Market Overview

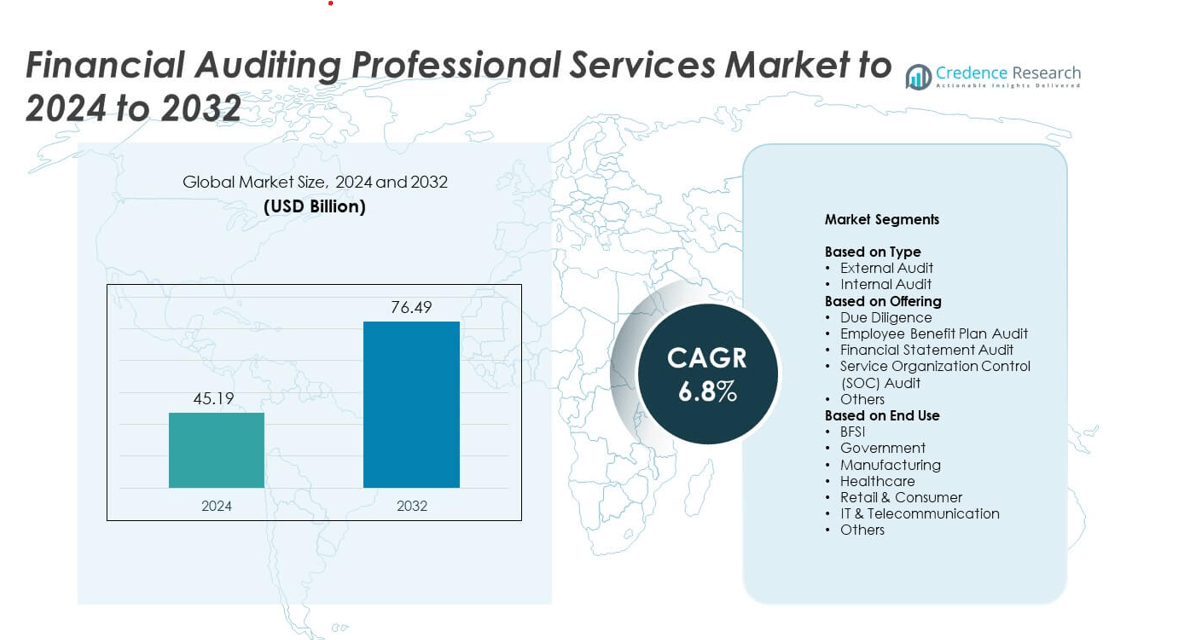

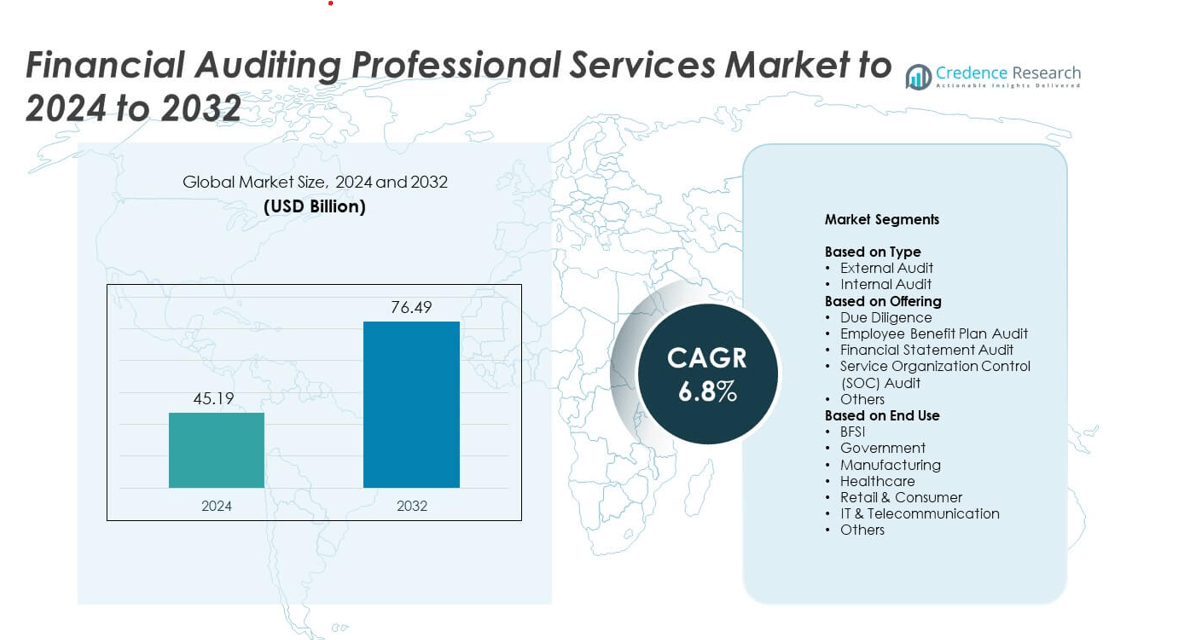

Financial Auditing Professional Services Market size was valued USD 45.19 Billion in 2024 and is anticipated to reach USD 76.49 Billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Financial Auditing Professional Services Market Size 2024 |

USD 45.19 Billion |

| Financial Auditing Professional Services Market, CAGR |

6.8% |

| Financial Auditing Professional Services Market Size 2032 |

USD 76.49 Billion |

Deloitte, KPMG, PricewaterhouseCoopers, Ernst and Young (EY), Grant Thornton, BDO, RSM International, Plante Moran, CohnReznick, Mazars, Baker Tilly, McGladrey, and Protiviti lead the Financial Auditing Professional Services Market. These firms maintain strong market positions through diversified service offerings, including external and internal audits, due diligence, and risk advisory. They emphasize technological integration, such as AI, cloud platforms, and advanced analytics, to enhance audit accuracy and efficiency. North America dominates the market, accounting for 37.1% of total revenue, driven by mature financial sectors, regulatory compliance mandates, and high adoption of audit technologies. Europe and Asia-Pacific also contribute significantly, supported by regulatory frameworks, industrial growth, and increasing cross-border transactions. The competitive landscape encourages continuous innovation, talent development, and expansion into emerging markets, enabling these firms to sustain growth and strengthen their global footprint.

Market Insights

- The Financial Auditing Professional Services Market was valued at USD 45.19 Billion in 2024 and is projected to reach USD 76.49 Billion by 2032, at a CAGR of 6.8%.

- Growth is driven by regulatory compliance, corporate governance, and adoption of advanced audit technologies across BFSI, healthcare, IT, and manufacturing sectors.

- Trends include cloud-based and digital audit solutions, risk-focused audits, and increasing demand in emerging markets like Asia-Pacific, Latin America, and the Middle East.

- Major players focus on technology integration, talent development, and sector-specific expertise to strengthen services and global presence.

- North America leads with 36% share, Europe 28%, Asia-Pacific 22%, Middle East & Africa 8%, and Latin America 6%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The external audit segment dominated the market with a 58% share in 2024, driven by regulatory compliance and corporate governance requirements. Companies increasingly rely on external auditors to ensure transparency in financial reporting and adherence to international accounting standards. The demand is fueled by stricter government regulations, investor scrutiny, and the growing complexity of corporate financial structures. Internal audits, while essential for risk management and operational efficiency, hold a smaller share but are expanding due to organizations focusing on internal controls, fraud detection, and process optimization across industries.

- For instance, PwC announced that in fiscal year 2024, its professionals in 149 countries helped more than 180,000 clients. The firm also noted that its client base includes 86% of the Fortune Global 500

By Offering

Financial statement audits led the segment with a 52% market share in 2024, driven by mandatory reporting requirements and investor confidence needs. Organizations prioritize accurate financial disclosures, especially in sectors with high regulatory oversight, to ensure credibility with stakeholders. Due diligence and SOC audits are gaining traction due to mergers, acquisitions, and third-party risk assessment requirements. Employee benefit plan audits support compliance with labor laws and financial transparency, further boosting the overall adoption of auditing services across industries with complex benefit structures.

- For instance, Amazon Web Services’ spring 2025 SOC reporting covered 184 services, reflecting rising third-party assurance and SOC audit activity.

By End Use

The BFSI sector accounted for the largest share at 34% in 2024, supported by stringent regulatory frameworks and high transaction volumes. Financial institutions increasingly engage auditing services to ensure compliance with local and international regulations, risk management, and fraud prevention. Government and manufacturing sectors are also expanding their audit engagements due to accountability mandates and operational complexity. Healthcare, retail, IT, and telecommunication industries are investing in audits to enhance transparency, protect investor interests, and maintain robust internal controls, driving the overall market growth.

Key Growth Drivers

Regulatory Compliance and Corporate Governance

Stringent regulatory frameworks and corporate governance requirements drive demand for financial auditing services. Organizations rely on external and internal audits to ensure transparency, reduce fraud, and comply with local and international accounting standards. Investor and regulatory scrutiny compels firms to adopt comprehensive auditing practices. BFSI and healthcare sectors particularly emphasize compliance audits, enhancing adoption. Increasingly complex financial transactions and cross-border operations further elevate the need for professional auditing, establishing regulatory compliance as a critical growth driver in the market.

- For instance, Workiva served 6,305 customers as of 31 Dec 2024, supporting compliance programs and regulated disclosures at scale.

Technological Advancements in Audit Tools

Integration of AI, data analytics, and blockchain enhances efficiency, accuracy, and fraud detection in auditing processes. Automation reduces manual errors, accelerates financial statement analysis, and allows auditors to focus on risk assessment. Cloud-based solutions provide real-time data access and secure collaboration across departments. Adoption of advanced audit technologies drives demand from large enterprises and multinationals. Continuous innovation in auditing software improves productivity, reduces costs, and enables proactive decision-making, positioning technological advancement as a key growth driver in the market.

- For instance, KPMG equipped 90,000 auditors with its Clara platform’s integrated GenAI, accelerating risk assessment and documentation.

Growing Demand from Diverse End-Use Industries

Expansion across BFSI, healthcare, IT, and manufacturing sectors fuels the need for auditing services. Organizations strengthen internal controls, mitigate risks, and enhance financial transparency. Rising mergers, acquisitions, and cross-border transactions boost demand for due diligence and SOC audits. Government and regulatory mandates further encourage comprehensive audit adoption. The diversity of industries seeking auditing ensures steady market growth, as businesses prioritize accountability, investor confidence, and operational efficiency to maintain competitiveness.

Key Trends and Opportunities

Adoption of Cloud-Based and Digital Audit Solutions

The market increasingly favors cloud-based and digital auditing platforms. Remote auditing, AI-driven analytics, and real-time monitoring improve efficiency, reduce costs, and enable faster reporting. Secure data management and enhanced collaboration support audit teams and clients. Rising demand for digital audits presents opportunities for scalable, technology-driven services. Enterprises integrate innovative tools into audit processes to gain insights, ensure compliance, and improve transparency, making cloud adoption a key trend and growth opportunity in the market.

- For instance, MindBridge reports analyzing over 135 billion financial transactions on its AI platform, enabling continuous, cloud-based audit analytics.

Focus on Risk Management and Fraud Detection

Risk-based auditing helps organizations identify financial discrepancies and operational inefficiencies. Advanced analytics enable early detection of fraud, misstatements, and non-compliance. BFSI and manufacturing sectors increasingly adopt risk-focused audits. Professional service providers can offer specialized risk assessment, forensic auditing, and advisory solutions. Enhanced risk management ensures compliance and strengthens stakeholder confidence, representing a key trend and market opportunity for expanding auditing services.

- For instance, Mastercard’s systems analyze up to 160 billion transactions annually for fraud scoring, strengthening risk-focused audit procedures.

Expansion in Emerging Markets

Emerging economies show rising demand for auditing services due to industrialization, foreign investments, and regulatory reforms. Companies in Asia-Pacific, Latin America, and the Middle East increasingly engage audit firms for compliance and financial transparency. Market players can leverage region-specific expertise and tailored solutions. Growing multinational presence and cross-border transactions in these regions drive expansion, presenting strategic opportunities for service providers to strengthen their global footprint and capture high-growth markets.

Key Challenges

Shortage of Skilled Audit Professionals

Limited availability of qualified auditors with expertise in advanced technologies and regulatory compliance poses a major challenge. Talent gaps affect service quality, efficiency, and the ability to manage complex audits. Firms must invest in training, certifications, and retention strategies to address workforce shortages. Rapid evolution of audit tools increases demand for specialized skills, making talent scarcity a key challenge that could hinder market growth and affect competitiveness.

Data Security and Confidentiality Concerns

Handling sensitive financial information exposes auditing firms to cyberattacks, breaches, and regulatory penalties. Ensuring confidentiality and secure data management is critical for client trust. Cloud-based and digital audit adoption amplifies the need for robust cybersecurity measures. Firms must implement advanced security protocols and compliance frameworks to mitigate risks. Data privacy concerns and potential legal liabilities present a key challenge that can affect market growth and require careful risk management strategies across all service offerings.

Regional Analysis

North America

North America led the Financial Auditing Professional Services Market in 2024, holding a 36% share. The region benefits from stringent regulatory frameworks, mature financial sectors, and high adoption of advanced audit technologies. BFSI, healthcare, and IT industries drive consistent demand for external and internal audits, due diligence, and SOC audits. The presence of major audit firms and strong corporate governance mandates reinforce market growth. Increasing cross-border transactions and investment activities further support demand for comprehensive financial auditing services, positioning North America as the dominant regional market with robust adoption of technology-driven solutions and specialized audit offerings.

Europe

Europe accounted for 28% of the market in 2024, driven by regulatory compliance, transparency mandates, and corporate governance initiatives. Strong demand from manufacturing, BFSI, and government sectors supports consistent growth. Companies adopt advanced audit solutions, including AI, cloud-based platforms, and risk management tools, to ensure accuracy and efficiency. Cross-border operations within the European Union increase the need for standardized audits and financial statement verification. Market players focus on enhancing service offerings to meet stringent regulations, providing due diligence, SOC audits, and financial statement audits, making Europe a significant contributor to the global financial auditing services landscape.

Asia-Pacific

Asia-Pacific held a 22% market share in 2024, reflecting rapid industrialization, foreign investments, and regulatory reforms. The region sees increasing adoption of auditing services across BFSI, manufacturing, IT, and telecommunication sectors. Growing cross-border transactions and government mandates for transparency drive demand for financial statement audits, internal audits, and due diligence services. Emerging economies such as China, India, and Japan are investing in advanced audit technologies, including AI analytics and cloud-based solutions. Expanding industrial and corporate activities, coupled with rising awareness of compliance and risk management, position Asia-Pacific as a high-growth region in the financial auditing professional services market.

Middle East & Africa

Middle East & Africa captured 8% of the market in 2024, fueled by infrastructure expansion, regulatory reforms, and increased foreign direct investments. Governments and large enterprises in the region are increasingly seeking auditing services to ensure financial transparency and compliance with international standards. BFSI, oil & gas, and construction sectors are primary contributors to service demand. Firms are adopting cloud-based and risk-focused audit solutions to address operational complexities. The rising presence of multinational corporations and public-private partnerships further drives market growth, presenting opportunities for service providers to expand region-specific offerings and strengthen their professional auditing footprint.

Latin America

Latin America accounted for 6% of the financial auditing services market in 2024, supported by growing industrialization, investment inflows, and regulatory initiatives. Companies across BFSI, manufacturing, and retail sectors increasingly rely on auditing services to ensure compliance, enhance financial transparency, and mitigate risks. The adoption of digital audit tools, automation, and cloud-based solutions is gradually increasing in the region. Governments are implementing stricter reporting mandates, driving the demand for financial statement audits, due diligence, and SOC audits. The market presents opportunities for local and international firms to expand service portfolios and cater to the evolving compliance needs of the region.

Market Segmentations:

By Type

- External Audit

- Internal Audit

By Offering

- Due Diligence

- Employee Benefit Plan Audit

- Financial Statement Audit

- Service Organization Control (SOC) Audit

- Others

By End Use

- BFSI

- Government

- Manufacturing

- Healthcare

- Retail & Consumer

- IT & Telecommunication

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Deloitte, KPMG, PricewaterhouseCoopers, Ernst and Young (EY), Grant Thornton, BDO, RSM International, Plante Moran, CohnReznick, Mazars, Baker Tilly, McGladrey, and Protiviti lead the competitive landscape in the Financial Auditing Professional Services Market. These firms maintain strong market positions through diversified service portfolios, including external audits, internal audits, due diligence, and risk advisory. Emphasis on technological integration, such as AI, cloud platforms, and advanced analytics, enhances efficiency and accuracy. Strategic investments in emerging markets and sector-specific expertise allow expansion across BFSI, healthcare, manufacturing, and IT industries. Firms focus on strengthening client relationships, improving compliance capabilities, and offering specialized audit solutions to meet regulatory requirements. The competition encourages continuous innovation, talent development, and service differentiation. Consolidation trends and collaborations further intensify market dynamics, driving quality, reliability, and transparency in professional auditing services while enabling companies to sustain growth and capture new opportunities globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Deloitte

- KPMG

- PricewaterhouseCoopers

- Ernst and Young (EY)

- Grant Thornton

- BDO

- RSM International

- Plante Moran

- CohnReznick

- Mazars

- Baker Tilly

- McGladrey

- Protiviti

Recent Developments

- In 2025,Deloitte Launched “AI Advantage for CFOs,” leveraging AI platforms like Amazon Bedrock to automate financial processes and extract insights, signaling a move toward more sophisticated, AI-powered financial operations.

- In 2025, EY India launched an “Automated Regulatory Tool” built on Snowflake to automate financial reporting compliance, aiming to automate 80% of the reporting process.

- In 2024, KPMG Announced upgrades to its proprietary GenAI tool, “KPMG Audit Chat,” and its global smart audit platform, “KPMG Clara”.

Report Coverage

The research report offers an in-depth analysis based on Type, Offering, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and advanced analytics will enhance audit accuracy and efficiency.

- Cloud-based and digital auditing solutions will see increased implementation.

- Demand for risk-based and forensic audits will grow across industries.

- BFSI and healthcare sectors will continue to drive market expansion.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will offer growth opportunities.

- Mergers, acquisitions, and cross-border transactions will boost due diligence services.

- Integration of blockchain will improve transparency and data integrity in audits.

- Regulatory compliance requirements will remain a major growth driver globally.

- Talent development and training initiatives will become critical to address workforce shortages.

- Cybersecurity and data protection measures will gain priority in audit processes.