Market Overview:

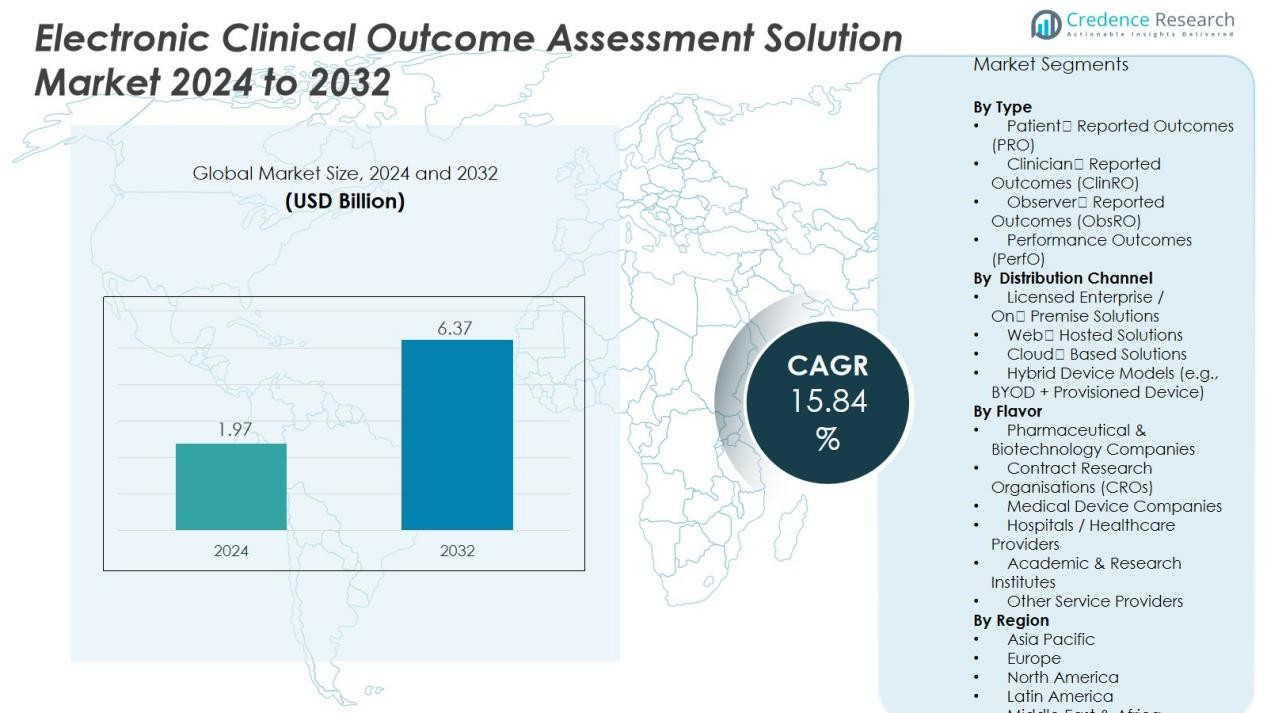

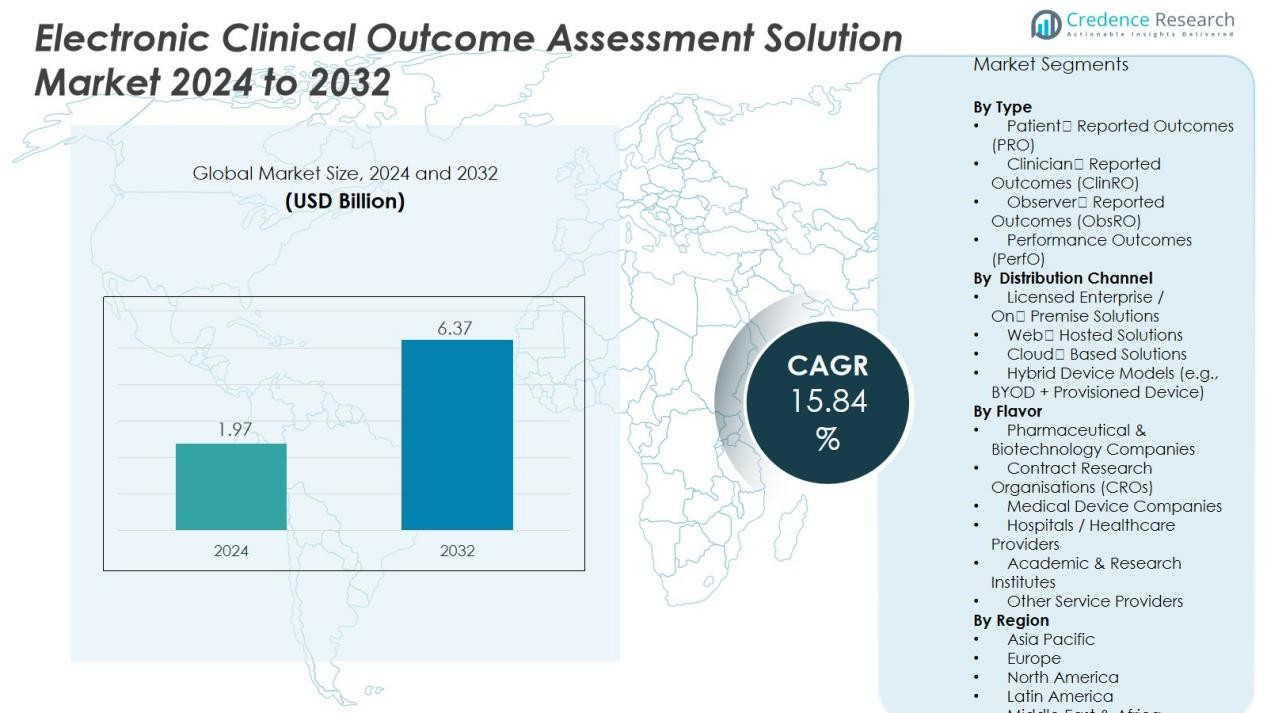

The Electronic Clinical Outcome Assessment Solution Market size was valued at USD 1.97 billion in 2024 and is anticipated to reach USD 6.37 billion by 2032, at a CAGR of 15.84 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Clinical Outcome Assessment Solution Market Size 2024 |

USD 1.97 Billion |

| Electronic Clinical Outcome Assessment Solution Market, CAGR |

15.84 % |

| Electronic Clinical Outcome Assessment Solution Market Size 2032 |

USD 6.37 Billion |

Key drivers behind the growth of the eCOA market include the shift from paper-based outcome assessments to electronic platforms, which improve accuracy, efficiency, and compliance. There is also a growing adoption of patient-reported outcomes (PRO), clinician-reported outcomes (ClinRO), observer-reported outcomes (ObsRO), and performance outcomes (PerfO) through digital devices. In addition, rising pharmaceutical R&D expenditures, a higher number of clinical trials globally, and the growing importance of real-world evidence (RWE) and patient-centricity are all contributing to market growth. The increasing use of mobile devices, wearables, and cloud-based platforms further accelerates the adoption of eCOA solutions.

North America currently leads the eCOA solutions market, driven by a strong clinical trial infrastructure, widespread adoption of digital health tools, and the presence of major pharmaceutical and biotechnology companies. Europe follows closely, benefiting from favorable regulatory frameworks and increasing digital health investments. The Asia Pacific region is expected to experience the highest growth rate, fueled by expanding clinical trial activity and rising investments in R&D. Additionally, emerging markets in Latin America, the Middle East, and Africa present growth opportunities, though they face challenges in terms of infrastructure and regulatory alignment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electronic Clinical Outcome Assessment Solution Market was valued at USD 1.97 billion in 2024 and is expected to reach USD 6.37 billion by 2032, growing at a CAGR of 15.84% during the forecast period.

- North America holds the largest market share at approximately 42.2% in 2024, driven by a robust clinical trial infrastructure, strong digital health adoption, and major pharmaceutical companies.

- Europe follows closely with a market share of 30-35%, benefiting from regulatory harmonization, active adoption of patient-reported outcomes, and national health system investments in digital health.

- Asia Pacific is the fastest-growing region, holding nearly 20% of the market share, supported by increasing clinical trial volumes, improvements in healthcare infrastructure, and rising R&D investments.

- In terms of segment share distribution, Patient-Reported Outcomes (PRO) account for the largest share, while the deployment model sees a dominance of web-hosted solutions, followed by cloud-based platforms.

Market Drivers:

Market Drivers:

Shift to Digital Solutions in Clinical Trials

The shift from traditional paper-based outcome assessments to electronic clinical outcome assessment (eCOA) solutions is one of the primary drivers in the market. Electronic systems enhance data accuracy, reduce human error, and streamline the data collection process in clinical trials. By leveraging digital tools, clinical trials become more efficient, enabling real-time data capture and faster processing. This shift also helps in minimizing the administrative burden for researchers and improving patient engagement.

- For instance, Signant Health’s eCOA platform was used in a Phase III Pfizer vaccine trial and helped achieve a 98%+ patient compliance rate with real-time data capture across more than 100 study sites.

Rising Demand for Patient-Centric Clinical Trials

Patient-centricity has become a focal point in clinical trials, driving the demand for eCOA solutions. With a greater emphasis on capturing patient-reported outcomes (PRO), clinician-reported outcomes (ClinRO), and performance outcomes (PerfO), these digital solutions enable seamless data collection from patients in real-time. This patient-centric approach enhances the overall quality of clinical trial data and allows for a more accurate representation of patient experiences. eCOA solutions support this shift by providing tools for easy integration with wearable devices, mobile apps, and other digital health platforms.

- For Instance, Suvoda’s eCOA platform, utilized by Cara Therapeutics across 10 countries in two pruritus studies, improved patient questionnaire compliance substantially while streamlining localization across 20 languages, enabling more efficient multi-country trial operations.

Increasing Regulatory Focus on Real-World Evidence (RWE)

Regulatory bodies are increasingly focused on incorporating real-world evidence (RWE) into clinical trials. eCOA solutions align well with this focus by facilitating the collection of data outside of controlled environments, such as during at-home patient monitoring. These tools enable more comprehensive data sets that capture the real-world experience of patients, thus supporting regulatory approval processes. The integration of eCOA solutions in these trials ensures compliance with evolving guidelines and accelerates approval timelines.

Technological Advancements in Mobile and Cloud-Based Solutions

Technological advancements in mobile and cloud-based platforms are further fueling the adoption of eCOA solutions. Cloud technology ensures seamless data storage and real-time access across global clinical trial sites, improving collaboration among researchers and sponsors. Mobile solutions allow for direct patient interaction, providing an efficient way to collect data remotely. These advancements contribute to greater flexibility and scalability in clinical trials, making it easier for sponsors to conduct large-scale trials across diverse geographies.

Market Trends:

Expansion of BYOD and Hybrid Device Models in Clinical Trials

The Electronic Clinical Outcome Assessment Solution Market continues to witness an increasingly prominent role for Bring Your Own Device (BYOD) and hybrid device deployment models in clinical trials. Stakeholders now prefer solutions that allow patients to use personal smartphones or tablets, which lowers site burden and enhances global participant reach. Hybrid models, which offer a mix of provisioned and personal devices, provide flexible data‑capture pathways and support diverse patient populations. These deployment models ensure smoother trial operations in remote and decentralized settings while maintaining regulatory‑grade data integrity. The adoption of such device strategies has grown in response to logistical challenges and the demand for greater patient convenience. Market research identifies the hybrid device model as one of the fastest‑growing segments in the wider eCOA landscape.

- For example, Clario delivered a hybrid BYOD solution for a major pharmaceutical company’s 600-patient atopic dermatitis observational study across 10 countries, achieving remote data capture completion rates exceeding 90%, with 80% of patients using their own iOS and Android smartphones while 20% received provisioned devices as backup.

Integration of Artificial Intelligence, Cloud Platforms and Decentralised Trial Models

The market demonstrates strong momentum toward integrating artificial intelligence (AI), cloud‑native infrastructure and hybrid or decentralised clinical trial (DCT) models. AI algorithms now assist with signal detection, anomaly identification and participant engagement through adaptive interfaces. Cloud platforms facilitate real‑time data aggregation across geographies and devices, which enables sponsors and CROs to make decisions more rapidly. Decentralised trials depend heavily on remote data capture tools and support broader patient enrolment without geographic limitation—this development reinforces demand for eCOA solutions. The trend toward mobile health applications and Internet‑of‑Things (IoT) devices in capturing patient‑reported outcomes further underpins this shift. Industry reports emphasise that regulatory and clinical‑research entities are increasingly comfortable with these technological models, which accelerates the solution uptake.

- For instance, Science 37 contributed 47% of the total U.S. participants for a specific Phase 3 hepatology trial as the top-enrolling site, while achieving 11x faster enrollment velocity compared to traditional sites in that same study.

Market Challenges Analysis:

Complexity of Implementation and Integration

The Electronic Clinical Outcome Assessment Solution Market faces significant challenges related to implementation and system integration. Many clinical teams encounter licensing complications for assessment instruments, which introduce delays and increase operational burden. It also struggles with post‑production changes where even minor modifications to questionnaire content can cascade into schedule shifts, translation needs, and regulatory documentation amendments. In multi‑site or multi‑region trials, aligning diverse platforms with legacy systems and ensuring uniform data flow adds further complexity. These factors raise cost and timeline uncertainty, reducing appeal for sponsors with tight deadlines or limited budgets. Effective deployment demands meticulous planning, stakeholder coordination, and vendor expertise to avoid data‑collection bottlenecks.

Data Privacy, Regulatory Compliance and Cost Constraints

Data security and regulatory compliance represent another major barrier in the electronic clinical outcome assessment solution market. The capture and transmission of sensitive patient outcomes require adherence to frameworks such as HIPAA, GDPR and FDA’s 21 CFR Part 11, and meeting cross‑border data‑localisation rules further complicates deployment. It also encounters pressure from increasingly stringent versions of these regulations, while smaller organisations often lack the infrastructure or budget to implement robust security controls. High initial costs — including licensing, training, hardware procurement and system validation — restrict uptake among smaller research sponsors or CROs. Without strong safeguards and cost‑efficient models, adoption stalls despite the clear operational advantages of digital solutions.

Market Opportunities:

Expansion into Emerging Geographies and New Therapeutic Domains

The Electronic Clinical Outcome Assessment Solution Market offers substantial growth opportunities through expansion in emerging geographies and under‑penetrated therapeutic areas. Many biotech and pharmaceutical firms now conduct trials in regions such as Asia Pacific and Latin America, where trial volumes are rising and infrastructure is improving. It can capitalise on this trend by offering tailored platforms that meet regional regulatory and language needs. The increasing prevalence of chronic and rare diseases drives demand for outcome‑assessment tools in novel therapeutic domains. Vendors that align with these therapy‑area expansions can capture new revenue streams and build long‑term partnerships.

Innovation in Technology and Data‑Driven Services

The market can also benefit from innovation in data‑driven services and advanced technological integration. Cloud‑native platforms, mobile‑first data collection, and connectivity with wearables enable richer, real‑time outcome data capture. It supports sponsors and CROs seeking deeper patient‑centred insights and cost‑efficient trial operations. AI‑powered analytics and predictive modelling present another fertile opportunity; solutions that turn raw outcome data into actionable trial intelligence can differentiate vendors. Service models that bundle software with analytics, training and regulatory support further enhance value proposition and open recurring‑revenue pathways.

Market Segmentation Analysis:

By Type

The market segments by type include patient‑reported outcomes (PRO), clinician‑reported outcomes (ClinRO), observer‑reported outcomes (ObsRO) and performance outcomes (PerfO). PRO solutions hold the largest share because they capture direct insights from patients about symptoms and treatment impact. ClinRO and ObsRO address data reported by clinicians and caregivers, respectively, while PerfO targets measurable tasks or activities performed by patients. Adoption of these types depends on trial design, therapeutic area and regulatory requirements. Growth in rare‑disease and chronic‑disease trials boosts demand for multiple outcome types.

- For instance, Medidata’s myMedidata platform is part of a broader technology ecosystem that has powered over 36,000 clinical trials in total, involving more than 11 million patients across approximately 2,300 customers and partners.

By Deployment Model

Deployment models in the market comprise licensed enterprise solutions, web‑hosted solutions and cloud‑based solutions. Web‑hosted models currently dominate due to their relatively low upfront investment and ease of access via internet browsers. Cloud‑based delivery gains traction thanks to scalability, remote access and global trial site connectivity. Licensed on‑premise solutions still operate in highly regulated settings that require full control. The choice of deployment influences cost structure, validation effort and geographic coverage. Hybrid models also emerge, blending personal‑ and provisioned‑device use in global trials.

- For Instance, Veeva Systems’ cloud clinical platform is used by a large majority of the top 20 global pharmaceutical companies for running multicountry trials with remote data access.

By End‑Use

End‑use segmentation covers pharmaceutical & biotechnology companies, contract research organizations (CROs), medical‑device companies, hospitals/healthcare providers and academic/research institutes. Pharmaceutical/biotech firms represent the largest user group because they carry out the majority of clinical trials and sponsor outcome‑assessment platforms. CROs follow, leveraging eCOA tools to serve multiple sponsors and trials efficiently. Medical‑device firms and hospitals increasingly adopt these solutions for post‑market studies and registries. Academic and research institutes adopt eCOA solutions for investigator‑initiated studies, though budget constraints slow uptake. The varying needs of each end‑use drive differentiated product configurations and service models.

Segmentations:

By Type:

- Patient‑Reported Outcomes (PRO)

- Clinician‑Reported Outcomes (ClinRO)

- Observer‑Reported Outcomes (ObsRO)

- Performance Outcomes (PerfO)

By Deployment Model:

- Licensed Enterprise / On‑Premise Solutions

- Web‑Hosted Solutions

- Cloud‑Based Solutions

- Hybrid Device Models (e.g., BYOD + Provisioned Device)

By End‑Use:

- Pharmaceutical & Biotechnology Companies

- Contract Research Organisations (CROs)

- Medical Device Companies

- Hospitals / Healthcare Providers

- Academic & Research Institutes

- Other Service Providers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Overview

North America holds a market share of approximately 42.2% in the Electronic Clinical Outcome Assessment Solution Market for 2024. It leads the sector with strong presence of pharmaceutical and biotechnology firms engaged in extensive clinical trials and outcome‑assessment initiatives. The region features mature digital health infrastructure, high regulatory standards, and significant R&D investment, which drive adoption of outcome‑assessment platforms. It benefits from a patient population familiar with digital tools and high data‑connectivity across research sites. The prevalence of large contract research organizations (CROs) and established service providers further supports deployment. It faces moderate growth because of market maturity and competition across providers. The strong base in North America sets a benchmark for global solution vendors and service partners.

Europe and Emerging Growth in Latin America, Middle East & Africa

Europe accounts for a market share close to the low‑to‑mid‑30% range within the Electronic Clinical Outcome Assessment Solution Market. It benefits from regulatory harmonisation across the EU, increasing focus on patient‑reported outcomes, and active adoption of digital health platforms in clinical research. National health systems drive registry‑based studies and outcome monitoring, creating opportunities for eCOA platforms. Latin America, the Middle East & Africa collectively contribute a smaller share—likely under 15%—but their growth potential remains significant. These regions witness rising clinical‑trial activity and investment in digital infrastructure, yet still face barriers in validation, data‑localisation and regulatory clarity. Vendors that tailor solutions to local languages, compliance and decentralised trial models may gain traction.

Asia Pacific Regional Prospects

Asia Pacific holds an estimated market share slightly under 20% in the Electronic Clinical Outcome Assessment Solution Market. It displays the fastest growth trajectory among regions, supported by expanding clinical‑trial volumes in countries like China, India and Japan. The region benefits from improving health‑tech infrastructure, favourable regulatory reforms and increasing outsourcing of trials by global sponsors. It also poses challenges in terms of data‑security requirements, multilingual support and variable connectivity across sites. Providers that deliver scalable, cloud‑based platforms with regional localisation will capture significant opportunity. The rapid adoption trend in Asia Pacific suggests this region will command an increasingly larger portion of global demand in upcoming years.

Key Player Analysis:

- AssisTek

- Climedo Health GmbH

- Clinical ink

- CRF Health

- EvidentIQ

- ICON plc

- IQVIA

- Integra IT S.A.S

- Kayentis

- Medidata

- Oracle Corporation

- Raylytic GmbH

Competitive Analysis:

The competitive landscape of the Electronic Clinical Outcome Assessment Solution Market features several key players that set the pace for innovation and market positioning. Notable vendors include AssisTek, Climedo Health GmbH, Clinical Ink, CRF Health and EvidentIQ, each demonstrating a strong presence and differentiated service offering. AssisTek emphasizes eCOA as its core focus, supported by over 25 years of domain‑specific experience in clinical research. Climedo Health offers a flexible, patient‑centric platform that encompasses ePRO, eCRF and eSurveys to meet the evolving demands of clinical trials. Clinical Ink provides integrated eSource and eCOA solutions designed to optimise patient engagement and data management across sites, sponsors and CROs. CRF Health maintains a robust footprint with global deployment capabilities and regulatory compliance for endpoint collection in trials. EvidentIQ brings interoperability to the table, with an eCOA solution that links seamlessly to multiple EDC systems and emphasises encrypted, real‑time data capture. Overall, the market remains competitive and dynamic, with vendors striving for technological differentiation, global reach and strategic partnerships to capture share in this evolving landscape.

Recent Developments:

- In March 2024, Climedo Health GmbH was highlighted in industry sources for its role as a partner for pharma and medtech companies, focusing on patient-centric digital solutions for decentralized trials. Climedo continued to provide integrated eCOA and EDC systems intended to streamline data collection and improve trial efficiency.

- In November 2023, Clinical Ink expanded its patient engagement solutions by entering into partnership with Observia, integrating Observia’s behavioral science technology to enhance patient retention and protocol adherence throughout clinical trials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Deployment Model, End‑Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Electronic Clinical Outcome Assessment Solution Market will expand into real‑time remote monitoring, allowing sponsors to collect outcome data outside traditional clinical settings and reach broader patient populations.

- It will deepen integration with wearable devices and mobile health applications to enable continuous performance and physiologic endpoint collection, thereby enhancing trial insights and patient engagement.

- The market will witness growth in hybrid and decentralised clinical trial models, which demand flexible deployment of outcome‑assessment tools to support home‑based, virtual and on‑site data capture simultaneously.

- Vendors will introduce modular, scalable platforms that allow trial teams to configure outcome modules rapidly and deploy them across global sites, reducing setup time and lowering entry barriers for smaller studies.

- It will see increased alignment with artificial intelligence and machine learning capabilities, which will analyse large‑scale endpoint data to identify patterns, predict risks and optimise trial protocols.

- The market will offer service‑based subscription models and bundled analytics services, shifting from one‑time platform sales to recurring revenue streams and higher customer lifetime value.

- It will expand into emerging therapeutic areas such as rare diseases, neurology and digital therapeutics, where outcome‑assessment demands remain high and digital capture offers significant advantages.

- The market will deepen regional penetration in Asia Pacific, Latin America and Middle East & Africa, where clinical‑trial outsourcing, infrastructure upgrades and digital‑health adoption support growth.

- It will emphasise compliance‑ready frameworks for global regulatory regimes, helping sponsors meet data‑integrity, audit‑trail and localisation mandates in multiple jurisdictions.

- The market will encourage partnerships between outcome‑assessment vendors and electronic data‑capture, electronic health‑record and tele‑health‑platform providers, fostering ecosystem interoperability and richer data linkages.

Market Drivers:

Market Drivers: