Market overview

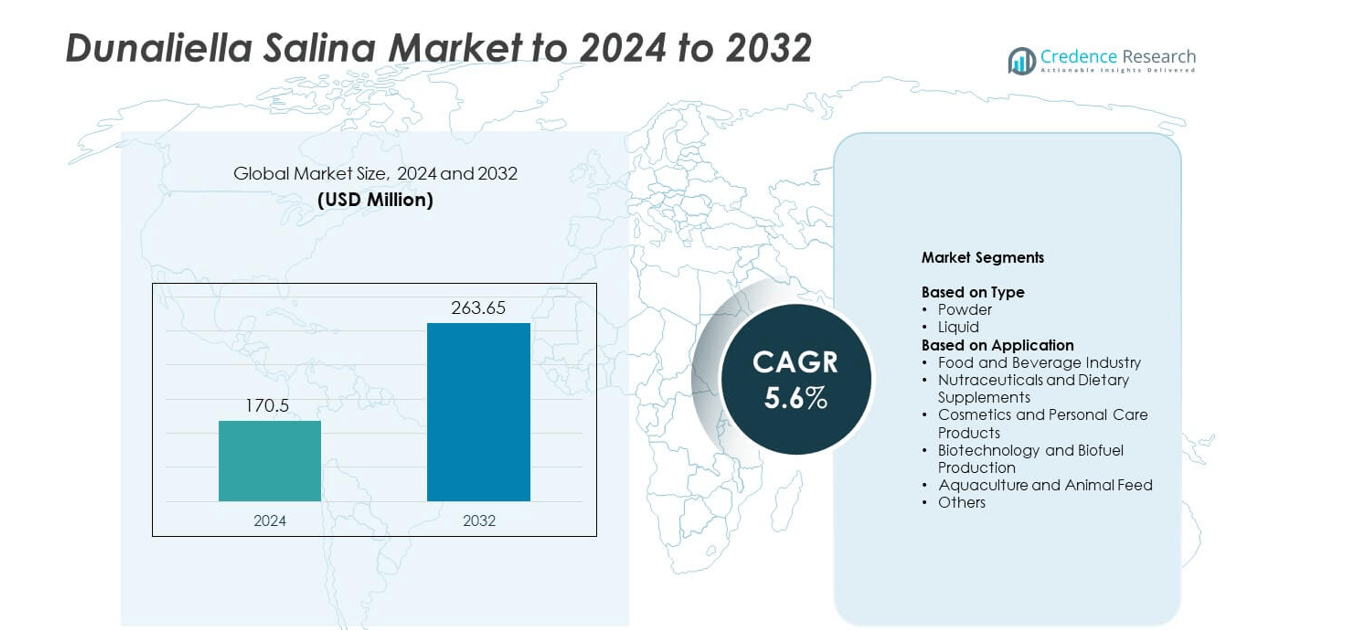

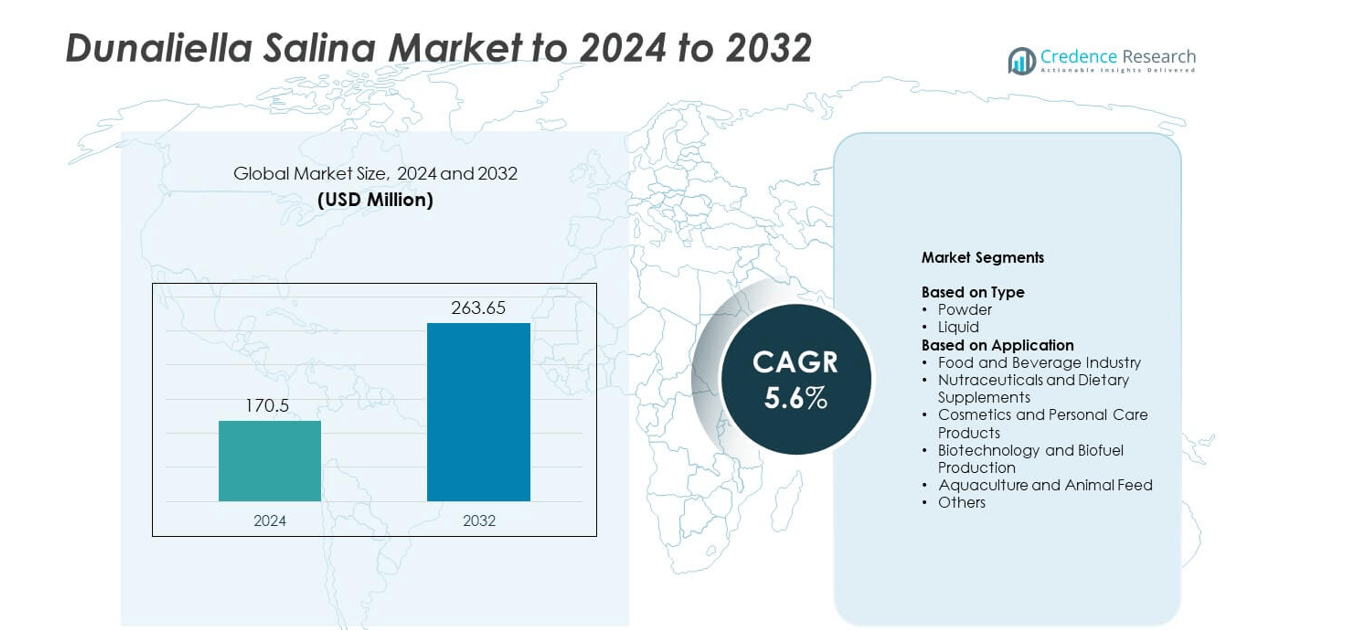

The Dunaliella Salina market size was valued at USD 170.5 million in 2024 and is anticipated to reach USD 263.65 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dunaliella Salina Market Size 2024 |

USD 170.5 million |

| Dunaliella Salina Market, CAGR |

5.6% |

| Dunaliella Salina Market Size 2032 |

USD 263.65 million |

The Dunaliella Salina market is characterized by the presence of leading players such as Cyanotech Corporation, Parry Nutraceuticals, Algatechnologies Ltd., Borregaard LignoTech, A4F, Shanghai Haoyue Group Co., Ltd., New Shores Holdings Limited, Nutress B.V., Aquapharm Biodiscovery, Plankton Australia Pty Ltd., and EID Parry (India) Ltd. These companies are focused on improving cultivation efficiency, enhancing pigment extraction technologies, and expanding global distribution networks. Strategic alliances and sustainability-driven R&D investments strengthen their market positioning. North America leads the global Dunaliella Salina market with a 34% share, driven by advanced biotechnology infrastructure, high consumer awareness of natural ingredients, and strong regulatory support for clean-label product development.

Market Insights

- The Dunaliella Salina market was valued at USD 170.5 million in 2024 and is projected to reach USD 263.65 million by 2032, registering a CAGR of 5.6%.

- Rising demand for natural beta-carotene and antioxidants in food, nutraceuticals, and cosmetics industries drives market growth.

- The market is witnessing a shift toward sustainable algal cultivation and advanced photobioreactor systems for higher yield and purity.

- Leading companies are investing in R&D to enhance extraction efficiency and expand product portfolios, strengthening global competitiveness.

- North America held the largest share of 34% in 2024, followed by Europe at 28% and Asia Pacific at 25%, while the powder segment dominated the market with a 67% share due to its superior stability and ease of use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The powder segment dominated the Dunaliella Salina market with a 67% share in 2024. Its dominance is driven by extended shelf life, high stability, and easy formulation integration in dietary supplements and cosmetics. Powdered Dunaliella Salina is preferred in nutraceuticals for its concentrated beta-carotene and antioxidant content. Manufacturers favor powder form due to cost-effective storage and transport benefits. Rising demand for natural colorants and nutritional additives in food and beverage industries continues to enhance the growth of this segment globally.

- For instance, multiple suppliers list Dunaliella powder with a beta-carotene content ranging from 2% to 10%. A commercial capsule containing 300 mg of this powder might therefore have a beta-carotene content between 6 mg and 30 mg

By Application

The nutraceuticals and dietary supplements segment held the largest share of 39% in 2024. Growth is driven by increasing consumer preference for natural antioxidants and carotenoid-rich supplements promoting eye and skin health. Dunaliella Salina serves as a rich source of beta-carotene and other bioactive compounds that support immunity and cellular protection. Rising health awareness and clean-label product demand strengthen adoption across supplement manufacturers. Expanding applications in personalized nutrition further contribute to this segment’s dominance in the global market.

- For instance, Solgar lists 7,500 mcg vitamin A activity from D. salina per softgel on its Oceanic Beta-Carotene label.

Key Growth Drivers

Rising Demand for Natural Beta-Carotene Sources

The growing preference for natural colorants and antioxidants in food, supplements, and cosmetics drives Dunaliella Salina adoption. Its high beta-carotene content offers a sustainable alternative to synthetic pigments. Consumers and manufacturers increasingly favor microalgae-derived ingredients for their clean-label and eco-friendly profile. Expanding regulations limiting artificial additives further strengthen demand for Dunaliella-based natural colorants, particularly in nutraceutical and functional food industries.

- For instance, Bluebonnet Nutrition discloses 7,500 mcg (7.5 mg) of beta-carotene per softgel, sourced from D. salina along with other natural mixed carotenoids

Expanding Applications in Nutraceuticals and Dietary Supplements

Rising health awareness and focus on immune support and anti-aging supplements propel Dunaliella Salina demand. Its rich antioxidant profile, including carotenoids and essential nutrients, enhances use in dietary formulations. Manufacturers are integrating Dunaliella extracts into capsules, powders, and functional beverages. The trend aligns with the global movement toward plant-based, nutrient-dense supplements targeting longevity and wellness.

- For instance, NOW Foods provides 7,500 mcg beta-carotene (25,000 IU) per softgel derived from algal sources, including D. salina.

Advancements in Algal Cultivation and Extraction Technologies

Technological progress in photobioreactor systems and controlled cultivation improves yield and purity of Dunaliella Salina biomass. Modern extraction processes enhance bioavailability and maintain pigment stability, making the algae more suitable for high-end applications. These innovations reduce production costs and enable large-scale commercialization across food, pharma, and cosmetic sectors. The continuous focus on sustainable production supports long-term market expansion.

Key Trends & Opportunities

Emergence of Sustainable and Circular Bioprocessing

Companies are adopting closed-loop systems and renewable energy for Dunaliella cultivation. These methods cut water use and carbon emissions while increasing biomass efficiency. Sustainability-focused production strengthens brand positioning in global markets emphasizing green sourcing. The shift toward eco-friendly cultivation supports long-term profitability and regulatory compliance.

- For instance, Evodos specifies algae-harvesting systems handling up to 750 L/h (model 10) for efficient low-water dewatering of microalgae.

Growing Penetration in Functional Food and Beverage Applications

Dunaliella Salina extracts are increasingly used in energy drinks, fortified foods, and natural colorant formulations. Rising consumer demand for plant-based, nutrient-rich food products enhances its integration. Food manufacturers leverage Dunaliella’s antioxidant benefits to boost nutritional and visual appeal. This trend expands opportunities across clean-label and health-focused product portfolios.

- For instance, MarkNature’s official website lists the specifications for its Dunaliella Salina Powder (food grade), with typical maximum heavy metal limits including arsenic (As) ≤ 3 mg/kg and lead (Pb) ≤ 2 mg/kg.

Key Challenges

High Production and Processing Costs

Dunaliella Salina cultivation requires advanced photobioreactors, temperature control, and costly nutrient inputs. These raise operational costs compared to traditional sources of carotenoids. Limited scalability and complex extraction processes further affect price competitiveness. Manufacturers face pressure to optimize efficiency and adopt cost-effective harvesting solutions.

Regulatory and Quality Standardization Barriers

The absence of uniform global regulations for microalgae-based ingredients limits commercialization. Variations in purity, labeling, and approval standards across regions slow market entry. Companies must navigate complex compliance frameworks for food, cosmetic, and pharmaceutical applications. Strengthening standardization and international guidelines remains essential for broader acceptance.

Regional Analysis

North America

North America held the largest share of 34% in the Dunaliella Salina market in 2024. The region’s growth is driven by rising demand for natural carotenoids and antioxidants across the nutraceutical and cosmetic industries. The United States leads due to strong investment in algae cultivation technologies and increasing preference for plant-based supplements. Regulatory support for natural additives and expanding use in fortified foods also contribute to market expansion. Continuous product innovation by regional biotechnology companies further strengthens the market’s dominance across North America.

Europe

Europe accounted for a 28% share of the Dunaliella Salina market in 2024. The market benefits from high demand for sustainable and natural ingredients in food, cosmetics, and pharmaceuticals. Countries such as Germany, France, and the Netherlands are leading due to strong R&D in microalgae biotechnology. Stringent regulations against synthetic colorants have accelerated the shift toward natural beta-carotene sources. The growing adoption of clean-label formulations and government focus on bio-based products further enhance Dunaliella cultivation and extraction initiatives across Europe.

Asia Pacific

Asia Pacific captured a 25% share of the Dunaliella Salina market in 2024. Growth is primarily driven by increasing awareness of microalgae’s nutritional benefits and expanding use in dietary supplements. China, Japan, and South Korea lead regional demand, supported by investments in large-scale algal cultivation facilities. Rising consumer spending on health and personal care products fuels product uptake. The region’s vast aquaculture industry also supports usage in animal feed applications. Rapid technological advancements and government-backed bioeconomy initiatives continue to accelerate regional market growth.

Latin America

Latin America held an 8% share of the Dunaliella Salina market in 2024. The region’s growth is supported by increasing adoption of natural ingredients in food and beverage applications. Brazil and Chile are key markets, benefiting from favorable climatic conditions for algal cultivation. Expanding aquaculture and feed industries drive additional demand. Local research initiatives and collaborations with biotechnology firms are helping improve production efficiency. Rising export potential for natural carotenoid-rich products further positions Latin America as an emerging producer in the global market.

Middle East & Africa

The Middle East & Africa accounted for a 5% share of the Dunaliella Salina market in 2024. Growth is supported by the availability of saline water resources ideal for algae cultivation, particularly in countries like Israel and the United Arab Emirates. Increasing investments in biofuel research and high-value natural pigments drive regional production. Government efforts to diversify economies and promote sustainable biotechnology contribute to long-term expansion. Rising interest in microalgae-based functional products strengthens market potential across both food and cosmetic sectors in the region.

Market Segmentations:

By Type

By Application

- Food and Beverage Industry

- Nutraceuticals and Dietary Supplements

- Cosmetics and Personal Care Products

- Biotechnology and Biofuel Production

- Aquaculture and Animal Feed

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Dunaliella Salina market features strong competition among key players such as Cyanotech Corporation, Parry Nutraceuticals, Algatechnologies Ltd., Borregaard LignoTech, A4F, Shanghai Haoyue Group Co., Ltd., New Shores Holdings Limited, Nutress B.V., Aquapharm Biodiscovery, Plankton Australia Pty Ltd., and EID Parry (India) Ltd. Companies are focusing on advanced cultivation systems, including closed photobioreactors and saline water optimization, to enhance yield and pigment concentration. Strategic collaborations with biotechnology firms and research institutions are helping improve extraction efficiency and carotenoid purity. Market participants are expanding their global presence through partnerships and joint ventures targeting the nutraceutical, cosmetic, and functional food sectors. Increasing investment in sustainable production and algae-based bioactive compounds supports product diversification. Continuous innovation in processing technology and a focus on environmentally friendly practices enable companies to strengthen competitiveness while meeting growing demand for natural, high-value ingredients across multiple industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cyanotech Corporation

- Parry Nutraceuticals

- Algatechnologies Ltd.

- Borregaard LignoTech

- A4F

- Shanghai Haoyue Group Co., Ltd.

- New Shores Holdings Limited

- Nutress B.V.

- Aquapharm Biodiscovery

- Plankton Australia Pty Ltd.

- EID Parry (India) Ltd.

Recent Developments

- In 2025, EID Parry (India) Ltd. and Parry Nutraceuticals (its subsidiary) have been involved in algae-based ingredient development and nutraceutical applications including beta-carotene from Dunaliella Salina,

- In 2023, Borregaard’s primary products included lignin-based biopolymers, specialty cellulose, biovanillin, and bioethanol, used across industries like construction, agriculture, and pharmaceuticals.

- In 2023, A4F was an active participant in the Horizon Europe project, INNOAQUA. The project’s goal was to leverage microalgae, including Dunaliella salina, as a sustainable and low-carbon protein source to enhance the sustainability and competitiveness of the European aquaculture sector.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing demand for natural carotenoids and antioxidants.

- Technological advancements in photobioreactors will improve production efficiency and biomass yield.

- Rising consumer preference for plant-based and clean-label products will drive wider adoption.

- Nutraceutical and dietary supplement applications will continue to dominate global demand.

- Integration of Dunaliella extracts in functional foods and beverages will gain traction.

- Sustainable cultivation practices will strengthen its role in the circular bioeconomy.

- Regional investments in algae-based biotechnology will boost commercialization.

- Regulatory harmonization will enhance global trade and product standardization.

- Collaboration between research institutes and industry players will drive innovation.

- Expanding applications in cosmetics and pharmaceuticals will support long-term market growth.