CHAPTER NO. 1 : INTRODUCTION 21

1.1. Report Description 21

Purpose of the Report 21

USP & Key Offerings 21

1.2. Key Benefits for Stakeholders 22

1.3. Target Audience 22

CHAPTER NO. 2 : EXECUTIVE SUMMARY 23

CHAPTER NO. 3 : EAST AFRICA INSTRUMENT CLEANERS & DETERGENTS MARKET FORCES & INDUSTRY PULSE 25

3.1. Foundations of Change – Market Overview 25

3.2. Catalysts of Expansion – Key Market Drivers 27

3.2.1. Momentum Boosters – Growth Triggers 28

3.2.2. Innovation Fuel – Disruptive Technologies 28

3.3. Headwinds & Crosswinds – Market Restraints 29

3.3.1. Regulatory Tides – Compliance Challenges 30

3.3.2. Economic Frictions – Inflationary Pressures 30

3.4. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 31

3.5. Market Equilibrium – Porter’s Five Forces 32

3.6. Ecosystem Dynamics – Value Chain Analysis 34

3.7. Macro Forces – PESTEL Breakdown 36

3.8. Price Trend Analysis 37

3.9. Price Trend by Product Type 38

3.10. Buying Criteria 39

CHAPTER NO. 4 : COMPETITION ANALYSIS 40

4.1. Company Market Share Analysis 40

4.1.1. East Africa Instrument Cleaners & Detergents Market Company Volume Market Share 40

4.1.2. East Africa Instrument Cleaners & Detergents Market Company Revenue Market Share 42

4.2. Strategic Developments 44

4.2.1. Acquisitions & Mergers 44

4.2.2. New Product Launch 45

4.2.3. Agreements & Collaborations 46

4.3. Competitive Dashboard 47

4.4. Company Assessment Metrics, 2024 48

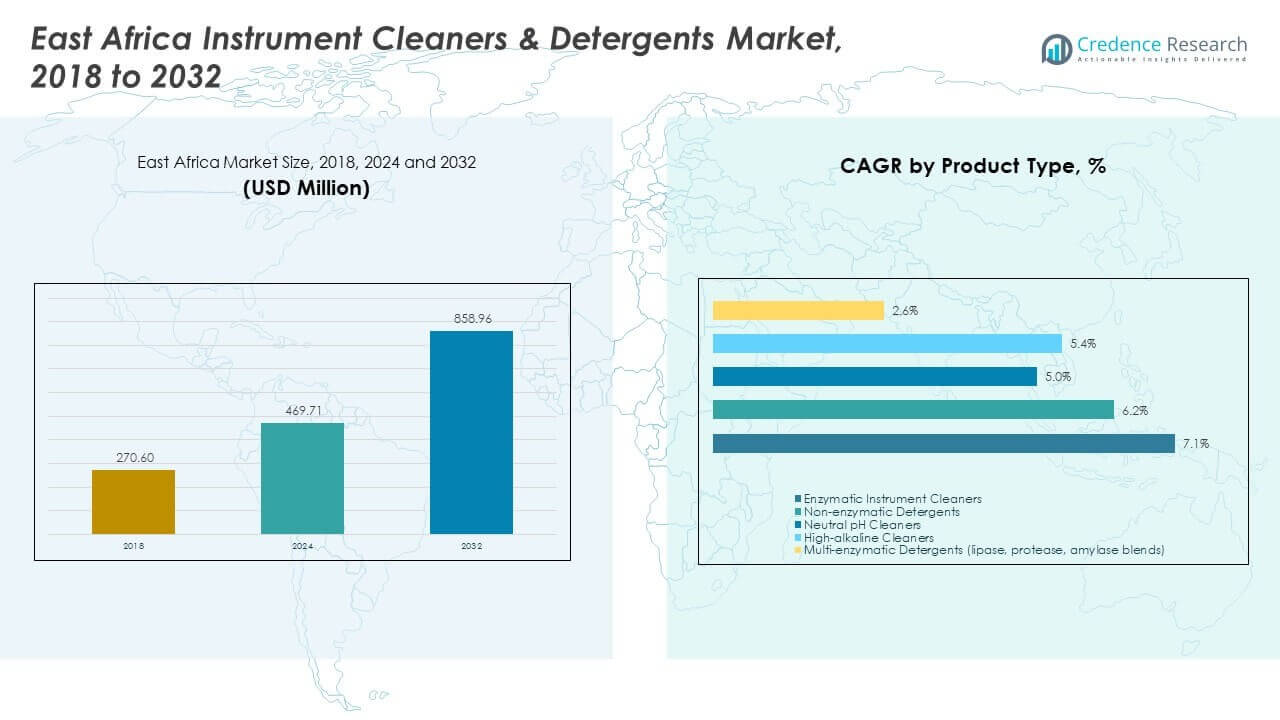

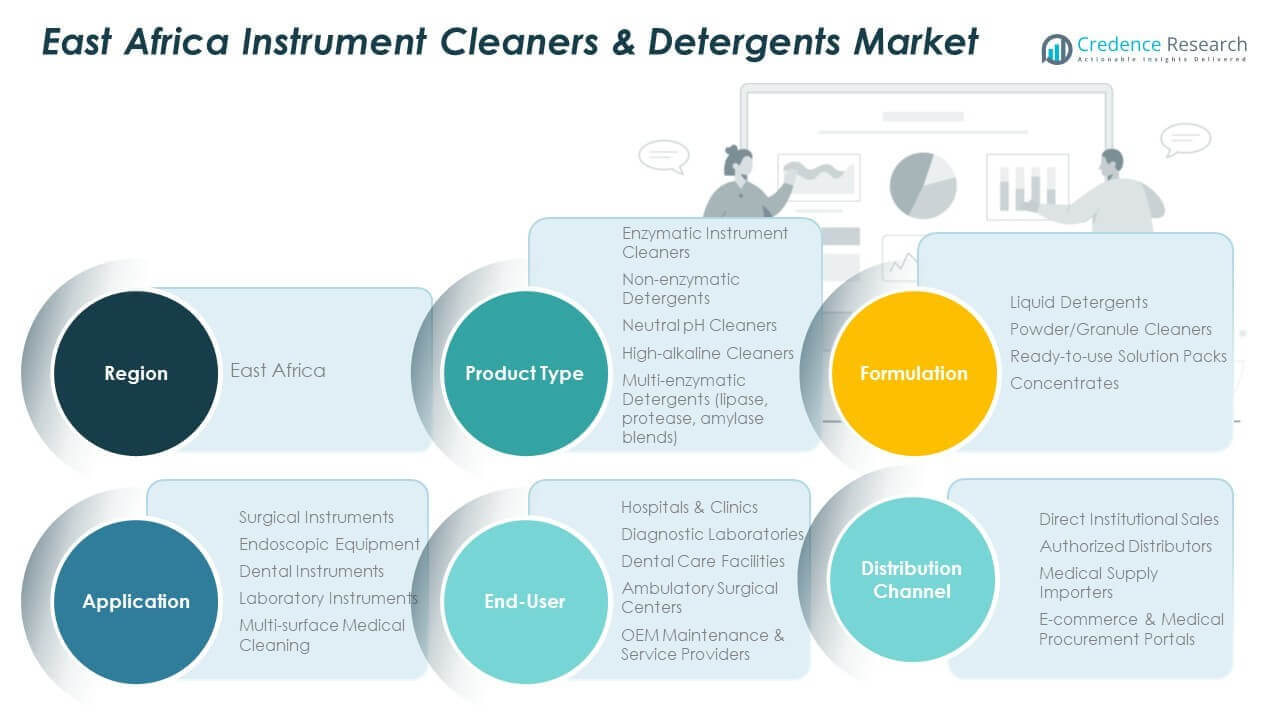

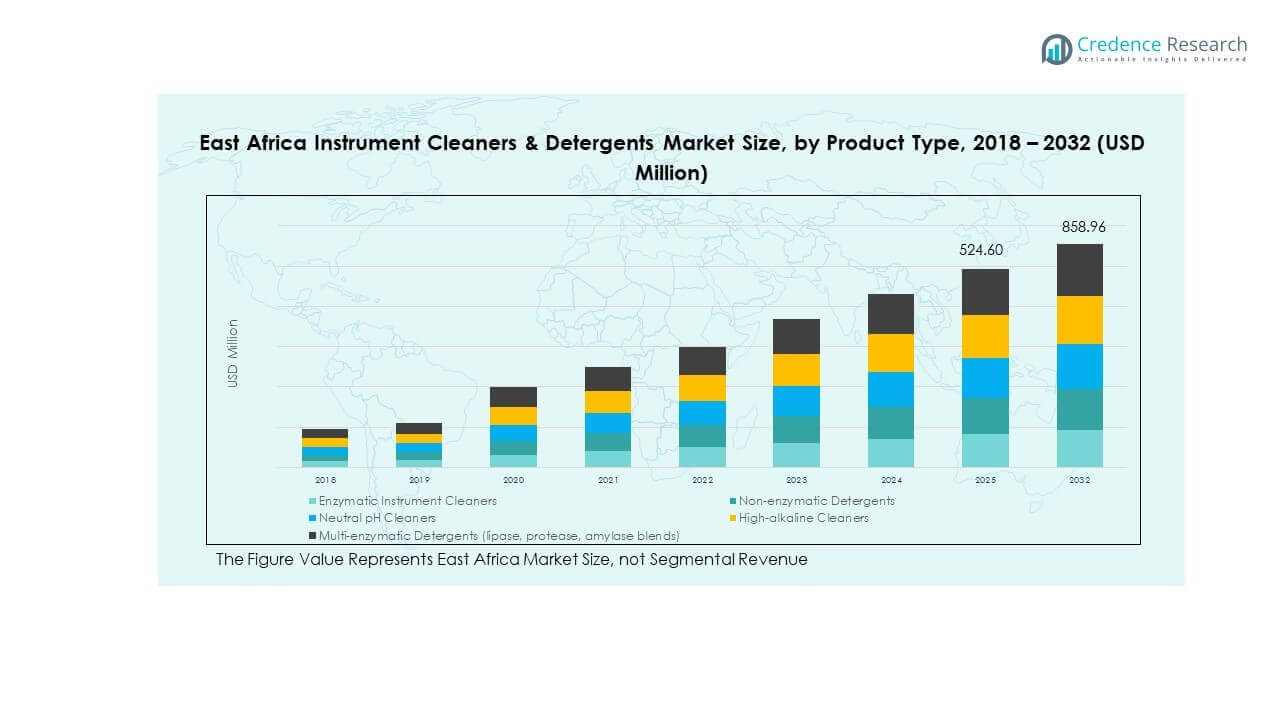

CHAPTER NO. 5 : EAST AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY PRODUCT TYPE 49

CHAPTER NO. 6 : EAST AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY FORMULATION 54

CHAPTER NO. 7 : EAST AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY APPLICATION 61

CHAPTER NO. 8 : EAST AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY END-USER 66

CHAPTER NO. 9 : EAST AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY DISTRIBUTION CHANNEL 71

CHAPTER NO. 10 : EAST AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY COUNTRY 76

CHAPTER NO. 11 : COMPANY PROFILE 81

11.1. 3M Healthcare 81

11.2. STERIS Corporation 84

11.3. Ecolab Inc. 84

11.4. Getinge AB 84

11.5. METREX (A Sybron company) 84

List of Figures

FIG NO. 1. East Africa Instrument Cleaners & Detergents Market Revenue Share, By Product Type, 2024 & 2032 49

FIG NO. 2. Market Attractiveness Analysis, By Product Type 50

FIG NO. 3. Incremental Revenue Growth Opportunity by Product Type, 2024 – 2032 51

FIG NO. 4. East Africa Instrument Cleaners & Detergents Market Revenue Share, By Formulation, 2024 & 2032 54

FIG NO. 5. Incremental Revenue Growth Opportunity by Formulation, 2024 – 2032 55

FIG NO. 6. Incremental Revenue Growth Opportunity by Formulation, 2024 – 2032 56

FIG NO. 7. East Africa Instrument Cleaners & Detergents Market Revenue Share, By Application, 2024 & 2032 61

FIG NO. 8. Market Attractiveness Analysis, By Application 62

FIG NO. 9. Incremental Revenue Growth Opportunity by Application, 2024 – 2032 63

FIG NO. 10. East Africa Instrument Cleaners & Detergents Market Revenue Share, By End-User, 2024 & 2032 66

FIG NO. 11. Market Attractiveness Analysis, By End-User 67

FIG NO. 12. Incremental Revenue Growth Opportunity by End-User, 2024 – 2032 68

FIG NO. 13. East Africa Instrument Cleaners & Detergents Market Revenue Share, By Distribution Channel, 2024 & 2032 71

FIG NO. 14. Market Attractiveness Analysis, By Distribution Channel 72

FIG NO. 15. Incremental Revenue Growth Opportunity by Distribution Channel, 2024 – 2032 73

FIG NO. 16. East Africa Instrument Cleaners & Detergents Market Revenue Share, By Country, 2024 & 2032 76

FIG NO. 17. Market Attractiveness Analysis, By Country 77

FIG NO. 18. Incremental Revenue Growth Opportunity by Country, 2024 – 2032 78

List of Tables

TABLE NO. 1. : East Africa Instrument Cleaners & Detergents Market Revenue, By Product Type, 2018 – 2024 (USD Million) 52

TABLE NO. 2. : East Africa Instrument Cleaners & Detergents Market Revenue, By Product Type, 2025 – 2032 (USD Million) 52

TABLE NO. 3. : East Africa Instrument Cleaners & Detergents Market Volume, By Product Type, 2018 – 2024 (Metric Tons) 53

TABLE NO. 4. : East Africa Instrument Cleaners & Detergents Market Volume, By Product Type, 2025 – 2032 (Metric Tons) 53

TABLE NO. 5. : East Africa Instrument Cleaners & Detergents Market Revenue, By Formulation, 2018 – 2024 (USD Million) 57

TABLE NO. 6. : East Africa Instrument Cleaners & Detergents Market Revenue, By Formulation, 2025 – 2032 (USD Million) 58

TABLE NO. 7. : East Africa Instrument Cleaners & Detergents Market Volume, By Formulation, 2018 – 2024 (Metric Tons) 59

TABLE NO. 8. : East Africa Instrument Cleaners & Detergents Market Volume, By Formulation, 2025 – 2032 (Metric Tons) 60

TABLE NO. 9. : East Africa Instrument Cleaners & Detergents Market Revenue, By Application, 2018 – 2024 (USD Million) 64

TABLE NO. 10. : East Africa Instrument Cleaners & Detergents Market Revenue, By Application, 2025 – 2032 (USD Million) 64

TABLE NO. 11. : East Africa Instrument Cleaners & Detergents Market Volume, By Application, 2018 – 2024 (Metric Tons) 65

TABLE NO. 12. : East Africa Instrument Cleaners & Detergents Market Volume, By Application, 2025 – 2032 (Metric Tons) 65

TABLE NO. 13. : East Africa Instrument Cleaners & Detergents Market Revenue, By End-User, 2018 – 2024 (USD Million) 69

TABLE NO. 14. : East Africa Instrument Cleaners & Detergents Market Revenue, By End-User, 2025 – 2032 (USD Million) 69

TABLE NO. 15. : East Africa Instrument Cleaners & Detergents Market Volume, By End-User, 2018 – 2024 (Metric Tons) 70

TABLE NO. 16. : East Africa Instrument Cleaners & Detergents Market Volume, By End-User, 2025 – 2032 (Metric Tons) 70

TABLE NO. 17. : East Africa Instrument Cleaners & Detergents Market Revenue, By Distribution Channel, 2018 – 2024 (USD Million) 74

TABLE NO. 18. : East Africa Instrument Cleaners & Detergents Market Revenue, By Distribution Channel, 2025 – 2032 (USD Million) 74

TABLE NO. 19. : East Africa Instrument Cleaners & Detergents Market Volume, By Distribution Channel, 2018 – 2024 (Metric Tons) 75

TABLE NO. 20. : East Africa Instrument Cleaners & Detergents Market Volume, By Distribution Channel, 2025 – 2032 (Metric Tons) 75

TABLE NO. 21. : East Africa Instrument Cleaners & Detergents Market Revenue, By Country, 2018 – 2024 (USD Million) 79

TABLE NO. 22. : East Africa Instrument Cleaners & Detergents Market Revenue, By Country, 2025 – 2032 (USD Million) 79

TABLE NO. 23. : East Africa Instrument Cleaners & Detergents Market Volume, By Country, 2018 – 2024 (Metric Tons) 80

TABLE NO. 24. : East Africa Instrument Cleaners & Detergents Market Volume, By Country, 2025 – 2032 (Metric Tons) 80