whom were above 65 years according to clinical data from more than 7,000 implanted individuals.

By End-use:

Hospitals represent the leading end-use segment, capturing the largest market share due to their access to electrophysiology labs, cardiac surgery units, and advanced imaging systems required for CRT implantation and post-procedure monitoring. The segment’s dominance is driven by increasing hospitalization of heart-failure patients, robust reimbursement pathways, and the presence of specialized cardiology teams. Cardiac care centers show steady growth as they expand device-based therapy capabilities, while ambulatory surgical centers remain limited by regulatory and infrastructure constraints. Hospitals continue to anchor the market as the primary hub for complex CRT-D and CRT-P procedures.

Key Growth Drivers

Growing Heart Failure Burden and Rising Eligibility for Device-Based Therapy

The increasing global prevalence of chronic heart failure continues to be a primary catalyst for CRT device adoption. A growing number of patients present with reduced ejection fraction, left bundle branch block, and conduction delays that make them clinically eligible for CRT-D or CRT-P implantation. Updated international guidelines increasingly recommend CRT for symptomatic patients with persistent electrical dyssynchrony, reinforcing wider use in moderate-to-severe heart failure. Improvements in diagnostic imaging, ECG precision, and risk stratification tools allow clinicians to identify CRT candidates earlier, improving acceptance across diverse patient populations. Aging demographics further intensify demand as individuals aged 65 years and above exhibit the highest incidence of advanced heart failure. Combined with expanding access to advanced cardiac care centers and electrophysiology units, these factors firmly position CRT devices as a core therapeutic solution in the management of progressive heart-failure-related electrical dysfunction.

- For instance, Boston Scientific’s HeartLogic™ multisensor index has been clinically validated to detect impending heart-failure events a median of 34 days earlier than symptoms, based on data from over 900 patients in the MultiSENSE study enabling timely intervention and expanding eligibility for CRT-based management.

Technological Advancements in CRT-D and CRT-P Systems

Innovations in battery longevity, lead durability, and defibrillation algorithms significantly accelerate the adoption of next-generation CRT devices. Modern CRT-D systems incorporate enhanced arrhythmia detection logic, real-time hemodynamic monitoring, and adaptive pacing features that improve patient outcomes. MRI-compatible CRT-P and CRT-D devices also gain strong traction as MR imaging becomes routine in long-term cardiac and non-cardiac disease management. Wireless remote monitoring platforms improve early event detection, reduce rehospitalization, and support data-driven clinical decisions. Leadless pacing advances and quadripolar lead technology further increase implantation success, reduce phrenic nerve stimulation, and optimize ventricular resynchronization. These innovations improve procedural efficiency for electrophysiologists and enhance long-term reliability, positioning technologically advanced CRT systems as preferred choices in complex heart-failure management. As device capabilities evolve, adoption widens across both high-acuity hospital settings and specialized cardiac centers.

- For instance, Medtronic’s Percepta™ Quad CRT-P system uses its VectorExpress™ algorithm to test up to 16 left-ventricular pacing vectors in under 2 minutes, while its AdaptivCRT™ algorithm automatically adjusts pacing every 60 seconds, which clinical evaluations have shown can reduce atrial fibrillation episodes by 59% in over 7,000 patients.

Expanding Access to Cardiac Care Infrastructure and Skilled Electrophysiologists

Growing investments in cardiac specialty centers, electrophysiology labs, and advanced imaging infrastructure strongly influence CRT adoption. Hospitals worldwide are improving capabilities for biventricular pacing procedures through investments in hybrid operating rooms, 3D mapping systems, and perioperative monitoring tools. Simultaneously, the expanding pool of electrophysiologists trained in complex device implantation enhances the availability of CRT therapy in both developed and emerging healthcare markets. Public and private healthcare programs increasingly support reimbursement and insurance coverage for device-based heart-failure management, reducing financial barriers for eligible patients. In emerging regions, large-scale cardiac disease screening programs and improvements in referral networks boost early detection of CRT-suitable cases. These systemic developments ensure more consistent patient access to timely device implantation and follow-up care, strengthening overall procedural volumes and sustaining long-term market expansion.

Key Trends & Opportunities

Rising Adoption of Remote Monitoring and AI-Enabled Predictive Care

Remote monitoring has become central to the long-term management of CRT patients as clinicians prioritize early detection of arrhythmias, device malfunctions, and heart-failure deterioration. AI-driven analytics now assist in predicting decompensation events and personalizing pacing algorithms based on patient-specific physiological patterns. Unified digital platforms enable continuous data transmission, improving clinician oversight and reducing emergency hospital visits. These capabilities enhance therapy adherence and enable proactive intervention, especially in high-risk populations. The increasing integration of cloud-connected platforms, algorithmic risk scoring, and device-performance analytics creates significant opportunities for manufacturers to differentiate their products. As digital health ecosystems expand, AI-assisted CRT monitoring is expected to evolve into a standard clinical expectation, offering major value to healthcare providers seeking efficiency and more accurate prognostic tools.

- For instance, BIOTRONIK’s Home Monitoring® system demonstrated a median 1-day transmission time for clinically relevant events compared with 35 days under conventional follow-up, according to the TRUST trial involving 1,339 patients, enabling significantly earlier clinical intervention.

Shift Toward MRI-Compatible and Minimally Invasive CRT Systems

The growing clinical reliance on MRI as a diagnostic standard has accelerated demand for fully MRI-conditional CRT-P and CRT-D devices. Manufacturers are increasingly developing systems with safe imaging compatibility, allowing patients requiring repetitive MRI scans to receive CRT without safety restrictions. Additionally, the trend toward minimally invasive implantation supported by quadripolar leads, improved delivery systems, and smaller device footprints creates new opportunities for broader patient acceptance and procedural efficiency. These advancements align with the healthcare sector’s shift toward reduced surgical trauma, faster recovery, and improved procedural precision. The ability to combine imaging safety, miniaturized designs, and simplified implantation positions MRI-compatible minimally invasive CRT systems as high-growth product categories.

- For instance, Abbott’s Gallant™ CRT-D system is MRI Ready™ for full-body 1.5T scanning when placed in MRI Mode, following its FDA-cleared labeling. The device supports whole-body SAR limits up to 2.0 W/kg under approved scan conditions, ensuring safe imaging access for CRT patients.

Key Challenges

Complexity of CRT Implantation and Variability in Patient Response

CRT implantation requires high electrophysiology expertise, precise lead positioning, and advanced imaging support, creating procedural complexity that not all centers can accommodate. A significant challenge is the variability in patient response, with a notable portion of individuals experiencing limited or no improvement after implantation despite meeting guidelines. Anatomical variations, suboptimal left ventricular lead placement, and comorbidities can all influence therapeutic outcomes. These non-responder rates complicate clinical decision-making and may discourage adoption in borderline cases. Furthermore, the need for specialized postoperative monitoring and follow-up adds operational burden to healthcare systems, highlighting the need for better predictive tools and optimized procedural workflows.

High Procedural and Device Costs in Resource-Limited Settings

CRT-D and CRT-P devices, particularly advanced MRI-compatible variants, carry high procurement costs that restrict adoption in low- and middle-income regions. Additional expenses associated with implantation such as electrophysiology lab infrastructure, imaging guidance, lead revision capabilities, and long-term monitoring create financial barriers for both hospitals and patients. Limited reimbursement coverage and uneven insurance access further constrain therapy availability. These cost-driven obstacles reduce market penetration in regions where the burden of heart failure is growing but healthcare budgets remain constrained. Overcoming this challenge requires expanded reimbursement policies, cost-optimized device designs, and greater investment in cardiac care infrastructure to broaden access to CRT therapy globally.

Regional Analysis

North America

North America holds the largest share of the CRT devices market, accounting for approximately 38–40%, supported by strong adoption of CRT-D systems, high diagnosis rates of advanced heart failure, and well-equipped electrophysiology labs. The United States drives most regional demand due to comprehensive reimbursement, widespread use of MRI-compatible systems, and extensive integration of remote cardiac monitoring platforms. Continuous infrastructure upgrades in cardiac centers, availability of skilled electrophysiologists, and rapid uptake of next-generation pacing algorithms reinforce the region’s dominant position, ensuring sustained leadership in global CRT device utilization.

Europe

Europe represents the second-largest regional market, contributing around 30–32% of global CRT device demand. Strong adherence to ESC guidelines, robust reimbursement policies in Western Europe, and high procedural expertise support widespread implantation of both CRT-P and CRT-D systems. Germany, the U.K., France, and Italy lead adoption due to advanced cardiac care networks and established device follow-up pathways. Increasing preference for MRI-conditional CRT devices, expanding electrophysiology units in secondary hospitals, and rising prevalence of age-related heart failure continue to strengthen Europe’s stable and high-value market base.

Asia-Pacific

Asia-Pacific is the fastest-growing region and accounts for approximately 20–22% of global market share, driven by rising healthcare modernization, improved access to cardiac care, and growing awareness of CRT’s clinical benefits. China, Japan, India, and South Korea dominate regional volume as tertiary care centers expand electrophysiology capabilities. Government investment in cardiac disease screening and increasing adoption of MRI-compatible CRT-P systems support broader patient eligibility. Although CRT-D use remains cost-restricted in some emerging economies, rapid population aging and strengthening reimbursement frameworks position Asia-Pacific as a key long-term growth engine.

Latin America

Latin America contributes around 5–6% of the global CRT devices market, supported by expanding access to advanced cardiac procedures in major economies such as Brazil, Mexico, Argentina, and Chile. Growing urban hospital infrastructure, increasing prevalence of conduction disorders, and improving specialist training support gradual therapy expansion. CRT-P systems see stronger uptake due to affordability advantages, while CRT-D adoption remains limited by reimbursement gaps. Continued government investment in cardiology services and partnerships with global device manufacturers are gradually strengthening regional procedural capacity and improving patient access.

Middle East & Africa

The Middle East & Africa region holds approximately 3–4% market share, with growth driven primarily by the Gulf Cooperation Council (GCC) countries. Saudi Arabia, the UAE, and Qatar invest heavily in advanced cardiology centers, enabling higher CRT-P and CRT-D implantation volumes. Africa remains in early adoption, with access largely limited to private or specialized tertiary hospitals. Cost constraints, limited reimbursement, and shortage of electrophysiology expertise remain key barriers. However, rising heart-failure burden, regional healthcare modernization, and strengthening medical tourism in the Middle East create steady, incremental opportunities for CRT device expansion.

Market Segmentations:

By Product

- CRT-Pacemakers

- MRI Compatible CRT-P Devices

- Conventional CRT-P Devices

- CRT-Defibrillators

- MRI Compatible CRT-D Devices

- Conventional CRT-D Devices

By Age

- Below 44 years

- 45–64 years

- 65–84 years

- Above 85 years

By End-use

- Hospitals

- Cardiac Care Centers

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cardiac Resynchronization Therapy (CRT) devices market is defined by a concentrated group of global medical technology leaders that consistently advance device performance, safety, and long-term reliability. Key players including Medtronic, Abbott, Boston Scientific, Biotronik, and MicroPort compete through innovations in battery longevity, quadripolar and shapeable lead designs, enhanced arrhythmia-detection algorithms, and fully MRI-conditional CRT-P and CRT-D platforms. Companies increasingly differentiate through remote monitoring ecosystems that enable real-time physiological insights and predictive heart-failure management. Strategic priorities include expanding clinical evidence, strengthening electrophysiology training programs, and building integrated cardiac-care portfolios that enhance physician loyalty. Geographic expansion into Asia-Pacific and Latin America also remains a focus as rising heart-failure prevalence broadens the eligible patient pool. Partnerships with hospitals, digital-health platforms, and reimbursement bodies further reinforce market penetration, creating a competitive environment centered on technological leadership, clinical performance, and comprehensive post-implantation support.Top of FormBottom of Form

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, BIOTRONIK launched the Amvia Sky HF-T QP pacemaker and CRT-P in Canada, with the first implant performed at the Centre Hospitalier de l’Université.

- In July 2024, Abbott Laboratories introduced an upgraded CRT-D system featuring improved heart-synchronization and advanced remote-monitoring capabilities for heart failure patients.

- In February 2024, MicroPort Scientific Corporation launched a new CRT-D defibrillator along with its GALI SonR CRT system and NAVIGO 4LV left-ventricular pacing lead in Japan, expanding its footprint in CRT therapy

Report Coverage

The research report offers an in-depth analysis based on Product, Age, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- CRT-D systems will experience stronger adoption as clinicians prioritize combined resynchronization and defibrillation capabilities for advanced heart-failure patients.

- MRI-compatible CRT-P and CRT-D platforms will become the standard of care as imaging-safe designs gain universal clinical preference.

- Remote monitoring and AI-driven predictive analytics will increasingly guide therapy optimization and early detection of heart-failure deterioration.

- Leadless and minimally invasive pacing technologies will gain traction, reducing procedural complexity and improving patient comfort.

- Battery innovations and enhanced power-management algorithms will extend device longevity and reduce replacement procedures.

- Quadripolar lead systems and adaptive pacing technologies will improve responder rates and strengthen clinical effectiveness.

- Expansion of electrophysiology infrastructure in emerging markets will broaden patient access to CRT implantation.

- Reimbursement improvements and value-based care models will accelerate therapy adoption across underserved regions.

- Integration of CRT data into digital cardiology platforms will enhance long-term care coordination and patient monitoring.

- Collaboration between device manufacturers and cardiac centers will intensify to support training, clinical studies, and personalized therapy pathways.