Market Overview

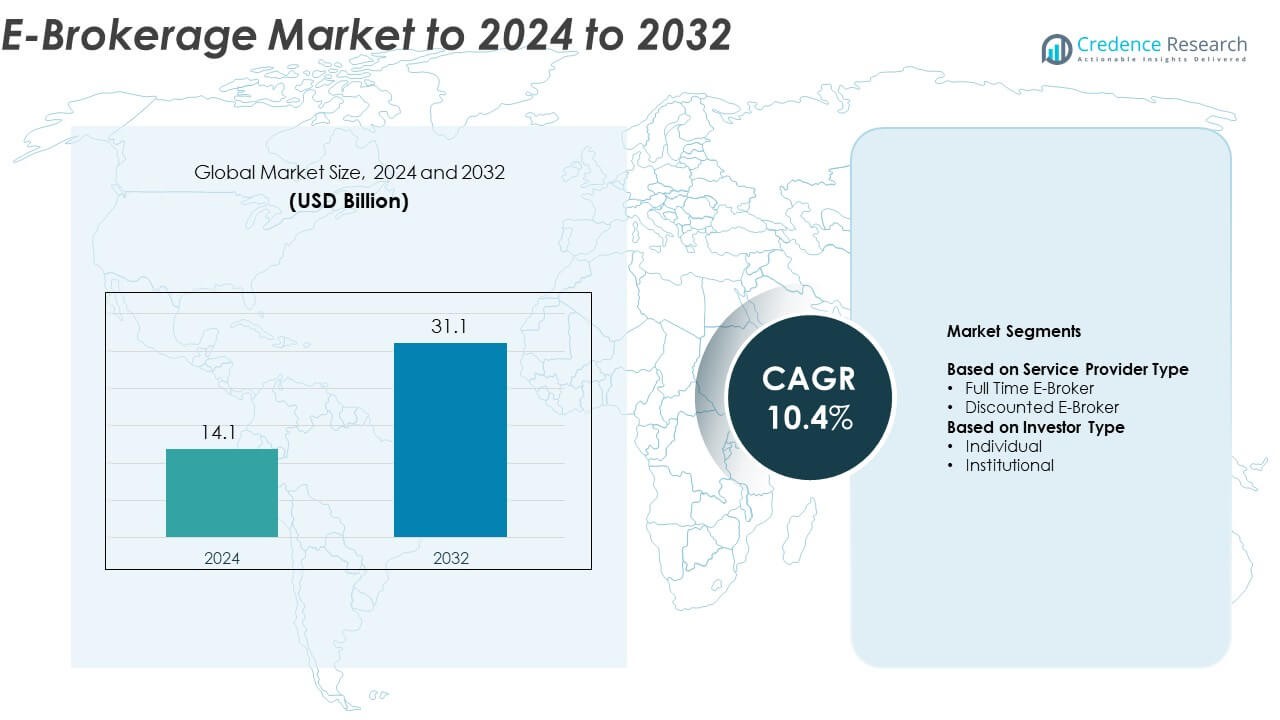

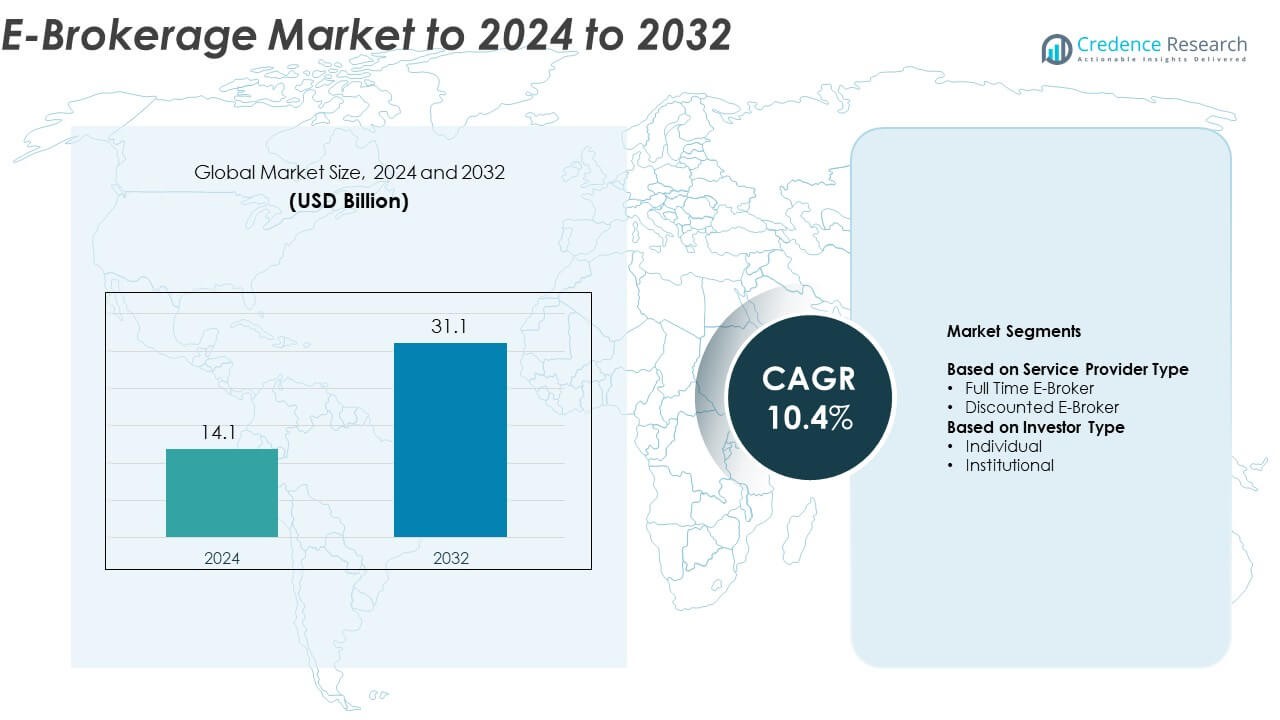

The E-Brokerage Market size was valued at USD 14.1 billion in 2024 and is anticipated to reach USD 31.1 billion by 2032, at a CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-Brokerage Market Size 2024 |

USD 14.1 Billion |

| E-Brokerage Market, CAGR |

10.4% |

| E-Brokerage Market Size 2032 |

USD 31.1 Billion |

The E-Brokerage market is led by key players such as Fidelity Investments, Robinhood Markets, Inc., The Charles Schwab Corporation, Interactive Brokers LLC, Bank of America Corporation, E*TRADE, IG Group Holdings Plc, Plus500 Ltd., XTB Group, and Ally Financial Inc. These companies dominate through advanced digital trading platforms, competitive pricing, and diversified investment offerings. North America leads the global market with a 37.8% share in 2024, supported by strong fintech innovation and high retail investor participation. Europe follows with a 26.4% share, driven by robust regulatory frameworks and growing neobroker adoption, while Asia-Pacific accounts for 28.9%, emerging as the fastest-growing region due to rapid digital transformation and expanding retail investment activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The E-Brokerage market was valued at USD 14.1 billion in 2024 and is projected to reach USD 31.1 billion by 2032, expanding at a CAGR of 10.4%.

• Growing digitalization and the surge in retail investor participation are key drivers fueling market expansion, supported by commission-free platforms and enhanced mobile accessibility.

• Trends such as AI-based advisory tools, algorithmic trading, and cross-border investment access are reshaping trading behavior and improving investor engagement.

• Competition is intensifying as major players enhance customer experience through automation, low-cost trading, and diversified financial products, while smaller brokers face consolidation pressure.

• North America leads with 37.8% share, followed by Asia-Pacific at 28.9% and Europe at 26.4%, while the discounted e-broker segment holds around 61.3% share, driven by cost efficiency and flexible trading models.

Market Segmentation Analysis:

By Service Provider Type

The discounted e-broker segment dominates the E-Brokerage market, accounting for around 61.3% share in 2024. Its leadership stems from the growing preference for low-cost trading platforms among retail investors and the rise of commission-free trading models. Digital-first brokers leverage automation, AI-based advisory tools, and mobile-friendly interfaces to attract cost-conscious investors. The surge in online trading activity, driven by improved internet penetration and simplified onboarding, further accelerates adoption. Full-time brokers continue to serve high-net-worth clients, but their share is declining due to rising digital competitiveness.

- For instance, Webull reported 24.9 million global registered users in its financial results for the second quarter of the 2025 financial year (April–June 2025), highlighting strong adoption of mobile-based, zero-commission trading.

By Investor Type

The individual investor segment holds the largest share, accounting for nearly 68.7% of the E-Brokerage market in 2024. The dominance is fueled by increased financial literacy, smartphone access, and social investing trends among millennials and Gen Z. Retail participation in equity and derivatives trading has expanded rapidly through user-friendly apps and real-time analytics. Online platforms offering fractional investing and robo-advisory services have widened accessibility. Meanwhile, institutional investors maintain steady activity levels, but their share is smaller due to reliance on traditional brokerage systems and direct market access platforms.

- For instance, eToro had 35 million registered users as of June 2024, a number which grew to 40 million by May 2025. The company had 3.6 million funded accounts in late 2024 (specifically, 3.63 million as of June 30, 2025).

Key Growth Drivers

Rising Retail Investor Participation

The rapid increase in retail investor activity is a major growth driver for the E-Brokerage market. Affordable trading platforms, seamless account opening, and zero-commission models have expanded market accessibility. Younger investors are increasingly engaging in equities, ETFs, and cryptocurrencies through digital brokers. The integration of user-friendly mobile apps and educational content further encourages participation. This trend is supported by growing financial awareness and social media influence, making digital brokerage platforms central to modern investment behavior.

- For instance, Robinhood ended 2024 with 25.2 million funded accounts, an increase from 23.4 million at the end of 2023.

Technological Advancements in Trading Platforms

Continuous technological innovation significantly drives E-Brokerage market expansion. Platforms integrating AI, predictive analytics, and algorithmic trading deliver faster, data-driven decisions. Enhanced cybersecurity frameworks and blockchain-based transaction systems boost investor trust and transparency. The adoption of cloud infrastructure allows scalability and improved latency for real-time trading execution. These advancements enhance user experience and operational efficiency, positioning digital brokerages as preferred investment channels over traditional intermediaries.

- For instance, TradeStation facilitated over $31.1 million in total price improvements on all equities and options orders for its customers in 2024.

Shift Toward Low-Cost and Self-Directed Investing

The increasing preference for low-cost and self-directed investment solutions propels market growth. Investors are moving toward commission-free platforms that offer autonomy and flexibility in portfolio management. Discount brokers continue to gain market share by reducing transaction fees while offering advanced analytical tools. The rise of do-it-yourself investing aligns with a global trend toward financial independence and transparency. This shift accelerates competition among brokers to deliver personalized yet cost-efficient services.

Key Trends & Opportunities

Integration of Artificial Intelligence and Automation

AI-powered tools are transforming E-Brokerage operations through personalized recommendations, sentiment analysis, and automated trading strategies. Machine learning enhances decision-making accuracy and supports robo-advisory solutions for portfolio optimization. Automation in customer service and trade execution improves speed and efficiency. These innovations enable brokers to serve larger user bases with minimal human intervention while maintaining accuracy and reliability, opening opportunities for scalable, data-driven service delivery.

- For instance, Nutmeg, which is owned by JPMorgan, reportedly had amassed over 265,000 clients as of late 2025. The company was in the process of rebranding to J.P. Morgan Personal Investing, with the new brand officially launching in November 2025.

Expansion of Cross-Border and Multi-Asset Platforms

Global investors are increasingly seeking access to multiple asset classes through unified platforms. E-brokerage providers are responding by integrating equities, derivatives, digital assets, and mutual funds into single interfaces. The growing demand for cross-border trading opportunities creates room for partnerships with global exchanges. As investment boundaries blur, brokers offering seamless global access and multi-currency support gain a competitive advantage in capturing diverse investor bases.

- For instance, Interactive Brokers reported 3.3 million client accounts executing trades across more than 150 global markets in 2024

Key Challenges

Regulatory Compliance and Data Security Concerns

Stringent financial regulations and evolving compliance frameworks remain key challenges for E-Brokerage firms. Adhering to anti-money laundering, KYC, and data protection laws increases operational costs and complexity. The surge in digital trading heightens exposure to cyber threats, requiring continuous investment in encryption and fraud prevention technologies. Non-compliance risks reputational damage and financial penalties, making robust governance essential for sustaining market credibility.

High Market Competition and Price Pressure

Intense competition among brokerage platforms creates pricing pressure and margin constraints. The widespread adoption of commission-free trading has reduced profitability, compelling firms to explore new revenue streams like premium analytics or advisory services. Maintaining platform differentiation amid price-sensitive users is increasingly difficult. Smaller brokers face consolidation threats as larger players leverage economies of scale to dominate customer acquisition and retention.

Regional Analysis

North America

North America dominates the E-Brokerage market with a 37.8% share in 2024, driven by high retail investor participation and advanced digital infrastructure. The United States leads the region due to the widespread use of online trading apps and commission-free platforms. Robust regulatory frameworks and investor education programs support sustained growth. The presence of major players offering diverse asset classes and AI-driven trading tools further strengthens market adoption. Increasing interest in cryptocurrency and sustainable investments also contributes to expanding user engagement across digital brokerage platforms.

Europe

Europe holds around 26.4% share of the E-Brokerage market in 2024, supported by strong financial ecosystems and digital adoption. The United Kingdom, Germany, and France lead regional activity with well-regulated markets and growing fintech innovation. Investors increasingly prefer online brokers offering transparent fee structures and ESG-linked investment options. The region’s open banking framework and cross-border investment flexibility enhance accessibility. Continuous technological upgrades and partnerships between fintech firms and traditional financial institutions sustain growth, while rising competition among neobrokers accelerates digital transformation across the European investment landscape.

Asia-Pacific

Asia-Pacific accounts for approximately 28.9% share of the global E-Brokerage market in 2024, emerging as the fastest-growing region. Expanding internet connectivity, increasing retail trading in India, China, and Japan, and mobile-first investment culture drive this momentum. The rise of millennial investors and local brokerage apps offering multilingual interfaces boost participation. Government-backed financial inclusion programs and relaxed investment norms also foster expansion. Rapid digital transformation, combined with strong demand for equities and ETFs, positions Asia-Pacific as a key growth hub for online trading platforms.

Latin America

Latin America represents about 4.5% share of the E-Brokerage market in 2024, with Brazil and Mexico leading adoption. Growing awareness of digital finance, rising smartphone penetration, and regional fintech development support market expansion. Online brokers offering simplified access to global markets are gaining popularity among retail investors. Despite regulatory differences and limited infrastructure in smaller economies, increased financial literacy and innovation in payment systems enhance accessibility. The region’s young, tech-driven population continues to drive momentum for digital investment platforms.

Middle East & Africa

The Middle East & Africa region captures around 2.4% share of the global E-Brokerage market in 2024. Expanding digitalization, rising disposable incomes, and growing interest in equity trading contribute to gradual growth. The United Arab Emirates and Saudi Arabia lead the market with advanced fintech ecosystems and regulatory reforms encouraging digital investment. Africa shows emerging potential as smartphone adoption and mobile trading increase. However, challenges such as limited financial literacy and uneven internet access slow wider adoption. Ongoing government initiatives to boost capital market participation will support steady development.

Market Segmentations:

By Service Provider Type

- Full Time E-Broker

- Discounted E-Broker

By Investor Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the E-Brokerage market features major players such as Fidelity Investments, Robinhood Markets, Inc., The Charles Schwab Corporation, Interactive Brokers LLC, Bank of America Corporation, E*TRADE, IG Group Holdings Plc, Plus500 Ltd., XTB Group, and Ally Financial Inc. The market is highly competitive, with firms focusing on advanced digital infrastructure, low-cost trading, and innovative customer engagement tools to strengthen market presence. Companies are expanding service portfolios through AI-driven advisory solutions, mobile trading platforms, and personalized analytics. Strategic partnerships, mergers, and acquisitions are common as firms aim to enhance technological capabilities and expand regional reach. The growing preference for zero-commission models continues to reshape pricing structures, prompting providers to explore new revenue sources such as premium analytics and margin trading. Competitive differentiation now relies heavily on user experience, platform reliability, and regulatory compliance, driving continuous innovation across the global E-Brokerage industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Bank of America Corporation (Merrill/Merrill Edge) Merrill and Bank of America Private Bank launched a new alternative investments program for ultra-high-net-worth clients.

- In 2025, Charles Schwab reported opening 439,000 new brokerage accounts, monthly.

- In 2024, Robinhood announced accqusition TradePMR to expand into registered investment advisor services targeting high-net-worth clients, signaling a strategic move to evolve from a discount broker to a full financial services platform

Report Coverage

The research report offers an in-depth analysis based on Service Provider Type, Investor Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth through increased digital adoption among retail investors.

- AI-driven trading analytics and personalized insights will enhance user engagement and retention.

- Mobile-first brokerage platforms will dominate, catering to millennial and Gen Z investors.

- Cross-border and multi-asset trading will expand as global investment access improves.

- Strategic partnerships between fintech firms and traditional brokers will strengthen service portfolios.

- Cloud-based infrastructure and API integration will improve trading efficiency and scalability.

- The rise of cryptocurrency trading features will diversify platform offerings.

- Regulatory harmonization across regions will encourage international expansion of digital brokers.

- Advanced cybersecurity frameworks will become a core focus to ensure investor trust.

- Consolidation among small brokers will continue as competition intensifies and margins narrow.