Market Overview

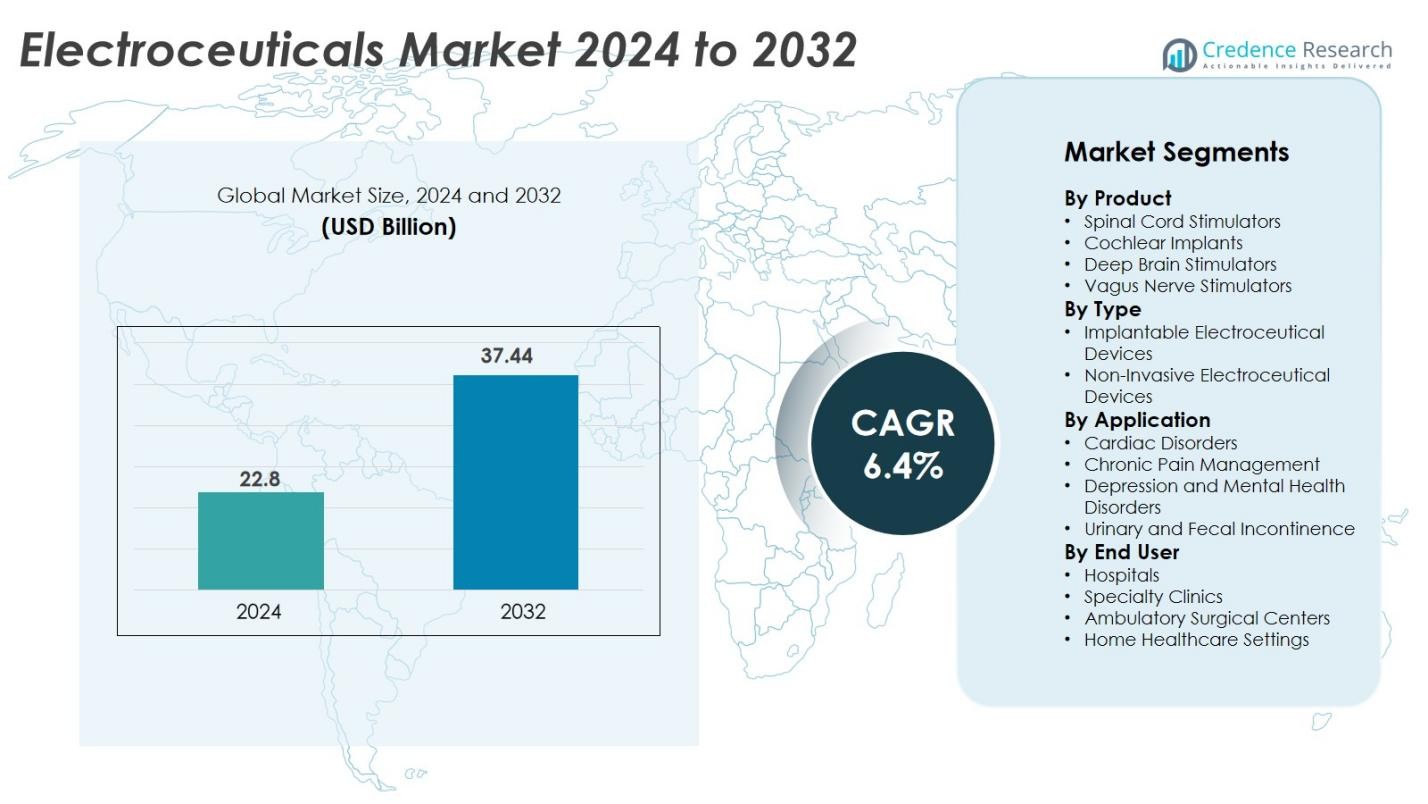

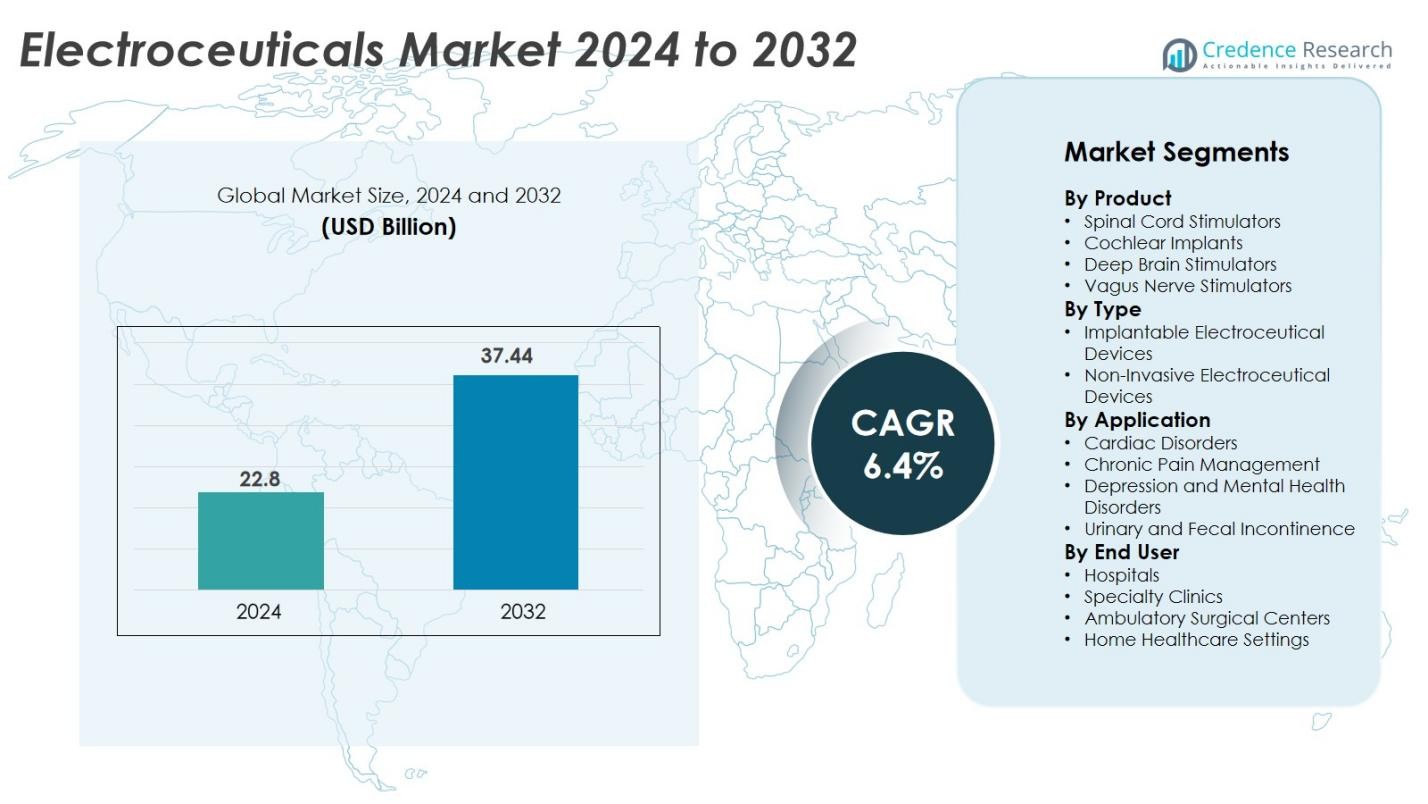

Electroceuticals market size was valued USD 22.8 billion in 2024 and is anticipated to reach USD 37.44 billion by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electroceuticals Market Size 2024 |

USD 22.8 Billion |

| Electroceuticals Market, CAGR |

6.4% |

| Electroceuticals Market Size 2032 |

USD 37.44 Billion |

The Electroceuticals market is driven by prominent players such as Boston Scientific Corporation, Cochlear Limited, Abbott Laboratories, LivaNova PLC, Nevro Corp., ElectroCore Inc., Sonova Holding AG, Biotronik, NeuroPace Inc., and Nurotron Biotechnology Co. Ltd. These companies focus on advanced neurostimulation, cardiac rhythm management, and cochlear implant solutions, supported by continuous R&D, strategic partnerships, and product upgrades. North America remains the leading regional market, holding 41% share due to strong reimbursement systems, high adoption of implantable stimulators, and a well-established healthcare infrastructure that encourages early uptake of innovative electroceutical technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electroceuticals market was valued at USD 22.8 billion in 2024 and will reach USD 37.44 billion by 2032, growing at a CAGR of 6.4%.

- Rising cases of chronic pain, hearing loss, Parkinson’s disease, and cardiac disorders boost demand for advanced neurostimulators and cochlear implants.

- Trends such as miniaturized implants, wearable non-invasive stimulators, AI-based therapy control, and remote monitoring strengthen long-term adoption across hospitals and home-care settings.

- Strong competition exists among Boston Scientific, Abbott, Cochlear Limited, Biotronik, and Nevro, with companies focusing on rechargeable implants, wireless programming, and targeted therapy systems to improve patient outcomes.

- North America leads with 41% share, while Spinal Cord Stimulators hold 42% share by product, supported by high chronic pain cases and strong reimbursement; Asia-Pacific grows rapidly due to improved access to surgery, local device manufacturing, and rising neurological diagnosis rates.

Market Segmentation Analysis

By Product

Spinal Cord Stimulators hold the dominant share of 42% in the Electroceuticals market. These devices remain widely adopted for chronic pain relief in patients who do not respond to conventional therapies. Growing spinal injury cases and rising healthcare spending support higher implantation rates. Cochlear Implants capture 31%, driven by a surge in hearing loss cases among aging populations. Deep Brain Stimulators account for 17%, mainly used in Parkinson’s and tremor treatment, while Vagus Nerve Stimulators represent 10%, supported by demand in epilepsy and depression care.

- For instance, Cochlear Limited is the most implanted cochlear device brand, accounting for 51.5% of primary implantations in a study involving 2,347 patients, with a 7-year revision surgery rate below 5% in adults, showing a high reliability and patient retention globally.

By Type

Implantable Electroceutical Devices lead the segment with 68% market share. Hospitals prefer implantable systems due to long-term efficiency, precise neural stimulation, and strong clinical success rates in pain, cardiac, and neurological care. Increasing FDA approvals for implantable stimulation systems are expanding adoption across global markets. Non-Invasive Electroceutical Devices hold 32%, supported by growing demand for wearable stimulation solutions. Patients favor non-invasive systems for lower treatment costs, shorter recovery time, and easy home-based usage.

- For instance, Boston Scientific’s WaveWriter Alpha system features 32 contact points and 32 waveform options, enhancing pain modulation precision.

By Application

Chronic Pain Management dominates the market with 39% share. Demand grows rapidly as spinal disorders, neuropathic pain, and post-surgical pain cases rise. Spinal cord stimulators and non-invasive nerve stimulation systems are widely used as alternatives to opioids, which boosts long-term adoption. Cardiac Disorders hold 28%, driven by pacemakers and defibrillators used for arrhythmia management. Depression and Mental Health Disorders account for 19%, supported by advancements in deep brain and vagus nerve stimulation. Urinary and Fecal Incontinence represents 14%, expanding steadily due to aging populations and rising pelvic health concerns.

Key Growth Drivers

Growing Burden of Chronic Diseases and Pain Disorders

Rising cases of chronic pain, neurological disorders, and hearing impairment strongly drive the Electroceuticals market. Healthcare providers prefer electro-based therapies because they reduce drug dependency and limit side effects. Many patients with chronic back pain and neuropathic conditions are shifting toward spinal cord stimulation to avoid long-term opioid use. Cochlear implants also see strong adoption, as global hearing loss cases increase among elderly populations. Clinical studies continue to show lasting improvements in mobility, nerve stimulation, and pain relief, which motivates hospitals to expand their treatment portfolios. The availability of advanced implants and minimally invasive procedures further attracts patient interest.

- For instance, Boston Scientific reported that over 80% of patients using its WaveWriter Alpha spinal cord stimulator experienced at least a 50% reduction in chronic pain.

Technological Advancements and Device Innovation

Continuous innovation in neurostimulation technology supports market expansion. Companies design smaller implants with longer battery life, stronger signal precision, and wireless programming. Integration of AI and real-time data analysis improves stimulation accuracy, which raises treatment success rates. Many modern cochlear implants enhance speech clarity and sound processing, helping patients adapt faster after surgery. Implantable pulse generators, rechargeable systems, and MRI-safe designs also encourage physicians to recommend device-based therapy. Cloud monitoring and remote control allow doctors to adjust settings without physical visits, improving patient comfort.

- For instance, Medtronic’s Percept RC Deep Brain Stimulator with BrainSense technology provides adaptive stimulation, extending device longevity to 15 years.

Increasing FDA Approvals and Reimbursement Support

Regulatory approvals for new neurostimulators, cochlear implants, and vagus nerve devices continue to expand treatment options. Broader clinical trial success gives hospitals confidence to adopt these systems. Reimbursement policies in developed regions cover implantation and follow-up care, reducing the financial burden on patients. Several governments promote non-drug pain therapies to reduce opioid addiction, which directly supports electroceutical adoption. Insurance coverage for hearing implants and cardiac pacemakers also strengthens the market pipeline. As reimbursement frameworks widen in emerging economies, device manufacturers and healthcare providers see new growth avenues. Strong regulatory backing improves patient trust and accelerates market penetration.

Key Trends & Opportunities

Miniaturized Wearable and Home-Use Neurostimulation Devices

A major trend involves smaller, portable electroceutical devices for home use. Wearable stimulators help patients manage migraines, depression, and chronic pain without surgery. The demand for telehealth and remote monitoring encourages companies to build smartphone-connected devices. These systems track nerve response, offer personalized therapy settings, and reduce hospital visits. Growth in consumer wellness, sports recovery, and rehabilitation markets also creates opportunities for non-invasive devices. As patients look for safer alternatives to pain medication, wearable neurostimulators become more popular among older adults and athletes.

- For instance, NeuroMetrix’s Quell 2.0 wearable stimulator provides personalized pain therapy using AI algorithms that analyze various health data points (such as sleep, activity, and pain reports) through the companion app.

Expanding Use of Electroceuticals in Mental Health and Cognitive Disorders

Electroceuticals are gaining traction in depression, anxiety, PTSD, and Alzheimer’s research. Deep brain and vagus nerve stimulators show measurable improvements in treatment-resistant depression. Psychiatric hospitals are adopting stimulation-based therapies to reduce dependence on long-term medication. Start-ups and large medical device companies are investing in brain-mapping, targeted stimulation, and AI-assisted signal control. Rising mental health awareness and higher diagnosis rates strengthen demand in major markets. As clinical trials continue to prove effectiveness, mental health applications will become one of the fastest-growing revenue opportunities.

- For instance, Medtronic’s BrainSense™ Adaptive Deep Brain Stimulation has been implanted in over 1,000 patients worldwide, demonstrating real-time therapy personalization based on brain activity.

Key Challenges

High Cost of Implants and Limited Access in Developing Regions

Electroceutical implants involve high procedure costs, device expenses, and postoperative care. Many patients in low-income regions cannot afford cochlear implants or spinal cord stimulators due to weak reimbursement systems. Hospitals also face procurement barriers because advanced devices require skilled surgeons and specialized infrastructure. These factors slow adoption outside major cities. Although non-invasive devices cost less, most demand still comes from developed countries. Expanding production, lowering device prices, and improving insurance coverage will be essential for wider global access.

Complex Surgical Procedures and Safety Concerns

Implanting electroceutical devices requires high surgical expertise, long training hours, and advanced equipment. Patients may face risks such as infection, device failure, or system revision surgeries. Long-term safety studies are necessary before healthcare providers approve new technologies. Some patients hesitate to adopt implants due to fear of surgery or internal hardware. Strict regulatory testing and post-market surveillance increase development time for manufacturers. Companies must invest in improved bio-compatible materials, MRI-safe components, and smarter software to reduce risks and build greater patient confidence.

Regional Analysis

North America

North America holds the largest share of 41% in the Electroceuticals market. The region benefits from advanced healthcare infrastructure, strong reimbursement systems, and high adoption of neurostimulation and cardiac rhythm management devices. Increasing cases of chronic pain, hearing disabilities, and Parkinson’s disease drive the use of spinal cord stimulators and cochlear implants. Major medical device companies operate large R&D and manufacturing centers across the U.S., supporting rapid commercialization of new technologies. Favorable FDA approvals and rising patient awareness reinforce long-term market demand.

Europe

Europe accounts for 30% of the Electroceuticals market, led by Germany, the U.K., France, and the Nordic region. Aging populations and rising neurological disorders drive implant adoption, especially for deep brain and vagus nerve stimulators. Strong regulatory standards, structured insurance coverage, and government-backed clinical research encourage hospitals to invest in advanced electroceutical therapies. Many medical universities conduct clinical trials on chronic pain, epilepsy, and mental health stimulation devices, supporting technology validation. Market growth also benefits from prominent companies in Germany and Switzerland that supply innovative neurostimulators and cochlear implant systems.

Asia Pacific

Asia Pacific holds 19% share and represents the fastest-growing regional market. China, Japan, South Korea, and India experience strong growth due to increasing healthcare investments and improved access to surgical care. Rising cases of hearing loss among aging populations support large-scale adoption of cochlear implants. Local manufacturers in China expand their presence with cost-effective electroceutical devices, widening patient access. Governments launch awareness programs for neurological and cardiac disorders, boosting diagnosis and treatment rates. Rapid urbanization and medical device imports further strengthen regional expansion.

Latin America

Latin America captures 6% market share, driven by demand for cardiac pacemakers, cochlear implants, and nerve stimulation therapies. Brazil and Mexico lead due to rising medical tourism and expanded private hospital infrastructure. However, inconsistent reimbursement and high device costs limit wide-scale adoption. Partnerships with global device makers improve supply availability and surgeon training. Growth remains steady as more patients seek alternatives to pain medication and long-term drug therapy.

Middle East & Africa

The Middle East & Africa region holds 4% share, supported by growing investments in high-end medical equipment and specialty hospitals. The UAE, Saudi Arabia, and South Africa expand neurology and cardiology treatment centers, boosting adoption of implantable devices. Limited healthcare funding and low awareness restrict uptake in rural areas. International manufacturers collaborate with government health programs to supply cost-effective neurostimulation and hearing implant systems. The region shows long-term growth potential as healthcare modernization accelerates.

Market Segmentations:

By Product

- Spinal Cord Stimulators

- Cochlear Implants

- Deep Brain Stimulators

- Vagus Nerve Stimulators

By Type

- Implantable Electroceutical Devices

- Non-Invasive Electroceutical Devices

By Application

- Cardiac Disorders

- Chronic Pain Management

- Depression and Mental Health Disorders

- Urinary and Fecal Incontinence

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Home Healthcare Settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electroceuticals market features strong competition among global medical device leaders focused on neurostimulation, cardiac rhythm management, and cochlear implant technologies. Companies invest heavily in R&D to develop smaller implants, wireless programming, MRI-compatible systems, and remote monitoring capabilities. Firms such as Boston Scientific, Abbott Laboratories, and Biotronik expand product portfolios with rechargeable pulse generators and targeted stimulation platforms for pain, arrhythmia, and epilepsy. Cochlear Limited and Sonova lead the hearing implant segment with advanced sound processors and speech enhancement systems. Many players pursue mergers, clinical collaborations, and hospital partnerships to improve device accessibility and physician training. New entrants emphasize wearable and non-invasive systems, creating price competition in migraine therapy, depression care, and post-surgical pain management. Regulatory approvals and reimbursement agreements remain critical advantages for established brands. As technology advances toward AI-guided stimulation and home-based therapy, companies with integrated digital platforms are positioned to gain stronger market share in coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nurotron Biotechnology Co. Ltd.

- Sonova Holding AG

- ElectroCore, Inc.

- Nevro Corp

- Biotronik

- NeuroPace, Inc.

- Cochlear Limited

- Abbott Laboratories

- LivaNova PLC

- Boston Scientific Corporation

Recent Developments

- In October 2025, Cellionyx exited stealth mode and introduced Cytomotion, an FDA-registered Class I electroceutical device designed to enhance human healing and performance.

- In 2024, Nevro Corp expanded its HFX iQ platform with AI-powered closed-loop stimulation to optimize chronic pain treatment through real-time data feedback.

- In February 2023, Morphoceuticals secured USD 8 million in a Seed-2 funding round to advance its AI-guided electroceutical therapy platform aimed at regenerative medicine applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for implantable neurostimulators will rise as chronic pain and neurological disorders increase.

- Cochlear implant adoption will expand with aging populations and better clinical outcomes.

- Wearable and non-invasive stimulators will gain traction for home-based therapy.

- AI-enabled signal control and personalized stimulation settings will improve treatment accuracy.

- Remote monitoring and cloud-connected devices will reduce hospital visits and boost patient compliance.

- More countries will introduce reimbursement support for electroceutical procedures.

- Clinical trials for depression, PTSD, and cognitive disorders will widen therapeutic applications.

- Miniaturized implants with longer battery life will enhance patient comfort and reduce revision surgeries.

- Local manufacturing in emerging markets will lower costs and increase accessibility.

- Partnerships between device makers, hospitals, and research centers will accelerate innovation and market expansion.